Home / Real estate / Land / Taxes

Back

Published: 04/01/2017

Reading time: 10 min

0

796

In accordance with the law, the use of land in the Russian Federation is paid. In this regard, organizations and ordinary citizens are required to pay tax for the ownership of their land plots.

At the same time, funds received as land tax (LT) go to the local budget. This tax is one of the main sources of the local budget, which can be used for various needs of local municipalities.

- Laws

- Cadastral value of plots

- Calculation of ZN

- Tax benefits

- Tax rate in Moscow region

- Calculation examples Example 1

- Example 2

Laws

The need to pay for land in the form of ZN was introduced by Art. 65 ZK. Art. 66 of this code determines the general procedure for assessing the cadastral value (CV) of land.

In accordance with Art. 387 of the Tax Code, land tax is regulated by the Tax Code of the Russian Federation (Chapter 31) and legal acts of local authorities. In the territories of Moscow, St. Petersburg and Sevastopol, the ZN is established in accordance with the Tax Code and the laws of these cities. In particular, Law No. 74 of November 24, 2004 is in force in Moscow.

On the territory of the Moscow Region (MO) acts of local authorities are in force. An example is the Decision of the Moscow Region Zaraisky Council of Deputies No. 3/43 of 02/20/16.

Land tax: payment deadlines for legal entities

The definition of deadlines for tax payment by current legislation is also given to the introduction of local entities. Therefore, each enterprise is guided by the adopted regional documents. Most often, they set certain deadlines for paying advances and the final tax amount. And, if the exact dates of quarterly advances must be established for each region, then the deadline for the final payment for the year should not be later than established in the Tax Code of the Russian Federation: legal entities pay land tax no later than February 1 of the reporting year.

Cadastral value of plots

Starting from 2021, the calculation of taxation is carried out according to the new tax base, which is used as the cadastral value (CV) of the site. Sometimes, to assess the CV of land in the cadastral sector, the average specific indicator of the cadastral value of 1 m² of land (UPKS) is used.

In Moscow, Government Decree No. 791-PP at the end of 2021 approved the results of the assessment of the city’s lands.

At the same time, the CS for each cadastral quarter depends on its location and the permitted use of the land plot. At the same time, in the capital, the UPCS indicator can reach 100,000 rubles/m².

In 2013, a revaluation of land assets in the Moscow region was carried out. At the same time, the cost of storage

has grown significantly. The results of the cadastral assessment of lands for agricultural purposes, dacha (horticultural) use, and lands of settlements were approved by orders of the Ministry of Ecology of the Moscow Region (No. 563-RM, 564-RM and 566-RM, respectively).

At the same time, the results were divided by municipal districts and cadastral sectors. In addition, the cadastral value of land in each sector was divided depending on the type of land use.

At the same time, for the use of land in populated areas for dachas and gardening farms, the range of UPKS ranges from 133 rubles/m² (Serebryanye Prudy) to 2580 rubles/m² (in Podolsk). In Klin this UPKS is 512 rubles/m², and in Zaraysk - 597 rubles/m².

At the same time, permission to use land for the construction of multi-storey buildings raises the UCC in Podolsk to almost 7,600 rubles/m², and in Serebryanye Prudy – to 2,700 rubles/m².

In the cities of the nearest Moscow region, such UPKS reaches 10,000 rubles/m².

Calculation of ZN

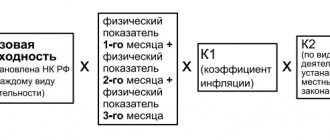

The amount of tax payers for individual payers is determined by the tax authorities, and organizations evaluate the tax payer independently. To check the correctness of the ZN, you can calculate it yourself using the formula:

N=K*S*M/12, where:

- N – land tax, rub.;

- K is the cadastral value of the land plot as of January 1, rubles;

- C — tax rate, %;

- M - time of land ownership (month).

In addition, when calculating the salary, the share of the right to the land and the available benefits must be taken into account.

When calculating ZN, the value of KS can be found on the Internet on the Rosreestr website in the “Public cadastral map” section. To do this, you must indicate the site number or its address.

A table will be issued showing the area of the land plot and its cadastral value.

In accordance with the Tax Code (Article 394), the tax rate should be no more than 0.3% for plots used:

- for agricultural production;

- for dwellings;

- for subsidiary farming, gardening, dacha farming;

- for the defense or security of the country.

The tax rate for memory for other purposes should not exceed 1.5%.

What changes can we expect in land taxation?

According to the new amendments, all citizens who own land will have to pay household tax. the buildings. You will have to pay for everything:

- Houses;

- Garages;

- Sheds;

- Barns, etc.

When calculating taxes on such real estate, a cadastral valuation will be used. Today, inventory value is used here. It is noticeably inferior to its cadastral analogue. And the tax on it is minimal.

Having a problem? Call a lawyer: +7

— Moscow, Moscow region

+7

— St. Petersburg, Leningrad region

The call is free!

Ultimately, the tax on summer cottages may increase. Everything depends only on the presence of buildings on the site and their cost. Therefore, only those owners who have a solid dacha farm near Moscow can be wary of overpayments. It is worth noting that such taxation has already been introduced in some areas for legal entities. But this caused a wave of lawsuits. Therefore, this practice may not “take root” on a mass scale.

Tax benefits

In Art. 395 of the Tax Code lists the categories of organizations that are exempt from the ZN.

These include organizations of people with disabilities, religious organizations, construction

organizations in terms of land plots used for roads, enterprises associated with folk crafts, as well as organizations that are participants in special or free economic zones and others.

Some categories of citizens have benefits on the tax base (NB).

This benefit is that the National Security Fund for beneficiaries is reduced by 10,000 rubles. The preferential category includes Heroes of the USSR, the Russian Federation, disabled people of the 1st and 2nd groups, veterans and disabled people of wars and hostilities.

Chernobyl victims, citizens who were exposed to radioactive radiation in Semipalatinsk, during and during nuclear weapons testing, also have benefits.

Tax rate in Moscow region

The tax rate specified in the Tax Code is the highest threshold.

Therefore, local authorities for one reason or another may reduce this rate. For example, local authorities, by their decision, can reduce the tax rate for pensioners and large families.

For household plots and summer cottages in the Moscow region, different rates apply in different areas.

Of the 35 districts of the Moscow Region, 16 have maximum rates of 0.3%. In one (Mytishchi) district the rate for all gardeners was reduced to 0.15%. In other areas, NS varies from a minimum value to 0.3%.

This minimum ranges from 0.07% (in the Ramensky district) to 0.2% (in the Kashira, Lyubertsy, Noginsky and Ruzsky districts).

Tax on agricultural land in 2016

Land tax rates for legal entities are the same as for citizens. The possibility of benefits for organizations under this tax is provided for by regional legislation. At the federal level, benefits are established only for companies resident in special economic zones.

Current legislation is based on the principle of recognizing the special value of land plots involved in agricultural production. The legislation also provides for state support for persons using this land for agricultural production. Therefore, reduced tax rates apply to land plots classified as agricultural land. The base rate is defined as 0.3% of the cadastral value. Local authorities can reduce this rate to 0%. This may take into account the nature of the use of the land plot, its location, agrochemical, geodetic or geographical parameters.

Calculation examples

Example 1

Calculate land tax for the full year 2021 for ZU No. 103 SNT “Inventor” in the Zaraisky district of the Moscow Region. Cadastral number ZU 50:38:0050302:210. The plot belongs to a pensioner.

To calculate, you need to do the following:

- Go to the Rosreestr website (https://pkk5.rosreestr.ru)/

- In the “Plots” section, dial the cadastral number of the land plot.

- A table will appear. Storage area = 600 sq.m. Cadastral value = 203640 rub.

- To determine the tax rate, go to the Federal Tax Service website (https://nalog.ru/m50/service/tax/) to the “Certificates and benefits” section

- Select the territory (Zaraisky district), type of tax (land) and tax period (2016).

- Find the section “Zaraisk urban settlement”.

- You are viewing the "Bets" section. For gardeners the rate is 0.3%.

Checking the availability of local benefits according to the Decision of the Zaraisk Council of Deputies “On Land Tax” shows that there are no benefits for this category of owners.

Then the ZN for this section will be equal to: N=K*C=203640*(0.3/100)=610.92 rubles.

Example 2

The charger is used for gardening and has KS = 800,000 rubles. It is jointly owned by two brothers, one of whom is disabled of the 2nd group. The ZN tax rate in this area is 0.3%.

Determine the ZN that will be paid by each of the ZU owners.

The first owner - a disabled person of the 2nd group must pay ZN:

H1=(K-10000)*C*Kd=(800000-10000)*(0.3/100)*0.5=1185 rub.

In the formula, Kd = 0.5 is a coefficient that takes into account shared ownership of property.

The second owner must pay:

H2=K*S*Kd=800000*(0.3/100)*0.5=1200 rub.

As can be seen from the calculation results, the benefit for a disabled person is only 15 rubles.

The establishment of an easement can occur both with the consent of the owner (private) and without his consent (public). How to properly buy a plot of land from the owner and what nuances should be taken into account? Find out about it here.

Why is land surveying tedious and in what cases is it mandatory? You can read more about this in our article.