General rules for filling out a payment form for tax penalties

Penalties intended for payment to the Federal Tax Service are the amount resulting from the later payment of taxes to the budget compared to the deadlines established for this (clause 1 of Article 75 of the Tax Code of the Russian Federation). They are transferred to the same inspectorate where the corresponding taxes are paid.

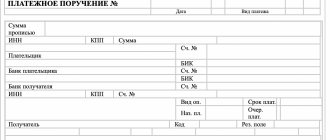

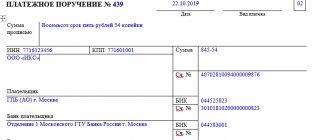

The document for payment of penalties is drawn up according to the same principles as for the tax payment itself, but with a number of nuances. Just like for tax payments, the following is entered into it:

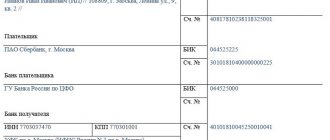

- name, TIN, KPP and bank details of the payer;

- name, TIN, KPP and bank details of the tax authority;

- order of payment, KBK, OKTMO, basis for payment;

- purpose of payment.

With its own characteristics, the payment of penalties reflects:

- Sequence of payment. Her choice will depend on the basis for which the payment is made.

- KBK. The basic set of numbers for penalties is always similar to that used for the tax for which penalties are paid, but signs 14–17 are necessarily 2100, indicated only for penalties.

- Basis of payment. Here there is not always enough reason for payment (there are several of them for penalties). Data may be required about the period for which the payment is made and the document against which the payment is made.

- Purpose of payment. It is indicated that penalties are paid and for what tax; there may also be a need for other information.

The rules for issuing payment orders for the payment of penalties on taxes from 2021 also apply to insurance premiums subject to the Tax Code of the Russian Federation. But when paying penalties on contributions for injuries that remain under the jurisdiction of the Social Insurance Fund, you will also have to take into account a number of features.

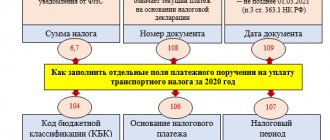

The basis for the payment indicated in the payment document for penalties depends on whether it is made voluntarily or according to a document issued by the Federal Tax Service:

- The voluntary nature of the payment will be indicated by the letters ZD entered in field 106. Their presence allows you not to make other notes related to the basis of the payment (about the payment period, number and date of the document), and limit yourself to putting numbers in the fields intended for them (107–109) 0. If the amount paid can be linked to a specific tax period, then in field 107 you can make a link to it in the format MS.05.2019 or KV.02.2019.

- Documents drawn up by the Federal Tax Service regarding penalties are divided into: Request for payment. According to it, in field 106 you should enter the letters TR, and in the fields following it - the payment period specified in the request (field 107), the request number (field 108) and its date (field 109).

- Checking act. For it, the letters AP will appear in field 106 and, just like for the demand, you will need to enter the payment deadline specified in the act, the act number and its date in lines 107–109.

Based on the basis of the payment, the order of payment will be determined (letter of the Ministry of Finance of Russia dated January 20, 2014 No. 02-03-11/1603):

- for voluntary payment, the number 5 should be entered;

- payment according to a document issued by the Federal Tax Service - number 3.

The tax period for which payment is made may be additionally indicated in the purpose of the payment.

How to calculate tax penalties

How much you will have to pay will depend not only on the number of days that will pass from the end of the period given for payment of the contribution or tax. The refinancing rate that is current at the time of its determination will also have a direct impact on the value we are interested in.

The required indicator is established by an organization such as the Central Bank of the Russian Federation. Its meaning changes from time to time, so each time you need to clarify it again.

According to the letter of the law, the amount of penalties accrued on overdue taxes daily is 1/300 of the current refinancing rate. Let us remind you once again that before determining the exact amount, you need to clarify the current information on the rate.

In principle, as you can see, it is not difficult to independently calculate the amount of your debt. To do this, you only need to know the following indicators:

- rate determined by the Central Bank;

- the number of days that have passed since the end of the period allocated for tax payment;

- the amount of tax or contribution that you mistakenly did not pay to the state treasury.

Remember that the information you use in calculations must be constantly updated, as its current values change over time

Using online services to determine the amount of debt

However, for those who do not want to make boring calculations on their own, there is always the opportunity to use various online services for determining debt, of which there are a great many on the Internet today. It is also recommended to turn to them because the calculation algorithms in the programs do not give failures and erroneous information, since they bypass the human factor, and independent calculation is fraught with inaccuracies.

The services you find on the Internet will operate on the same principle. Even the interface of these online programs is very similar. To use them, you always need to follow approximately the same procedure.

Stage No. 1. At this stage, the date from which the accrual of penalties on the amount of debt to the state began, as well as the type of tax for which there was a delay, is indicated. Look at the calendar and select the box next to the end day of the period given for transferring funds to the state. The number indicated in this box must be indicated in the corresponding column of the program.

Indicate the tax and select the date required for calculation, on which the accrual of penalties started

Stage No. 2. Now we indicate the date when you are expected to deposit funds. It's quite rare that it ends up being the same day that you discover you're getting a penalty, so it's best to make your calculations with at least a day or two to spare.

Now indicate the date on which payment will be made by you

Stage No. 3. At the last, third stage, the amount of tax debt is indicated. We remind you that this will be the amount that you were supposed to transfer to the Federal Tax Service, but did not do so for some reason.

After all the data has been entered, click on the calculate button.

Next, enter the amount of debt in rubles

Basis of payment

TP - current year payments

ZD - voluntary repayment of debt for expired tax periods when

no requirement to pay taxes (fees) from the tax authority

BF - current payments of individuals, bank clients, paid from their bank account

TR - repayment of debt at the request of the tax authority to pay taxes (fees)

RS - repayment of overdue debt

OT - repayment of deferred debt

RT - repayment of restructured debt

VU - repayment of deferred debt due to the introduction of external management

PR - repayment of debt suspended for collection

AP - repayment of debt according to the inspection report

AR - repayment of debt under a writ of execution

DE - customs declaration;

PO - customs receipt order;

CV - decree-receipt (when paying a fine);

CT - a form of adjustment of customs value and customs payments;

ID - executive document;

IP - collection order;

TU - requirement to pay customs duties;

DB - documents of accounting services of customs authorities;

IN - collection document;

KP - an agreement on interaction when large taxpayers make payments in a centralized manner;

When indicating the number of the corresponding document, the “N” sign is not affixed.

How to pay penalties on taxes

You must pay penalties accrued after you missed the tax payment date using separate payment-type orders.

When drawing up the indicated documents, which are then submitted for verification to the tax service, it is necessary to take into account some nuances. So, for example, in the column in which the basis for making this payment is indicated, you can indicate one of three possible designations.

In order for the tax office to accept payment from you, you need to fill out the payment order correctly

Table 2. Designations in the payment order when paying off penalties

| Description of the circumstances | What designation should be specified? |

| If the payment of the penalty accrued to you daily is made on your own, on the basis of documents such as a reconciliation report or a certificate indicating the calculations made. | In this case, the designation “ZD” is used, which must be indicated in the payment order. |

| When a penalty is paid, which is required subsequently after the relevant tax audit decision is made. | In this case, the abbreviation “AP” is used. |

| If a penalty is paid that was requested by the Federal Tax Service inspection. | In this situation, the abbreviation “TR” is entered in the column we need. |

However, the nuances indicated in the table, as well as other characteristics of the transaction for transferring penalties to the state treasury, should be well known to the employees of the accounting department of your company, even though they made a serious mistake by not fulfilling their tax obligations to the state. In this case, we advise you, as a leader, to take control of everything.

The payment order is sent directly to the Federal Tax Service. To transfer funds, you need to use the appropriate details of the organization.

What consequences can an organization face if there is no timely payment of taxes to the state treasury?

In a special article we will tell you what penalties for transport tax are, how much the required financial sanction will be taken from you, and what is the procedure for paying it this year.

What happens if you don’t pay your deposit on time?

Taxes on apartments, transport and other property are required to be paid on time, regardless of whether a notice has been received or not. The owner is obliged to independently appear at the local inspectorate of the Federal Tax Service no later than December 31 of the following year for the expired tax period (Article 23 of the Tax Code) in case of failure to receive a receipt in order to clarify the reason and amount for payment.

The tax service has the right to file a lawsuit against a person who is hiding from paying duties to withhold a debt from his personal property. And also to debit the required amount from the bank account. The court may make a decision to satisfy the claim, if conclusive evidence is provided, even without the consent of the defaulter, who is obliged to repay the debt.

An appeal for debt collection to a judicial authority is authorized to repay the debt within a three-year period from the date of the first notification of the debtor. If the debt amount is less than 3,000 rubles, the application to the court is submitted within six months after the designated period (3 years). If more than 3 thousand rubles, then after 6 months, when this amount was exceeded.

A copy of the court decision is addressed to the debtor, who has the right to appeal it within 20 days. The court's decision is suspended. Both parties are invited for further proceedings.

A negligent taxpayer may not be allowed to leave the country, and his property may be seized. Debt collection by court decision is fraught with the cost of paying state fees. Sending him to the bailiffs threatens an additional 7% of the debt amount (not less than 500 rubles).

Regardless of the timeliness of receipt of the notification, penalties may not be paid. After 3 years, they are canceled. It is not beneficial for the Federal Tax Service to go to court to collect them. Penalties do not entail any restrictions.

So, the most convenient way to pay the penalty is through the Sberbank-online service using the TIN. Through it, you can also find out how to find out exactly why the tax authority accrued penalties.

The video will tell you how to find out your tax debts:

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below:

See which KBK code to pay penalties for personal income tax in 2021 and how to fill out the payment form correctly. You can also download the full KBK table for penalties for personal income tax.

Activate trial access to RNA magazine or subscribe with a discount

From the article you will learn:

- To which KBK should personal income tax penalties be transferred?

- How can a tax agent fill out a payment order and KBK for penalties for personal income tax in 2021?

- What has changed in the procedure for calculating penalties?

- When should personal income tax be calculated, withheld and paid for employees in order to avoid penalties?