Who must pay insurance premiums in 2021 and when?

The responsibility for calculating and transferring contributions is assigned to organizations and individual entrepreneurs if they have hired employees, as well as to individual entrepreneurs for themselves. In addition, notaries, patent attorneys, lawyers and appraisers must pay insurance premiums. A specific list of such payers is contained in Art. 419 of the Tax Code of the Russian Federation.

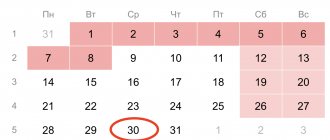

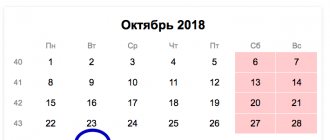

Insurance premiums must be transferred no later than the 15th day of the month following the month in which contributions were calculated. If the transfer deadline falls on a holiday or weekend, then contributions must be paid no later than the next business day.

Insurance premiums

The general premium rate for next year will be reduced to 21% from 30%. As for the general VAT rate, it will, on the contrary, be increased to 21% from 18%, and the limits of both rates will be changed upward. As a result, the data will be at the same level.

The insurance premium is part of the state social protection system for the country's population. And this is very important for the citizens of the country. This contribution obliges every person who carries out his activities to take out insurance in the event of changes in the social and financial situation of the citizen.

There are funds that have their own budgets that are not associated with the state monetary system. As a result, they are called extra-budgetary funds. The treasury of the funds is replenished from insurance premiums, and the source of funds comes from money transfers by enterprises. They are also the insurers.

If there is a budget deficit in the funds, then it is necessary to turn to transfer payments for help. They will be taken from the country's federal budget. The amount of insurance premiums is determined taking into account the work activities of the company's employees.

Where to send insurance premiums in 2018

Starting from 2021, the administration of insurance premiums has been transferred to the Federal Tax Service, and therefore this kind of transfers should be sent there. This point concerns contributions to pension, health and social insurance, except for contributions for injuries, which, as before, must be transferred to the Social Insurance Fund.

Important! According to paragraph 11 of Art. 431 of the Tax Code of the Russian Federation, insurance premiums must be sent to the location of either the company’s head office or its separate division.

Companies of all legal forms, as well as individual entrepreneurs, must pay the appropriate contributions to the Federal Tax Service at the place of registration for themselves and their employees. The procedure for transferring contributions also does not depend on the taxation used by business entities. In addition, if an individual entrepreneur decides to pay voluntary social contributions for himself, they must be transferred to the Social Insurance Fund, as stated in clause 5 of Art. 4.5 of the Federal Law “On Compulsory Social Insurance...” dated December 29, 2006 No. 255-FZ.

Changes and latest news on contributions in 2021

The most important change regarding insurance premiums affects individual entrepreneurs. From 2021, individual entrepreneurs will no longer depend on the amount of the minimum wage (minimum wage); from 2021, these amounts are set at a certain amount, which will now be indexed every year.

If we talk about insurance premiums paid from wages, no major changes are expected - rates have remained at the same level. The maximum value of the base for calculating contributions to compulsory pension insurance and compulsory social insurance has changed, as happens every year. In addition, the list of activities of simplifiers that are entitled to a reduced contribution rate has been slightly modified: it has been brought into line with the updated OKVED-2 directory.

The form of the report on accrued/paid ERSV contributions has also changed. For the first time, entrepreneurs will report for the 1st quarter of 2021 using the new form.

Contribution rates remained unchanged.

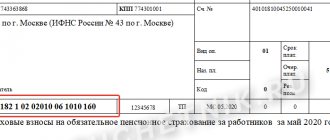

How to fill out a payment order for the transfer of insurance premiums in 2021.

Payment orders for insurance premiums are processed in the same way as when transferring tax payments, and the following must be taken into account:

- in the column “payer status” code 01 is entered;

- in the “payee” column you must indicate the number of the tax office at the place of registration;

- in column 106, a two-digit payment code is entered as the basis for payment;

- the tax period is entered in column 107;

- columns 108 and 109 indicate the number and date of the request for payment of insurance premiums, if it is received from the Federal Tax Service and is the basis for the transfer of funds.

Where to pay insurance premiums in 2021?

Where to pay insurance premiums in 2021 for pension, medical and social insurance? Who administers the unfortunate contributions? Have BCCs changed for payment of insurance premiums in 2021? When should contributions be made? Read the answers to these and other questions in our article.

Where should contributions be paid for compulsory health insurance, compulsory medical insurance and compulsory social insurance?

What details should I use to transfer contributions regulated by the Tax Code of the Russian Federation?

Where to send “unfortunate” contributions

Deadlines within which fees must be paid

Results

Where should contributions be paid for compulsory health insurance, compulsory medical insurance and compulsory social insurance?

Legislative innovations in insurance premiums, which came into force in 2021, have led to the replacement of the authority that performs the functions of the administrator of these payments. The tax service became such an authority for the majority of contributions, and began to control payments intended for:

- for Social Insurance Fund in terms of sick leave and maternity leave;

- Pension Fund and Compulsory Medical Insurance Fund, including those paid by individual entrepreneurs for themselves.

Since 2021, all provisions reflecting the specifics of the application of such payments as insurance premiums have been regulated by a special chapter of the Tax Code of the Russian Federation.

Once included in the Tax Code of the Russian Federation, insurance premiums began to obey all its rules, i.e. they turned out to be equivalent to budget payments paid in a special order, which concerns not only the rules for processing payment documents, but also the details for transfer.

To learn how the functions of tax authorities and funds turned out to be differentiated in terms of contributions that came under the control of the Federal Tax Service, read the material “Attention - a memo for payers of contributions from the Federal Tax Service .

Where are insurance premiums paid in 2021? Contributions regulated by the Tax Code of the Russian Federation should be paid to the budget at the location of the taxpayer, and if he has separate structural units that calculate and pay wages, then at the location of such structural units. Individual entrepreneurs pay contributions for themselves and for employees at their place of residence.

Payment documents, as before, are issued separately for the payment intended for each of the funds, but in accordance with the requirements valid for tax payments.

At the same time, there are contributions that were not affected by the 2017 changes. These are the so-called “accident” premiums associated with occupational injury insurance.

They are still subject to the provisions of the Law “On Compulsory Social Insurance” dated July 24, 1998 No. 125-FZ, and the FSS remains their curator.

Where should those paying insurance premiums transfer such payments in 2021? The answer is obvious: as before - in social insurance at the place of registration of the policyholder, which may also be its separate division.

An important point is to indicate the correct BCC

A particularly important point is that the correct BCCs have been entered for payment of insurance premiums, since errors in this column will lead to the wrong direction or return of funds.

The main BCCs for insurance premiums for employees are presented in the following table:

| Payment | KBK | ||

| OPS | Compulsory medical insurance | FSS | |

| Contribution | 18210202010061010160 | 18210202101081013160 | 18210202090071010160 |

| Penya | 18210202010062110160 | 18210202101082013160 | 18210202090072110160 |

| Fine | 18210202010063010160 | 18210202101083013160 | 18210202090073010160 |

For more detailed information on various BCCs for insurance premiums, read this material.

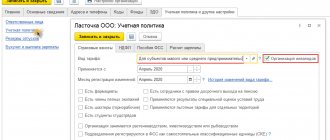

Features of filling out the ERSV

The calculation of insurance premiums in 2021, the form of which consists of a title page and several sections, is a voluminous document. Accountants do not fill out all the sheets, since section 2 is intended only for peasant farm managers.

Entering personal data

In the third section of the calculation of insurance premiums in 2021, it is necessary to enter information about employees working under an employment or civil agreement. Indicated:

- SNILS and TIN;

- All details of the identity document.

The type of insurance is noted, but information about working conditions and length of service is not provided.

General requirements for registration of ERSV

The website provides an example of calculation of insurance premiums - it is submitted in paper or electronic form. Registration on paper is allowed for companies with a staff of no more than 25 people per year. Data is entered into the reporting only in printed font.

When filling out the form you must:

- Enter numbers and letters from left to right.

- Reflect monetary indicators in rubles and kopecks without rounding.

- Enter information only with blue, black or purple paste.

- Use capital letters for text.

- Do not correct entries with putty.

- Print the form only on one side of the sheet and staple it.

The procedure for filling out the calculation of insurance premiums for 2018 provides for zero values for the quantity and amount if this indicator does not exist. In other cases, a dash is allowed.

You can find zero calculations for insurance premiums here (link)

Algorithm for filling out new insurance documentation

The calculation form for insurance premiums is a unified form introduced by Order MMV-7-11/551. Compilation is done as follows:

- The title page contains information from the registration documents.

- Personalized data on insured citizens is entered into section 3, including on maternity leave and employees on maternity leave without pay.

- Subsections on insurance premiums are filled in – 1.1. and 1.2. in section 1.

- Appendix 2 is compiled with information about VNiM contributions - charges, insurance costs and compensation for it are prescribed. Information on social benefits is entered in line 070 and Appendix 3.

- At the end, OKTMO codes are given, the amount of contributions for the entire period and the last 3 months is indicated.

It is necessary to indicate the federal codes of the organization, the tariffs of the tax payer, the option of sending the form, documents (internal passport of a citizen of the Russian Federation, passport of a foreign citizen, military ID). The pages of the document are numbered in chronological order, their number is entered in the title field. The reporting is certified by the head of the enterprise with his signature and seal.

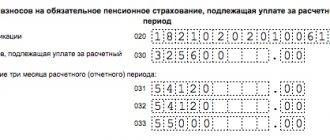

Before completing the 2021 calculation, calculate your total SV amounts. On line 030 payments are entered for the entire period, in lines 031 - 033 - broken down by month, in lines 040 and 020 the BCC is entered, and in line 090 - additional insurance coverage from the employer.

The calculation is submitted before January 30, April, July and October 2021. According to clause 7 of Art. 6.1 of the Tax Code, if the last reporting day coincides with a weekend, the deadline is postponed to the next working day.

According to the new form and amended rules, reporting documentation is submitted to the Federal Tax Service for 2021. Information on payments and accruals for insurance is provided quarterly. If an error is made in the TIN, SNILS or personalized data of employees, the document will not be accepted by the tax service. The representative of the insurance agent sends a report to government agencies on the basis of a notarized power of attorney.

Similar articles

- Procedure for filling out calculations for insurance premiums (2018)

- Sample zero calculation for insurance premiums (2018)

- Calculation of insurance premiums 2021 form

- Calculation of insurance premiums in 2021

- Unified calculation of insurance premiums in 2021 (example)

Special rules for transferring insurance premiums to individual entrepreneurs for themselves

Entrepreneurs are required to transfer contributions for mandatory health insurance and compulsory medical insurance to the tax office at the place of residence, and voluntary contributions for social insurance to the territorial department of the Social Insurance Fund at the place of registration. In this case, all contributions must be transferred to the tax office, regardless of the period for which they were calculated. The division into periods before 2021 and after 2021 is carried out based on the use of specific BCCs.

For periods after 2021, the following BCCs must be used:

| Payment | KBK | |

| OPS | Compulsory medical insurance | |

| Fixed contributions | 18210202140061110160 | 18210202103081013160 |

| Contributions in the amount of 1% on the amount of income over 300 thousand rubles. | – | |

| Penya | 18210202140062110160 | 18210202103082013160 |

| Fine | 18210202140063010160 | 18210202103083013160 |

More detailed information on the BCC for individual entrepreneurs' insurance premiums for themselves can be obtained from this article.

As for the deadlines for paying insurance premiums for individual entrepreneurs for themselves within an income of 300 thousand rubles, the deadline is December 31 of the same year. If this day falls on a holiday or weekend, funds must be transferred on the next first business day. In this case, this amount can be paid in a one-time payment or divided into several parts (up to 1 month). Contributions in the amount of 1% on the excess income of 300 thousand rubles. must be paid no later than July 1 of the following year.

When an entrepreneur ceases to operate, contributions must be transferred no later than 15 days from the date of registration of the closure of the individual entrepreneur.

New base for insurance premiums for employers

Every year the government reviews the maximum values for the base from which contributions are calculated. In 2021, these values are as follows:

| Insurance premiums | Limit value | Bid |

| For pension insurance | RUB 1,021,000 | 22%, after reaching the limit for an individual employee, contributions to compulsory pension insurance are accrued from his income at a rate of 10% |

| For social insurance | 815,000 rub. | 2.9%, after reaching the limit for an individual employee, contributions are no longer calculated from his income |

| For health insurance | Not installed | 5,1% |