The amount of insurance contributions to the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund of the Russian Federation and the Social Insurance Fund of the Russian Federation will not change in 2021 and in the next three years. New limits on the base for calculating insurance premiums in 2021

.

The changes are related to the implementation of the list of instructions of the President of the Russian Federation in terms of ensuring, until 2021 inclusive, the unchanged conditions for the payment of insurance premiums established by law before January 1, 2015. The amendments come into force on January 1, 2021. Let us recall that the minimum wage in 2021 will be increased to 6204 rubles

and it must be taken into account when calculating insurance premiums.

READ ON THE TOPIC:

The minimum wage in 2021 will be 6,204 rubles: the procedure for applying and calculating wages

On November 28, 2015, the President of the Russian Federation signed a federal law that establishes the amount of insurance contributions until 2021 inclusive

(Federal Law of November 28, 2015 No. 347-FZ “On the Payment of amendments to Article 33-1 of the Federal Law “On Compulsory Pension Insurance in the Russian Federation” and Article 58-2 of the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, Social Insurance Fund of the Russian Federation, Federal Compulsory Medical Insurance Fund”).

According to the amendments made, the law specifies the amount of insurance premiums until 2021 inclusive. The same rates are already in effect in 2015 and will not increase for three years. New contribution rates to the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund of the Russian Federation and the Social Insurance Fund of the Russian Federation will be in effect from 2021, 2017 to 2021 inclusive. Moreover, additional tariffs will remain at the same level.

The amount (rate) of insurance contributions to the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund of the Russian Federation and the Social Insurance Fund of the Russian Federation in 2015, 2021 - 2021

Currently and subsequent years, the following deductions are established:

- Pension Fund of Russia (PFR) within the maximum amount of taxable income from the beginning of the year - 22%

, above the limit -

10%

; - Federal Compulsory Medical Insurance Fund (FFOMS RF) in – in the amount 5,1%

; - Social Insurance Fund of the Russian Federation (FSS RF) - in the amount of 2.9%

(Part 1.1 Article 58.2 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, Social Insurance Fund of the Russian Federation , Federal Compulsory Medical Insurance Fund").

Let us remind you that from January 1, 2021

New maximum values of the base for calculating insurance premiums are also established:

- in the FSS of the Russian Federation it will be 718 thousand rubles

.,

- for contributions to the Pension Fund – 796 thousand rubles.

This base is calculated for each individual on an accrual basis from the beginning of the year.

Document:

Decree of the Government of the Russian Federation of November 26, 2015 No. 1265 “On the maximum value of the base for calculating insurance contributions to the Social Insurance Fund of the Russian Federation and the Pension Fund of the Russian Federation from January 1, 2021”).

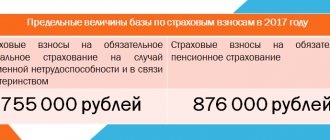

Limit base for insurance premiums in 2016

In 2021, employers will have to pay more contributions than in 2015 due to an increase in the marginal base for calculating compulsory insurance contributions. New indexed values, relevant from January 2021, are determined by Resolution No. 1265 of November 26, 2015:

- 796,000 rub. – contributions to the Pension Fund (711,000 in 2015);

- 718,000 rub. – contributions to the Social Insurance Fund (670,000 in 2015).

Contributions to the Compulsory Medical Insurance Fund are calculated regardless of the size of the base, that is, from the entire amount of payments to an individual. The income limit for medical deductions has been abolished since 2015.

| Employee income | Bid |

| To the Pension Fund | |

| Less than or equal to 796,000 | 22% |

| Over 796,000 | 10% |

| In the FSS | |

| Less than or equal to 718,000 | 2,9% |

| Over 718,000 | 0% |

| In the Compulsory Medical Insurance Fund | |

| The entire amount of income | 5,1% |

The base limit for mandatory insurance contributions to the Pension Fund of the Russian Federation and the Social Insurance Fund is different, which is due to the different mechanism for calculating this limit, which has been in effect since the beginning of 2015.

The size of the maximum base for contributions to the Social Insurance Fund is regulated by the fourth paragraph of Article 8 of Law No. 212-FZ and is established annually by decree of the Government of the Russian Federation.

With regard to contributions to the Pension Fund, this parameter is regulated by clause 5.1 of Article 8 of Law No. 212-FZ, which establishes that the limit indicator is indexed every year depending on the average salary in the Russian Federation, multiplied by 12, taking into account the increasing coefficients prescribed in this paragraph. For 2021, the coefficient has been determined to be 1.8. The resulting value is rounded. This procedure for calculating the limit will be valid until 2021.

The maximum value of the base for calculating insurance premiums in 2016 in the Compulsory Medical Insurance Fund

There is no limit for the MHIF.

Contributions for compulsory health insurance at a general rate of 5.1 percent, as in 2015, will need to be calculated on the full amount of payments to employees, regardless of their income. Tariffs for employers who are not eligible for reduced tariffs

| Conditions for applying the tariff | Fund | Limit value of the calculation base for calculating insurance premiums (rub., per year) 1 | Tariff, % | Base |

| From payments: – to Russian citizens; – foreigners (stateless persons) who permanently or temporarily reside in Russia and are not highly qualified specialists; – citizens of the EAEU member states, regardless of status5 | Pension Fund | Up to 800,000 rub. inclusive | 22,0 | Federal Law of November 28, 2015 No. 347-FZ “On Amendments to Article 33-1 of the Federal Law “On Compulsory Pension Insurance in the Russian Federation” and Article 58-2 of the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, Fund social insurance of the Russian Federation, Federal Compulsory Medical Insurance Fund" |

| —//— | —//— | Over 800,000 rub. | 10,0 | —//— |

| —//— | FSS | Up to 723,000 rub. inclusive | 2,9 | —//— |

| —//— | —//— | Over 723,000 rub. | 0,0 | —//— |

| —//— | FFOMS | Not installed | 5,1 | —//— |

| From payments to foreigners (stateless persons) who are temporarily staying in Russia and are not highly qualified specialists Exception: citizens of EAEU member states5 | Pension Fund | Up to 800,000 rub. inclusive | 22,0 | Federal Law of November 28, 2015 No. 347-FZ “On Amendments to Article 33-1 of the Federal Law “On Compulsory Pension Insurance in the Russian Federation” and Article 58-2 of the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, Fund social insurance of the Russian Federation, Federal Compulsory Medical Insurance Fund”, Part 1, Art. 7, part 2.1 art. 22, part 1 art. 22.1 and art. 33.1 of the Law of December 15, 2001 No. 167-FZ |

Limit value of the base in 2021 for calculating insurance premiums: table, new limits

Attention! Especially for accountants, we have prepared free guides that will help you correctly calculate and pay insurance premiums:

It is convenient to keep records of salaries and personnel in the BukhSoft program. It is suitable for individual entrepreneurs, LLCs, budgetary institutions, non-profit organizations, banks, insurance organizations, etc.

The program includes complete personnel records, time sheets, payroll calculation for any system, sick leave and vacation pay calculators, uploading of transactions into 1C, automatic generation of all reporting (FSS, 2-NDFL, DAM, persuchet, etc.) and much more.

Compare tariffs and prices ⟶

The 2021 base limit in the Russian Federation is needed so that employers receive benefits when annual payments to employees reach large amounts. Once annual benefits reach and exceed the cap, employers contribute less to pensions and social security payments for sick leave and maternity leave. This information is reflected in reports submitted to the tax authorities, the Pension Fund and the Social Insurance Fund.

The situation with payments to OPS is a little more complicated due to the fact that several tariffs are established for them - general, additional and reduced. When calculating contributions, a situation may arise when you need to calculate and make payments according to two tariffs for the same payment. We'll talk about this in more detail below.

Limit values of the base for calculating insurance premiums in 2021

Contribution limits were introduced starting in 2011 and increased annually. Until 2015, limits were set not only for pension contributions and social insurance contributions for sick leave and maternity leave, but also for medical contributions. Read more about this in Table 1.

Table 1.

Limit values of the base for calculating insurance premiums in 2021

| Period | Limit base 2021 for compensatory pension, in rubles | Maximum base 2021 for OSS, in rubles | Compulsory medical insurance base, in rubles |

| 2021 | 1 150 000 | 865 000 | – |

| 2021 | 1 021 000 | 815 000 | – |

| 2021 | 876 000 | 755 000 | – |

| 2021 | 796 000 | 718 000 | – |

| 2015 | 711 000 | 670 000 | – |

| 2014 | 624 000 | 624 000 | 624 000 |

| 2013 | 568 000 | 568 000 | 568 000 |

| 2012 | 512 000 | 512 000 | 512 000 |

| 2011 | 463 000 | 463 000 | 463 000 |

Base Limit Regulation 2021

As before, in 2021, the maximum limits on contributions to annual employee benefits are set by the Government of the Russian Federation.

Maximum base 2021 according to OPS

In 2021 The limit on contributions to pension insurance is 1,150,000 rubles. The amount of contributions for payments within and above the 2021 base limit depends on the contribution rate. As you know, the pension contribution rate can be:

- general;

- reduced;

- additional.

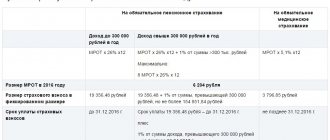

At the regular rate, contributions to compulsory pension insurance are equal to:

- from rewards no more than the limit - 22%;

- from above-limit rewards – 10%.

At preferential rates for above-limit remuneration, the employer does not pay pension contributions. And for additional rates, the 2021 base limit does not apply. Read more about this in Table 2.

Table 2.

Limit base for insurance premiums in 2021, table for compulsory pension insurance

| Annual amount of payments to the employee | Payments to OPS | ||

| at regular rates | at preferential rates | At additional rates | |

| Within the limit (no more than 1,150,000 rubles) | 22% | Depending on the basis for the benefit | Depending on the degree of harmfulness of working conditions |

| Exceeding the maximum PFR base 2021 (more than 1,150,000 rubles) | 10% | 0% |

A current sample payment slip for pension contributions is given below, this document can be downloaded:

The amount of pension contributions is determined by the formula:

In this case, the monthly payment is calculated using the formula:

FSS: maximum base value for 2021

In 2021 the limit on payments under OSS for maternity and sick leave is 865,000 rubles. If annual payments to an employee do not exceed this limit, then the employer makes payments at the following rates:

- 1.8% – for foreign employees temporarily staying in Russia;

- 2.9% – for other employees.

For above-limit remunerations, the employer does not make mandatory social payments.

A current sample payment form for the payment of social contributions for disability and maternity is given below, this document can be downloaded:

Limit base for calculating insurance premiums in 2021: table

In 2021 Limits on the annual amount of payments to an employee are established only for pension payments and social insurance payments for sick leave and maternity leave.

The rate of these contributions depends on the ratio of the annual amount of remuneration and the limit, and exceeding the 2021 base limit is beneficial to the employer. And for compulsory medical insurance contributions, the tariff now does not depend on the amount of payments.

Read more about this in Table 3.

Table 3.

Limit base 2021

| Type of contribution | Annual amount of employee benefits | Regular employer rate |

| Social benefits for sick leave and maternity | No more than 865,000 rubles |

|

| Social benefits for sick leave and maternity | More than 865,000 rubles | 0% |

| Medical | Any | 5,1% |

| Pension | No more than 1,150,000 rubles | 22% |

| Pension | More than 1,150,000 rubles | 10% |

For comparison, tariffs for 2021 the same, but the limits on annual payments to employees are significantly lower. Employer savings were more achievable with lower payments to staff.

Table 4.

Limit base for calculating insurance premiums in 2021

| Type of contribution | Annual amount of remuneration to an employee, in rubles | Regular employer rate |

| Social benefits for sick leave and maternity | No more than 815,000 |

|

| Social benefits for sick leave and maternity | More than 815,000 | 0% |

| Medical | Any | 5,1% |

| Pension | No more than 1,021,000 | 22% |

| Pension | More than 1,021,000 | 10% |

Examples of calculations taking into account the maximum base 2021

The base for mandatory contributions is staff remuneration, monetary and non-monetary. To compare the base with the limit, the employer totals the payments for the year for each employee. Let's show the calculation using numerical examples.

Example 1

.

A production worker at Symbol LLC receives a salary of 120,000 rubles in 2021. In February he was on vacation and received 100,000 rubles in vacation pay. Due to the fact that working conditions are difficult, Symbol pays contributions to the compulsory public health insurance at an additional rate of 6%. The accountant monitored annual payments and the savings limit throughout the year:

| Month of 2021 | Total annual remuneration | Annual remuneration within the limit | Annual remuneration above the limit | OPS at a rate of 22% | OPS at a rate of 10% | OPS at a rate of 6% |

| January | 120 000 | 120 000 | – | 26 400 | – | 7200 |

| February | 220 000 | 220 000 | – | 48 400 | – | 13 200 |

| March | 340 000 | 340 000 | – | 74 800 | – | 20 400 |

| April | 460 000 | 460 000 | – | 101 200 | – | 27 600 |

| May | 580 000 | 580 000 | – | 127 600 | – | 34 800 |

| June | 700 000 | 700 000 | – | 154 000 | – | 42 000 |

| July | 820 000 | 820 000 | – | 180 400 | – | 49 200 |

| August | 940 000 | 940 000 | – | 206 800 | – | 56 400 |

| September | 1 060 000 | 1 060 000 | – | 233 200 | – | 63 600 |

| October | 1 180 000 | 1 150 000 | 30 000 | 253 000 | 3000 | 70 800 |

| November | 1 300 000 | 1 150 000 | 150 000 | 253 000 | 15 000 | 78 000 |

| December | 1 420 000 | 1 150 000 | 270 000 | 253 000 | 27 000 | 85 200 |

Example 2

.

Let's use the condition of example 1 and assume that the Symbol production worker is a citizen of Russia. We will show how an accountant in 2021 considers social insurance payments for sick leave and maternity leave as a cumulative total.

| Month of 2021 | Annual remuneration within the limit | Annual remuneration above the limit | Payments to OSS at a rate of 2.9% |

| January | 120 000 | – | 3480 |

| February | 220 000 | – | 6380 |

| March | 340 000 | – | 9860 |

| April | 460 000 | – | 13 340 |

| May | 580 000 | – | 16 820 |

| June | 700 000 | – | 20 300 |

| July | 820 000 | – | 23 780 |

| August | 865 000 | 75 000 | 25 085 |

| September | 865 000 | 195 000 | 25 085 |

| October | 865 000 | 315 000 | 25 085 |

| November | 865 000 | 435 000 | 25 085 |

| December | 865 000 | 555 000 | 25 085 |

Source: https://www.BuhSoft.ru/article/1191-predelnaya-bazy-2021-nachisleniya-vznosov

Billing and reporting periods

Insurance premiums in 2021

stipulate that the settlement period for them is the 2016 calendar year. It consists of reporting periods: first quarter, half a year, nine months. Insurance premiums in 2021 must be paid monthly to the following funds:

- Russian Pension Fund;

- Social Insurance Fund of Russia (FSS of Russia) (for compulsory social insurance for temporary disability and in connection with maternity);

- to the Federal Compulsory Medical Insurance Fund (FFOMS).

Who pays contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund

Insurance contributions to these extra-budgetary funds are required to be paid to the following categories of entrepreneurs:

- organizations with employees who are paid wages and (or) contractors - individuals who receive remuneration for their work;

- Individual entrepreneurs with employees who are paid wages, and (or) contractors - individuals who receive remuneration for their work;

- Individuals without individual entrepreneur status who pay salaries to employees and (or) remuneration to contractors - individuals;

- Individual entrepreneurs and individuals who are engaged in private practice (notaries, lawyers, doctors) and work for themselves and not for an employer.

Criminal liability for non-payment of insurance premiums

Companies will be held criminally liable for evading payment of insurance contributions to the Pension Fund and the Social Insurance Fund. The draft to which the corresponding amendments are made

in Articles 199.3 and 199.4 of the Criminal Code of the Russian Federation, the Government of the Russian Federation introduced it to the State Duma.

For non-payment of insurance premiums by a company, the maximum possible punishment will be imprisonment for three years, for an entrepreneur - for a year. As in the case of taxes, the culprit will be held accountable - the one who decided to underestimate contributions. Usually this is the director. The chief accountant is a witness unless it is proven that he plays a key role in the company (for example, he is a co-founder) and participated in organizing the schemes.

The funds hope that the law will force debtors to repay the arrears. Decisions to initiate cases will be made by investigators, and funds will not be able to influence them. But the Pension Fund and the Social Insurance Fund will have the opportunity to put pressure on debtors, promising criminal prosecution.

The draft amends Article 199.2 of the Criminal Code of the Russian Federation, which provides for liability for concealing property from collection. It will apply to both taxes and contributions - their amounts will be plus. But the project shares responsibility for concealing property on a large and especially large scale. In the case of a large size (2–10 million rubles for companies and 0.6–3 million rubles for entrepreneurs), the maximum penalty will be softer than now—not five years in prison, but three. This reduces the statute of limitations for prosecution from six to two years.

The maximum base for calculating insurance premiums for 2012 - 2020. Table

| Year | Base for calculating contributions transferred to the Social Insurance Fund | Base for calculating contributions transferred to the Pension Fund |

| year 2012 | 512,000 rubles | |

| year 2013 | 568,000 rubles (+10%) | |

| year 2014 | 624,000 rubles (+10%) | |

| 2015 | 670,000 rubles (+7%) | 711,000 rubles (+13%) |

| 2016 | 718,000 rubles (+7%) | 796,000 rubles (+12%) |

| 2017 | 755,000 rubles (+5%) | 876,000 rubles (+10%) |

| 2018 | 815,000 rubles (+8%) | 1,021,000 rubles (+16.5%) |

| 2019 | 865,000 rubles (+6.3%) | 1,150,000 rubles (+12.6%) |

| 2020 | 912,000 rubles (+5.5%) | 1,292,000 rubles (+12.4%) |

| From 2012 to 2021 | + 78% | +152% |