Changes in payments from 2021

In 2021 and earlier, in regions not participating in the Direct Payments project, the following scheme was in effect.

First, the employer transferred his funds to the employee, and then the Social Insurance Fund reimbursed him the entire amount. Starting from 2021, in all regions of the Russian Federation, payments to women are made directly by the FSS (see “Starting from 2021, in all regions of Russia, benefits will be paid directly from the FSS”).

The new algorithm for interaction between the employer and the fund is set out in the regulation approved by Decree of the Government of the Russian Federation dated December 30, 2020 No. 2375. It says that having received an application and supporting documents from the employee, the accounting department must transfer to the FSS the information (in particular, sick leave registers) necessary for the appointment and benefit payments. This must be done no later than 5 calendar days from the moment the woman brought the papers.

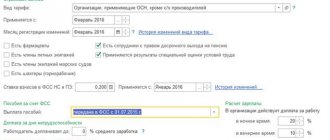

The method of transferring information (sick leave registers) depends on the average number of individuals to whom payments were made in the previous billing period (for newly created companies - on the current number of personnel). If this figure exceeds 25 people, the information is submitted electronically. If the number is equal to or less than 25 people, you can submit information on paper (for information on how to calculate the average number of employees, see “Crib sheet for calculating the average number of employees”).

Create and submit sick leave registers for free using the “FSS Benefits” service

Who is paid maternity benefits?

According to Article 6 of Federal Law No. 81-FZ dated May 19, 1995, maternity benefits (B&R) are awarded to women (including those who have adopted a child under three months of age):

- working;

- unemployed if they were fired due to the liquidation of the employer company (loss of individual entrepreneur status, termination of lawyer status, etc.) within 12 months preceding the day they were recognized as unemployed;

- full-time students in professional and other educational organizations;

- undergoing military service under a contract, as well as service in law enforcement and customs authorities.

Calculate your salary and benefits taking into account the increase in the minimum wage from 2021 Calculate for free

What is the amount of maternity benefit in 2021?

The calculation algorithm is given in the Regulations on the specifics of the procedure for calculating benefits for temporary disability and pregnancy and childbirth (approved by Decree of the Government of the Russian Federation dated June 15, 2007 No. 375). First you need to find the average earnings, compare it with the limits, and then calculate the amount of the B&R benefit.

Calculation of average daily earnings

Total earnings

It includes payments to the employee from whom contributions were paid for compulsory social insurance in case of temporary disability and in connection with maternity.

In general, it is counted for two calendar years preceding the year in which the maternity leave began. If a woman goes on leave for employment and labor in 2021, the total earnings are determined for 2020 and 2021.

ATTENTION. If in the two previous calendar years a woman was on another maternity leave or on maternity leave for at least one day, one or two years can be transferred to an earlier period. The basis must be a written statement. Let's give an example. Let's say maternity leave starts in March 2021. Moreover, in 2021 the employee was on maternity leave, and in 2021 she was on maternity leave. She wrote a statement, and her total earnings were calculated for 2021 and 2018.

Total earnings are taken into account in the part that does not exceed the maximum value of the base for contributions in case of temporary disability and in connection with maternity. This value is approved annually by the Government of the Russian Federation. Earnings for each of the two years separately should be compared with the maximum values of the base (for an example, see Table 1).

Calculate maternity benefits taking into account current indicators Calculate for free

Table 1

An example of comparing total earnings with the maximum values of the base when calculating benefits for the BiR

| Indicators | The period for which total earnings are calculated | |

| 2019 | 2020 | |

| Limit value of the base for the corresponding year | 865,000 rub. | 912,000 rub. |

| Total earnings | 870,000 rub. (exceeds) | 890,000 rub. (does not exceed) |

| Amount taken into account when calculating maternity benefits | 865,000 rub. | 890,000 rub. |

| Total total earnings for two years | RUB 1,755,000 (865,000 + 890,000) | |

Number of days in the billing period

To find it, you need to take two quantities:

- The number of calendar days in the period for which total earnings are calculated.

- The number of calendar days of the excluded period. It includes time of illness, maternity leave, and parental leave for up to 1.5 years. Also included in the excluded period are days when the woman was released from work according to the laws of the Russian Federation with full or partial retention of her salary (if contributions were not transferred from payments in case of temporary disability and in connection with maternity).

Then the second value should be subtracted from the first value.

Average daily earnings

It is equal to the total earnings divided by the number of days of the billing period.

Example 1

Ksenia Ivanova goes on vacation in April 2021. Her total earnings for 2021 and 2021 amounted to 500,000 rubles. (base limits are not exceeded). There are 731 calendar days in 2020-2019. Of these, Ivanova was on sick leave for 15 calendar days. The number of days in the billing period is 716 days. (731 - 15). Average daily earnings amounted to 698.32 rubles. (RUB 500,000: 716 days).

Comparison of average daily earnings with limits

Minimum maternity payments in 2021

The amount of the B&R benefit cannot be as small as desired. If a woman’s average earnings are below the minimum wage established on the start date of maternity leave, the benefit should be considered based on the minimum wage.

It is necessary to compare two values of average daily earnings: actual and based on the minimum wage. To do this you need to do the following:

- Divide the actual total earnings by the number of days in the billing period.

- Multiply the minimum wage as of the start date of maternity leave by 24 months and divide by 730 days.

- Compare the figures obtained. If the first is greater than or equal to the second, the benefit must be calculated based on the first value. If the first is less than the second, the benefit should be determined based on the second value (example in Table 2).

table 2

An example of comparing two values of average daily earnings: actual and based on the minimum wage

| Start date of maternity leave | April 1, 2021 |

| Total earnings for 2021 and 2021 | 100,000 rub. |

| Minimum wage for 2021 | RUB 12,792 |

| Number of calendar days in 2021 and 2021 | 731 days |

| Number of days of the excluded period (sick leave) | 45 days |

| Number of days in the billing period | 686 days (731 - 45) |

| Actual average daily earnings | RUB 145.77 (RUB 100,000: 686 days) |

| Average daily earnings based on the minimum wage | RUB 420.56 (RUB 12,792 x 24 months: 730 days) |

| Conclusion | The actual average daily earnings are less than this figure calculated based on the minimum wage. Therefore, benefits should be calculated according to the minimum wage |

The amount of maternity benefit is equal to the average daily earnings multiplied by the number of vacation days according to the BiR.

The amount of maternity benefits, calculated based on the minimum wage, in 2021 is:

- RUB 58,878.4 - if the duration of leave under the BiR is 140 days;

- RUB 65,607.36 - if the duration of leave under the BiR is 156 days;

- RUB 81,588.64 - if the duration of leave under the BiR is 194 days.

Calculate wages and benefits according to labor accounting at an enterprise with different remuneration systems, coefficients and allowances

Maximum amount of maternity payments in 2021

If the employee did not write an application to transfer the pay period to earlier years, the total earnings for maternity leave are considered for 2021 and 2021.

Taking into account the maximum base values, the maximum average daily earnings will be 2,434.25 rubles ((865,000 rubles + 912,000 rubles): 730 days).

The amount of maternity benefit cannot exceed the following values:

- RUB 340,795 - if the duration of leave under the BiR is 140 days;

- RUB 379,743 - if the duration of leave under the BiR is 156 days;

- RUB 472,244.5 - if the duration of leave under the BiR is 194 days.

Calculation of the benefit amount according to BIR

You need to take the average daily earnings and multiply by the number of calendar days of vacation according to the BiR according to the certificate of incapacity for work (140, 156 or 194 days).

IMPORTANT. When paying benefits under the BiR, the average daily earnings are multiplied by 100%, regardless of length of service. Personal income tax is not charged or withheld from this payment.

Example 2

In May 2021, Daria Petrova brought a maternity bulletin to the accounting department, according to which the duration of leave is 140 calendar days. Petrova did not submit an application to postpone the billing period.

The employee’s total earnings in 2021 amounted to 750,000 rubles, and in 2021 - 730,000 rubles. (base limits are not exceeded).

During 2019-2020, Petrova was on the ballot for 14 calendar days.

The accountant determined that the actual average daily earnings are equal to 2,064.16 rubles ((750,000 rubles + 730,000 rubles): (731 days - 14 days)).

Next, I compared the resulting figure with the limits and made sure that:

- actual average daily earnings do not exceed the maximum permissible value (RUB 2,064.16 < RUB 2,434.25);

- the actual average daily earnings are greater than the average daily earnings calculated based on the minimum wage (RUB 2,064.16 > RUB 420.56).

As a result, the maternity benefit amounted to 288,982.4 rubles (2,064.16 rubles × 100% × 140 days). Petrova received this amount in her hands.

ATTENTION. If the employee’s insurance experience is less than 6 months, then an additional condition is introduced. The BiR benefit for a full month cannot exceed the minimum wage multiplied by the regional coefficient (if it is introduced in a given area). The amount of payment for an incomplete month is calculated as follows. The minimum wage (taking into account the regional coefficient) is divided by the number of calendar days in a given month and multiplied by the number of days of maternity leave in a given month.

Calculate your salary and benefits taking into account the increase in the minimum wage from 2021 Calculate for free

Maximum payment in 2021

As a general rule, the amount of maternity leave payments is determined based on average earnings.

The basis for the calculation is the two full years in which the employee received wages before going on vacation.

It happens that during the year an employee received income exceeding the maximum base. This value is the upper limit when calculating the amount of maternity pay.

Therefore, the maximum possible amount is set when the size obtained in the calculation is greater than the permissible amount.

The amount of payment is determined based on the maximum base of insurance payments.

Two values are compared: average daily income and daily maximum benefit. If the first amount is greater than the second, then compensation will be calculated according to the last option.

Payment limits increase annually. So, in 2021, the maximum insurance base is RUB 815,000.

The maximum benefit amount depending on the number of sick days will be as follows:

- 140 days for normal childbirth – 282,106.70 rubles;

- 156 during pregnancy and childbirth with complications – RUB 314,347.47;

- 194, if several children are born - 390,919.29 rubles.

Amounts of “children’s” benefits in 2021

| Type of benefit | Size |

| Monthly allowance for child care up to 1.5 years | Paid every month. Amount for a full month = average daily earnings * 30.4 * 40%. The amount for an incomplete month is proportional to the number of calendar days of the month in which the woman was on maternity leave. The maximum possible payment amount per month is RUB 29,600.48. If the average monthly salary is not more than the minimum wage, the benefit amount for a full month is: in January 2021, 6,752 rubles; from February 2021 - 7,082.85 rubles. (if working part-time, it must be multiplied by a coefficient reflecting the length of working time; if there is a regional coefficient, by this coefficient). The monthly benefit amount cannot be lower than: - in January 2021: when caring for the first, second and subsequent children - 6,752 rubles. (multiplied by the regional coefficient if available); - from February 2021: when caring for the first, second and subsequent children - RUB 7,082.85. (multiplied by the regional coefficient if available). |

| One-time benefit for the birth of a child | Paid once. In January 2021 - 18,004.12 rubles. From February 2021 - RUB 18,886.32. |

| One-time benefit for women registered in the early stages of pregnancy | Paid once. In January 2021 - 675.15 rubles. From February 2021 - 708.23 rubles. |

Required documents

In order to go on vacation and prepare for the birth of a baby, as well as receive all the payments due, a woman must collect and submit the necessary documents on time.

For maternity leave, submit to the HR department:

- A certificate of incapacity for work for the entire period of rest, drawn up correctly.

- A certificate of registration at 12 weeks of pregnancy from the antenatal clinic in order to receive the appropriate benefit.

- A free-form application, usually based on the employer's template.

- All salary information and payment details are usually available in the organization's accounting department. If this is a new place of work, then you need to provide certificates of income from the previous place.

To count on child care every month, you need to prepare:

- identification document;

- original and copy of birth certificate;

- statement.

To receive a lump sum birth benefit, the father obtains a certificate from his employer stating that he was not paid. Documents are submitted before the child turns six months old.