01.07.2019

0

323

4 min.

Paying taxes is an obligation that applies to every employed member of society. The existing system of collecting fees is a product of gratuitous contributions by individuals and organizations to ensure the functionality of the state, municipalities and the maintenance of disabled categories of citizens. Employees who decide to quit often ask their employer the question: is compensation for vacation subject to an insurance premium or not?

For officially employed people, the employer automatically makes monthly contributions to the inspectorate. Taxable income includes salary, bonuses and vacation payments, work on holidays and overtime, sick leave, compensation for unused vacation upon dismissal.

The procedure for calculating personal income tax on dismissal payments

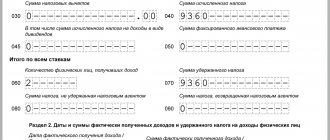

The amounts that are paid to an employee in the event of dismissal can be divided into taxable and non-taxable with income tax (NDFL).

Taxable include :

- all accruals to the employee for time worked and work performed;

- payment of unused vacation days.

There is no need to charge personal income tax on severance pay within the established limit and some types of compensation payments (Article 217 of the Labor Code of the Russian Federation).

The process of determining the tax base includes:

- Identification of taxable and non-taxable charges.

- Summation of only taxable accruals.

- Application of deductions to the amount of taxable charges.

The tax is calculated using the formula:

Tax base × 13% (for non-residents 30%) |

Payments with the consent of the parties

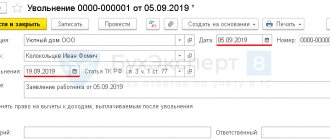

When an employee’s departure occurs by mutual consent, according to the Labor Code of the Russian Federation, the following algorithm is provided:

- the director of the organization or the head of the individual entrepreneur must issue an order to dismiss a specific employee. In this decree the latter must put his signature;

- the person resigning must fill out a statement in which he indicates the reason for leaving work. It must be spelled out with the mandatory wording: “By agreement of the parties”;

- the employer signs the application, thereby giving his consent. The document must contain the appropriate wording (Article 78 of the Labor Code). Also, in the book of the dismissed person, a note about dismissal is placed under the paragraph “Agreement of the parties”.

The drawn up order must contain a clause on compensation for unused vacation and other compensation, if any. In this case, the costs fall on the employer.

At the same time, there are situations when the deadline for dismissal has already arrived, but the employee cannot leave his workplace due to production needs. This happens during dangerous human activity (firefighter, etc.) or when the immediate departure of a person can have an extremely negative impact on the company’s income (production stop, logistics disruption, etc.). In this case, he must write a second application. It is also possible to postpone the date of the agreement to another period.

Deadline for paying personal income tax on salary upon dismissal

All tax accrued on payments upon termination of an employment contract must be paid no later than the day following the date of their actual transfer to the employee (clause 6 of Article 226 of the Tax Code of the Russian Federation). When the deadline for transferring tax upon dismissal coincides with a day off, settlements with the budget for personal income tax are made on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Important

Although now almost all companies pay salaries by bank transfer, and making payments on the day of dismissal is not a problem, there are situations when the date of separation and receipt of money do not coincide. For example, small organizations may issue wages through a cash register, but the employee does not show up to collect the money on the last working day. Then the company is obliged to make payments no later than the next day after the date the dismissed person applied for the debt (Article 140 of the Labor Code of the Russian Federation).

Example 1

The company pays employees wages through a cash register. The employee resigns on 08/20/20__. However, he did not show up for the payment and brought a statement demanding its issuance only on 09/02/20__. The company, in compliance with the law, made a full settlement with him on 09/03/20__. When should she remit personal income tax?

Decision: based on the above provisions of paragraph 6 of Art. 226 of the Tax Code of the Russian Federation - no later than 09/04/20__.

Norms of the laws of the Russian Federation on the provision of annual leave

Following Art. 115 of the Labor Code of the Russian Federation, regular main (basic) paid leaves are provided to team members for 28 calendar days. Every year, the main leave, which lasts more than 28 days (we are talking about extended main leaves), is provided by the enterprise to the employee, guided by the Labor Code of the Russian Federation or other current federal laws.

Additional annual paid leave is intended for employees:

- those engaged in work in harmful, difficult and dangerous conditions;

- having a special (atypical) nature of work;

- for those whose working day is not clearly defined in time - not standardized;

- working in industries of the Far North (or in areas equivalent to them),

- and in other cases that are described by the Labor Code of the Russian Federation and other federal laws.

Each employer, taking into account its production realities and financial capabilities, has the right to independently determine additional leave for an employee for a group of its employees (unless regulatory documents provide otherwise). The conditions, procedure and algorithm for granting such leaves correspond to collective agreements or company acts. Such documents are accepted with the participation of the company’s trade union organization.

Some categories of citizens whose work is related to the specific conditions of the work performed are given additional paid leave every year. Its duration is related to the characteristics or nature of the work performed. The Government of the Russian Federation determines a list of categories of citizens to whom such leave can be offered, as well as its minimum duration.

Employees whose days are not standardized are also given additional leave. Its length is determined by the internal rules of the employer’s company, but it is never shorter than three calendar days. When the TD (employment contract) that an employee signs describes the work schedule as not standardized, he can count on at least three additional days added to his vacation.

Back to contents

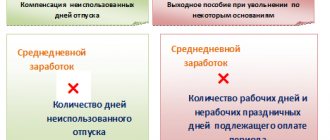

The procedure for calculating insurance premiums upon dismissal

When deciding what taxes to pay when dismissing an employee, you should not forget about insurance premiums, as well as contributions in connection with accidents at work. The composition of payments subject to taxation includes almost all accruals under an employment or civil law contract. The list of non-taxable amounts is clearly stated in Art. 422 of the Tax Code of the Russian Federation.

The procedure for determining the taxable base for contributions upon dismissal is as follows:

- Accounting for all amounts due to the employee in connection with termination of cooperation.

- Identification in the list of charges that fall under those given in Art. 422 of the Tax Code of the Russian Federation, benefits.

- Deduction from the total amount of accruals of non-taxable amounts - according to Art. 422 of the Tax Code of the Russian Federation.

The calculation of the amount of contributions upon dismissal is carried out according to the formula:

Taxable base × Percentage of contributions to the relevant fund |

Replacing vacation with compensation

Part of the regular paid leave exceeding 28 days, at the request of the employee, can be replaced with material compensation if the management is provided with a written application from the employee. When summing up regular annual vacations or when transferring them to the next working year, part of each vacation can be paid, over twenty-eight days, or any number of them from the remaining part.

It is important to emphasize the limitations in this matter. Replacing regular regular leave or paid leave with compensation for expectant mothers and persons under 18 years of age is illegal. Following Art. 126 of the Labor Code of the Russian Federation, employees engaged in difficult work or dangerous enterprises also do not have the right to be reimbursed for additional leave in cash (this does not apply to the payment of money for unclaimed leave to dismissed employees). If the employee signed a letter of resignation, then, in compliance with Article 127 of the Labor Code of the Russian Federation, he is required to compensate for all unused days.

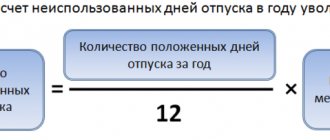

The principle of calculating compensation for unclaimed vacation days is formulated in Letter of Rostrud No. 164-6-1 dated 03/04/2013, and in the Rules on regular and additional vacations, which were approved by the CNT of the USSR on 04/30/1930 (hereinafter referred to as the Rules) (clauses 28 and 29 ). Due to the fact that these rules are not established in the modern Labor Code of the Russian Federation, these documents should be followed if there is a need for proportional payments of compensation.

Full compensation in accordance with the Rules (clause “a”, paragraph 28) is received by employees who have worked from five and a half to eleven full months, when the dismissal is associated with the liquidation of the enterprise, its individual parts, reduction of staff or work, reorganization of the enterprise (institution) or temporary suspension activities.

Except for the circumstances specified in paragraphs. “a” – “d” clause 28 of the Rules, compensation for employees is calculated proportionally. Thus, compensation for unused vacation upon dismissal can be received by employees who have worked at the enterprise for the appropriate amount of time (5.5 - 11 months), if they quit for other reasons not related to those listed above, incl. at will. Compensation is received by all employees who have worked with the company for less than 5.5 months, and the reason for dismissal is not important. This paragraph defines the algorithm for paying compensation to employees who have worked for a company or enterprise for less than a year. For the second year, funds are paid in proportion to the time worked.

When dismissing employees, the time subject to financial compensation is calculated based on the fact that vacation is fully due only to those employees who have worked at the enterprise for a whole year, that is, twelve months from the date of filling the vacancy (but not from 01.01, as the calendar year is calculated). This rule has been in effect for seventy years and does not contradict the modern Labor Code of the Russian Federation.

As stated in paragraph 1 of the Rules, leave is provided to employees once per year of work with the employer. It is calculated from the day a person is hired to work. But if the working year is not fully worked out, the vacation days that need to be compensated are calculated in proportion to the months worked by the employee at the enterprise. The surplus that arises and amounts to less than 15 days does not participate in the calculation, and the surplus amounting to more than 15 days is counted as a full month (based on clause 35 of the Rules).

The Supreme Court of the Russian Federation on December 1, 2004 No. GKPI04-1294 in the Decision and dated February 15, 2005 No. KAS05-14 in the Determination attested to the legality of clause 28 of the Rules, indicating that the Federal Laws do not regulate the issue of mechanisms for calculating compensation for leave that was not used by employees who worked before dismissal for at least eleven months. Moreover, the Federal Law does not include provisions that would prohibit regulating this problem in exactly this way.

Taking into account these standards, specialists who have worked for a specific employer for more than 11 months, giving the right to full and paid leave, must be promptly paid full compensation. This does not contradict the Regulations, because Article 121 of the Labor Code of the Russian Federation, this time, that is, leave, is included in the length of service, which accordingly gives the right to receive paid basic leave (based on Letter of Rostrud dated December 18, 2012 No. 1519-6-1). Therefore, it compensates unused vacation only to the employee who quits. Part of the annual paid leave, starting from the 29th calendar day, can be replaced with compensation at the written request of the employee. Next, we’ll talk about how compensation is calculated and whether compensation for unused vacation upon dismissal is subject to taxes.

Back to contents

Deadline for transferring contributions from the salary of the dismissed person

All contributions must be transferred no later than the 15th day of the month following the month of payment of income (clause 1 and clause 3 of Article 431 of the Tax Code of the Russian Federation). This rule also applies when dismissing an employee.

However, for the purpose of paying contributions, the date of payment is the day of actual delivery of the amounts to the employee (clause 1 of Article 424 of the Tax Code of the Russian Federation). If this date falls on a weekend, then payments should be made no later than on the next working day.

Example 1

The employee resigned on 9/20/20__. On the same day, full payment was made to him. The due date for payment of contributions is no later than 10/15/20__.

Example 2

The employee quit on 09/20/20__, but did not show up for the payment, and only requested it on 10/01/20__. The accounting department carried out the calculation and payment of the debt on 10/02/20__. The due date for payment of contributions in this case should be 11/15/20__. But this day falls on a weekend, so the deadline is until 11/16/20__.

Read also

23.10.2020

Annual leave - aspects that are important to emphasize

- the duration or time of annual paid leave (basic and additional) is calculated in calendar days and may have a maximum limit. If the period of main and additional annual leave includes non-working days and holidays, they are not included in the amount of calendar days of leave. The duration of paid holidays is summed up;

- Every employee must be provided with paid leave annually. Already in the first year of work, the employee receives the right to use it. This right arises after six months of permanent work in the company. Such leave is allowed to the employee until the end of the six-month period - by agreement with management;

- The order in which employees will be granted paid leave is determined every year by drawing up vacation schedules;

- Annual paid leave is moved or extended by the employer at the written request of the employee and taking into account his wishes. Vacation must be rescheduled in the following cases:

- if the employee is temporarily disabled;

- if during the vacation period the employee is forced to perform government duties (if the labor legislation stipulates exemption from work for the period of their performance)

- in other cases, which are reflected by labor legislation or local regulatory framework.

Annual leave must be paid on time. If the employee’s payment is not received on time or he is notified about the start of his vacation later than 2 weeks (14 days) before it begins, the employee has the right to apply for a postponement of the annual paid vacation. Its beginning in this case is consistent with the leadership.

In those exceptional circumstances when the provision of leave to staff in the current year will entail unfavorable results for the activities of the organization (company or individual entrepreneur), it may be postponed to the next year. Such a transfer is permitted only with the consent of the employee. However, it must be used no later than twelve months after the end of the previous working year.

According to the Labor Code of the Russian Federation, it is prohibited not to provide an employee with annual leave for more than a couple of years in a row. Persons under eighteen years of age and employees who work in unsafe and difficult conditions also fall under this category, according to Art. 124.

Back to contents