What is account 69 in accounting

69 accounting account is a tool used to accumulate information on accruals and payments for all types of personnel insurance. It is located in Section VI “Calculations” of the Chart of Accounts for accounting of the financial and economic activities of the organization.

Extra-budgetary funds of the Russian Federation

In 2021, contributions to state funds are set in the following amounts (without benefits):

- FFOMS - 5.1%;

- PFR - 10% (above the maximum base of 1.1 5 million rubles) and 22% (up to the maximum base of 1.15 million rubles);

- FSS - 0% (above the maximum base of 865 thousand rubles) and 2.9% (below the maximum base of 865 thousand rubles).

Balance characteristics

The initial and final indicators of the balance sheet are very important information that reveals the real state of affairs regarding social contributions.

The debit balance of account 69 displays the following:

- The total amount of debt owed by debtors for payment of the Unified Social Tax is the funds transferred to the employee from the Social Insurance Fund.

- Displays the procedure for receiving money for payment of social tax to budget-type funds.

- Records the fact of payment of social benefits from state insurance authorities.

At the end of the balance, the amount of total debt of state funds to the organization is indicated. The reason for the appearance of a balance at the end of the reporting year is the excess payment of insurance premiums, which must be transferred back to the company’s account or if an overpayment under the Unified Social Tax is revealed.

In the case of a loan, information about the calculation of social insurance contributions is displayed. If there is a balance on the account at the beginning of the period, this indicates the presence of an outstanding debt to pay the Unified Tax.

Due to the fact that the balance for each subaccount has its own display, you can easily find out which payments were not made.

At the end of the period, the credit balance of account 69 indicates the amount of total debt for contributions to the budget and the Pension Fund. After the calculations, all information is transferred to the liability section of the balance sheet and recorded in the financial reporting documents of the enterprise.

Characteristics of account 69

On the account 69 reflects information not only on the accrual and payment of monthly payments to state funds, but also penalties and penalties imposed for late and non-payment.

Debit 69 of the account shows the amounts of paid contributions to compulsory medical insurance, the Pension Fund of the Russian Federation and the Social Insurance Fund, funds that are reimbursed to employees of the enterprise upon the occurrence of an insured event, as well as overpaid amounts that were returned by state funds. For loan 69, you can control the accrual of installments that are payable, as well as penalties and fines for late payments.

You can determine whether account 69 is active or passive after analyzing its balance at the beginning and end of the reporting period. Such a balance can show both an overpayment and arrears of payments, therefore it can be a credit or debit, respectively, defining account 69 as active-passive.

Scheme 69

The debit balance reflects the debt incurred by government agencies to the organization. It arises as a result of overpaid insurance premiums and is subject to refund. The emergence of a credit balance occurs as a result of the formation of amounts of accrued but not yet paid contributions. Due to the fact that balances are displayed in the context of subaccounts, you can immediately determine which payments have not been made.

The accounting department of the enterprise has the right to include all accrued contributions as indirect, direct or other costs, depending on the type of settlement with personnel on the basis of which the contributions were paid. Thus, the accrued amounts of payments reduce the taxable profit of the enterprise.

The amounts of insurance payments are accrued monthly when making settlements with personnel, and payment of accruals made is carried out until the 15th of the next month.

Accounting entries with account 69

There are not so many transactions in which the designated account can be used. The PBU presents the following operations:

| Debit correspondence | Loan correspondence | the name of the operation |

| 69 | 51/52/55 | The accrued amount of contributions is transferred from the current account to a specific department |

| 69 | 70 | The employee has received sickness benefits, maternity benefits, or other social benefits |

| 99 | 69 | Penalties are charged for late amounts transferred |

| 73.03 | 69 | Penalties were withheld for the payment of insurance premiums from company employees guilty of violation |

| 51/52 | 69 | The amount credited to the account as an excess of the company's expenses for social benefits to employees |

In the balance sheet, the balance of account 69 is reflected in the section of settlements with debtors and creditors. The account balance is included in the total cost.

Existing subaccounts 69

Account 69, the sub-accounts of which reflect data in the context of state funds receiving payments, shows the accrued and paid amounts of contributions:

- 69-01 - an account for reflecting social insurance payments that are paid to the Social Insurance Fund.

- 69-02 - accounting for pension accruals in favor of the Russian Pension Fund. Depending on the activity of the enterprise, additional sections may be opened on this sub-account to reflect information on contributions for additional payments to certain categories of employees, for example, aviation workers, coal industry organizations, and those employed in work with harmful or difficult working conditions.

- 69-03 - accounting for payments for compulsory health insurance for employees. The subaccount is divided into payments to the Federal Compulsory Medical Insurance Fund and the territorial one.

- 69-07 - contributions to the funded part of the pension, made on the basis of the employee’s application.

- 69-08 - employer contributions for employees to private medical centers.

- 69-11 - an account for accrual (expense) of amounts for insurance against occupational diseases or industrial accidents in favor of the Social Insurance Fund.

Attention! If an enterprise has relationships with other extra-budgetary funds, then accounting provides for the possibility of opening other sub-accounts to simplify the accounting of transactions.

Subaccounts 69

What types of accounting accounts are there?

4 September 2015 lazareva Views:

The accounting account is intended to summarize information about the organization’s property and liabilities. Each account is designed to reflect information about a specific type of property or liability. You can read more about what an account is and why you need it in this article.

There are a total of 99 accounts, the description of which is given in the Chart of Accounts. All 99 accounts are divided into active, passive and active-passive.

Read below about the distinctive features of these accounts.

Correspondence of account 69 with other accounts

Account 69 in most cases corresponds with the accounts on which the calculation of wages is reflected (in relation to deductions made from the enterprise’s funds). However, correspondence is also possible with accounts that record profits and losses, expenses and income of the enterprise. This is the count. 99, and correspondence with him reflects the accrual of fines issued and penalties incurred for late payments and non-payments.

Correspondence under debit 69 occurs with the following accounts:

- Section V “Cash” - 50, 51, 52, 55. In this case, the entries reflect transactions carried out with the company’s money in any form: cash and non-cash located on the company’s current, foreign currency or special accounts.

- Section VI “Calculations” - 70. This is the main corresponding account reflecting calculations for personnel wages.

Correspondence for loan 69 occurs with the following accounts:

- Section I “Non-current assets” - 08.

- Section III “Production Costs” - 20, 23, 25, 26, 28, 29. The accounts correspond to the calculation and payment of insurance premiums for workers of various types of production, depending on the specialization of the enterprise.

- Section IV “Finished products and goods” - 44 (for trade workers).

- Section V “Cash” - 51, 52. In this case, transactions carried out with non-cash funds in the current and foreign currency accounts of the enterprise are reflected.

- Section VI “Calculations” - 70, 73. These are the main corresponding accounts, reflecting calculations for wages and other transactions with personnel.

- Section VIII “Financial results” - 91, 96, 97, 99.

Main correspondence

Typical transactions for account 69

The main entries for account 69 “Calculations for social insurance and security” are discussed in the table:

| Account Dt | Kt account | Wiring Description | A document base |

| 69 | 51/52/55 | Transferring payments through a bank | Payment order |

| 69 | 70 | Calculation of benefits to an employee from extra-budgetary funds (illness/work injury/pregnancy and childbirth, etc.) | Help-calculation |

| 99 | 69 | Penalties for late payments | Help-calculation |

| 73.03 | 69 | Penalties for the payment of insurance premiums to extra-budgetary funds were withheld from the guilty employees of the enterprise | Act, certificate-calculation |

| 51/52 | 69 | Reflects the amount received if expenses exceed payments | Bank statement |

Contributions for injuries: what is the bill?

Accounting for calculations of contributions to social insurance against industrial accidents and occupational diseases is kept on account 69 - “Calculations for social insurance”. It is divided into three sub-accounts:

- 69.1 – transfers to the Social Insurance Fund;

- 69.2 – calculations of contributions to the Pension Fund;

- 69.3 – transfers to the FFOMS.

Accordingly, account 69.1 is intended to account for contributions for injuries. It is divided into second order accounts:

- 69.1.1 – social insurance;

- 69.1.2 – insurance against accidents at work (contributions for injuries).

You can also use subaccount 69.11 to account for contributions.

Account 69: postings

Under the loan, mandatory deductions are simultaneously corresponded with those registers to which personnel salaries are attributed. For enterprises whose activities are related to the manufacture of products, the amount of contributions is distributed according to costs:

- Production;

- General;

- Auxiliary areas of work.

In companies providing services, the correspondence of account 69 is drawn up with 26 “General business expenses”. Trading companies include accruals in 44 “Sales expenses”.

Attention! Contributions to the wages of employees participating in the creation and modernization of fixed assets are accounted for in 08 “Investments in non-current assets” and 07 “Equipment for installation”. Examples: construction of buildings, restoration and completion of equipment, replacement and improvement of computers.

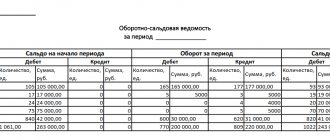

What does a turnover look like on count 69?

This depends on the company itself - it is granted the right to develop accounting registers taking into account the specifics of its activities (Clause 5, Article 10 of Law No. 402-FZ).

If your accounting is organized in a specialized accounting program, SALT according to the account. 69 might look like this:

If you decide to develop your own SALT form, it may look different. In this case, you must take into account several requirements for the composition of the data that must be reflected in this register.

In what cases is count 69 applied?

Posting Dt 69 Kt 69 “Calculations for social insurance and security” is used to reflect debt on insurance contributions and its repayment.

In accordance with the instructions approved by the order of the Ministry of Finance of the Russian Federation “On approval of the Chart of Accounts for accounting financial and economic activities” dated October 31, 2000 No. 94n (hereinafter referred to as the Instructions), the following sub-accounts can be opened for account 69:

- 69.01 - for insurance contributions from VNiM;

- 69.02 - contributions to compulsory pension insurance;

- 69.03 - contributions for compulsory medical insurance.

It should be noted that the payer of contributions can enter additional sub-accounts, for example, 69.11 for contributions from NS and PZ, and in general provide his own analytics of account 69, taking into account the chart of accounts used in the organization.

Description of the account “Federal Compulsory Medical Insurance Fund”

To account for the calculation and payment of contributions for compulsory health insurance, the subaccount “Federal Compulsory Medical Insurance Fund” is used. Accruals are made by the employer without fail on the wages of all employees without exception. Payments to the Federal Fund guarantee the employee the provision of free medical care in the event of an insured event.

The basic tariff rate is 5.1% of the salary. Information sector organizations, as well as firms founded by scientific enterprises, carry out accruals at a rate of 4%.

Characteristics of the balance on the debit of account 69

The opening and closing balances reflected in the financial statements of a business contain valuable information about social contributions. Let's consider the characteristics of the debit opening balance:

- Indicates the amount of debt owed by debtors under the UST - the total amount of funds paid to the employee at the expense of the Social Insurance Fund of the Russian Federation.

- Shows the process of transferring social tax to budget funds.

- Reflects the accrual of social benefits through state insurance.

The ending balance in the debit of account 69 sums up the amount of receivables from the state to the enterprise. The reason for the formation of a balance at the end of the reporting period is the need to reimburse the amount of social insurance paid by the enterprise or an overpayment of the unified social tax.

Accounts 69.00 analytical accounting

In the course of the company's activities, account 69 occupies a special place in accounting. Subaccounts are opened for the following types of transactions:

- accounting for social insurance of employees (subaccount 69.1);

- calculation and transfer of contributions to the Pension Fund of the Russian Federation (subaccount 69.2);

- payments for compulsory medical insurance of employees (subaccount 69.3).

If an organization makes payments for certain categories of social insurance, the charter of the enterprise regulates the use of additional subaccounts of accounting account 69.

Account credit balance 69

Social insurance tax is calculated on the credit of the account, so the initial balance in the credit will indicate the presence of debt to the state under the Unified Social Tax. Each of the subaccounts has a separate balance, which makes it easy to see which payments were not made.

At the end of the reporting period, the credit balance indicates the total amount of debt for mandatory payments to the budget and the Pension Fund. After calculation, the data is transferred to the liability side of the balance sheet and reflected in the financial statements of the enterprise.

Why do you need SALT according to account 69?

The law does not allow accounting outside of accounting registers (clause 3 of Article 10 of Law No. 402-FZ of December 6, 2011 “On Accounting”). One of the accounting registers is the balance sheet for account 69 “Calculations for social insurance and security”. It accumulates information on settlements with extra-budgetary funds (FSS, Pension Fund, Compulsory Medical Insurance Fund) during the reporting period.

Without using this statement, it is impossible to generate data for the reporting period on accrued and paid insurance premiums, that is, to adequately judge the state of mutual settlements with these funds.

Without SALT according to the account. 69 it will not be possible to draw up a balance sheet that reliably reflects the company’s receivables and payables in terms of payments for social insurance and security.

Inspectors almost always request SALT during inspections and have the right to fine company officials under Art. 15.11 Code of Administrative Offenses of the Russian Federation in the absence of accounting registers.

The law qualifies the absence of accounting registers as a gross violation of one of the requirements for accounting, the fine for which can range from 5,000 to 10,000 rubles, and in case of repeated violation - up to 20,000 rubles.

Account 69: subaccounts

Settlements with extra-budgetary funds are carried out separately for each category of accruals, depending on their purpose. To detail information on payments, subaccounts 69 are organized:

- Mandatory contributions are assigned to second order accounts:

- – settlements with the Social Insurance Fund for a single insurance fee regarding sick leave for illnesses, pregnancy and childbirth, as well as child care benefits;

- - Pension Fund;

- - Health insurance;

- – accrual and expenditure of funds from the Social Insurance Fund for injuries and occupational diseases.

- – contributions to the funded part of the pension according to the staff’s application, withheld from wages;

- – contributions by the employer for employees to private medical institutions.

Description of the account “Social insurance payments”

Subaccount 69.01 “Calculations for social insurance” is used to record transactions for the calculation and payment of voluntary insurance contributions for compulsory state social insurance.

These include:

- payment of benefits related to temporary disability (sick leave);

- payment of benefits related to industrial accidents;

- payments in connection with maternity (sick leave for pregnancy and childbirth).

The account is also used to pay benefits to employees in case of occupational diseases at work.

If necessary, subaccounts are opened for the account for each individual transaction, depending on its type.