Deduction rules

The updated Tax Code, namely Chapter 34 introduced in 2021, regulates the relationship between Russian employers and funds: the table of contributions to funds in 2021 will show their values and the BCC codes by which transfers are made.

The current fiscal legislation establishes that an employer, be it an organization or an individual entrepreneur, who uses hired labor in its activities, is obliged to calculate and pay insurance contributions to the state budget. Payments and taxes from wages in 2021, depending on their purpose, are sent to the corresponding extra-budgetary funds. The funds are then used as financing:

- pensions and pension savings of Russian citizens;

- free medical care;

- benefits and payments for temporary disability of workers, including maternity.

Let us note that employers must transfer contributions from accidents and occupational diseases to the Social Insurance Fund. The specifics of the application of this type of insurance coverage are enshrined in Law No. 255-FZ.

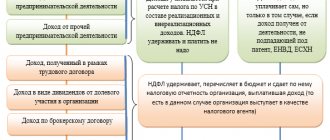

In addition to insurance coverage, employers calculate income tax on wages in 2021 to the Federal Tax Service. Personal income tax, or personal income tax, has a flat rate of 13%.

What expenses should be taken into account as social security contributions?

According to Russian laws, expenses for social obligations include contributions to social, pension and health insurance. Until 2001, such expenses also included contributions to the fourth extra-budgetary fund - the Employment Fund. But after the transition to a single social tax, employers’ obligations were reduced to transferring payments only to three extra-budgetary funds.

Despite the fact that the employment fund has long been gone, some departmental guidelines for accountants still retain the wording stating that a certain percentage of labor costs must be transferred to this organization. But this recommendation no longer needs to be followed.

Objects of taxation

Despite the different concepts, many citizens believe that the payroll tax in 2021 is not only personal income tax, but also all insurance contributions. But officials quite strictly differentiated these terms.

Note that the key difference between personal income tax and insurance coverage is that income tax is withheld directly from the salary amount. But the employer pays insurance premiums to the budget from his own funds, that is, he accrues them “in excess” of the wages.

The object of taxation in both cases is the amount of remuneration for labor. For example, the payroll tax applies not only to official salary, but also to all types of compensation and incentive payments. For example, bonuses, extra pay for night work, payment for overtime hours and holidays.

What percentage?

The amount of payroll deductions can vary significantly depending on where the funds are sent.

Today, the following deductions must be made from the amount provided as wages:

- 22% towards the calculation of a future pension;

- 13% towards payment of personal income tax;

- 5.1% to the Compulsory Medical Insurance Fund;

- 2.9% to the Social Insurance Fund;

- from 0.2 to 8.5% for insurance against accidents that may occur at work (the exact amount depends on the risk class, which includes the profession and position of the employee).

Rates and deductions

Currently, employers withhold personal income tax on all income of their employees at a flat rate. We noted the percentage of the 2021 payroll tax: personal income tax is 13%. Officials have provided a number of tax deductions for working professionals.

Thus, an employee has the right to claim a child deduction - the most common in Russia. Legislators also provided for professional, property, investment and social tax benefits. Read more in the article “How a citizen can get a tax deduction.”

Tariffs for insurance premiums

To calculate contributions for pension, health insurance and in case of VNIM, the following are established:

- Basic tariffs

- Reduced rates

- Additional tariffs for OPS

VNiM contributions are insurance contributions to the Social Insurance Fund for temporary disability and maternity.

Basic tariffs of insurance premiums for compulsory health insurance, compulsory medical insurance and for cases of VNiM

If the employer does not have the right to apply reduced tariffs, then insurance premiums must be calculated from the salaries of employees according to the basic

tariffs.

| Rates | Insurance premiums for OPS | Insurance premiums for VNIM (in case of temporary disability) | Insurance premiums for compulsory medical insurance |

| From payments within the established limit of the base for calculating contributions | 22% | 2.9%, 1.8% - from payments to foreigners and stateless persons temporarily staying in the Russian Federation (except for highly qualified specialists) | 5,1% |

| From payments in excess of the established limit of the base for calculating contributions | 10% | X |

Reduced rates of insurance premiums for compulsory medical insurance, compulsory medical insurance and for cases of VNIM

Reduced rates are provided for policyholders making payments and other remuneration to individuals

insurance premiums. In this case, contributions are calculated within the established limit of the base.

This means that if an employee’s salary exceeds the base limit, then insurance premiums for payments in excess of the established limit are not charged.

| Policyholders | Rates |

| Individual entrepreneurs and organizations included in the SME register for payments in excess of the minimum wage | From 04/01/2020: for compulsory medical insurance - 10.0%, for VNiM - 0%, for compulsory medical insurance - 5% This tariff also applies to payments in excess of the established maximum base amount |

| Charitable organizations on the simplified tax system | During 2021 - 2024: for compulsory medical insurance - 20.0%, for VNiM - 0%, for compulsory medical insurance - 0% |

| Non-profit organizations (except for state (municipal) institutions) on the simplified tax system, carrying out activities in the field of social services for citizens, scientific research and development, education, healthcare, culture and art, mass sports (with the exception of professional) | |

| Organizations engaged in the production and sale of animated audiovisual products produced by them | During 2021 - 2023: for compulsory medical insurance - 8.0%, for VNiM - 2.0%, for compulsory medical insurance - 4.0%. In case of temporary disability from payments to foreign citizens (stateless persons) temporarily staying in the Russian Federation (except for highly qualified specialists) - 1.8% |

| Insurers making payments to crew members of ships registered in the Russian International Register of Ships | During 2021 – 2027: for compulsory health insurance – 0%, for VniM – 0%, for compulsory medical insurance – 0% |

| Participants in the special administrative region in the territories of the Kaliningrad Region and Primorsky Territory, making payments to crew members of ships registered in the Russian Open Register of Ships | |

| Participants of the Skolkovo project | For compulsory medical insurance - 14.0%, for VNiM - 0%, for compulsory medical insurance - 0% |

| Organizations operating in the field of information technology | For compulsory medical insurance - 6.0%, for VNiM - 1.5%, for compulsory medical insurance - 0.1% |

| Participants of the free economic zone in the territories of the Republic of Crimea and the city of Sevastopol | |

| Residents of the territory of rapid socio-economic development | |

| Residents of the free port of Vladivostok | |

| Residents of the special economic zone in the Kaliningrad region | |

| Organizations developing electronic components and electronic products |

From 01.04.2020

Until

June 30,

2020, there is a zero tariff for small and medium-sized businesses operating in the sectors of the economy most affected by the coronavirus.

Additional tariffs for insurance premiums for compulsory health insurance

For payments in favor of insured persons who are employed in certain types of work, policyholders must also pay contributions to compulsory health insurance at the following additional rates.

| Conditions | Class of working conditions | Subclass of working conditions | Additional tariff in relation to payments in favor of individuals who are employed in the work specified in Part 1 of Art. 30 of the Law on Insurance Pensions | |

| clause 1 | p.p. 2 – 18 | |||

| There is no special assessment of working conditions (up-to-date certification of workplaces) | — | — | 9% | 6% |

| There is a special assessment of working conditions (up-to-date certification of workplaces) | Optimal | 1 | — | |

| Acceptable | 2 | — | ||

| Harmful | 3,1 | 2% | ||

| 3,2 | 4% | |||

| 3,3 | 6% | |||

| 3,4 | 7% | |||

| Dangerous | 4 | 8% | ||

What is the base limit?

If wages exceed the established limit, the applicable tariff for calculating insurance premiums changes.

| Insurance premiums | Base limit | |||

| 2021 | 2020 | 2019 | ||

| For compulsory pension insurance | RUB 1,465,000 | RUB 1,292,000 | RUB 1,150,000 | |

| For compulsory social insurance in case of temporary disability and in connection with maternity (VNiM) | RUB 966,000 | 912,000 rub. | 865,000 rub. | |

There is no maximum base for calculating insurance premiums for compulsory health insurance

.

Salary deduction rates

When applying for a job, an employee has the right to know what tax rates are imposed on his monthly income. So, in 2020, the first tax that a working person will have to pay is income tax, calculated at 13%. You must also be prepared to share the following amounts with government funds:

- Contributions for social needs are sent to the insurance part of the Pension Fund, regulated by a rate of 16%. If the insured individual is already 49 years old as of 2021, no premiums will be charged. The same applies to the funded part of the Pension Fund - it will not affect citizens over 49 years of age; other workers are required to transfer money in the amount of 6% of income.

- Contributions for social needs provide for the situation if an employee is temporarily unable to work, submits a doctor’s medical report and sick leave (with stamps and signatures) drawn up in accordance with legal standards. In this regard, he, being healthy, makes contributions in the amount of 2.9%.

- Insurance against accidents at work primarily takes into account the level of professional risk, so the worker will have to sacrifice his hard-earned money on an individual basis.

- In 2020, 5.1% of wages goes to the Federal Compulsory Health Insurance Fund.

If we sum up all the indicated rates, we can calculate that in 2020, contributions for social needs amount to 30% of a worker’s officially registered earnings. Of course, wages in Russia are not very high, so for part of the population, giving the state almost a third of their accrued income means living from hand to mouth. Therefore, reduced tax rates apply to those earning the minimum wage.

The procedure for paying insurance premiums and declaring in 2019-2020

The bases for the application of basic and reduced contribution rates have been established for 2021 and 2021. Once the cap limit is reached, lower rates apply.

| 2019 | ||||

| Contributions | Limit amount | Basic rate | Reduced rate | |

| on OPS | RUB 1,150,000 | 22% | 10% | |

| on OSS | 865,000 rub. | 2,9% | contributions are not charged | |

| on compulsory medical insurance | not installed | 5,1% | ||

| 2020 (planned) | ||||

| Contributions | Limit amount | Basic rate | Reduced rate | |

| on OPS | RUB 1,292,000 | 22% | 10% | |

| on OSS | 912,000 rub. | 2,9% | contributions are not charged | |

| on compulsory medical insurance | not installed | 5,1% | ||

Accrued contributions are transferred to the appropriate details once a month. The month of payment is preceded by the month of accrual. Payment is due until the 15th day inclusive. Declaration is carried out by submitting a calculation in the established form. Both payments and settlement of contributions are sent to the Federal Tax Service.

Find the BCC for payment of insurance premiums in 2019-2020 here.

The procedure for paying and declaring contributions to OSS for industrial accidents is somewhat different. Declaration is carried out quarterly in Form 4-FSS, and calculations are made according to the insurance tariff specified in the Law “On Insurance Tariffs” dated December 22, 2005 No. 179-FZ.

In 2021, the procedure for paying and declaring contributions will not change. The list of fees payable will also remain the same. The tariffs for deductions to funds from wages established in Art. 425 of the Tax Code of the Russian Federation and Art. 1 of Law No. 179-FZ.