An organization can switch to special tax regimes if the conditions established by law are met. The most common special regime is the simplified taxation system (STS). The regime has a number of advantages, one of them is that in general cases a simplified company does not have to pay VAT to the budget. The accountant does not need to waste time on paperwork related to the payment of this tax. However, at the same time, an obligation arises to restore VAT on acquired property, which will be used after the transition to the simplified tax system.

Submit your VAT return using the Kontur.Accounting web service. The system itself will generate a declaration based on primary documents and check it before sending.

Get free access for 14 days

In fact, the restoration of VAT upon transition to the simplified tax system means that the company must re-calculate the tax claimed for deduction. Companies have the right to switch to the new tax regime starting from January 1 of the next calendar year. The previously deducted tax must be returned to the budget in the fourth quarter of the previous year. Failure to comply with the requirement may result in sanctions from the Federal Tax Service.

Let's consider three typical business situations for abstract, which switches to simplified terms from January 1, 2021.

New status - new rules

So, your company, meeting the criteria for “simplified”, has decided to switch to the simplified tax system with OSNO.

On the one hand, this is good news: less taxes means less headaches. And what taxes! One of the most complex and “paper” is VAT: invoices, declarations, books of purchases and sales. If you simplify, you won't need all this. There are some exceptions, which you can read more about here .

On the other hand, being on the OSN, you were not only obliged to charge VAT, but also had the right to a deduction, which you, of course, used. However, one of the most important conditions for the use of deductions (subclause 1, clause 2, article 171 of the Tax Code of the Russian Federation) is the use of assets and inventory items in activities that are subject to VAT.

ConsultantPlus experts spoke in detail about the nuances of accounting for VAT during the transition from OSNO to simplified tax system:

If you do not have access to the K+ system, get a trial online access for free.

With the transition to the simplified tax system, this condition will no longer be met for you, which means that you, in accordance with subparagraph. 2 p. 3 art. 170 of the Tax Code of the Russian Federation, you will be required to restore previously deducted VAT on those goods, materials and assets that remained on the balance sheet at the time of the transition to the new taxation system. And this must be done by submitting a declaration for the quarter preceding the transition to the simplified tax system.

Example

The company, which switched from 01.01.2021 from OSNO to the simplified tax system, has the following balances on its balance sheet as of 12/31/2020: raw materials and supplies - 100,000 rubles, goods - 200,000 rubles. According to the inventory data, the company previously claimed VAT for deduction. In this case, when switching to the simplified tax system, it will be necessary to restore VAT by making the following entries on December 31, 2020:

Dt 19 Kt 68 – 60,000 (20% × (100,000 + 200,000)) - VAT on goods and materials, previously deducted, has been restored.

Dt 91 Kt 19 – 60,000 - restored VAT is included in other expenses.

Attention! The procedure for recording VAT restoration operations in accounting should be described in the accounting policy. It may be similar to that shown in the example. It is also possible not to use account 19, but to charge the accrual of the restored tax directly to expenses.

Conditions for simplification

Not everyone can become a simplifier. The Tax Code of the Russian Federation has provided for a number of conditions in Art. 346.12:

- the amount of income for the last 9 months should not exceed 112.5 million rubles excluding VAT, if you were a payer;

- small staff - up to 100 people;

- cost of fixed assets minus depreciation - no more than 150 million rubles;

- no branches;

- the share of legal entities in the authorized capital is less than 25%;

- your area of activity is not indicated in Art. 346.12 Tax Code of the Russian Federation.

You can abandon the general system in favor of the simplified tax system when creating an organization within 30 days or from the new calendar year - to do this, simply submit an application to the Federal Tax Service before the end of the year.

Restoration of VAT on fixed assets and intangible assets

Here there will be a slightly different picture: VAT (the one that was accepted for deduction when purchasing property) is not restored in full, but only from its residual value. At the same time, the restored VAT on these assets, in accordance with Art. 264 of the Tax Code of the Russian Federation, must be taken into account as another expense that reduces taxable profit (letters of the Ministry of Finance of Russia dated 04/01/2010 No. 03-03-06/1/205, dated 01/27/2010 No. 03-07-14/03).

Example

A company switching from 01/01/2021 from OSNO to simplified taxation system has a car with an initial cost of 3 million rubles, while depreciation was accrued on the date of transition in the amount of 1 million rubles. The amount of VAT that was previously declared for deduction is 600,000 rubles. In this example, we first need to calculate the residual value of the car (it will be equal to 2 million rubles), after which we can determine the amount of VAT attributable to this cost:

600 000 × 2 000 000 / 3 000 000 = 400 000.

Now let’s reflect the calculations made in the transactions:

Dt 19 Kt 68 – 400,000 – VAT on fixed assets, previously deducted, has been restored;

Dt 91 Kt 19 – 400,000 - restored VAT is charged to other expenses.

Reinstatement of VAT when changing the tax regime: general provisions

There are often cases when an individual entrepreneur or the management of an organization, due to the economic situation or for other reasons, decides to switch to the simplified tax system.

To learn how the tax regime changes, read the material “Procedure for transition from OSNO to simplified tax system in 2021–2021 (conditions).”

After a change in the taxation regime, taxpayers continue to use assets acquired under the general taxation system to conduct their activities:

- goods (works, services);

- fixed assets;

- intangible assets;

- property rights, etc.

For simplicity of presentation, we will further refer to these categories as goods.

If for goods on the balance sheet at the date of transition to the simplified tax system, VAT was accepted for deduction, it must be restored upon transition to the simplified tax system (subclause 2, clause 3, article 170 of the Tax Code of the Russian Federation). If, before the change of the taxation regime to the simplified tax system, VAT deduction on goods was not declared, then there is no tax to be restored (letter of the Ministry of Finance of Russia dated October 18, 2016 No. 03-07-14/60503).

In addition, in accordance with the letter of the Federal Tax Service of Russia for Moscow dated November 26, 2009 No. 16-15/124316, if fixed assets were used in activities that were not subject to VAT, then the tax on them is not subject to restoration.

Also, the taxpayer will not have to restore VAT when switching to the simplified tax system if goods were purchased without “input” VAT (letter of the Ministry of Finance of Russia dated March 14, 2011 No. 03-07-11/50).

When a taxpayer returns from the simplified tax system back to OSNO, the right to re-deduct the previously restored VAT is not provided. This is confirmed by letters from the Ministry of Finance dated March 26, 2012 No. 03-07-11/84, dated January 27, 2010 No. 03-07-14/03, etc.

Important! ConsultantPlus recommends that the Tax Code of the Russian Federation does not provide for the restoration of deductible VAT from the advance payment upon transition to the simplified tax system, if the delivery occurs already during the period of application of the special regime. However, if you do not want disputes with inspectors, restore the entire tax amount. What this position entails and what risks there may be if you act differently, find out in K+.

At what rate to restore VAT?

This question may be relevant if you have on your balance sheet non-depreciated fixed assets acquired during the period when VAT was levied at a rate different from that in force during the recovery period. For example, when switching to the simplified tax system from 2021, these are fixed assets acquired before 2004 with VAT at a rate of 20%. In this case, when the VAT is restored during the period of validity of the 18% rate (in the 4th quarter of 2021), a logical question arises: at which of these rates should the tax be restored? The Ministry of Finance provides some clarification on this matter (for example, in letter dated 08/02/2011 No. 03-07-11/208).

Despite the fact that in the recovery quarter VAT is calculated based on 18%, it is necessary to restore the tax credited at the previously valid rate (and it was this rate that was indicated in the corresponding invoice). Therefore, the tax should be restored precisely at the rate in effect at the time of acquisition of the property. If the invoice was lost or destroyed due to the expiration of the mandatory storage period for primary documents, then the restoration of the tax on property put into operation before 2004 is carried out at a rate of 20% on the basis of an accounting certificate (clause 14 of the Rules for maintaining a sales ledger , approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

A similar, but opposite situation could arise during the transition to the simplified tax system from 2021, when in the 4th quarter of 2021 it became necessary to restore VAT on property purchased before 01/01/2019 at a rate of 18%.

Read the article “Procedure for VAT recovery when switching to the simplified tax system (nuances)” , which also describes this situation.

If VAT is restored on goods or materials that are taxed at a rate of 10%, then VAT must be restored at exactly this rate.

Where to enter information on restored VAT when switching to the simplified tax system

The answer to this question is contained in clause 14 of the rules for maintaining a sales book (Appendix 5 to Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137). There are also corresponding clarifications from the Ministry of Finance in letter dated November 16, 2006 No. 03-04-09/22 and the Federal Tax Service in letter dated September 20, 2016 No. SD-4-3 / [email protected] , which contain recommendations for filling out the purchase book and sales book.

Important! Recommendation from ConsultantPlus Register the invoice on the basis of which you accepted VAT for deduction in the sales book for the amount that needs to be restored (clause 14 of the Rules for maintaining the sales book). If the established storage period for the invoice has expired and you do not have it, register... (for more details, see K+).

In the VAT return, the restored tax is reflected in line 080 of section 3 with a breakdown in section 9 for each operation. If VAT is restored on a property, then for the year in the 4th quarter declaration it is necessary to fill out Appendix 1 to Section 3.

What VAT transaction codes are indicated in the declaration and accounting registers, read in this article.

How to fill out and submit a VAT return, read the materials in our special section, which is dedicated to VAT reporting.

What to do with VAT on previously received advances

Let’s assume that while working for OSNO, you received an advance payment for a future delivery, which took place when you had already become a “simplified worker.” Having received an advance, you paid VAT on this amount to the budget. But by switching to the simplified system, you cease to be a tax payer. What to do in this case with VAT when switching to the simplified tax system?

The answer is contained in the provisions of Art. 346.25 Tax Code of the Russian Federation. In the last quarter of the year preceding the transition to the simplified tax system, the tax on advances received, which was previously paid to the budget, can be deducted. To do this, it is necessary to transfer the amount of VAT to the buyer’s bank account (clause 5 of Article 346.25 of the Tax Code of the Russian Federation). And of course, you should still have documents confirming this operation (letter of the Federal Tax Service of Russia dated February 10, 2010 No. 3-1-11 / [email protected] ).

By the way, the arbitrators come to the conclusion that such documents can be not only payment bills, but also agreements on offsetting refundable VAT amounts against future payments under the same agreement (Resolution of the Federal Antimonopoly Service of the North-Western District dated 08/04/2010 No. A21-11991/2009) . In addition, the judges believe that a company can use its right to deduction even when the contract under which the advance was received was terminated and the money received was not returned to the buyer (Resolution of the Federal Antimonopoly Service of the Volga District dated July 18, 2008 No. A65-26854/2007 ). Thus, taxpayers have every chance to defend their right to a deduction in the situation under consideration.

For advances, see also our material “Acceptance for deduction of VAT on advances received.”

Expenses and income of the period in which the transition occurs

- The organization received funds as payment for contracts that will be executed under the simplified regime before the transition to a special regime - the money is included in income on the date of transition to the simplified regime.

- Income that was recognized using the accrual method is reflected in the income tax base, and the funds were credited to the account after the transition to the simplified system - the money is not included in income under the simplified tax system.

- The funds were paid under the general regime, and expenses were made under the simplified regime - expenses are recognized under the simplified regime under the object “income-expenses” on the date of their implementation.

- Costs were paid on a simplified basis and recognized on an accrual basis before switching to a special regime; labor costs and material expenses paid before the transition to the simplification are not recognized as expenses for the simplification.

Results

Restoring VAT during the transition to a simplified tax system is an issue that has many nuances. When submitting a return for the last quarter in which OSNO was applied, you should carefully study the information about which transactions will require a mandatory tax refund and what deductions can be left. Unfortunately, it will not be possible to re-claim the deduction when returning to OSNO.

If you are interested in how to pay taxes if a notice of transition to the simplified tax system was submitted by mistake, then read the article “What to do in case of an error with a simplified tax system object?”.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137

- Letter of the Federal Tax Service of Russia dated September 20, 2016 No. SD-4-3/ [email protected]

- Resolution of the Federal Antimonopoly Service of the North-Western District dated 08/04/2010 No. A21-11991/2009

- Resolution of the Federal Antimonopoly Service of the Volga Region dated July 18, 2008 No. A65-26854/2007

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

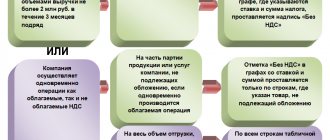

Advance payment for future supplies or services/work

Submit your VAT return using the Kontur.Accounting web service. The system itself will generate a declaration based on primary documents and check it before sending. Get free access for 14 days

The specified organization carried out repairs in 2021 by a third party. Is there an obligation to recover VAT on work performed, claimed for deduction? In fact, Everest LLC continues to use this premises. However, such a situation is not a basis for reinstating the tax.

Another situation: the company plans repairs in 2021 after switching to the simplified tax system, but at the same time makes an advance payment in 2021. In this case, the previously deducted tax must be restored. VAT restoration under the simplified tax system must also be made when making an advance for a future supply of goods and materials.