From 01/01/2020, in accordance with the new procedure No. 207n dated 11/29/2019, new BCCs for insurance premiums began to apply from 2020.

The accrual and payment of SV is regulated by the Tax Code (Chapter 34 of the Tax Code of the Russian Federation), 125-FZ of July 24, 1998, 179-FZ of December 22, 2005.

All SVs are paid according to the tariffs determined for each type of payment in accordance with current legislation. Find out more about how rates and benefits are set.

IMPORTANT!

From April 1, 2021, reduced tariffs will be introduced for small and medium-sized businesses. The new tariff of 15% applies only to the amount of workers’ earnings exceeding the minimum wage. But the BCC for insurance premiums for April 2021 remained the same. Read more in the article: “Anti-crisis measures during coronavirus quarantine: rights and responsibilities of organizations.”

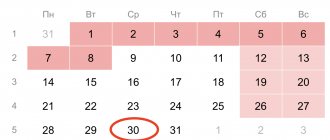

When to pay

Despite the fact that budget transfers for social insurance from 2021 are transferred to different authorities (to the Federal Tax Service and the Social Insurance Fund), the payment deadline is the same for each SV. Policyholders are required to transfer all necessary payments to the relevant authorities before the 15th day of the month following the reporting month (clause 3 of Article 431 of the Tax Code of the Russian Federation, clause 4 of Article 22 125-FZ).

Read more: payment deadlines for all social insurance payments

Here is a list of the main insurance premiums that must be paid for employees, and the KBK table for insurance premiums for 2021 contains all the data that specialists will need when paying insurance premiums.

KBK IP – fixed payment in 2021: penalties and fines

If payments are delayed, the Federal Tax Service assesses penalties and fines, which should be paid to special cash registers. As a general rule, for penalties and fines the numbers from 14 to 17 in the code itself change, although there are some exceptions. For individual entrepreneurs, when paying penalties for fixed insurance premiums for 2021, the KBK is used, in which for penalties the 14th digit in the code is replaced from 1 to 2, and for fines from 1 to 3:

- Penalty of the Pension Fund of Russia - 182 1 0210 160;

- MHIF penalty - 182 1 0213 160;

- Pension Fund fines - 182 1 0210 160;

- Compulsory Compulsory Medical Insurance fines - 182 1 0213 160.

Budget classification codes

| Payment Description | Payment type | Budget classification code |

| Compulsory pension insurance at basic rates (KBK for pension contributions) | NE | 182 1 0210 160 |

| Penalty | 182 1 0210 160 | |

| Fines | 182 1 0210 160 | |

| Compulsory health insurance | NE | 182 1 0213 160 |

| Penalty | 182 1 0213 160 | |

| Fines | 182 1 0213 160 | |

| Compulsory social insurance | NE | 182 1 0210 160 |

| Penalty | 182 1 0210 160 | |

| Fines | 182 1 0213 160 |

Decoding budget classification codes (KBK)

Each budget classification code consists of 20 digits (sections). The KBK codes contain the following information in encrypted form:

1. Code of the main administrator of budget revenues (manager of budget funds). 2. Code of the type of income and expenses, including: taxes; insurance premiums; duties; obligatory payments. 3. Classification code for public sector management operations.

The numerical value is indicated in payment orders. The table shows the KBK codes that are relevant in 2021, including codes for fines (penalties).

OPS at additional rates

| Type payment | BCC for OPS - the tariff does not depend on the results of the special assessment | Code - the tariff depends on the results of the special assessment |

| List 1 - insured persons employed in work in accordance with clause 1, part 1, art. 30 400-FZ | ||

| Basic payment | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0210 160 | 182 1 0200 160 |

| Fines | 182 1 0210 160 | 182 1 0200 160 |

| List 2 - insured persons employed in work in accordance with clause 2-18, part 1, art. 30 400-FZ | ||

| NE | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0210 160 | 182 1 0200 160 |

| Fines | 182 1 0210 160 | 182 1 0200 160 |

Additional SV is paid by the employer and the insured person for separate codes, directly to the Pension Fund.

Here are the BCCs for insurance contributions to the Pension Fund in 2021 used for transfers by the employer:

- at the expense of the employee - 392 1 0200 160;

- at the expense of the employer - 392 1 0200 160.

The insured person independently - 392 1 0200 160.

Use similar BCC values for insurance premiums for May 2020 when filling out payment orders.

KBK insurance premiums in 2021: table

Table 1. Basic tariffs.

| Purpose | Code by payment type | ||

| NE | Penalty | Fine | |

| OPS | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| Compulsory medical insurance | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| OSS VNiM | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

Table 2. Additional tariffs (codes of penalties and fines - in accordance with Order of the Ministry of Finance No. 36n dated 03/06/2019).

| Purpose | Special assessment | Main code | Penalty | Fines |

| Harmful working conditions | Affects | 182 1 0220 160 | 182 1 0200 160 | 182 1 0200 160 |

| Does not affect | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 | |

| Difficult working conditions | Affects | 182 1 0220 160 | 182 1 0200 160 | 182 1 0200 160 |

| Does not affect | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

Table 3. Injuries.

| Payment type | Code |

| NE | 393 1 0200 160 |

| Penalty | 393 1 0200 160 |

| Fine | 393 1 0200 160 |

Table 4. Transfers of individual entrepreneurs for themselves.

| Purpose | Code by payment type | ||

| NE | Penalty | Fine | |

| OPS | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| Compulsory medical insurance | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| OPS 1% of profit > 300,000 rubles | 182 1 0210 160 | – | – |

Who pays

Insurance refers to payments to the budget system of the Russian Federation, which are transferred by employers who attract workers under labor and civil law contracts. They are transferred to the budget for the purpose of further redistribution to the needs of citizens upon the occurrence of certain insured events: temporary disability, pregnancy and parental leave, retirement, etc.

Specialists must transfer payments for compulsory pension and health insurance, maternity and temporary disability to the territorial tax office. Payments for accidents and occupational diseases (injuries) are sent to the regional Social Insurance Fund.

The insured is any legal entity or individual who uses hired labor in their activities. Insurance payers include the following categories of policyholders:

- legal entities - commercial and non-profit organizations, budgetary institutions;

- individual entrepreneurs who pay remuneration to employees;

- individual entrepreneurs working for themselves;

- individuals who hire workers to meet their household needs.

IMPORTANT!

At the end of the reporting period, SV payers must provide information about accruals and payments made to regulatory authorities. Learn more about current reporting information.

What do you need to know?

Legal entities, organizations, and, of course, individual entrepreneurs need to know the current codes. KBK insurance contributions to the Pension Fund in 2021 for individual entrepreneurs for employees for compulsory pension insurance is necessary for everyone, so this issue is being studied especially carefully.

Related news:

- New land tax in 2021

- Subsidies for utility bills 2021 in Russia

- Changes to the simplified tax system in 2021

- Salary increase for postal workers in 2021 in Russia

- Benefits for large families in 2021

- Predictions about what awaits Donbass in 2021

Depending on the taxpayer category, different sets of payments may vary. For example, a legal entity pays tax on income in cash or in kind. An individual entrepreneur must pay for himself, as well as tax for each of his employees.

Individual entrepreneurs make cash contributions for themselves for health and pension insurance, and they must make the transfer to two addresses. One goes to the tax office, and the other to the Social Insurance Fund (this includes transfers for injuries).

When indicating a code in a payment document, it is very important to avoid inaccuracies or omissions. The point is that the risk of error here is not that the money that is paid under the KBK will not go where it should go. In this case, they will be listed as part of the unexplained income, and not only will the person lose money, the tax service will be able to charge him a penalty until the situation is resolved, which means that KBC insurance contributions to the Pension Fund for individual entrepreneurs for himself in excess of 300,000 rubles must be paid during.

KBK: patent tax system 2021

The patent is paid by entrepreneurs, choosing the BCC that corresponds to the type of budget.

| KBK | Decoding |

| 182 1 0500 110 | Patent tax credited to the budgets of city districts |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Patent tax credited to the budgets of municipal districts |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Patent tax credited to the budgets of federal cities of Moscow and St. Petersburg |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

CBC depending on the special assessment of working conditions (SOUT)

The entrepreneur is also obliged to accrue payments to the Pension Fund from the salaries of employees engaged in production technological processes, which provide the right to apply for an insurance pension ahead of schedule. The list of these works is contained in Part 1 of Article 30 of Federal Law No. 400-FZ of December 28, 2013. As for the BCC for payments to the Pension Fund of the Russian Federation, the additional coding tariffs differ not only depending on the harmfulness of the work, but also from the point of view of the fact that a special assessment of working conditions (SOUT) is carried out at such workplaces:

Table 4. For harmful and dangerous work.

| Contribution: | KBK: |

| In connection with the results of the SOUT: | |

| Next payment: | 182102 02132 061020 160 |

| Penya: | 182102 02132 062100 160 |

| Fine: | 182102 02132 063000 160 |

| Regardless of the results of the SOUT: | |

| Next payment: | 182102 02132 061010 160 |

| Penya: | 182102 02132 062110 160 |

| Fine: | 182102 02132 063010 160 |

Table 5. For particularly harmful and dangerous work.

| Contribution: | KBK: |

| In connection with the results of the SOUT: | |

| Next payment: | 182102 02131 061020 160 |

| Penya: | 182102 02131 062100 160 |

| Fine: | 182102 02131 063000 160 |

| Regardless of the results of the SOUT: | |

| Next payment: | 182102 02131 061010 160 |

| Penya: | 182102 02131 062110 160 |

| Fine: | 182102 02131 063010 160 |

Fixed contributions of individual entrepreneurs in 2021 for themselves

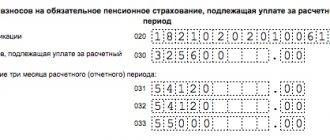

The amount of fixed payments to funds in 2021 for an entrepreneur is as follows:

- For compulsory pension insurance . Within the framework of the Tax Code (clause 1, clause 1, article 430), the amount of contributions is calculated differently depending on the annual income received. There are two categories: income does not exceed 300 thousand rubles per year and exceeds this amount.

To determine income, the following parameters are taken:

| Tax system | Business income |

| General tax regime | The tax base is determined from the conditions of clause 3 of Article 210 of the Tax Code and is the amount of income minus the amounts of tax deductions. If the amount of deductions exceeds the income received, then it is recognized as zero. |

| Simplified taxation system | The income of an entrepreneur is calculated according to the norms of Art. 346.15 Tax Code. |

| A single tax on imputed income | Imputed income is taken into account according to tax legislation (Article 346.29). |

| Unified agricultural tax | Income received in accordance with clause 1 of Article 346.5 of the Tax Code. |

In the event that the income from a citizen’s business or other activities for the year does not exceed the limit of 300 thousand rubles, the fixed payment for compulsory pension insurance in 2021 will be 32,448 rubles.

If the annual income received is more than 300 thousand rubles, the payment is calculated in the following order:

- the amount established by law is 32,448 rubles ;

- plus is calculated from it 1%.

Both amounts are summed up and are subject to payment to the Pension Fund.

There is a limit on the amount of insurance contributions for pension insurance. The calculated value cannot be more than 259,584 rubles , i.e. This is the maximum amount that can be relied upon for OPS.

- For compulsory health insurance. Its size is determined by the Tax Code (clause 2, clause 1, article 430) in the amount of 8,426 rubles . This is exactly how much, under any conditions, the entrepreneur is obliged to send to the fund in 2021.

Summarizing the total expression of mandatory payments to extra-budgetary funds from a citizen registered as an individual entrepreneur, it should be noted that from an annual income of no more than three hundred thousand rubles, transfer a fixed payment in the amount of 32,385 rubles .

| 2018 | 2019 | 2020 | |

| Pension Fund | RUR 26,545 | RUB 29,354 | RUB 32,448 |

| FFOMS | 5840 rub. | 6884 rub. | 8426 rub. |

| Total | RUR 32,385 | RUR 36,238 | RUR 40,874 |

Payers

In addition to the insurance premiums common to all employers, some also need to pay additional ones. This responsibility applies to:

- organizations and individual entrepreneurs where there is work in hazardous working conditions (clause 1 of article 428 of the Tax Code of the Russian Federation, clause 1 of part 1 of article 30 of the Federal Law of December 28, 2013 No. 400-FZ);

- employers whose employees work in difficult working conditions, in agriculture, on railway or public transport, in logging, in mining operations and in some other sectors of the economy (clause 2 of article 428 of the Tax Code of the Russian Federation, clause 2-18 Part 1, Article 30 of the Federal Law of December 28, 2013 No. 400-FZ).