Instruction 1: they forgot to include the employee in SZV-M

If you forgot to include a person in the SZV-M, you should fill out an adjustment report form. To do this, take the usual form SZV-M, approved. Resolution of the Board of the Pension Fund of 01.02.2016 No. 83p, and fill it out as follows:

- In sections 1 “Insured Details” and 2 “Reporting Period”, indicate the same data as in the original SZV-M, which needs to be supplemented if there were no errors in these sections of the original SZV-M.

- In section 3 “Form type (code)”, enter the code “additional” - this means that the form is submitted to supplement the information about insured persons previously accepted by the Pension Fund for the reporting period.

- In section 4 “Information about insured persons”, include information about the “forgotten” employee. There is no need to repeat information about other employees already reflected in the original SZV-M.

Give the completed adjustment SZV-M form to your manager for signature and then send it to the Pension Fund.

Method 2. Adding an external report to ZUP 3 or BP 3

An external report can be added to ZUP 3 or Accounting 3.

Adding an external report is described for ZUP 3. For BP 3, the same connection principles apply.

In ZUP 3, to add an external report in the Administration - Printed forms, reports and processing - Additional reports and processing section, use the Add from file...

Continue after the Security Warning

Select the downloaded external report.

After adding the report, on the Commands we will indicate the section in which the external report will be available

We will specify the users who will be able to run the report

You can open the report in the section in which it was added (in our example, in the Personnel ), in the Service - Additional reports section

And run it using the Run

You can then work with the report as shown in Method 1.

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C:ZUP, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Example and sample

We will show you how to use the instructions described in the previous section with an example.

The original SZV-M, prepared by the accountant of SpetsStroyka LLC for January 2021, contained information about 48 employees of the company. The report was submitted on 02/10/2021. After the SZV-M was accepted by the Pension Fund of Russia, the accountant discovered an inaccuracy in it - the report did not reflect the employee with whom the GPC agreement was in effect in January 2021.

What to do? There is an urgent need to adjust SZV-M for one employee.

In order to supplement the information of the original SZV-M for January with the missing information, the accountant prepared and sent to the Pension Fund the SZV-M report with the form type “additional”.

Section 4 of the adjustment report includes only the “forgotten” employee. Information about other employees does not need to be adjusted.

Look at the example of what the SZV-M adjustment looks like if you forgot one employee:

This is what the SZV-M adjustment looks like if you need to add an employee. How can I correct the error if the original SZV-M reflected extra data? We’ll talk about this further, but first let’s focus on another equally important question: will there be a fine for a forgotten employee?

Method 1. Opening a report through the “Main Menu”

You can open an external report from the Main Menu using the command File – Open

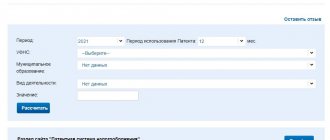

In the report, you can get a list of working employees for whom personnel activities were registered until 2021, but information was never transmitted via SZV-TD . To do this, set the following values for the details:

- There is an event = Yes ,

- Event transferred = No

If you want to check whether all working employees for whom SZV-TD have personnel events registered in the database until 2021, you should set the parameters for the details:

- There is an event = No

- Event transferred = No

Will there be a fine?

The first question that worries an employer when identifying errors in the original SZV-M: is it possible to add an employee by adjusting the SVZ-M without a penalty?

If you manage to submit to the Pension Fund the corrective SZV-M for the forgotten employee quickly, there will be no fine before the end of the deadline established by law for submitting the original SZV-M. Let us remind you that the SZV-M for the reporting month must be submitted to the Pension Fund no later than the 15th day of the month following the reporting month (clause 2.2 of Article 11 of Law No. 27-FZ dated 01.04.1996).

If the legal reporting deadlines have passed, you will have to fight off the fine in court. In any case, the Pension Fund of Russia will issue it to the company (500 rubles for each forgotten employee) and to its manager (300-500 rubles according to Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation).

The fund's specialists will only record the violation in the protocol, and the court will consider it (clause 4, part 5, article 28.3, part 1, article 23.1 of the Code of Administrative Offenses of the Russian Federation). Moreover, it does not matter to the Pension Fund that the company independently identified and corrected the error (letter from the Pension Fund of March 28, 2018 No. 19-19/5602). The Fund believes that only information that has already been reflected in the original SZV-M can be adjusted without penalty. And a forgotten employee is a set of new data that was missing in the original report.

Chances of court cancellation of fines

In court, the chances of canceling the fine issued to the company are quite high. According to the judges, when the company itself found and corrected the error, financial sanctions cannot be imposed on it (decision of the Supreme Court of the Russian Federation dated 02/08/2019 No. 301-KG18-24864).

A fine is also unlikely if the error was found by the Pension Fund of Russia specialists, and the company managed to submit the supplementary SZV-M form within 5 days after receiving the notification from the fund (Determination of the RF Armed Forces dated July 5, 2019 No. 308-ES19-975).

Since July 2021, a new procedure for collecting Pension Fund fines has been in effect. Find out which ones exactly in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

It will not be possible to cancel a fine issued to a manager even in court (Resolution of the Supreme Court of the Russian Federation dated July 19, 2019 No. 16-AD19-5).

Find out even more about fines, including for SZV-M, from the materials:

- “What is the penalty for failure to submit the SZV-M report?”;

- “What is the fine for an LLC for operating without a cash register”;

- “Amounts of fines for failure to submit tax reports.”

Instruction 2: remove the extra employee from SZV-M

If an extra employee is included in the SZV-M, an adjustment to the original SZV-M will also be required.

A similar situation is solved using the following algorithm:

- Complete and send the SZV-M report to the Pension Fund, indicating the code “o. A report with such a code will mean that the original SZV-M contains unnecessary or erroneous information.

- Take the data for sections 1 and 2 of the corrective form from the original SZV-M.

- In section 4, duplicate only those information that turned out to be redundant/erroneous.

As a result of submitting the cancellation form SZV-M, the previously submitted data will be reset to zero (for those employees you indicate in section 4 of the adjustment SZV-M).

Let's show with an example how to fix SZV-M if an extra employee got into it.

The original SZV-M for March 2021, sent to the Pension Fund on April 15, 2021, mistakenly reflected information on two employees whose employment contracts were not valid in March 2021.

The extra employees in the SZV-M (March report) were discovered only in May - when registering the next SZV-M.

The accountant of SpetsStroyka LLC immediately completed the cancellation form SZV-M and sent it to the Pension Fund.

How to remove employees using the SZV-M adjustment, see the example:

You will find instructions for all occasions on our website:

- “Military registration in an organization - step-by-step instructions 2021”;

- “Step-by-step instructions for changing the general director in an LLC”;

- “Instructions for filling out Form 12-F (nuances)”.

The Supreme Court supported the employer in a dispute with the Pension Fund over fines for SZV-M

Yulia Rybalko, leading payroll specialist

The essence of the trial:

With the advent of personalized reports SZV-M and SZV-STAZH, disputes still arise over fines for late submission and errors in reports. Let us remind you that the law establishes a fine of 500 rubles for each insured person in the report if it is submitted late or with an error. If the organization has a large staff, then the amount of the fine is appropriate.

Not everyone knows that if errors in the report are discovered independently, before the same shortcomings are identified by the Pension Fund, then penalties will not be applied. However, the Pension Fund of the Russian Federation and insurers interpret this norm differently, which is what leads to disputes about the legality of applying fines in the event of filing a supplementary SZV-M. Arbitration practice shows that there is no clear answer to this question.

The Supreme Court put an end to the dispute in its decision of July 22, 2019 No. 305-ES19-2960 in case No. A40-22593/2018. Let us explain in detail.

The company submitted reports via telecommunication channels in the SZV-M form in relation to 589 insured persons with an erroneous indication of the period - December 2021. Subsequently, having identified an error, the Company canceled these reports, while simultaneously submitting the SZV-M form, indicating the period - November 2021. The Pension Fund calculated a fine in connection with the Company’s violation of the deadline for submitting SZV-M reports for November 2021, based on the amount of 500 rubles. for each insured person. The Pension Fund of Russia fined the company.

It should be noted that the organization has made changes to the previously submitted information in accordance with the provisions of Federal Law No. 27-FZ dated April 1, 1996 and the instructions “On the procedure for maintaining individual (personalized) records of information about insured persons,” approved. by order of the Ministry of Labor dated December 21, 2016 No. 766n. At the same time, Law No. 27-FZ does not establish a period during which the policyholder can independently identify an error or incomplete information before it is discovered by the pension fund and submit reliable data to the pension fund.

The company, in turn, challenged the Pension Fund's decision in court. In three court instances, the Company lost a dispute with the Pension Fund on the issue of holding it accountable in the form of a fine for late submission of information in the SZV-M form. But the Supreme Court of the Russian Federation decided the case differently.

Accordingly, the court came to the conclusion that the Company’s submission of reports for November 2021 in the SZV-M form, previously submitted on time, but with a clearly erroneous indication of the reporting period, is an independent identification of an error, which excludes the Company being held liable.

Results

The SZV-M form can be initial, supplementary or canceling. By correctly entering the form type code in section 3 and generating the correct (corrected, supplemented, subject to cancellation) personal information of employees in section 4, you can correct the information in the original report. If the Pension Fund decides to fine the employer for filing a corrective report, you can try to challenge it in court.

Sources:

- Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) registration in the compulsory pension insurance system”

- Resolution of the Board of the Pension Fund of the Russian Federation dated October 15, 2019 No. 519p “On approval of the Procedure for adjusting individual (personalized) accounting information and making clarifications (additions) to an individual personal account”

- Order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n “On approval of the Instructions on the procedure for maintaining individual (personalized) records of information about insured persons”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When to fix SZV-M

The current form was approved in Resolution of the Board of the Pension Fund of the Russian Federation No. 83p dated 01.02.16. The document is submitted to the fund every month before the 15th day. An important condition under which clarifications are possible is the fact that the Pension Fund’s report has been accepted. After all, resubmission of a document occurs only after the initial acceptance of the original one.

If incorrect information is found in a previously submitted report, a supplementary or cancellation form is filled out. For example, if one employee is forgotten, an adjustment to SZV-M is submitted with the additional code. When submitting data for a retired specialist, clarification with the OTMN type is also required.