General information about the tax regime of the simplified tax system

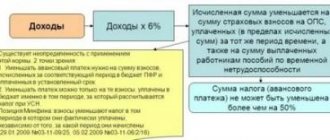

Business entities using the simplified tax system under the “6% income” scheme are required to pay a tax amount of 6% of the income received, excluding reflected expenses. This tax regime is beneficial to entrepreneurs and organizations that have a consistently low income, but do not incur regular expenses. In addition, the legislation imposes minimum requirements for “USN” employees who pay tax at a rate of 6% regarding accounting and reporting.

If a “simplified person” receives a high income, but at the same time his activities involve regular expenses, then it is advisable for such a business entity to use the simplified tax system according to the “income minus expenses 15%” scheme. This tax regime allows the “USN agent” to reduce the tax base at the expense of incurred expenses.

What is the simplified tax system?

The simplified taxation regime stands for “Simplified Taxation System”. It is based on a simpler form of reporting and a different procedure for making tax contributions. Many forms of legal entities use this tax accounting system as a basis, since it has a number of advantages.

Let us describe the advantages of this system:

- according to paragraph 14 of Article 346 of the Tax Code of the Russian Federation, in this system it is possible to choose the tax object “income taxes” (6%) or “income taxes minus expenses” (15%);

- the most economical tax accounting system;

- according to accountants, it allows for the simplest form of reporting;

- absence of other tax levies (property, VAT, etc.), but there are exceptions;

- Possibility of submitting declaration reports once per calendar year.

Note! Better than 6% or 15%, each legal entity must make its own choice. But if your expenditure is 55% and above, then it is better to work in the simplified taxation system of 15%. Pay attention to Article 346 (clause 16) of the Tax Code - detailed information about which items can be written off as expenses when operating your legal entity. Also keep in mind that it is prohibited to use two taxation objects at the same time on the simplified tax system: 6% and 15%.

Return to content

Simplified tax system at a rate of 6% and 15%: pros and cons

When choosing a tax regime, take into account the specifics of your company’s activities, the level of income and expenses, and their regularity. Below we provide a comparative description of the regimes within the framework of the simplified tax system. If you are a simplified tax payer, then regardless of the chosen scheme (6% or 15%), you can take advantage of the following main advantages of the simplified regime:

- Minimum requirements for record keeping and reporting. A “USN officer” is not required to file a tax return quarterly; a “simplified person” should report to the Federal Tax Service once a year. As for keeping records, you are only required to keep a Book of Income and Expenses.

How to notify the Federal Tax Service about the application of the simplified tax system from 2021

In order for the transition to the simplified tax system to take place on time, you need to submit a notification in form No. 26-2.1. If you submit an incorrect application in 2020, you will have to wait for the transition and pay taxes under the OSN for another year.

In the notification you need to indicate the Federal Tax Service code and fill out the “ Taxpayer Identification ” field:

- entrepreneurs who switch to the simplified tax system upon registration - code1

;

- newly created companies, as well as those who switch to simplified UTII - code 2

;

- entrepreneurs who switch to the simplified tax system from other tax regimes - code 3

.

The entrepreneur also fills out the field “ Switches to a simplified taxation system ” in the notification:

- new individual entrepreneurs and organizations put the code 2

;

- those who switch to the simplified tax system from other modes - code 1

;

- those who have lost the right to UTII indicate the code 3

.

Then the applicant indicates the amount of income for nine months without VAT, as well as the residual value of fixed assets as of October 1 of the current year.

The notification can be submitted to the tax office in person, by mail or through the MFC. The notification is submitted at the location of the organization or the place of residence of the individual entrepreneur.

The document can be drawn up on paper or in electronic form, approved by Order of the Federal Tax Service No. MMV-7-6 / [email protected] dated November 16, 2012.

So, there is no need to wait for confirmation from the Federal Tax Service on the application of the simplified tax system. Having notified the tax office, you can apply the simplified regime as long as the business meets its criteria. Read about these criteria in the article “Who can apply the simplified tax system in 2021?”

Astral

January 17, 2021 14599

Was the article helpful?

89% of readers find the article useful

Thanks for your feedback!

Comments for the site

Cackl e

Products by direction

1C-Reporting

—> Service for transmitting reports to regulatory authorities from 1C:Enterprise programs

How can a tax collector switch from 6% to 15%

As practice shows, if the expenses of the “USN agent” account for more than half of the income, then in this case it is advisable for business entities to change the tax regime to “income minus expenses 15%”. The transition order is presented below.

Step 1: Prepare the notice. Unlike registration, when switching to the “income – expenses 15%” scheme, you are not required to collect an impressive package of necessary documents. In this case, you just need to draw up a notification in Form 26.2-6. You can fill out the form on paper or electronically on the Federal Tax Service website.

Step 2. Send a notification to the Federal Tax Service. Depending on your desire and convenience, you can:

- fill out the notification at home and submit it to the fiscal service in person. In this case, it is advisable to make 2 copies of the document: one for the Federal Tax Service specialists, the second for you with a note from the office about acceptance;

- send the document in paper form by mail. To do this, you will need to go to the nearest post office, where you can send a notification letter. Upon receipt of the document, the Federal Tax Service employee will sign for receipt, and you will be sent a “stub” with the date the document was accepted;

- use the electronic resource of the Federal Tax Service and send a notification via the Internet. To do this, you need to first register on the Federal Tax Service website. After registration, you can fill out an application electronically and submit it online.

Do not forget about the deadlines for submitting an application for the transition: if you plan to apply the simplified tax system of 15% from 2021, then you must submit a notification no later than 12/31/17.

Application for changing the object of taxation

So, the businessman decided to change the object of taxation starting next year in accordance with the law. He must fill out and submit to the tax office at the place of registration by December 31 of the current year a notification in form 26.2-6. Its form is available for download at the beginning of the article.

Check out the completed version there.

If you submitted a notification about the application of the simplified tax system for the first time, but then realized that you incorrectly indicated the taxable object in the notification, you can change it if you submit a new notification before the expiration of the due date, that is, before December 31, and attach a letter asking to cancel the previous notification.

Notification of the transition from 15 to 6% under the simplified tax system and vice versa can also be submitted electronically via telecommunication channels (TCS).

Typical errors in calculations

Let's consider three main mistakes made by organizations and individual entrepreneurs when switching to a non-USN 15%.

Mistake #1. Transition to the simplified tax system of 15% during the reporting year.

Individual Entrepreneur Kukushkin is a payer of the simplified tax system of 6%. In June 2021, due to a change in the specifics of his activities and a significant increase in the level of expenses, Kukushkin submitted an application to change the regime - from the simplified tax system of 6% to 15%. From 07/01/17 Kukushkin calculates the tax at a rate of 15%, taking into account expenses incurred.

Kukushkin has the right to change the regime only from the beginning of next year (not earlier than 01/01/18). This rule applies to all taxpayers, regardless of the reasons for the regime change. Based on the notification submitted in June, Kukushkin becomes a tax payer at a rate of 15% from 01/01/18.

Mistake #2. Transfer of organizations - parties to the property trust management agreement.

Kursiv LLC is a party to the property trust management agreement. In December 2021, due to a decrease in expenses, Kursiv filed a notification about changing the regime to the simplified tax system of 6%. “Kursiv” does not have the right to change the regime to the simplified tax system of 6%, since the company is participating in a management agreement. This limitation is provided for in Art. 346.14 Tax Code. “Kursiv” can apply the simplified tax system only at a rate of 15%.

Mistake #3. Change of tax regime after reorganization.

In March 2021, Factor LLC (payer of the simplified tax system 6%) was reorganized into Vector LLC. Upon the fact of the reorganization, Vector filed a notice of change of regime to the simplified tax system of 15%. From 2nd quarter 2021 Vector pays advance tax at a rate of 16%.

For reorganized companies, the general rule for switching to the simplified tax system is 15%: organizations can change the regime only from the beginning of the year. The notification submitted by Vector in March 2021 is the basis for the application of the simplified tax system of 15% from 01/01/18.

Time frame for transition to simplified tax system

You can start using the simplified tax system within the time limits established by the Tax Code of the Russian Federation. There is no need to wait for confirmation from the Federal Tax Service.

Current deadlines for transition to simplified tax system for 2021:

| Taxpayer | Notice deadlines | Start of application of the simplified tax system |

| Newly created individual entrepreneurs and LLCs | Simultaneously with registration or within the next 30 calendar days | Immediately after sending the notification |

| Individual entrepreneurs and LLCs that are already conducting commercial activities | Until December 31, 2021. The notification is submitted from October 1 to reliably indicate income for the previous 9 months. | From January 1, 2021 following the year in which the notification was submitted |

| Individual entrepreneurs and LLCs that stopped paying UTII | No later than 30 calendar days after termination of the obligation to pay UTII | From the beginning of the month in which individual entrepreneurs and LLCs ceased their activities on UTII |

If the last day for submitting a notice falls on a weekend, the deadline is extended to the first working day after it.

Rubric “Question and answer”

Question No. 1. 12/14/17 Individual Entrepreneur Murashkin submitted documents to the Federal Tax Service on the transition to the simplified tax system of 15%. Murashkin delivered the notification personally; Murashkin kept one copy of the document as confirmation of the application. From what moment is Murashkin considered a tax payer at rate 15? Does Murashkin need to receive additional notification from the Federal Tax Service?

The law does not oblige the Federal Tax Service to additionally inform payers about the transition from the simplified tax system of 6% to 15%. Based on the notification that Murashkin submitted on 12/14/17, he is considered a tax payer at a rate of 15% from 01/01/18.

Question No. 2. Zeus LLC, which previously used the simplified tax system of 6%, changed the regime to the simplified tax system of 15% from 01/01/18. In November 2021, Zeus purchased a batch of stationery for resale (cost 12,303 rubles). Stationery products were sold on 02/12/18 (sales price 18,401 rubles). How can Zeus take into account income and expenses from the sale of stationery?

The sale price (18,401 rubles) should be reflected in the income of the 1st quarter. 2021. Despite the fact that stationery was purchased during the period of application of the simplified tax system of 6%, their cost can be taken into account in expenses (RUB 12,303). Reason – stationery products were sold during the period of application of the simplified tax system of 15%.

Features of the transition from the object of taxation “income” to “income minus expenses”

According to paragraph 4 of Article 346.17 of the Tax Code of the Russian Federation, all expenses that were incurred when applying the object of taxation “income” are not taken into account in the future after the transition to “income minus expenses”. This means that if goods, materials, fixed assets, intangible assets, etc. were paid for (or purchased) at the object of taxation of the simplified tax system “income”, then it is IMPOSSIBLE to take them into account in the cost after the transition to the simplified tax system “income minus expenses”.

This is confirmed by the recent Letter of the Ministry of Finance dated September 25, 2018 N 03-11-11/68478.

However, there are also letters from the Ministry of Finance that express a completely different point of view. These letters are responses to targeted requests from taxpayers (they are not legal acts). In these letters, the Ministry of Finance allows the cost of goods purchased during the period of application of the simplified tax system “income”, and sold and paid for during the period of the simplified tax system “income minus expenses” to be taken into account in full as expenses.

In addition, fixed assets paid for during the period of application of the simplified tax system “income”, and put into operation after the transition,

can be taken into account as part of the expenses for the simplified tax system “income minus expenses”.

(Letter of the Ministry of Finance dated May 26, 2014 N 03-11-06/2/24949, Letter of the Ministry of Finance dated 10/18/2017 N 03-11-11/68187).

From our point of view, when switching from the taxation object of the simplified tax system “income” to the simplified tax system “income minus expenses”, we recommend not including them in expenses

goods, works, services, fixed assets acquired (paid for) during the period of application of the simplified tax system “income”, and sold, put into operation after the transition to the simplified tax system “income minus expenses”. To receive a definite answer regarding your organization or individual entrepreneur, we recommend contacting the Ministry of Finance with a targeted request. Having the Ministry of Finance's response available, it will be possible to act in accordance with their recommendations.