What taxes do pensioners pay and what benefits do they have?

In accordance with paragraph 2 of Art. 217 of the Tax Code of the Russian Federation, state pension provision does not fall under the group of taxable income. No tax is paid on the pension and is not deducted when calculating its amount.

The current tax legislation distinguishes between several main categories of taxes paid by individuals: federal, regional, local. These categories include all obligations that individuals, including pensioners, are required to comply with.

For convenience, each of these categories will be considered separately. It will also be determined whether pensioners are required to pay this type of tax, or have the right to receive benefits or a complete exemption.

What is exempt from the fee regardless of the discount?

There are times when pensioners, regardless of whether the regional local authorities have decided on preferential taxation or not, are not required to pay for owning a vehicle.

No need to pay:

- A car that is equipped for driving by a disabled person is not subject to tax;

- Vehicles were purchased through the Social Security Administration for the transportation of a disabled person or a child with a disability, and the power of this vehicle is no more than 100.0 hp;

- People who have the status of Hero of the Soviet Union, or Russia;

- People with disabilities of the first group, as well as the second group;

- WWII veterans.

If a citizen has 2 vehicles, then it is necessary to submit an application to the Federal Tax Service at the place of residence, asking for a benefit to be accrued for one type of vehicle, and for the second vehicle the full cost of the transport tax must be paid.

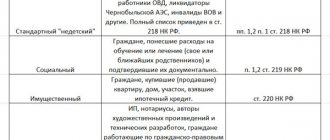

Personal income tax

In terms of income received by pensioners, with the exception of the state pension, no benefits are provided. For working pensioners, employers pay personal income tax in the same manner as for other employees.

If a pensioner is engaged in any income-generating activity, then he is obliged to pay personal income tax on time in the amount of 13% of income. The tax is classified as federal, so regional and local authorities cannot in any way influence the fulfillment of this obligation.

This obligation applies to all other types of income, including lottery winnings. Therefore, any income must be taxed. Here, pensioners are treated the same as all other citizens of the Russian Federation. Summary: pensioners pay income tax on income not specified in Art. 217 Tax Code of the Russian Federation.

There are no benefits for individuals, including pensioners. This rule most affects working pensioners, whose taxes are actually paid by the employer. Pensioners pay all federal taxes that apply to individual entrepreneurs and individuals, and specified in Article 13 of the Tax Code of the Russian Federation.

Determination of taxation after the fact

Taxes are funds that citizens of the Russian Federation pay to the state budget. That is, in theory, everyone should pay for everything, but there are categories of people who are eligible for relief in taxes and fees.

Pensioners under the Federal Law are exempt from taxes on transport, land and property, but the concept of “exemption” also has its own nuances: the transport tax belongs to the regional category, so the payment rules vary depending on the territory of residence.

Taxation nuances:

- transport tax refers to regional fees, so whether to pay or not to pay is decided by local authorities. Every year the decision may be different, but only under the Federal Law the exceptions remain unchanged;

- land tax, its rates are set by local authorities, including for privileged categories of citizens. There are regions of the Russian Federation where pensioners are completely exempt from tax, and there are some where they are partially exempt, so there is no need to say for sure;

- Property tax is considered a regional tax; throughout Russia, pensioners are exempt from it.

At the federal level, some changes were made for land tax pensioners in 2018. Based on this, pensioners can partially reduce taxation. On 6 acres of land out of all available land in property, you can not pay tax. This means that if a pensioner has 2 plots of 10 and 8 acres, then he will pay for one in full, and from the second he will subtract 6 acres and pay only for the remaining ones.

In relation to the tax on property, which in fact is the property of a pensioner, there is the concept of “tax deduction”. It can be applied once in a lifetime, but provided that the buyer was a singular pensioner and other family members were not involved. You can return 13% of the amount, but if it is no more than 2 million rubles.

Personal income tax is a tax that is the main opportunity for the state treasury to replenish the budget. According to the law, there are no concessions for anyone. However, personal income tax is already included in all goods and services that people use, so it is impossible to say unequivocally that pensioners do not pay this tax.

Transport tax

This type of tax is included in the regional category. That is, there is no single tax rate, as is the case with income tax. The final rate is set at the regional level, so this indicator may differ in two different regions of the Federation.

Therefore, the transport tax does not fall under federal incentive programs. If benefits are provided, then only at the regional level. As practice shows, in a number of regions of the Russian Federation, concessions on this tax are provided for WWII veterans, labor veterans, heroes of the USSR (Russian Federation), and disabled people of certain groups.

For example, in Moscow, ordinary pensioners who are not included in the list of beneficiaries pay transport tax on the same basis as other categories of citizens. Therefore, to clarify this information, the pensioner needs to contact the territorial tax authorities at the place of residence (permanent registration).

The remaining regional taxes are the gambling business tax and the corporate property tax. They apply to legal entities and do not affect pensioners in any way. As a result: pensioners pay only transport tax among regional taxes. If a pensioner can count on a benefit, then for this he needs to submit an application to the tax authorities: these preferences are of a purely declarative nature.

Land tax

A dacha registered as a plot of land is subject to tax recalculation.

This is a federal benefit that applies to all pensioners and pre-retirees in the country.

A benefit is implemented in the form of deducting six acres of land from the total allotment (or several allotments).

Example 1 : a pensioner owns a plot of land with an area of 8 acres. He can write a statement deducting six hundred square meters, after which he pays only for three hundred square meters.

Example 2 : a pensioner owns land with an area of 500 square meters. Having submitted an application to the Federal Tax Service, he takes advantage of the benefit and does not pay at all for his allotment.

Example 3 : a pensioner owns two plots of land: one is 4 acres, and the other is 5. An application to the tax service will give him the right to deduct 6 acres from the total number of square meters of land. Thus, only three hundred square meters from one of the plots will be taxed.

Property tax for individuals

This type is included in the category of local taxes. Taxpayers here are individuals who have ownership rights to property recognized as an object of taxation. Despite the fact that the tax is recognized as local, tax benefits introduced by Federal Law dated October 4, 2014 N 284-FZ are common to all.

Pensioners who have the right to receive a state pension, regardless of the circumstances, as well as persons who have reached 55 and 60 years of age (men and women). In addition to pensioners, federal legislation provides for a number of preferential categories (Article 407 of the Tax Code of the Russian Federation).

Personal property tax for pensioners: what are the benefits?

The benefit for pensioners is not expressed in a reduction in the tax rate or any other components of this tax. Federal legislation exempts pensioners from paying personal property taxes in respect of only one item of each type of property subject to taxation.

In accordance with paragraph 4 of Art. 407 of the Tax Code of the Russian Federation, the following types of taxable objects are recognized:

- Apartment, part of an apartment (share), room.

- Private house or part of a house.

- Premises used for professional creative activities - ateliers, workshops, studios, libraries, open thematic museums.

- Garage, parking space, parking space.

- Outbuildings whose area does not exceed 50 square meters. meters, and which are used for personal farming, individual housing construction, summer cottage farming, and gardening.

The bottom line is that one object from each category of property is exempt from tax. That is, this is one apartment, one residential building, one garage, and then on the same principle. If a pensioner has one house and one garage, then in both these areas he is completely exempt from paying taxes.

If there are two apartments and several parking spaces, then the pensioner chooses one apartment and one space for which he will not pay tax. The tax base will be calculated for the other apartment and other parking spaces. The same applies to all other categories: a pensioner can choose only one object from each category. For the rest you will have to pay tax in accordance with local regulations.

A benefit is provided only if the object is not used by the taxpayer for business purposes. The use of benefits is of a declarative nature. The pensioner must submit an application in the prescribed form to receive the benefit to the territorial tax authorities.

If a pensioner has not notified the tax authorities of his right to receive a benefit, the Federal Tax Service, upon receiving relevant information from other sources, receives grounds to apply the benefit unilaterally, without the knowledge of the taxpayer. In this case, the benefit applies to the object in respect of which the maximum tax amount is calculated. And such a mechanism is provided for all categories of taxable objects.

What tax benefits are available to pensioners, and from what taxes are they exempt?

Pensioner and pre-retirement person - who is entitled to age-related tax benefits?

Tax benefits for old age were previously associated with the fact of retirement. Women had the right to retire at 55 years old, men at 60 years old, and after that they received a number of tax breaks. After the

pension reform, the retirement age in Russia will increase for 5 years - up to 60 years for women and up to 65 years for men. But most of the tax benefits granted to old-age pensioners today are also entitled to people who are called pre-retirees. These are women over 55 years old and men over 60 years old.

Officially, they cannot yet obtain pensioner status, but they already have the right not to pay part of the taxes. The Tax Code allows.

Statuses of pensioners entitled to benefits

By law, all pensioners can take advantage of tax benefits, regardless of the basis on which they receive a pension. These could be people receiving a pension:

- according to the age

- for the loss of a breadwinner,

- on disability, including disabled children.

At the federal level, tax benefits for pensioners are also provided if they:

- awarded the Order of Glory, have awards of heroes of the USSR and Russia,

- participated in the Great Patriotic War or other hostilities,

- served in the army for at least 20 years.

At the regional level, the list of pensioners exempt from paying tax contributions may be wider. This list may include labor veterans who do not receive any privileges at the federal level.

In addition, the benefit itself can be expanded, for example, for land tax. As a general rule, pensioners are not completely exempt from it, but may not pay only for 6 acres. In some regions, people who have reached retirement age are completely exempt from paying state duty, regardless of the area of the plot. You can find out what tax benefits for pensioners are available in your region on the Federal Tax Service website.

What taxes are pensioners exempt from?

Tax breaks apply to both income and property. Pensioners throughout the country do not have to pay:

- Personal income tax from a pension assigned by the state;

- property tax

- land tax

Each type of taxation must be considered separately, as there are nuances everywhere. People of retirement age are not completely exempt from payments to the budget. Below we will discuss each of them in detail.

Do pensioners pay personal income tax?

Personal income tax ceases to be withheld as soon as a person stops receiving wages, and his main income becomes a state-assigned pension. But here it is important to understand several points.

Personal income tax is not deducted only from pensions.

If the pensioner continues to work and receives a salary, the employer is obliged to withhold and transfer 13 percent to the budget, as before.

The obligation to pay part of other income to the budget remains.

We are talking about income from renting an apartment and providing professional services, for example tutoring, nanny services or apartment renovation work.

If a person in adulthood is ready to continue working, he still has the strength and desire to work for himself, the state does not prohibit him from doing this. But of the income received, 13 percent will have to be given to the budget. To reduce the tax burden, you can register as self-employed and give 4-6 percent of your income to the state.

Do pensioners pay property tax?

With regard to this tax, people of retirement age have the widest benefits. Women after 55 years of age and men after 60 years of age are exempt from paying it. No need to pay to the budget for ownership:

- room;

- apartment or part thereof;

- home;

- garage;

- outbuilding with an area of up to 50 square meters.

If a person has an apartment, a house and a garage, there is no need to pay for anything, since the benefit applies to all types of real estate. But if a pensioner has 2 apartments or 2 garages, he will have to pay for one thing from each category. For what? It's up to you.

Submit a tax notice and indicate the object for which you want to use the benefit. If you don’t do this, the tax authorities will still exempt you from paying the duty, only they will choose the object at their discretion. Typically, the property with the highest tax value is automatically designated as preferential.

Pensioners also do not pay for owning premises that are used for creative activities, for example, as an atelier, art workshop, art gallery or photo studio. The right to the benefit is lost if a person rents out this premises and receives income.

Should pensioners pay land tax?

Starting from 2021, pensioners throughout Russia are exempt from paying land tax. This decision applies to all areas of the so-called social purpose, that is, used for individual residential construction, or summer cottages.

But the benefit only applies to an area of 6 acres. If your plot is smaller, then you don’t need to pay anything to the budget. If it’s more, the tax is calculated on the difference between your area and six hundred square meters. If the land area is 8 acres, you will have to pay the duty for 2 acres.

Do pensioners pay transport tax?

At the federal level, there is no transport tax benefit. People of retirement age must annually transfer money to the budget for owning a car on an equal basis with other owners.

Rates are determined by the tax code and depend on engine power. If the power is small, up to 100 hp. pp., the minimum rate is 2.5 rubles per force. With a power of 100-150 hp. the rate will be 3.5 rubles.

In regions, authorities can reduce the tax burden of transport tax or exempt certain categories of people from paying it. But usually, not all age pensioners are included in the group of beneficiaries, but only those who have a disability, the status of a veteran or a hero of the Russian Federation. Tax breaks can also be made for owners of old cars. You can find out in more detail whether there is a benefit for you in your region on the Federal Tax Service website.

How can a pensioner obtain an exemption from paying property taxes?

The tax benefit is of a declarative nature, that is, to receive it you need to contact the Federal Tax Service with an application. People who already enjoy benefits on other taxes do not need to do this. For example, with the introduction of preferential six hundred square meters of land, pensioners who did not pay property tax had their land tax recalculated.

Tax authorities do this if they have documents in their database that confirm your right to benefits.

If you have just applied for a pension, you need to submit documents, otherwise the benefit will not be calculated. Confirmation of your eligibility is a pension certificate. Together with your passport and a completed application on the form, you must contact the local tax office, having previously made an appointment. If you use electronic services to pay taxes and you have a personal account on the Federal Tax Service website, you can submit an application there.

There are no set deadlines for applying; you can do so at any time. But the Federal Tax Service asks you not to delay your applications so that the tax authorities have time to calculate your property taxes on the new basis by the next calendar period. The recommended deadline for submitting applications is before May 1, taxes are calculated for the previous calendar year.

What to do if property taxes continue to accrue to a pensioner?

It happens that the documents are submitted, but the tax payment arrives with the same figures. There is no need to pay for it. You must write to the tax office that you are entitled to a benefit, but it was not taken into account in the notification.

You can submit an appeal in person or through the electronic service of the Federal Tax Service. The application will be reviewed and, if a technical error is detected, a notification will be sent with corrected data. Perhaps there was no error, but there were not enough documents confirming your right to the benefit. In this case, a Federal Tax Service employee will contact you and ask you to provide the missing papers.

Popular questions

Let's look at the questions that often arise about paying taxes for people receiving a pension.

Do pensioners pay tax on the sale of an apartment?

When selling housing, pensioners do not enjoy additional benefits. There is a general rule enshrined in the Tax Code. If the apartment has been owned for more than three years, you do not need to pay state duty; if less, pay 13 percent of the proceeds.

One more condition applies here: in order not to pay tax, the housing sold by the pensioner must be the only one. If there are several apartments, it will not be possible to avoid paying the tax.

Is there a tax deduction for an apartment for pensioners?

Tax deduction for an apartment is the amount that can be requested and received from the state if you buy an apartment. Only those people who pay personal income tax can apply for it. Non-working pensioners do not pay personal income tax and have no right to receive a deduction, except for those who have recently retired.

People who have just received a pension have the right to apply for a tax deduction for an apartment within a year and submit documents immediately for the three years preceding the pension. This allows you to receive a round sum from the state - up to 260 thousand rubles.

What benefits are available to working pensioners?

People of retirement age who want to continue working can enjoy the full list of benefits mentioned above. They are exempt from paying property tax, land tax - on 6 acres, and personal income tax is not deducted from the pension assigned by the state.

Are there benefits for military retirees?

Military personnel with more than 20 years of experience are classified as preferential citizens. At the same time, a person does not necessarily have to reach retirement age; he receives the right to enjoy tax benefits based on his military service. The list of benefits is the same: the state removes the obligation to pay property tax and land tax for 6 acres. The Tax Code does not provide for other tax benefits, but they can be introduced at the regional level.

Land tax

Land tax is included in the group of local taxes. Federal legislation establishes a list of benefits that reduce the tax base or completely exempt subjects from paying land tax.

Pensioners are entitled to receive such benefits. The mechanism for providing it is to reduce the tax base, based on a decrease in the area of the land plot by 600 square meters. meters. Land tax for individuals is calculated based on the area of the plot, therefore, if the total area is, for example, 1000 sq. meters, then the tax base will be calculated only on 400 square meters. meters (4 acres). Consequently, here we are talking, rather, not about complete exemption, but only about a reduction in the tax base.

Full exemption is due only if the tax base is 0, ― if the area of the plot is equal to or less than 600 square meters. meters. These amendments apply to areas located:

- Owned by the taxpayer.

- In lifelong inheritable ownership.

- For permanent (indefinite) use.

Regardless of the number of plots that a taxpayer owns or uses, the reduction in the tax base applies to only one of them. The pensioner independently sends a notification to the tax authorities, which marks one of the areas for which the benefit will be applied.

If the notification is not received, the Federal Tax Service has the right to obtain such information independently. If a pensioner owns several objects, the tax authorities apply the benefit to the one in respect of which the maximum tax amount is calculated.

Legal basis for benefits for pensioners on land and transport taxes

The existence and size of benefits are described in the Tax Code of the Russian Federation. Articles 13 and 14 address the issue of which taxes are federal and which are regional. Unlike taxation on property and income, which are recognized as federal, the transport tax is regional (according to Article 14), and the land tax is local, as specified in Article 15. Consequently, tax rates and rights to benefits are established by different authorities:

- federal;

- regional;

- local.

Benefits for pensioners

In this regard, each region of the country has its own categories of beneficiaries who are entitled to their own benefits, different from others. This provision is regulated by Articles 387 of the Tax Code, paragraph 2, and 357 (part 3). It should be remembered that you cannot receive benefits for several objects of each type - this is prohibited according to Article 407, paragraph 3. This means that if a pensioner owns two or more cars, or 2 or more plots of land, local authorities will partially or completely remove the obligation to pay tax on only one of the objects in each category.

By declaring his rights to a benefit, the pensioner, for his part, undertakes to provide the tax office not only with his application, but also with confirmation that there are indeed grounds for the benefit. One of such confirmations may be a disability certificate or a pension certificate.

Pensioner's ID

In addition, the pensioner must be the legal owner of a car or land, from paying tax on which he is exempt - this is stated in Article 407, paragraph 6. A document about this must also be submitted to the Federal Tax Service. If the taxpayer provides an incomplete package of documents, the Federal Tax Service requests them itself and does not provide benefits until all documents are provided.

Complete list of taxes paid by pensioners

These are the main taxes that pensioners are required to pay on an equal basis with other citizens. For each of the regional and local taxes, benefits may be provided. Where and exactly what benefits apply should be clarified locally. At the same time, a non-exhaustive list of mandatory taxes is as follows:

- Income tax - on all sources of income not expressly specified in Art. 217 Tax Code of the Russian Federation.

- Property tax for individuals.

- Transport tax.

- Land tax.

In addition to these payments, there is payment for utilities, which are commonly called taxes. Still, this is not an entirely correct point of view: utilities should be considered separately from taxes.

about the author

Anatoly Darchiev - higher education in economics with a specialty in “Finance and Credit” and higher education in law in the direction of “Criminal Law and Criminology” at the Russian State Social University (RGSU). Worked for more than 7 years at Sberbank of Russia and Credit Europe Bank. He is a financial advisor to large financial and consulting organizations. Engaged in improving the financial literacy of visitors to the Brobank service. Analyst and banking expert. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

How to apply for tax benefits?

Tax benefits are provided on an application basis. The application can be submitted in person by contacting the Federal Tax Service, sent by registered mail, or sent remotely through the official website of the tax service. Along with the application, it is advisable to provide a package of documents to confirm the benefits. Typically, the Federal Tax Service asks to submit papers within a specified period, depending on the type of tax.

DOWNLOAD Unified form for tax benefits for pensioners

The application is submitted to the tax office at the taxpayer’s place of residence or the location of the property.

| Type of tax | What package of papers do you need to collect? | Application deadline |

| Property tax |

| May 1, by choice of taxable object - until November 1 |

| Land tax |

| Nov. 1 |

| Transport tax |

| Nov. 1 |

Submitting additional documents to the Federal Tax Service is not an obligation, but a citizen’s right. If the pensioner is unable to provide papers, the tax office will conduct an audit on its own.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Anatoly Darchiev

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya