In what cases is count 67 applied?

The account “Settlements for long-term loans and borrowings” is maintained by the organization receiving the credit (loan). In some cases, an enterprise needs to make expensive acquisitions, for example, equipment, but there is no free working capital at the moment. In such cases, it makes sense to take a long-term loan - that is, with a repayment period exceeding one tax period.

The account reflects information about counterparties (creditors) and loan agreements.

After the loan repayment period is reduced to 365 days, it can be transferred from 67 to 66 account “Short-term loans and borrowings”, or left on account 67. The chosen accounting method is fixed in the accounting policy of the organization.

Typical correspondence

Transferring a liability to a short-term liability

| Dt | CT | Operation description | Sum | Document |

| 67 | 66 | The amount was transferred to short-term | 680000 | Accounting information |

Regulatory documents and analytical accounting for account 67

Regulatory documents for accounting on account 67 are the Chart of Accounts and Instructions for its application (Order of the Ministry of Finance dated October 31, 2000 No. 94n), as well as PBU 4/99 “Accounting statements of an organization”, PBU 15/2008 “Accounting for expenses on loans and loans" and other legislative standards.

There are two ways to account for long-term loans/credits:

- on account 67 from the opening date until the end of the maturity period;

- first on account 67 until there are 365 days left until the maturity date, after which the remaining loan amount is transferred to account 66 until the loan/credit accounts payable is completely closed.

The choice of accounting method should be specified in the accounting policy.

Analytical accounting for account 67 is carried out separately:

- on loans/credits;

- to lenders/creditors;

- credit institutions discounting bills and other debt obligations, issuers of bills, bills of exchange;

- issues and placement of bonds;

- foreign currency loans/credits (with mandatory accrual of exchange rate differences on the day of transactions or at the end of the month), etc.

For the purpose of separate accounting, separate sub-accounts are opened for account 67. Accepted sub-accounts must be approved in the working chart of accounts.

Getting a loan

Example

The organization Quadrum LLC received a loan from the bank in the amount of 1,578,000 rubles for a period of 3 years. Principal and interest are paid monthly in equal amounts.

Postings

| Dt | CT | Operation description | Sum | Document |

| 67 | Credit transferred to the organization's account | 1578000 | Bank statement | |

| 91.2 | 67 | Monthly interest accrued (payable) | 15122,50 | Accounting information |

| 67 | Monthly debt payment | 43833,33 | Payment order | |

| 67 | Monthly interest on loan | 15122,50 | Payment order |

Typical transactions for account 52

In the description of account 52 in the Chart of Accounts, almost all accounts appearing in the Chart of Accounts are listed as accounting accounts in correspondence with which postings are allowed. This suggests that foreign currency funds can be used for the same types of transactions as money stored in ruble accounts (subject to the ban on settlements with residents), that is:

- for payment of travel allowances and salaries;

- saving and increasing funds using special accounts;

- settlements with counterparties and payment of taxes;

- issuing loans and obtaining borrowed funds;

- settlements with founders and divisions.

However, from this entire set you can select those correspondence that characterize typical transactions for account 52. These are, for example:

- Dt 52 Kt 62 - receipt of funds from a foreign buyer;

- Dt 60 Kt 52 - payment to a foreign supplier or bank for services;

- Dt 91 Kt 52 and Dt 52 Kt 91 - a reflection of negative or positive exchange rate differences;

- Dt 57 Kt 52 and Dt 52 Kt 57 - accounting for the amount of foreign currency when selling or buying foreign currency;

- Dt 50 Kt 52 - withdrawal of currency for issuance to a business traveler abroad;

- Dt 58 Kt 52 - issuing a loan in foreign currency;

- Dt 52 Kt 66 (67) and Dt 66 Kt 52 - receipt and repayment of a foreign currency loan, as well as payment of interest on it (if interest is paid in foreign currency);

- Dt 52 Kt 75 and Dt 75 Kt 52 - making a contribution to the capital company by a foreign founder and paying dividends to him.

ConsultantPlus experts explained how to revalue the balance of funds in a foreign currency account. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Salary payments from a foreign currency account are possible for employees performing their functions abroad (Dt 70 Kt 52).

Read about the nuances of accounting for currency transactions in the material “Accounting for currency transactions (PBU, postings).”

Obtaining a loan by issuing bonds

The bond determines the right of its owner to receive from the issuer (the one who issued this security) its nominal value within a specified period, as well as, in some cases, a fixed percentage of the nominal value or other property rights.

Expenses for the issue (issue) of bonds are included by the organization in non-operating expenses.

Bonds can be placed at par value, above par value or below par value. In the first case, accounting is carried out only on account 67, in the second case, the difference is taken into account on account 98 “Deferred income”. In the second case, the difference is reflected by entries Dt 91.2 - Kt 67 evenly over the write-off period.

Example of placement above par

Mercury LLC placed a bond on the secondary market worth 15,000 rubles, with a par value of 10,000 rubles. The repayment period is 24 months.

Postings

| Dt | CT | Operation description | Sum | Document |

| 67 | The amount of the bond's par value is reflected | 10000 | Bank statement | |

| 98 | DS received above the nominal value are reflected | 5000 | Bank statement | |

| 98 | 91.1 | Monthly: 5000/24 | 208,33 | Accounting information |

Below par placement example

Saturn LLC placed bonds at a price of 8,000 rubles with a par value of 10,000 rubles. The repayment period is 18 months.

Postings

| Dt | CT | Operation description | Sum | Document |

| 67 | Reflects the amount of funds received from the placement of bonds | 8000 | Bank statement | |

| 91.2 | 67 | Monthly: 2000/18 - price deviation from nominal | 111, | Accounting information |

Accounting for advances received in settlements with customers

If the buyer pays for the goods in advance and makes an advance payment, then to account for settlements with buyers, in this case, subaccount 2 “advance received” is opened on account 62, while subaccount 1 will reflect settlements with buyers in the general case.

VAT is considered and payable on advances received. Then, when goods, works or services are transferred to the buyer, VAT is charged again, this time on the proceeds. The accrued amount of VAT on the advance received is restored, and then an entry is made to offset the advance. You can read more about accounting for VAT on advance payments in the article: “Accounting for VAT on advance payments and gratuitous transfers.”

Postings for accounting for advances received (account 62)

| Debit | Credit | Operation name |

| 51 | 62. Advance received | An advance was received from the buyer to the bank account |

| 76.VAT on advances received | 68 | VAT is charged on the advance received |

| 62/1 | 90/1 | Revenue from sales of goods is reflected |

| 90/3 | 68 | VAT accrued on goods sold |

| 62. Advance received | 62/1 | Offset of advance against debt repayment |

| 68 | 76.VAT on advances received | Accepted for deduction of VAT in connection with the sale of goods paid in advance |

What an accountant needs to know about a loan agreement

Of course, the accountant must have a copy of the document - a credit agreement or loan agreement with a payment schedule for them. To correctly reflect transactions on loans and borrowings in an accounting program, you need to know:

- conditions and form of credit (loan);

- term and procedure for repayment of the principal debt;

- term and procedure for payment of interest.

If you immediately accrue all payments in the accounting program for the future, you will not have to remember them at the end of the reporting period or at the time of their payment. Just remember to adjust all future postings if the conditions for repayment of credit or borrowed funds change.

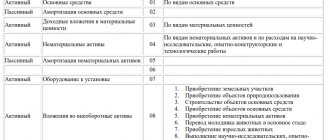

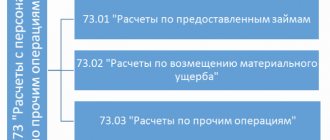

Sub-accounts are opened for account 67:

- 67-01 Long-term loans and borrowings.

- 67-02 Interest on long-term loans and borrowings.

Debit 51, 52, 55, 60... Credit 67-01 - reflects the amounts of long-term loans and borrowings received by the organization.

Long-term loans raised by issuing and placing bonds are accounted for separately in account 67-01. Moreover, if bonds are placed at a price exceeding their par value, then entries are made Debit 51-00... Credit 67-01 (at the par value of the bonds) and 98 (for the amount of the excess of the bond placement price over their par value). The amount allocated to account 98 is written off evenly during the circulation period of the bonds to account 91. If bonds are placed at a price below their face value, then the difference between the placement price and the face value of the bonds is added evenly over the circulation period of the bonds Debit 91 Credit 67-01 .

Interest payable on loans and borrowings received is reflected in the credit of account 67 in correspondence with the debit of account 91. Accrued interest amounts are accounted for separately.

Debit 67 Credit <cash accounts> - loans and borrowings have been repaid. Credits and borrowings not paid on time are accounted for separately.

Analytical accounting of long-term loans and borrowings is carried out according to:

- types of credits and loans, credit institutions and other lenders who provided them.

- individual loans and borrowings.

A separate sub-account to account 67 records settlements with banks for accounting (discount) transactions of bills and other debt obligations with a maturity of more than 12 months.

The accounting (discount) operation of bills and other debt obligations is reflected by the bill-holder organization Credit 67 (face value of the bill) and Debit 51-00 or 52-00 (actually received amount of funds) and 91 (account interest paid to the credit organization).

Debit 67 Credit <accounts receivable account> - reflection of the amount of the bill during the accounting (discount) operation of bills and other debt obligations is closed on the basis of a notification from the credit institution about payment.

Debit 67 Credit <cash accounts> - an entry is made when the bill holder organization returns funds received from a credit organization as a result of discounting (discounting) bills or other debt obligations, due to failure by the drawer or other payer of the bill to fulfill their payment obligations. At the same time, debt for settlements with buyers, customers and other debtors, secured by an overdue bill of exchange, continues to be recorded in the corresponding accounts receivable.

Analytical accounting of discounted bills is carried out according to:

- counterparties (credit institutions that have discounted bills or other debt obligations);

- contracts (separate bills).

Accounting for settlements with credit institutions, lenders and drawers within a group of related organizations, the activities of which are compiled in consolidated financial statements, is kept separately on account 67.

Account 67 “Settlements for long-term loans and borrowings” is used by legal entities to display data on mutual settlements for borrowed funds received for the use of the company for periods of more than 12 months

Account 67 in accounting is necessary for generalization and subsequent analysis of information about ongoing mutual settlements under credit agreements (loan agreements) and interest accrued for the use of borrowed money. Data on mutual settlements for long-term agreements over 12 months is displayed here.

Attention! For accounting of short-term loan agreements (less than 12 months), account 66 is used.

Count 67 is passive. The loan displays the amounts of funds received for temporary use by the enterprise in correspondence with accounts 60,50,51,52, etc. By debit – partial or full repayment of loans and credits.

Attention! For interdependent companies that present unified financial statements based on the results of their activities, mutual settlements for ongoing borrowings are displayed separately.

Additional borrowing can be provided by the company through the issue and subsequent placement of bonds. These transactions are accounted for separately on account 67. In cases where securities are placed at a price above their face value, the excess amount is additionally displayed on account 98. The difference is written off evenly throughout the entire period of placement of securities. In cases where securities are placed at a price below face value, then during the period circulation of bonds, the difference between the values is added evenly from Kt67 to Dt91.

Also, if necessary, a sub-account can be opened for account 67 to separately display information on transactions of transfer of bills by the bill holder to the bank and other obligations of the organization with maturities of more than 12 months (the face value of the transferred bill is taken into account according to Kt67). The completion of the bill accounting operation is carried out on the basis of the received notice from the bank (other financial organization) by displaying the amount of the bill according to Dt67 in correspondence with the accounts receivable. Operations for the return of funds by the bill holder company to the bank as a result of failure to comply with the terms of agreements by the drawer are recorded under Dt67.

Please note! Accounts receivable, the collateral of which were overdue bills of exchange, remain displayed in special accounts.

General account information

Account analytics 67 accounting extended, providing separate accounting:

- for credit institutions in the context of loan agreements;

- for lenders (companies or individuals) in the context of loan agreements;

- by currency of loans and borrowings;

- on interest accrued for the use of credit or borrowed funds;

- and according to other criteria convenient for the organization.

The account may have sub-accounts:

- 67.01 “Settlements on loans and borrowings in Russian rubles”;

- 67.02 “Settlements on loans and borrowings in foreign currency”;

- 67.03 “Calculations of interest for the use of loans and borrowings.”

Account 67 of the accounting chart of accounts is part of the sixth, settlement section. The account is passive. The credit turnover of the account shows the amount of funds received in debt, and the debit turnover shows their return.

In general, accounting account 67 is an indicator of the financial instability of the company. The greater its share in the balance sheet liability, the more the company is exposed to commercial risks. This is the unsightly characteristic of account 67.

Now let's look at the wiring in detail.

Obtaining credits and loans in non-monetary form

The law allows for loans or borrowings in the form of goods or raw materials (materials). These are so-called commercial (commodity) loans. The postings for obtaining a commercial loan will be as follows.

| Contents of operation | Account debit | Account credit | Document | Transaction amount |

| Receipt of goods under a commercial loan agreement | 41.01 (10.01) | 67.01 | Consignment note, loan agreement | Amount according to the document, excluding VAT |

| Amount of VAT on goods received under a commercial loan agreement | 19 | 67.01 | Invoice for delivery note for receipt of goods under a loan agreement | VAT amount on the document |

Posting for accrual of interest under a commercial (commodity) loan agreement.

| Contents of operation | Account debit | Account credit | Document | Transaction amount |

| Interest accrued for using a commercial loan | 91 | 67.03 | Commercial loan agreement, payment schedule | Amount according to the document, excluding VAT |

Account 67 in accounting - common entries for business transactions

- Receiving funds under long-term loan agreements

Dt50,51,52,55 Kt67 – received cash or wire transferDt10.41 Kt67 – capitalization of inventory items, goods under a short-term loan agreement

Dt60 Kt67 – transfer of existing debts to suppliers into a loan from them, transfer of received loans and credits to cover accounts payable

- Display of interest accrued for payment for the use of money

Dt91.02 Kt67 - Write-off of outstanding overdue accounts payable

Dt67 Kt91.01 - Displaying the difference between the par value and the circulation price of securities, accounting for the difference in funds actually received on bills compared to the par value.

Dt91.02 Kt67 - Repayment of loans and credits

Dt67 Kt50,51,52,55 – cash withdrawal from the cash register or non-cash transferDt67 Kt62 – repayment of mutual claims

Characteristics of account 67

This account is included in section VI of the Standard Plan, in which the accounts of the settlement group are located. They are created to characterize relationships with different debtors and creditors. In the modern economy, it is difficult for the average enterprise to manage without borrowing funds. Often this step becomes a “breakthrough” in the development of entrepreneurship.

Accounts 66 and 67 were created specifically to record transactions on loans and credits issued to the company. The procedure for organizing accounting for them is similar, but has one significant difference - the duration of the relationship between the lender and the borrower. Account 66 describes the relationship of the parties to short-term loans, i.e. those that last less than 12 months. Account 67 is intended to account for longer-term transactions occurring over 12 months or more.

It has a passive structure, since account balances at the end of the month are reflected as part of the company's sources. For a loan, there is an increase in borrowed funds (an increase in accounts payable), and for a debit, there is a decrease in debt obligations.