The reporting form has changed for 2021

The Federal Tax Service, by order dated 09/11/2020 No. ED-7-3/ [email protected] , changed the form of the income tax return; the order will come into force on 01/01/2021 and applies to the return for 2021. We report for the 3rd quarter on the current form and in electronic format.

The amendments are related to changes in legislation and the Tax Code of the Russian Federation since the approval of the previous form. The report has been changed:

- sheet 02 “Tax calculation”;

- Appendix No. 4 to l. 02 “Calculation of the amount of loss or part of a loss that reduces the tax base”;

- Appendix No. 5 to l. 02 “Calculation of the distribution of advance payments and corporate income tax to the budget of a constituent entity of the Russian Federation by an organization that has separate divisions”;

- Section A “Calculation of investment tax deductions from advance payments and taxes subject to credit to the budget of a constituent entity of the Russian Federation” of Appendix No. 7 to l. 02 “Calculation of investment tax deduction”;

- Section D “Calculation of the reduction in the amount of advance payments and corporate income tax subject to credit to the federal budget when the taxpayer applies an investment tax deduction” of Appendix No. 7 to l. 02 “Calculation of investment tax deduction”;

- sheet 04 “Calculation of corporate income tax on income calculated at rates different from the rate specified in paragraph 1 of Article 284 of the Tax Code of the Russian Federation”;

- page with barcode “00214339” in sheet 08 “Income and expenses of a taxpayer who has made an independent (symmetrical, reverse) adjustment”;

- Appendix No. 2 to the declaration.

The FTS form also updated the barcodes. In 2021, the reporting took into account preferential tax treatment for:

- residents of the Arctic;

- IT companies;

- companies that process hydrocarbons into petrochemical products and produce liquefied natural gas.

Check for free that you filled out the new form correctly using ConsultantPlus.

Income tax: how to fill out and submit the declaration the first time

In March, companies submit their annual income tax returns. By this time, you can tighten up all the “tails” if you need to submit adjustments for previous periods. Declarations submitted on an accrual basis are more difficult than, for example, a VAT return - if you have an error in the amount, you do not need to redo all the reports for subsequent periods.

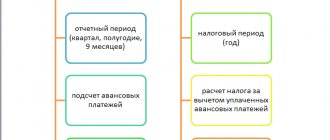

Calculation of advance payments

Filing reports always takes place in a nervous environment (if it is not a “dummy”), and rarely can anyone boast that they have submitted their income tax return in advance. But if you, like the majority, are once again refilling your income tax return at the last minute, then problems may arise with the accrual of advances, which will put you in an awkward position in front of the Federal Tax Service inspector. We recommend using the table to check the calculation of advance payments.

Payment of advance payments

You have calculated everything correctly, paid the tax and sent the declaration. Sometimes accountants overpay tax a little, on a “so it may be” principle. If suddenly there is a fine or penalty, then you can count it against the overpayment. But there are pitfalls here. When paying monthly advance payments, we sometimes pay the entire quarterly amount at once to protect ourselves, because there is a possibility of forgetting about them. But, just like overpayment of tax, the total amount of the advance payment is a double-edged sword. In the 1C: Accounting program, edition 3, it is possible to request reconciliation of settlements with the Federal Tax Service.

When checking calculations against the tax office, you should always remember that you paid for the entire period, and they will write off the amounts monthly, and a large positive balance of calculations only indicates that the tax office has not yet written off the required monthly amount. Therefore, to control the balance, it is better to reconcile a week after the 28th. Usually, just after a week, data on payments appears in the Federal Tax Service database, from which they provide extracts.

Income tax: main changes in 2021

One of the most pleasant changes is the investment tax deduction, which was approved by Federal Law No. 335-FZ of November 27, 2017. You can reduce the income tax (namely the tax itself, and not the basis for calculation) by part of the cost of the purchased operating system or its modernization. You can take as a credit up to 90% of the costs, but the amount of tax paid must be at least 5% of the tax base to the regional budget and at least 10% to the federal budget. The following conditions must also be met:

- the accounting policy of the organization must stipulate the use of INV;

- local legislation supports this benefit;

- The OS must be purchased or upgraded from 01/01/2018;

- The OS must belong to III-VII depreciation groups with a service life of 3 to 20 years.

All requirements are specified in detail in Art. 286.1 Tax Code of the Russian Federation.

Now it has become very popular to send employees for training. From 2021, an employer can take into account the costs of training an employee when calculating income tax in accordance with Art. 264 Tax Code of the Russian Federation. The legislator, trying to support domestic developments, added new items to the list of R&D costs (Article 262 of the Tax Code of the Russian Federation). From 2021, these include exclusive rights to inventions and utility models, but only if they are used specifically for scientific purposes.

Contact us and we will answer them, 8(804) 333-16-02

Best regards, e-office24 team!

Share with your friends!

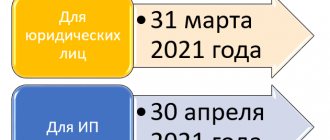

Due date in 2021

Income tax payers are divided into two categories:

- those who pay advances quarterly;

- those who pay advances monthly.

Companies whose income for the previous 4 quarters does not exceed 15 million rubles (the limit has been increased in 2021 from 10 million rubles) are entitled to submit declarations quarterly. Other companies pay advances once a month from actual profits, so they also fill out reports every month.

Let's present the deadline for filing income tax returns in the form of tables.

Quarterly reporting

| Period | Term |

| 2020 | Until March 28, 2021 |

| 1st quarter 2020 | Until 04/28/2020 |

| Half year | Until July 28, 2020 |

| 9 months | Until October 28 |

Monthly reporting

| 1 month 2020 | Until February 28 |

| 2 months 2020 | Until March 30 |

| 3 months 2020 | Until April 28 |

| 4 months 2020 | Until May 28 |

| 5 months 2020 | Until June 29 |

| 6 months 2020 | Until July 28 |

| 7 months 2020 | Until August 28 |

| 8 months 2020 | Until September 28 |

| 9 months 2020 | Until October 28 |

| 10 months 2020 | Until November 30 |

| 11 months 2020 | Until December 28 |

| 2020 | Until 01/28/2021 |

Deadline

The profit report is submitted quarterly, but calculations are entered into it on an accrual basis.

All taxpayers submit four declarations per year: annual, 3 months, 6 months and 9 months. However, advance payments are made to the budget not only quarterly, but also monthly, depending on the law that guides the company. Upcoming form submission deadlines will be in 2021:

- Annual report for 12 months of 2015 – March 28, 2016;

- For 3 months of 2021 – April 28, 2021;

- For 6 months of 2021 – July 28, 2021;

- For 9 months of 2021 – October 28, 2021.

In 2021, by coincidence, the nominal deadlines coincide with the calendar ones, but this does not always happen. If the day of dispatch falls on a weekend or coincides with a public holiday, the deadline is moved to the next working day.

Failure to submit a document within the deadlines specified above entails a whole range of troubles:

- A fine of 5 to 30% of the tax amount. If the amount is very small or the form is submitted at a loss, the tax authorities will increase the amount to one thousand rubles.

- The fine for an official for missing deadlines is from 300 to 500 rubles.

- Blocking of the current account until the report is submitted, and no transactions are possible on the blocked account, even paying taxes. This will certainly lead to penalties and new fines.

- Several delays put the organization on the waiting list for an on-site inspection. There is an open list of conditions that lead to such measures against a taxpayer, and late submission of reports is one of them.

If you are interested in how to submit 4-NDFL, check out this material.

What has changed in the declaration in 2021

The current form of the income tax return was approved by order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected] Compared to the previous form, it has undergone significant changes: the barcode has changed, new taxpayer identification codes have appeared. For the majority of organizations this is still 01, but there are also the following:

- 07 and 08 - for participants in investment projects and investment contracts;

- 09 and 10 - for educational and medical organizations;

- 11 - for those who combine medical and educational activities;

- 12 - for social service organizations;

- 13 - for travel agencies;

- 14 - for regional MSW operators.

If, in accordance with regional legislation, the taxpayer has the right to a reduced tax rate, in line 171 on sheet 02 we indicate the details of the regional regulatory act.

In addition, lines have appeared to indicate the tax base for participation in an investment partnership; new appendix No. 7 to l. 2 must be completed by those applying the investment deduction.

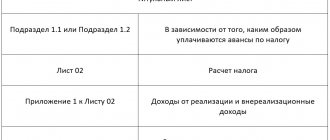

How to fill out correctly for the 3rd quarter of 2021

The current tax return for corporate income tax consists of:

- title (sheet 01);

- subsection 1.1 of section 1;

- sheet 02;

- appendices No. 1 and No. 2 to l. 02.

This is a required part.

The remaining applications and pages are completed if the following conditions are met:

- subsections 1.2 and 1.3 of section 1;

- appendices No. 3, No. 4, No. 5 to l. 02;

- sheets 03, 04, 05, 06, 07, 08, 09;

- appendices No. 1 and No. 2 to the declaration.

See the detailed procedure for filling out the income tax return in 2021 in the appendix to order No. ММВ-7-3/ [email protected]

How are indicators reflected in the income statement?

The results of calculating income and expenses taken into account for tax purposes are recorded in the income tax return, also on an accrual basis.

As a result, the income received from the previous reporting period is added to the income of the current quarter, and similarly for expenses.

The amount of advance income tax payable for a quarter, half a year and 9 months is shown minus the amounts paid for previous reporting periods. And if a loss is received, the amount of tax payable will be reduced by the amount previously paid to the budget in advance.

Similar articles

- Advance payments on profits

- An example of filling out a simplified taxation system income tax return for 2021

- Rules for calculating the minimum tax under the simplified tax system

- How to calculate income tax

- How to calculate income tax: example

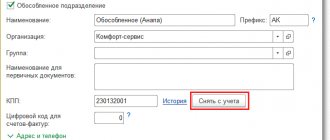

Important nuances of filling out the declaration

Need to consider:

- The title contains information about the organization; successors of reorganized companies indicate the Taxpayer Identification Number (TIN) and KPP assigned before the reorganization. The codes of the reorganization forms and the liquidation code are indicated in Appendix No. 1 to the procedure for filling out the declaration.

- Two additional sheets - 08 and 09. Sheet 08 are filled out by organizations that have adjusted (lowered) income tax due to the use of below-market prices in transactions with dependent counterparties. Previously, this information was placed in Appendix 1 to l. 02.

- Sheet 09 and Appendix 1 to it are intended to be filled out by controlling persons when accounting for the income of controlled foreign companies.

- Sheet 02 contains fields for taxpayer codes, including the new taxpayer code 6, which is indicated by residents of territories of rapid socio-economic development. It also contains lines for the trade fee, which reduces the payment, and fields filled in by participants in regional investment projects.

- Sheet 03 shows the current dividend rate of 13%. In section “B”, the following codes are now entered in the field for the type of income:

- 1 - if income is taxed at the rate provided for in paragraphs. 1 clause 4 art. 284 Tax Code of the Russian Federation;

- 2 - if income is taxed at the rate provided for in paragraphs. 2 clause 4 art. 284 Tax Code of the Russian Federation.

- Filling out the income tax return for 2021 on lines 241 and 242 occurs by reflecting in them deductions for the formation of property for statutory activities and the insurance reserve; there are no separate lines for reflecting losses - current or carried forward to future periods - on this sheet.

- To reflect non-operating income after self-adjustment of the tax base for controlled transactions, a separate sheet 08 is provided.

- In Appendix 2 l. 08 there is a field for indicating taxpayer codes.