Postings on 71 accounts - settlements with accountable persons

The subaccount of account 10 is determined by the type of materials received Cost of materials without VAT Bill of lading (form No. TORG-12) Receipt order (TMF No. M-4) 19.3 60.01 The amount of VAT related to the materials received is reflected VAT amount Bill of lading (form No. TORG-12) Invoice 68.2 19.3 The amount of VAT relates to reimbursement from the budget. The posting is made if there is a supplier invoice Amount VAT Invoice Purchase book Bill of lading (form No. TORG-12) 60.01 51 Reflects the fact of repayment of accounts payable to the supplier for previously received materials Purchase cost of goods Bank statement Payment order Postings for accounting for the supply of materials on prepayment 60.02 51 Reflects prepayment to the supplier for materials Advance payment amount Bank statement Payment order 10 60.01 Receipt of materials from the supplier to the organization's warehouse is reflected.

The procedure for issuing reports

It is allowed to issue money against an advance report only to employees of the enterprise. Accountable amounts are issued in cash from the cash register or transferred non-cash to a bank card.

The main rule when issuing money is that the employee must account for the previously accountable amount received. At enterprises, as a rule, an order is assigned to persons who have the right to receive funds on account, since an agreement on financial liability is concluded with them:

When paying money to an accountable person, the following rules must be followed:

- Check the balance of the accountable person (according to the accounting register data). Reason: clause 6.3 of the instructions of the Central Bank of the Russian Federation No. 3210, which states that it is prohibited to issue funds for reporting to an employee who has not reported on a previously received amount.

- Receive a written statement from the employee in any form, reflecting the main details: purpose of receipt, required amount, deadline for submitting the report, date. The application must be endorsed by the head of the company or an authorized person.

A 3-day period has been established when the employee must account for the accountable amounts received, return the funds to the cash desk and submit a report. If the employee does not report on time, then the amount received by him should be withheld from the employee’s income and personal income tax should be charged (Article 137 of the Labor Code of the Russian Federation). Wherein:

Important: deductions from an employee can only be made upon written request and no more than 20% of wages (Article 138 of the Labor Code of the Russian Federation)

If a debt (especially a large amount) of an accountable person has been registered for a long time, then the tax inspector, during an audit, can re-qualify such a payment as a loan or consider it income (paragraph 3 of Article 137 of the Labor Code of the Russian Federation) and charge additional personal income tax.

The maximum amount for reporting is not provided for by law, but it is worth considering that if an employee settles accounts with contractors on behalf of the enterprise, then under one agreement you can pay no more than 100,000 rubles.

Advance report

The employee reflects all cash expenses in the advance report. An employee can spend accountable amounts on the purchase of goods, materials, fixed assets, intangible assets, and payment for the business needs of the company.

The diagram shows the types of expenses for account 71 and the primary documents that should be attached to the expense report:

Get 267 video lessons on 1C for free:

If an employee has an overspend on accountable amounts, that is, the employee has spent his personal funds, then the company has the right to reimburse it subject to established procedures.

The nuances of issuing money for reporting

The employees to whom an economic entity can issue financial resources for reporting purposes are determined by order of management. The rules for providing money are regulated by the instruction of the Central Bank of the Russian Federation No. 321-U dated March 11, 2014. The employee to whom it is issued on account should not have outstanding advance reports.

If an employee has spent more money than was allocated, then, provided there is supporting documentation, the expenses will be reimbursed. The money will be transferred to a bank account or given out in cash at the cash desk.

Regulatory basis for settlements with accountable persons

According to the Tax Code, funds against the report can be issued to an employee solely for the purpose of carrying out the production activities of the organization. The accountable person can use the money received during a business trip or directly for business needs. Upon incurring expenses, the employee provides an advance report in form AO-1. It must be accompanied by invoices, receipts and other documents certifying that the employee incurred expenses in connection with production needs.

The procedure for issuing funds to an employee on account is regulated by the Procedure for Conducting Cash Transactions in the Russian Federation.

If a company sends an employee on a business trip, the employee who received the funds can spend it on:

- travel, including the cost of purchasing tickets;

- accommodation (apartment rental, hotel room, etc.);

- expenses related to accommodation (the so-called “per diem”);

- obtaining a visa, medical insurance (for business trips abroad).

An employee who has received money on account is required to report on its use within 3 days after the completion of a business transaction (the end of a business trip or the purchase of a necessary product).

Purchase of fuel and lubricants in cash

The accounting policy of the enterprise should reflect the following points:

- a list of employees entitled to receive cash for refueling cars under report;

- deadlines for their provision of advance reports in the AO form, to which cash or sales receipts received at the gas station must be attached.

Transactions reflecting the purchase of fuel and lubricants for cash:

- D 71 “Settlements with accountable persons” – K 50 “Cash”;

- D 10 “Materials”, subaccount 3 “Fuel” – K 71 “Settlements with accountable persons”.

Use of plastic cards

As a rule, the most common case is when the driver receives a card at work to refuel the car and withdraws a certain amount of cash from it.

In this case, the wiring is done like this:

- D 71 – K 50-3 – receipt of the card by the driver for reporting;

- D 71 – K 57 – debiting the amount from a corporate card;

- D 10-3 – K 71 – cost of received fuels and lubricants according to information from drivers’ advance reports and gas station reports;

- D 19 – K 71 – payment of VAT on received fuels and lubricants;

- D 57 – K 55 – bank debit from the card account;

- D 68 – K 19 – tax deduction for VAT;

- D 50-3 – K 71 – return of the card by the driver to the cashier.

Accounting for fuel and lubricant costs

Fuel consumption standards are set individually in each organization and confirmed by order of the manager. The primary documents for accounting for fuel and lubricant costs are waybills. In addition, the responsible person takes speedometer readings and makes control measurements, recording the results in a fuel consumption card. The remaining fuel in car tanks is taken into account in subaccount 10 and transferred to the next month or quarter.

The accounting department checks the card data with the results reflected in the waybills. In accounting, fuel consumption is reflected by the posting: D 20 (main production) – K 10-3 (writing off fuel and lubricants as production costs).

Documents confirming the acquisition of inventory items by the accountant

An accountable person is an employee who has received funds for business, administrative and other expenses.

What documents regulate mutual settlements with accountable persons, how money is issued on account, what difficulties may arise in the tax accounting of expenses incurred by an accountable person, see the material “Procedure for taxation of settlements with accountable persons.”

To account for the money received for the purchase of goods and materials, the accountable person fills out an advance report, which indicates exactly what valuables, in what quantities and in what amounts were purchased.

You can see an example of filling out an advance report (AO), as well as a completed AO, in the material “Sample of filling out an advance report in 2015.”

Supporting documents are attached to the advance report, i.e. documents confirming these expenses. Let's look at what documents these might be. An employee of an organization, having received money on account, can purchase goods and materials anywhere: in a retail chain, in a small organization, having received a sales receipt and, if available, a cash receipt as documents confirming the purchase. In this case, a sales receipt confirms the fact of purchase of goods and materials, and a cash receipt confirms their payment.

What should an accountant do if the accountant did not bring a cash receipt, see the material “Features of an advance report without a cash receipt.”

An important point is the acceptance of correctly completed documents.

For what exactly should be indicated in the documents submitted by the accountable person, see the material “Check the details in the accountable person’s documents so as not to be subject to personal income tax.”

If inventory items were purchased from an organization that is not a VAT payer, these documents are quite sufficient to accept an advance report and capitalize inventory items for it.

In order for the accountable person, when purchasing goods and materials, to act before the selling organization not as an individual, but as a representative of his enterprise, it is necessary to issue a power of attorney for this employee. The power of attorney must contain the date of issue and expiration date. The written power of attorney is registered in a special journal and handed over to the employee. By presenting a power of attorney to the seller, the employee acts on behalf of his organization. All documents provided to him by other enterprises will be issued in the name of his employer. By purchasing goods and materials in this way, he will receive both a delivery note and an invoice indicating the details of his organization, which will allow him to accept “input” VAT for deduction.

Accounting

Accounting for mutual settlements with accountable persons is carried out, according to the Chart of Accounts, on account 71 “Settlements with accountable persons”.

Settlements with accountable persons: postings

| Contents of operation | Debit | Credit |

| Amounts issued for reporting | 71 | 50, 51 |

| Expenses are reflected according to the submitted advance report, depending on the specifics | 08, 10, 20, 25, 26, 44, 60, 91 | 71 |

| Unspent sub-report returned | 50, 51 | 71 |

| A report not returned on time was attributed to shortages | 94 | 71 |

| Debt is written off from wages with the consent of the employee | 70 | 94 |

| The debt on the sub-account is reflected, for which it is impossible to repay at the expense of wages | 73 | 94 |

| Accountable debt collected by court decision | 50, 51 | 73 |

Typical transactions for 71 accounts

C is used to reflect transactions with accountable persons. When issuing funds, amounts are posted according to Dt 71, when expenses are allocated - according to Kt 71.

The issuance of funds to an employee can be made either in cash or in non-cash form:

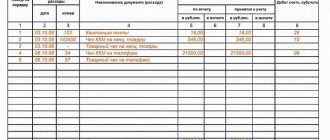

| Dt | CT | Description | Document |

| 71 | 50 | Funds were issued in cash through the cash register | Account cash warrant |

| 71 | 51 | Funds were transferred to a bank card | Payment order |

| 71 | 55 | Funds were issued from special bank accounts | Bank statement |

| 71 | 52 | Funds in foreign currency were transferred to a bank card | Bank statement |

| 71 | 50.3 | Travel documents were issued to an employee who is going on a business trip | Account cash warrant |

If the amount of funds issued has not been fully spent, the balance may be returned:

| Dt | CT | Description | Document |

| 50 | 71 | Refund by employee in cash through the cash register | Receipt cash order |

| 52 | 71 | Transferring the balance of funds to a special bank account | Bank statement |

| 55 | 71 | Crediting the balance of funds in foreign currency | Bank statement |

Transactions with accountable persons can be reflected using production accounts:

| Dt | CT | Description | Document |

| 20 | 71 | Reflection of accountable amounts as part of the main production expenses | Advance report, supporting documents |

| 23 | 71 | Reflection of accountable amounts as part of auxiliary production expenses | Advance report, supporting documents |

| 28 | 71 | Reflection of accountable amounts as part of the costs of correcting defects | Advance report, supporting documents |

| 29 | 71 | Reflection of accountable amounts as part of the expenses of service production | Advance report, supporting documents |

At retail trade enterprises, sales expenses may be incurred through an accountable person:

| Dt | CT | Description | Document |

| 44 | 71 | Reflection of sales expenses incurred through an accountable entity | Advance report |

Goods and materials purchased by an accountable person are reflected in accounting by the following entries:

| Dt | CT | Description | Document |

| 10 | 71 | Materials purchased by the accountable person have been received | Advance report |

| 41 | 71 | Goods purchased by the accountable person have been received | Advance report |

Example of accounting entries for 71 accounts

To the employee of Consul LLC Petrenko S.P. funds were issued for the report in non-cash form in the amount of 2,500 rubles. to purchase paper. In fact, Petrenko S.P. spent 2840 rubles, VAT 433 rubles, which was confirmed by an advance report and a sales receipt. Overexpenditure in the amount of 340 rubles. Petrenko was credited to his bank card.

The following entries were made in the accounting of Consul LLC:

| Dt | CT | Description | Sum | Document |

| 71 | 51 | To the bank account of Petrenko S.P. funds credited for household needs | 2500 rub. | Payment order |

| 10 | 71 | The paper purchased by Petrenko arrived (RUB 2,840 - RUB 433) | 2407 rub. | Advance report, sales receipt |

| 19 | 71 | VAT amount reflected | 433 rub. | Advance report, sales receipt |

| 91.02.1 | 19 | VAT is included in expenses | 433 rub. | Advance report, sales receipt |

| 71 | 51 | To the bank account of Petrenko S.P. the amount of overspending is credited | 340 rub. | Payment order |