How the duration of vacation is calculated: basic rules

How to calculate the number of vacation days? An employer may have such a question, for example:

- when sending an employee on vacation and issuing him vacation pay;

- payment of compensation for unused vacation upon dismissal or without it.

In both cases, the calculation of calendar days of vacation occurs according to the general scheme. It is based on the basic holiday rule, which is contained in Art. 115 of the Labor Code of the Russian Federation: for each year of work, an employee is entitled to at least 28 calendar days of basic paid leave. As a rule, this is the period of time provided for rest for employees of most companies.

Vacation is extended for days of illness, performance of government duties, and in some other cases (Article 124 of the Labor Code of the Russian Federation).

Some categories of workers are entitled to extended vacations by law. These include:

- employees under 18 years of age;

- municipal and civil servants;

- educational staff;

- disabled people;

- drug control officials;

- investigators and prosecutors working in areas with special climates;

- other categories of workers.

An organization can set a different vacation duration by recording this in a local document.

Study the nuances of providing additional leave using materials from our website:

- “Additional leave for irregular working hours”;

- “The Supreme Court clarified how to calculate the duration of additional vacations”.

Thus, the first thing you need to do before calculating calendar days for calculating vacation is to determine the employee’s length of service in the organization.

In general, a person can take vacation for the first year of work in a new place after working for six months. But by agreement with the employer, you can go on vacation earlier. Holidays for subsequent years are provided at any time according to the vacation sequence established by the employer.

After the length of service has been calculated, you need to determine how many days of vacation the employee is entitled to. You need to proceed from the following: with the generally accepted 28-day vacation provided in calendar days, for each month worked the employee is entitled to 2.33 days of vacation (28 days / 12 months).

Leave compensation upon dismissal

When an employee quits, he must be paid monetary compensation for unused vacation days. The amount of this compensation is calculated using the formula:

| NUMBER OF DAYS OF UNUSED VACATION × AVERAGE DAILY EARNINGS |

To calculate the number of days of unused vacation upon dismissal, you must first determine:

- length of service giving the right to leave;

- the period for which compensation is due.

Let's look at this further with an example.

Calculating vacation time

We begin counting the length of service from the date the vacationer was hired. In other words, the calculation is carried out not according to calendar years, but according to so-called working years.

Example

For an employee who was employed on 04/11/2020, the first working year will be the period from 04/11/2020 to 04/10/2021, the second - from 04/11/2021 to 04/10/2022, etc.

When calculating vacation days for an employee’s worked period, we take into account the time when he:

- worked directly;

- did not actually work, but his position was retained;

- was on vacation at his own expense (but no more than 14 calendar days per year);

- forced to skip work due to illegal dismissal or suspension;

- was suspended without undergoing a mandatory medical examination through no fault of his own.

April, part of May, as well as June 24 and July 1, 2021 were declared non-working by the President of the Russian Federation V.V. Putin. Is it necessary to include non-working days that coincide with annual leave in the number of vacation days, ConsultantPlus experts explained. Get free trial access to the legal system and switch to a ready-made solution.

The answer to the question of whether vacation days are excluded when calculating vacation pay is partly positive. So, we exclude from the experience:

- periods of unpaid leave exceeding 14 days;

- "children's" holidays;

- time away from work without good reason.

Example

The employee was hired by the organization on 07/11/2019 and worked until 03/20/2021 without leave. He was sick from 02/12/2021 to 02/21/2021.

First, the number of months in the worked period is determined.

12 months (07/11/2019 – 07/10/2020) + 8 months and 10 days (07/11/2020 – 03/20/2021) – 10 days of illness = 20 months.

Number of vacation days: 28 / 12 × 20 = 46.67 days.

Work experience giving the right to annual paid leave

In order to send an employee on vacation and calculate his vacation pay, you need to know the number of days of vacation he is entitled to. And to do this, you first need to calculate the employee’s vacation period, that is, the period of work that gives the right to annual paid leave. Article 121 of the Labor Code of the Russian Federation reveals in detail which periods should be taken into account when calculating length of service, and which should be excluded.

The length of service that gives the right to leave includes:

- actual work time;

- the time when the employee did not actually work, but his place of work was retained;

- time of forced absence through no fault of the employee;

- the time of suspension from work due to failure to undergo a medical examination through no fault of the employee;

- leave without pay, granted to an employee at his request, within 14 days.

The length of service that gives the right to leave does not include:

- time of absence from work without a valid reason;

- Holiday to care for the child;

- leave without pay granted to an employee at his request for more than 14 days.

Vacation leave should be counted starting from the day the employee was hired.

As a rule, annual paid leave is provided in the amount of 28 days per working year - this is the main paid leave. In some cases, additional paid leave is added to the main leave. It is provided for certain categories of employees specified in the Labor Code of the Russian Federation; details about additional paid leave can be found in the article: “Providing additional annual paid leave.”

An employee has the right to take leave after working for 6 months. If an employee has worked a full 11 months, then he is entitled to 28 days of basic leave.

When calculating vacation experience, periods not taken into account are subtracted from the period worked, and the resulting period is expressed in full months. An incomplete month is rounded up to one month if more than half the days are worked in that month. If less than half is worked, then this incomplete month is not taken into account. For example, if your work experience is 10 months and 10 days, then 10 days will not be taken into account. And if you worked for 10 months and 20 days, then the total length of service will be 11 months.

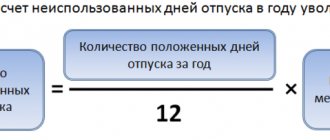

Formula for calculating unused vacation days

Once the length of service that gives the right to vacation has been determined, you can calculate the number of days of vacation due according to this length of service. To do this you need to use the following formula:

If an employee resigns, he is entitled to compensation for unused vacation days; read about this in detail in the article: “How to calculate compensation for unused vacation.”

How to correctly calculate the vacation period if it falls on a holiday

In Art. 120 of the Labor Code of the Russian Federation establishes a rule according to which non-working holidays that fall on vacation are not included in the vacation itself. In practice, there are two options for calculating vacation days:

- The vacation period is indicated by its start date and the number of calendar days. In this case, the employee returns from vacation 1 day later.

Example 1

Leave was granted to the employee from 03/04/2021 for 14 calendar days. March 8 is a holiday, so he should start work not on March 18, 2021, but on March 19, 2021.

- The vacation period is indicated by its start and end dates. In this case, the days of rest used are considered to be the days of the corresponding time period minus holidays.

Example 2

Leave was granted to the employee from 03/02/2021 to 03/15/2021. There are 14 days according to the calendar. But due to the fact that the March 8 holiday falls during this period, the vacation is considered to be used in the amount of 13 days.

When making calculations for vacation in an incomplete month, you should also take into account calendar days that fall within the period worked, and not just working days (actually worked). Thus, holidays, as well as weekends that do not fall under the periods listed in paragraph 5 of the Regulations approved by government decree No. 922 dated December 24, 2007, must be included in the calculation of vacation days as those that fall under the worked period .

Find out how to extend your sick leave during vacation here.

You can confirm the conclusions and calculations we have made with the help of the Personnel Guide “Annual Basic Paid Leave” of the ConsultantPlus system. To do this, get a free trial access to K+.

The procedure for calculating vacation time

How to calculate the number of unused vacation days? The following order must be applied:

- calculate the length of service, based on which the exact number of days will be calculated;

- calculate how many days the employee is entitled to. If he has already used part of the “vacations”, these must be subtracted from the resulting value.

A special role should be given to calculating length of service. It is necessary to take into account all periods that are included in accounting, and all periods that are not included.

Approximately, for one month worked, a person has the right to take 2.33 days off.

To calculate the number of unused vacation days, you can use the reference table

For accurate calculation use the following formula:

DnOt = (28 / 12) * PolM – IspDn, where

DnOt is the number of days that a person has the right to count on, HalfM is the exact number of fully worked months (if less than half is worked, then this month is not included in the calculation, if more than half is rounded up, the month is included in the calculation) , IspDn is the exact number of days that the employee has already had time off. If he did not do this, this parameter is not included in accounting.

How to calculate vacation days in 2020-2021 (example)

Let's give an example of calculating the days of the billing period for vacation in 2021, taking into account the subtleties and nuances outlined above.

Let’s say an employee got a job at the company on June 17, 2018.

During his work period he:

- was ill from 12/04/2018 to 12/12/2018 and from 02/12/2019 to 02/19/2019;

- took vacation at his own expense from 04/07/2019 to 04/13/2019 and from 08/24/2019 to 09/13/2019;

- was on paid leave from 06/02/2019 to 06/22/2019, from 03/30/2020 to 04/19/2020, from 08/29/2020 to 09/11/2020.

On January 15, 2021, he decided to quit, having first taken off all the days that he did not use during his work.

See also “How to properly arrange leave followed by dismissal?” .

Let's see how many vacation days are due per year if the company has a standard vacation duration of 28 days.

Step 1. Determine the length of service

The total length of service from 06/17/2018 to 01/15/2021 will be 2 years 6 months and 29 days.

We do not touch periods of illness and vacation. They are taken into account in the length of service that gives the right to leave, as non-working periods during which the employee’s place of work is retained.

Vacation at your own expense can be included in the length of service within 14 calendar days per working year. We have 2 such periods:

- for the working year from 06/17/2018 to 06/16/2019 - 7 days (from 04/07/2019 to 04/13/2019);

- for the working year from 06/17/2019 to 06/16/2020 - 21 days (from 08/24/2019 to 09/13/2019).

The second period does not fit within the 14-day limit, which means that 7 days of excess will have to be excluded from the length of service.

Thus, the vacation period is 2 years 6 months and 22 days. Round up to full months, discarding 7 days, and we get 2 years and 7 months.

Step 2. Calculate the number of vacation days that the employee is entitled to for the specified period

This is 56 days for 2 full years and another 17 days for an incomplete year of work (28 days / 12 months × 7 months = 16.33 days. Rounding was done according to the rules adopted by the organization (in accordance with the recommendations set out in the letter of the Ministry of Health and Social Development of the Russian Federation dated 07.12 .2005 No. 4334-17) in favor of the employee. Total 73 days.

Step 3. Determine the number of unused vacation days

During his work, the employee took leave three times:

- From 06/02/2019 to 06/22/2019. This period was a non-working holiday on June 12, so not 21, but 20 days of rest were used.

- From 03/30/2020 to 04/19/2020. There were no holidays here, and the vacation was 21 days.

- From 08/29/2020 to 09/11/2020. There were no holidays here either, and the vacation was 14 days.

A total of 18 days remain unused (73 – 20 – 21 – 14). Their employee can take time off immediately before dismissal - from 12/21/2020 to 01/15/2021 (including New Year holidays). So, the calculation of vacation in 2021 - an example with a detailed description, has been made.

Calculation of vacation days in 2021

Every officially employed citizen has the right to annual paid leave of 28 calendar days. Vacation is paid based on the average earnings of the employee for the last calendar year. This does not mean a calendar year, but a working year, and the countdown begins not from January 1, but from the date of concluding an employment contract with a specific employer.

The right to take annual leave arises for an employee after six months of working for a given employer. If the parties to the contract reach an agreement, the leave may be granted earlier.

If an employee quits without working for even six months, the employer is obliged to pay him compensation for unused vacation days. How to calculate how many vacation days an employee has accumulated? The formula for calculating vacation pay is not that complicated.

You need to know which periods are taken into account for the length of service that gives you the right to leave.

Starting from the second year of fulfilling his labor duties, the employee’s vacation is provided in accordance with the schedule, which must be approved at each enterprise before December 15 of the current year for the next year. Every employee should be familiar with the methodology for calculating vacation pay.

Vacation pay is calculated using the formula:

OTP = (Salary / (12 * 29.3))* number of vacation days, where:

- OTP – the amount of compensation received for vacation;

- Salary is the salary of a given employee for the entire period worked; 12 – number of months in a year;

- 29.3 – average number of days in a month. This value is set at the Government level.

Calculation and payment of vacation pay must be made no later than 3 calendar days before the start of the employee’s vacation. It is more difficult to use the above formula if the employee has not completed a full working year.

To calculate how many vacation days a given employee has earned, you must use the formula:

(29.3 / 12) * total number of months worked. 29.3 / 12 = 2.44 days each employee has for the month actually worked.

When calculating vacation pay, the following periods are taken into account, according to Art. 121 Labor Code of the Russian Federation:

- actual work time;

- days when the employee was actually absent from the workplace, but it remained with him. Such cases are given in the Labor Code of the Russian Federation and other regulations;

- days of forced absence;

- other periods specified in Art. 121 Labor Code of the Russian Federation.

For example, an employee got a job on November 2, 2021, and quit on April 28, 2021. He worked the entire period in full, without any omissions. Thus, he “accumulated” 5 months of experience for vacation. Since April has “passed” the halfway point, it is considered fully. Therefore, the employee has “accumulated” 2.44 * 5 = 12.2 vacation days. According to the rounding rules - 12 calendar days.

Vacation pay formula

What does the formula for calculating average earnings for vacation pay look like:

Srzar = Zarpl / (12 * 29.3), where:

- srar is the average salary for 1 day of work for a specific employee;

- Salary is the entire accrued salary of a particular employee for the last working year;

- 12 – number of months in a year;

- 29.3 – average number of days in 1 month.

For example, an employee got a job on June 2, 2021, and from June 1, 2021, he has the right to go on vacation. During this period he received 578,000 rubles. Thus, his average wage for 1 day of work is:

578,000 / (12 * 29.3) = 1,638.32 rubles.

The formula for calculating days according to the vacation calendar is as follows:

(29.3 / 12) * total number of months worked. Each employee has 29.3 / 12 = 2.44 days for the month actually worked. For example, an employee worked a full 7 months for this employer. Therefore, upon dismissal, he has the right to receive compensation for 7 * 2.44 = 17 calendar days of vacation.

Calculation formula

The formula for calculating vacation days looks like this:

Average earnings of a given employee * number of vacation days.

Each employee has the right to independently split his vacation, but with the condition that one half of it will be at least 14 calendar days. He has the right to divide the remaining days. But you need to reach an agreement with the employer, since splitting the vacation is out of the general schedule, and this may affect the rest of other employees.

Average earnings for 1 day of work are calculated using the following formula:

All earnings for the last calendar year / 12 * 29.3

Vacation pay in 2021 is calculated taking into account the Regulations on the procedure for calculating average earnings, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922. New calculation rules have not been developed or approved for several years.

The amount of money that an employee will receive during his vacation period is influenced by the following factors:

- the period for which the calculation is made;

- average employee earnings. It is for the purposes of calculating this indicator that it is necessary to obtain a corresponding certificate from the previous employer. This will prevent you from “losing” some amounts and periods;

- work experience;

- the number of days of rest that the employee wishes to use. The maximum amount of compensation will be paid for 28 calendar days of vacation.

Only those employees who officially work under an employment contract have the right to leave. If a civil contract has been concluded with an employee, then such an employee does not have the right to leave.

The standard duration of vacation is 28 calendar days.

But there are some categories of workers who, due to their profession and position, may qualify for additional days of rest.

The first leave is granted after six months of work, then according to the schedule. There are employees who can go on vacation at a time convenient for them, despite a previously approved document:

- women who will soon go on maternity leave;

- employees who have officially adopted a child under three years of age;

- minor workers.

Important! Each employee, by agreement with the employer, has the right to receive leave without pay. In this case, there is no need to calculate anything, since management does not have to pay for these days. But if you take such a vacation for more than 14 days, this will affect indicators such as length of service and length of the working year.

Number of days in the period

In order to correctly calculate the amount due to a specific employee for the vacation period, you need to know what period you need to take for the calculation.

To calculate vacation pay, you must take the previous 12 months and the actual time worked in them. The company may set a different billing period (for example, six months or a quarter). But this norm must be enshrined in a collective agreement or other regulatory act. The employee must be familiarized with this provision by signing upon entry to work.

A self-determined period should not worsen the employee’s position as if a “standard” period were used in the calculation.

If an employee decides to take a vacation after six months, then the time actually worked is taken into account for the calculation. When calculating, you need to know which periods are excluded. These include the days the employee was on sick leave (for various reasons) and on unpaid leave (more than 14 days).

Source: https://trudinspection.ru/alone-article/otpuska/%D1%84%D0%BE%D1%80%D0%BC%D1%83%D0%BB%D0%B0-%D1%80% D0%B0%D1%81%D1%87%D1%91%D1%82%D0%B0-%D0%BE%D1%82%D0%BF%D1%83%D1%81%D0%BA%D0 %BD%D1%8B%D1%85-%D0%B4%D0%BD%D0%B5%D0%B9/

Calculation of vacation in 2020-2021: total amount of vacation pay

Vacation pay is calculated using the formula:

OTP = SDZ × CHDO,

Where:

SDZ - average daily earnings;

NDO - number of vacation days.

Example

From March 21, 2021 to April 17, 2021, the employee was granted 28 days of vacation. The period from 03/01/2020 to 02/28/2021 has been fully worked out. An employee receives a monthly salary of 32,000 rubles. In December 2021, he received a bonus of 5,500 rubles. based on the results of work for November 2020.

Salary = 32,000 × 12 + 5,500 = 389,500 rubles.

SDZ = 389,500 / 12 / 29.3 = 1,107.79 rubles.

OTP = 1,107.79 × 28 = 31,018.12 rubles.

Note! If errors are identified in the calculation of vacation pay, they should be recalculated. If you overpay, you must deduct it from the employee’s salary strictly with his consent. If you underpay, pay extra.

How to calculate vacation pay if there is no income in the billing period?

How to calculate vacation pay for the year if the billing period includes months with no income or only those that are excluded from the calculation? Actions here will depend on the availability of income in other periods:

- if it was present in the periods preceding the calculation period, then the calculation period is shifted to those months when the income was;

- if there was no income in the previous billing periods, then the calculation is made based on the data for the days worked in the month of going on vacation;

- if there is no income even in the month of going on vacation, then the calculation is based on the salary (tariff rate).

For the first option, the formulas for calculating vacation pay will be the same as those given in the previous section.

In examples of how to calculate vacation pay for the year in the remaining cases, the formula given in the previous section will be transformed as follows:

- for the second option, from the terms shown in brackets, the one obtained as the product of the number 29.3 by the total number of months in the billing period will disappear;

- in the third option, income will be replaced by the salary (tariff rate), and instead of the part contained in brackets, the number 29.3 will have to be used.

How is the vacation period calculated?

And if the situation with the billing period for a full calendar year is clear, then what to do if the year is not fully worked out, on what basis is the number of vacation days calculated?

As the legislator established, vacation is calculated according to the following principle: for each full month worked, the employee is entitled to 2.3 days of rest (main vacation).

However, a situation may arise in which an employee works for less than a full month, how to calculate in this case? If an employee works 14 or more days in a month, a rest period of 2.3 days is accrued for such a month; if the period worked in a month is less than 14 days, no vacation is assigned for such a month.

As previously established, annual paid leave is a period of legal rest for an employee; for this period, wages must be maintained and paid to the employee in the form of vacation pay. How to correctly calculate wages for a given period?

Results

Calculating vacation days and payment for it is easy. The main thing is to know the basic rules (and, as we see, they have not changed in 2020-2021) and take into account some, for example, “holiday” nuances. The rest, as they say, is a matter of technique.

Our vacation pay calculator will help you calculate vacation pay or check your calculation.

Sources:

- Labor Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 24, 2007 No. 922

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.