Deadline for submitting the transport tax report for 2021

From January 2021, you no longer need to submit a transport tax return. The tax authorities will independently calculate the amount of tax payable and send you a notification.

ConsultantPlus experts explained in detail what to do if you have not received a tax message. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

The authority to calculate taxes was transferred to the fiscal authorities due to the fact that:

- The Tax Code of the Russian Federation (clauses 2.1, 3, Article 362) unambiguously defines the formula for calculating payment depending on real information about the availability of transport registered with the legal entity, and the base, rate and increasing/decreasing coefficients valid for each unit.

- The Federal Tax Service Inspectorate (taking into account the possibilities of interdepartmental interaction) has access to current information about vehicles registered to the taxpayer, and it is able to reliably assess the correctness of tax calculations.

We recommend that you check your tax accruals with the amount that you calculated and paid yourself. If they are equal, then the tax was calculated and paid correctly. If the amounts differ, check:

- the correctness of your tax calculation;

- accuracy of the information provided in the message (about the object of taxation, tax base, rate, etc.).

The tax payment deadline has also changed. It is no longer approved by local officials.

Find out exactly how tax payment deadlines have changed in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

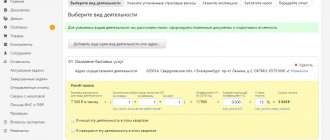

Rules for filling out the declaration

The form in which the transport tax declaration must be submitted was introduced by Order of the Federal Tax Service dated December 5, 2016 No. ММВ-7–21/ [email protected]

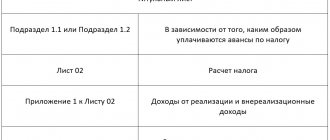

The tax report consists of the following parts:

- Title page.

- Section 1 “The amount of tax payable to the budget.”

- Section 2 “Calculation of the tax amount for each vehicle.”

The title page records the taxpayer’s parameters, which can be found in the organization’s constituent documentation.

These include:

- TIN and checkpoint of the organization;

- code of the time period for which the tax report is submitted;

- code of the tax authority in the specified territory;

- full name of the organization;

- code of the activity that is the main one.

The title page of the tax return must indicate the code of the period for which the document is presented.

Section 1 is filled out based on the calculations made and contains the following lines:

- 010 - KBK for tax;

- 020 - OKATO at the place of registration of the vehicle;

- 021 - indicator from line 250 of section 2 (this is the calculated amount of the fee);

- 023, 025, 027 - quarterly advance payments;

- 030 - the difference between the amount of the annual declaration and advance payments;

- 040 - is intended to indicate amounts that reduce the final amount of tax (for example, if there was previously an overpayment under the tax bill).

At the same time, section 1 contains three identical blocks in columns 020–040 for different OKTMO. This is relevant for organizations whose vehicles are not registered in the same territorial division.

Section 1 of the transport tax return records the amount of tax that must be paid to the budget.

The data entered in section 2 makes it possible to determine the final amount of tax to be paid.

Section 2 contains the following columns:

- 020 - OKTMO;

- 030 — vehicle code from the directory;

- 040–060 — vehicle characteristics;

- 070–080 - tax base and code of its unit of measurement from the directory;

- 090–100 — environmental class and number of years from the start of vehicle production (to be filled in only by payers in whose region a differentiated tax rate applies);

- 110 - number of months of useful use of the vehicle in the reporting year;

- 120 is a coefficient that is calculated by dividing the line 110 by 12;

- 130 — tax rate;

- 150–210 - these columns are intended for entering tax benefit parameters;

- 220 — calculation of the benefit amount (p. 070/p. 100*p. 160);

- 230 - the amount of tax payable to the budget (line 140 minus line 180 or line 140 minus line 200 minus line 220).

Section 2 of the tax return calculates the tax amounts for each vehicle.

Rules for filing a transport tax return:

- The total expression in the report form must be rounded to the nearest full ruble.

- The sheets of the form are numbered in order starting from the title page.

- It is unacceptable to make changes, corrections or corrections in a paper report.

- You can only fill out the document by hand using black, blue and purple ink and block letters.

- Only one alphabetic or numeric value is entered into each cell.

- Empty cells should be filled with dashes.

- Each sheet must be printed on a separate sheet.

- A damaged document will not be accepted.

If a legal entity does not own vehicles, there is no need to submit a tax report. A report with zero indicators is also not submitted to the FMS.

Checking the correctness of filling out the tax return

So that the Federal Tax Service does not have any questions when checking the transport tax return, and the taxpayer does not need to explain the discrepancy of any indicators in the future, it is necessary to carefully check the report before sending it to the Federal Tax Service. Many tax claims are related to discrepancies in document columns.

Possible errors when filling out such a declaration:

- underestimation or overestimation of the amount of transport tax that must be paid;

- the absence of a tax benefit code in the document, which may affect the amount of calculated tax;

- incorrect indication of the registration plate of the vehicle, as a result of which it is not possible to identify the object of taxation;

- taxpayer's TIN entry with an error;

- incorrect indication of the tax base, etc.

To help organizations, the Federal Tax Service has developed control ratios that allow you to check the correctness of filling out reports. The control ratios are contained in the letter of the Federal Tax Service of Russia dated March 3, 2017 No. BS-4–21/ [email protected] The document can be found here.

Using control relations in your work will make it possible to:

- understand whether the final tax amount is determined correctly or not;

- monitor all tax report indicators and correct shortcomings in a timely manner.

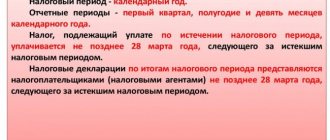

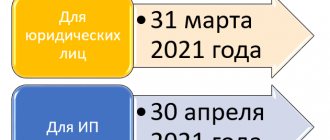

When to pay and report

Let us repeat that individuals do not submit a transport tax report in 2021. But private traders and organizations are required to report quarterly. In other words, the reporting period for TN is a quarter, but the tax period is a year. So, use a professional accountant’s calendar (transport tax 2020), submit your declaration no later than February 1 of the year following the reporting year.

Let us remind you that regional authorities have the right to cancel reporting periods. What does it mean? This means that when reporting periods are cancelled, companies will not be required to make advance payments for the tax liability, nor submit calculations for this tax liability.

So, the deadlines for paying transport tax in 2021 (accountant’s calendar) are set for each region separately. For example, one subject of the Russian Federation may establish quarterly deadlines for payment of the Labor Code, while another may completely cancel advance payments. However, the final payment for the year is the same for everyone - until February 1 of the next year.

Fines for violating deadlines for submitting declarations

Filing a declaration late will result in penalties being imposed on the organization. The amount of the fine will be 5% of the tax not paid on time. The Federal Tax Service will charge a fine for each month of delay, even if it is incomplete.

Fine amount:

- minimum - 1 thousand rubles;

- maximum - no more than 30% of the amount of tax not paid on time.

In case of delay, an official of the organization may be subject to administrative liability.

He may be at risk:

- warning;

- fine from 300 to 500 rubles.

More serious punishment awaits those guilty under Art. 199 of the Criminal Code. Here, evasion of payment is expressed in the form of failure to submit a declaration to the tax authority or entering invalid data into documents.

The head (including accountant) of an organization may face:

- fine from 100 thousand rubles;

- prohibition from holding office for the period specified in the sentence;

- imprisonment for a term of six years.

Transport tax is paid by all car owners, but only legal entities are required to submit a declaration on this tax to the FMS. The submitted document consists of a title page and two sections, which contain comprehensive information about the transport, its owner and the amount of tax calculated. The document is sent to tax authorities before February 1 of the year following the reporting period. If the management of an organization does not submit a declaration or does so untimely, it faces penalties or even more serious consequences.

- Author: ozakone

Rate this article:

- 5

- 4

- 3

- 2

- 1

(0 votes, average: 0 out of 5)

Share with your friends!

Deadlines for submitting reports to the Federal Tax Service and paying taxes for the 2nd quarter of 2021

Deadlines for submitting a VAT return and deadlines for paying VAT for the 2nd quarter of 2021. The VAT return must be submitted no later than July 25, 2021. VAT payment deadline for the 2nd quarter of 2021: July 25, 2021, August 27, 2018, September 25, 2021 (1/3 of the tax amount accrued for the 2nd quarter).

Deadlines for submitting reports and paying income tax for the 2nd quarter of 2021. The income tax return for the 2nd quarter of 2021 is submitted no later than July 30, 2021. The deadline for paying income tax for the 2nd quarter of 2021 is no later than July 30, 2021.

Deadlines for submitting the calculation of insurance premiums for the 2nd quarter of 2018. The calculation of insurance premiums for the 2nd quarter of 2021 is submitted to the Federal Tax Service no later than July 30, 2018.

Deadlines for submitting reports and paying taxes when applying the simplified tax system for the 2nd quarter of 2021. Organizations and individual entrepreneurs using the simplified tax system must pay an advance tax payment no later than July 25, 2018. Providing quarterly tax reporting under the simplified tax system is not provided.

Deadlines for submitting reports and paying taxes when applying UTII for the 2nd quarter of 2021. The UTII declaration sent no later than July 20, 2018. The UTII tax for the 2nd quarter of 2021 must be paid no later than July 25, 2021.

Deadlines for submitting 6-NDFL reports for the 2nd quarter of 2018. The calculation in form 6-NDFL for the 2nd quarter of 2021 must be sent no later than July 31, 2021.

Deadlines for submitting reports and paying property taxes for the 2nd quarter of 2021. The property tax return for the 2nd quarter of 2021 is submitted no later than July 30, 2021. Payers of property tax are companies with property on their balance sheet; the tax payment deadline is no later than July 30, 2021.

Deadlines for submitting a single simplified declaration for the 2nd quarter of 2018. The unified simplified tax return for the 2nd quarter of 2021 is submitted no later than July 20, 2021. This declaration is submitted only if at the same time: - there was no movement of funds in current accounts and at the cash desk; - there were no objects of taxation for the taxes for which they are recognized as payers.

Send reports to the Federal Tax Service via the Internet

Results

The frequency of reporting on transport tax is established by the Tax Code of the Russian Federation equal to a year. But starting from 2021, there is no need to declare tax. The tax authorities will calculate the amount of tax to be paid independently, based on data from interdepartmental interaction. The tax payment deadline has also changed.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.