Journal-order form of accounting

The form of accounting in which all data on business transactions is taken into account and systematized in journals for recording business transactions is called journal-order.

The basic principles are:

- Entries are made exclusively on credit accounts, indicating correspondence on debit.

- Synthetic and analytical accounting records are combined in a single accounting system.

- Data is reflected in accounting documents in the context of indicators necessary for control and reporting.

- You can apply combined journals to related accounts.

- You can create them monthly.

It is not necessary to use this form of accounting. An organization can keep records using a memorial order form, which is based on drawing up memorial orders for each business transaction. This type has a number of disadvantages: a significant lag between analytical accounting and synthetic accounting, as well as increased labor intensity: you have to duplicate records several times.

Answers to questions about business transactions

Question No. 1. What is complex wiring?

This is a record reflecting an action that is based on a combination of at least three accounts: several debit accounts with one credit account or vice versa.

Question No. 2. How are rental costs calculated?

Expenses are taken into account as for ordinary types of work on accounts 20-29, 44. For example,

Question No. 3. Why do you need a business transaction log?

In it, each fact of the company's work turns into a posting indicating the correspondence of accounts and the amount.

Question No. 4. In what order are business activities taken into account?

First, they are registered according to confirming papers according to the calendar order, then in a certain order they are entered into the accounting registers in the correspondence of accounts.

Question No. 5. What is account assignment?

This is writing directly on the correspondent account document based on its content before registering the transaction in accounting.

So, each operation in accounting leads to a change in the composition of the company’s funds and sources of education: capital, reserves, liabilities. The operation is documented, recorded by appropriate postings and subsequently recorded in the accounting registers.

Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓Legal Consultation is freeMoscow, Moscow region call: +7 (499) 288-17-58

Call in one click St. Petersburg, Leningrad region call

Call in one click From other regions of the Russian Federation, call: 8 (800) 550-34-98

One-click call

Magazine forms

For public sector employees, the Ministry of Finance developed and recommended unified forms (Orders No. 123n dated September 23, 2005 and No. 25N dated February 10, 2006). But it is not necessary to use them (No. 402-FZ dated December 6, 2011). The organization has the right to independently develop and approve forms for accounting journals. But for this they should be approved by a separate order of the manager or in the form of an appendix to the accounting policy.

Features of reflecting accounting entries

Each production action must be documented. Changes arising from the operation are of a dual nature and occur in two interrelated accounting objects. A characteristic feature of the operation is that it is shown on the accounts twice: in debit and credit. This relationship represents the correspondence of accounts.

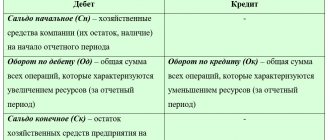

Transactions are reflected on accounts at the time of their occurrence, i.e., as they are completed. Double entry reveals the opposite nature of the asset and liability accounts, linking them to the form of the balance sheet. On the left they reflect the balances of the property (debit), on the right - the sources of its appearance (credit).

Correspondent accounts and balance form a single system, connected by double entry, which is based on three principles:

- Duality of reflection;

- Fixation of amounts for Dt and Ct accounts;

- In both accounts, changes are shown in the same amount.

For control, the registration of the action in accounting is repeated twice. First of all, it is reflected as a fait accompli confirmed by documents, then - by the distribution of amounts among correspondent accounts.

Example 2. Posting

Contents of the operation: materials worth 85 thousand rubles were received from the supplier.

Reasoning:

The changes affected two accounts: account. 10 — balances of inventory items and invoices increased. 60 - the debt to the supplier has increased.

Account 10 - active, takes into account assets, growth is put in Dt;

Account 60 - passive, height - according to Kt.

The increase in assets and liabilities corresponds to operations of the third type. The posting is written as follows: Dt 10 Kt 60.

List of current journals

State employees use these types.

| Magazine number | Type of operations |

| №1 | Cash desk and cash flow |

| №2 | Bank current accounts |

| №3 | Calculations with accountable persons |

| №4 | Settlements with suppliers and contractors |

| №5 | settlements with debtors on income |

| №6 | Calculations for wages, scholarships, allowances |

| №7 | Disposal and transfer of non-financial assets |

| №8 | Settlements for other transactions |

| №9 | Validation |

Non-profit organizations use others.

| Name of journal-order | Contents of operations |

| JO No. 1 | Cash flow at the institution's cash desk |

| JO No. 2 | Current accounts |

| JO No. 3 | Special bank accounts |

| JO No. 4 | Payments for loans and borrowings (short-term and long-term) |

| JO No. 6 | Settlements with suppliers and contractors |

| JO No. 7 | Calculations with accountable persons |

| JO No. 8 | Calculations for taxes and fees, intra-business transactions, calculations for advances |

| JO No. 10 | Primary production |

| ZhO No. 11 | Accounting for finished products (goods, works or services) |

| JO No. 12 | Accounting for target financing |

| ZhO No. 13 | Fixed assets and depreciation |

| JO No. 15 | Retained earnings (uncovered loss) |

| JO No. 16 | Investment in non-current assets |

Journal of business transactions: sample filling with postings

Accounts are a tool for coding, accounting and grouping economic assets and transactions. We will look at the account in more detail in the corresponding chapters. Double entry - recording a business transaction on the debit of one account and on the credit of another - provides an interconnected and controlled reflection of the transaction. Coding a business transaction using double entry is called an accounting entry. Inventory – checking the availability of inventory, cash and financial obligations. Valuation and calculation are methods of determining the cost of economic assets, the costs of their acquisition and construction, production costs, costs of selling products, etc. Balance sheet is a way of summarizing and grouping economic assets and their sources as of a certain date. We have already looked at an example of a balance sheet above; we will look at it further. Accounting statements are a general picture of the property and financial condition of an enterprise, as well as a reflection of its economic activities for the reporting period.

see also Functions and tasks of an accountant

Features of the formation of accounting registers

Law No. 402-FZ establishes mandatory requirements for accounting documentation. Regardless of what type of form was chosen by the organization: unified or developed independently.

Mandatory register details:

- The name of the document and its form.

- Full name of the institution.

- Start date and end date of journal entries. The period for which it was formed.

- Type of grouping of accounting objects (chronological or systematic grouping).

- Indication of the unit of measurement of accounting objects, or the monetary value of the measurement.

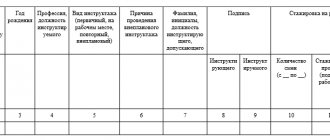

- Indication of officials responsible for maintaining the register.

- Signatures of responsible persons.

Registration logs are compiled on paper or electronically. For the latter, you will need an electronic signature to certify the document. Without a signature (electronic or handwritten), the journal order is considered invalid.

Corrections are permitted. They can only be entered by the person responsible for maintaining the journal. Next to it, you should indicate the date and certify the correctional entry with a signature, with a description of the position and full name of the person responsible.

Features of the K-1 form

So, the book of accounting facts of economic activity can be used by companies that do not produce products or large-scale work with large resource costs.

The book of Form No. K-1 is at the same time a register of analytical and synthetic accounting, on the basis of which it is easy to determine the size of the company’s assets, determine the nature of their sources as of a given date, and it is also possible to draw up the company’s financial statements. The book optimally combines all applicable accounting accounts, on which the amounts for recorded transactions are accumulated.

The enterprise independently chooses the method of maintaining the form: it can draw up a book for recording the facts of economic activity on a monthly basis or keep one book for the entire reporting year, having previously laced it, numbered the pages and certified the last sheet, on which the number of sheets is indicated in words, with a seal (if any) and the signature of the person, carrying out accounting for the company.

Filling rules

Each magazine has its own filling requirements. Let's take a closer look at the basic filling rules.

Journal of registration of incoming and outgoing cash orders (JO No. 1)

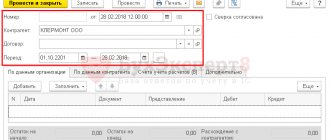

We make entries based on the cashier’s report, confirmed by the relevant documents (RKO and PKO) at the end of the working day. If movements at the cash register are insignificant, it is allowed to make entries in the register 3-5 days in advance, according to several reports at the same time. Then in the “Date” field we indicate the period for which we are making records. For example, 3-6 or 20-23.

Magazine order 2

Entries are made on the basis of bank statements and other supporting documents (checks, personal account statements). It is allowed to make one entry on several bank statements. In this case, in the “date” field, be sure to indicate the start and end date of the statements.

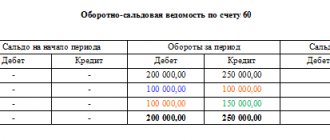

Magazine order 6

We fill out the register based on documents confirming settlements with suppliers and contractors. Merging records is not allowed. The final balances of the previous period are transferred to the next register, in the “Balance at the beginning of the month” field.

Magazine order 7

We register settlements with accountable persons. We make separate entries for each advance report. Concatenation or grouping of rows is not allowed.

Magazine order 8

We indicate data for each operation:

- advance payments and settlements with contractors and suppliers (issued and received);

- settlements with budgets for taxes and fees;

- settlements with various creditors and debtors;

- on-farm operations.

Magazine order 10

We make records of expenses for our own production, in the context of each business transaction (depreciation, wages of production personnel, materials, deferred expenses, etc.).

Journal warrant 11

We reflect data on accounting of finished products. It is allowed to enter generalized information. The form of the journal is developed by the organization independently, taking into account the specific features of the activity (production).

Document text:

Approved by methodological recommendations of the Ministry of Finance, Ministry of Taxes of September 24, 2008 N 15-3/1026/2/415

Form K-1 BOOK OF ACCOUNTING FOR BUSINESS OPERATIONS ——————————————————————————— ¦Registration of transactions ¦ Presence and movement¦ +—————— ———+—————————————————+ ¦N ¦date and N¦contain- ¦amount¦Costs on ¦Cash ¦Calculated ¦Sales ¦ ¦p/p¦document- ¦zhanie ¦ ¦production¦(account 50) ¦account (accounts ¦(account 90) ¦ ¦ ¦menta ¦operations¦ ¦(account 20) ¦ ¦51, 52, 55) ¦ ¦ ¦ ¦ ¦ ¦ +———— +————+————+————-+ ¦ ¦ ¦ ¦ ¦de- ¦cre- ¦de- ¦cre- ¦de- ¦cre- ¦debit ¦credit¦ ¦ ¦ ¦ ¦bet ¦dit ¦bet ¦dit ¦bet ¦dit ¦(self-¦(payment-¦ ¦ ¦ ¦ ¦ ¦(at-¦(dis- ¦(at-¦(dis-¦(at-¦(dis- ¦ ¦no) ¦ ¦ ¦ ¦ ¦ ¦move) ¦move) ¦move) ¦move) ¦move) ¦move) ¦most)¦ ¦ +—+———+———+——+——+—— +——+——+——+——+——+——+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦ 10 ¦ 11 ¦ 12 ¦ +—+——— +———+——+——+——+——+——+——+——+——+——+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ —-+—— —+———+——+——+——+——+——+——+——+——+——- ————————————————— —————————— ¦enterprise funds ¦ +———————————————————————————-+ ¦Calculations ¦Calculations with ¦Calculations according to ¦Calculations for ¦Non-real-¦Profit ¦And others¦ ¦for payment of ¦supply- ¦taxes and ¦insurance ¦sation¦and use-¦ ¦ ¦of labor (accounts (accounts¦fees (account ¦(account 69) ¦ income and ¦ ¦ ¦ ¦ ¦ ¦ 60), poku-¦ 68) ¦ ¦ expenses ¦ (account 99)¦ ¦ ¦ ¦ patels ¦ ¦ ¦ (account 92)¦ ¦ ¦ ¦ ¦ (account 62),¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦various ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦debtors¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦and credit ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ (accounts¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦76) ¦ ¦ ¦ ¦ ¦ ¦ +————+———-+————-+————-+———+———+———+ ¦debit¦crea- ¦de-¦crea- ¦debit ¦credit¦debit ¦credit¦de-¦cre- ¦debit¦cre¦de-¦cre-¦ ¦(de- ¦dit ¦bet¦dit ¦(re-¦(for- ¦(re-¦(for - ¦bet¦dit ¦(is- ¦dit¦bet¦dit ¦ ¦given)¦ (on- ¦ ¦ ¦number-¦dol- ¦number-¦dol- ¦ ¦ ¦pol-¦ ¦ ¦ ¦ ¦ ¦num- ¦ ¦ ¦but) ¦feminine- ¦but) ¦feminine- ¦ ¦ ¦call-¦ ¦ ¦ ¦ ¦ ¦leno)¦ ¦ ¦ ¦ness)¦ ¦ness)¦ ¦ ¦nie) ¦ ¦ ¦ ¦ +——+ ——+—+——+——+——+——+——+—+——+——+—+—+—-+ ¦ 13 ¦ 14 ¦15 ¦ 16 ¦ 17 ¦ 18 ¦ 19 ¦ 20 ¦21 ¦ 22 ¦ 23 ¦24 ¦25 ¦ 26 ¦ +——+——+—+——+——+——+——+——+—+——+——+—+—+ —-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ——+——+—+——+——+——+——+——+—+——+——+— +—+——

Main stages of the organization's work

In the course of the enterprise’s activities, 3 processes can be distinguished, which are taken into account by separate operations:

- Supply - takes into account the receipt of goods and materials from third-party companies, repayment of transport and procurement costs.

- Production - inventory items are released into production, wages and taxes are calculated.

- Sales - the revenue received from the sale of goods (provision of services) to counterparties is recorded, the corresponding costs are written off, and profit is determined.

The totals of assets (current and non-current funds) and liabilities (capital, reserves, liabilities) are called balance sheet currency.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Tags: asset, balance sheet, accountant, business transactions journal, business transactions journal, personnel, capital, loan, tax, expense, reserve, write-off

Types of accounting transactions

Depending on the interaction of assets and sources, there are 4 types of operations.

Active - affect the composition of funds, i.e., the balance sheet asset, without affecting the results. These include actions to use inventory items, liquidate accounts receivable, receive money from a bank account to the cash desk, issue money on account, etc.

The first type of change is reflected by the formula:

A + ΔI – ΔI = P, where

A - balance sheet asset;

P - passive;

ΔИ - change in property due to economic action.

Passive operations affect the sources of formation of assets, i.e., the liability side of the balance sheet. The result is constant. Such operations include: deductions from earnings, the formation of reserves or the accrual of dividends from profits for distribution, replenishment of the authorized capital from additional funds, etc.

This type of operation can be reflected as follows:

A = P + ΔI – ΔI.

Active-passive increasing - increase the asset, liability and currency by an identical amount. These include: repayment of debt on deposits in the authorized capital, accrual of depreciation of fixed assets, advances from buyers, receipt of borrowed funds, etc.

This type of operation looks like this:

A + ΔI = P + ΔI.

Active-passive decreasing - reduce the asset, liability and balance sheet total by the same amount. This is the payment of earnings, payment of debts to creditors.

A - ΔI = P - ΔI.

Example 1. Type 4 operation

Based on bills and bank statements, 214 thousand rubles were transferred to the supplier. for the materials received. The result of the operation will be a change in two items: the asset account will decrease. 51 by 214 thousand rubles, in liabilities the account will decrease. 62 for 214 thousand rubles. The asset and liability totals changed by an equal amount. The balance identity is preserved.

Consideration of four types of business transactions led to the following conclusions:

- Each fact of activity is reflected in at least two balance sheet items;

- Changes to the asset (types 1, 2) do not change the currency of the document;

- Changes in assets and liabilities (types 3, 4) change the currency by the same amount;

- Any operations maintain equality of balance sheet totals.

Table. Examples of postings by type of operation.

| Debit | deviation | Credit | deviation | |

| Type 1. | ||||

| Raw materials transferred to production | 20 | + | 10 | — |

| Payment received from buyer | 51 | + | 60 | — |

| Received money in cash | 50 | + | 51 | — |

| Type 2. | ||||

| Personal income tax withheld from salary | 70 | — | 68 | + |

| The reserve is replenished from profits to be distributed | 84 | — | 82 | + |

| Advance paid to supplier using borrowed funds | 60 | — | 66 | + |

| Type 3. | ||||

| Received materials from supplier | 10 | + | 60 | + |

| Salary accrued | 20 | + | 70 | + |

| The loan amount has been credited to the account | 51 | + | 66 | + |

| Type 4. | ||||

| Loan repaid | 66 | — | 51 | — |

| Employees' salaries transferred | 70 | — | 51 | — |

| Payment has been made to the supplier for the goods | 51 | — | 60 | — |