When is vacation pay paid?

The deadline for paying vacation pay is three calendar days before the start of the vacation.

The start date of the vacation is recorded in the vacation schedule or in the employee’s application. That is, for example, an employee who goes on vacation on Friday must be paid vacation pay on Tuesday. If the payment day falls on a weekend or holiday, issue vacation pay the day before (Letter of Rostrud dated July 30, 2014 No. 1693-6-1).

Vacation pay can be issued along with your salary. The main thing is not to miss the payment deadlines. For example, the salary payment deadline is October 5. An employee who goes on vacation on October 6 must be paid vacation pay on October 2 and can transfer his salary. An employee who goes on vacation on October 9 can be given both salary and vacation pay on October 5.

Personal income tax on vacation pay in 2021: when to transfer

Personal income tax is withheld from the entire amount of vacation pay. In this case, the deadline for paying the tax into the budget is no later than the last day of the month in which vacation pay is paid, and if it is a day off, on the first working day of the next month. For example, an employee goes on vacation from January 25 to February 15, 2021. His vacation pay was paid on January 19. In this case, consider the income received on the date of issuance of vacation pay - January 19. Tax must be withheld from the payment on the same day. And personal income tax must be transferred to the budget no later than January 31, 2020 (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Personal income tax payment from vacation pay

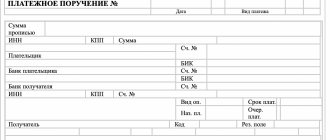

How to correctly fill out a payment order for personal income tax in 2021 is stated in the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n and the Regulation of the Bank of Russia dated June 19, 2012 No. 383-P. The payment order must be filled out on a unified form. This is form 0401060.

Personal income tax on vacation pay must be transferred by the end of the month in which the money was issued (paragraph 2, clause 6, article 226 of the Tax Code of the Russian Federation). Field 107 indicates the month in which employees received vacation pay. For example, if the company issued vacation pay in November 2021, then MS.11.2020 is indicated. If in December, then MS.12.2020. A sample of filling out a personal income tax payment slip in 2021 is presented below.

In 2021, transfer personal income tax from vacation pay to KBK 182 1 01 02010 01 1000 110. Also see “KBK Handbook for 2021”. This code is used by LLCs and individual entrepreneurs that have employees. The procedure for filling out payment slips for personal income tax on vacation pay does not differ for them.

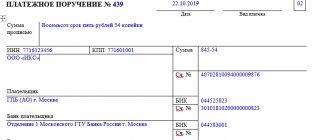

Here is a sample payment order for the payment of personal income tax on vacation pay in 2020:

If you find an error, please select a piece of text and press Ctrl+Enter.

Payment order for vacation pay and sick leave

Personal income tax Until recently, the question of when an organization should transfer personal income tax on vacation pay was considered controversial. Many accountants believed that since vacation pay relates to wages, income tax can be paid at the end of the month along with personal income tax on wages for that month.

The officials, in turn, argued that the tax on vacation pay must be transferred at the time the vacation pay is issued to the employee. At the beginning of this year, the Supreme Arbitration Court resolved the dispute and recognized that tax on income from vacation pay must be transferred either on the day the money is received in the bank, or on the day the money is transferred to the employee’s card. This conclusion is set out in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/07/12 No. 11709/11. Experts from the Ministry of Finance of Russia share the same opinion (letter dated 06.06.12 No. 03-04-08/8-139).

What it is

Based on the Regulations of the Bank of Russia dated June 22, 2012, the purpose of payment refers to the details specified for the transfer of funds. The payment order can be drawn up both electronically and in paper form. But in all cases, the necessary details, including the payer, recipient, sender's bank and payment destination, must be filled in.

Transfer of non-cash payments

All payment orders can be divided into three types:

- transfers to private individuals;

- transferring money to your own accounts;

- payment for goods or receipt of services by individual entrepreneurs or legal entities.

Important! If, when completing a payment order, the necessary details are not specified correctly, the bank may reject the transaction until the inaccuracies are corrected.

Rules for issuing a payment order

- payment order number in the current tax period;

- date of execution of the order;

- type of payment, payment method : by mail, electronic system, etc.;

- field 101 is one of 26 values established by the Order. Since the payer here is a tax agent, it is necessary to enter the number “02”;

- Suma in cuirsive.

- TIN of a legal entity or individual entrepreneur reflected in registration documents;

- KPP - a unique nine-digit number reflected in the certificate of registration with the tax authority;

- full name of the organization , legal entity or individual entrepreneur, as well as the address of the organization or location;

- account number assigned by the bank at the time of registration (20 characters);

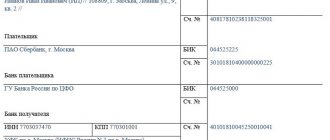

Payer bank details:

- full or abbreviated name of the bank, as well as its location . For example, Joint Stock House “Bank Payment” OJSC, Saratov;

- bank identification code (BIC) , which is assigned to each bank for identification in settlements. The number can be found in the special directory of BIC banks;

- correspondent account number of the financial institution (20 characters).

- full or abbreviated name of the recipient financial institution , as well as its location;

- BIC of the receiving bank;

- a unique twenty-digit number of a correspondent account of a financial institution.

- division of the Federal Tax Service , as well as its location;

- TIN of the Federal Tax Service department;

- Checkpoint of the Federal Tax Service;

- account number in the recipient's bank (20 characters).

- type of operation - a two-digit code indicating the purpose of the operation on the account. For payment orders it is always set to 01;

- the purpose of the payment is not indicated unless otherwise provided by the bank;

- priority of payment established in 345-FZ . The value is set to 5;

- code - a unique accrual code in accordance with the Order of the Ministry of Finance. Usually set to 0;

After indicating the purpose of the payment, the payer's stamp and signature are affixed. It is unacceptable to leave blank fields in the document. If there are any, you must enter the value “0”.

The basic rules for filling out the form are reflected in the letter of the Federal Tax Service No. BS-4-11 / [email protected] According to this letter, in field “107” it is necessary to indicate the month in which vacation pay was accrued, indicating only the month and year, without the number.

How the fields are filled in

Each type of translation has its own rules for filling out the column.

Payments for services

If an individual transfers money as payment for the provision of any service, then the following information must be indicated in the payment:

- full name of the service received, goods purchased or work performed;

- number of the agreement under which the legal relationship between the buyer and seller was established;

- period of provision of work or performance of services;

- payer's bank account;

- if the service was provided in relation to a certain type of property, it must be specified in the payment order. For example, an apartment, a house, a plot of land.

When repaying the payer's debt for the previous period, the month for which the transfers are made is indicated.

Purpose of payment when paying for services

Transfer of own funds

If physical a person transfers money between his personal accounts, then the purpose of the transfer is not required. This is necessary if a person sends money to his account, but in a different bank. In such a situation, you must write “transfer of own funds” in the field. The phrase may sound different, but its meaning should be that the money is not intended for third parties and is not used to pay for any service.

Purpose of payment - what to write and filling options

Non-cash transfers and the use of Internet banking are becoming popular among clients of financial institutions. When making this type of payment online, you must fill out a payment order. It is important to do this correctly so that the funds go in the right direction. Most often, citizens have the question of what to write in the payment instructions?

What it is

Based on the Regulations of the Bank of Russia dated June 22, 2012, the purpose of payment refers to the details specified for the transfer of funds. The payment order can be drawn up both electronically and in paper form. But in all cases, the necessary details, including the payer, recipient, sender's bank and payment destination, must be filled in.

Transfer of non-cash payments

All payment orders can be divided into three types:

- transfers to private individuals;

- transferring money to your own accounts;

- payment for goods or receipt of services by individual entrepreneurs or legal entities.

Important! If, when completing a payment order, the necessary details are not specified correctly, the bank may reject the transaction until the inaccuracies are corrected.

Column "purpose of payment"

How the fields are filled in

Each type of translation has its own rules for filling out the column.

Payments for services

If an individual transfers money as payment for the provision of any service, then the following information must be indicated in the payment:

- full name of the service received, goods purchased or work performed;

- number of the agreement under which the legal relationship between the buyer and seller was established;

- period of provision of work or performance of services;

- payer's bank account;

- if the service was provided in relation to a certain type of property, it must be specified in the payment order. For example, an apartment, a house, a plot of land.

When repaying the payer's debt for the previous period, the month for which the transfers are made is indicated.

Purpose of payment when paying for services

Transfer of own funds

If physical a person transfers money between his personal accounts, then the purpose of the transfer is not required. This is necessary if a person sends money to his account, but in a different bank.

In such a situation, you must write “transfer of own funds” in the field.

The phrase may sound different, but its meaning should be that the money is not intended for third parties and is not used to pay for any service.

Transfer to a third party

You can transfer funds to a third party either by card number or by bank account details. The payment purpose field must contain the purposes of the transfer:

- present;

- alimony;

- material aid.

These can be any transfers that are not related to business or commercial activities.

To transfer money to a private person for performing a certain service, it is necessary that the recipient of the payment has the status of an individual entrepreneur. Otherwise, the bank will refuse to carry out the transaction. If money is transferred for performing any work, it is necessary to register “installation of a dispenser”, “replacement of a meter”, “transport services”.

Transfer to another bank

If the money is sent to another bank, then the reason must be entered in the “payment purpose” field. If we are talking about transferring an organization, you will need to specify for what service and under what agreement the payment is made.

A separate point should be made about replenishing electronic wallets. The payment details must indicate “replenishment of electronic wallet No.”

Transfer to another bank

Transfer of alimony

Payment of child support for minor children is made by the accountant of the organization in which the payer employee works. Part of the money is deducted from the salary on the basis of a writ of execution.

Each payment order is assigned an individual number upon transfer. It is registered automatically after saving the payment. The document must be completed as follows:

- date of payment;

- the document type is selected as electronic;

- complete information about the payer and recipient is filled in, full name, TIN, bank name and account details are indicated;

- the amount is written both in words and in digital values;

- 01 is selected as the type of payment for alimony;

- The order of payments is set to number one;

- In the paragraph the purpose of payment is stated - child support, full name, month, reasons.

Important! Based on Article 855 of the Civil Code of the Russian Federation, alimony payments must be transferred first.

Payment of alimony under a writ of execution

Transfer when paying vacation pay

The Federal Tax Service controls all transactions related to vacation pay and dismissal of employees of enterprises and individual entrepreneurs. The basic rules for filling out payment orders are enshrined in the Federal Tax Service letter No. BS-4/44/13984. In accordance with the approved rules, the purpose of payment in field 107 indicates the month in which vacation pay is accrued, as well as the year, but the number is not indicated.

At the bottom of the document, the reasons for drawing up the order and the month in which vacation pay was accrued are indicated as an assignment. It is important that the payment is transferred no later than the end date of the month in which the charges were made.

Refund of excess transferred funds

If excess funds were transferred to a citizen’s current account or bank card, there is no need to hide this fact. In accordance with Article 1107 of the Civil Code of the Russian Federation, both individuals and legal entities are obliged to return such funds immediately.

Based on paragraph 2 of the same article, it says that the use of other people's funds may be subject to interest at the rate of the Bank of Russia. Therefore, if erroneous entries are found on your bank statement, you must report this immediately.

To do this, you will need to write a notification to the bank in any form. The return application itself is filled out in accordance with the regulations of the financial organization. Notification must be sent no later than ten days from the date of discovery of erroneous deposits.

The bank can do this in two ways:

- if a banking organization can independently write off erroneous amounts, then it will be able to do this without receiving an order from the counterparty. This is the easiest way to resolve the issue, since it takes the minimum amount of time;

- if there is no right to direct debit, then you must wait for the counterparty’s order to return the erroneously credited funds.

When filling out a payment order, in the “purpose of payment” column, you must indicate “return of funds transferred in excess.” In this case, the following entries need to be made in accounting:

51 debit - 62 credit - acceptance of erroneous funds;

62 debit - 51 credit - transfer of erroneously accepted funds.

You will also need to resolve the issue with the tax service regarding the payment of taxes for this amount. If the company operates under the simplified tax system, then all income subject to taxation must be replenished according to the day the erroneous payment was received. As soon as the return is transferred, the founder of the company issues a reversal of the income on the day of sending.

If the company operates according to the OSNO system, then neither the crediting nor the return operation will be reflected in the accounting.

Refund

Wrong transfer of amount

If a person received erroneously transferred funds to an account, then when returning them, they must indicate “return of erroneously transferred funds.” To carry out the return procedure, the buyer must send an appeal to the seller with the details of the incorrect payment and a request to return the funds. Bank details for transfer must be attached to the letter.

If an erroneous transfer of money was made on the basis of an agreement, then the funds must be returned on the basis of its termination. In such a situation, a termination agreement must be drawn up. Based on this document, a refund is generated. In the purpose of payment, the accountant must list the number and date of the agreement.

Since the funds mistakenly credited to the seller’s account do not belong to him, when returning the payment, the VAT wording is used in the purpose of payment.

Other possible options

Non-cash payments are made when transferring for housing and communal services, to pay taxes. When paying off a tax debt, the amount can be paid in full or a partial advance payment can be made. If payment is made using arbitrary details, you must specify the type of taxation:

- on property;

- land;

- transport.

If the sender transfers money voluntarily to the account of a charitable organization, “charity” is entered in the “purpose of payment” field.

Payment of taxes

Recommendations for correct filling

The timely execution of transfers will depend on how correctly the payment order is filled out. The filling rules and samples are approved by the Central Bank. The transfer details are entered into the payment form.

The “payment purpose” column is numbered 24. It can accommodate a maximum of 210 characters if we are talking about an electronic form of the document. The column must contain the following information:

- assignment of payment for services rendered, delivery of goods, performance of work;

- the name of the goods and services for which funds are transferred must be written down;

- what type of payment was made: advance, partial, final;

- number of the agreement on the basis of which the money was transferred;

- other payment details, for example, utility bills, rent.

There are no strict requirements for drawing up the document. The most important thing is that it contains all the necessary information.

Thus, “payment purpose” is an important detail that guarantees the correct receipt of funds. It will be easier to return an incorrect payment if all the necessary information is provided correctly.

Source: https://ontask.ru/development-finances/naznachenii-platezha-chto-pisat-i-varianty-zapolneniya.html

Recommendations for correct filling

The timely execution of transfers will depend on how correctly the payment order is filled out. The filling rules and samples are approved by the Central Bank. The transfer details are entered into the payment form.

The “payment purpose” column is numbered 24. It can accommodate a maximum of 210 characters if we are talking about an electronic form of the document. The column must contain the following information:

- assignment of payment for services rendered, delivery of goods, performance of work;

- the name of the goods and services for which funds are transferred must be written down;

- what type of payment was made: advance, partial, final;

- number of the agreement on the basis of which the money was transferred;

- other payment details, for example, utility bills, rent.

There are no strict requirements for drawing up the document. The most important thing is that it contains all the necessary information.

Thus, “payment purpose” is an important detail that guarantees the correct receipt of funds. It will be easier to return an incorrect payment if all the necessary information is provided correctly.

Payment order transfer of vacation pay sample

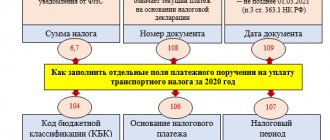

Columns 61 and 103 of the payment order indicate the checkpoint and tax identification number. In field 104, the KBK code for paying personal income tax on vacation pay is indicated. It was changed in 2021.

The rules for filling out a payment order for the payment of personal income tax are approved by the Order of the Ministry of Finance. They indicate that in field 107 you need to reflect the tax period. The frequency of tax payment can be monthly, quarterly, semi-annual or annual. Here are a few examples. Personal income tax on wages, bonuses and material benefits must be transferred to the budget no later than the day following the day of payment of income (paragraph 1, clause 6, article 226 of the Tax Code of the Russian Federation). Example. The employer paid wages for July to employees on August 4, 2021. In this case, the date of receipt of income will be July 31, the date of tax withholding will be August 4.

Deadlines for filing income taxes

Vacation pay is always subject to income tax. The employee receives the amount minus personal income tax. Tax withholding is made on the day of issuance of vacation pay, and its transfer is due no later than the last day of the current month.

This rule also applies to rolling vacation pay, when the start of the vacation falls on one month and the end on another.

Thanks to such payment deadlines, the accountant can transfer income tax at the end of the month for several employees who went on vacation. To pay, it is enough to fill out one payment order form.

Example:

The employee took leave from February 20 to March 12, 2021. They accrued his vacation pay on February 16 and withheld income tax on the same day. Personal income tax must be transferred by February 28 of this year.

The letter from the Federal Tax Service dated July 12, 2016 states that it is necessary to fill out separate payment orders if income tax is transferred on vacation pay this month and personal income tax on wages for last month.

How is it filled out?

When filling out a payment order, it is important to remember that all amounts are written in full rubles. Pennies are rounded according to arithmetic rules.

There should also be no blank fields. The write-off amount and date should be written in words and numbers. The chronological order of payment invoice numbering should not be violated.

Each field on the payment form has its own number.

The payer status is indicated in 101 fields. According to the law, there are three types of status and corresponding codes:

- Tax agent, code - "02".

- Individual entrepreneur, code – “09”.

- Individual, code – “13”.

If the payment is filled out by a budget organization, then code “02” is filled in.

In field 16 entitled “Recipient” it is written – Federal Treasury Department for .... region. The name of the tax office is also written in brackets.

Columns 61 and 103 of the payment order indicate the checkpoint and tax identification number.

In field 104, the KBK code for paying personal income tax on vacation pay is indicated. It was changed in 2018. Now, when listing vacation pay, you should indicate the code 18210102010011000110.

21 fields indicate the order of payment; there are two types. The number 5 is put if the monthly withheld personal income tax is transferred, and the number 3 is put when the income tax is transferred in connection with the requirement of the tax inspectorate. Such designations are needed so that the bank understands in what order to transfer money.

Column 105 in the payment slip is filled out in connection with the order of Rosstandart of 2013. The OKTMO code is indicated here, which has eight digits.

In the next 106th column of the payment order, the target direction of the payment is filled in. It consists of two letters:

- ZD – voluntarily transferred debt.

- AP – repayment of arrears according to the tax inspection report.

- TP – current payment.

- TR – repayment of debt at the request of inspection authorities.

If none of these encodings are suitable, then you need to write “0”.

The frequency of payment of income tax is indicated in the payment slip in gr. 107.

Here you can write a specific date.

The word “frequency” means the period for which the tax is transferred. She may be:

- Menstruation - MS,

- Quarterly - KV,

- Semi-annual - PL.

- Annual - GD.

For example, if money is transferred from vacation pay assigned in March 2021, then “MS.03.2019” is written on the payment form.

In gr. 108 of the payment order form, as a rule, is always entered “0”. The figure needs to be changed when the debt is repaid due to the requirement of the regulatory authority.

In field 109 of the order, write the date of certification of the declaration for tax payment. The number “0” is entered when the tax is transferred earlier than the declaration is submitted. If the debt is repaid at the request of the tax office, then the repayment date is filled in this field.

In the remaining columns of the payment order, the details of the payer and recipient of the amount and other data are entered:

- 3 – payment order number.

- 4 – document date.

- 6 – amount in words.

- 7 - sum in numbers.

- 8 – name of the payer.

- 9 – Payer’s current account.

- 10 – Payer’s bank.

- 12 – Payer’s bank account.

- 13 – Recipient's bank.

- 17 – Recipient's bank account.

Fields 11 and 14 indicate BIC, that is, bank identification code.

Column 24 indicates the purpose of the payment.

Incorrect information will result in the payment being returned, which may result in late income tax penalties.

After filling out the document, it is secured with a signature and seal.

What purpose of payment should I indicate when transferring?

When filling out a payment order from vacation pay, you need to indicate its purpose. Since vacation pay is written on a separate payment slip from the salary, the following purpose is indicated in this field: “Income tax for individuals on vacation pay for _______ 2019.”

The name of the month in which the accrual is made is indicated in the blank space.

Sample payment slip

Below is an example of filling out a payment order when transferring income tax on vacation pay:

Personal income tax on vacation pay in 2021: when to transfer

For individuals - last name, first name, patronymic of the individual fulfilling the duty of the payer to make payments to the budget system of the Russian Federation. In the 4th and 5th digits of the tax period indicator, the month number of the current reporting year is indicated for monthly payments, the quarter number for quarterly payments, and the half-year number for semi-annual payments. If the tax is paid only once a year, then zeros (“0”) must be entered here.

In personal income tax payments, you must fill out field 107 “Tax period”. According to personal income tax, the period is one year. The rules for filling out payment orders say that if there is more than one payment deadline for an annual payment and there are specific dates for each deadline, then these dates must be filled in (clause 8 of the Rules, approved by order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n). Personal income tax on vacation pay is required to be transferred when issuing money. Whether this means that the exact date is filled in on the payment slip, we found out from the Ministry of Finance.

When to transfer personal income tax

In a payment order for the transfer of personal income tax, like any other tax, it is required to indicate the KBK , OKTMO, the basis for payment (current payment or repayment of debt for expired periods, etc.), data of the tax period for which payment is made, number and date document on the basis of which the tax is transferred. If there is no information about the basis document, then the value 0 is entered in the corresponding fields of the payment order.

Sample personal income tax payment order

The “Payment Type” field starting from January 1, 2015 in tax bills does not need to be filled in due to the changes made by Order of the Ministry of Finance of Russia dated October 30, 2014 No. 126n “On Amendments to Appendices No. 1, 2, 3 and 4 to the Order of the Ministry of Finance Russian Federation dated November 12, 2013 No. 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation.”

The organization establishes the form of payment of wages in the employment or collective agreement (Part 3 of Article 136 of the Labor Code of the Russian Federation). The Labor Code of the Russian Federation also applies to foreign employees (Article 11 of the Labor Code of the Russian Federation). This means that the organization has the right to provide for the payment of wages in cash in the employment contract with a foreigner.

How to indicate vacation pay in a payment order

If none of these encodings are suitable, then you need to write “0”. The frequency of payment of income tax is indicated in the payment slip in gr.

This code is used by LLCs and individual entrepreneurs that have employees. The procedure for filling out payment slips for personal income tax on vacation pay does not differ for them.

With regard to wages, everything is more and less clear - the month for which wages are paid is indicated. For example, if you pay personal income tax on wages for January 2018 in February, in field 107 you need to indicate: “MS.01.2018”. According to personal income tax, the period is one year. The rules for filling out payment orders say that if there is more than one payment deadline for an annual payment and there are specific dates for each deadline, then these dates must be filled in (clause 8 of the Rules, approved by order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n). Personal income tax on vacation pay is required to be transferred when issuing money.

Online magazine for accountants

Home Rules for filling out a payment order when paying personal income tax on vacation pay in 2021 - According to the law, in 2021 the procedure for filling out a payment order has changed. There have been changes in the payment of vacation pay and the timing of personal income tax transfers from this type of income.

Below we discuss how to fill out each field of the payment order, and also present a completed sample order. CONTENT:

- Deadlines for filing income taxes

- How is it filled out?

- What purpose of payment should I indicate when transferring?

- Sample payment slip

- Useful video

- conclusions

Deadlines for processing income tax Holidays are always subject to income tax.

The employee receives the amount minus personal income tax. Tax withholding is made on the day of issuance of vacation pay, and its transfer is due no later than the last day of the current month.

Purpose of payment when transferring vacation pay

For example, it is impossible to generate one payment slip for the payment of personal income tax from wages and from compensation upon dismissal, since despite the fact that they have the same deadline for transferring personal income tax (the day following the payment of income), they do not have the same date of receipt of income (for wages). payment is the last day of the month, for compensation - the day of payment). It is necessary to withhold and transfer personal income tax from vacation pay when paying them. The date of payment is known exactly, which is why it is written in the order (clause 1 of Article 223, clause 6 of Article 226 of the Tax Code of the Russian Federation). Since the new year, the rules for paying insurance premiums have changed, and there are other changes in the preparation of payment bills. In this article we will talk about this and give an example of a ready-made payment document. We will also figure out how to transfer taxes to the budget in 2021. Payment orders for the transfer of tax to the budget to the appropriate account of the Federal Treasury are filled out in accordance with the Rules established by Order of the Ministry of Finance dated November 12, 2013 N 107n. And what’s most interesting is that it was field “107” (matching the Order number) of the tax payment that turned out to be problematic. This is also surprising because no changes were made to the Rules in this part. So why did all the fuss suddenly arise?

Sample payment order for personal income tax 2021 from employee salaries

In general, when paying wages, the day on which the income was actually received is the last day of the month of payroll. Personal income tax is withheld on the day of its payment. When paying salaries in installments, you must pay tax on each installment.

In general, personal income tax is not withheld from the advance payment. However, it must be withheld when the advance is paid on the last day of the month or when the employee receives income in kind or material benefit in the current month.

Make a payment slip and transfer personal income tax on the day of salary payment or no later than the next day.

How to fill out field 107 in a personal income tax payment slip from vacation pay

New rules for filling out payment orders from 2021 will help you correctly draw up a payment document and pay all taxes on time.

There is no liability for errors in field 107 of the payment order. For example, if the company recorded when paying tax on vacation pay - MS.06.2015. The main thing is that the company withholds and transfers personal income tax on time. Payments will not be lost and will reach the inspection. Therefore, if the company previously filled out field 107 differently, there is no need to clarify the instructions.

Namely, separate payment deadlines have now been established for personal income tax on wages, vacation pay and sick leave. Therefore, personal income tax from your salary must be paid in one payment.

Yes, starting from 2021, a company may indeed not have to pay taxes and fees on its own—they can be paid for the company by a third party. Such amendments were finally approved by the State Duma.

Purpose of payment payment for sick leave

A certificate of incapacity for work can be issued and closed by one medical institution, with the exception of the case if the treatment was initially inpatient and completed in an outpatient treatment organization. A sick leave certificate must be issued on the day of application to a medical institution.

If a person seeks medical help after a working day, then the date of the next day can be indicated on the certificate of incapacity for work. If a person caring for a patient is on maternity or regular leave, on leave without pay, then sick leave is issued at the end of these leaves.

When drawing up a sick leave certificate, use purple, black or blue ink or a ballpoint pen.

The recording is made in Russian. If an error is made when filling out, then you must write down: “Believe the corrected one” and confirm it with the doctor’s signature and seal.

We fill out a payment order to pay sick leave and personal income tax.

And what covers two months: January and February, is it still necessary to write personal income tax for February 2015? please decipher your answer. In the payment receipt field, write in the payment basis field: indicate the period MS.02.2015, therefore, no matter what period the b/l covers, the personal income tax withheld from it will apply to the month in which you paid it and if suddenly for some reason If you paid this same bill in April, then the personal income tax on it would already be for April and would not be accrued in the program, and there seems to be no mention of personal income tax anywhere.

If the tax is not provided, then it is done.

So, having figured out what to write in the “purpose of payment” column, one more circumstance should be taken into account. The payment order must be filled out on a unified form - form 0401060.

A sample of filling out a personal income tax payment in 2021 from sick leave is presented below. In 2021, transfer personal income tax from sick leave to KBC 182 1 0100 110. Also see “KBK Handbook for 2021”.

8 Rules, approved.

by order of the Ministry of Finance of Russia dated 12.11.

2013 No. 107n). In field 107 the 10-digit tax period code is entered. New rules for filling out payment orders for the transfer of taxes and fees Thus, from July 2021, separate payment documents with different indicators of the tax period should be generated.

This is done if tax legislation provides for more than one deadline for payment of tax payments and specific dates for payment of the tax (fee) are established for each deadline.

Payment of benefits (or vacation? or sick leave?) for pregnancy and childbirth? I don’t see any sick leave number.

I only find on the Internet a paid resource for downloading a sample, I don’t risk getting involved. Purpose of payment when paying sick leave and personal income tax on sick leave We fill out a payment order for paying sick leave and personal income tax on sick leave.

What do we indicate in field 107? Personal income tax from sick leave and vacation pay: how to fill out line 107 of the personal income tax payment and vacation pay: how to fill out line 107 of the payment slip The Federal Tax Service of the Russian Federation in its letter dated 09/01/2018 No. BS-3-11/ clarified the procedure for filling out detail 107 in the order on the transfer of funds upon payment Personal income tax on sick leave benefits and vacation pay.

Important The Department reminds that in detail “107” of the order for the transfer of funds, the specific date for payment of the tax is indicated if the legislation provides for more than one deadline for payment of such a tax payment.

What do we indicate in field 107? Personal income tax from sick leave and vacation pay: how to fill out line 107 of the personal income tax payment and vacation pay: how to fill out line 107 of the payment slip The Federal Tax Service of the Russian Federation in its letter dated 09/01/2018 No. BS-3-11/ clarified the procedure for filling out detail 107 in the order on the transfer of funds upon payment Personal income tax on sick leave benefits and vacation pay.

The Agency reminds that in detail “107” of the order for the transfer of funds, the specific date for payment of the tax is indicated if the legislation provides for more than one deadline for payment of such a tax payment.