How to submit reports during reorganization

If you are reorganizing your business, there are important income tax changes to consider in 2021. Thus, from January 1, the Tax Code of the Russian Federation regulates the rules for submitting reports in this situation. This is a new paragraph 5 of Article 230, introduced by Law No. 335-FZ of November 27, 2021.

The main requirement is this: regardless of the type of reorganization - accession/separation/transformation/merger - the legal successor is obliged to submit Form 2-NDFL and report 6-NDFL for the reorganized structure to the Federal Tax Service at the place of its registration, if it has not done so. If there are several legal successors, then the responsibility of each is established by the transfer deed or separation balance sheet.

Also see “New rules for determining the tax period for various taxes for individual entrepreneurs and legal entities.”

Updating the income certificate form

The Russian Tax Service has developed an updated form for a certificate of income of an individual in form 2-NDFL. The draft corresponding order was published on the Unified portal for posting draft regulatory documents. It is expected that it will be relevant for income information for 2017.

Let us remind you that the appearance of the 2-NDFL certificate is fixed by the order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/485. Why did you need to update this form?

The essence is in the changes that we wrote about at the beginning of this article: so that the legal successors of the tax agent can submit 2-NDFL for him. For this purpose, 2 new fields have appeared in Section 1 “Tax Agent Data”:

- “Form of reorganization (liquidation)” (put the appropriate code from 0 to 6);

- “TIN/KPP of the reorganized organization.”

In other cases, these lines are not filled in.

According to the new rules, the legal successor indicates the OKTMO code at the location of the reorganized structure or its separate division.

In the “Tax Agent” field, the legal successor of the reorganized organization indicates exactly its name (or its divisions).

In addition, from Section 2 “Data about an individual - recipient of income”, lines related to the address of residence have been removed. And in Section 4 of the 2-NDFL certificate, investment ones are excluded from tax deductions.

Changes in personal income tax 2018: table

Editor's note:In calculating 6-personal income tax they offer:

— enter the details for the legal successor:

1) “form of reorganization (liquidation) (code)”, where one of the values is indicated: 1 - transformation, 2 - merger, 3 - division, 5 - accession, 6 - division with simultaneous accession, 0 - liquidation;

2) “TIN/KPP of the reorganized organization”, where the legal successor puts down his TIN and KPP (the rest put dashes);

— set codes for the legal successor (215 or 216, if he is the largest taxpayer), entered in the details “at the location (accounting) (code)”;

— in the “tax agent” field, indicate the name of the reorganized organization or its separate division;

— establish the opportunity for the successor to confirm the accuracy of the information.

They also propose to change the codes for legal entities that are not major taxpayers: instead of code 212 in the details “at location (accounting) (code)” they will have to indicate 214.

To confirm the authority of the representative, you will need to indicate not only the name of the document, but also its details.

In addition, the barcode will change.

Similar innovations will be introduced into the calculation format.

It is assumed that the amendments will take effect starting with the calculation for 2017, but not earlier than two months after the publication of the order.

In the 2-NDFL certificate they plan:

— by analogy with the previous form, enter the fields to be filled out by the legal successor: “Form of reorganization (liquidation) (code)” and “TIN/KPP of the reorganized organization” (other legal entities do not fill out these fields).

— clarify the “Tax Agent” fields of Section 5: the successor of the tax agent will have to enter number 1 in this field, and the representative of the successor will have to enter number 2;

— to confirm the authority of the representative, indicate the name of the document and its details;

— enter a new barcode;

- from section 2 remove the fields “Address of residence in the Russian Federation”, “Code of country of residence” and “Address”, and from Sect. 4 - mention of investment deductions.

The procedure for filling out the form will also change, so the assignee:

— in the “Sign” field, enter the number “3” if submitting a regular certificate, and the number “4” if reporting unwithheld tax;

— indicates the OKTMO code at the location of the reorganized company or its separate division;

— in the “Tax Agent” field reflects the name of the reorganized company or its separate division;

— indicates the form of reorganization, TIN/KPP in the appropriate fields.

The assignee will also have to report to its inspectorate about the tax not withheld by the reorganized company, if it itself has not done so. The new procedure will eliminate the possibility of submitting such information on electronic media.

The format of the certificate will also be clarified.

The amended certificate will be useful starting with reporting for 2017

Update of 6-NDFL calculation

A completely new 6-personal income tax will not be introduced in 2021, but amendments to it are already known. Let us remind you that the form of this calculation was approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/450.

The text of the draft order was published on the Unified portal for posting draft regulatory documents.

We list the main changes to 6-NDFL in 2021:

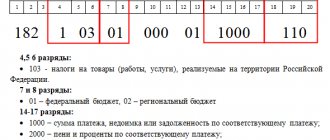

- title page; in particular, the barcode “15201027” has been changed to “15202024”;

- the largest taxpayers provide the TIN and KPP at the location of the organization as in the certificate of registration at the location (5th and 6th category of KPP - “01”);

- The successor organization submits calculations to the Federal Tax Service at its location for the last period of submission and updated calculations for the reorganized structure (in the form of accession/merger/division/transformation) indicating on the title page in the line “at the location (accounting) (code)” numbers "215"; in this case, at the top of the title you need to provide the TIN and KPP of the assignee;

- in the line “tax agent” indicate the name of the reorganized organization or its separate structure.

There are other amendments to the 6-NDFL calculation form from 2021 related to the reorganization. For example, a table of reorganization/liquidation codes (from “0” to “6”).

Accountants are required to use the updated form starting with the 2017 report. Let us remind you that the deadline for submitting 6-NDFL for 2021 is April 2, 2021 inclusive.

For more information, see “Deadlines for submitting 6-NDFL in 2021.”

Personal income tax reporting in 2021: what changes

When settling income tax payments with the state, two reporting forms are used - 2-NDFL and 6-NDFL. The need to introduce the 6-NDFL report into Russian practice is mainly due to the need for tax workers to receive detailed information about income tax calculated and paid to the budget.

Changes in certificate 2-NDFL 2021 are primarily related to the approval of a new tax report form.

Help 2-NDFL: changes 2018

Companies and businessmen must report on the results of 2021 by submitting a report in a new, adjusted form. Report 2-NDFL in 2018 (we will consider the changes below) was approved by order of the Federal Tax Service No. ММВ-7-11/485 dated October 30, 2017. The main change in form occurred on the title page of the document. Namely, two new fields appeared on it, affecting information about the reorganized organization, such as the form of reorganization, INN/KPP of the company.

2-NDFL (changes for 2018 were discussed above) should be submitted to the authorized bodies within the same deadlines, that is, no later than April 1 of the year following the reporting period. In the event that the tax agent does not have the opportunity to withhold tax from income, provide information in Form 2-NDFL (from 2021, changes were approved by order of the Federal Tax Service dated October 30, 2017). should be no later than March 1st.

Thus, 2-NDFL in 2021 (what changes occurred with the report were discussed above) is characterized by a new form.

Report on form 6-NDFL from 2021

The calculation according to Form 6-NDFL was also slightly modified in 2018. The reporting document was approved by order of the Federal Tax Service No. ММВ-7-11/18 dated January 17, 2018. The new document has been assigned a new barcode, which is displayed on the cover page. Among other changes, we can highlight the ability to reflect information about the legal successor of the reorganized company. The new document should be applied starting with reporting for 2021.

Control ratios 6 personal income tax and 2 personal income tax

Having considered the features of calculating income tax in 2018, what changes took place, we note that mainly the innovations are related to the introduction of new forms of tax reports 2-NDFL and 6-NDFL. For the purpose of correctly filling out these documents, it is important for an accountant to be aware of the latest changes in legislation and to operate with them when preparing reporting forms.

What were the changes to personal income tax in 2021?

Similar articles

- KBK for personal income tax for employees

- Personal income tax calculated and withheld, what is the difference?

- Offset of overpayment of personal income tax against future payments

- What is the size (in percentage) of personal income tax in Russia?

- Income declaration form for individuals 2017

Updating the declaration in form 3-NDFL

Also, the Russian Tax Service has prepared changes to the personal income tax return form in form 3-NDFL. It was approved by order of the Federal Tax Service dated December 24, 2014 No. ММВ-7-11/671. Apparently, the updated 3-NDFL form will be introduced in 2021, including for reporting for 2021.

So, we received a new edition:

- title page of the 3-NDFL declaration;

- Sheet D1 “Calculation of property tax deductions for expenses on new construction or acquisition of real estate”;

- sheet E1 “Calculation of standard and social tax deductions”;

- Sheet 3 “Calculation of taxable income from transactions with securities and transactions with derivative financial instruments (DFI)”;

- Sheet I “Calculation of taxable income from participation in investment partnerships.”

There are also amendments to other sheets of 3-NDFL.

In addition, the 3-NDFL declaration received a completely new sheet K entitled “Calculation of income from the sale of real estate.”

Also see “What documents to attach to the 3-NDFL declaration.”

New rules for tax on winnings

Gamblers simply need to know what changes to personal income tax await them in 2021. The fact is that Law No. 354-FZ of November 27, 2021 radically changed the procedure for taxation of winnings from gambling and lotteries, as well as the deduction of personal income tax from them.

There are 3 basic rules (new provisions of Article 214.7 of the Tax Code of the Russian Federation):

| № | Winning amount | What about the tax? |

| 1 | The player was lucky for 4000 rubles or less | There is no need to pay personal income tax, since this is non-taxable income (new provision of clause 28 of article 217 of the Tax Code of the Russian Federation) |

| 2 | From 4,000 to 15,000 rubles | The lucky one himself transfers personal income tax from the income that was given to him by the organizer of the lottery or game |

| 3 | 15,000 rubles and more | All responsibilities lie with the tax agent |

Of course, no deductions are allowed for gambling pleasures. The corresponding phrase appeared in the second paragraph of paragraph 3 of Art. 210 Tax Code of the Russian Federation.

It is also clarified that the tax is calculated separately for each winning amount.

Salary tax table in 2021 in percentage

So, let’s summarize all salary taxes existing in Russia into a single table and find out the minimum and maximum percentage that is withdrawn from our actually earned wages by the state.

| Type of tax | Min. bid | Max. bid |

| Income tax (NDFL) | 13% | 30% (for non-residents) |

| Contributions to pension plans |

| |

| Contributions for temporary disability and maternity |

| |

| Contributions for injuries | 0,2% | 8,5% |

| Health insurance | 5,1% | 5,1% |

Thus, even if the contributions for injuries in your case are minimal, you pay 43.2% of what you earn to the state in the form of salary taxes.

If such contributions in your case are maximum, then you pay in the form of taxes and social contributions more than half of what you actually earned.

Personal income tax and Moscow renovation of housing stock

Those whose housing was subject to demolition and renovation in Moscow should be aware of what changes in income tax await them in 2021 and in the future.

According to Law No. 352-FZ of November 27, 2021, there will be no tax on income in the form (new clause 41.1 of Article 217 of the Tax Code of the Russian Federation):

- equivalent monetary compensation for old housing;

- housing (share in housing), which was provided instead of the one that was subject to renovation.

Also, the Tax Code of the Russian Federation stipulates a mechanism for providing a property deduction in the event of the sale of housing provided for renovation (new subparagraph 2, paragraph 2, Article 220 of the Tax Code of the Russian Federation). Income can be reduced by expenses associated with the purchase:

- vacated housing;

- and/or living space provided in connection with renovation.

And the period of ownership of the new apartment is combined with the period of ownership of the previous housing (new paragraph of paragraph 2 of Article 217.1 of the Tax Code of the Russian Federation).

Personal income tax in 2021: what changes (rate and tax deductions)

As for the income tax rate, it remains unchanged in 2021. Accordingly, for tax residents of our country, that is, those citizens who stay on its territory for more than 183 consecutive days, the rate is set at 13%.

For individuals who do not have resident status, a rate of 30% of the amount of income received is still provided.

Every individual is interested in the question of how personal income tax deductions are applied in 2021, what changes are reflected in Articles 218-220 of the Tax Code of the Russian Federation.

Submitting 2-NDFL on paper

There are no changes to the current tax deduction system under tax legislation. As a result, citizens, if there are appropriate grounds, have the opportunity to reduce the amount of transfers to the budget by the amount of deductions.

Compensation to shareholders is not assessed

Absolutely new for personal income tax from 2021 - this is paragraph 71 of Art. 217 Tax Code of the Russian Federation. Law No. 342-FZ of November 27, 2021 added to the list of non-taxable payments. These include compensation from the compensation fund received by the shareholder within the framework of the Law of July 29, 2021 No. 218-FZ “On the protection of the rights of shareholders in the event of bankruptcy of developers.”

Since many people got burned by this scheme for acquiring new housing, the state decided to support those who were not lucky enough to move into a completed house.

Down payment for a car is not taxed

The list of non-taxable personal income tax payments has been supplemented with one more item. This is payment of part of the down payment towards the cost of the purchased car from the federal treasury when applying for a loan to purchase a car (the procedure is regulated by the Government of the Russian Federation. This is a new paragraph 37.3 of Article 217 of the Tax Code of the Russian Federation, which was introduced by Law No. 335-FZ of November 27, 2021.

The essence of this latest news about personal income tax changes in 2021 is that they are retrospective in nature. The exemption is valid from January 1, 2021.

Increase in income tax rate

The main goal of the tax system is to replenish the state treasury at all levels without harming economic growth.

Currently, the country faces a difficult financial situation. The lack of appropriate conditions for the development of small and medium-sized businesses, unemployment, rising prices for services and goods, sanctions from other countries have become the reasons for the worsening of the economic crisis in Russia.

The President of the Russian Federation set a task for the government to create new tax conditions. Although reform in this area has been brewing for a long time, increasing the tax burden for ordinary citizens was chosen as a source of replenishing the country’s budget.

An increase in personal income tax for individuals in 2021 is planned from the base rate of 13% to 15% inclusive.

At the moment, such innovations are only at the stage of discussion and consideration of the possibility of implementation. However, chances are high that this tax levy will be increased.

It was also proposed to consolidate a progressive rate scale, which would reduce the tax burden on the low-income population and citizens with a small monthly income, raising the amount of personal income tax for persons receiving a significant amount of profit.

In addition, the option of exempting certain categories of citizens who receive income below a certain limit from taxation is being considered. What is the size of the minimum profit exempt from paying tax, and whether this is possible in practice, is still unknown.

New rules for taxing savings on interest on loans

Law of November 27, 2021 No. 333-FZ, from January 1, 2021, adjusted the provisions of sub-clause. 1 clause 1 art. 212 of the Tax Code of the Russian Federation. It has now become more clear when exactly saving on interest on a loan/loan leads to income tax.

There is personal income tax when:

- the money was received from an interdependent organization/entrepreneur or there is an employment relationship with them;

- in fact, savings are material assistance or a form of counter-fulfillment of an obligation to the borrower (for example, when the latter delivered goods, performed work, provided a service)

There is a benefit when the borrower received money at an interest rate less than 2/3 of the rate of the Central Bank of the Russian Federation.

Until 2021, personal income tax arose if a loan at a low interest rate was issued not only to an interdependent individual.

Personal income tax rates in 2021, table

Personal income tax rates in 2021, table

The Tax Code has several personal income tax rates in 2021 - 9, 13, 15, 30, 35%. The personal income tax rate depends on the type of income and the recipient - whether he is a tax resident or not.

Personal income tax rates in 2021. Personal income tax at a rate of 13%

The rate of 13% is considered the basic one. It applies to all income of tax residents of the Russian Federation for which officials have not established special rates (clause 1 of Article 224 of the Tax Code of the Russian Federation). For example, among the income taxed at a rate of 13% under personal income tax, there are salaries, bonuses, and dividends. Tax deductions are also applied to such income. But they do this before they apply personal income tax rates and calculate the amount of tax.

The income of non-residents of Russia is calculated separately for each payment and is not reduced by deductions. The personal income tax rate is 13% in the following cases:

- an individual receives income from employment in Russia;

- the individual works as a highly qualified specialist;

- an individual who is a participant in the State Program for the resettlement of compatriots living abroad to the Russian Federation, as well as close relatives of such individuals who have moved together to Russia;

- foreign citizens or stateless persons who are refugees or have received temporary asylum in the territory of the Russian Federation receive income from labor activities;

- income, crew members of ships that sail under the State Flag of the Russian Federation.

All employees were concerned about the question of whether there would be a rate increase in 2018. The Ministry of Finance answered this question in its letter dated September 26, 2017 No. 03-04-05/62106. Officials explained that the existing tax system takes into account the interests of both taxpayers and the budget system, and the 13 percent rate is attractive for investment.

In addition, the introduction of a progressive scale for the income of individuals was not provided for in the main directions of the tax and customs tariff policy of the Russian Federation for 2021 and for the planning period, which is 2021 and 2021.

From here we conclude that officials decided to leave the same interest rate for personal income tax in 2021 as they used before. The changes affected only the procedure for calculating tax on this type of income, such as a discount.

Personal income tax rates in 2021. Personal income tax at a rate of 30%

A rate of 30% is applied to income on securities, except for dividends issued by Russian organizations, in the following cases:

- income from securities is recorded in the securities account of a foreign nominal holder, foreign authorized holder or in the securities account of depository programs;

- the recipient of the income did not provide the tax agent with information in accordance with the requirements of Art. Code 214.6.

Officials established exceptions for the application of a 30% rate for income tax in paragraph 8 of Article 214.6 of the Tax Code.

To determine what percentage of the personal income tax rate to apply to non-residents, check whether rates of 13 or 15 percent have been introduced for their income. If not, then use 30 percent (clause 3 of Article 224 of the Tax Code). The tax is calculated for each payment separately, deductions are not applied (clause 4 of article 210, clause 3 of article 226 of the Tax Code).

Personal income tax rates in 2021. Personal income tax at a rate of 35%

Income subject to personal income tax at a rate of 35 percent is the income of residents. This is the highest tax rate (clause 2 of Article 224 of the Tax Code). Tax is calculated for each payment separately; deductions are not applied.

Federal Law No. 333-FZ of November 27, 2017 “On Amendments to Article 212 of Part Two of the Tax Code of the Russian Federation” deserves special attention. The law introduced clarifications for cases of recognition of material benefits that employees receive from savings on interest for the use of borrowed funds. This income is included in the base for calculating personal income tax if:

- borrowed funds were received from a company or entrepreneur who is a related party or with whom the recipient has an employment relationship;

- savings are actually material assistance, or a form of counter-fulfillment by an LLC or individual entrepreneur of an obligation to an individual.

- Personal income tax rates in 2021. Personal income tax at a rate of 15%

A rate of 15% is applied to the income of non-resident individuals. Moreover, payments are received in the form of dividends from Russian organizations.

Personal income tax rates in 2021. Personal income tax at a rate of 9%

The rate is used when determining tax on the following income of tax residents:

- interest on mortgage-backed bonds issued before January 1, 2007;

- income of the founders of trust management of mortgage coverage under participation certificates issued before January 1, 2007.

- Source

Personal income tax rates in 2021, table

Taxation of interest on domestic marketable bonds is changing

By virtue of Law No. 58-FZ of April 3, 2021, from January 1, 2018, the procedure for taxing income in the form of interest on outstanding bonds of domestic firms and enterprises that have been issued for circulation since 2021 has been changed.

In fact, these interests are now subject to personal income tax as deposits in banks at a rate of 35% (new edition of clause 2 of article 224 of the Tax Code of the Russian Federation). Namely, the difference between the amount of interest payment (coupon) and the amount of interest, which is calculated:

- by bond par value;

- the refinancing rate of the Central Bank of the Russian Federation, increased by 5 percentage points and valid during the period of payment of coupon income.

Example

Interest on bonds owned by E.A. Shirokov, paid every year. The nominal value of the bonds is 2000 rubles. The Central Bank refinancing rate at the time of payment of income is 8.25%.

This means that 435 rubles will be subject to personal income tax:

2000 × 35% – 2000 × (8,25% + 5%)

Let us remind you that until 2021, the entire amount of income on outstanding bonds was subject to tax.

Attention!

The new procedure does not apply (letter of the Federal Tax Service dated July 24, 2017 No. BS-4-11/14422, information from the Federal Tax Service of Russia <On personal income tax taxation of interest on bonds>):

- for securities not traded on the organized market;

- income from any mutual funds;

- bonds denominated in foreign currency;

- bonds issued before 01/01/2017.

Then the tax is taken from the entire income of an individual.

Also see: Key Bet for 2021.

Personal income tax and its changes in 2021

Close-up of the hands of a business woman sitting at desk while checking numbers printed on paper

rates in 2021.

Basic personal income tax rate

· for residents – 13 percent

· for non-residents – 30 percent

Tax residents are considered to be employees who actually stay in the Russian Federation for at least 183 calendar days over the past year.

Certain types of income may be taxed at a higher or lower personal income tax rate. When calculating taxable income, it can be reduced by the amount of deductions: standard, property and social.

Tax residents are considered to be employees who actually stay in the Russian Federation for at least 183 calendar days over the past year. 9% personal income tax rate 2018

, it is subject to:

o Income of foreign citizens who are non-residents: highly qualified specialists, people working under a patent, citizens of the EAEU.

o Interest on mortgage-backed bonds issued before January 1, 2007

15% personal income tax rate

2018

, it is subject to:

o Income received by the founders of trust management of mortgage coverage. Such income is required to be received on the basis of mortgage participation certificates that were issued to mortgage coverage managers before January 1, 2007.

o Dividends received from Russian companies by citizens who are not tax residents of Russia

15% personal income tax rate 2018

, it is subject to:

o All income of non-residents. The exceptions are dividends and income of foreigners: highly qualified specialists; foreign citizens working for individuals on the basis of a patent or from the EAEU.

30% personal income tax rate 2018

, it is subject to:

o Rewards and winnings in organized games, competitions and other promotional events. Tax is paid on the value of such rewards and winnings, which exceeds four thousand rubles per year.

35% personal income tax rate 2018

, it is subject to:

o Interest on bank deposits insofar as they exceed the amount of interest, which is calculated as follows:

For deposits in rubles - based on the refinancing rate of the Central Bank of the Russian Federation, increased by five percent. In this case, for such purposes, they take the refinancing rate that is relevant during the interval for which the presented interest is accrued. If the refinancing rate changed during this period, the new rate should be applied from the moment it was established.

For deposits in foreign currencies - based on nine percent per annum.

Material benefits from saving on interest on credit (borrowed) funds. At the same time, you must pay income tax in 2021 on the following amounts:

o For credits (loans) in rubles - from the amount of excess of the interest calculated taking into account 2/3 of the current refinancing rate (key rate), which was established by the Central Bank of the Russian Federation at the time of payment of interest, over the interest calculated on the basis of the terms of the agreement.

o For credits (borrowings) in foreign currency - from the excess amount of interest, which is calculated based on nine percent per annum, over the amount of interest calculated on the basis of the terms of the agreement.

o Income of shareholders from an agricultural credit consumer cooperative or a credit consumer cooperative:

1. payment for the use of funds contributed by shareholders by a consumer credit cooperative;

2. interest on the use of money by the agricultural credit consumer cooperative, which is attracted from shareholders in the form of loans.

3. The calculation of personal income tax is required to be carried out on the part of the excess of the amount of the indicated income over the amount of interest calculated on the basis of the refinancing rate of the Central Bank of the Russian Federation, increased by five percent.

Personal income tax rate on wages of foreign citizens (in percentage) in 2021.

In 2021, the personal income tax rate on the wages of a foreign worker is also directly dependent on his tax status. However, for certain foreign borrowers, special rules remain relevant, which apply to:

o refugees or people who have received temporary asylum in the Russian Federation;

o highly qualified specialists;

o people working in the Russian Federation for hire on the basis of a patent;

o residents of states that are members of the EAEU.

Personal income tax on the income of foreign citizens who are residents of Russia is calculated at the same rates as on the income of Russian residents (see above). Documentary proof of tax resident status is required.

If a foreign worker works abroad, including at home at his place of residence or in a foreign branch (representative office) of a Russian company, his remuneration for the performance of his work duties is classified as income received from foreign sources. A foreign citizen who has the status of a resident of the Russian Federation independently pays personal income tax on income that was received abroad. Personal income tax is not always collected on the income of foreign citizens who are not residents of the Russian Federation. Based on the place of their employment, remuneration paid to them is classified either as income that was received from sources on the territory of the Russian Federation, or as income from foreign sources. Income that was received by non-resident foreign employees outside the Russian Federation, are not subject to personal income tax.

Personal income tax of EAEU citizens in 2021

Labor regulation of citizens of the EAEU (Belarus, Kyrgyzstan, Armenia, Kazakhstan) is carried out in accordance not only with the tax and labor code of the Russian Federation, but also with the treaty on the EAEU. The norms of the international treaty remain a priority. For this reason, the income of people who are citizens of states from the EAEU, working on the basis of civil law and labor contracts, is taxed at a rate of 13 percent from the first day of employment. It does not matter how long the person actually stayed in Russia at that moment. If a foreign citizen from the EAEU loses the status of a tax resident of his state, he will also lose the right to preferential taxation. For this reason, personal income tax on his income will need to be recalculated in accordance with the rate of 30 percent , as for a non-resident.

The following are subject to personal income tax above the limit:

o gifts whose value exceeds four thousand rubles per year;

o financial assistance exceeding four thousand rubles per year;

o financial assistance in the event of the birth of a child, exceeding fifty thousand rubles;

o severance payments that are higher than three times the average salary;

o daily allowance exceeding seven hundred rubles per day for business trips within the Russian Federation and 2,500 rubles for business trips abroad.

If you found our article about personal income tax rates in 2021 useful, please upvote or share information on how to pay payroll tax in 2021 on social media. networks.

What income is/is not subject to personal income tax in 2021?

The following are exempt from paying personal income tax in 2021:

o benefits for employees with children – for childbirth and pregnancy, child care, etc.;

o payment of education to employees;

o reimbursement of mortgage interest;

o payment for an exam to determine whether an employee meets a professional standard.

Personal income tax in 2021 is levied on:

o wages, as well as bonuses (for example, in the case of overtime work);

o remuneration under civil law contracts (except for copyright);

o disability benefits;

o remuneration to members of the board of directors;

o compensation for unused vacation;

o vacation pay;

o dividends.

Taxed above the limit:

o gifts whose value exceeds four thousand rubles per year;

o financial assistance exceeding four thousand rubles per year;

o financial assistance in the event of the birth of a child, exceeding fifty thousand rubles;

o severance payments that are higher than three times the average salary;

o daily allowance exceeding seven hundred rubles per day for business trips within the Russian Federation and 2,500 rubles for business trips abroad.

No personal income tax with targeted social assistance

Law of October 30, 2021 No. 304-FZ clarified the wording of paragraph five of paragraph 8 of Article 217 of the Tax Code of the Russian Federation from 01/01/2018. According to it, amounts of targeted assistance to citizens who are legally entitled to receive social support are not subject to income tax.

The source of these payments may be:

- federal treasury;

- regional budget;

- municipal budget;

- off-budget fund.

The appearance of this amendment is due to the fact that the current legislation does not disclose who “socially vulnerable categories of citizens” are.

Deflator coefficient for foreigners with a patent

Order of the Ministry of Economic Development of Russia dated October 30, 2021 No. 579 for the 201st year established a deflator coefficient of 1.686. Let us remember that in 2021 it was 1.623.

In 2021, the fixed advance payment of 1,200 rubles for obtaining or renewing a work patent for a foreigner will be increased by this figure (clause 3 of Article 227.1 of the Tax Code of the Russian Federation). You should also not forget about the coefficient that is set in your region.

Taking into account the new deflator coefficient, the fixed advance in 2018 will be 2032.2 rubles (1200 rubles × 1.686). But the final amount for a patent depends on the coefficient in a particular region of Russia.

Let us remind you that in 2021, an employer can reduce the tax on a foreigner’s income by fixed payments if such an employee submits an application and the Federal Tax Service issues a special notice to the company (clause 6 of Article 227.1 of the Tax Code of the Russian Federation).

Also see “2-NDFL for a foreign worker”.

Read also

01.02.2018

Current personal income tax rates

Tax authorities collect personal income tax from the entire working population of the country, levying this tax on wages, dividends, deposits and winnings. The only exceptions are those types of income that are received in the form of social payments from the state - they, according to Russian legislation, are exempt from paying personal income tax. In 2021, personal income tax indicators for different types of income are expressed as follows:

- citizens of the Russian Federation who receive a salary pay personal income tax in the amount of 13% of its amount;

- individuals who received income in the form of dividends also pay 13% of the fee to the budget;

- citizens of Belarus, Kyrgyzstan, Kazakhstan and Armenia - countries that are part of the EAEU, officially working in Russia, pay a fee of 13%;

- the same rate (13%) must be paid by individuals belonging to the categories of refugees and immigrants;

- residents of the country who received winnings or made an investment must deduct 35% of this income;

- Non-residents carrying out labor or business activities in Russia pay a tax of 30% on income.

Thus, today in Russian tax practice a flat scale of taxation of income of Russians is used. At the same time, according to specialists from Rosstat, the average nominal salary in the country is 38,590 rubles, i.e. a person receiving such an amount pays a monthly contribution of just over 5,000 rubles. It is easy to calculate that in annual terms this will be approximately 60,000 - an amount that for Russians with the income mentioned above is very significant.

At the same time, experts who insist on the need to introduce a progressive tax scale say that today an increase in the amount of taxes collected is most often carried out at the expense of the least affluent categories of people. This practice leads to the fact that the gap between the richest and poorest Russians is growing at a catastrophic pace.

In 2021, personal income tax may be raised by 2%