List of non-operating income

Another approach to determining this form of profit is to list the possible types of income that Art. 250 Tax Code classifies as non-operating:

- profit received from equity participation in other associations (if additional shares are purchased with dividends, then this income is excluded from non-operating income);

- penalties, fines, penalties paid to the company under contracts (or even not yet paid, but only awarded or recognized by the debtor);

- compensation received for damage or loss;

- insurance payments;

- profit from leasing or subletting tangible assets or real estate (except for those situations when this activity is the main activity for the company - then this is already income from the provision of services);

- assets received free of charge, for example, as a gift;

- past profit for the reporting year;

- the cost of surplus property credited to the balance sheet based on the results of the regular inventory;

- payment of debts on loans and deposits, the statute of limitations of which has already expired (“unexpectedly returned debt”);

- profit from differences in exchange rates;

- the result of revaluation of assets;

- some others.

Accounting

Clause 10 of the Accounting Regulations 9/99 establishes that the amount of proceeds from the sale of fixed assets, interest for the use of the enterprise’s finances, and income from participation in the capital of other legal entities is determined in a manner similar to income from core activities. Fines are taken into account in the amounts specified in the court decision or settlement agreement with the debtor. The value of gratuitously received assets is accepted as market value.

Creditor amounts are included in income at the price indicated in the accounting records. Other income is accounted for based on the actual amounts appearing in the accounting documentation at the time of declaration. Additional assessment of assets is carried out according to the rules established for such cases.

An example of how income received by an enterprise from renting out property is accounted for in accounting.

Dt 76.5, 62.1 Kt 91.1 – the amount of income for the leased property was accrued

Dt 91.2 Kt 68.2 – VAT charged

Dt 50.1 Kt 76.5 – accounting of cash receipts to the company’s account from the tenant of the property was made.

However, there are exceptions to the accounting rules that apply to some cases of non-core income of the enterprise. For example, fixed assets received free of charge are accounted for in account 98. That is, account 91 is used to account for income that has a direct monetary value. Ideally, the amounts of non-operating income (tax accounting) should coincide with similar income included in PBU as other income. This should be carefully monitored due to the fact that regulatory organizations have the right to verify the correctness of the attribution of income to tax and accounting records.

The difference, that is, those other accounting incomes that are not included in non-operating income for tax accounting, is the amount under Article 251 of the Tax Code. From an economic point of view, the income indicated in it does not increase the company’s benefits from directly conducting business, that is, they are not taken into account when determining the income portion and drawing up a declaration.

Other income in accounting

The list of other income is given in paragraph 7 of PBU 9/99 and is open. Other income is:

- receipts related to the provision of the organization’s assets for temporary use for a fee;

- receipts related to the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property;

- proceeds related to participation in the authorized capitals of other organizations (including interest and other income on securities);

- profit received as a result of joint activities;

- proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products, goods;

- interest received for providing the organization's funds for use, as well as interest for the bank's use of funds held in the organization's account with this bank;

- fines, penalties, penalties for violation of contract terms;

- assets received free of charge, including under a gift agreement;

- proceeds to compensate for losses caused to the organization;

- profit of previous years identified in the reporting year;

- amounts of accounts payable and depositors for which the statute of limitations has expired;

- exchange differences;

- the amount of revaluation of assets;

- Other income.

The chart of accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by the Order of the Ministry of Finance of Russia dated October 31. 2000 No. 94n, account 91 “Other income and expenses” is intended to summarize information on other income and expenses of the reporting period.

It is recommended to open the following sub-accounts for account 91 “Other income and expenses”:

- 91–1 “Other income”;

- 91–2 “Other expenses”;

- 91–9 “Balance of other income and expenses.”

Receipts of assets recognized as other income are recorded in subaccount 91–1 “Other income”. Subaccount 91–9 is intended to identify the balance of other income and expenses for the reporting month.

Accounting for account 91 is carried out as follows. Cumulatively during the reporting year, entries are made in subaccounts 91–1 and 91–2. Each month the balance of other income and expenses is determined by comparing the turnover in the debit of subaccount 91–2 and the credit of subaccount 91–1, which is then written off from subaccount 91–9 to account 99 “Profits and losses”. That is, account 91 does not have a balance at the reporting date.

What is included in non-operating income?

Income is an economic benefit received by a participant in economic relations (business) in kind or in monetary terms (clause 1 of Article 41).

All receipts to the company’s accounts that are not directly related to revenue from the sale of goods and products of its own production are considered other receipts. This category has its own definition - non-operating income.

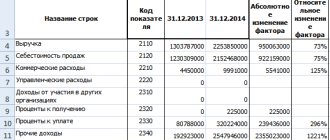

They appear in tax accounting in accordance with the list given by the legislator in Article 250 of the Tax Code. Here is a complete list of cases when income is recognized as non-operating and is included in the income declared by the enterprise for the reporting period. Which receipts relate to non-operating income are indicated in table No. 1.

| No. | Non-operating income |

| 1 | equity participation in legal entities and organizations (dividends); |

| 2 | exchange rate differences after foreign currency transactions; |

| 3 | fines, penalties, penalties recognized by the debtor or awarded by a court decision; |

| 4 | property rental; |

| 5 | rights to use intellectual property; |

| 6 | interest on loans, credits, accounts and deposits in a bank institution; |

| 7 | restored reserves; |

| 8 | gratuitously received property or rights to it; |

| 9 | participation in a partnership; |

| 10 | newly identified income from previous periods; |

| 11 | positive difference from the revaluation of the currency value of the property; |

| 12 | fixed assets and intangible assets received free of charge under international agreements of the Russian Federation; |

| 13 | the cost of materials after dismantling (disassembling) fixed assets that are being taken out of service; |

| 14 | misuse of funds received in the form of a charitable contribution or earmarked proceeds, as well as funds aimed at creating financial reserves for radiation and nuclear safety; |

| 15 | reduction in the value of the authorized capital in the reporting period with the condition of refusal to return a certain amount of contributions to participants; |

| 16 | return of deposits previously included in the expenses of the tax base for the reporting period, starting from 01/01/2021; |

| 17 | overdue accounts payable; |

| 18 | income from transactions with derivative financial instruments (forwards, futures, options, swaps) that meet the requirements of the legislation that forms the securities market; |

| 19 | surplus inventories of goods and materials for industrial purposes after recalculation; |

| 20 | the cost of the results of operations of media products that are replaced when written off or returned; |

| 21 | profit adjustment in accordance with Articles 105.12 and 105.13 of the Code; |

| 22 | return to the donor the equivalent of property or securities in cash; |

| 23 | the difference in the amount that is subtracted from the excise tax; |

| 24 | profit of a non-resident company controlled by a resident of the Russian Federation. |

As a rule, the amount at which the above revenues are taken into account in tax accounting is similar to the accounting requirements. But there are some exceptions, for example, the sale of fixed assets with different monthly depreciation amounts.

To make it easier to comply with the requirements, the legislator has included in a separate article in the Tax Code (Article 251) income that cannot be included in the income portion when preparing the income tax return. Income corresponding to the list specified in the article cannot be considered non-operating.

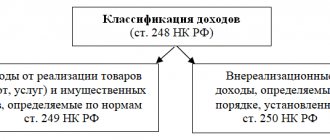

Article 250. Non-operating income

1. Analysis of the rules of Art. 250 shows that:

a) they provide a legal definition of non-operating income. In contrast to the Income Tax Law Art. 250 uses a clearer criterion for classifying income as non-operating income: they recognize any income that is not directly classified as income from sales by the rules of Art. 249 NK (see commentary to it);

b) the concept of “non-operating income” established in Art. 250, can be applied exclusively for the purposes of taxation with corporate income tax: it should not be extended to cases of determining the tax base of objects of other types of taxes;

c) in Art. 250 provides for types of non-operating income. However, the legislator left their list open: in a particular case, there may be other types of non-operating income (see, for example, the commentary to Articles 276, 290 of the Tax Code);

d) non-operating income should be distinguished not only from income from sales, but also from income that is not taken into account when determining the tax base (see commentary to Article 251 of the Tax Code).

2. Non-operating income includes, in particular:

1) income from equity participation in other organizations (for example, income of organizations from participation in the authorized capital of an LLC or JSC, in the joint capital of a limited partnership). See detailed comment about this. to Art. 275 NK;

2) income from purchase and sale transactions of foreign currency by organizations. It should be taken into account that:

— non-operating income includes amounts received from the sale of part of foreign exchange earnings (received from the export of goods (works, services)), subject to mandatory sale in accordance with the Currency Law and other legal acts in the field of foreign exchange control and foreign exchange regulation, and amounts received from the voluntary sale of foreign currency by organizations;

- non-operating income of banks includes amounts received not only from transactions for the purchase and sale of foreign currency (in the form of the difference between the actual purchase (sale) price of foreign currency and the official exchange rate of foreign currencies established by the Central Bank on the date of settlement for such a transaction), but also from some other operations (for more details, see the commentary to Article 290 of the Tax Code);

— for other organizations (i.e., those that are not commercial banks and other credit organizations), non-operating income includes income from sales (purchases) arising due to the fact that the sale (purchase) rate of currencies is higher (lower) than the official rate established by the Central Bank on the date completing a transaction. In practice, the question arose: do non-operating income arise if an organization sells foreign currency strictly at the official exchange rate of the Central Bank of Russia? No, they do not arise: it is no coincidence that in paragraph 1 of Art. 250 the legislator used the phrase “income... arises when the selling rate... is higher (lower)... than the rate of the Central Bank of the Russian Federation”;

3) income received in the form of fines, penalties and (or) other sanctions (penalties, etc.), sanctions for violations by the organization’s counterparty of contractual obligations:

— paid by the counterparty to the organization voluntarily (for example, in accordance with the terms of the contract);

— awarded in favor of the organization by the court.

Non-operating income also includes the following amounts of compensation received by the organization:

a) losses (i.e. expenses that the organization has made or will have to make to restore its violated rights, loss or damage to property (real damage), as well as lost income that this organization would have received under normal turnover conditions if it the right was not violated (lost profit) (Article 15, 393 of the Civil Code, see more about this in the book: Guev A.N. Article-by-article commentary on part one of the Civil Code of the Russian Federation. 2nd edition. M.: INFRA- M, 2001. P. 37, 627);

b) damage. In practice, the question arose: is the concept of “losses” also covered by the concept of “damage”? No, it is not covered. Damage can be caused to the organization and its employees who are involved in the so-called. material liability according to the provisions of Art. 118 - 126 Labor Code (see commentary on them in the book: Guev A.N. Article-by-article commentary on the Labor Code of the Russian Federation. 4th edition. M.: BEK, 2001). That is, the legislator took into account that “losses” are an institution of civil legislation, and “damage” is an institution of labor legislation;

4) income received by the organization from leasing or subleasing property. In this case, it does not matter whether the agreement (in accordance with Articles 609, 651 of the Civil Code) is subject to state registration. In practice, the question arose: does income received from the so-called non-operating income apply? "rehire"? No, it doesn't apply. The fact is that re-letting is the transfer by the tenant of his rights and obligations under the lease agreement to another person (i.e., essentially, an assignment of property rights, which means there is income from the sale, see the commentary on this to Article 249 , 279 Tax Code), and sublease is the sublease of leased property by the creditor (Article 615 of the Civil Code, see commentary on it in the book: Guev A.N. Article-by-article commentary on part two of the Civil Code of the Russian Federation. 3rd ed. M.: INFRA-M, 2001);

5) income from provision for use (for example, under a commercial concession agreement, under a license agreement):

a) results of intellectual activity (works of science, literature, etc.);

b) means of individualization (for example, trade names, trademarks, service marks);

c) rights arising from patents for inventions and industrial designs. In practice, the question arose: do non-operating incomes received from the provision of copyright certificates, diplomas for discoveries, patents for utility models, and innovation proposals belong to non-operating income? Yes, they do. In this case, the legislator quite rightly left the list of types of intellectual property and documents of protection for them open. Therefore, income received, for example, from the provision of a patent for a utility model for use, relates to non-operating income. Another question arose: do income from the provision of know-how for use count as non-operating income? Yes, they do. See more about this in the book: Guev A.N. Commentary on civil legislation not included in parts one and two of the Civil Code of the Russian Federation. M.: INFRA-M, 2001. P. 1 - 227;

6) income in the form of interest received on:

a) loan agreement (for example, if one non-banking organization provided a loan to another organization);

b) loan agreement (loan can be provided only by banks and other credit organizations, Article 819 of the Civil Code). See comment. to Art. 290 NK;

c) a bank account agreement (for example, in the form of interest accrued by the bank in favor of organizations based on average daily balances);

d) bank deposit agreement (for example, if a legal entity has opened a deposit account in a bank). See more about this in the book: Guev A.N. Article-by-article commentary to part two of the Civil Code of the Russian Federation. Ed. 3rd. M.: INFRA-M, 2001. P. 451 - 483;

e) securities (i.e. government bonds, bonds, bills, checks, deposit and savings certificates, bearer savings books, bills of lading, shares, Article 143 of the Civil Code) and other debt obligations (i.e. not directly covered by Art. 143 of the Civil Code and the Securities Law to the number of securities). In practice, questions arose:

Do the rules of paragraph 6 of Art. 250 on interest awarded by the court (in accordance with Article 395 of the Civil Code) in favor of the organization for the use of other people's funds? No, they do not: the fact is that the legal nature of the interest mentioned in paragraph 6 of Art. 250 (they essentially represent a fee for a loan, loan, etc.), and interest awarded in accordance with Art. 395 of the Civil Code (they essentially represent a measure of liability applied to the faulty party), are different (see more about this in the book: Guev A.N. Commentary on the decisions of the Plenum of the Supreme Court of the Russian Federation on civil cases. M.: INFRA -M, 2001. P. 129 - 169);

Do the amounts awarded in favor of the organization in accordance with Art. 395 GK? Yes, they do. The fact is that in Art. 250, the legislator left open the list of types of income that are classified as non-operating (it is no coincidence that Article 250 states that “non-operating income is recognized, in particular, as income ...". In addition, non-operating income includes all income that does not relate to income from sales (See the commentary on this to Article 249 of the Tax Code.) It is obvious, for example, that interest awarded in accordance with Article 395 of the Civil Code does not relate to sales income;

Does interest received by an organization on a commercial and (or) commodity loan count as non-operating income? Unfortunately, in paragraph 6 of Art. 250 there is a gap: apparently, the legislator needs to eliminate it. Systematic analysis of Art. 250 NK and Art. 807, 819, 822, 823 of the Civil Code shows that interest received by an organization on a commercial and (or) commodity loan relates to non-operating income;

7) income in the form of amounts of restored reserves for:

a) expenses for the formation of reserves for doubtful debts (see commentary to Article 266 of the Tax Code);

b) expenses for the formation of a reserve for warranty repairs and warranty service (see the commentary on this to Article 267 of the Tax Code);

c) expenses of insurers, as well as in the formation of bank reserves (see commentary to Articles 292, 294 of the Tax Code);

d) expenses for the formation of reserves for the depreciation of securities from professional participants in the securities market engaged in dealer activities (see commentary to Article 300 of the Tax Code);

income in the form of gratuitously received property, work, services or property rights. It should be borne in mind that:

income in the form of gratuitously received property, work, services or property rights. It should be borne in mind that:

a) in accordance with Art. 575 of the Civil Code, donations in relations between commercial organizations are not allowed (if the value of the donation exceeds 5 minimum wages). If such a gratuitous transfer takes place, then, firstly, for tax purposes, non-operating income is generated, subject to corporate income tax, and secondly, the transaction itself may be declared invalid (essentially, there is a void transaction - Article 168 GK);

b) for the correct application of clause 8 of Art. 250, it must also be taken into account that if property (work, services) is transferred free of charge, property rights are included in Art. 251 of the Tax Code to “income not taken into account when determining the tax base” for corporate income tax, then there is no reason to classify such a transfer as non-operating income;

c) if property (work, services) is transferred free of charge, then the non-operating income received by the organization is assessed based on market prices (and not the prices specified in the agreement on gratuitous transfer). Wherein:

— market prices are determined taking into account the following provisions of Art. 40 NK:

"1. Unless otherwise provided by this article, for tax purposes the PRICE OF GOODS, works or services INDICATED by the parties to the TRANSACTION is accepted. Until proven otherwise, this price is assumed to be IN MARKET PRICE LEVEL.

2. Tax authorities, when exercising control over the completeness of tax calculation, have the right to CHECK THE CORRECTNESS of the application of prices for transactions only in the following cases:

1) between MUTUALLY DEPENDENT persons;

2) for COMMODITY EXCHANGE (barter) transactions;

3) when making FOREIGN TRADE transactions;

4) in case of a DEVIATION of more than 20 percent upward or downward from the level of prices applied by the taxpayer for identical (homogeneous) goods (works, services) within a short period of time.

3. In the cases provided for in paragraph 2 of this article, when the prices of goods, works or services applied by the parties to the transaction deviate upward or downward by more than 20 percent from the MARKET PRICE of identical (similar) goods (works or services), The tax authority has the right to make a MOTIVATED DECISION on the additional assessment of tax and penalties, calculated in such a way as if the results of this transaction were assessed based on the application of market prices for the relevant goods, works or services.

The market price is determined taking into account the provisions provided for in paragraphs 4 - 11 of this article. In this case, the usual price surcharges or discounts when concluding transactions between non-related parties are taken into account. In particular, DISCOUNTS caused by:

SEASONAL and other fluctuations in consumer demand for goods (works, services);

loss of quality or other CONSUMER properties of goods;

expiration (approximation of the expiration date) of the expiration date or sale of goods;

marketing policy, including when promoting new products that have no analogues to markets, as well as when promoting goods (works, services) to new markets;

implementation of experimental models and samples of goods in order to familiarize consumers with them.

4. The market price of a product (work, service) is recognized as the price that HAS Developed through the interaction of DEMAND and SUPPLY in the market of identical (and in their absence, homogeneous) goods (work, services) under comparable economic (commercial) conditions.

5. THE MARKET FOR GOODS (work, services) is recognized as the sphere of circulation of these goods (work, services), determined on the basis of the buyer’s (seller’s) ability to actually purchase (sell) the product (work, service) in the market closest to the buyer without significant additional costs. (seller) in the territory of the Russian Federation or outside the Russian Federation.

6. Products that have the same basic characteristics characteristic of them are recognized as IDENTICAL.

When determining the identity of goods, taking into account, in particular, their physical characteristics, quality and reputation in the market, country of origin and manufacturer. When determining the identity of goods, minor differences in their appearance may not be taken into account.

7. Homogeneous goods are those that, while not identical, have similar characteristics and consist of similar components, which allows them to perform the same functions and (or) be commercially interchangeable.

When determining the homogeneity of goods, their quality, presence of a trademark, reputation in the market, and country of origin are taken into account.

8. When determining market prices for goods, works or services, transactions between persons who are NOT INTERDEPENDENT are taken into account. Transactions between related parties can be taken into account only in cases where the interdependence of these persons did not affect the results of such transactions.

9. When determining the market prices of a product, work or service, INFORMATION about transactions concluded at the time of sale of this product, work or service with identical (homogeneous) goods, work or services under comparable conditions is taken into account. In particular, such terms of transactions as the quantity (volume) of goods supplied (for example, the volume of a consignment), deadlines for fulfilling obligations, payment terms usually applied in transactions of this type, as well as other reasonable conditions that may affect prices are taken into account.

In this case, the conditions of transactions on the market of identical (and in their absence, homogeneous) goods, works or services are recognized as COMPARABLE if the difference between such conditions either does not significantly affect the price of such goods, works or services, or can be taken into account through amendments.

10. IN THE ABSENCE of transactions on identical (homogeneous) goods, works, services in the relevant market for goods, works or services, or due to the lack of supply of such goods, works or services on this market, as well as in the IMPOSSIBILITY OF DETERMINING the corresponding prices due to the absence or inaccessibility information sources to determine the market price, the SUBSEQUENT SALE PRICE METHOD is used, in which the market price of goods, works or services sold by the seller is determined as the difference in the price at which such goods, works or services are sold by the buyer of these goods, works or services during their subsequent sale (resale), and the usual costs in such cases incurred by this buyer during resale (without taking into account the price at which goods, works or services were purchased by the specified buyer from the seller) and promotion to the market of goods, works or services purchased from the buyer, as well as the buyer's usual profit for this field of activity.

If it is impossible to use the subsequent sales price method (in particular, in the absence of information on the price of goods, work or services subsequently sold by the buyer), the COST METHOD is used, in which the market price of goods, work or services sold by the seller is determined as the sum of costs incurred and the usual profit for this field of activity. In this case, the usual in such cases direct and indirect costs for the production (purchase) and (or) sale of goods, works or services, the usual costs for transportation, storage, insurance and other similar costs are taken into account.

11. When determining and recognizing the market price of a product, work or service, OFFICIAL SOURCES OF INFORMATION on market prices for goods, work or services and stock exchange quotations are used.

12. When considering a case, the court has the right to take into account any circumstances relevant to determining the results of the transaction, not limited to the circumstances listed in paragraphs 4 - 11 of this article.

13. When selling goods (work, services) at STATE REGULATED PRICES (tariffs) established in accordance with the legislation of the Russian Federation, the specified prices (tariffs) are accepted for tax purposes.

14. The provisions provided for in paragraphs 3 and 10 of this article, when determining market prices of financial instruments of futures transactions and market prices of securities, are applied TAKEN INTO ACCOUNT OF THE FEATURES provided for by the chapter of this Code “Profit (income) tax of organizations” (emphasis added. - A. G.).

See more about this in the book: Guev A.N. Article-by-article commentary to part one of the Tax Code of the Russian Federation. Ed. 2nd. M.: CONTRACT, 2001. P. 141 - 154;

- the determined market price cannot be (for the purposes of clause 8 of Article 250) lower than the residual value of the property that is subject to depreciation (see the detailed commentary on this to Articles 256 - 259 of the Tax Code);

- if goods, as well as works and services, are transferred free of charge, then in any case the determined market price cannot be lower than the cost of production (purchase) of goods (works, services) (see detailed commentary on this to Article 252 - 255, 260 - 272, 318 - 333 NK);

d) information on prices must be confirmed by the organization purchasing the property (work, services):

- either documentary (for example, an organization receives from its counterparty documents on the cost of acquiring property, on the book value of property);

- or by submitting assessment reports (expert opinion, statements) from an independent appraiser to the tax authority (for example, a commercial organization specializing in real estate appraisal, if the building was received free of charge).

There is a significant exception from the general rules of Art. 40 Tax Code (on sources of information on market prices). In this regard, the rules of paragraph 8 of Art. 250 (as special rules before general rules);

9) income received by the organization in the form of income from participation in a simple partnership (agreement on joint activities) in accordance with Art. 1041 - 1054 Civil Code. It should be borne in mind that:

a) as a general rule, the profit received by the partners as a result of joint activities is distributed in proportion to the value of their contributions to the common cause, unless otherwise provided by the simple partnership agreement or other agreement of the partners (Article 1048 of the Civil Code). Such non-operating income is taken into account in accordance with Art. 278 NK (see commentary to it);

b) when a partner withdraws from the agreement, the property contributed by him (as a contribution to a simple partnership) is returned to him, unless otherwise provided by agreement of the parties (Article 252, 1050 of the Civil Code). However, along with this, other property may be transferred to him. In the case when the property returned to the partner exceeds (in value) the property transferred by him, non-operating income arises (for this difference). The issue is resolved in a similar way in the event of a participant’s successor leaving the partnership. The reasons for the withdrawal of a partner from the participants in the joint activity for the purposes of clause 9 of Art. 250 doesn't matter;

10) income identified (for example, during an internal audit, audit, when transferring affairs to a new chief accountant) in the form of income for previous years. In this case, non-operating income is included in the tax base in the reporting (tax) period (see the commentary on these concepts to Article 285 of the Tax Code) in which they were identified;

11) income in the form of a positive exchange rate difference received by the organization from revaluation (carried out in connection with a change in the official exchange rate of the Central Bank of Russia):

a) property and claims (liabilities), the value of which was expressed in any currency other than rubles of the Russian Federation;

b) funds in foreign currency accounts of the organization opened in banks (both Russian and foreign, but operating in the Russian Federation. This does not apply to funds in accounts in foreign banks, including Russian banks, open in foreign countries);

12) income in the form of a positive difference received from the revaluation of property, carried out in the manner prescribed by law in order to bring the value of the property to the current market price (it is determined taking into account the provisions of Article 40 of the Tax Code and the IIIP index published by the State Statistics Committee of Russia). It should be taken into account that:

a) rules of paragraph 12 of Art. 250 do not relate to the revaluation of depreciable property (for this, see the commentary to Articles 256 - 259 of the Tax Code), as well as to changes in the exchange rate of securities (for this, see the commentary to Articles 280, 281 of the Tax Code);

b) the positive difference resulting from the revaluation of precious stones does not relate to non-operating income, but to “income not taken into account when determining the tax base” (see commentary to Article 251 of the Tax Code);

13) income received during dismantling or disassembly during the liquidation of fixed assets (see the comments on them to Articles 319, 322 - 325 of the Tax Code) taken out of service (regardless of the reason), in the form of:

— materials (for example, bricks, tiles, other building materials suitable for further use);

- other property (for example, in the form of raw materials, energy).

However, income received from the sale of materials and other property during dismantling, disassembly, etc., carried out in accordance with Art. 5 of the Convention on the Prohibition of the Development, Production, Stockpiling and Use of Chemical Weapons and Their Destruction of January 13, 1993, do not apply to non-implementation (see the detailed commentary on this to subparagraph 19. paragraph 1 of article 251 of the Tax Code);

14) income received by the organization within the framework of:

a) charitable activities. It should be taken into account that in accordance with Art. 1 of the Charity Law:

“Charity activities are understood as the voluntary activities of citizens and legal entities for the disinterested (FREE or preferential) transfer of property to citizens or legal entities, including money, disinterested performance of work, provision of services, provision of other support” (emphasis added. - A .G.).

Directing money and other material resources, providing assistance in other forms to commercial organizations, as well as supporting political parties, movements, groups and companies are not charitable activities (Article 2 of the Law on Charity).

Most often, charitable activities are carried out in the form of charitable assistance and donations. In practice, a question arose: due to the fact that a donation is a type of gift (Article 582 of the Civil Code), is a donation in favor of a commercial organization allowed, and if it took place, is the object of taxation formed by corporate income tax? Of course, a donation to a commercial organization (if the value of the donation exceeds 5 minimum wages) is not allowed (Article 575 of the Civil Code): this is a void transaction. However, for tax purposes, an object for taxation by corporate income tax nevertheless arises. The conclusion is made on the basis of a systematic interpretation of Art. 2, 575, 582 Civil Code and Art. 11, 250 NK;

b) all kinds of targeted revenues (for example, for the construction of apartments for the disabled, preschool institutions), as well as targeted funding from extra-budgetary sources.

The above income is converted into non-operating income:

- only if the conditions for their receipt are violated (usually they are stipulated either by the donor, or a charitable organization, or in the sources of targeted income and financing, but in some cases these conditions are provided directly by law or other regulatory legal acts);

- from the moment when the recipient of the funds actually misused them. This point can be revealed, for example, during a tax audit. Of course, along with the inclusion of such income as non-operating income, the taxpayer may be held liable under Art. 120, 122 Tax Code (see more about this in the book: Guev A.N. Article-by-article commentary on part one of the Tax Code of the Russian Federation. 2nd edition. M.: CONTRACT, 2001. P. 477, 482).

If an organization received (as targeted financing) budget funds and violated the terms of such financing, then the norms of budget legislation, rather than tax legislation, are subject to application. In practice, questions arose:

Is it meant in paragraph 14 of Art. 250 and cases of targeted financing from the budgets of a constituent entity of the Russian Federation and local budgets? Yes, the legislator means budgets of all levels;

Can a taxpayer be held liable under Art. 120, 122 of the Tax Code, if, as a result of violation of the terms of targeted budget financing, there was non-payment or incomplete non-payment of the tax amount? Yes, such liability of the taxpayer occurs: it does not depend on the measures provided for by the norms of budget legislation (Article 108 of the Tax Code). It must be taken into account that the provisions provided for in paragraph. 14 clause 6. art. 6 of the Law on Income Tax, the benefit is valid until the end of the implementation of targeted socio-economic programs (projects) of housing construction, the creation, construction and maintenance of professional retraining centers for military personnel, persons discharged from military service, and members of their families, carried out through loans, credits, free financial assistance provided by foreign legal entities, citizens, governments, international organizations. Provided for in paragraph 9 of Art. 6 of the Law on Income Tax, benefits (for taxpayers implementing investment projects) established by the constituent entities of the Russian Federation and local governments as of July 1, 2001, are valid until the end of the period for their provision. If the validity period of such benefits is not established, then until the end of the payback period of the investment project, but no more than 3 years from the date of their provision (Article 2 of Law No. 110);

Rules clause 14 art. 250 oblige taxpayers:

— submit to the tax authorities (at the place of their tax registration) a report on the use of the funds mentioned above. Such a report must be submitted in writing in a form approved by the Ministry of Taxation of Russia (and if the taxpayer received budget funds, in a form approved by the Ministry of Finance of Russia). Pending approval of these forms, taxpayers submit a report in any form, but containing all the necessary information; in addition, previously approved forms continue to be valid (to the extent that does not contradict Chapter 25 of the Tax Code);

- submit the said report at the end of the tax period (i.e. the calendar year in which the above-mentioned receipts took place);

15) income received by NPPs in the form of targeted funds and aimed at forming reserves to ensure the functioning of NPPs and their safety. However, these incomes are included in non-operating income only to the extent that they were used by the taxpayer for other purposes. In any case, the tax authority is obliged to prove the misuse of the funds mentioned;

16) income in the form of amounts by which there was a decrease (within a quarter, half a year, nine months, a year, see the commentary on this to Article 285 of the Tax Code):

a) authorized capital (it is formed in commercial organizations such as business companies, for example, in CJSC, LLC);

b) share capital (it is created in general and limited partnerships);

c) authorized capital (it is formed in state and municipal unitary enterprises and a number of non-profit organizations). Unfortunately, in paragraph 16 of Art. 250 there is a gap: it is not taken into account that in production cooperatives (and this is one of the types of commercial organizations) a mutual fund is created (and not an authorized fund or authorized capital). Apparently, the legislator needs to fill this gap. From now on, there is no reason to extend the rules of paragraph 16 of Art. 250 for producer cooperatives. The income mentioned above is included in non-operating income only to the extent that the specified decrease:

- carried out simultaneously (i.e. both the refusal and the reduction must take place within the same reporting (tax) period) with the refusal of the organization to return to its participants parts of the contributions (contributions) previously made by them to the authorized (share) capital ( fund). Alas, in paragraph 16 of Art. 250 a serious mistake was made: in joint-stock companies there is no return of “the corresponding part of contributions (contributions).” Firstly, there are no contributions, and secondly, in relation to shareholders, we can only talk about the redemption of their shares (including the JSC itself). Apparently, the legislator needs to clarify the wording of paragraph 16 of Art. 250: otherwise (taking into account Article 3, 108 of the Tax Code) its application in practice will be very difficult;

- is not related to the need to comply with legal requirements (see the commentary on this to subparagraph 18, paragraph 1, article 251 of the Tax Code);

17) income in the form of refund amounts from a non-profit organization (for example, foundations, associations, autonomous partnerships) previously paid by the organization in the form of contributions (contributions). Unfortunately, in paragraph 17 of Art. 250 does not take into account the features of some non-profit organizations (for example, foundations), which do not provide for the return of previously paid contributions (Article 119 of the Civil Code). The mentioned income is included in non-operating income only on the condition that the returned contributions (contributions) were previously included in the tax base (see the commentary on this to Articles 274 - 282 of the Tax Code);

18) income in the form of amounts of accounts payable (i.e., the organization’s debt to its creditors, for example, if it did not pay for the supply of goods), written off:

- due to the expiration of the limitation period (remember that the general limitation period is 3 years, unless for certain types of claims the law establishes special (i.e. shorter or longer) limitation periods, Articles 196, 197 of the Civil Code );

- on other grounds (for example, when a debt is forgiven (Article 415 of the Civil Code), due to the termination of an obligation based on an act of a state body (Article 417 of the Civil Code)). However, non-operating income does not include amounts of accounts payable to budgets written off in the prescribed manner (see the commentary on this to subparagraph 22, paragraph 1, article 251 of the Tax Code);

19) income received from transactions with financial instruments of futures transactions and not mentioned in Art. 249, 251 of the Tax Code (for more details, see the comments to Articles 301 - 305 of the Tax Code);

20) income in the form of the value of surplus commodity and material assets identified by the organization as a result of inventory. In this case, it is necessary to be guided by the Inventory Regulations, Method. decree. on inventory, the norms of the current Law on Accounting, the Regulations on Accounting, other legal acts on accounting and inventory (taking into account the norms of Articles 319, 322 - 333 of the Tax Code, see commentary to them).

Don't forget to include these incomes in non-operating income

Taxpayers often miss out on certain types of profit, which are also considered non-operating, thereby, wittingly or unwittingly, underestimating the tax base. However, these revenues to the organization’s budget are included in non-operating income:

- interest on issued loans, deposits, promissory notes (both in relations with counterparties and with the Central Bank);

- market value of materials obtained as a result of dismantling written-off property;

- charitable contributions received by the company and targeted donations used for the stated purpose;

- assessment of written-off and returned printed products;

- correction of calculated profit due to changes in calculation methods;

- plus the difference between deductions and excise taxes.

NOTE! Understating profits due to the omission of certain items of income, committed due to intent or lack of knowledge, is fraught with troubles on the part of the regulatory tax authorities: this may well be regarded as tax evasion.

Don't make a mistake when accounting for non-operating income

Determining all profit items is a rather complex and cumbersome task in which it is not easy to avoid mistakes. Let's look at the most common difficulties that arise when recognizing non-operating income, and also analyze how to more effectively avoid them.

- Dating problems. Income tax is “tied” to a certain accounting period, usually a year. Therefore, it is very important what date a particular receipt will be assigned to. Sometimes the issue of determining the date can be controversial. For example, insurance compensation was paid - undoubtedly non-operating income. To what period should this profit be attributed? There are two different possible answers, depending on which tax calculation method the taxpayer uses:

- with the cash method, the date of transfer of funds from the insurance company will be important (clause 2 of Article 273 of the Tax Code of the Russian Federation);

with the accrual method, the key date will be the day when the insurer made the decision to pay (subclause 4, clause 4, article 271 of the Tax Code of the Russian Federation).

- Issues of reimbursement and compensation. Often, compensation obtained legally does not cover the damage received by the company. The businessman believes that since he actually suffered a loss, which was not covered by the funds received, they will not be included in profit, and therefore no tax is due on them. The letter of the law says something else: any insurance compensation is subject to taxation, even if the property cannot be restored or there is absolutely nothing to take from the person convicted of its theft (letter of the Federal Tax Service dated November 15, 2005 No. 22-2-14-2096).

- Free services. If the company was provided with certain services free of charge, this is not a personal matter of the managers at all, but a change in the balance. These services must be reflected in non-operating income at the average market value (Article 105.3 of the Tax Code of the Russian Federation). The value of the asset itself, in which the gratuitous services were “invested,” will not increase - after all, the owner did not spend his own money on it.

- Reduction of authorized capital . When the authorized capital becomes less than net assets, the resulting difference must either be divided among all participants or attributed to non-operating income. If the capital reduction is triggered by legal requirements, no adjustment is required.

- A debt that will no longer be called upon . If the creditor is overdue on your debt or the counterparty company was liquidated without demanding payment of obligations, this is again non-operating income. You should not try to hide an unexpectedly generated surplus of funds - tracking such “delays” is the responsibility of the taxpayer. If the tax office finds this, you will be charged with a violation, even if there is no director’s order to write it off (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 8, 2010 No. 17462/09).

- Money received from penalties . Any contract usually contains obligations in case of violation of any provisions. If the counterparty “got” a fine, this does not mean that your company has already automatically received this income. These funds will become accountable non-operating profit only when the debtor recognizes the required amount or there is a corresponding court decision.

The same difficulties may arise when setting the date for receipt of rental income. According to the agreement, rent is paid at one frequency or another, and the accounting date may be shifted from that specified in the agreement to the day the money is actually received.

The procedure for recognizing non-operating income when calculating income tax

The procedure for accounting for non-operating income depends on the type of income, as well as on what method of accounting for income and expenses you use: cash or accrual method.

Under the accrual method, recognize income in the reporting (tax) period in which it arose. The fact of payment in this case does not matter (clause 1 of Article 271 of the Tax Code of the Russian Federation).

The only exceptions are organizations that extract hydrocarbon raw materials - they recognize income in a special manner (clause 1.1 of Article 271 of the Tax Code of the Russian Federation).

The dates of recognition of specific types of non-operating income are indicated in paragraphs 4 - 6 of Art. 271 Tax Code of the Russian Federation. For example:

- property received free of charge (work, services) must be included in income on the date of signing the acceptance and transfer certificate (clause 1, clause 4, article 271 of the Tax Code of the Russian Federation);

- you must take into account dividends received in cash on the date of their receipt in the current account or cash register (clause 2, clause 4, article 271 of the Tax Code of the Russian Federation);

- take into account the amounts of restored reserves as of the last day of the reporting (tax) period (clause 5, clause 4, article 271 of the Tax Code of the Russian Federation).

Under the cash method, non-operating income, as a general rule, must be recognized on the day of actual receipt of funds to bank accounts or to the cash desk, receipt of property (work, services) or property rights (clause 2 of Article 273 of the Tax Code of the Russian Federation).

Regardless of the method used for accounting for income and expenses, the amount of non-operating income must be determined in monetary form. If the income is received in kind, then determine its size based on the transaction price, taking into account the provisions of Art. 105.3 of the Tax Code of the Russian Federation (clauses 3, 5 of Article 274 of the Tax Code of the Russian Federation).

If non-operating income is received in a foreign currency, then it must be converted into rubles at the official exchange rate established by the Bank of Russia on the date of recognition of the corresponding income under the accrual method or on the date of receipt of payment - under the cash method. This follows from paragraph 3 of Art. 248, paragraph 8 of Art. 271, paragraph 2 of Art. 273 Tax Code of the Russian Federation.

The amount of non-operating income can be determined on the basis of primary documents, tax accounting documents or other documents that confirm the receipt of income (clause 1 of Article 248 of the Tax Code of the Russian Federation).

Recognition of expenses as non-operating

The importance of attributing expenses specifically to this type of expense helps in reducing the tax base for income tax.

Write-off of expenses is carried out using one of two methods, and for each the Tax Code of the Russian Federation has its own procedure:

- When using the accrual method, you need to use clause 7 of Art. 272 Tax Code of the Russian Federation;

- for the cash method , the procedure described in paragraph 3 of Art. 273 Tax Code of the Russian Federation.

The moment of recognition of expenses depends on the choice of method: in the first case, this is the date of documentary confirmation of the basis, and in the case of using the cash method, the actual occurrence of the event.

It is necessary that expenses have mandatory documentary evidence; this requirement is clearly stated in the Tax Code of the Russian Federation. What kind of confirmation this will be will have to be decided on a case-by-case basis.

For example, when writing off as a non-operating expense losses from a fire that occurred in a given period, one of the documents can serve as confirmation:

- a certificate issued by the fire service (government body);

- report from the scene of the incident;

- act of establishing the cause of the fire;

- inventory acts, etc.

Accounting for other income and expenses

If everything is already clear with the definition of other costs and income, now you need to answer the question: “Non-operating income and non-operating expenses: what account is this?” To account for them, account 92 of the same name is used. This account has 4 sub-accounts that must be closed at the end of the tax year.

Financial data for these subaccounts allows you to calculate the balance of other income, as well as expenses for 1 reporting month.

Similar articles

- Accounting for the right to use software free of charge

- Operating expenses and income

- What is the object of taxation for income tax

- Profit before tax

- Profit before tax

What income is usually forgotten to be classified as non-operating income?

Having clarified the enormous importance of non-operating income in determining the base for calculating taxes (after all, if it is underestimated, charges of tax evasion will arise), it is worth considering situations where taxpayers, either out of ignorance or deliberately, overlook certain items of income.

So, income not received from sales includes (Article 250 of the Tax Code of the Russian Federation):

- income related to participation in other organizations (clause 1);

- positive exchange rate difference (items 2, 11);

- fines, penalties and other sanctions (including insurance compensation) awarded or recognized by the debtor, expressed in material form (clause 3);

- income from leasing property (clause 4) and granting rights to use intellectual property (clause 5), if this type of activity is not the main one, taken into account according to the rules of Art. 249 Tax Code of the Russian Federation;

- interest on deposits, loans issued, including on the Central Bank or other promissory notes (clause 6);

- income arising from the restoration of reserve amounts (clause 7);

- the cost (according to market valuation) of property or property rights received free of charge, as well as work or services (clauses 8, 12);

How to determine the amount of income from the gratuitous use of property, see here.

- income arising from participation in a simple partnership (clause 9);

- income from previous years discovered in the current period (clause 10);

- the cost of materials that were obtained during disassembly (dismantling) of assets taken out of use (clause 13);

- contributions and donations used for other than intended purposes, both within the framework of charity and aimed at targeted financing (clauses 14, 15);

- amounts of deposits in the management company that were not returned to participants when capital was reduced (clause 16);

- deposits returned from NPOs (clause 17) or donations (clause 23);

- written off accounts payable (clause 18);

- income from transactions with securities (clause 19);

- surpluses discovered during inventory (clause 20);

- the cost of written-off or returned printed products (clause 21);

- the amount of profit adjustment as a result of applying various calculation methods for tax accounting (clause 22);

- positive difference between deductions and excise taxes (clause 24);

- profit of a controlled foreign organization (clause 25).

Examples of errors in determining non-operating income

- Compensation for losses

Taxpayers often have great difficulties when calculating tax (income tax or simplified tax system) on the insurance compensation received. These amounts are quite often not taken into account by taxpayers as part of non-operating income, since they believe that, having lost property or suffered losses from an insured event and received (often only partial) compensation from the insurer, they do not have to pay tax.

But this is not so: even if, as a result of an insured event, property was completely lost or it was recognized as not subject to restoration, the insurance compensation received must be included in income and taken into account when determining the tax base. In support of this position, there are explanations from the fiscal authorities contained in the letter of the Federal Tax Service dated November 15, 2005 No. [email protected]

A similar situation arises in the case of compensation to a taxpayer who has suffered from theft for damages to those convicted of this crime.

- Free transfer

If a taxpayer receives services for the reconstruction of assets on his balance sheet free of charge, he is obliged to reflect these services as part of non-operating income. The cost of services is calculated as the market average, but not lower than the costs incurred in accordance with Art. 105.3 Tax Code of the Russian Federation. However, the taxpayer will not be able to increase the value of the assets improved as a result of the reconstruction, since he did not actually incur any costs.

- Decrease in capital

Taxpayers have many questions in situations where the size of the authorized capital (hereinafter referred to as the authorized capital) is reduced to a value less than the value of net assets. The position here is ambiguous, not only because of the existing nuances, but also due to the existing ambiguous judicial practice.

In the event of a decrease in the authorized capital and non-repayment of the cost of correction (reduction in the price of shares or shares) to participants, the tax payer company has an obligation to reflect the resulting difference in the composition of non-operating income. The arbitrators also adhere to the same position - a similar explanation can be found in the ruling of the Supreme Arbitration Court of the Russian Federation dated October 13, 2009 No. VAS-11664/09.

By paying the participants/shareholders the difference in the value of shares/shares, the taxpayer company is relieved of the obligation to accrue non-operating income from these amounts.

An exception to the rules is the situation when such a reduction of the capital (to the amount of net assets) is carried out as required by law (letter of the Ministry of Finance dated 08/06/13 No. 03-03-10/31651).

If the size of the capital decreases below the value of the company’s net assets, in any case, non-operating income will arise in the amount of this discrepancy. There is a position of the fiscal authorities on this matter (letter of the Federal Tax Service dated 09/06/12 No. AS-4-3/ [email protected] ) and positive judicial practice (resolution of the Federal Antimonopoly Service of North Kazakhstan Region dated 04/07/08 No. F08-1417/08-503A).

Although the letter of the Ministry of Finance dated 08/06/13 No. 03-03-10/31651 indicates that in this case there is no need to accrue non-operating income. Therefore, in order to avoid the emergence of controversial situations, the size of the charter capital should not be allowed to decrease below the value of net assets.

- Overdue accounts payable

Any overdue or unclaimed accounts payable by the liquidated counterparty must be reflected as part of non-operating income. At the same time, it is the direct responsibility of taxpayers to track and inventory such debt. As evidence of this position, one can cite a court decision - resolution of the Federal Antimonopoly Service of the Central District dated June 18, 2015 No. F10-1759/2015.

At the same time, the inspectors do not take into account the absence of an order from the director to write off such accounts payable while simultaneously recording the amount as income. This is stated in the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 06/08/2010 No. 17462/09.

- Penalties under the contract

The situation with the penalties specified in the contract is also ambiguous. Thus, in case of failure to fulfill contractual obligations, one of the parties has the right to impose a fine on the violator. At the same time, the specified amounts of fines are included in income only if the debtor recognizes the calculated amount of fines or there is a corresponding court decision.

The position of the inspection authorities is that if the parties have signed an agreement containing a provision for the application of penalties, then in the event of failure to fulfill obligations, the amount of the penalty is calculated automatically (letter dated August 26, 2013 No. 03-03-06/2/34843). This position was recognized by the court as illegal (decision of the Supreme Arbitration Court of the Russian Federation dated August 14, 2003 No. 8551/03).

In addition, the court decision (resolution of the 12th AAS dated February 17, 2015 No. 12AP-12462/2014) indicates that fiscal officials cannot recognize accounts payable without the necessary primary documents.

Write-off by the creditor - does income arise?

Write-off of accounts payable for which the statute of limitations has expired should be recognized as non-operating income (clause 15 of Article 251 of the Tax Code of the Russian Federation). One of the circumstances that is sufficient to reflect a written-off debt obligation as specified income is the termination of the work of the creditor and its removal as an operating entity from the state register in accordance with Art. 21.1 of the Law “On State Registration...” dated 08.08.2001 No. 129-FZ. This approach is confirmed by numerous explanations from employees of regulatory authorities and court decisions (letter of the Ministry of Finance of Russia dated March 25, 2013 No. 03-03-06/1/9152, resolution of the Federal Antimonopoly Service of the Moscow Region dated April 3, 2014 No. F05-1769/2014).

Such events should be reflected as non-operating income on the last day of the limitation period. This approach is confirmed by letters from the Ministry of Finance of Russia (for example, letter dated January 28, 2013 No. 03-03-06/1/38).

If we turn to judicial practice, the situation here is not so clear, since a single decision has not been formed. There are 2 options for court decisions on at what point a written-off creditor should be recognized as income:

- Debt with an expired period allotted for its collection must in any case be included in non-operating income in the period in which this period expired. This fact is not affected by the audit of income, the publication of the relevant administrative document and the presence of documentary justification. The basis for this is clause 78 of the Regulations on accounting and financial reporting in the Russian Federation (approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n). This approach is outlined in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 06/08/2010 No. 17462/09. A number of court decisions support this point of view. Moreover, the FAS ZSO resolution dated April 22, 2010 No. A27-18504/2009 states that if this requirement is not met, the organization will receive an unjustified tax benefit, which is a direct violation of the law.

- Even if the statute of limitations on an existing obligation has expired, without justification and an order (order) from the manager, it is impossible to take into account accounts payable as part of non-operating income. In this case, the arbitrators also refer to the provisions of clause 78 of the same Accounting Regulations. This approach was voiced in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 15, 2008 No. 3596/08, as well as in decisions of lower courts.

***

Non-operating income is listed in Art. 250 Tax Code of the Russian Federation. The list can be supplemented by organizations independently. Moreover, if such income is not described in this article, companies will have to justify their position regarding the inclusion or non-inclusion of a particular operation in the profit base. And even those incomes that are named in Art. 250, have a number of features that, under certain circumstances, make it possible not to consider them as an object for taxation, and therefore accountants need to be extremely careful.

Similar articles

- Loan agreements on the simplified tax system

- Operating expenses and income

- Non-operating income and expenses

- Accounting for the right to use software free of charge

- Income and expenses from ordinary activities

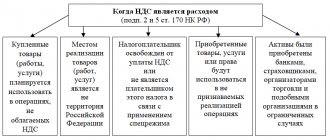

Reflection in the VAT return

Differences in the amounts of income according to profit and VAT declarations may be due to the fact that the first includes income items, receipts for which to the accounts of the enterprise should not appear in the second:

- transfer of goods into ownership or use free of charge;

- fines not related to payment of the cost of goods;

- write-off of a bad creditor;

- providing a discount that is not related to a change in the price of the product;

- bank interest on the account balance;

- positive exchange rate differences;

- dividends;

- reserve restoration;

- capitalization of inventory items after dismantling or inventory.

There is no direct connection between profit reporting and VAT in terms of indicating the amounts considered in the income item of the reporting period in the latter.

This is confirmed by the form of this document of the Federal Tax Service, approved by order dated October 29, 2014 No. MMB-7-3/ [email protected] (as amended on December 28, 2021 No. CA-7-3/ [email protected] ).

But some types of receipts to the accounts of an enterprise, classified under Article 250 of the Tax Code, are still subject to VAT. In particular, one of such income is interest on loans previously received by the payer.

This amount is included by the payer in Section 7 in the period when interest was accrued, but is not the tax base. In this section, the payer reflects transactions that should not be taxed, performed outside the territory of the Russian Federation. In addition, this section may include amounts of advance payments for goods for the production of which, using approved technology, the enterprise needs to spend more than six months.

Accrual of interest on deposits and issued loans - non-operating income

Every entrepreneur, when organizing his own business, strives for a single goal - to make a profit. But for this you need to generate some income. Income can be received from the sale of products of own production, goods previously purchased for the purpose of resale, as well as from the performance of work and the provision of services. This concerns the main activity of an economic entity.

But there is another type of income. Thus, an individual entrepreneur or organization can open a deposit account with a banking institution in order to receive additional funds in the form of accrued interest on the balance of this account. Additional income can also be obtained by issuing funds to other economic entities and charging the borrower interest for use. Accrued interest receivable on both deposits and loans issued will constitute so-called non-operating income, which must subsequently be taken into account when calculating income tax.

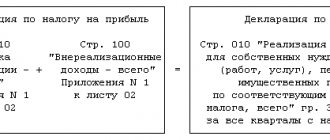

In the income tax return, the amounts of accrued interest receivable will be included in line 100 of Appendix 1 to Sheet 02.

What about the VAT return? Are the specified non-operating incomes included in it?

Starting from the report for the 4th quarter of 2021, it is necessary to use a new VAT declaration form, approved. by order of the Federal Tax Service dated August 19, 2020 No. ED-7-3/ [email protected]

To calculate what taxes is Article 250 of the Tax Code of the Russian Federation used?

As non-operating income Art. 250 of the Tax Code of the Russian Federation recognizes such income from the taxpayer’s business activities that are not reflected in Art. 249 Tax Code. As is known, Art. 249 of the Tax Code of the Russian Federation is devoted to income from the sale of goods (products) and the provision of services (work).

The importance of non-operating income in tax accounting is difficult to overestimate, because taxes are withheld from them, just like from proceeds from the sale of goods.

Thus, the formula “income under Art. 249 Tax Code + income under Art. 250 of the Tax Code " is used when calculating the tax base when determining income tax (Articles 247, 248 of the Tax Code of the Russian Federation). This formula is also needed to determine the tax base for the simplified tax system (Article 346.16 of the Tax Code of the Russian Federation) and for the Unified Agricultural Tax (Article 346.5 of the Tax Code of the Russian Federation).

What is recognized as non-operating income when calculating income tax?

Non-operating income includes all income taxable to income tax that is not income from sales. An approximate list of non-operating income is given in Art. 250 Tax Code of the Russian Federation. These include, for example:

- income from equity participation in other organizations (dividends);

- fines, penalties and other sanctions for violation of contractual obligations, amounts of loss or damage that were recognized by the debtor voluntarily or on the basis of a court decision that has entered into force;

- rent (if it is not income from sales for you);

- income of previous years identified in the current reporting (tax) period;

- subsidies (except for subsidies designated as non-taxable);

- insurance compensation received to compensate for damage caused;

- interest on deposit;

- interest on issued loans (credits).

This list is open. You can include in non-operating income other income taxable income that is not specified in Art. 250 of the Tax Code of the Russian Federation, if they are not income from sales for you.

| See also: How income from sales is taken into account when calculating income tax |