What payments are individual entrepreneurs required to make?

Individual entrepreneurs, along with legal entities, pay taxes and fees, but with some differences:

| Payments | IP | Legal entities |

| Income tax | No | Yes |

| Taxes and fees under a production sharing agreement | No | Yes |

| Gambling tax | No | Yes |

| Organizational property tax | No | Yes |

| Property tax for individuals | Yes | No |

| Personal income tax | Yes | No (hold) |

| Insurance premiums | Yes | Yes |

| Taxes (depending on the tax system) | Yes | Yes |

| Voluntary payments | Yes | Yes |

Thus, there is a significant difference in the taxation of individual entrepreneurs and legal entities, but both are responsible for paying and meeting the deadlines for paying taxes.

Declaration on property tax of organizations

If an organization owns property (real estate) as an owner, it is obliged to submit a corresponding declaration and pay tax.

The main innovation regarding property tax is that from 2020, tax calculations for advance payments have been cancelled. Now organizations submit only declarations. The declaration form has changed.

The property declaration for 2021 must be submitted by March 30, 2020 (Article 386 of the Tax Code of the Russian Federation).

An electronic declaration is sent to the Federal Tax Service of companies with more than 100 employees (clause 3 of Article 80 of the Tax Code of the Russian Federation).

Individual entrepreneurs pay property tax as an individual; they do not submit reports.

What taxes do individual entrepreneurs working under special tax regimes pay?

An individual entrepreneur operating under a special tax regime must comply with the deadlines for paying taxes established by the tax legislation of the Russian Federation:

| Tax system | Tax payment deadline | Normative act |

| Simplified taxation system (STS) | Advance payments before the 25th day of the month following the reporting quarter: · April 25, 2021 · July 25, 2021 · October 25, 2021 · April 30, 2021 | Art. 346.21 Tax Code of the Russian Federation |

| Unified tax on imputed income (UTII) | By the 25th day of the month following the reporting quarter: · April 25, 2021 · July 25, 2021 · October 25, 2021 · January 25, 2021 | Article 346.32 of the Tax Code of the Russian Federation |

| Unified Agricultural Tax (USAT) | For 2021: until April 02, 2021 For 2021:

| Article 346.9 of the Tax Code of the Russian Federation |

| Patent tax system (PTS) |

| Art. 346.51 Tax Code of the Russian Federation |

simplified tax system

Experienced accountants know that working with the simplified tax system is much easier. And all because simplifiers do not pay the most difficult taxes to calculate: VAT, income tax and property tax. Only in exceptional cases can simplifiers become payers of these taxes (clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

All workers and employees must submit data on insurance premiums. This means that they, just like companies on OSNO, will submit insurance premium payments to the Federal Tax Service in 2020.

Simplified workers also submit to the Federal Tax Service information on the average number of employees, accounting statements and income reports of employees and other individuals. persons according to forms 2-NDFL and 6-NDFL.

Land and transport taxes are paid by those companies that have these taxable objects.

The deadlines for mandatory reporting have already been given above for the general regime.

A specific report in this case is the annual declaration under the simplified tax system.

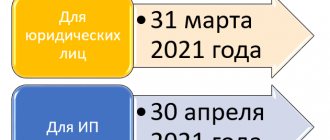

In order to meet the deadlines, companies must send taxes for 2021 to the inspectorate’s bank account and declare their activities by 03/31/2020 (Article 346.23 of the Tax Code of the Russian Federation), and individual entrepreneurs by 04/30/2020 inclusive.

Simplified tax advances are transferred to the account of the Federal Tax Service (Clause 7, Article 346.21 of the Tax Code of the Russian Federation):

- until April 27 inclusive - for the 1st quarter of 2021;

- until July 27 inclusive - for the 1st half of 2021;

- until October 26 inclusive - for 9 months of 2021.

What taxes do individual entrepreneurs working for OSNO pay?

Individual entrepreneurs who have chosen the general taxation system are required to pay taxes within the following deadlines:

| Type of tax | Tax payment deadline | Normative act |

| Personal income tax (NDFL) | For 2021: until July 16, 2021 For 2021:

| Art. 228 Tax Code of the Russian Federation |

| Value added tax (VAT) | No later than the 25th of the next month | Article 174 of the Tax Code of the Russian Federation |

| Tax on property involved in income-generating activities | For 2021: until December 01, 2021 For 2021: until December 01, 2021 | Art. 409 Tax Code of the Russian Federation |

Income tax return

In fact, income tax is calculated and reported once a quarter. Since the profit tax is considered a cumulative total, the reporting will not be quarterly, but for the first quarter, half a year, 9 months and a year (Article 285 of the Tax Code of the Russian Federation). During reporting periods, advance payments are made, and at the end of the year, the taxpayer sends to the treasury a tax reduced by previously paid advances (Article 287 of the Tax Code of the Russian Federation). There is no need to pay tax at all if the organization operates at a loss.

In 2021, the same deadlines for sending the declaration have been retained (Article 289 of the Tax Code of the Russian Federation):

- until March 30 inclusive - for 2021;

- until April 28 inclusive - for the 1st quarter of 2021;

- until July 28 inclusive - for the 1st half of 2021;

- until October 28 inclusive - for 9 months of 2021.

But reporting for 2021 should be submitted no later than March 29, 2021 (provided that the legislator does not change the deadlines for annual reporting).

The frequency of advance payments directly depends on the company’s income. When the average income for the quarter exceeds 15 million rubles, you should report and pay advances every month (clause 3 of Article 286, Article 287 of the Tax Code of the Russian Federation).

The profit declaration must be submitted electronically if the company employs more than 100 people. In other cases, it is permissible to report on paper (clause 3 of Article 80 of the Tax Code of the Russian Federation).

Individual entrepreneurs do not submit income tax returns. Entrepreneurs are assigned a separate form - 3-NDFL. For 2021, these reports must be submitted by 04/30/2020.

Deadlines for paying taxes for individual entrepreneurs in 2021

In 2021, individual entrepreneurs pay taxes and insurance premiums within the following deadlines:

| Payment type | Payment deadline | Normative act |

| Fixed payments for compulsory pension insurance and compulsory health insurance | Until December 31, 2021 | Article 432 of the Tax Code of the Russian Federation |

| Additional payments for compulsory pension insurance (if income exceeds 300,000 rubles) | Until July 01, 2021 | Article 432 of the Tax Code of the Russian Federation |

| Property tax for 2021 | Until December 01, 2021 | Article 409 of the Tax Code of the Russian Federation |

| Excise taxes | Until the 25th day of the month following the reporting month | Article 204 of the Tax Code of the Russian Federation |

| Mineral extraction tax | Until the 25th day of the month following the reporting month | Article 344 of the Tax Code of the Russian Federation |

| Water tax | Until the 20th day of the month following the reporting quarter | Article 333.14 of the Tax Code of the Russian Federation |

| Trade fee | Until the 25th day of the month following the reporting quarter | Article 417 of the Tax Code of the Russian Federation |

| Fee for the use of fauna objects | Until the 20th of the current month | Article 333.5 of the Tax Code of the Russian Federation |

| Personal income tax (for yourself) | Advance payments are paid on the basis of tax notices: 1) for January – June – no later than July 15, 2021 in the amount of half the annual amount of advance payments; 2) for July - September - no later than October 15, 2021 in the amount of one fourth of the annual amount of advance payments; 3) for October - December - no later than January 15, 2021 in the amount of one fourth of the annual amount of advance payments. | Article 227 of the Tax Code of the Russian Federation |

| Personal income tax (for employees) | No later than the first working day after payment of wages to employees (in the case of payment for sick leave or vacation pay - no later than the last day of the month when payments were made) | Article 226 of the Tax Code of the Russian Federation |

| Contributions for injuries | No later than the 15th day of the month following the month of payment of wages | Art. 431 Tax Code of the Russian Federation |

The individual entrepreneur worked in the period from 03/30/2020 to 05/11/2020

Mandatory payments for individual entrepreneurs

If the entrepreneur worked during the pandemic, then the timing

Insurance payments of individual entrepreneurs intended for the Pension Fund and the Compulsory Medical Insurance Fund in 2020 are divided into two parts and paid to the Federal Tax Service:

- First, before July 1, 2021, the variable part of contributions for 2021 is paid for income exceeding RUB 300,000.

- Then, by December 31, 2021, you need to pay the fixed part of the contributions to the Pension Fund and the Compulsory Medical Insurance Fund for 2021.

Property payments for 2021 (real estate for personal use, transport, land) are paid by individual entrepreneurs if such property is available until December 2, 2021 based on a notification from the Federal Tax Service.

Excise taxes, mineral extraction tax, water, payments for the use of wildlife objects are paid by individual entrepreneurs only if there are grounds for such payments. In this case, the payment deadlines for them during the year are as follows:

- Excise taxes, mineral extraction tax - until the 25th day of the month following the reporting month.

- Water tax - until the 20th day of the month following the reporting quarter.

- Trade fee - until the 25th day of the month following the reporting quarter.

- The fee for the use of wildlife objects is monthly until the 20th day of the current month and the first 10% payment upon receipt of a permit.

Payment of taxes and contributions on payments to employees is made within the following terms:

- Personal income tax - no later than the first working day following the day of actual payment of income (except for vacation and sick pay - the tax on them must be paid no later than the last day of the month of issuance of these payments);

- insurance premiums for compulsory health insurance, compulsory medical insurance and compulsory health insurance from VNiM - no later than the 15th day of the month following the month of income accrual;

- insurance premiums for injuries to the Social Insurance Fund - no later than the 15th day of the month following the month of income accrual.

Taxes paid by individual entrepreneurs under OSNO

The tax payment deadlines for individual entrepreneurs who have chosen the OSNO tax system are as follows:

- Personal income tax. For 2021, the tax must be paid by July 15, 2020. Advance payments for 2021 are paid in 3 payments on new dates: until April 27, 2021 for the 1st quarter, until July 27, 2020 for the half-year, until October 26, 2021 for 9 months.

- VAT is paid monthly until the 25th.

- The tax on property used in business activities for 2021 is paid within the same period established for payment of tax on personal property of individual entrepreneurs (December 2, 2020), based on a notification received from the Federal Tax Service.

Features of individual entrepreneur payments in special modes

The use of any of the special regimes (STS, UTII, PSN, Unified Agricultural Tax) exempts individual entrepreneurs from paying personal income tax, VAT and property tax used for business purposes (except for those assessed at cadastral value). These taxes under each of the special regimes are replaced by one payment (single tax), which has its own payment deadlines:

- Simplified tax system - during the year, advance payments for the previous quarter are paid by the 25th day of the next month. In 2021, taking into account weekend transfers, these will be: April 27, July 27 and October 26. The deadline for paying tax for 2021 is April 30, 2020; 2021 - April 30, 2021. If during the year the activity on the simplified tax system is terminated, then the final payment must be made before the 25th day of the month following the month of termination of the application of the simplified tax system.

- UTII - payments are made quarterly based on the results of the quarter by the 25th day of the next month. For the 4th quarter of 2019, payment must be made by January 25, 2021. For payments for 2020, these dates will be: April 27, July 27, October 26, 2020, January 25, 2021.

- Unified Agricultural Tax - payments in 2021 and according to its results there will be three. Payments for 2019 must be made by March 31, 2021. And for 2021 you have to pay twice: an advance payment (until July 27, 2021) and a final payment (until March 31, 2021). If during the year the activity on the Unified Agricultural Tax is terminated, then the final payment must be made before the 25th day of the month following the month of termination of the use of the Unified Agricultural Tax.

- PSN - for a patent issued for a period of less than 6 months, you can make 1 payment (until the expiration of the patent). If the patent is valid from 6 to 12 months, then it is paid in two payments: 1/3 of the amount - no later than 90 calendar days from the start of the patent, the balance - no later than the end of its validity.

How to choose a special regime for individual entrepreneurs, read the material “UTII or simplified tax system: which is better – imputed or simplified?”

When combining regimes, taxes must be paid within the time limits corresponding to each tax payable.

How to combine UTII and simplified taxation system as an individual entrepreneur, read the article “Features of combining the UTII and simplified taxation system modes at the same time .

Voluntary payments to individual entrepreneurs

An individual entrepreneur can voluntarily pay contributions to the Social Insurance Fund, subject to appropriate registration with the fund. The payment to the Social Insurance Fund will be calculated depending on the minimum wage, but at a rate of 2.9%. Payment for 2021 is also made no later than December 31, 2021 for the current year.

Responsibility for violation of deadlines for payment of taxes by individual entrepreneurs

Responsibility for violation of tax payment deadlines is provided:

| Violation | Penalties |

| Conducting business activities without registration | 10% of income (at least 40,000 rubles) |

| Violation of deadlines for filing an application for tax registration | 10,000 rubles |

| Violation of deadlines for submitting tax returns | 5% of taxes (at least 1,000 rubles) |

| Violation of tax payment deadlines | 20% of the tax amount (in case of intentional non-payment of tax 40% of the tax amount) |

Insurance premiums for individual entrepreneurs “for themselves”

An individual entrepreneur must pay insurance premiums “for himself” (fixed payments) under any taxation system, even if he does not conduct any activity and does not receive any profit. If an individual entrepreneur works alone (without employees), then he must pay contributions only “for himself.”

During 2021, an entrepreneur needs to make 2 payments:

| For pension insurance | For health insurance | Total |

| RUB 32,448 | RUB 8,426 | RUB 40,874 |

Also, individual entrepreneurs whose annual income for 2021 will be more than 300,000 rubles will have to pay an additional 1% of the amount of income exceeding these 300,000 rubles until July 1 of the next year.

For more details, see the page about fixed payments for individual entrepreneurs.

Questions and answers

- I am an individual entrepreneur operating under the general taxation system. In order to pay personal property tax, do I need to wait until I receive a notification from the Federal Tax Service?

Answer: In order to pay the property tax for individuals, you need to wait until you receive a notification from the Federal Tax Service, and then pay the tax.

- If I missed the deadline for paying taxes by 2 days, will a fine be imposed?

Answer: In accordance with the tax legislation of the Russian Federation, if the tax is not paid within the specified period, the tax is considered unpaid, and therefore a fine and penalties are assessed. Even 2 days specified by you will be considered as a violation of the tax legislation of the Russian Federation.

UTII

It is easier for companies and individual entrepreneurs to maintain tax records in this special regime, because the legislation allows them not to pay a number of taxes: on profit, on property and VAT (clause 4 of Article 346.26 of the Tax Code of the Russian Federation). Other taxes are paid on a general basis.

In addition to standard reports (see the list in the example about OSNO), impostors fill out a UTII declaration and send it to the Federal Tax Service:

- until January 20 inclusive - for the 4th quarter of 2021;

- until April 20 inclusive - for the 1st quarter of 2021;

- until July 20 inclusive - for the 2nd quarter of 2021;

- until October 20 inclusive - for the 3rd quarter of 2021.

Advance payments are made quarterly by the 25th day of the month following the reporting period.

The company will lose the right to UTII if the number of employees exceeds 100 people (clause 1, clause 2.2, article 346.26 of the Tax Code of the Russian Federation).

Organizations and individual entrepreneurs who employ employees submit orders of magnitude more reports than companies without employees. To avoid getting confused about reporting deadlines, use this reporting calendar.