Let's look at how to calculate compensation to an employee upon dismissal for unused vacation days. We'll show you how to quickly perform calculations using an online calculator.

The company's management is obliged to provide annual vacations to its employees.

During the rest period, employees retain their position and average earnings. The duration of annual main leave is 28 calendar days. Some categories of citizens are granted increased leave: for example, for minors - 31 days. Also, Article 117 of the Labor Code of the Russian Federation establishes the right for individual employees to receive additional paid leave every year: in harmful, dangerous working conditions, with irregular working hours, working in the regions of the Far North, etc. The following situation often arises: an employer dismisses an employee when he is still did not use all the days of his allotted vacation. In this case, the employee needs to transfer compensation for unused vacation (Article 127 of the Labor Code of the Russian Federation), if he did not want to “take off” these days before dismissal.

At the same time, it is very important to correctly determine the amount of compensation, since non-payment may lead to legal disputes and holding the manager accountable.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

The procedure for calculating compensation for unused vacation

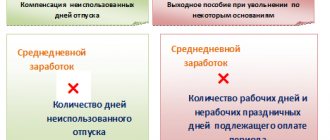

The formula for determining vacation compensation is as follows:

Compensation for unspent vacation = average daily earnings * number of days of unspent vacation

The two parameters of this formula have their own calculation rules; we present them below.

The procedure for determining average daily earnings (Article 139 of the Labor Code of the Russian Federation):

To calculate average daily earnings, you need to take the sum of all payments to an employee over the last year, then divide it by 12 months and then divide it again by 29.3. The last number is a constant indicating the average number of days in a month.

The list of payments used in calculating average earnings includes:

- wages according to different remuneration systems;

- bonuses;

- salary in non-monetary form;

- other bonuses and remunerations provided for by the internal regulations of the enterprise.

However, other payments not related to wages are not taken into account. For example, compensation for food or travel, purchasing vacation vouchers, etc.

Let’s assume that an employee has not worked fully for some months. For example, he was on sick leave and could not perform his work duties due to a technical failure at the enterprise through no fault of his own. Then the formula for average daily earnings will be adjusted:

To determine the number of days in partial months in the denominator, you need to adjust the average number of days in a month (29.3):

The procedure for calculating the number of days worked for the purpose of determining the duration of vacation (Article 121 of the Labor Code of the Russian Federation):

The second step in calculating compensation is determining the number of days entitlement to vacation. The length of service for these purposes includes:

- days when the employee performed his job duties;

- holidays, weekends, annual paid leave;

- forced absences from work through no fault of the employee. For example, in case of illegal dismissal;

- vacation time at the request of the employee at his own expense (no more than 14 days).

Please note that the working period does not include the following days:

- when an employee was absent without a valid reason;

- leave to care for a minor child;

- vacation at your own expense, when its duration is more than 14 days;

- when the employee was removed from work by management for the reasons listed in Art. 76 Labor Code of the Russian Federation. For example, appearing in the office while intoxicated, refusing a mandatory medical examination or training required for a given position, etc.

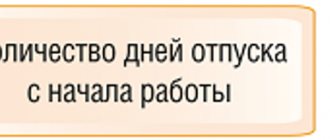

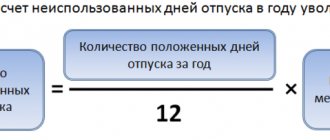

After this, the number of vacation days that the employee is entitled to for the time worked is calculated. The countdown begins from the date of hire. The right to leave arises 6 months after employment in this organization. The number of vacation days that an employee can use is determined by the formula:

A month in which 15 days or more can be counted as length of service for the purposes of calculating vacation is considered to be fully worked.

Next, from the “earned” vacation, you must subtract the number of days that the employee has already used. As a result, we obtain the number of days required to calculate compensation.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

How to calculate vacation pay upon dismissal

Attention

| Dear readers! If you have not found the necessary information on a particular issue on our website, ask it online by phone: Also, get free legal assistance on our website. The question you asked will not keep you waiting long! |

Upon dismissal, this is the final calculated payment by the organization to an employee who has decided to quit and has unspent vacation days, for which they must be refunded. Let's take a closer look:

- to whom and in what cases it is due;

- no compensation is due;

- calculation algorithm;

- an example of calculation in practice of two different situations;

- compensation income code.

During the dismissal process, the employer must pay the employee not only the salary he earned, but also compensation for unpaid vacation (this point is discussed in detail in Article 127 of the Labor Code of the Russian Federation). This is provided that, right before resigning, the employee does not want to use his vacation (this is only possible if he is not fired for a serious offense).

What is the procedure for dismissing the chief accountant? How is the transfer of affairs carried out? Is the chief accountant responsible after dismissal?

Let's take a closer look at how compensation is calculated and who is entitled to it.

If at the time of dismissal the employee did not have time to take the 28 days of vacation required by law, or if he managed to rest part of the vacation, but still had days left, then he can receive monetary compensation.

According to the current labor code, in order to obtain the right to leave, a citizen must work for one employer for at least six months. After this, the organization will have to pay every month that the employee managed to work. If he quit after working more than half (more than 15 days), then compensation will be accrued to him as for a full month.

Payment for unused vacation must be paid on the employee's last day of work. His right to compensation will apply regardless of the reason for his dismissal. Also, upon dismissal, there must be a mandatory payment for all past vacations that the employee did not take earlier, if any.

Not allowed

There are cases when the company is not obliged to pay compensation to the employee for unused vacation and this will be legal, for example:

- The employee has already completed his statutory vacation;

- He managed to work less than half a month;

- He is employed under a GPC agreement.

In addition, when calculating vacation time not taken, all hours actually worked are taken into account. In this case, upon dismissal, all the time for the entire period of work is taken into account. But here the guilty actions of the employee can be taken into account. If such took place, then unspent vacation may not be compensated.

In addition, there are cases when the law prohibits replacing assigned leave with monetary compensation, for example:

- When working conditions are too difficult or hazardous to health;

- If this is a minor employee;

- If the employee is a girl who is on maternity leave.

Calculation algorithm

Calculation of compensation consists of several sequential steps:

- Calculating the number of days of vacation not taken.

- How is the accounting period taken into account when determining average daily income?

- Checking payments when calculating average income.

- Calculation of compensation.

You are being fired, have already been fired illegally, or the employer is infringing on your labor rights and there are evidentiary facts, your right to file a complaint with the labor inspectorate, who benefits from early layoffs and whether consent is required for dismissal before the expiration of the notice period

Let's consider all the steps listed in more detail.

How to calculate {q} Such calculations should be carried out by an accountant. First of all, he calculates how many days the employee has left that he did not have time to take off. If he managed to work for more than 11 months, then he is entitled to 28 days. And then for every 11 months another 28 days.

| Number of days off. | = | Number of days off. in a year | / | 12 months | X | number of months slave. | – | Number of working days otp. |

The amount obtained from such calculations must be rounded up.

If an employee worked for more than 11 months, he is entitled to compensation for each full year worked. If an employee worked for several years and quit in the middle of the year, then the remaining days of the non-entire year are also calculated using this formula.

We invite you to familiarize yourself with: List of documents for registering property rights under an assignment of claim agreement

If an employee has worked for more than a year, then 12 months are taken as the calculation period (meaning 12 months before dismissal). If it is less than a year, then all months from the first day of work to the last before the month of dismissal are taken as the calculation month.

In this case, the billing period should not include:

- The time the employee was on vacation;

- Business trip;

- Sick leave;

- Liberation.

If for some reason the entire billing period consists of exclusion days, then the previous months are taken into account.

| Calc. period | = | 29,3 | X | Quantity fully used. month. | number of work calendar days in not fully worked. months |

| Number of work Kalend. days in not fully worked. months | = | 29,3 | / | Number of calendars. days in not completely worked out. calendar months | X | ( | Number of calendars. days in not completely worked out. calendar months | – | Excl. days | ) |

When calculating average earnings, it is income that is taken, not salary, since bonuses and allowances are also included here.

| Wed. days earnings | = | Payments included in the calculation of avg. salary | / | Calc. period |

Compensation calculation

| Vacation compensation | = | Wed. day earnings | X | Number of non-working days otp. |

Online calculator for calculating sick leave for temporary incapacity for work - go further

When is it necessary to pay compensation for unused vacation?

All amounts that the employee should receive based on the results of the calculation, including compensation for unused vacation, are transferred on the last working day in this organization. Suppose the person did not work that day. Then compensation must be paid no later than the day following the date on which the employee submitted a request for payment.

For financial or other reasons, a company may delay the payment of compensation to a terminated (or resigned) employee. Failure to pay or pay funds on time is a violation of the law. In this case, for each day of delay, the former employee is provided with an additional payment. The percentage of this payment cannot be less than 1/150 of the key rate of the Central Bank of the Russian Federation. The amount is determined by multiplying this percentage by the unpaid earnings. In addition, the employee may seek compensation for moral damage through the court.

Failure to pay or incomplete payment to the employee of all amounts due entails administrative liability under Parts 6 and 7 of Art. 5.27 Code of Administrative Offences. If an administrative offense is established, the following sanctions will be applied to the employer:

| Primary violation | Repeated violation | |

| To officials | Warning or fine 1,000 - 5,000 rubles. | Fine 10,000 - 20,000 rubles. or disqualification for 1-3 years |

| To legal entities | Fine 1,000 - 5,000 rubles. | Fine 10,000 - 20,000 rubles. |

| To persons conducting business without forming a legal entity | Fine 30,000 - 50,000 rubles. | Fine 50,000 - 70,000 rubles. |

There are situations where failure to pay or underpayment of compensation to an employee is considered a crime. In this case, the provisions of the Criminal Code of the Russian Federation will be applied to the perpetrators. Criminal liability may arise:

- in case of partial non-repayment - after three months of delay in transferring compensation;

- in case of non-payment - after two months of delay.

At the same time, the employer must have a selfish motive for delaying compensation. For example, an organization has funds in its current account to pay a settlement, but the manager used them for his own personal interests. Authorized persons may face a fine, removal from office, forced labor, or even, in especially severe cases, imprisonment (Article 145.1 of the Criminal Code of the Russian Federation).

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

How to calculate compensation upon dismissal in 2021 if the working month is incomplete

The legal topic is very complex, but in this article we will try to answer the question “How to calculate compensation upon dismissal in 2021 if the working month is incomplete.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

But days off and “extra” days off due to part-time work are different concepts. An employee may be released from work on his or her scheduled working day. Whereas on an “extra” day off due to part-time work, he should not work at all.

An employee is entitled to 28 calendar days of vacation for each working year. It is necessary to determine the number of unused vacation days if it is known that in 2021 the employee took vacation from September 1 to September 10 (10 calendar days).

Billing period

The number of calendar days taken into account when working part-time. Each day worked is included in the number counted as a whole unit. The fact that the employee was not employed for 8 hours during the working day does not matter. There is no need to apply a part-time adjustment factor. This is not provided for in the Regulations on Average Earnings.

The procedure for calculating an employee’s average earnings for paying compensation for unused vacation to a part-time employee does not differ from the usual one.

The calculation is made in the manner established by the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 (hereinafter referred to as Regulation No. 922).

Since the employee receives a lower salary, then, accordingly, the amount of compensation he will receive is less than if he worked the full standard working time.

Calculation of compensation upon dismissal under part-time conditions

In accordance with Art. 127 of the Labor Code of the Russian Federation, upon dismissal, an employee is paid monetary compensation for unused vacation. When working part-time, the average daily earnings to pay for vacations and pay compensation for unused vacations are calculated in accordance with paragraphs. 10, 11, and 12 of this Regulation No. 922.

According to Art.

121 of the Labor Code of the Russian Federation, the length of service that gives the right to annual basic paid leave, in particular, includes the time of actual work, the time when the employee did not actually work, but is beyond him in accordance with labor legislation, collective agreements, agreements, local regulations, labor the contract preserved the place of work (position), including the time of annual paid leave, non-working holidays, weekends and other rest days provided to the employee. Therefore, the number of unused vacation days for which compensation is paid for part-time employees is determined in the same way as for regular employees.

Question:

Moreover, in accordance with clause 28 of the Rules, all employees who have worked for less than 5.5 months, regardless of the reasons for dismissal, receive proportional compensation, that is, at the rate of 2.33 days (28 days of vacation: 12 months) for each fully worked month .

Moreover, in accordance with clause 35 of the Rules on regular and additional holidays, approved by the USSR National Labor Commission on 30.04.

1930 No. 169, when calculating the terms of work giving the right to proportional additional leave or compensation for leave upon dismissal, surpluses amounting to less than half a month are excluded from the calculation, and surpluses amounting to at least half a month are rounded up to a full month if less than half is worked month, this month is not taken into account. If more than half a month has been worked, this month is counted as fully worked.

- First of all, you should understand what period is considered to be the settlement period. Possible options: 12 full months preceding the month of dismissal. That is, if an employee quits in October 2021, the calculation period will be the year from October 1, 2021 to September 30, 2020.

- The entire period of work with less than a year of service with the employer. That is, if an employee started working in April 2021 and leaves in October 2021, then the calculation period will be the period from the date of admission in April to September 30, 2021.

- 12 full months (or part of this period) before going on maternity leave, if the employee quits immediately after leaving maternity leave or parental leave.

- Current month, if an employee who has worked for less than a month leaves.

- salary in monetary and non-monetary form based on salary, piece rates, tariff rates, percentage of revenue, etc.;

- vacations and other cases of breaks in work while maintaining average earnings;

- Read on the topic: Code of compensation for unused vacation in certificate 2 of personal income tax 2020

Compensation for unused vacation upon dismissal in 2020

- paid for a full year of work if the employee got a job less than a year ago but worked for more than 11 months;

- paid for a full working year if the employee has worked for more than 5.5, but less than 11 months, and is dismissed due to the liquidation of the employer, staff reduction or conscription;

- for the second and subsequent working years it is paid in proportion to the time worked (letter of Rostrud dated 03/04/2013 No. 164-6-1);

How is the amount for unused vacation calculated?

- in connection with the refusal to transfer to another job for medical reasons (clause 8, part 1, article 77 of the Labor Code of the Russian Federation);

- in connection with the liquidation of an enterprise (deregistration of individual entrepreneurs) (clause 1, part 1, article 81 of the Labor Code of the Russian Federation);

- in connection with the reduction (clause 2, part 1, article

81 of the Labor Code of the Russian Federation); - in connection with the dismissal of the manager, his deputies or the chief accountant due to a change in the owner of the organization (clause 4, part 1, article 81 of the Labor Code of the Russian Federation);

- in connection with conscription into the army (clause 1 of article 83 of the Labor Code of the Russian Federation);

- in connection with the reinstatement of the predecessor who held the position of the dismissed person (clause 2 of Article

83 of the Labor Code of the Russian Federation); - in connection with a medical report about the inability to hold a position (clause 5 of Article 83 of the Labor Code of the Russian Federation);

- in connection with death (clause 6 of article 83 of the Labor Code of the Russian Federation);

- due to the occurrence of emergency circumstances (clause 7 of article 83 of the Labor Code of the Russian Federation).

Manager Morozov A.A. (see also example above) joined the company on February 14, 2021.

And he quit on April 20 of the same year. This means that the calculation will include the time from February 14 to March 31, 2021. That is, part of February and all of March. Accordingly, the salary is taken only for these two months. Amounts for April do not count.

We recommend reading: In Voronezh Until How Long Can You Listen to Music 2020

- the number of February days, taking into account the fact that the employee did not work for a full month (started on February 14). And in leap year 2020, February has 29 days, not 28, as usual. The total indicator is 16.1655 (29.3: 29 x 16);

- the March average is 29.3.

Do I need to write an application for compensation for unused vacation upon dismissal in 2021?

As a general rule, compensation for unused vacation is paid upon dismissal. 2020 is no exception. In the article we examined this situation in detail. They told us how to calculate unused days and the payment itself. How to document everything.

If the employer does not pay the resigning employee compensation for unused vacation, and the labor inspectorate finds out about this (for example, the employee writes a complaint), then the employer will be fined. The amount of the fine is (Part 6, Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

By the way, if the employer pays compensation for unused vacation, but in violation of the established deadline, then along with this compensation the employer is obliged to pay the employee another compensation - for the delay in labor payments (Article 236 of the Labor Code of the Russian Federation). Its size can be calculated by our Compensation Calculator for delayed wages.

Compensation for unused vacation upon dismissal and personal income tax

- During the first three months in the amount of 75%.

- Over the next four months at a rate of 60%.

- Over the next five months in the amount of 45%.

- In the future, the individual will be paid the minimum benefit amount (the coefficient established for a specific region will be applied).

In paragraph

35 of the Rules there is the following rule: if an employee worked less than half the days in a month, then compensation is not due for him; if half or more has been worked, then compensation must be calculated as for a fully worked month.

Should I pay compensation for vacation when leaving for less than a month? Let’s look at examples

- The employee was hired on December 1, 2021, the date of dismissal is December 16, 2021.

The working month is from December 1 to December 31 (31 calendar days in total). In this period, 15 days were worked (out of the 31st), for incomplete December this is less than half, so compensation for unused vacation is not due. - The employee was hired on September 23, 2021, the date of dismissal is October 7, 2021.

Working month – from September 23 to November 22 (30 calendar days). In this period, 15 days were worked (out of 30), that is, exactly half, which is rounded up to a full month. - The employee was employed on October 18, 2021, the date of dismissal is November 2, 2021. Working month.

from October 18 to November 17 (31 calendar days) 16 days worked (out of 31), this is more than half, so compensation is paid as for a full month.

What should an employment contract contain?

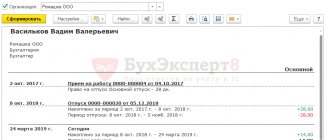

The calculation of the amount of compensation required occurs on the last days of the employee’s work in this institution. The funds are issued to the subordinate along with personal documents, including the employee’s work book with information about dismissal entered there. In order for an accountant to establish the exact amount of all amounts, he must have the following information:

When calculating unused days, the employee’s length of service is rounded to months. If in an incomplete month the employee worked less than half before dismissal, round down; if half or more - to the larger one. That is, you can work for 10.5 months, and receive vacation pay compensation as for 11.

Ivan receives a salary of 100,000 RUR per month. In February 2021, he was paid a bonus of 6,000 RUR for Defender of the Fatherland Day, but it is not provided for by the local regulations of the employing organization. Ivan also receives 1000 R monthly compensation for travel expenses.

Calculation of average daily earnings

First, let's calculate the length of service: from August 10, 2021 to November 23, 2021, 2 years, 3 months and 14 days have passed. Since Ivan took more than 14 days without pay over the last year, the excess will be deducted from the length of service - this is three days. Total employee experience before dismissal: 2 years, 3 months and 11 days.

Labor legislation obliges employers to provide a full list of payments due to full-time employees upon dismissal, including temporary workers if they have performed labor duties in a given company for at least six months. They are also entitled to compensation for all days of the main vacation that they did not have time to use during their work. In order to correctly calculate payments due to temporary workers, the accountant must have the following data:

Compensation for temporary workers upon dismissal in 2020

If an employee has worked for the company for 11 full months, he has earned the right to full annual leave, since the month of the previous annual leave will also be included in the working year.

In all other situations, compensation will be calculated on general terms, that is, for 1 month of work the employee will receive 2.33 days of rest.

If one month of work turns out to be incomplete, it will be counted as full if more than half of its days are worked or will be excluded from the calculation if less than 15 days are worked (14 days if February).

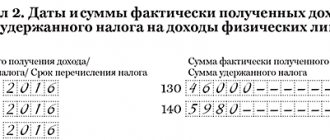

Vacation compensation in reporting forms

The question arises whether the compensation paid to the employee should be reflected in the 2-NDFL certificate and the quarterly 6-NDFL form. The documents must reflect all payments to the employee that were subject to personal income tax. In accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, compensation for unused vacation is not included in the list of income exempt from taxation. Art. 422 of the Tax Code of the Russian Federation also does not provide for exemption from insurance premiums. Therefore, as in the case of salaries, the company will be a tax agent for personal income tax and will have to pay all necessary contributions to the budget.

The tax must be transferred to the budget no later than the day following dismissal and payment of compensation. Contributions are transferred no later than the 15th day of the month following the month in which the employee received the payment.

Compensation for vacation in calculation of 6-NDFL:

In fact, compensation will be considered received on the day of dismissal. Therefore, line 100 of 6-NDFL will indicate the employee’s last working day. All payments upon dismissal and personal income tax on them are indicated in one amount. The payment is indicated on the form for the period in which the employee left. An exception would be the situation when an employee leaves on the last day of the quarter. In this case, the obligation to remit the tax will appear only in the next reporting period (clause 13 of the Federal Tax Service Letter dated November 1, 2021 No. GD-4-11/ [email protected] ). The transaction will be considered unfinished in the current reporting period. Therefore, termination payments should be included in the next quarter's report.

Compensation for vacation in certificate 2-NDFL:

Compensation for unused vacation days upon dismissal is indicated in 2-NDFL as a separate line. The correct code is 4800 (“Other income”).

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

Calculation of compensation upon dismissal

If an employee has worked for 1 month, vacation compensation upon dismissal must be paid, taking into account certain features.

What matters is the term of the employment contract, whether the job is primary or part-time. In Art. 127 of the Labor Code of the Russian Federation does not contain exceptions to the right to receive monetary payment for the remaining days of vacation upon dismissal. If an employee is hired for an indefinite period, but works properly for a month and quits, compensation will be calculated in 2.33 days. For an incomplete month worked, vacation compensation upon dismissal depends on the vacation period earned: less than 15 days or 15 or more. Additional vacations are also included in the calculation of length of service. If a minor employee is dismissed, the payment will be calculated as 2.58 days per month worked.

Rounding days to calculate compensation is not prohibited, so some organizations practice this calculation method. The only condition is rounding in favor of the employee, that is, 2.33 is recognized as 3 days. It is impossible to worsen the employee’s position in relation to the legally established rules.

But in the case of a fixed-term employment contract for a period of up to 2 months, 2 vacation days are accrued per month of service. This rule is established by Art. 291 Labor Code of the Russian Federation .

Labor legislation allows concluding employment contracts for seasonal work. Based on Art. 295 of the Labor Code of the Russian Federation, those involved in work for a period of no more than six months are granted leave at the rate of 2 days per month of service.