Deadlines for submitting reports according to the simplified tax system

Declaration under the simplified tax system, as follows from Art.

346.23 of the Tax Code of the Russian Federation, taxpayers submit once a year after the expiration of the tax period. In paragraph 1 of Art. 346.19 of the Tax Code of the Russian Federation, the tax period according to the simplified tax system is defined as a period of 1 calendar year. The deadline for filing a return depends on the form in which the taxpayer exists:

- simplified organizations are required to submit a declaration no later than March 31 after the end of the year;

- For simplified individual entrepreneurs, the deadline for submitting a declaration under the simplified tax system is April 30.

These deadlines are set as deadlines, but they are subject to the general rule of postponing deadlines to a later date in situations where the last day of the deadline coincides with a weekend or holiday. These rules also apply for the deadline for submitting a declaration under the simplified tax system for 2020.

When should I submit a declaration under the simplified tax system for 2021? There are no special features here: the deadline for submitting a tax return under the simplified tax system in 2021 is determined according to the usual rules.

In accordance with these rules, the deadline for submitting a declaration under the simplified tax system for 2021 for both legal entities and individual entrepreneurs will coincide with the legally established date of 03/31/2021 and 04/30/2021, respectively.

A declaration under the simplified tax system must be submitted in another situation that has a special deadline for filing reports. This situation arises when the simplified taxation system is terminated before the end of the tax period and in the event of loss of the right to use this system. The declaration will need to be filed by the 25th day of the month following the quarter in which the relevant event occurred.

Tax period and deadlines for filing returns

The simplified taxation system reduces the tax reporting of small businesses to an annual declaration. Organizations submit it to the Federal Tax Service at their location, individual entrepreneurs - at their place of residence. The declaration is drawn up based on the results of the tax period, which for the simplified tax system is a calendar year (Article 346.19 of the Tax Code of the Russian Federation). The deadlines for filing a declaration with the Federal Tax Service are indicated in paragraph 2 of Art. 346.23 of the Tax Code of the Russian Federation:

- organizations - until March 31 of the year following the reporting year;

- individual entrepreneurs - until April 30 of the year following the reporting year;

- organizations and individual entrepreneurs that have ceased business activities - until the 25th day of the month following the month in which activities were ceased;

- organizations and individual entrepreneurs that have lost the right to the simplified tax system - no later than the 25th day of the month following the quarter in which the right to the simplified tax system was lost.

Submit electronic reports via the Internet.

The Kontur.Extern service gives you 3 months free of charge! Try it

Declaration according to the simplified tax system

The declaration under the simplified tax system is formed based on the results of work for the corresponding period. The data for it is taken from the book of income and expenses, which payers of the simplified tax system must maintain throughout the year, recording in it every fact of receiving income or making an expense.

The declaration form is frequently updated, so you need to regularly monitor its current version.

Find the form on which you need to fill out a declaration for 2021 in this article.

The declaration can be submitted to the tax authorities via telecommunication channels or in paper form (in person or via mail).

ConsultantPlus experts explained in detail how an organization should fill out a simplified taxation system declaration. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Find out how to fill out a simplified tax return if you have suffered a loss here.

Frequency of formation of simplified taxation system declaration

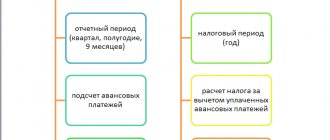

The tax period for the simplified tax system is the calendar year (clause 1 of article 346.19 of the Tax Code of the Russian Federation). But it distinguishes reporting periods, the duration of which is determined quarterly on an accrual basis and turns out to be equal (clause 2 of article 346.19 of the Tax Code of the Russian Federation):

- first quarter;

- half a year;

- 9 months.

Reporting periods are intended for calculating, based on their results, the amounts of advance payments payable to the budget (clause 3, clause 4 of Article 346.21 of the Tax Code of the Russian Federation). However, the filing of simplified taxation reporting for these periods is not provided for by law.

A report on the simplified tax system by a taxpayer who complies with all the restrictions that give the right to use this system is submitted once a year - based on the results of the past year (clause 1 of article 346.23 of the Tax Code of the Russian Federation). It consists of a declaration, the form of which is approved by Order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected]

This form is used regardless of which object for taxation is chosen by the taxpayer - income or income minus expenses. The object of taxation determines only the need to fill out a certain set of main sections of the declaration. Such a report will be required to be submitted even if the indicators requiring inclusion in its main sections have zero values.

However, submitting a declaration under the simplified tax system may also become an emergency. This happens in two cases:

- when the taxpayer stops conducting activities in respect of which the simplified tax system was applied (clause 2 of article 346.23 of the Tax Code of the Russian Federation);

- when a taxpayer, due to a violation of the requirements giving the right to use the simplified tax system, loses the opportunity to use this system (clause 3 of Article 346.23 of the Tax Code of the Russian Federation).

In both of these situations, the declaration will have to be submitted in the month following the month (in the first case) or quarter (in the second case) of the relevant event, drawing it up on the same form that is used for the annual report.

Deadlines for payment of simplified tax

Despite the absence of the obligation to report quarterly, payers of the simplified tax system must make independently calculated advance tax payments every quarter.

Find out the formula for calculating the advance payment here.

Advance payment under the simplified tax system for the 1st, 2nd and 3rd quarters must be made no later than the 25th day of the month following the reporting period.

The tax payment deadline for the 4th quarter coincides with the deadline for submitting the declaration and is made on the basis of its data. Thus, the date of tax payment for the 4th quarter of 2021 will coincide with the dates of submission of the declaration under the simplified tax system for 2021 and will fall, respectively, on 03/31/2021 (for legal entities) and 04/30/2021 (for individual entrepreneurs).

What is the deadline to submit a declaration and pay the simplified tax system if during the year an individual entrepreneur switched to self-employment without deregistering as an entrepreneur? The answer to this question is in ConsultantPlus. Check it out for free by getting trial access to the system.

Find out useful information about the deadlines for paying taxes and contributions on our website:

- “What is the deadline for paying property tax for individuals?”;

- “What is the deadline for transferring personal income tax in the report on Form 6-NDFL?”.

Accountant calendar 2021 simplified tax system

For convenience, we will present the deadlines for submitting the main reports in simplified form for 2021 in the form of a table and explain what to submit.

| Reporting | Period | Deadline | ||

| Organization | Individual entrepreneur with employees | Individual entrepreneur without employees | ||

Reporting to the Federal Tax Service | ||||

| Declaration according to the simplified tax system | year | no later than March 31 of the following year | no later than April 30 of the following year | |

| Financial statements | year | no later than 3 months after the end of the year | no need to submit reports | |

| Insurance premium report | quarter, half year, 9 months, year | no later than the 30th day of the month following the quarter, half-year, nine months, year | ||

| 6-NDFL | quarter, half year, 9 months, year |

| no need to submit a report | |

| 2-NDFL | year | no later than April 1 of the following year | no need to submit a report | |

| Information on the average number of employees | year | no later than January 20 of the current year - for the previous year | no need to submit a report | |

Reporting to the Pension Fund | ||||

| SZV-M | month | no later than the 15th of the next month | no need to submit a report | |

| SZV-STAZH | year | no later than March 1 of the following year | no need to submit a report | |

Reporting to the Social Insurance Fund | ||||

| Form 4-FSS | quarter |

| no need to submit a report | |

You will find the exact dates for submitting reports for “simplified people” in 2021 in the article “ Schedule for submitting reports in 2021. ”

If a company has taxation objects on the simplified tax system for the calculation and payment of land, transport, water tax or property tax based on the cadastral value, then reporting on them is submitted within the deadlines established by law.

Read also

15.08.2019

Penalty for failure to submit or late submission of a declaration

For missing the deadline for submitting a declaration, an individual entrepreneur or organization may be subject to tax liability in the form of a fine, the amount of which depends on whether there is tax to be paid, as well as on whether it was paid before the reporting is submitted.

So, if the tax was paid or if zero reporting is submitted, the fine will be 1,000 rubles.

If the tax is not paid, the fine will be 5% of the tax payable on the declaration for each month of delay, but not more than 30% in total.

That is, if according to the declaration the tax payable is 25,000 rubles. the fine for a month of delay will be equal to 1,250 rubles.

5 / 5 ( 2 voices)

Deadlines for submitting other mandatory reports to the simplified tax system

The remaining mandatory tax reports under the simplified tax system are related to the taxation of payments to individuals. These are various forms for personal income tax and contributions to extra-budgetary funds. By the way, for individual entrepreneurs all these reports can be considered conditionally mandatory. If an entrepreneur does not hire employees and does not enter into civil contracts with individuals, then he does not submit the reports listed below on personal income tax and insurance contributions.

When to submit reports under the simplified tax system:

- For 2021, forms 6-NDFL and 2-NDFL are submitted by enterprises and individual entrepreneurs making payments to individuals on old forms for the last time. From 2021, these forms are combined into one and submitted according to the rules for submitting form 6-NDFL. These forms are not always filled out, but only in cases where the payer must, in accordance with the law, perform the functions of a tax agent, that is, withhold and transfer personal income tax to the budget from payments made. Form 6-NDFL - during the year it is submitted quarterly on the last day of the month following the reporting quarter, at the end of the year it is submitted until March 1. During the same period - before March 1 - you must submit Form 2-NDFL to the Federal Tax Service (it is submitted once a year).

- The deadline for submitting calculations for contributions to the Social Insurance Fund in Form 4-FSS depends on whether it is submitted electronically or on paper. Employers whose number of employees does not exceed 25 people have the right to submit the form on paper. In paper form, 4-FSS is submitted quarterly throughout the year, before the 20th day of the month following the reporting period, and at the end of the year - before January 20. The electronic version of this report must be submitted by the 25th of the month following the billing period and by January 25, respectively.

- Currently, all payments to extra-budgetary funds (except for contributions to accident insurance) are administered by the tax authorities and a single report is submitted for them - calculation of insurance premiums. The deadline for submitting calculations under the simplified tax system is until the 30th day of the month after the end of the reporting quarter and until January 30 at the end of the year (generally established).

Starting with annual reporting for 2021, a new form of calculation for insurance premiums will be applied. Read what it looks like and how to fill it out in ConsultantPlus. You will receive even more relevant materials if you sign up for a free trial access to K+.

- The SZV-M report contains information about persons insured in the pension insurance system with whom the taxpayer has concluded employment or civil law contracts. It is submitted to the Pension Fund monthly, before the 15th of the next month.

Attention! From February 2021, policyholders are required to submit another monthly report to the Pension Fund - SZV-TD. Read more about it here. By February 15, 2021, all those who have not done this before must pass it.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Another reference report - information on the average headcount - is no longer provided from 2021. This information is included in the calculation of insurance premiums.

Deadline for submitting a report on the simplified tax system 2021 in case of loss of the right to simplification

If the established limits for restricting the use of the simplified tax system are violated, the organization (IP) loses the right to use the simplified tax system and must switch to the simplified tax system from the beginning of the quarter in which the violation of the requirements was committed (clause 4 of article 346.13 of the Tax Code of the Russian Federation).

If the right to a simplified tax regime is lost, a tax return under the simplified tax system is sent to the Federal Tax Service no later than the 25th day of the next month following the quarter in which the payer lost the simplified tax regime (clause 3 of Article 346.23 of the Tax Code of the Russian Federation).