General introductions

Let me clarify that the report form itself assumes that it reflects information on the calculation of income, as well as the withholding of amounts by the tax agent. This is a kind of consolidated file of all those individuals who earned their income from the tax agent, about the detailed tax amounts, the right to receive tax deductions and all such information necessary for calculating the tax.

The report also has a strictly limited deadline for its submission. All entities are required to submit a quarterly cumulative report to the tax office at the place of registration no later than the last day of the month after the reporting period. The deadline for submitting the annual report is April 1 of the following reporting year.

The form itself has two parts:

- Title page.

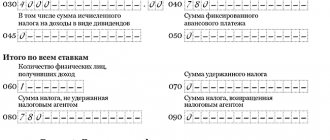

- The first section is “Generalized indicators”.

- The second section “Dates and amounts of income actually received and withheld personal income tax.”

The amounts to be calculated are taken from the accounting data of earned values from the tax agent, and all tax deductions that occur according to the tax registers are also taken into account.

What is - certificate 2-NDFL

Organizations and individual entrepreneurs with hired employees are tax agents for the calculation and withholding of personal income tax. In addition to the need to withhold and transfer personal income tax to the state budget, they also have the obligation to report to the tax inspectorate.

One of the forms of reporting is the 2-NDFL certificate, the form of which was approved by Order of the Federal Tax Service of the Russian Federation dated October 2, 2018 No. ММВ-7-11 / [email protected] It is mandatory for use, and a violation of the law on the issue of filling out or submitting certificates for verification entails the imposition of administrative liability.

How to create a calculation?

Next, we will talk with you about how to create 6-NDFL in 1C ZUP 3.0. The very good news is that this form is issued to the user automatically, but subject to a number of conditions. So, what are these conditions, I decided to indicate to you in the table.

| No. | Name |

| Condition 1 | You have indicated a person’s right to apply to him a tax deduction of the type for which he has a confirmed right |

| Condition 2 | You have calculated and accounted for the amount of tax withheld |

| Condition 3 | The software displays the entire person’s earnings for the tax period |

The machine contains a prescribed algorithm for generating a report, and for this you should open the reporting form, then the 1C certificate.

Using a universal report to check individual 6-NDFL indicators

Users of the program “Salaries and personnel management, ed. 3 very often encounter a situation where the amount of income included in line 020 of the 6-NDFL report does not coincide with the total amount of salary accruals. Identifying the cause of discrepancies, especially if the organization has a large number of employees, may not be so easy. Let's try to figure out why they can arise, and using which tool in the Payroll and HR Management program is most convenient to track them.

We will generate a 6-NDFL report for the 1st quarter of 2018 for the Kron-Ts organization. The amount of accrued income that falls into line 020 of section 1 is RUB 3,910,513.21. (see Fig. 1).

Rice. 1.

If you create a brief summary of accruals and deductions, then the total line will contain the amount of 3,910,862.53 rubles. (see Fig. 2).

Rice. 2.

It would be logical to assume that among the accruals reflected in the first quarter, there are those that are not subject to personal income tax and, accordingly, do not fall into the 6-personal income tax report (for example, child care benefits). However, as we see, there are no such ones on the list. What then is the reason? The answer to this question will help us find a universal report, which we will configure in a certain way.

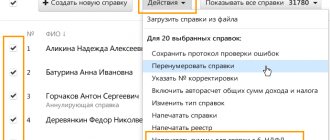

Select the menu item Salary -> Salary reports -> All reports . Next, select the All sections branch, and in the list displayed on the right side of the window, we find a universal report (see Fig. 3).

Rice. 3.

We will generate a universal report on the accumulation register Income Accounting for calculating personal income tax (see Fig. 4).

Rice. 4.

In order to customize the report in the way we need, click on the button More -> Other -> Change report option .

Next, in the window for setting up the report structure, right-click on the line <Detailed records> and in the context menu that appears, select Delete (see Fig. 5).

Rice. 5.

After this, we configure the report structure as follows:

- Button Add -> New grouping, select the Organization field;

- Add button -> New table;

- Place the cursor at the Line position. Add button -> New grouping, select the Registration field;

- Place the cursor at the Line position. Add button -> New grouping, select the Registration field;

- Place the cursor at the Line position. Add button -> New grouping, select the Registration field;

- Place the cursor on the Registration position. Add button -> New grouping, select the Period field -> Start date -> Start of month;

- Place the cursor on the Column position. Add button -> New grouping, select the field Date of receipt of income -> Start date -> Start of month.

As a result, we obtain the report structure presented in Figure 6.

Rice. 6.

Click on the Finish editing button.

Next, we need to set up selection by date of receipt of income. To do this, on the report form, click on the Settings , and in the form that opens, select the Advanced . We add the following selections:

- Date of receipt of income Greater than or equal to 01/01/2018

- Date of receipt of income Less than or equal to 03/31/2018

We indicate that both selections must be displayed in the report header (see Fig. 7).

Rice. 7.

Click on the Close .

To save, select More -> Report options -> Save report option (see Fig. 8).

Rice. 8.

In the window that appears, enter the name of the option, for example, Universal report - personal income tax .

Our report is ready to use. In order for it to include all income, the date of receipt of which relates to the 1st quarter of 2018, you need to clear the period field (see Fig. 9) and click the Generate .

Rice. 9.

The result of generating the report is presented in Figure 10. The rows of the resulting table are grouped by periods in which the documents reflecting income for the 1st quarter of 2021 were posted. The columns are grouped directly by month of income.

Rice. 10.

As we see, in December 2017, some income was posted, which from the personal income tax point of view relates to January 2021. If you decipher it using the registrar, it becomes clear that it was a sick leave (Fig. 11).

Rice. eleven.

Indeed, if in the document Sick Leave for December 2017 we put a payment date that refers to January 2021 (see Fig. 12), we will get a discrepancy between the summary of accruals and deductions and the amount of income included in the 6-NDFL report.

Rice. 12.

Now let's try to generate a Universal Report - Personal Income Tax in a slightly different way. We will set the period for generating the report - the 1st quarter of 2021. We will not make a selection based on the dates of receipt of income (see Fig. 13).

Rice. 13.

Having generated the report, we will see that in March 2021 income was reflected, which from the personal income tax point of view relates to April 2021, and, therefore, cannot be included in the 6-personal income tax report for the 1st quarter (see Fig. 14).

Rice. 14.

Having deciphered the registrar, we find that this is a sick leave document for March 2021, paid in April 2018 (see Fig. 15)

Rice. 15.

If we return to a brief summary of accruals and deductions, we get the following: RUB 3,910,862.53. (total accrued according to the summary) + 5,704.11 rub. (sick leave from the document for December, paid in January) – 6,053.43 rubles. (sick leave from the list for March, paid in April) = 3,910,513.21 rubles. – this is exactly the amount that falls into line 020 of the 6-NDFL report for the 1st quarter of 2018.

This is far from the only useful setting for a universal report. One of our next publications will tell you how you can use it to check the calculated and withheld personal income tax displayed in the 6-NDFL report.

Algorithm of user actions

Any manipulation performed in the machine requires attentiveness and coordination of the stages. So our case implies a certain procedure and we will study it further.

Step 1 – The create button will help you define a new reporting form.

Step 2 – In the report types, find the 6-NDFL we need and then click select.

Step 3 – In the window that opens, enter the desired company, when accounting for several, the reporting period and click on create. Please note that if there are separate divisions for which a separate balance sheet is not maintained, the report form must be different for each such division.

Step 4 – So that you can make a report to several tax departments at once at the place of registration, there is a flag to create for several tax authorities. Afterwards, it is worth noting the tax authorities and registering those with which the company and its separate divisions are registered and where the reporting needs to be sent. As a result, you will receive a tax calculation based on the reporting form. But be sure to go into each one and check that the calculations are correct.

Step 5 - On the title page in the field at the location (accounting) (code) you are required to enter the code for the place of submission of the calculation and for domestic companies it is 220. You have the right to turn on an automatic report and do it yourself, then for the main and subsidiaries you you do a separate calculation of the handicap and in the column Submitted to the tax authority (code) with the filling command you assign the calculations.

Next, I want to tell you how to compose each section of the report we are studying.

How to generate 6-NDFL in 1C ZUP 3.0: instructions

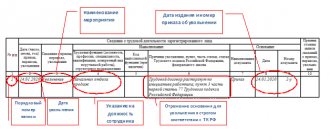

Title page 6-NDFL

The checkpoint field at the top requires the user to name the reason code for registration at the place of residence of the company or at the place of registration of a separate division. The tax agent identification number is entered in the TIN field accordingly. According to the regulations, the machine assigns a zero correction number, since this is supposedly the first time you are sending a report and the corrections do not yet have any basis. In auto mode, the machine enters information into the Submission period (code) and Tax period (year) cells and they are drawn from the initial settings. The tax encoding consists of a four-digit code and implies an indication of where the company and its divisions are reporting and where they are registered. The place where you are going to transfer your reports is indicated in the column according to the location (accounting) (code).

Examples of filling out documents and reporting

Let's start by looking at the simplest example - salary for January 2016. To pay a salary for an employee not together with everyone, but on a separate sheet, it is possible to reflect this in the program

Accrued - 216268,34

, personal income tax -

26663

, deductions -

8400

Let's look at filling out 6-NDFL.

The difference is for a maternity leave person who is not subject to personal income tax.

Now let’s complicate the example with vacation pay

Do not forget about the date of payment of income, it must be equal to the date of actual payment.

We indicate the type of payment correctly - vacation pay

.

We look at 6-NDFL section 2