Late submission of reports

Based on the results of the income received or in case of taxation with a fixed payment amount, the individual entrepreneur must submit declarations.

Reporting is submitted:

- Within the deadline established for each declaration form separately. For example, the deadline for UTII is the 20th of the month following the end of the quarter.

- On forms adopted for the reporting period. If an individual entrepreneur submits declarations of an unspecified form, the reporting is not considered submitted.

You can find out which forms are relevant in the reporting period on the official website of the Federal Tax Service or from tax consultants. When submitting reports on an outdated form, the inspector has the right not to accept the document. What to do if reports are submitted on the last day of submission and there is no time for rework? The declaration must be sent by mail and then the correct document must be submitted.

If the individual entrepreneur does not operate, it is necessary to submit “zero” declarations in which there is no data. Reporting with missing data is submitted by individual entrepreneurs in the absence of movement of material assets, receipt of revenue and other indicators characterizing activity. For failure to submit declarations on time with missing data, a fine of 1 thousand rubles is imposed.

In cases where a situation arises with failure to submit reports for which the amount payable has been accrued, a fine will be charged from the accrued tax. The amount of sanctions is 5% of the amount of the tax liability, but not more than 30%.

Companies with a headcount above a certain limit must submit declarations electronically. For violation of the reporting procedure, a fine of 200 rubles is imposed.

Failure to submit tax reports on time - fines

Failure to comply with deadlines for submitting tax reports to the tax authorities, or failure to submit them at all, is often tolerated by taxpayers. One of the reasons for missing the deadline is a change in the tax reporting template, or a change in the order of its submission.

Do not forget that if the last day for filing reports falls on a Sunday or a non-working national holiday, then it is shifted to the next working day following this weekend or holiday (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

IMPORTANT! In the absence of tax activities that do not involve non-submission of reports in the absence of an object of taxation, a zero tax return must be submitted. Its absence will entail a fine of 1,000 rubles. (letter of the Ministry of Finance dated October 7, 2011 No. 03-02-08/108).

Violation of the deadlines for submitting declarations (calculations) entails the imposition of penalties in the amount of 5% of the unpaid amount of tax subject to payment (additional payment) on the basis of this tax document (declaration), for each full or partial month from the day established for its submission, but no more 30% of the specified amount and not less than 1000 rubles, according to Article 119 of the Tax Code of the Russian Federation.

In addition to penalties for violating the deadlines for submission, which are established by the Tax Code, fines are also provided for by the Administrative Code of the Russian Federation, which must be paid by officials responsible for the timely submission of tax reports (declarations) Article 15.5 of the Code of Administrative Offenses of the Russian Federation. Penalties vary from 300 to 500 rubles, or an administrative penalty in the form of a warning may be imposed.

Also, tax authorities can send a notification to the bank about blocking an existing current account for late submission of tax returns (clause 3 of Article 76 of the Tax Code of the Russian Federation). The account is blocked if tax reporting is not submitted within 10 days after the expiration of the deadline for submission. The tax authorities block all accounts opened at the time of the account analysis.

Statute of limitations for tax violations: from what point does the countdown begin?

Three years

, during which the Federal Tax Service can hold the taxpayer liable for non-payment of tax, are counted from the beginning of the tax period following the period in which the tax must be paid.

Note: Information from the Federal Tax Service

The Federal Tax Service notes that taxpayers often believe that the statute of limitations should begin to be calculated from the end of the tax period for which the unpaid tax was accrued. This approach to calculating the statute of limitations, according to tax authorities, is incorrect. Because according to the law, tax is calculated and paid after the end of the tax period. This means that an offense in the form of non-payment or incomplete payment of tax occurs after the end of the period for which the tax is calculated.

For example, the company did not pay income tax for 2012. The deadline established by law for paying taxes for 2012 expires on March 28, 2013. Those. the tax offense took place already in 2013, and, therefore, the statute of limitations for bringing to justice is counted from 01/01/2014 to 01/01/2017.

What is the statute of limitations for debt collection?

The general limitation period is three years (). However, according to the law, for certain types of requirements the period can be reduced or increased (Article 197 of the Civil Code of the Russian Federation). For example, a transaction can be declared invalid within a year (clause 2). One of the shareholders can challenge the sale of a share in the common property within three months if his pre-emptive right to purchase has been violated (clause 3 of Article 250 of the Civil Code of the Russian Federation). The duration of the limitation period in accordance with paragraph 2 of Article 200 of the Civil Code of the Russian Federation is determined in the following order:

- for obligations for which the fulfillment period is determined - at the end of the obligation fulfillment period;

- for obligations for which the fulfillment period is not defined or is determined by the moment of demand - from the day the creditor submits a demand for fulfillment of the obligation. If the creditor has given the debtor some time to fulfill the demand - after the end of the last day of the obligation to fulfill the obligation.

Statute of limitations

may be interrupted. The basis for interrupting the limitation period is the actions of a person indicating the recognition of a debt. After a break, the limitation period begins anew; the time elapsed before the break is not counted in the new period. However, there is a limitation: the limitation period cannot exceed 10 years from the date of violation of the right, even if the period was interrupted. The exception is cases established by the Law of March 6, 2006 No. 35-FZ on countering terrorism.

Note: Article 203 and paragraph 2 of Article 196 of the Civil Code of the Russian Federation.

Limitation period, Limitation period for administrative liability

There are several statutes of limitations. If 2 months have passed since the administrative offense was committed, then the statute of limitations has passed (). But the statute of limitations for the execution of a resolution imposing an administrative penalty is 1 year from the date it entered into legal force (). If 2 months have passed since the day you were supposed to pay the fine, you won’t be charged, but within a year they can (they often don’t file for small amounts) file a complaint with the bailiff service (they will initiate enforcement proceedings and offer to voluntarily pay the fine within 5 days, fail to pay - forced collection of a fine and an enforcement fee of 7% of the fine amount). After a year has passed, you can forget about the uncollected fine.

Statute of limitations

- this is the period during which a decision on sentencing can be made in the case. Then you can appeal it for at least a year - if the decision made within the statute of limitations is left unchanged, you will be held accountable.

to menu

A foreign citizen without a patent was hired

If an individual entrepreneur employs a citizen of another country who does not have permission to work in the Russian Federation (residence permit or patent), this entails serious consequences.

The fine for illegally hiring a foreign citizen will be (Article 18.15 of the Code of the Russian Federation on Administrative Offences):

- from 25,000 to 50,000 rubles;

- in Moscow and the Moscow region, St. Petersburg and the Leningrad region - from 35,000 to 70,000 rubles.

If an employee from another country has a work permit in the Russian Federation, this is still not enough. When employing such a person, the individual entrepreneur is obliged to inform the FMS within three days from the date of signing that he has entered into an employment contract with a foreign citizen.

The fine imposed for failure to notify the FMS of the conclusion of an employment contract (each) with a citizen of another country (former article):

- From 35,000 to 50,000 rubles.

- In Moscow and the Moscow region, St. Petersburg and the Leningrad region - from 35,000 to 70,000 rubles.

Practical examples.

- An individual entrepreneur from St. Petersburg hired two employees with Turkish citizenship who did not have permits. He did not send the required notification to the FMS. This entrepreneur must pay a fine:

- For illegal employment of two foreign citizens - from 70 to 140 thousand rubles.

- For failure to notify the FMS - from 70 to 140 thousand rubles.

- An individual entrepreneur from Yekaterinburg entered into an employment contract with a citizen of Moldova. His patent to work in the Russian Federation was issued as expected. However, the entrepreneur forgot to notify the FMS about concluding an employment contract with a foreigner. A fine of 25 to 50 thousand rubles will be assessed.

Activities are carried out without a license

There is a list of labor areas that are subject to licensing. These include educational activities, maintenance of medical equipment, production of medicines, communication services, replication of software (if it does not belong to the seller) and more.

An individual entrepreneur conducting activities of this kind in the absence of an issued license risks receiving a fine in accordance with paragraph 2 of Art.

14.1 of the Code of the Russian Federation on Administrative Offences, which will amount to 4000–5000 rubles, as well as confiscation of products and means of production. Get a savings estimate

Drawing up a protocol

To punish you, tax officials must draw up a protocol on an administrative offense. Checking the contents of the protocol, as well as the timing of its preparation, is pointless. Firstly, because violation of the deadlines for drawing up the protocol and the deadlines for sending it to the judge is not grounds for closing the administrative case. Secondly, even if the tax authorities will not indicate any necessary information in the protocol, they will have the opportunity to correct everything. After all, the judge, having received the protocol and identified shortcomings in it, will return it to the tax authorities for revision

Attention

If you are overdue for filing your return by more than 10 business days, tax authorities may block your organization’s accounts.

Let us note that tax authorities must notify you in any way about the place and time of drawing up the protocol, so that you can be present and make your comments if necessary. But even if they do not notify you, the administrative case will not be closed automatically because of this. .

As a rule, when an accountant brings reporting to the Federal Tax Service after the deadline for its submission, inspectors try to immediately draw up a protocol and hand it over to the accountant. Sometimes even threatening not to accept “overdue” reports until the accountant takes the minutes.

If you do not appear at the inspection, but information about you is in the Federal Tax Service database, then the protocol will be drawn up without you and a copy of it will be sent to you by mail

Extenuating circumstances

The following factors can be identified as mitigating circumstances in case of failure to submit or not timely submission of a declaration:

- the offense was not committed intentionally and for the first time;

- the period of delay is very short;

- the ability to confirm a difficult financial situation;

- no consequences for the state. budget;

- maternity leave or temporary disability.

Mitigating circumstances allow you to apply for a waiver of the fine

If at least one circumstance is suitable, then it makes sense to write a corresponding petition to the Federal Tax Service. Perhaps, by decision of the tax office, the fine will be reduced, and for some, canceled altogether.

Filing a tax return is an important stage in the activities of an entrepreneur. Timely actions will save you from overpaying fines, thereby saving time, money and keeping your nervous system intact.

Fines in accordance with tax laws

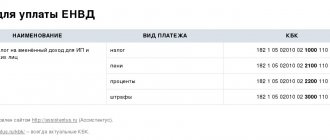

The powers of the tax authorities to resort to punitive measures are provided for in Article 119 of the Tax Code of the Russian Federation. The amount of the fine will be determined not only by the amount of days of delay, but also by the fact of payment of the Unified Tax to the state treasury:

| Type of violations | Amount of fine |

| If the tax was transferred to the state budget in accordance with the established deadlines, but the calculation was not provided on time. | From 1,000 rubles |

| The “zero” UTII declaration was not submitted on time | From 1,000 rubles |

| If both the tax and the report were submitted to the tax authorities late | · 5% of the amount of unpaid tax for each full and partial month of delay · 30% of the amount of unpaid tax (but not less than 1,000 rubles), if the duration of the delay exceeds 6 months |

| If the Single Tax was paid on time, but not in full, and the individual entrepreneur delayed submitting the UTII declaration | The fine is calculated similarly to the previous paragraph, however, the amount of unpaid tax will be the difference between its full amount and the part already paid. provides that a penny will be added to the balance of unpaid tax for each month of delinquency |

This article provides for bringing to administrative responsibility persons whose job responsibilities include the preparation and submission of tax reports. Each violation may be subject to a fine of 300 to 500 rubles.

The fine determined under the Code of Administrative Offenses of the Russian Federation must be repaid within 60 days after the fact of the offense is established. Otherwise, the debt may be collected in court, which, in turn, will lead to another fine, but in double the amount (but not less than 1,000 rubles).

In addition to monetary penalties, the offender may be subject to other forms of administrative punishment:

- detention for up to 15 days;

- community service lasting up to 50 hours.

If we are talking about amounts of unpaid tax on a particularly large scale, the offender, in addition to administrative penalties, may be held criminally liable.

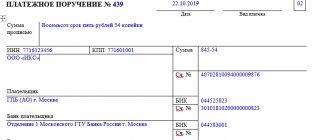

Fine for late payment

Delay in filing a UTII return even by 1 business day threatens the taxpayer with a fine, but its size is determined by the period of delay. But tax legislation establishes a fine of 5% of the amount of tax payable to the budget based on the results of the declaration, but not less than 1000 rubles. The maximum penalty threshold also exists; it is equal to 30% of the amount of tax payable to the budget based on the results of the declaration.

The amount of the fine is assigned to the individual entrepreneur or the enterprise as a whole, but the official may also be subject to punishment (a fine of 300 to 500 rubles or a warning).

In addition to fines, a delay of more than 10 days can lead to another punishment, this is the blocking of the current accounts of an organization or individual entrepreneur (Article 76 of the Tax Code of the Russian Federation). Only payment of budget fees and taxes is allowed. Please note that the requirement to block accounts applies to all banking organizations. After filing the declaration, tax inspectors withdraw their demand, but the accounts remain frozen for some time (usually from 10 to 14 days).

Fine for UTII declaration 2021

Each payer for each tax must submit a return to the tax office, except in cases provided for by law. This follows from paragraph 1 of Article 80 of the Tax Code of the Russian Federation. If, for example, in relation to a special tax regime (STR) in the form of a patent system, the obligation to submit a declaration is not provided, then payers of the single tax on imputed income (UTII) are required to submit declarations quarterly. Failure to fulfill this obligation will entail corresponding liability. The fine for violating the procedure for filing a UTII declaration in 2021 is provided for by both the Tax Code of the Russian Federation and the Code of Administrative Offenses of the Russian Federation.

Declaration of UTII

Payers who use SNR in the form of UTII payment pay tax to the budget and report to the relevant inspectorate of the Federal Tax Service of Russia on a quarterly basis. The UTII payer, based on the results of each quarter during the year, must submit a declaration with tax calculation to the tax office (Article 80, Article 346.32 of the Tax Code of the Russian Federation).

The deadlines for filing a UTII declaration in 2021 are as follows:

For the 4th quarter of 2021 - no later than January 20, 2021; For the 1st quarter of 2021 - no later than April 20, 2021; For the 2nd quarter of 2020 – no later than July 20, 2021; For the 3rd quarter of 2021 - no later than October 20, 2021.

It is important to understand that the single tax is calculated based on possible, and not actually received, income (Article 346.27, paragraph 1 of Article 346.29 of the Tax Code of the Russian Federation). For this reason, the payer needs to declare not actual, but imputed income

Payers of UTII pay a fixed tax and report to the tax office even with minimal or no income.

An individual entrepreneur or organization that has ceased the relevant activity for which they pay UTII is removed from tax registration.

Form N UTII-3 – for the organization; Form N UTII-4 – for an individual entrepreneur.

For UTII payers who have not been deregistered, the following is prohibited:

In what cases is non-payment of taxes not an administrative offense?

If the payer, after identifying the fact of non-payment of taxes before bringing him to administrative responsibility, voluntarily pays the amounts due, the amount of the administrative fine may be reduced by 2 times.

What does non-payment of taxes (fees) to the budget lead to?

- on a large scale (Part 1 of Article 243 of the Criminal Code of the Republic of Belarus) is punishable by a fine, or deprivation of the right to hold certain positions or engage in certain activities, or arrest, or restriction of freedom for up to 3 years, or imprisonment for the same term;

- on an especially large scale (Part 2 of Article 243 of the Criminal Code of the Republic of Belarus) is punishable by restriction of liberty for a term of up to 5 years or imprisonment for a term of 3 to 7 years with confiscation of property or without confiscation and with deprivation of the right to occupy certain positions or engage in certain activities or without deprivation.

The taxpayer did not pay UTII for the 1st quarter of 2021, that is, until April 25, 2020. In this case, the formation of the reporting period of limitation begins from 07/01/2020. During the period from 04/26/2020 to 07/01/2021, the tax office may hold the payer of an individual entrepreneur or legal entity liable for non-payment.

Error No. 1. Very often, taxpayers confuse the deadlines for filing a UTII declaration and paying taxes on it. And sometimes they even think that this is one date. It is necessary to clearly understand that the UTII declaration is submitted by the 20th of the post-reporting month, and the tax payment deadline is by the 25th.

Most common mistakes

Question No. 2. What if the tax office did not count the overpayment for previous periods against upcoming payments, identified a delay, and assessed penalties and fines? In such a situation, you must immediately contact the Federal Tax Service office with a personal visit with evidence of the existence of an overpayment; you will have to write a letter about offsetting the overpayments against upcoming payments. In such a situation, penalties and fines will most likely be removed.

Is there a zero UTII declaration?

The amount of UTII tax is calculated based on the imputed income that an entrepreneur who has a certain amount of a physical indicator can receive. The organization's real profit is not taken into account in the formula. Budget payments are mandatory even for those commercial structures that are temporarily not operating or are operating at a loss.

According to the law, there is no zero declaration for UTII. Submitting a reporting form with zeros to the tax office will be considered a violation of the law. The businessman will have to submit an updated document in which the real numbers of the physical indicator will be written down and calculations will be made based on them.

The state’s position regarding zero reporting is clear: the latter is considered incorrect and invalid. If an LLC or individual entrepreneur does not conduct business, it must be deregistered (deregistered as an LLC) as a payer of imputed tax. Otherwise, they will make quarterly budget payments in the same volume.

Declaration on UTII for the first quarter of 2021: sample filling according to the new rules

Reading time:

The deadline is approaching, no later than which UTII taxpayers must report on the imputed tax. Check our quick reference and sample form to see if you're missing anything.

When do you need to submit your UTII declaration for the first quarter of 2021?

The UTII declaration for the first quarter of 2021 must be submitted no later than April 20, and the tax must be paid no later than April 25.

Deadlines for submitting the UTII declaration for 2021:

- for the first quarter – no later than April 20, 2021;

- for the second quarter – no later than July 20, 2021;

- for the third quarter – no later than October 20, 2021;

- for the fourth quarter – no later than January 20, 2021.

If you do not submit your UTII declaration for the first quarter of 2021 on time, you will be fined under paragraph 1 of Article 119 of the Tax Code of the Russian Federation.

The fine for each month of delay is 5% of the amount of tax that is indicated in the declaration for payment (additional payment), but was not paid on time. They cannot collect more than 30% of the tax amount. Less than 1000 rub.

The director or chief accountant for being late in submitting the UTII declaration for the first quarter of 2021 may be fined from 300 to 500 rubles under Article 15.5 of the Code of Administrative Offenses of the Russian Federation.

Who and where submits the UTII declaration for the first quarter of 2021

All tax payers – both companies and individual entrepreneurs – must report on UTII. The reporting is sent to the inspectorate at the place of business where the taxpayer is registered as a UTII payer.

What form should I use to submit the UTII declaration for the first quarter of 2017?

The UTII declaration is filled out according to the form from the order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/353. The declaration has a title page and 3 sections.

What has changed in the UTII declaration in 2021

From 2021, individual entrepreneurs can take into account insurance premiums paid for themselves in the same quarter when calculating UTII. Legislators took this into account in section 3 of the UTII declaration.

Line 040 “The total amount of UTII payable to the budget for the tax period” is now calculated differently, taking into account line 030 “The amount of insurance contributions paid by an individual entrepreneur in a fixed amount for compulsory pension insurance and compulsory health insurance.”

How to fill out a UTII declaration for the first quarter of 2021

filling out the UTII declaration for the first quarter of 2021

Let’s assume that the UTII declaration for the first quarter of 2021 is filled out by a company that repairs jewelry in the city of Bui, Kostroma Region. The company has only one type of activity and one workshop in the city.

Title page

The title page shows information about the company - full name, tax identification number and checkpoint. The adjustment number is 0 if the company submits a declaration for the first time for the reporting period. Tax period – 21, reporting year – 2021.

The code for the type of economic activity must be taken from the All-Russian Classifier of Types of Economic Activities (OKVED2).

Do not forget to add dashes to the end of the line if there is still space left after entering the data. The same applies to lines in which the company cannot enter anything. For example, according to data on reorganization, if one was not carried out.

Special attention to the line with the code “At the place of registration”. The data there must be taken in accordance with Appendix 3 to the Procedure, approved by order of the Federal Tax Service of Russia dated July 4, 2014

No. ММВ-7-3/

The line “Submitted to the tax authority” contains the inspection code. View it using the Federal Tax Service.

Section 1

Section 1 shows the data that the accountant provides in sections 2 and 3. Line 010 contains the code of the municipality in whose territory it operates on UTII. And line 020 will show the tax payable, which is calculated in the following sections.

Section 2

At the top of the section, you must enter the address of the place of business activity along with the index and OKTMO code.

Jewelry repair in the town of Bui, Kostroma Region, is considered a household service, so the line “Code of business activity” contains the value “01”. The codes must be viewed in Appendix 3 to the Procedure approved by order of the Federal Tax Service of Russia dated July 4, 2014 No. MMV-7-3/

Below in section 2 we will directly calculate the tax.

Section 3

The taxpayer's attribute will be 1, because he has employees.

Line 010 will contain the value from line 110 of section 2. He had one. If there are several sections 2, you need to add up the numbers of all lines of 110 of them.

In line 020 you must show insurance premiums paid in the first quarter of 2021. The final amount of tax that must be transferred to the budget is shown on line 040. This is the difference between lines 010 and 020 of section 3.

What can an individual entrepreneur be fined for?

If there are several reasons why an individual entrepreneur may face fines:

- The individual entrepreneur violated the deadlines for submitting reports (tax, statistical);

- The individual entrepreneur did not pay taxes and contributions on time;

- an entrepreneur operates without a license, but must have one;

- violation of cash accounting;

- improper maintenance of KUDiR;

- The required OKVED is not open.

In addition to the tax, an individual entrepreneur may also receive an administrative fine. Its amount under the Code of Administrative Offenses is significantly less than for an LLC. For example, if an individual entrepreneur placed an advertisement that he did not agree with local authorities, he will face the largest fine in the amount of 5 thousand rubles, and an LLC - 1 million rubles. But this is only if we are talking about administrative offenses; with tax offenses, everyone is equal.

Fines are possible during any tax audit of individual entrepreneurs (desk, field), labor inspectorate (if employees work without concluding a contract) and other structures that are responsible for the safety of people and the environment.

Next, we will consider in more detail the most common fines provided for individual entrepreneurs.

Fine to entrepreneur for lack of IP

According to the law, if an individual a person receives regular income from the sale of his products, the provision of services, and any resales; he is required to register with the tax authorities, open an individual entrepreneur or register as self-employed, submit reports (if required) and pay taxes.

Fiscal officials may find out by chance that the activity is ongoing but there is no tax status - from social media. networks, advertisements of an advertising nature placed on special platforms, purchases of control services, for example, car repairs, hairdressing services, from bank information about replenishing a card, with the same amounts, etc. We are talking about receiving regular income, and not just any -or a one-time amount. Receipt of income must be recorded with supporting documents, a protocol on the violation must be drawn up, and the culprit will be summoned to the inspectorate to give an explanation.

If the fact of violation is confirmed, the individual will be held accountable in the form of an administrative fine (income received up to 1 million rubles per year), or criminal liability will be discussed (if the income received is much higher). You also need to pay all taxes and, accordingly, penalties on them. In the same way, a case will be considered against an individual who has closed an individual entrepreneur but continues to receive income.

We recommend reading: Where is it profitable to open a current account for individual entrepreneurs: comparison of tariffs for cash settlement services and reviews.

Individual entrepreneur fine for non-payment of taxes

If during a desk audit it turns out that the tax base was underestimated and you did not pay the tax on time (this may simply be a technical error), the tax office will charge a fine. The Federal Tax Service will also require payment of the amount of overdue tax. To all this will be added penalties for late payment.

Therefore, it is better to double-check the submitted reports, and if you find an error, you need to urgently pay the missing tax and send it to the tax return. This way, fines and penalties can be avoided.

If criminal intent to evade paying taxes is proven, and the amount of arrears is more than 900 thousand rubles. over the last three reporting periods, a criminal case may be opened against the individual entrepreneur. The maximum fine amount reaches about 500 thousand rubles. Depending on the severity of the offense, arrest for a period of six months to three years may be considered.

Individual entrepreneur fines for lack of a license

If an individual entrepreneur operates in one of the areas subject to mandatory licensing:

- Passenger Transportation;

- medical activities;

- educational;

- pharmaceuticals;

- detective services

and does not have a properly issued license, then a fine cannot be avoided. As well as all raw materials, manufactured products and equipment may be subject to confiscation.

If during the inspection it is discovered that the individual entrepreneur sells strong alcohol (which is prohibited by law), the fines will be impressive - from 100 to 200 thousand rubles. All alcoholic beverages will be confiscated. This rule does not apply to the sale of beer. An individual entrepreneur can trade them in compliance with the established rules.

Individual entrepreneur fine for KUDiR

All transactions that an individual entrepreneur had during the year must be recorded in the book of income and expenses. Penalties are also provided for its absence. The exception is those entrepreneurs who work for UTII. On the simplified tax system “Revenues” and the patent, only the revenue (receipts from sales) part of the book is filled out.

We recommend reading: What kind of reporting does an individual entrepreneur submit to the tax authorities and funds: types, rules, dates and deadlines.

Individual entrepreneur fine for failure to submit reports

If you have an open individual entrepreneur, but do not actually work, you will still have to submit reports. She will have zero indicators. The exception is the UTII declaration. It cannot be zero: it always contains a physical indicator, which does not depend on whether an activity is in progress or not. Therefore, in order to avoid unnecessary taxes, during the suspension of work, you need to submit a corresponding notification to the tax office.

If you have employees, you will have to report to the Pension Fund and the Social Insurance Fund, which also provides for liability for failure to submit reports on time.

Fines for individual entrepreneurs in trade

If your seller violated the rules of trade, responsibility for this offense will still lie with you, in this case, as the employer. This could be selling beer and cigarettes to minors or something else. Then it’s your right to decide whether to punish the employee for the damage caused.

If illegal sales of alcoholic beverages are discovered in a store, the Department of Economic Crimes will deal with you. The amount of penalties depends on the violations identified.

Reasons for blocking a bank account

- non-payment (incomplete payment) of personal income tax on salaries, bonuses, fees to freelancers and other payments to individuals (70% of companies whose accounts were blocked);

- very fast (within a few hours or minutes) withdrawal of money from accounts after they are received (55% of companies);

- working with unreliable counterparties (50% of companies);

- being in the “red zone” for taxes. Those. taxes were paid in amounts not comparable with the scale and type of business (45% of firms);

- the organization is on the black list, that is, on the list of companies that have already had problems according to the Federal Service for Financial Monitoring (38%);

- payment of VAT in insufficient amounts (35%);

- negative rating for cash withdrawals. Those. companies rented significantly more than similar companies did (9% of firms).

Note: Accounts were blocked only if the company met not one, but several criteria for dubiousness.

Will there be a fine for failure to submit a UTII return on time?

There will definitely be a fine for failure to submit a UTII declaration on time in 2021. How much it is and what other measures can be taken in relation to a negligent UTII payer, read in this material.

What does tax legislation provide for failure to file a return?

The sanctions that the tax office may apply if it does not receive the required report on time are prescribed in Art. 119 of the Tax Code of the Russian Federation. The exact amount of the fine that will be established depends not only on the submission of the declaration (calculation), but also on the actual payment of the amount of tax due under this declaration to the budget:

- If the tax due for the period was fully transferred to the budget by the payment deadline, and only the declaration was “late,” the fine will be at least 1,000 rubles. The same liability occurs if the zero declaration is not submitted on time.

- If neither the declaration was submitted nor the tax was paid, a fine will be charged on the entire amount of tax not received by the budget in the following order: 5% of the amount of unpaid tax for each month of delay (full or incomplete). This means that even if there is a delay of several days, there is already one incomplete month.

- The total amount of fines can be a maximum of 30% of the amount of unpaid tax, but not less than 1000 rubles. That is, a fine of 5% can be charged for each of the 6 months from the date of delay. If the taxpayer manages not to report and pay for a longer period, the fine will still be 30%.

In addition, penalties will be charged for the tax underpaid to the budget in its own way, according to Art. 75 of the Tax Code of the Russian Federation, regardless of whether any other sanctions were applied to the taxpayer or not.

What sanctions are imposed for failure to submit a report on time under the Code of Administrative Offenses of the Russian Federation?

Violation of tax laws entails not only tax sanctions, but also administrative liability. In case of failure to submit a tax return, the provisions of Art. 15.5 Code of Administrative Offenses of the Russian Federation.

According to Art. 15.5 of the Code of Administrative Offenses of the Russian Federation, officials (responsible for submitting reports and paying taxes) may be given a warning or imposed a fine, which ranges from 300 to 500 rubles for each violation.

NOTE! According to the Code of Administrative Offenses of the Russian Federation, fines must be paid within 60 days from the date of the decision on the offense. Such fines in case of non-payment may be collected through the court.

The following may also be prescribed:

- administrative arrest for up to 15 days;

- forced community service lasting up to 50 hours.

It should be remembered that in certain cases (resulting in a shortfall in tax receipt by the budget in an amount defined as particularly large), in addition to administrative liability, criminal liability may also be applied.

You can find out in detail what and when criminal liability is imposed on negligent taxpayers in our section.

What additional measures may be applied to those who do not submit UTII reports?

For those who do not submit their UTII reports on time, general additional measures may be applied. Among other things, first of all, you should remember about blocking the bank accounts of an unscrupulous taxpayer.

The ability for tax authorities to block bank accounts is provided for in Art. 76 Tax Code of the Russian Federation. If the submission of the declaration is overdue by more than 10 working days after the filing date established by law, the tax office has the right to send to the banks where the taxpayer is serviced a decision to suspend transactions on his accounts.

Transactions are blocked in the expenditure part (that is, money will be credited to the account, but the taxpayer will not be able to use it). When blocking, the following nuances are taken into account:

The account is blocked without prior notification to the taxpayer. The Federal Tax Service did not support the idea of warning about blocking (see letter of the Federal Tax Service dated July 28, 2016 No. AS-3-15/).

Is there a fine for late submission of UTII?

Submitting a UTII declaration: it is important to submit it on time

The unified tax on imputed income (hereinafter referred to as UTII) is a type of tax that is paid for certain types of business without fixing profits, based on indirect indicators.

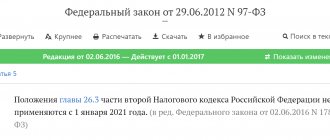

The taxation system, based on UTII and representing a special tax regime, is regulated by Ch. 26.3 of the Tax Code of the Russian Federation (Part 2). Information about the prospects for the existence of UTII can be found in our article Will UTII be abolished and when? Read about the calculation of periods for UTII in the material Which period for UTII is considered reporting or tax?

According to paragraph 3 of Art. 346.32 of the Tax Code of the Russian Federation, UTII declarations are submitted to the tax authorities no later than the 20th day of the month following the tax period, which, according to Art. 346.30 of the Tax Code of the Russian Federation is 1 quarter. The declaration is submitted in accordance with the order of the Federal Tax Service of the Russian Federation “On approval of the tax return form for UTII” dated 07/04/2014 No. ММВ-7-3/ Features of submitting a declaration when deregistering a taxpayer are enshrined in the letter of the Federal Tax Service of the Russian Federation “On reflecting UTII accruals” dated 20.03. 2020 No. GD-4-3/

For officials, a fine for failure to submit UTII on time is levied under Art. 15.5 of the Code of the Russian Federation on Administrative Offenses and amounts to 300–500 rubles. Alternatively, a warning is provided.

To find out whether you need to submit a zero UTII declaration, read our article Zero UTII declaration - the need to submit.

Delay in filing a declaration and liability for late submission of a declaration: judicial practice

A fine for UTII in case of delay in filing a declaration is imposed, in addition to officials, on the organization itself in accordance with clause 1 of Art. 119 of the Tax Code of the Russian Federation. In accordance with this norm, the penalty for late submission of the UTII declaration is 5% of the amount of tax not paid on time based on the declaration, but not less than 1,000 rubles. and no more than 30% of this amount.

In addition to the fine for late submission of the UTII declaration in accordance with clause 3 of Art. 76 of the Tax Code of the Russian Federation, a decision may also be made to suspend transactions on accounts.

Failure to pay a fine for failing to submit a UTII return on time may become the basis for the tax office to file an administrative claim in court. If the fine does not exceed 20,000 rubles, then the case is considered through summary proceedings (appeal ruling of the Sverdlovsk Regional Court dated July 27, 2016 in case No. 33a-12279/2016).

A difficult financial situation and long-term treatment (if the declarant is an individual entrepreneur) may be grounds for reducing the amount of the fine collected (Resolution of the AS DO of June 28, 2016 No. F03-2698/2016 in case No. A24-3217/2020).

When bringing officials to justice, the period for bringing them to justice is 1 year from the date of the violation. Termination of proceedings based on general terms (3 months for a decision made by a judge, and 2 months in relation to decisions made by other persons) is the basis for canceling the decision to terminate proceedings (resolution of the Khabarovsk Regional Court dated 02.06.2016 No. 4A-357/2016) .

So, the fine for late submission of the UTII declaration is established both for the organization (under Article 119 of the Tax Code of the Russian Federation) and for the officials responsible for filing the declaration (under Article 15.5 of the Code of Administrative Offenses of the Russian Federation). In addition to a fine, a decision may be made against the organization to suspend account transactions. A decision may be made against an official to issue a warning instead of a fine. Also, the difficult financial situation of the complainant may be grounds for reducing the amount of the fine collected.

Examples of calculating the amount of monetary recovery

Let's look at examples of how the fine for declaring UTII in 2021 and 2021 is determined.

Example 1.

IP Ivanov A.A. I submitted my tax return to the Federal Tax Service a week later than due. The document says that the amount of tax payable is 100,000 rubles. The late fee will be 5% of this amount, which is equal to 5,000 rubles.

Example 2.

IP Sidorov B.B. actually did not conduct activity for six months. After this time, he was going to close the individual entrepreneur, but remembered that he had not given a declaration even once in the last six months.

The fine for individual entrepreneurs will be 1,000*6 = 6,000 rubles. This monetary sanction will not prevent the closure of the individual entrepreneur, but will transfer to B.B. Sidorov. as an individual. It is better to pay the amount on time, because otherwise the bailiffs will get involved.

Deadline for submitting declarations

Now about the consequences of failure to submit declarations on time. Here, the minimum fine for a declaration submitted late is 1 thousand rubles. – under favorable conditions, this is the lower limit of punishment established by the Tax Code of the Russian Federation. Even if the fine is calculated to be less, it will be increased to 1,000 rubles. The size of the delay does not matter. The approach to those who are one day late and to those who are a month late is the same!

If you are not only late with the declaration, but also paid the tax itself later than the legally approved deadline, then the fine will be greater. Its amount will depend on the size of the overdue tax payment and the number of months of delay - both full and incomplete.

Let's give an example: let's say you are an individual entrepreneur on UTII. 2021 has ended, the declaration for the 4th quarter is required until January 20, 2021. You submitted your declaration only at the beginning of April - on the 8th. The tax was not paid: out of 22 thousand rubles. Only 4 thousand rubles were transferred for payment. What's the result?

We count the months of delay: the overdue period was 3 full months (from 01/21/19 to 03/20/19) plus one incomplete (03/21/19 to 04/08/19). The fine will be calculated over 4 months.

How is the fine calculated? The amount of the fine is equal to 5% of the amount of arrears multiplied by the number of months of delay. True, there is an upper limit in the form of 30% of the amount not paid on time.

In our example, the tax arrears are 22 – 4 = 18 thousand rubles.

The amount of the fine is 18 thousand * 5% * 4 months. = 3.6 thousand rubles. The maximum amount will be 18 thousand * 30% = 5.4 thousand rubles. As a result, the fine to be paid is 3,600 rubles.

Important! Failure to comply with the procedure for submitting a declaration in electronic form will result in another fine of 200 rubles.

Non-payment (as well as incomplete payment of tax) due to an understatement of the tax base (income and expenses were incorrectly calculated), other reasons leading to incorrect calculation, as well as other unlawful actions, faces a fine of 20% of the unpaid amount.

Example: at the end of the year, you calculated the simplified tax system (income minus expenses) in the amount of 20,000 rubles - this amount was paid to the budget on time. Based on the results of the tax audit, it was established that part of the expenses was recognized unlawfully. As a result, the tax base was understated. Based on the results of the audit, the tax base was recalculated upward; the correctly calculated tax amount = 30,000 rubles. Thus, the arrears amounted to 10,000 rubles. In addition to tax arrears, you will have to pay a fine of 10,000 * 20% = 2,000 rubles.

The same acts, provided that they were done intentionally, will lead to an increase in the fine to 40% of the unpaid amount.

The judge decides what the punishment will be

The tax authorities send the compiled protocol to the magistrate

You must be notified of the date and place of consideration of the case. Although in practice, the case may be considered without you, without even informing you that it will be considered. In this case, you, in principle, can complain that you were not notified, and the case may be returned for a new consideration. But in the end, this will not help you avoid a fine at all. Most likely, you will simply delay the moment of punishment.

ADVICE

If you do not have a written job description and you are not afraid of the wrath of your manager, then in court you can argue that submitting returns to the tax office is not part of your job responsibilities. After all, according to the Accounting Law, the chief accountant’s duty is to maintain accounting records. Then the manager should be fined, not you. Who knows, perhaps while the tax authorities are re-issuing the protocol and the judge is considering the case materials, the statute of limitations for bringing to justice will expire, and the manager will also avoid punishment.

If the judge still finds you guilty, he will issue a ruling imposing an administrative penalty. A copy of the ruling will be handed to you personally or sent by registered mail.

Should increased contributions be collected from individual entrepreneurs: the position of the Pension Fund of Russia

In Letter No. NP - 30 - 26/9994 dated July 10, 2017, the Pension Fund indicates that the norm of Law No. 212 - Federal Law on the collection of contributions from individual entrepreneurs that are several times higher than standard does not imply the possibility of recalculating the obligations of individual entrepreneurs arising as a result of failure to submit a declaration. The Fund considers it legitimate to demand social contributions from an entrepreneur, even with zero income, for a fixed part of them, in the maximum amount.

At the same time, the Pension Fund of the Russian Federation notes that when an individual entrepreneur submits a tax return, albeit late, but within the billing period for which contributions are calculated, recalculation of obligations is still possible. It is obvious that such a position still goes beyond the scope of Law No. 212 - Federal Law or, at least, reflects an attempt by the Pension Fund of the Russian Federation to interpret the provisions of this law in a certain way. In this case, the interpretation is not in favor of entrepreneurs.

The Federal Tax Service of Russia has a different point of view on the issue of recalculation of contributions.

What fines and penalties may there be for UTII | Business case

29.09.2015

Imputation remains one of the most popular tax systems for small businesses in the country; the main reason for this demand is the relatively low tax rate and the ability to maintain simplified accounting, although all these advantages do not provide immunity from UTII fines.

So how to avoid fines and what exactly are they used for when using UTII?

UTII fines for registration

Any song begins with music, and familiarity with the penalties of the Federal Tax Service for individual entrepreneurs begins with registration. Actually, earlier we examined in detail the documents that are submitted to the tax office for registration as a payer of the UTII-1 and UTII-2 application, here about the basic profitability and the adjustment coefficients K-1, K-2. What happens if you don’t submit?

The fines for failure to register or late registration are quite large:

- Option one - employees of the Federal Tax Service caught you “by the hand” if the individual entrepreneur carries out activities without registering as a UTII payer. Then the fine under UTII will be at least 40 thousand rubles, the maximum amount is not limited and is 10% of the income received as a result of the work of an individual entrepreneur or LLC without registration. True, there is one caveat: the amount of income can only be really justified through documentation, so in most cases the fine will be 40 thousand rubles.

- Option two - the entrepreneur independently submitted documents late; details of when it needs to be submitted were discussed in the article about UTII. Then you face a fine of 10 thousand rubles.

Fines for UTII declarations

Even if you submitted your registration application on time and are working quietly, you should not forget about the timely submission of your UTII declaration. For late submission of imputation reports, there is even a very good fine.

The minimum amount of the fine for failure to submit a UTII return is 1 thousand rubles, but the amount may be higher; a maximum of 5% of the tax amount will be charged.

Example, based on the declaration, you have to pay 100,000 thousand rubles, as a result the fine will be 5,000 rubles.

Remember - if you suddenly do not have time to submit a report on time, it is better to submit a blank one but on time, and after a couple of days already with the correct numbers

Just remember that it is very important to prevent the Federal Tax Service from starting an inspection, so in cases with the specified information you have literally a couple of days head start

Tax fines

The most severe penalties are provided specifically for late payment of taxes. There are two options:

- - first, 20% of the amount of late paid tax.

- - second, 40% of the amount imputed in the presence of malicious intent.

To be honest, it is quite difficult to prove that the delay was without malicious intent; for example, a certificate from the hospital that you had an operation or traveled outside the country. In fact, “intention or not” largely depends on the position of a particular tax official or his boss.

The only really good option and insurance itself is overpayment, of course there is no extra money, in practice I can say that it is much cheaper to keep a quarterly overpayment on your personal card at the Federal Tax Service. Which will be included in the payment as the tax is calculated, this is better than paying fines on UTII.

The overpayment amount can be returned to your current account upon request.

What else is worth knowing about UTII sanctions

- First, in addition to the fine for late payment, a UTII penalty is charged. The amounts there are small, but you shouldn’t forget about it.

- Second, despite the fact that federal laws No. 52FZ and No. 59FZ of April 2, 2014 removed the obligation from entrepreneurs to notify the Federal Tax Service about opening a current account, the fine for this still remains and amounts to 5 thousand rubles.

- Third, if you are called as a witness and you are the payer of the imputation, then for failure to appear you can be fined 1 thousand rubles, and for refusing to testify another 3 thousand, maybe small things, but very unpleasant.

about taxes, let's see how to fill out a declaration

How to fill out a UTII declaration (details https://pilotbiz.ru/category/nalogooblozhenie-malogo-biznesa/envd/), calculation example,

Upload date: 2015-05-02

Fines for UTII Link to main publication

Tax fines for individual entrepreneurs: summary table

To help you use the information collected in this article, please review the following table.

| Type of violation | Tax penalty |

| Late submission of an application for registration with the tax service. | 10 thousand rubles. |

| Carrying out the activities of an individual entrepreneur without registering with the fiscal service, as required by the Tax Code of the Russian Federation | 10% of the income received during the entire period of such activity, but not less than 40 thousand rubles. |

| Failure to timely submit information regarding changes to bank accounts | 5 thousand rubles. |

| Non-payment of taxes or underpayment as a result of underestimation of the tax base, incorrect calculation of taxes or other actions or inaction (if the act does not fall under the category of tax offenses in Article 129.3 of the Tax Code of the Russian Federation) | 20% of the amount of unpaid tax |

| Intentional non-payment of taxes or underpayment of taxes as a result of underestimation of the tax base, incorrect calculation of taxes or other actions (inaction) | 40% of the unpaid tax amount |

| Incorrect submission of tax returns and other documents in electronic form (according to the Tax Code of the Russian Federation) | 200 rub. |

| Failure to provide information about controlled transactions completed during a calendar year, or providing false information about them to the tax service | 5 thousand rubles. |

| Gross violation in accounting for income and expenses on a taxable object within a certain tax period (in the absence of signs of a tax violation) | 10 thousand rubles. |

| Gross violation in accounting for income and expenses on a taxable object for more than one tax period | 30 thousand rubles. |

| Gross violation in accounting for income and expenses at the taxation site, resulting in an underestimation of the taxable base | 20% of the amount of unpaid tax, but not less than 40 thousand rubles. |

| Unlawful non-withholding and (or) non-transfer (as well as withholding and (or) transfer not in full) of taxes, the amounts of which are established by the Tax Code of the Russian Federation | 20% of the amount subject to withholding and (or) transfer. |

| Violations in the possession, use and disposal of seized or pledged property | 30 thousand rubles. |

| Failure to submit documents or information on time, if such an action does not fall under the category of tax offenses prescribed in Articles 119 and 129.4 of the Tax Code of the Russian Federation | 200 rubles for the absence of each document |

Please note that this list of violations and penalties is not complete, since it only includes tax penalties for individual entrepreneurs imposed for certain types of arrears. At the same time, there are much more significant deviations regarding large-scale tax evasion. They entail administrative and criminal liability and are punishable by fines amounting to hundreds of thousands of rubles and even actual imprisonment. By the way, these types of obligations may arise for individual entrepreneurs simultaneously with tax obligations. These and other issues will not be discussed in this material, since they affect another voluminous area of knowledge.

Failure to pay a fine is also a fine.

You must pay the fine according to the details specified in the resolution within 30 calendar days from the date the resolution comes into force. And it is considered as such after the expiration of the period established for appealing it. That is, if you have not appealed this decision, then the fine must be paid no later than the day from the moment you received the decision. If you do file a complaint, the time limit for paying the fine will begin to count from the date the most recent court decision in your case entered into force.

If you do not pay the fine on time, the bailiff will collect the fine. In addition, for violating the deadline for paying the initial fine, you face a new, additional fine in our situation - 1000 rubles. That is, if you were fined for late filing of a declaration, for example, but you did not pay this fine, then you will have to pay 1,300 rubles. In addition to paying two administrative fines, you will have to pay an enforcement fee, which in our case will be Total - 1800 rubles, and if the fine was initially 500 rubles. - then 2000 rubles. Therefore, it is better not to delay paying the fine for late submission of the declaration.

In our opinion, if you really missed the deadline for submitting your declaration, it is better to pay a fine. After all, the time and possibly material costs (for example, if you engage lawyers to draw up legally competent complaints) associated with challenging a decision are not comparable to the size of the fine itself.

Amounts of penalties for individual entrepreneurs

We have collected the amounts of fines for IP violations in the table:

| Violation | Minimum fine (RUB) | Maximum fine (RUB) |

| Work without opening an individual entrepreneur | 500 | 2 thousand |

| Non-payment or late payment of tax | 20% of the amount payable (if there is no gross violation - an error without intent) | 40% of non-payment if criminal intent is proven |

| Activities without a license | 4 thousand | 5 thousand |

| Ignorance KUDiR | 10 thousand if one tax period is missed |

|

| Tax reporting was not submitted on time | 1 thousand | — |

| Failure to submit SZV-M | 500 rub. for each hired employee | — |

| Failure to submit statistical reports |

|

|

| Attracting employees without drawing up an employment contract |

|

|

| No cash register | 10 thousand rubles | up to half the sale amount, but not less than 10 thousand rubles. |

| Activities are carried out without opening the required OKVED | warning | 5 thousand |

Sanctions for violation of accounting rules

In the process of conducting business, an individual entrepreneur must keep records of assets, income and expenses. Based on accounting data, the amount of taxes indicated in the declaration and contributed to the budget is determined. The Tax Code of the Russian Federation (Article 120) provides for a fine for gross violation of accounting rules for the absence of:

- Primary accounting forms confirming expenses incurred and accounting data.

- Recording transactions and availability of accounting registers.

- Regular ignorance or incorrect reflection in the accounts of business transactions, movements of material assets, cash and other assets.

The amount of the sanction is set at 10 or 30 thousand rubles if a violation is detected over several periods. The minimum amount is provided for individual entrepreneurs who have paid the full amount of taxes. If a violation reveals an understatement of the base when calculating taxes, sanctions are imposed in the form of 20% of the amount of non-payment with a minimum penalty of 40 thousand rubles.

Each system has its own accounting and document flow procedures. The most minimal accounting is provided by UTII, in which the individual entrepreneur only keeps records of the physical indicator. Failure to record income, property, and assets with UTII does not entail a fine from the Federal Tax Service. The accounting requirements for UTII are simpler than a patent, the purchase of which requires taking into account income to prevent excess.

Tags: asset, accountant, job description of the general director, UTII, coefficient, loan, tax, order, problems, expense

What tax penalties for individual entrepreneurs face in this or that case?

Tax fines for individual entrepreneurs for violation of accounting rules or distortion of reporting

An entrepreneur who has committed violations in maintaining tax records (for example, lack of primary documentation) is liable under Article 120 of the Tax Code of the Russian Federation. He could face a fine of 10 thousand rubles.

If such violations occurred over more than one period, the amount of sanctions may increase to 30 thousand rubles.

If deviations from the rules lead to a decrease in the tax base, the fine will be 20% of the amount of arrears (it cannot be less than 40 thousand rubles).

Obviously, paying a tax fine for an individual entrepreneur does not relieve him of the need to repay the main obligation and penalties on it for the delay.

Tax penalties for individual entrepreneurs for failure to fulfill the duties of a tax agent

In this situation, the agent faces a fine of 20% of the untransferred amount.

In some cases, an individual entrepreneur may pay tax not for himself, but for someone else. For example, a businessman is required to pay personal income tax on the income of his employees, and an individual entrepreneur who has leased state property is required to pay VAT on this item.

Failure to fulfill these obligations entails a fine of 20% of the amount not paid to the budget.

And if an entrepreneur provides false information to the tax authority, sanctions of another 500 rubles may be applied to him for each false document.

Tax penalties for individual entrepreneurs for incomplete payment, non-payment or exceeding the deadline for paying taxes

If the fiscal service discovers that you have uncollected tax, in accordance with Article 69 of the Tax Code of the Russian Federation, it will send you a demand for its repayment with penalties already accrued. Arrears not paid within the period established by this requirement are collected forcibly (Article 46 of the Tax Code of the Russian Federation). And in accordance with Art. 122 of the same document, the taxpayer may also face a fine of 20% of this amount, and if malicious intent is discovered in his actions, then the entire 40%.