Each organization, after passing the registration procedure with the Federal Tax Service, forms an initial capital, called authorized capital.

Its minimum amount is 10,000 rubles. The founders independently determine the amount of the company's authorized capital and fix the value in the statutory documents. Next, the management company must be reflected in the accounting records of the company, for which account 80 is used, which is called “Authorized capital”.

What account is the LLC's management company reflected in?

The amount of the authorized capital reflected in the charter of a registered limited liability company must be taken into account in the accounting department of the enterprise.

In accordance with the Plan, account 80 is provided for accounting for the share capital of an LLC.

The posting for the formation of the management company is carried out once on the date of registration of the constituent documents by the tax authority.

Changes to Article 80 are made only in two cases:

- Liquidation of an organization - accounting when closing an LLC.

- Change in the size of the authorized capital (decrease or increase).

HIGHLIGHTS OF THE WEEK

01/30/20216:18 Special modes

Answers to questions from the Federal Tax Service for individual entrepreneurs on a patent

02.02.202110:57

Checks

Consolidated inspection plan for 2021 published

03.02.202115:11

Personnel

A new “coronavirus” payment has been established

01.02.202112:00

Personnel

Amounts of child benefits for 2021. Table

01.02.202110:01

Special modes

Reduce the patent for contributions: a notification form has appeared

PODCAST 4.12.2020

What has changed in taxes and reporting since 2021?

All episodes

Comments on documents for an accountant

Workers in “harmful” jobs are idle: should they pay additional tariff contributions?

02/05/2021 If employees performing work under dangerous and difficult conditions are idle, payments for this…

Payment for employee meals is free of insurance premiums

02/05/2021 If subsidies for employee meals are of a social nature, insurance premiums need not be paid...

Is it possible to apply NAP when assembling and selling computer systems?

02.02.2021 Federal legislation establishes a list of types of activities for which it is permitted to use...

‹Previous›Next All comments

Characteristics - subaccounts, what is accounted for as debit and credit?

In accordance with the Accounting Plan, account 80 is intended to reflect information about the amount of the organization’s authorized capital (share capital), its changes in the course of the enterprise’s activities.

The balance of account 80 must always correspond to the amount of the capital reflected in the constituent documents of the company. If the amount of capital changes, then information about the new amount must be reflected both in the charter of the LLC and in accounting account 80.

That is, at any point in time, the amount indicated on account 80 must be equal to the Criminal Code from the charter.

For an LLC, the minimum authorized capital is 10,000 rubles; the enterprise can, at its own discretion, form a larger charter capital.

Account 80 is passive - intended for accounting for liabilities - authorized capital. Its amount is always reflected on the loan; the balance of account 80 is always in credit.

Limited liability companies do not open subaccounts on account 80. The exception is production cooperatives, which can open the following subaccounts:

- 80-1 – Mutual fund;

- 80-2 – Collective fund.

Sub-accounts can also be opened by joint-stock companies:

- 80-1 – Common shares;

- 80-1 – Preferred shares.

Analytics for the 80-account can be organized by founders.

Characteristics of account 80

The economic function of the register is an initial investment to ensure the activities of newly created companies and a minimum guarantee secured by property to partners in the event of the enterprise’s failure to fulfill its obligations. Depending on the organizational and legal form of legal entities, the balance of account 80 must correspond to:

- The total value of shares issued at the moment of registration by the joint-stock company at par price;

- The authorized capital of state and municipal organizations;

- Share capital of simple partnerships;

- Initial capital of limited liability companies;

- Mutual fund of commercial and non-profit cooperatives.

Which count of 80 is active or passive? The financial essence of active accounting registers is to display information about the funds that an organization can operate, and passive ones are to show the sources of these assets. Since the economic purpose of the authorized (share, share, joint stock) capital is an accumulator of monetary and material values for the purpose of further use, it can be argued that account 80 refers to passive registers.

Legislatively, for commercial private and government structures, a minimum amount of initial investment is established, which must be paid in cash or non-cash money (Article 66.2 of the Civil Code of the Russian Federation):

| Amount, thousand rubles | Type of enterprise |

| 300 000,00 | Banks |

| 90 000,00 | Credit institutions |

| 120 000,00 | Insurance organizations |

| 100 00,00 | PJSC |

| 10,00 | LLC, JSC, production cooperatives |

| 39,000.00 (from 07/01/2017) | Unitary institutions |

If the authorized capital is accepted by the founders in a larger amount, then the excess over the minimum can be contributed by other assets.

Accounting

Since the authorized capital is a liability, it should be taken into account as a credit to the passive account 80.

Accounting of the authorized capital includes the reflection of entries in account 80 in the following cases:

- formation of a management company upon registration of a company;

- increase in capital;

- reduction of the Criminal Code;

- closure of the company (liquidation).

All entries in account 80 are reflected on the dates of state registration of changes by the tax authority.

The first entry is reflected on the date of state registration of the company, while account 80 corresponds with account 75 “Settlements with founders”.

The wiring looks like this:

- Dt 75.1 Kt 80 – entry to reflect the founder’s debt on the contribution to the management company of the LLC.

Next, the accounting records reflect the entries for making contributions as they are received, depending on the method of payment for the share, account 75 corresponds from the asset account (property, money).

During the activities of the organization, postings to account 80 can only be reflected if its value changes.

This procedure is also carried out by the state. registration of changes with the tax authority. The posting can only be reflected on the registration date, not earlier.

The increase in capital is reflected by the following transactions:

- Dt 84 Kt 80 – authorized capital increased due to retained earnings at the end of the year;

- Dt 83 Kt 80 – the capital is increased due to additional capital;

- Dt 75.1 Kt 80 – The Criminal Code is increased due to additional contributions from the founders (current or new).

A decrease in the capital is reflected by the following entries:

- Dt 80 Kt 75.1 – Criminal Code is reduced by reducing the share of the LLC participant (or its repayment upon exit);

- Dt 80 Kt 81 – Criminal capital is reduced due to the repayment of the company’s own share;

- Dt 80 Kt 84 – Criminal Code reduced as required by law.

If no changes are made to the authorized capital, then the account 80 will only have to be encountered when closing the LLC. In this case, account 80 should be closed and the founders should be returned the value of their shares.

When liquidating an LLC, the following entries are reflected in the accounting records:

- Dt 80 Kt 75.1 – reflects the amount of the capital to be distributed among the founders of the LLC, is carried out for the entire amount of the authorized capital.

Postings

Below is a table showing typical accounting entries for account 80:

| Operation | Debit | Credit |

| When registering an LLC | ||

| The authorized capital of the LLC has been formed - the debt of the founders to the organization is reflected | 75.1 | 80 |

| With an increase in the Criminal Code | ||

| Reflected increase in capital at the expense of LLC property (profit) | 84 | 80 |

| The increase in capital due to the additional fund is reflected | 83 | 80 |

| The increase was taken into account due to additional contributions from the founders of the LLC | 75.1 | 80 |

| When decreasing the capital | ||

| The decrease in the capital due to the withdrawal of the participant and payment of his share is reflected | 80 | 75.1 |

| A decrease in the capital due to a decrease in the value of the founders’ shares is reflected | 80 | 75.1 |

| The reduction in capital due to the redemption of the LLC’s own shares was taken into account | 80 | 81 |

| Reduction of the capital due to compliance with the law (when the value of assets has become less than the capital or not all contributions are made on time) | 80 | 84 |

| Upon liquidation of an LLC | ||

| The organization's debt to the founders in connection with the liquidation of the company is reflected | 80 | 75.1 |

What should the balance be?

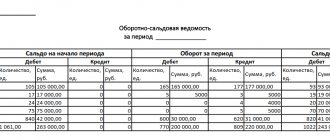

Account balance 80 is always a credit balance. Moreover, at any given time it must clearly correspond to the size of the authorized capital reflected in the charter of the LLC.

If the Criminal Code changes, changes must be made to the charter, which entail an adjustment to the balance of account 80.

Postings on account 80

The first entries in the accounting department will be transactions related to the formation of initial investments for starting business activities - Dt 75 Kt 80: the size of the authorized capital of LLC, cooperatives, or the par value of shares of JSC and PJSC is reflected in accordance with the decision of the founders No. 1 (“On the creation of an organization”) and the debt of the participants to the enterprise has been accrued.

In the process of conducting business activities by the enterprise, the balance of account 80 remains a credit and is reflected in the balance sheet on line 1310. For interested parties (investors, banks, partners), the indicator is important: it participates in the analysis of the financial solvency of the company as a variable for deriving coefficients for determining solvency.

In simple partnerships, account 80 is formed, bypassing the intermediate 75 “Settlements with founders”, that is, it is credited directly to the registers for recording valuables. Example – fixed assets and working capital received from participants:

| Debit | Credit | Sum |

| 01 | 80 | 10 000 000,00 |

| 51 | 80 | 5 000 000,00 |

During the operation of the companies, by the decision of the participants, the initial property is increased or decreased (but not less than the legally approved norm). Changes occur due to:

- With additional issue of securities;

- A fall in the par value of shares or their reduction;

- Acceptance of new members or exit of founders;

- Distribution of profits, covering losses;

- The excess of the authorized capital over the volume of net assets.

Typical transactions for account 80 in case of increasing the original size:

| Debit | Credit | Operation |

| 75 | 80 | Additional cash or property deposits, shares |

| 83 | 80 | As a result of the revaluation of foreign currency and non-current assets, additional funds were formed, by the amount of which the authorized capital was increased. |

| 84 | 80 | Profit distributed |

Account 80 “Authorized capital” records debit entries in the event of a decrease in the amount of the initial investment in correspondence with the registers:

- 81 – acquisition by the company of its own securities from participants and their redemption;

- 84 – compensation for losses received at the end of the reporting period;

- 75 – reduction in the nominal value of shares of founders’ contributions or shares, seizure of property of unitary enterprises;

- 01 - return of fixed assets contributed in the form of contributions from a simple partnership, production cooperatives, non-profit structures.

Increase in capital

The Criminal Code can be increased in the following cases:

- changes in the organizational and legal form of a legal entity or type of activity to those requiring a larger capital amount;

- the owners make a decision about this.

An increase becomes possible only with full payment of the initially formed capital stock and registration of changes in the amount of the capital stock in the charter. PJSC and JSC that have already placed all the shares declared in the charter capital, after registering the changes made to the charter, will have to register an additional issue or conversion of shares with the Federal Financial Markets Service, and then with the Federal Tax Service, within 3 months from the date of the decision to increase the charter capital.

An increase is possible in the following ways (with appropriate accounting entries):

- Admission of a new participant and increase in the authorized capital for his share (in LLC and HT): Dt 75 Kt 80.

- Making additional contributions by previous participants (in LLC, SUE, MUP, HT): Dt 75 Kt 80.

- Increasing the share due to retained earnings or additional capital (in LLC, SUE, MUP, HT): Dt 83, 84 Kt 80.

- Additional issue of shares of the same par value at the expense of additional contributions from shareholders or other persons (in PJSC and JSC): Dt 50 (51, 52, 70, 75) Kt 80.

- Increasing the par value of shares due to retained earnings or additional capital (in PJSC and JSC): Dt 83 (84) Kt 80. In this case, shares of one par value are replaced with shares of a different par value.

Personal income tax must be withheld from the amount of increase in the individual’s share at the expense of profit (letter of the Ministry of Finance of Russia dated February 21, 2013 No. 03-04-05/4-117). If the capital increases due to the revaluation of the capital or as a result of the reorganization of a legal entity, then such income from individuals will not be taxed (clause 19 of article 217 of the Tax Code of the Russian Federation).

Participants (shareholders) - legal entities, when their contribution to the capital company increases, does not generate income subject to income tax (subclause 15, clause 1, article 251 of the Tax Code of the Russian Federation, resolution of the Federal Antimonopoly Service of the Volga District dated February 16, 2009 No. A65-11409/ 2006).

Authorized capital – depositing funds into the current account and cash register

The easiest way to make a deposit is to pay it in money: to a current account or to a cash desk. For foreign participants, payment to a foreign currency account is acceptable.

Postings for contributions to the authorized capital in cash will be as follows:

- at the payee: Dt 50 (51, 52) – Kt 75;

- for the Russian founder: Dt 76 – Kt 50 (51).

Find out how to determine the amount of authorized capital in ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.