Account 68 in accounting: calculations of taxes and fees

The Tax Code of the Russian Federation and the legislation of regions and municipalities provide for the obligation of an economic entity to calculate a number of mandatory payments to the relevant budgets.

With the help of tax registers, business entities determine the tax base for a specific tax and calculate the mandatory payment itself for a specified period of time. Tax accrual must also be shown in the accounting records.

For these purposes, account 68 is used according to the Chart of Accounts. This account records the occurrence of a tax liability in the form of a specific tax amount, and also reflects its transfer to the budget. Here the occurrence of underpayment or overpayment of a particular tax is determined.

The same account reflects the organization’s obligation as a tax agent, for example, for personal income tax, income tax or VAT.

Account 68 in the balance sheet is reflected in the fifth section as part of short-term debt, if it has a balance on the credit of the account, and in the second section as part of short-term receivables. Therefore, the location of the account balance determines whether it is active or passive.

Line by line it looks like this:

- On line 1230 as part of accounts receivable (if there is an overpayment of taxes);

- On line 1450 as part of other obligations when providing a deferment in the payment of taxes;

- On line 1520 as part of accounts payable for the amount of accrued taxes, payment for which has not yet occurred.

Attention! The same account can reflect the organization’s settlements with the budget regarding the accrual and payment of assigned fines and penalties to the budget for late payment of taxes.

Tax accounts

The following accounts are used to reflect transactions related to the calculation, accounting and payment of taxes:

- Account 19 reflects the amount of VAT on material assets acquired by the organization: fixed assets, intangible assets, inventories.

- Account 68 takes into account all payments for personal income tax, taxes on real estate, vehicles, income from transactions with securities, mining, environmental fees, fees for the use of natural resources, etc.

- Account 69 is used to record contributions to social insurance and security, health insurance, and contributions to the Pension Fund.

- Account 90 is intended for accounting for tax payments subject to return (reimbursement) after the sale of products, primarily VAT and excise taxes.

- Account 91 is used to reflect VAT and excise taxes related to sold tangible and intangible assets that were on the balance sheet of the enterprise.

- Account 99 is used to account for the company’s losses, which include paid income tax, penalties, fines for violations of the procedure and deadlines for accrual and payment.

Read more - Article on the payment of various taxes to the budget.

Account characteristics

The accounting chart of accounts establishes that account 68 is intended to summarize information on the implementation of settlements with the budget for various tax payments. The same regulatory act determines where, in an asset or liability, this account is included. It is considered active-passive.

An account can have two balances simultaneously, both on the debit side of the account and on the credit side:

- The debit balance of account 68 reflects the presence of overpayment of taxes at the beginning of the reporting period. The credit balance of this account determines the company's tax debt to the budget. Based on which balance, debit or credit, the following algorithm for determining the balance at the end of the period applies.

- If the opening balance is debit, the debit turnover on the debit should be added to it and the credit amounts on the account should be subtracted from it. If the result is positive, it is reflected as a debit balance in account 68 at the end of the month.

- If initially the balance at the beginning of the period was located on the credit account, then the turnover on the credit account 68 should be added to it and the debit turnover should be subtracted. If the result is greater than zero, then the balance is a credit balance and is located in the credit of the account. Otherwise, the balance will be reflected in the debit of the account.

You might be interested in:

Account 20 in accounting “main production”: what is it used for, characteristics, subaccounts, postings

Account characteristics/description:

Subaccount 68.04.1 “Settlements with the budget” is intended to summarize information on settlements with the budget for income (profit) tax of organizations. This account does not reflect the details of the calculation of the amount of income tax made in accordance with PBU 18/02 “Accounting for income tax calculations”.

Organizations that do not apply the provisions of PBU 18/02 reflect the accrual of income tax amounts payable to the budget (or reduction of amounts due for payment to the budget) on this subaccount in correspondence with account 99.01 “Profits and losses”.

Organizations applying the provisions of PBU 18/02 reflect the accrual of current income tax amounts payable to the budget (or reduction of amounts due for payment to the budget) in this subaccount in correspondence with subaccount 68.04.2 “Calculation of income tax.”

Analytical accounting is carried out for budgets into which the tax is to be credited (sub-account “Budget Levels”). Subconto can take the following values:

- "Federal budget",

— “Regional budget”,

- “Local budget”.

Description of the parent account: Description of account 68.04 “Income Tax”

Subaccounts

Since the purpose of account 68 is to keep records of all transactions in a business entity related to the calculation and payment of taxes, then subaccounts to it should be opened for each type of such mandatory payments.

For example:

- 68/1 — Calculations for personal income tax;

- 68/2 — VAT calculations;

- 68/3 — Calculations for excise taxes;

- 68/4 - income tax calculations;

- 68/6 - calculations for land tax;

- 68/7 — calculations for transport tax;

- 68/8 - calculations for property tax;

- 68/10 - other payments to the budget;

- 68/11 - calculations for UTII;

- 68/12 - calculations for the single tax simplified tax system.

Attention! An organization has the right to open sub-accounts for itself only for those taxes that it actually pays. Therefore, the given list can be both expanded and shortened.

In addition to taxes, a business entity may be assessed fines and penalties. They can be accounted for in separate accounts within tax subaccounts, or you can open another subaccount 68/PENI, within which such payments can already be taken into account in terms of taxes.

Business operations:

“Entering opening balances: income tax”

Debit 000 “Auxiliary account” Credit 68.04.1 “Calculations with the budget“

What document is used in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Entering initial balances

in the “Enterprise” menu, type of operation: “

Calculations for taxes and fees (accounts 68, 69)”

“Transfer of funds from the organization’s current account to pay off debts to the budget for income tax”

Debit 68.04.1 “Calculations with the budget” Credit 51 “Current accounts“

What document is used in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Debiting from a current account

in the “Bank” menu, type of operation: “

Tax transfer”

“Calculation of income tax for organizations applying PBU 18/02”

Debit 68.04.2 “Calculation of income tax” Credit 68.04.1 “Calculations with the budget“

What document is used in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of operation: “

Calculation of income tax”

“Calculation of income tax for organizations that do not apply PBU 18/02”

Debit 99.01.1 “Profits and losses from activities with the main taxation system” Credit 68.04.1 “Calculations with the budget“

What document is used in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of operation: “

Calculation of income tax”

Corresponds with accounts

Account 68 can enter into transactions with the specified accounts.

From the debit of account 68 to the credit of accounts:

- Account 19 - when deducting VAT on previously acquired inventory items;

- Account 50 - such an entry can reflect the payment of various benefits to employees at the expense of the budget;

- Account 51 - when reflecting the payment of tax to the budget from the current account;

- Account 52 – when paying taxes to the budget from a foreign currency account. Considering the fact that such correspondence is directly stated in the chart of accounts, which is established by 94-N, it most likely will not occur in life, since payments to the budget must be made in rubles.

- Account 55 - when paying taxes to the budget from special bank accounts;

- Account 66 - if the repayment of tax obligations is carried out using short-term loan funds, while they themselves are transferred to the budget directly, without intermediate crediting to the organization’s account.

- Account 67 - if the repayment of tax obligations is carried out using long-term loan funds, while they themselves are transferred to the budget directly, without intermediate crediting to the organization’s account.

By crediting the account, it enters into correspondence with the debit of the following accounts:

- Account 08 - when allocating the listed fees, customs duties, and non-refundable taxes to the initial cost of capital investments;

- Account 10 – when allocating the listed fees, customs duties, and non-refundable taxes to the original cost of materials;

- Account 11 – when allocating the listed fees, customs duties, and non-refundable taxes to the initial cost of animals and young animals;

- Account 15 – when allocating the listed fees, customs duties, and non-refundable taxes to the initial cost of materials, provided that the Accounting Policy provides for accounting for the purchase of materials through account 15;

- Account 20 - when attributing the listed fees, customs duties, and non-refundable taxes to the costs of production of the main products;

- Account 23 - when attributing the listed fees, customs duties, and non-refundable taxes to the costs of auxiliary production;

- Account 26 – when attributing the listed fees, customs duties, and non-refundable taxes to general corporate expenses;

- Account 29 – when attributing the listed fees, customs duties, and non-refundable taxes to the costs of auxiliary production and farms;

- Account 41 – when allocating the listed fees, customs duties, and non-refundable taxes to the original cost of goods purchased for resale;

- Account 44 - when attributed to costs associated with the sale of finished products, listed fees, customs duties, non-refundable taxes;

- Account 51 - when returning from the budget to the current account in excess of the transferred amounts of taxes and other payments;

- Account 52 – when returning from the budget to a foreign currency account in excess of the transferred amounts of taxes and other payments. Despite the fact that such correspondence is directly spelled out in the chart of accounts, which is established by 94-N, it most likely will not occur in life, since payments to the budget must be made in rubles.

- Account 55 - when returning excessively transferred amounts of taxes and other payments to a special account;

- Account 70 - when reflecting the withholding of personal income tax from employees’ salaries;

- Account 75 - when reflecting the withholding of personal income tax from dividends accrued to the organization's employees;

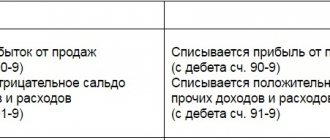

- Account 90 - when calculating taxes related to the sale of products (VAT, excise taxes, duties, etc.)

- Account 91 - when calculating taxes related to the sale of other property (VAT, excise taxes, duties, etc.)

- Account 98 - when reflecting taxes related to transactions of a future period;

- Account 99 - when reflecting the accrual of income tax, as well as tax sanctions (fines, penalties).

You might be interested in:

Account 70 in accounting: what is it used for, characteristics, subaccounts, examples of postings

Examples of wiring for dummies

Let's consider situations regarding the calculation and payment of various taxes

simplified tax system

| Debit | Credit | Type of transaction |

| 99 | 68/USN | An advance payment (tax) has been calculated according to the simplified tax system |

| 68/USN | 51 | Advance payment (tax) has been paid |

Personal income tax

| Debit | Credit | Type of transaction |

| 70 | 68/NDFL | Payroll tax withheld |

| 73 | 68/NDFL | Deduction made from financial assistance |

| 75 | 68/NDFL | Deductions were made from employee dividends |

| 84 | 68/NDFL | A withholding was made from dividends of a third party |

| 68/NDFL | 51 | Personal income tax transferred to the budget |

VAT on sales of goods

| Debit | Credit | Type of transaction |

| 41 | 60 | Purchased goods for resale |

| 19 | 60 | Incoming VAT reflected |

| 68/VAT | 19 | VAT credited |

| 62 | 90/1 | Product sold to buyer |

| 90/2 | 41 | Cost of goods sold written off |

| 90/3 | 68/VAT | VAT tax charged on the sale of goods |

| 68/VAT | 51 | Tax paid to the budget |

VAT on advance received

| Debit | Credit | Type of transaction |

| 51 | 62/AB | Advance received for goods |

| 76/VAT | 68/VAT | VAT is reflected on the prepayment received |

| 62 | 90/1 | Sales of goods reflected |

| 90/3 | 68/VAT | VAT charged on sales |

| 68/VAT | 76/VAT | VAT has been deducted from the advance payment |

Basic accounting entries for taxes

- Overpayment of taxes is reflected in accounting and returned from the budget.

- Tax penalties - payment of a fine for late taxes.

- Property tax is a regional tax that is imposed on certain types of fixed assets.

- Transport tax is a tax imposed on a company’s transport property.

- Land tax - paid by all land owners, including legal entities.

- Postings on UTII - how to take this type of tax into account in accounting

- Insurance premiums - how to pay taxes to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund.

- Personal income tax - how organizations should pay income tax for employees. Reflection of personal income tax in transactions.

- Unified social tax - 34% for employees of the organization.

Income tax

- Income tax - classifier and main entries for accrual and payment.

- Reflection of tax losses - if an enterprise has incurred losses, they can be taken into account to reduce the income tax base for future periods.

- IT and SHE - what they are and how to reflect their accrual and write-off in transactions.

VAT

- Basic transactions for VAT - a list of the main typical operations for calculating and paying tax.

- Postings for writing off VAT are transactions to pay off tax debt or include tax amounts (paid or payable) as costs or losses.

- Posting VAT on sales - accounting for tax on the sale of goods and services.

- Reflection of VAT for deduction in transactions - we reduce the VAT base.

- VAT refund - how to receive VAT compensation from the budget.

- VAT recovery - how to recover previously written off VAT.

- VAT calculation is the method of calculation and tax rate.

- Payment of VAT - how to pay and reflect it in accounting.

- VAT on advances - how to take into account advance amounts.

- Export VAT - features of working with exports.

simplified tax system

- Taxes of the simplified tax system - what taxes are paid under the simplified taxation system.

- Minimum tax is a method of paying taxes for the simplified tax system if the enterprise has a minimum turnover.