Calculation of the number of unused vacation days

To calculate the number of unused vacation days for which compensation is due, use the formula:

| Number of unused vacation days | = | Duration of full annual leave __________________________________ | × | Number of complete months worked | — | Number of vacation days used |

| 12 |

Take into account every year in which the employee did not take vacation or only partially took it off. After all, he had the right to rest annually (Article 114 of the Labor Code of the Russian Federation). In this case, we are not talking about the calendar, but about the working year. That is, count unused vacation days for every 12 working months, starting from the day of employment (clause 1 of the Rules on regular and additional vacations, approved by the People's Commissar of the USSR dated April 30, 1930 No. 169; hereinafter referred to as the Rules).

Do not include in such vacation experience:

- the time when the employee was absent from work without good reason (including in cases provided for in Article 76 of the Labor Code of the Russian Federation);

- parental leave until the child reaches three years of age;

- unpaid leave with a total duration of more than 14 calendar days.

This procedure follows from paragraph 2 of paragraph 28 of the Rules approved by the CNT of the USSR on April 30, 1930 No. 169, and Article 121 of the Labor Code of the Russian Federation.

For a full month worked, take a period equal to or greater than half a month. Exclude surpluses amounting to less than half a month from the calculation. This procedure is prescribed in paragraph 35 of the Rules approved by the CNT of the USSR on April 30, 1930 No. 169.

Important: there are cases when an employee must be paid compensation for a full year of work, even if in fact he was registered with the organization for a shorter period. In particular, this should be done when an employee leaves who has worked in the organization for less than 12 months, but at least 10.5. The fact is that for 11 months full compensation is due, and the 10.5 months worked must be rounded up to 11.

Also, full annual compensation is also due to those who have worked in the organization from 5.5 to 11 months, if the reason for such early dismissal was:

- staff reduction;

- liquidation of the organization;

- conscription;

- recognition of an employee as completely incapable of work according to a medical report.

Such norms are spelled out in paragraph 28 of the Rules approved by the People's Commissariat of the USSR dated April 30, 1930 No. 169. Moreover, the rules on the payment of full compensation should be applied to all employees. That is, both those who have worked in a given organization for less than one year in total, and those who have worked for more than one year.

This must be done provided that over the last working year they have worked 5.5 months (or more) of work experience, which entitles them to annual leave. The legitimacy of this approach is confirmed by the Recommendations of Rostrud dated June 19, 2014 No. 2. The courts take a similar position (see the cassation ruling of the Sverdlovsk Regional Court dated July 14, 2009 No. 33-7241/2009).

If an employee in his first and only working year in this organization (except for the cases listed above) was employed for less than 11 months, then for this year he is entitled to compensation in proportion to the time worked (clause 35 of the Rules approved by the People's Commissar of the USSR on April 30, 1930 No. 169). That is, the number of unused vacation days in this case is determined by the formula:

| Number of unused vacation days | = | Duration of full annual leave ______________________________ | × | Number of complete months worked |

| 12 |

In all other cases, pay:

- full annual compensation for every 12 months of the working year worked;

- proportional compensation if the employee worked for less than 12 months.

An example of calculating the number of unused vacation days for which compensation must be paid upon dismissal. The employee has worked for the organization for more than 11 months

A.S. Kondratyev has been working in the organization since April 15, 2014. He is entitled to annual leave of 28 calendar days.

On October 16, 2015, Kondratiev resigned. He never took annual leave, so he is entitled to compensation for unused leave.

The accountant determined the number of unused vacation days as follows.

From January 12 to January 25, 2015, Kondratyev was on leave without pay (14 calendar days). These 14 days must be taken into account when calculating the length of service for vacation and compensation for unused vacation (Article 121 of the Labor Code of the Russian Federation). This means that in the first working year the employee worked all 12 months and for this year he is entitled to full compensation. That is, the number of unused calendar days of vacation for the first working year is 28.

During the second working year, the employee worked less than 12 months (from April 15 to October 16, 2015). Therefore, the accountant calculated his proportional compensation for this year. To calculate the number of unused vacation days this year, the accountant determined that the number of full worked (working) months in the period from April 15 to October 16, 2015 is six:

- from April 15 to May 14, 2015;

- from May 15 to June 14, 2015;

- from June 15 to July 14, 2015;

- from July 15 to August 14, 2015;

- from August 15 to September 14, 2015;

- from September 15 to October 14, 2015.

The remaining number of days before the employee’s dismissal is two (from October 15 to October 16, 2015). This is less than half a working month. Therefore, they are not taken into account when calculating compensation.

The accountant determined the number of unused vacation days for the second working year as follows: 28 days. : 12 months × 6 months = 14 days

The total number of days for which compensation must be paid to Kondratiev for unused vacation upon dismissal was: 28 days. + 14 days = 42 days

An example of determining the number of unused vacation days when calculating compensation for unused vacation associated with dismissal. The employee has worked for the organization for less than 11 months

VC. Volkov has been working in the organization since November 21, 2014. The employee is entitled to annual leave of 28 calendar days.

On February 27, 2015, Volkov resigned. He did not take annual leave, so he is entitled to compensation for unused leave.

The accountant determined the number of unused vacation days as follows.

The employee worked for the organization for less than 11 months (from November 21, 2014 to February 27, 2015). Therefore, he is entitled to proportionate compensation. To calculate the number of unused vacation days, the accountant determined that the number of full worked (working) months is equal to three:

- from November 21, 2014 to December 20, 2015;

- from December 21, 2014 to January 20, 2015;

- from January 21, 2015 to February 20, 2015.

The remaining number of days before the employee’s dismissal is seven (from February 21 to February 27, 2015). This is less than half a working month (28 days: 2). Therefore, they are not taken into account when calculating compensation.

The accountant calculated the number of unused vacation days for which compensation must be paid to Volkov as follows: 28 days. : 12 months × 3 months = 7 days

An example of determining the number of unused vacation days when calculating compensation for unused vacation associated with dismissal. The employee has worked for the organization for less than 11 months. The employee was granted leave without pay

VC. Volkov has been working in the organization since January 22, 2015. The employee is entitled to annual leave of 28 calendar days. From February 3 to February 19, 2015, the employee was on leave at his own expense.

On April 10, 2015, Volkov resigned. He did not take annual leave, so he is entitled to compensation for unused leave.

The employee worked for the organization for less than 11 months, so he is entitled to proportional compensation. To calculate the number of unused vacation days, the accountant determined that during the period from January 22 to April 10, 2015, the employee worked two full months and 20 days. Since the employee took 17 days of unpaid leave (from February 3 to 19, 2015), the accountant deducted 3 days (17 days - 14 days) from the employee’s length of service. This is due to the fact that when calculating vacation pay, vacation at your own expense is included in the length of service, but within 14 days. Thus, the employee’s length of service was two months and 17 days, taking into account rounding - three months.

The accountant calculated the number of unused vacation days for which compensation must be paid to Volkov as follows: 28 days. : 12 months × 3 months = 7 days

Determination of length of service

Before accruing compensation payments to the employee, the number of days allotted for vacation is determined . To do this, calculate the total time worked. The starting point is the day the employee joins the enterprise. An employee has the right to apply for annual paid leave of 28 calendar days.

This right is granted to each employee after 11 months worked at the enterprise. You are allowed to take a vacation after 6 months, but the rest period will be shorter.

It should be noted that the Labor Code does not determine the procedure for establishing the number of rest days accumulated by an employee at the time of dismissal.

For these purposes, one should resort to the clauses of the Rules on regular and additional leaves in an article consistent with Labor legislation. Thus, a resigning employee who has worked at a certain enterprise for at least 11 months and has not exercised his right to leave is entitled to full compensation.

The employee has not been working since the beginning of the month

Situation: how to determine the number of full months worked in order to calculate compensation for unused vacation upon dismissal if the employee was not hired from the beginning of the month?

Take into account not calendar months, but working months. For example, if an employee was hired on January 23, then his full working month expires on February 22. The next working month begins on February 23, and ends on March 22, etc. Indirectly, this order is confirmed by the provisions of paragraph 1 of the Rules approved by the CNT of the USSR on April 30, 1930 No. 169.

Moreover, if an employee quits before the end of a full working month, then it is necessary to be guided by paragraph 35 of the Rules approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169. That is, when an employee has worked exactly half a month or more, take this month as a full one. Do not take into account the month in which the employee worked less than half.

Let’s say an employee worked for the organization from January 23 to March 14 before being fired. In this case, the number of working months will be:

- from January 23 to February 22 – one full working month;

- from February 23 to March 14 – 20 days, which is more than half the working month from February 23 to March 22 (28 days: 2).

Thus, rounding is done up to two months.

If calendar months were taken into account, the number of months worked would be reduced to one. January (from the 23rd to the 30th) and March (from the 1st to the 14th) would not be included in the calculation, and one month would remain - February (from the 1st to the 28th). This option is unprofitable for the employee and does not meet the requirements of the Ministry of Health and Social Development of Russia, set out in letter No. 4334-17 dated December 7, 2005.

Calculation examples

In certain cases, when an employee has worked at the company for less than the established period, he also has a chance to receive full vacation compensation. In other conditions, compensation payments are provided commensurate with the number of months of experience giving the right to annual paid leave in a part-time working year.

The quantitative relationship in this situation should be presented as follows:

Mo:12 = Ku: Ko, where:

- Mo - number of months worked

- 12 - number of months of the year;

- Ku - the amount of compensated days at the time of dismissal;

- Ko - volume of the vacation period.

Therefore, the vacation period is expressed by the following formula:

Ku = (Mo x Ko):12

For example, an employee terminates an employment relationship on his own initiative. The worked period of the current working year was 7 months, and the vacation period was 28 days. The number of paid vacation days is 28 days. x 7 months: 12 months = 16.33 days.

Rounding fractional days

Situation: to how many digits after the decimal point can the fractional number of days for which compensation must be paid for unused vacation associated with dismissal?

The more, the more accurate the calculation will be. An organization may round to two decimal places, or to three, or even to four.

When calculating the number of unused vacation days for which compensation must be paid, you may end up with a fractional number of days. For example, if an employee needs to be paid compensation for five months worked, the result is 11.6667 days (28 days : 12 months × 5 months).

The law does not say how to correctly round up the number of unused vacation days. Therefore, the organization can decide how to round such results independently.

However, most accounting programs provide for rounding the fractional number of days to two decimal places according to the rules of arithmetic. An organization can be guided by this order, or it can establish its own.

An example of determining the number of unused vacation days when calculating compensation for unused vacation associated with dismissal

Chief accountant A.S. Glebova has been working in the organization since May 13, 2014. On February 27, 2015, she resigned. The employee worked fully during this entire period.

Glebova worked for the organization for less than 11 months, so she is entitled to proportional compensation. To determine the number of unused vacation days, the accountant determined that the number of full (working) months of the employee’s work in the organization is nine (from May 13, 2014 to February 12, 2015).

The remaining number of days before the employee’s dismissal is 15 (from February 13 to February 27, 2015), which is more than half of the working month (28 days: 2). Therefore, the accountant also included these 15 days in the calculation.

As a result, it turned out that Glebova worked for 10 full months.

The organization has established a procedure for rounding the number of unused vacation days to four decimal places according to the rules of arithmetic.

The accountant calculated the number of unused vacation days as follows: 28 days. : 12 months × 10 months = 23.3333 days.

The employee's compensation was paid for 23.3333 calendar days.

The Russian Ministry of Labor told how to determine the number of days of unused vacation upon dismissal

Rounding off vacation days is not a mandatory procedure. The manager decides whether to round up vacation days or not, but in order not to deprive the employee of funds, rounding must be done upward. We will advise you on issues related to vacation pay, recording working days, and payroll calculations. We successfully cooperate with various customers. Among our clients you will find owners of large companies and directors of small private firms.

We are always ready to advise you on issues related to accounting, as well as prepare documentation, fill out a tax return and perform the necessary calculations. When dismissing, rounding off vacation days, as we noted earlier, is not necessary. However, it is forbidden to round down. If the tax service discovers that an employee with accumulated 20.5 days of vacation was paid compensation for only 20 days, this will be a clear violation of the Labor Code, providing for a fine in the amount of If the employee worked in the organization for 10 months and 15 days, this period of time is automatically rounded up up to 11 months exactly, and the employee has the right to 28 days of vacation pay, but only if he was not on vacation during this period of work.

A worked month can be considered a period of time equal to or greater than half a month. Our company’s specialists will make prompt calculations of vacation pay and prepare the appropriate documentation. If necessary, we are ready to consult with a staff accountant. You just need to contact us in any convenient way. Moscow, st. Butyrsky Val, village. Rounding of vacation days upon dismissal. Is it necessary to round off vacation days upon dismissal? When dismissing, it is not necessary to round off vacation days, as we noted earlier.

If the employee is paid compensation for 21 days, or 20.5 days, this will be legal. How many days of vacation is an employee entitled to for less than a full year? If an employee has worked for the organization for 10 months and 15 days, this period of time is automatically rounded up to 11 months exactly, and the employee is entitled to 28 days of vacation pay, but only if he was not on vacation during this period of work.

Transfer of a part-time worker to the main place of work

Situation: how to determine the number of unused vacation days when calculating compensation for unused vacation associated with dismissal? The employee was first a part-time worker, and then transferred to his main place of work.

When calculating the number of unused vacation days, take into account the time that the employee worked part-time before being transferred to the main place of work.

After all, part-time workers are granted leave on the same basis as other employees (Part 2 of Article 287 of the Labor Code of the Russian Federation). And upon dismissal, the organization must pay compensation to the employee for all unused vacations, including those due to a part-time worker (Article 127 of the Labor Code of the Russian Federation).

An example of determining the number of unused vacation days when calculating compensation for unused vacation associated with dismissal. The employee was first a part-time worker, and then transferred to his main place of work

A.I. Ivanov has been working part-time in the organization since April 22, 2014. On July 1, he was transferred to his main place of work. He is entitled to annual leave of 28 calendar days.

On February 27, 2015, Ivanov resigned. During the entire period of his work in the organization, he was not on vacation.

Ivanov worked in the organization for less than 11 months, so he is entitled to proportional compensation for unused vacation. To calculate the number of unused vacation days, the accountant determined that the number of full (working) months of an employee’s work in the organization is 10 (from April 22, 2014 to February 21, 2015).

The remaining number of days before the employee’s dismissal is six (from February 22 to February 27, 2015), which is less than half of the working month (28 days: 2). Therefore, they are not taken into account when calculating compensation.

That turned out to be 10 full months (including the employee’s part-time work).

The number of unused vacation days for which compensation must be paid to Ivanov was: 28 days. : 12 months × 10 months = 23.3333 days.

Rules for rounding vacation days upon dismissal and calculating compensation

It doesn’t often happen that on the day of dismissal an employee takes exactly as many vacation days as he earned. There are almost always unused vacation days, and the employee must compensate them. To calculate compensation, you must first determine the vacation period and calculate the number of such days, and then determine the billing period and payments taken into account for this period. Is he entitled to compensation for unused vacation, since he has not yet earned the right to vacation?

An employee begins to earn paid leave from the first day of work with this employer. Upon dismissal, vacation compensation is calculated in proportion to the months worked. If an employee has a month not fully worked, then no.

The employee is hired. The length of service for payment of compensation, as well as for vacation, is calculated not for calendar months, but for months worked. He is dismissed as having failed the test. Are we obligated to pay him compensation for unused vacation? The employee must be paid compensation for unused vacation if he worked for at least half a month under Art.

How to determine the number of days of unused vacation of such employees for payment of compensation upon dismissal? After all, weekends are included in the length of service for vacation and Art. When calculating it, you always get a fractional number of vacation days.

Do we need to round it to a whole number? However, you can establish the possibility of such rounding by your local regulations. However, in this case, rounding according to the rules of arithmetic is not allowed. Rounding should always be done in favor of the employee. Rounding in the opposite direction is illegal, as it worsens the employee’s situation. Letter from the Ministry of Health and Social Development from If there is no local regulation, take a fractional number of days to calculate compensation.

An employee was hired. How to calculate the number of days of unused vacation? STEP 1. We determine the number of months worked by the employee from the date of entry to work to the day of dismissal: from STEP 2. We exclude periods that are not included in the length of service for vacation. STEP 3. Determine the number of vacation days earned by the employee:.

To carry out repair work, our store entered into a fixed-term employment contract with the employee. But he quits of his own free will. The employee was hired. He warned that he would write a letter of resignation from the last day of vacation.

Do we understand correctly that he is not entitled to compensation for his vacation? The fact is that during the vacation itself, the employee also receives vacation pay of one hundred and fifty centimeters. The employee is hired. But when calculating average earnings, days of absenteeism are not excluded from the calculation period.

Because of this, the amount of vacation compensation for this employee is less, which is quite fair. A woman quits her job immediately after taking leave to care for a child of up to one and a half years. Before maternity leave, she took all the vacation days she was entitled to. Do we understand correctly that we should not pay her compensation for vacation upon dismissal? Maternity leave, unlike parental leave, is counted towards the length of service for leave under Art.

Therefore, you must pay her compensation during her maternity leave. An employee on maternity leave will be dismissed. What calculation period should be taken to calculate compensation for unused leave? Moreover, if the day of dismissal falls on the last calendar day of the month, then this month is included in the billing period d art. By Government Decree of However, at this time the woman was also on maternity leave.

That is, to calculate compensation for unused vacation, you need to take the period from Are you going to quit? The calculation period in your case is November. You did not take vacation. Therefore, take the salary for the period from which the employee will resign. Do you need to take into account the amount of compensation for unused vacation when preparing a salary certificate for calculating social insurance benefits? Contributions to the Social Insurance Fund are calculated for compensation, subp. At the same time, remember that this year payments to an employee exceeding rubles are not subject to contributions.

He asked to be given a salary certificate for the labor exchange. Do I need to take into account the amount of compensation when calculating and indicate it in the certificate for the labor exchange? By resolution of the Ministry of Labor, the employee is dismissed. Are we obligated to pay him vacation compensation in advance, just like vacation pay?

Compensation for unused vacation must be paid on the day of dismissal, the last day of work. If the employee was not at work on that day, and the salary is paid in cash through the cash register, then the amounts due to the employee must be paid no later than the next day after the dismissed employee submits a request for payment of the article Wants to quit All this time the employee had no sick leave, no business trips. He had no other payments during his work.

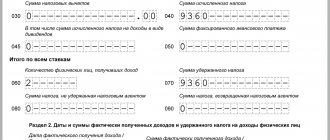

Used in advance Put a dash if the employee was not provided with leave in advance. Not used 9.32 Indicate the number of days of unused vacation. Used for salary indexation. Used to calculate individual indicators. What should be done. KBK what's new. Inventory accounting: new version of the accounting standard. Update of investment tax deduction. The use of PSN by entrepreneurs has been limited. Average headcount: January crept up unnoticed.

Ecological collection: what's new. Dismissal of remote workers: what the courts say. Change f. Children's benefits: indexing When an inspector needs an expert. Shift in the start date of the special assessment. We issue waybills. Tricky questions from special regime officers. Issues at the beginning of the year: regime change, transitional operations. SZV-TD: last personnel event. Worker travel: identifying unobvious income. We are introducing an electronic work book. Cash assistance to LLCs from individual founders: tax-free methods.

How the deadline for submitting accounting reports was postponed due to coronavirus. There is nothing to pay workers: what can be done. Any resident of Russia can become self-employed. Employers are advised to be more flexible. What to do if, due to the pandemic, the payment of part of the dividends had to be postponed. Office memos: useful samples. New procedure for collecting Pension Fund fines. Tax changes for IT companies: a New Year's gift. Test: salary, insurance premiums, accountability, accounting.

Employee quits after two months

Situation: how to calculate compensation for unused vacation if an employee with whom an open-ended employment contract is concluded quits after two months (has not completed the probationary period)?

In this case, calculate compensation for unused vacation upon dismissal in the usual manner (Article 139 of the Labor Code of the Russian Federation). That is, determine the number of unused vacation days in proportion to the time worked (clause 28 of the Rules approved by the People's Commissar of the USSR dated April 30, 1930 No. 169).

Do this even if the employee was on probation. The provisions of labor legislation do not provide for any special features for this category of workers (Part 3 of Article 70 of the Labor Code of the Russian Federation).

This approach is confirmed by the letter of Rostrud dated December 18, 2008 No. 6966-TZ.