Representation expenses under the simplified tax system

Almost no major deal goes through without discussing its terms at the negotiating table. Regardless of whether it is a large company or a small business, it pays income tax or tax according to the simplified tax system. Negotiations usually take place in restaurants, cafes, boardrooms, or simply in the director’s office over a cup of tea.

Sometimes expenses for business meetings reach quite significant amounts. Therefore, simplified taxpayers often have a question: is it possible to reduce income for entertainment expenses?

Legal entities and individuals who apply the simplified tax system “income minus expenses” have the right to reduce the tax base by the amount of expenses. However, not everything off, but only what is indicated in paragraph 1 of Art. 346.16 of the Internal Revenue Code. Expenses not listed in this article do not reduce the tax base during simplification. Unfortunately, entertainment expenses in Art. 346.16 of the Tax Code of the Russian Federation are not named .

The list of “allowed” expenses under the simplified tax system is closed . And any deviation from it is regarded by the inspection authorities as an offense . This is the main difference between the costs of the basic and simplified taxation systems. In practice, accountants, forgetting about this rule, include in the simplified tax base expenses that are taken into account only under the regular taxation system, but are not subject to tax accounting when applying this special regime.

To summarize:

- entertainment expenses under the simplified tax system “income minus expenses” are not included in the reduction of the tax base, since they are not included in the closed list under Art. 346.16 Tax Code of the Russian Federation.

- entertainment expenses under the simplified tax system “income” also cannot reduce the tax base, since practically no expenses reduce it.

It should be noted that input VAT on representative tax on the simplified tax system cannot be taken into account in expenses, since in this case the conditions of sub-clause are not met. 8 clause 1 art. 346.16 Tax Code of the Russian Federation.

Other expenses not included

In addition to entertainment expenses, the tax base cannot be reduced by the following expenses:

- for marketing services;

- for disinfection;

- to connect water and electricity supplies;

- for various promotions for clients;

- for drinking water for company personnel;

- for various printed publications subscribed by the organization;

- to attract workers from other companies (engaged in other activities);

- for the arrangement of the company's office;

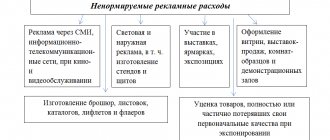

- for advertising;

- for staff pensions;

- VAT amounts;

- for certification of workplaces;

- to purchase property rights;

- customs duties when importing goods from abroad;

- penalty for violation of contract terms;

- registration costs.

Similar articles

- USN expenses accepted for taxation 2017

- Normalized expenses in 2016-2017 (advertising, entertainment, insurance)

- Expenses under simplified tax system 15: recognition procedure 2017

- Direct material costs

- Selling expenses in the income statement

An example of accounting for representative offices on the simplified tax system

For understanding, let's give an example.

LLC "Raduga" expenses for business negotiations with a business partner amounted to 10,000.00 rubles. (including VAT 20% - 1666.67 rubles). Expenses are confirmed by a restaurant invoice and an online receipt. The meeting is of an official nature and was held before the conclusion of an important contract for the supply of imported equipment. The company expects to conclude a deal on favorable terms.

In the accounting of Raduga LLC, operating on the simplified tax system (income minus expenses), representative expenses in the form of restaurant expenses will be reflected with the following entries:

Dt 26(44) Kt 71 – 10,000.00 rub. – entertainment expenses were allocated based on the director’s advance report;

Dt 71 Kt 51(50) – 10,000.00 rub. – money was paid for reporting to the director.

In tax accounting, entertainment expenses amount to RUB 10,000.00. will not be taken into account . Expenses that are not listed in paragraph 1 of Art. 346.16, cannot reduce taxable profit under the simplified tax system (letter of the Ministry of Finance dated March 23, 2017 No. 03-11-11/16982).

Purpose of spending funds

Most companies, regardless of the tax system applied, may face expenses for entertainment purposes. All organizations, both those on the traditional tax system and those under special regimes, should promote and develop their business. First, let's talk about entertainment expenses under the simplified tax system, income minus expenses in 2021.

There are several tax regimes in effect in Russia. One of them is the simplified taxation system (STS) or, in simple terms, “simplified”. Companies and individual entrepreneurs can switch to the simplified system if several mandatory conditions are met (Articles 346.12, 346.13 of the Tax Code of the Russian Federation):

- the type of activity carried out by the organization or individual entrepreneur;

- cost and quantitative indicators of activity (amount of income received, average number of employees, residual value of fixed assets).

Organizations that have switched to the simplified tax system do not pay income tax, property tax and VAT (except for some exceptions).

Representation expenses of the organization on the simplified tax system in 1C Accounting 8

Expenses associated with receiving and servicing employees of other enterprises are called entertainment expenses of the organization, and the procedure for accounting for such expenses for enterprises using the simplified taxation system will be different.

Let's consider how the organization's representative expenses are taken into account using the simplified tax system with the taxable object being income minus expenses in 1C Accounting 8th edition. 3.0.

Based on paragraph 22, paragraph 1, Article 264 of the Tax Code, entertainment expenses are:

— expenses associated with organizing official receptions for negotiators;

— costs of transporting guests to the meeting place and back;

— buffet service during meetings and negotiations;

— payment for the services of translators who are not on staff of the organization and who are invited to the event.

For enterprises that are on the general taxation system, entertainment expenses are included in expenses in an amount not exceeding 4% of the organization’s expenses for wages in the reporting period when entertainment expenses arose. The situation is different for enterprises using the simplified tax system, where the list of expenses is closed and entertainment expenses are not indicated in it; accordingly, they will not be included in expenses.

Representation expenses of the organization on the simplified tax system in 1C Accounting 8 ed. 3.0

In the 1C Accounting 8 program, the organization's entertainment expenses for the simplified tax system will be taken into account in accounting. Wiring: Dt 20, 26, 44, etc. Kt 71. However, for tax accounting in the column “NU Expenses” you need to indicate “Not Accepted”.

To reflect entertainment expenses, use the document “Advance report”, which can be found on the “Bank and cash desk” tab.

On the first tab “Advances” you need to indicate the document with which the funds were issued for reporting.

The entertainment expenses themselves are reflected on the “Other” tab.

On this tab you need to indicate documents that confirm hospitality expenses (invoices, receipts, etc.), their amount and the account to which these expenses are written off. This can be account 20, 26, 44 and other cost accounts depending on the organization and department. We also indicate the subaccount - Entertainment expenses and, if necessary, the division. And for tax accounting purposes, we choose that these expenses are “Not accepted.”

Thus, the organization’s entertainment expenses on the simplified tax system will be taken into account in accounting, but will not be accepted for tax accounting purposes, and will not be reflected in the book of income and expenses.

About how representation expenses of an organization are taken into account in the general taxation system in the 1C Accounting program, 8th ed. See version 3.0 here, version 2.0 here.

Did you like the article? Share on social media networks

15 percent

Let us say right away that entertainment expenses under the simplified tax system “income minus expenses” are not taken into account. This is explained simply. When calculating the single tax, only expenses that are named in the list of expenses from paragraph 1 of Article 346.16 of the Tax Code are accepted.

, can choose one of two possible objects of taxation: “income minus expenses” or “income”. In the first case, a 15 percent tax is paid on the financial result of an organization or individual entrepreneur. Moreover, you will have to pay a minimum tax of 1% even if the company suffered losses in the current year.

This list is closed, and there are no entertainment expenses there. The correctness of the conclusion about the impossibility of accounting for entertainment expenses with a simplified tax system of 15% is confirmed by officials of the Ministry of Finance (see, for example, letter dated October 11, 2004 No. 03-03-02-04/1/22).

6 percent

As for the object of taxation “income”, entertainment expenses under the simplified tax system “income” are also not taken into account when determining the amount of tax. The fact is that such companies and individual entrepreneurs cannot take into account any expenses at all (clause 1 of Article 346.18 of the Tax Code of the Russian Federation). It is clear that expenses for entertainment purposes are also not taken into account when determining the tax base.

Although it is impossible to reduce income by the amount of expenses incurred by the company with a simplified tax system of 6%, tax legislation allows you to reduce the tax on insurance premiums and sick leave. If the “simplified” person is a payer of the trade tax, which in some cases can further reduce the remaining tax.

As a result, entertainment expenses under the simplified tax system “6 percent income” do not reduce the single tax even when using a tax rate of 15 percent.

If you find an error, please select a piece of text and press Ctrl+Enter.

What expenses are entertainment expenses?

The definition of entertainment expenses is given to us by paragraph 2 of Article 264 of the Tax Code of the Russian Federation. Representative expenses are those associated with the reception and service of representatives of other organizations, citizens who are potential or actual clients of the organization, aimed at establishing profitable cooperation. It is important that the Tax Code of the Russian Federation emphasizes that the reception must be official and organized for partners from other companies. That is, when communicating with managers from your branches, it is impossible to take into account expenses as representative expenses. Such expenses include:

- Expenses for receiving potential partners to establish cooperation;

- Providing negotiation participants with transport to and from the event venue;

- Providing partners with drinks and food during negotiations;

- Payment for translator services for negotiations.

Like any other, entertainment expenses must be economically justified and supported by documents. Such requirements are imposed by Article 252 of the Tax Code of the Russian Federation.

Please note that not all expenses associated with negotiations and similar events can be taken into account as entertainment expenses. For example, if, in addition to negotiations with your partner, you are planning to attend a concert, then you will not be able to take into account these costs, since this event is considered entertainment. Also, for example, if you want to congratulate your partner on the holiday and send him a bouquet, you will not be able to count such expenses as entertainment expenses.

© photobank Lori