Basis and legal basis

The gambling tax is a regional direct tax.

It is regulated by Chapter 29 of the Tax Code of the Russian Federation, in force since January 1, 2004. For the purposes of determining this tax, it is established that the gambling business is an entrepreneurial activity in the organization and conduct of gambling, associated with the extraction of income by organizations in the form of winnings and (or) fees for gambling. Regional authorities have the right, by appropriate regional law, to introduce a tax on the gambling business and set its rate (taking into account the limits established by the Tax Code of the Russian Federation). However, if a regional law is not adopted, then the tax is still considered introduced and is fully regulated by the Tax Code of the Russian Federation. Unlike other regional taxes, the object of taxation, base, period and terms of payment of the tax on gambling business are fully regulated by the Tax Code of the Russian Federation and cannot be changed by the regional legislator.

Calculation and payment procedure with example

Detailed information about the process of calculating payments is given in Art. 370 Tax Code. The calculation formula is:

- Payment amount = number of taxable objects * their rate.

If there is more than one field on the gaming table, then the bet can increase by a multiple of the number of fields.

Let's give an example. For example, in your establishment there are 2 gaming tables with three fields each and 4 slot machines. Then:

- Payment amount = 6 * 125,000 + 4 * 7500 = 780,000 rubles.

This tax is paid at the place of registration of the taxable object no later than the 20th day of the month following the reporting month.

For more information about what this payment is and who must pay it, you can watch the following video:

Objects of taxation

The list of what is subject to taxation by the gambling business tax is established by Article 366 of the Tax Code of the Russian Federation. This:

- gaming table;

- slot machine;

- betting processing center;

- bookmaker's processing center;

- totalizator betting point;

- bet acceptance point of a bookmaker's office.

Each taxable object must be registered in the manner prescribed by law with the tax authority at the place of installation or location no later than two days before the date of its installation (opening). The taxpayer is also required to register any change in the number of taxable items within the same period.

The application form for registration of taxable objects was approved by Order of the Ministry of Finance of the Russian Federation dated December 22, 2011 N 184n.

Registration (submission of an application by the taxpayer) can be carried out in person, through a representative or by mail.

Tax authorities, within 5 working days from the date of receipt of the application, must issue a certificate of registration or make changes related to changes in the number of taxable objects to the previously issued certificate.

The procedure for registering gambling tax payers was approved by Order of the Ministry of Finance of the Russian Federation dated 04/08/2005 N 55n.

Registration

Objects of taxation are subject to a mandatory registration procedure with the relevant tax authority in the territory, according to the location of installation of slot machines or gambling tables, or at the location of the corresponding points for accepting bookmaker bets or totalizator bets.

The forms of the submitted application and the corresponding certificates must be approved by the federal executive body, which by law is authorized to exercise control and supervision in the field of taxes and fees of the relevant territory.

Application form for registration of object (objects) of taxation with tax on gambling business.

Application form for registration of changes (reduction) in the number of objects of taxation with the gambling business tax.

The tax base

The tax base for the tax on gambling business is determined for each object of taxation separately, based on their total number. The tax amount is calculated by the taxpayer independently as the product of the tax base for each object and the corresponding tax rate.

The tax is payable from the moment of carrying out licensed activities in the field of gambling business.

The procedure for calculating tax is explained in the Letter of the Federal Tax Service of the Russian Federation dated May 18, 2006 N GV-6-02/ [email protected]

How to file a tax return

By the 20th day of each month, gambling business organizations are required to submit a tax return. If the last day of the filing deadline falls on a weekend, it will be moved to the first working day. A report is compiled based on the data for the past month.

Don't miss other upcoming reporting deadlines - check our calendar.

A declaration is submitted at the place of registration of taxable objects . The exception is the largest taxpayers - they submit a report to the Federal Tax Service at the place of registration as the largest.

You can submit the declaration in person or through a representative, via TKS, or send it by mail in a valuable letter with a list of the contents.

Gambling tax rates

Tax rates are set by regional authorities of Russia. However, they must not exceed the limits established in Article 369 of the Tax Code of the Russian Federation. These marginal rates are:

- for one gaming table - from 25,000 to 125,000 rubles;

- for one slot machine - from 1500 to 7500 rubles;

- for one betting processing center - from 25,000 to 125,000 rubles;

- for one processing center of a bookmaker’s office - from 25,000 to 125,000 rubles;

- for one betting point - from 5,000 to 7,000 rubles;

- for one betting point of a bookmaker's office - from 5,000 to 7,000 rubles.

Subjects of the Russian Federation determine specific tax rates for the gambling business. In the absence of relevant laws of regional authorities, the lower limit established by Article 369 of the Tax Code of the Russian Federation is applied.

Defining Objects

The objects of taxation when calculating this tax are units of accounting for gaming objects, these include gaming tables, units of slot machines, as well as places where bets are accepted from bookmakers or bets.

Tax rates range from 1,500 to 25,000 rubles , depending on the selected object.

Let's look at an example.

The taxpayer organization, which received a certificate of registration of a new taxable object, decided to install one of these taxable objects in the form of a slot machine before the 15th of the month , in turn, another object subject to taxation in the form of a playing field was installed after the 15th .

In the analyzed situation, it turns out that the first new point for accepting betting bets was opened before March 15, and the second point opened after March 15. That is, in this case, in relation to the betting point, which was open until March 15, the full gambling tax rate was used, but in relation to the second betting point, ½ tax rate should be used .

So, for the gaming machine installed first, the organization will be required to pay 1,500 rubles, while for the gaming table the taxpayer will have to pay ½ of 25,000 rubles, that is, 12,500 rubles.

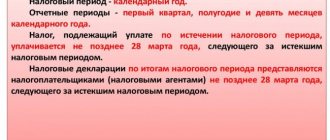

Procedure for paying tax and submitting a declaration

The gambling business tax is paid to the budget at the place of registration of the objects with the tax authority no later than the deadline for filing the declaration (20th day of the next calendar month). The tax amount is calculated by the taxpayer independently as the product of the tax base established for each taxable object and the tax rate provided for these objects.

Payment of tax if the organization has a separate division - at its location.

The gambling business tax declaration is also submitted monthly - no later than the 20th day of the month following the tax period. The declaration must take into account the change in the number of taxable objects in the expired tax period (month).

The declaration must be submitted to the tax authority at the place of registration of taxable objects. The largest taxpayers submit it to the tax authority at the place of registration as the largest taxpayers.

The tax return form and instructions for filling it out were approved by Order of the Federal Tax Service of the Russian Federation dated December 28, 2011 N ММВ-7-3/ [email protected] The declaration can be submitted by the taxpayer personally or through his representative, sent by mail with a list of attachments, or transmitted electronically form via telecommunication channels.

Please pay attention!

Taxpayers whose average number of employees for the previous calendar year exceeds 25 people, as well as newly created organizations whose number of employees exceeds the specified limit, submit tax returns and calculations in electronic form. The same rule applies to the largest taxpayers.

More information about submitting electronic reporting can be found here.

Payment procedure and terms

The tax payable, calculated based on the results of the corresponding taxation period, must be paid by the taxpayer directly to the budget, according to the place of registration of the taxpayer with the tax authority. The correct payment terms are indicated in the “Tax period” subsection.

Gambling business tax return form.

On the site you can learn about what VAT is and how to return it, in what cases it is possible to reimburse VAT from the budget, how to calculate UTII, how to pay dividends to the founders of an LLC using the simplified tax system.

Gambling tax in St. Petersburg

In St. Petersburg, the tax on gambling business is regulated by the Law of St. Petersburg dated July 3, 2012 N 395-66 - this document sets the tax rates. According to the Tax Code of the Russian Federation, only rates can be set at the regional level; all other aspects of the gambling tax are regulated by the Tax Code of the Russian Federation.

The rates are as follows:

- for one betting processing center - 125,000 rubles;

- for one processing center of a bookmaker’s office - 125,000 rubles;

- for one betting point - 7,000 rubles;

- for one betting point of a bookmaker's office - 7,000 rubles.

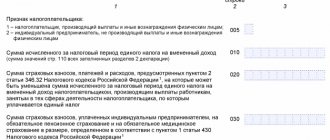

Section 1. Amount of tax to be paid to the budget

Section 1 is filled in automatically based on the information reflected in Section 2.

On line 010

The budget classification code is automatically specified according to which the tax on the gambling business is credited.

On line 020

the OKTMO code is indicated in accordance with the place where the taxpayer is registered for tax purposes.

On line 030

The amount of tax to be paid to the budget is automatically indicated and calculated using the formula:

page 030 = (page 070 + page 080 + page 090 + page 100 + page 110 + page 120) gr. 4 section 2 + tax amount for the processing centers of interactive bets of the bookmaker's office and totalizator

Attention! Before making changes to the tax return form on line 030

the amount of tax is indicated for the processing centers of interactive bets of the bookmaker's office and totalizator. At the same time, it is recommended to send an explanatory note to the tax authority calculating the amount of tax for new taxable items (letter of the Federal Tax Service dated 02/07/2018 No. SD-4-3 / [email protected] ).

In the field “I confirm the accuracy and completeness of the information specified on this page”

The date is automatically indicated.

Gambling tax in Moscow

In Moscow, the tax on gambling business is regulated by the Moscow Law of December 21, 2011 N 69 - this document sets the tax rates. According to the Tax Code of the Russian Federation, only rates can be set at the regional level; all other aspects of the gambling tax are regulated by the Tax Code of the Russian Federation.

The rates are as follows:

- for one processing center of a bookmaker’s office - 125,000 rubles;

- for one betting processing center - 125,000 rubles;

- for one betting point - 7,000 rubles;

- for one betting point of a bookmaker's office - 7,000 rubles.

Taxpayers and objects of taxation

Payers are companies that carry out their activities in the gaming business .

Article 17 of the Federal Law states that the list of activities that require a license includes the maintenance and organization of betting shops and gaming enterprises. Objects of taxation:

- special equipment for gambling;

- casino table, roulette;

- betting center;

- a legal institution that conducts money bets;

- acceptance point for totalizator and bookmaker bets.

A slot machine is equipment that is used to play risky games with any probability of winning.

A table for card games is a specially designated place with several fields for playing corresponding games. The point for accepting bets of a betting counter and a bookmaker's office is an equipped place for counting a single amount of money and determining winnings. Currently in Russia there are five zones for the listed games:

- "Primorye";

- “Siberian coin” – Altai region;

- “Yantarnaya” – Kaliningrad region;

- "Crimea";

- "Azov City" - Krasnodar region.

The Azov City gambling zone is one of five operating zones. It is subject to the Law of Tax Rates and has the following indicators:

- slot machine – 7500 rubles;

- gaming table – 125,000 rubles;

- bookmaker or totalizator processing center – 125,000 rubles;

- betting point – 7,000 rubles.

An application for registration of a taxable object must be submitted no later than 2 days before its installation . An application to register a decrease in the number of facilities indicates that the facility will be closed. Within five days after submitting the application, the tax authorities must issue the appropriate registration document.

The tax period is a calendar month .

The most popular options for bookmaker franchises in Russia can be found here.

If you are interested in how to obtain a bookmaking license, read this article.