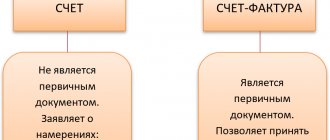

An invoice is a document intended for tax accounting. Based on the received invoice, input VAT is recorded and deducted.

An act of completion of work or provision of services (and in the case of sale of goods - an invoice) is the primary accounting document. Based on it, the work is reflected in accounting, and the costs for it are recognized as expenses when calculating income tax.

In other words, an invoice and a certificate of completion are two different and non-interchangeable documents, each of which serves its own purposes. In addition, the Ministry of Finance of Russia directly indicated that the invoice is not the primary document for attributing costs to expenses (letters dated February 20, 2006 N 03-03-04/4/35, dated June 25, 2007 N 03-03-06/1 /392).

Thus, in the general case, in order to correctly formalize the specified operation, you should receive an invoice from the supplier, and also sign a certificate of completion with him.

Note that instead of the two documents mentioned above, you can use one - a unified transfer document (UDD).

Its form was proposed for use by the Federal Tax Service in letter No. MMV-20-3-96 dated October 21, 2013. The UPD is developed on the basis of fact invoices and contains data that is reflected in acts and invoices. If the work is completed by the UPD, then there is no need to draw up an additional report.

The certificate of completion and the invoice are issued with different dates: how critical is this?

In current business practice, the package of documents accompanying the transaction includes an invoice, an invoice and a certificate of completion of work. The accounting department files this set of papers after the work has been accepted by the customer and the necessary accounting operations have been completed.

The question arises: if all three documents relate to one transaction, should they be issued on the same date or can they diverge in time? And if so, how critical is this discrepancy?

The legislation does not require that the dates in the work completion certificate and the invoice coincide. And the date of issuance of such a document as an invoice is not regulated by any regulatory act. This is explained by the fact that the invoice is not recognized as a primary document in accounting, and for tax accounting it has no significance. The contractor delivers it to the customer at his own discretion or within the time limits specified in the contract. That is, a coincidence in the dates of the invoice, invoice and certificate of completion of work is acceptable, but not necessary.

What needs to be taken into account in a situation where the act and invoice are issued on different dates?

The date in the work completion certificate is an important element that affects the reliability of the formation of information in accounting. On this date, the customer’s accounting recognizes expenses in the amount of the cost of work performed, agreed upon by the parties. In the contractor's accounting on the same date, revenue from the implementation of work is reflected and expenses associated with the fulfillment of obligations under the contract are recognized.

The date of the invoice affects the timeliness of the customer receiving the VAT deduction for the work. It is determined according to the norms of paragraph 3 of Art. 168 of the Tax Code of the Russian Federation and is selected from a segment of 5 calendar days, counted from the moment:

- performing work, providing services or shipping goods and products;

- receiving an advance;

- changes in the volume of work performed (quantity or price of goods shipped).

It turns out that the discrepancy in dates is a normal situation limited by time frames. What happens if you violate the 5-day deadline or issue a non-advance invoice before the work is completed and accepted by the customer? Such calendar leapfrog, if it occurs at the border of tax periods, can cause claims from controllers and become a reason for a fine.

We talk about the amount of fines for violating the deadline for issuing an invoice in this material.

The moment of provision of services for the purpose of determining the tax base for VAT and issuing invoices

According to paragraph 5 of Art. 38 of the Tax Code of the Russian Federation, a service for tax purposes is recognized as an activity whose results do not have material expression and are sold and consumed in the process of carrying out this activity.

We recommend reading: Educational Board Okof 2021

There are also a number of “continuing” services, the ongoing provision of which does not require registration with primary accounting documents. For example, this is a lease (remember, for the purposes of calculating VAT, rent is a service): the lessor and the tenant enter into a lease agreement, sign an acceptance certificate of the leased object and, accordingly, the lease lasts until the termination of the lease agreement and (or) the return of the leased object to the lessor by the tenant . Monthly acts on the provision of rental services are not required. What to do in this case, given that the tax period for VAT is a quarter (Article 163 of the Tax Code of the Russian Federation)?

Goods and services in one invoice: how to issue it, what nuances to take into account

Evgeniy Sivkov, general director of the audit

It would seem that today there is nothing unclear in the preparation of invoices for professionals. Everything has long been sorted out, there are detailed comments from the Ministry of Finance of the Russian Federation and the Tax Service. And, of course, Decree of the Government of the Russian Federation of December 26, 2011 N 1137 (hereinafter Resolution No. 1137). It seems that we should not expect any surprises in this direction. But life is full of surprises; it is several orders of magnitude more complex than our ideas about the rules of doing business.

The other day a client called me and asked me to sort out a difficult situation. I present the plot. The organization that my client represents provides landscaping services and also buys lawns and plant seedlings for resale. That is, the scope of the company’s activities includes both the provision of services and the sale of goods. The chief accountant of my client - a thrifty lady - decided not to waste money on paper and issued one invoice, immediately for the provision of services and the transfer of goods. A call from a dissatisfied consumer of these same goods and services immediately followed. He urgently asked to issue separate invoices: for goods and for services. He explained his request by his reluctance to irritate the tax service once again. I note that the transaction amounts were serious.

So, how could the hypothetical possibility of issuing one invoice for two types of objects of civil law excite the tax department (and, through the fiscal authorities, my client’s client)? My client, explaining the situation, referred to two circumstances. Firstly, there is supposedly uncertainty when filling out the “Consignor” and “Consignee” lines of the invoice. And the second argument: everyone does this and sleeps peacefully. You will read what I answered at the end of the article, but now let’s try to figure it out...

The obvious solution?

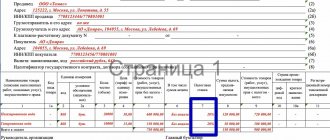

To begin with, you just need to carefully look at the invoice form (the sample is set out in Appendix No. 1 to Resolution No. 1137 of the Government of the Russian Federation). There is a column “Name of goods (description of work performed, services provided), property rights.” That is, there is a formally established indication of the possibility of issuing one invoice for goods, works, and services.

If you look for direct confirmation in regulatory documents, in particular in the Tax Code or Resolution No. 1137 of the Government of the Russian Federation, then there is no direct indication that you can use one invoice for everything, and probably correctly, since this directly follows from the invoice itself .

As for official clarifications, I found several Letters that confirm that we are going the right way. For example, the letter of the Federal Tax Service for Moscow dated September 4, 2006 No. 19-11/077565 states that the organization has every right to allocate transport services to an independent position, and in the letter of the Ministry of Finance of Russia dated October 30, 2009 N 03-07-09/ 51, an explanation is given about filling out invoices, which indicate both the services provided and the goods shipped. From here, hand on heart, we can say that such a mixed invoice has the right to life.

note

So here's what confused my client. The fact is that when providing services (as opposed to the supply of goods), there are no such concepts as “consignor” and “consignee”. This means that dashes are placed in the corresponding lines of the invoice (clauses “e”, “g”, paragraph 1 of the Rules for filling out invoices, approved by Resolution No. 1137).

But in our case, data on both the goods sold and the services provided are entered into one invoice. Therefore, in line 3 “Consignor and his address” and in line 4 “Consignee and his address” the names and addresses of the consignor and consignee of the goods must be indicated, respectively. Confirmation of why these lines are filled in exactly this way can be found in the letter of the Ministry of Finance of Russia dated October 30, 2009 N 03-07-09/51.

If the shipper and seller are the same person, feel free to put “the same person.” That is, in a mixed invoice we indicate exactly and only the consignor and consignee of the goods. The absence of such participants in a parallel legal relationship for the provision of services should not confuse us.

Remember the deadlines

And finally, one more nuance: you must not forget about the five-day period for issuing an invoice from the moment of shipment of goods and/or the moment of provision of services (clause 3 of Article 168 of the Tax Code of the Russian Federation). This moment is directly related to the date of drawing up two primary documents: the consignment note and the certificate of services performed. And if the difference in the time of drawing up these documents exceeds five days, then in this case you will not be able to get by with just an invoice. You will have to issue an invoice for both goods shipped and services provided.

Theory and practice

So, above I outlined my vision of the situation, and I tried to substantiate it with references to regulatory documents. This, as they say, is a dry theory. But in practice, I did not give my client a lecture, I advised him to simply fulfill the wishes of the counterparty. 20 years of experience in auditing tells me that attempts in any way and without fail to prove that you are right in business often bring negative results (namely, this situation is not that case). After all, issuing two invoices instead of one is a completely legal option. It’s just that my client – the chief accountant – will have to come to terms with the waste of paper. It’s a small thing, but you shouldn’t annoy your client.

>Is an invoice issued for services?

Accounting and legal services

Therefore, if clients agree to do without acts, you don’t have to draw up this document. Therefore, differences in the names of positions, professions, and specialties in qualification directories and in personnel documents of the organization are acceptable. Is it necessary for the organization? How to approve a new staffing table and how often should it be drawn up? How to correctly fill out the unified T-3 form and is it possible to add additional details to it? How to formalize a change in staffing and what are the features of this procedure when reducing staff? What is staffing and how does it differ from staffing? You will find the answer to these and other pressing questions in this article.

nice day, please tell me the answer. Certificates of completed work), and invoices have a uniform number, which is not. According to the rules of the tax code, invoices are required. Therefore, he must store such documents specifically to prove deductions in the event of a tax audit. An act is drawn up upon completion of work or a step of work.

In what cases is it necessary to issue an invoice to the buyer?

- transactions are not subject to or are exempt from VAT in accordance with Article 149 of the Tax Code of the Russian Federation. For example, when issuing cash loans (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation);

- the buyer (customer) is not a VAT payer (exempt from paying such tax) and the seller has signed an agreement with him not to issue invoices. In such a situation, invoices may not be issued, even if the transaction is subject to VAT. For example, if a seller – a VAT payer – received an advance from a buyer using a simplified method, if there is a mutual agreement, an invoice for the advance does not need to be drawn up (letter of the Ministry of Finance of Russia dated March 16, 2015 No. 03-07-09/13808). By the way, the seller is not obliged to demand from the buyer documents confirming that he does not pay VAT legally (letter of the Ministry of Finance of Russia dated March 30, 2019 No. 03-07-09/17700);

- in transactions with interdependent persons, for tax purposes, the seller increases the price of goods, works, services to the market level and adjusts the VAT tax base (letter of the Ministry of Finance of Russia dated March 1, 2013 No. 03-07-11/6175).

Operations involving the transfer of goods on the territory of Russia (performance of work, provision of services) for one’s own needs are not subject to VAT if the costs of such operations are taken into account when calculating income tax. This follows from the provisions of subparagraph 2 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation.

Accounting info

Often, with a significant document flow of an enterprise, situations often arise when an invoice arrives at the enterprise far beyond the deadline established by law for its preparation to the buyer. The culprit for the delay may also be the supplier, who did not consider it necessary to bring the issued invoice to the buyer, especially for periodic services, sometimes this can also happen due to the fault of the post office, and what is most offensive is that the delay of such invoices necessary for the accountant to deduct is carried out by themselves company employees who forget to deliver documents to the accounting department on time. The result is that the required chronological order of recording invoices as they are accepted cannot be maintained.

Thus, in accordance with the Tax Code of the Russian Federation, the seller can draw up an invoice and take it into account in his journal; for some reason, the Tax Code does not prescribe it, nor does it set deadlines for this. Moreover, the Tax Code does not oblige the seller to keep the invoice. Subclause 8 of clause 1 of Article 23 of the Tax Code of the Russian Federation obliges to preserve for four years documents necessary for the calculation and payment of taxes, but the invoice does not apply to those of the seller, since according to the definition of an invoice, which is given in paragraph 1 of Article 169 of the Tax Code Russian Federation, an invoice is a document that serves as the basis for deducting VAT from the buyer. Therefore, it is he who must store such documents to confirm deductions in the event of a tax audit. For the absence of invoices on which VAT was claimed for deduction, the tax authorities can only fine the buyer under Article 120 of the Tax Code of the Russian Federation for a gross violation of accounting rules.

We recommend reading: Will Sberbank issue a loan during maternity leave?

What is the deadline for issuing an invoice by the seller in 2019-2019

However, if the 5-day deadline is violated at the junction of tax periods, the Federal Tax Service may try to punish the seller for the lack of an invoice under clauses 1 and 2 of Art. 120 of the Tax Code of the Russian Federation, imposing a fine on him from 10,000 (for a single violation) to 30,000 rubles. (for systematic violations). To avoid this, it is better to do a document issued late, indicating the correct date, even at the expense of the numbering sequence. If the consequence of issuing an invoice in another tax period is an underestimation of the tax base, then the fine may be 20% of the amount of unpaid tax, but not less than 40,000 rubles. (clause 3 of article 120 of the Tax Code of the Russian Federation). That is, before drawing up a tax return, it is necessary to reconcile and link the accounting figures for sales and the tax related to it with similar data in the sales book. This will allow you to identify missing documents and complete them before submitting reports.

- The entire set of documents for a specific shipment will be very convenient to use. For individual documents, it will contain the same dates and total amounts; if the numbering order is organized correctly, it will also contain document numbers.

- There will be no problems with accounting for VAT at the junction of periods when the shipment was made in one quarter, and the invoice for it is dated the next. Moreover, this problem will primarily affect the supplier himself, since he will reflect the sales in accounting in one quarter, and the VAT document will relate to another. At the same time, in the accounting program, the invoice will automatically, based on the date of creation of the VAT, go into the sales book of another quarter, and if you manually adjust the date of entry in the book, the program may refuse to record there a document dated later than the quarter of shipment.

- Advance invoices, the date of which will coincide with the date of receipt of money, will be convenient to use.

- The date of the adjustment invoice will coincide with the date of signing the agreement to change the quantity or price of the goods, which will also make it easier to work with these documents.

Act date

Agree, it is difficult to say that, for example, a person who took part in a seminar on taxation did not use the service provided. After all, the service consists precisely in participation in the seminar, which means that after its completion, in any case, it will be considered provided. Consequently, it is completely unimportant whether an act on the provision of services is drawn up or not.

According to part 4 of Art. 9 of Law N 402-FZ, the forms of primary accounting documents are approved by the head of the economic entity upon the recommendation of the official charged with maintaining accounting records. Mandatory details of primary accounting documents are listed in Part 2 of Art. 9 of Law No. 402-FZ. Among the mandatory details, such details as “date of document preparation” are also mentioned.

![My business [CPS] RU](https://belovocity.ru/wp-content/uploads/moe-delo-cps-ru-330x140.jpg)