Worthy support for the activities of individual entrepreneurs in our country are special taxation regimes, which, compared with the generally accepted system, are endowed with considerable advantages.

One of these special regimes - the single tax on imputed income (UTII), colloquially better known as “imputation” - will be abolished in the coming 2021. Entrepreneurs who used it will have to switch to a different taxation system. Those who plan to register as an individual entrepreneur for the first time in the new year will also have to choose a suitable system. And since the general regime is obviously more complicated, most tax payers try to abandon it whenever possible - as a rule, in favor of such common alternatives as the simplified taxation system (USN, in common parlance - “simplified”) and the patent taxation system (PSN, or patent) .

What mode is best for an individual entrepreneur to choose, based on the needs, capabilities, specifics of business activity and other factors? To determine which tax system is right for you, you should first understand what each of them is, what their pros and cons are, and what can be found in common in these regimes. A brief educational program on the simplified tax system and PSN is conducted by accountant Maria Opekunskaya .

First thing's first - compliance

Before deciding which tax system - patent or simplified tax system - will be most profitable for you, you should check whether your activity meets certain criteria that allow you to choose one or another tax payment regime. This issue is especially relevant for those entrepreneurs who are already operating, receive a certain amount of profit and have employment contracts concluded with employees.

For a patent, restrictions on use are specified in Art. 346.45 of the Tax Code of the Russian Federation, and when deciding on the transition to the simplified tax system, an entrepreneur should study Art. 346.12-346.13 Tax Code of the Russian Federation. So, for example, to be able to use a patent, it is necessary that the maximum amount of profit in one year be 60 million rubles. In the case of the “simplified” system, the profit limits are 150 million rubles.

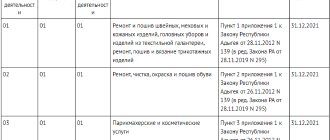

Another important point is that the average number of employees of an individual entrepreneur under the PSN should not exceed 15 people, while under the simplified tax system it is permissible to have up to a hundred employees as part of the individual entrepreneur. In addition, the PSN system in the coming 2021 will be extended only to 64 types of commercial activities and only in cases where the possibility of using this system is enshrined in regional legislation. For example, a patent is not applicable to the sale of goods that are subject to mandatory labeling. “Simplified” is appropriate in almost all types of activities, with rare exceptions prescribed in the Tax Code of the Russian Federation.

Comparison with simplified tax system

| Mode | PSN | simplified tax system (6%) |

| Advantages | Real income may significantly exceed estimated income, which means the amount of taxes payable will be less. There is no need to submit a declaration to the Federal Tax Service. Tax calculations are carried out by the Federal Tax Service. It is possible to combine with different tax regimes (even with the simplified tax system). You can purchase a patent for the desired period. | There is one income accounting book, regardless of the type of activity (if there is no patent). The amount of taxes can be reduced by the amount of contributions for yourself or employees. The regime's area of operation is much wider (the entire region/region). The amount of taxes is reduced as income decreases (but not less than the amount of mandatory contributions). More types of activities are available, other limits on the application of the tax regime are also higher (total income, number of employees). |

| Flaws | Income accounting is carried out for each patent separately. The tax amount is not reduced even if there is no income. The territory of a patent is most often limited to the boundaries of a municipality (one patent - one city or even a city district). Contributions for yourself/employees cannot be deducted from the cost of the patent. Significant restrictions (by type of activity, by number of employees, by total income) | You need to submit a tax return. The amount of taxes cannot be less than the amount of mandatory contributions. The mode does not combine well with others (only with PSN and UTII). There are restrictions on income, number of employees and available activities. |

The difference is most clearly visible when performing detailed calculations.

Situation 1

For example, an individual entrepreneur works in the village of Kashary, Lipetsk region, without hired workers, and provides shoe repair services.

A patent for 12 months in 2021 will cost him 5,760 rubles. To this amount you can add the amount of mandatory contributions - 40,874 rubles. Total - 46,634 rubles. per year of work, regardless of actual income. Learn more about all taxes for individual entrepreneurs under different taxation regimes.

With a simplified tax system of 6%, the amount of taxes will directly depend on earnings, but cannot be less than 40,874 rubles. (this is the amount of mandatory individual entrepreneur contributions for himself).

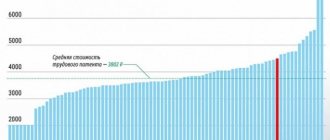

The change in the amount of taxes and fees is clearly visible in the graph below.

| Real income for the year | 300000 | 400000 | 500000 | 600000 | 700000 | 800000 | 900000 | 1000000 | 1100000 |

| simplified tax system 6% | 40874 | 41874 | 42874 | 43874 | 44874 | 48000 | 54000 | 60000 | 66000 |

| PSN | 46634 | 46634 | 46634 | 46634 | 46634 | 46634 | 46634 | 46634 | 46634 |

It turns out that the patent taxation system becomes beneficial in this case with real income over 700 thousand rubles per year.

Situation 2

The individual entrepreneur has one retail outlet in the Ostankino district of Moscow and is engaged in retail trade that falls under the requirements of the PSN. The cost of a patent for 1 year in this case will be 162 thousand rubles. The number of personnel does not affect the price of a patent. But the entrepreneur employs 2 sellers, for whom it is necessary to pay contributions to non-state funds. If the salary is equal to the minimum wage for Moscow (20,195 rubles/month), then the amount of contributions will be 20,195 rubles. * 12 months * 2 people * 30% = 145,404 rub.

Plus, for yourself - 40,847 rubles. Total 186,278 rub. (for the whole year).

Together with the cost of the patent, it comes out to 186,278 + 162,000 = 348,278 rubles.

If an individual entrepreneur applies only the simplified tax system, then the amount of taxes will be 6% of income and the amount received can be reduced by 50% of the amount of contributions. If your income grows above 300 thousand rubles/year, you must pay an additional 1% of the excess amount.

The dependence can be visualized like this.

| Real income (r.) | 1000000 | 2000000 | 3000000 | 3950000 | 4000000 | 5000000 | 6000000 | 7000000 |

| STS 6% (taxes + contributions) | 193278 | 221639 | 286639 | 348389 | 351639 | 416639 | 481639 | 546639 |

| PSN (patent + contributions) | 348278 | 348278 | 348278 | 348278 | 348278 | 348278 | 348278 | 348278 |

It turns out that PSN should be applied in this case only when the income from the outlet exceeds 3.95 million rubles/year (≈330 thousand rubles/month).

When should PSN be used?

- The most profitable situation is when the real income significantly exceeds the calculated one for the patent.

- With a clearly defined seasonal activity (a patent can only be taken out for a season).

- When starting a new activity (to assess the niche and potential development opportunities).

How does a patent differ from the simplified tax system?

“The key difference that should be especially noted for an individual entrepreneur is that when choosing the simplified tax system “Income”, all income actually received as a result of your activities will be taxed,” explained Opekunskaya. — If we are talking about choosing a patent, then in this case the entrepreneur will pay tax on the amount of possible income, which is established at the legislative level. If your actual income is above this level, you will not have to pay additional taxes.”

Types of "simplified"

The simplified tax system for entrepreneurs, as a rule, is of the following types:

- Six percent "simplification". In this case, it is assumed that 6% of the total profit will be paid, along with mandatory contributions for employees and yourself personally to the Pension Fund and the compulsory medical insurance service. A large number of such declarations under the simplified tax system for 2021 were submitted.

- Fifteen percent type. Assumes payment of 15% of profits minus expenses. As in the first case, payments to the above services for yourself and your employees are mandatory.

When choosing between the simplified tax system and a patent, you need to take into account the difference in the offset and calculation of insurance premiums. If a person works alone and calculates a single tax using the “simplified” approach, then contributions can be reduced quarterly, but not by more than 50%.

What are the advantages and disadvantages of “simplified” and PSN for an individual entrepreneur?

The indisputable advantages of “simplified”, which provide it with advantages over PSN for individual entrepreneurs, perhaps include the following:

- there are no restrictions on the implementation of several activities at the same time, while with PSN for each activity, as well as the place in which it is carried out, you will have to obtain its own separate patent;

- as mentioned above, it is possible to create a larger staff of workers (up to 100 people under the simplified tax system versus 15 people under the PSN);

- a larger annual income limit compared to a patent, exceeding which you lose the right to apply this tax regime.

“Simplified” also has its disadvantages in comparison with a patent. For example, the advantages of PSN include the following points:

- the tax base for a patent is determined by the amount of possible income;

- If a patent is issued for a period of six months or less, the tax will need to be paid after this period. With a PSN valid for 6-12 months, a third of the tax must be paid in the first 90 days, while the rest of the payments can “wait” until the patent expires. “Simplified” means mandatory quarterly payment of advance payments;

- with PSN it is not necessary to submit reports.

What is the price

The calculation of a patent for an individual entrepreneur is based on:

- potential annual income,

- numerical indicators of the business (number of employees/retail outlets, sales floor area in square meters, etc., depending on the chosen type of activity),

- the current deflator coefficient for 2020 is 1.592 (for 2021 - 1.518),

- tax rate (standard 6%, but regional authorities can reduce it to 4%).

Despite the presence of several components in the calculations, the final amount can be called fixed, since most of the indicators affecting the calculation do not change, or change rarely.

The maximum amount of potential income is determined by a threshold of 1 million rubles. (taking into account the deflator, for 2012 the upper limit will be 1.592 million rubles, excluding the possibility of a multiple increase depending on the region/municipal entity and type of activity).

So, for example, the cost of a patent for an individual entrepreneur for 2021 (for all 12 months), conducting retail trade in Moscow (Ostankinsky District) through 1 facility, will be 162 thousand rubles. (13.5 thousand rubles/month).

The first payment is 54 thousand rubles. (one third of the calculated amount, within a period of up to 90 days from the date of commencement of the patent), the second - 108 thousand rubles. (before the patent expires).

If the validity period of the patent is 5 months or less, the payment is made once, until the document expires.

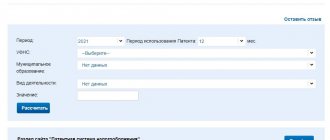

Tax calculations are carried out by the Federal Tax Service; individual entrepreneurs only need to provide the necessary data. You can get a preliminary amount using a special online service on the tax website.

Who can use a patent and how to obtain it?

According to Art. 346.43.Tax Code of the Russian Federation, the PSN system can be used by individual entrepreneurs whose average number of employees does not exceed, as we have already said, 15 people.

“Moreover, this applies to the entire tax period and applies to all types of business activities carried out by individual entrepreneurs,” Maria Opekunskaya clarified.

As for submitting an application to the tax authority about the individual entrepreneur’s desire to switch to PSN, this must be done 10 days before the start of his commercial activities as an individual entrepreneur. According to paragraph 3 of Art. 346.45 of the Tax Code of the Russian Federation, the duty of the tax authority is to issue a patent to the entrepreneur no later than five days from the date of receipt of this application.

How to combine PSN with “simplified”? Can these two systems be used simultaneously?

Based on the provisions of Chapter 26.5 of the Tax Code of the Russian Federation, individual entrepreneurs are not prohibited from combining several taxation systems within the framework of their activities. For example, when using PSN, an individual entrepreneur can simultaneously conduct activities that are subject to a different tax regime. In this case, the businessman is obliged to keep records of property, business operations and obligations in accordance with the requirements of the applicable taxation system prescribed by law.