Do I have to officially get a job after giving birth in order to send my working mother on maternity leave?

By law, parental leave can be taken by any family member who is actually caring for the child, regardless of whether he lives with the child or not.

If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call by phone for any region.

In order for a family member to receive a monthly child care allowance, a non-working mother must provide a certificate from the social security authorities (at the mother’s place of residence).

The certificate must confirm that she did not receive monthly child care benefits.

What is maternity leave

The phrase “maternity leave” combines two types of leave established by current legislation, which follow each other:

- maternity leave - issued with a sick leave certificate for a specified period;

- Parental leave is given for a period of up to three years, during which the length of service is not interrupted.

According to Articles 255 and 256 of the Labor Code of the Russian Federation, all women - employed or officially registered as unemployed, including military personnel or students - can go on maternity leave.

How long does it take for maternity benefits to be paid after filing sick leave?

In order for the employer to pay the benefit, he needs to provide a package of documents including:

- sick leave certificate (original),

- application for maternity leave with payment of benefits,

- an application for changing years, at the request of the woman, if during the billing period she had maternity leave or leave to care for an older child,

- a certificate of earnings from the previous employer, if the pay period includes work in another company.

You can transfer sick leave to your employer immediately after receipt, but no later than 6 months from the end of maternity leave. The employer pays the benefit from his own funds, and later, based on reporting in Form 4-FSS, social insurance will reimburse him for the entire amount of the benefit. At the same time, the law establishes a clear deadline for the payment of maternity benefits on sick leave: the benefit must be calculated, accrued and paid within 10 calendar days from the date of receipt of the sick leave by the employer (clause of the Procedure, approved by Order No. 1012n dated December 23, 2009).

If the deadline for payment of benefits is violated, the employer is liable, as in the case of delayed wages. The benefit is given to the woman in full; it cannot be split into parts.

How many weeks do they go on maternity leave?

Maternity leave is issued at the 30th week of pregnancy and lasts 140 days, but in some cases it can be increased.

| Full term (days) | Prenatal period (days) | Postpartum period (days) | Terms of service |

| 140 | 70 | 70 | Pregnancy and childbirth are normal. |

| 156 | 70 | 86 | There were complications during childbirth. |

| 160 | 90 | 70 | For pregnant women living in areas contaminated by radiation. The basis is the Law of the Russian Federation No. 1244-1 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant.” |

| 194 | 84 | 110 | A pregnant woman is expecting two or more babies. |

| 70 | — | 70 | When registering custody of a child under 3 months of age. |

| 110 | — | 110 | When registering guardianship over two or more children under 3 months of age. |

To go on maternity leave earlier than the deadlines established by law , there are two options:

- A woman takes out her planned leave before going on maternity leave and leaves 28 days earlier. Even those whose experience in a new job is less than 6 months can do this. The employer is obliged to consider the application and send it on leave out of turn.

- A pregnant woman goes on sick leave for health reasons if this is confirmed by a certificate from the antenatal clinic.

It is worth considering that these days will “fall out” from the calculation period when determining the lump sum maternity benefit.

Maternity leave is vacation or sick leave

1.2. According to the contract, all contributions must also be made to all funds, and therefore payments may be stopped. Therefore, the best option is part-time employment with an employer, part-time work. Here's the rationale. Article 14. Duration of payment of monthly child care benefits To persons specified in paragraphs two through five of part one of Article 13 of this Federal Law, with the exception of mothers dismissed during maternity leave, monthly child care benefits are paid from the date of provision maternity leave until the child reaches the age of one and a half years. Article 15. Amount of monthly child care allowance Monthly child care allowance is paid in the following amounts: 40 percent of average earnings, on which insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity are calculated - to the persons specified in paragraph two of part one of Article 13 of this Federal Law. At the same time, the minimum amount of the monthly child care benefit cannot be less than the amount of the monthly child care benefit paid to the persons specified in paragraphs six to eight of part one of Article 13 of this Federal Law; 40 percent of average earnings (income, salary) at the place of work (service) for the last 12 calendar months preceding the month of parental leave (month of dismissal during maternity leave) - to the persons specified in paragraphs three and the fifth part of the first article 13 of this Federal Law. At the same time, the minimum benefit amount is 1,500 rubles for caring for the first child and 3,000 rubles for caring for the second child and subsequent children. The maximum amount of child care benefits cannot exceed 6,000 rubles for a full calendar month. If a woman goes to work part-time while on maternity leave, she will retain the right to receive benefits (Part 3 of Article 256 of the Labor Code of the Russian Federation). The employer's consent is also not required for her to go to work on a part-time basis. But she must notify the employer in writing that the young mother intends to start working on a part-time basis (indicating from what date and under what working hours). After such a statement is received from the employee, the employer must take the necessary personnel actions. For example, enter into an additional agreement with the woman to the employment contract (with a mandatory indication of the new work schedule) and issue a corresponding order (indicating from what date the employee must start work and under what conditions). Monthly child care allowance is paid from the date of granting parental leave until the child reaches the age of one and a half years. But is it necessary to interrupt parental leave? If the above-mentioned norm of law is interpreted literally, the vacation should not be interrupted. However, in practice, if an employee works part-time (for example, four hours a day instead of eight) and is simultaneously on maternity leave, HR staff have certain difficulties when formalizing a particular procedure (for example, regular vacation, sick leave leaf). According to officials, if the mother goes to work full-time, the payment of benefits stops. The Ministry of Labor of Russia gave such clarifications in relation to citizens who are paid double benefits for child care under three years of age on the basis of clause 7 of Art. 18 of the Law of the Russian Federation of May 15, 1991 N 1244-1 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant” (Letter dated May 16, 2013 N 13-7/3030623-2831). When the mother of a child receiving benefits is unable to care for him due to illness or other reasons, the benefit may be assigned to another family member who actually cares for the child. However, in this case, the payment of benefits to the mother is terminated (paragraph 2 - 6, paragraph 42 of the Procedure for the assignment and payment of state benefits). The Constitutional Court of the Russian Federation came to the same conclusion in Resolution No. 3-P dated 02/06/2009. Moreover, the judges indicated that the person who actually cares for the child is not paid temporary disability benefits. In other words, in this case only child care benefits are provided (Part 3.1 of Resolution No. 3-P dated 02/06/2009). If maternity leave occurs while an employee is on maternity leave, the employee has the right to choose one of two benefits due to her during this period - maternity benefit or child care benefit. In other words, two types of benefits are not paid at the same time (Part 4, Article 13 of Law No. 81-FZ, Part 3, Article 10 of Law No. 255-FZ).

Vacation registration

To go on maternity leave, the employee writes an application addressed to the employer and attaches a sick leave certificate. The HR department accepts documents and issues an order for maternity leave indicating the date of leave.

Certificate of incapacity for work

A certificate of incapacity for work is usually issued by a gynecologist at 30 weeks or 28 for a multiple pregnancy.

In the cases below, the document is issued in the hospital where the woman gave birth:

- if multiple pregnancy was detected only during childbirth, then an additional sick leave certificate is issued for 54 days;

- in case of postpartum complications, sick leave is extended by 16 days;

- for early childbirth between 22 and 30 weeks, sick leave is issued for 156 days.

Certificate of incapacity for work during pregnancy

A sick leave certificate is an official form; its correct completion determines whether the document will be accepted by the Social Insurance Fund for the payment of benefits.

- The sick leave form is filled out in large block letters on a computer or manually using any pen with black ink, except ballpoint.

- If the entry does not fit on the line, it must be interrupted at the last cell; corrections and blots are not allowed.

If the Social Insurance Fund does not accept the sick leave, it is returned to the applicant. She must contact the doctor again so that she can be given the completed form again.

According to the law of May 1, 2017 No. 86-FZ, from 2021, medical institutions of the Russian Federation are required to issue sick leave certificates in electronic form . The law works, and sick leave is sent directly to the employer without the participation of the pregnant woman.

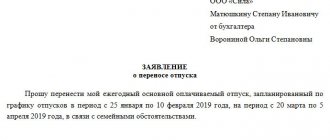

Statement

In your application for maternity leave, you must indicate that you want to receive the benefit of the same name. If a woman registers with an antenatal clinic in the early stages of pregnancy, then she has the right to an additional one-time benefit in accordance with Article No. 9 of Federal Law No. 81-FZ of May 19, 1995.

Sample application

There is no standard form for the application, but it must contain the following items:

- The header of the document indicating the applicant’s full name, full name and position of the manager.

- A request for maternity leave indicating the dates on the sick leave.

- Request for benefits.

- Bank account or bank card details.

- A copy of your passport.

- Certificate 2-NDFL from the previous place of work, if the change of organization occurred within 2 years preceding the maternity leave.

- A certificate (if available) from the antenatal clinic regarding registration before the 12th week of pregnancy.

- List of attached documents.

- Date, signature and transcript of the signature.

In return, the HR department employee issues a receipt confirming the acceptance of the documents.

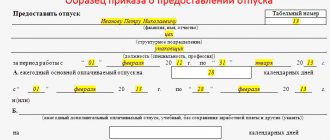

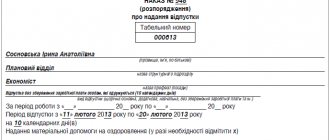

Order

After receiving documents for maternity leave, the HR department prepares an order.

Sample order for maternity leave

There is also no standard format for this document, but it must contain:

- Name of the organization.

- Date and document number.

- Full name of the applicant, her personnel number, name of position and structural unit.

- Type of vacation.

- Reason for vacation.

- Vacation start and end dates.

- Full name of the manager and his signature.

- The applicant is obliged to check the information in the order, put a date and signature, after which the order is filed in the employee’s personal file.

A woman has the right to return to work in the exact position from which she went on vacation immediately after the expiration of her vacation.

To do this, you do not need additional documents; it is enough to notify management before going to work.

What time do those who register late go on maternity leave?

It is recommended to register with a antenatal clinic in the early stages of pregnancy (up to 12 weeks), but not everyone does this. Sometimes women, for some reason, continue to work and consult a doctor when the 30 (28) week period has already passed.

In this case, sick leave must still be issued. The doctor will determine the expected date of birth, count back the required 30 (28) weeks from it and open a sick leave certificate from this date.

If a woman refuses to receive a certificate of incapacity for work within the prescribed period (this must be recorded in writing by a doctor), and then applies for it again, the document is issued for all days required by law, but not from the moment of the second application, but as expected, starting from 30 ( 28) weeks.

A woman on maternity leave on maternity leave is entitled to a benefit paid 100% from the Social Insurance Fund. ConsultantPlus experts explained in detail how to correctly calculate the amount of benefits in various situations. Get trial access to the system and review the calculation example.

Payments

Maternity leave is paid immediately for the entire period specified in the order. The one-time benefit is transferred to a current account or bank card using the details provided in the leave application.

Article 11 of Federal Law No. 255 establishes that each month of maternity leave must be paid 100% of the employee’s average monthly salary for the last 2 years of work in the organization.

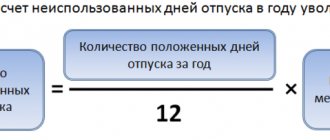

How to calculate maternity benefits?

Vacation benefits are calculated by the organization’s accountants or Social Insurance Fund employees if the region has become a platform for the “Direct Payments” project.

We calculate using the formula:

SZ = OZ/(731 - ID);

DV = NW × DD;

Where

SZ - average daily salary;

OZ - total earnings for the last 2 years;

731 — the number of calendar days for the billing period 2018-2019;

ID - excluded days: vacation, sick leave, business trips.

DV - maternity payments;

DD - days of maternity leave in accordance with the sick leave.

If the employee’s earnings are too low or the insurance period is less than 6 months, then a one-time benefit is calculated based on the minimum wage, which from January 1, 2021 is 11,280 rubles.

The minimum benefit amount is 51,918.90 rubles , and the maximum is 301,095.89 rubles .

The entire amount must be paid in a single payment within 10 days from the date of submission of all documents.

If a woman changed her place of work within two years before maternity leave, then the amount of the one-time benefit is calculated taking into account the provided 2-NDFL certificate from the previous place of work.

If a woman is officially employed not in one, but in several places, then she has the right to receive benefits in each of them.

Special cases of calculating a lump sum benefit:

- Female students receive maternity benefits calculated on the basis of the scholarship.

- Women dismissed due to the liquidation of an organization receive a fixed benefit in the amount of 628.47 rubles for each month of leave.

- Unemployed women do not receive maternity benefits.

Early registration benefit

The benefit for early registration is paid at the request of a woman if she registers with an antenatal clinic before 12 weeks of pregnancy.

In 2021, the amount of this payment is 628.47 rubles.

Birth benefit

The child birth benefit is paid once at the place of work of one of the parents. If two or more children were born, the benefit is paid for each. If the child is stillborn, no benefits are due.

In 2021 (as well as in 2018), its size is 16,759.09 rubles.

Child care allowance up to one and a half years old

Child care benefits up to 1.5 years are paid monthly in the amount of 40% of average monthly earnings.

If the average monthly earnings turned out to be less than the minimum wage, then the amount of the benefit is calculated as 40% of the minimum wage and is 4,512 rubles from January 1, 2019 .

Unemployed mothers apply for benefits at the department of social protection authorities at their place of residence. The payment amount is fixed and is:

- 3,142.33 rubles for the first child;

- 6,284.65 rubles for the second.

Calculation of payments

The amount of benefit that a woman will receive depends on her average earnings for the previous 2 years, the duration of maternity leave, the category of the recipient and the restrictions that the state imposes on the minimum and maximum amount of payments.

Calculation of benefits for workers under an employment contract

The amount of maternity leave for workers under an employment contract is calculated using the formula:

Benefit = Average daily earnings * Number of vacation days

A woman receives 100% of average earnings. But the amount cannot be lower than the minimum established by the state and more than a certain maximum. These amounts change for each year. We will consider the calculation method in separate sections of the article.

The number of vacation days is 140, 156 and 194 days.

Average daily earnings = Income for the 2 calendar years preceding the year of leave / Number of days in the billing period

Rules for determining average daily earnings:

- Income for 2 years includes all types of income from which social insurance contributions were transferred: basic and additional earnings, bonuses, vacation pay, etc. If a woman goes on maternity leave in 2021, then 2018 and 2021 will be taken into account.

- If during these 2 years a woman had no earnings or it was below the minimum wage, which is established at the federal level on the day she went on maternity leave, then the average earnings are assumed to be equal to the minimum wage.

- If the total length of service is less than 6 months, then the amount is calculated based on the minimum wage.

- If a region is included in the list where the regional coefficient is applied, then the average earnings increase by its value. Regional coefficients are published on the FSS website.

The number of days in the billing period is 730.

After reading, you will understand how to stop working for pennies at a job you don’t like and start LIVING truly freely and with pleasure!

The billing period is reduced by the period the employee is released from work while maintaining his salary, the number of days spent on sick leave, maternity leave or parental leave.

If a woman was on maternity or child care leave during the 2 years that were included in the calculation for a new maternity leave, then she has the right to replace this period with one or two previous ones. Thus, the state gives the opportunity to choose a more profitable term and, accordingly, higher average earnings.

Calculation of maternity leave for certain categories of citizens

Let's consider the amount of maternity payments for citizens who do not work under an employment contract. These include:

- Individual entrepreneurs, notaries, lawyers and other citizens who paid social insurance contributions on a voluntary basis.

Example. Svetlana was registered as an individual entrepreneur and paid annual contributions to the Social Insurance Fund on a voluntary basis. She is going on maternity leave in 2021. The minimum wage this year is 12,130 rubles. With a vacation duration of 140 days, the benefit will be: 12,130 * 24 / 730 * 140 = 55,831 rubles.

- Unemployed people who are left without work for the reasons listed in Federal Law No. 81-FZ receive 675.15 rubles in accordance with the Decree of the Government of the Russian Federation from February 1, 2020.

- Full-time students of technical schools, colleges, and universities receive maternity benefits in the amount of a scholarship. It does not matter whether they study for free or for free.

- For military personnel, amounts are calculated in the amount of monetary allowance.

Calculation of the minimum payment in 2020–2021.

The minimum payment for maternity leave is limited to the minimum wage, which is in effect at the time of going on leave.

Calculation of average daily earnings:

- 2020: 12,130 (minimum wage in 2021) * 24 / 730 = 398.79 rubles;

- 2021: 12,792 (minimum wage in 2021) * 24 / 730 = 420.56 rubles.

Minimum maternity payments in 2020–2021 will be:

| Duration of maternity leave | 2020 | 2021 |

| 140 days | 398,79 * 140 = 55 830,6 ₽ | 420,56 * 140 = 58 878,4 ₽ |

| 156 days | 398,79 * 156 = 62 211,24 ₽ | 420,56 * 156 = 65 607,36 ₽ |

| 194 days | 398,79 * 194 = 77 365,26 ₽ | 420,56 * 194 = 81 588,64 ₽ |

Calculation of the maximum payment in 2020–2021.

The maximum amount of payments is limited by the maximum base for calculating social insurance contributions. Government resolutions where you can see these numbers:

- For 2021

- For 2021

- For 2021

- For 2021 (effective from 01/01/2021).

Calculation of maximum average daily earnings:

- 2020: (815,000 + 865,000) / 730 = 2,301.37 RUR

- 2021: (865,000 + 912,000) / 730 = 2,434.25 RUR

Maximum maternity payments in 2020–2021 will be:

| Duration of maternity leave | 2020 | 2021 |

| 140 days | 2 301,37 * 140 = 322 191,8 ₽ | 2 434,25 * 140 = 340 795 ₽ |

| 156 days | 2 301,37 * 156 = 359 013,72 ₽ | 2 434,25 * 156 = 379 743 ₽ |

| 194 days | 2 301,37 * 194 = 446 465,78 ₽ | 2 434,25 * 194 = 472 244,5 ₽ |

FSS calculator

There is a calculator for calculating maternity benefits on the Social Insurance Fund website. You can independently calculate how much you will be paid at work after taking maternity leave.

Calculation examples

Let's look at a few examples of calculating maternity benefits.

Example 1 (standard conditions). Ekaterina received 35,000 ₽ monthly during 2021, and 40,000 ₽ in 2021. Over the years I have not been on sick leave or any other maternity leave; I worked full time. In 2021, I went on maternity leave for 140 days.

Allowance = (35,000*12 + 40,000*12) / 730 * 140 = 172,602.74 rubles.

They did not exceed the maximum level, so Ekaterina will receive the amount in full.

Example 2 (high salary). We will leave the previous conditions, but will increase the salary to 75,000 rubles per month in 2021 and 2019.

Allowance = (75,000*12 + 75,000*12) / 730 * 140 = 345,205.48 rubles.

The limit in 2021 is 322,191.8 rubles, so this is the amount that will be paid, and not the amount received during the calculation.

Example 3 (twins were born). Let's take the data from the first example. Catherine is entitled to 194 days of leave.

Allowance = (35,000*12 + 40,000*12) / 730 * 194 = 239,178.08 rubles – within the limit.

Example 4 (transfer of years of the billing period). Let me remind you: you can transfer years only if this will lead to an increase in benefits.

Elena was on maternity leave in 2021 and 2021. In 2021 she will go on another maternity leave. The benefit will be accrued to her based on the minimum wage, because she did not work and did not receive wages in the two previous years: 12,792 * 24 / 730 * 140 = 58,878.25 rubles.

But before the first maternity leave, Elena worked and received 40,000 rubles. per month. She writes a statement to the accounting department of her company with a request to take into account the years 2021 and 2021. In this case, maternity benefits will be: 40,000 * 24 / 730 * 140 = 184,109.59 rubles.

Maternity leave calculator

The FSS website has a calculator for approximate calculation of the amount of a one-time benefit.

In order for the calculator to give an accurate result, you must fill in the following fields:

- Set the indicator “Pregnancy and childbirth” in the “Type of disability” column.

- Fill in the vacation period in accordance with the data from the sick leave.

- In the “Calculation Conditions” tab, add the amount of earnings for 2021 and 2018 separately. The data of all employers is also entered here if a woman officially works in several jobs.

- Enter the number of calendar days to exclude.

How many days can maternity leave last?

The number of calendar days of maternity leave is determined by the Labor Code, law dated December 29, 2006 No. 255-FZ, law dated May 19, 1995 No. 81-FZ. In this case, the certificate of incapacity for work is issued in exactly the same form as a regular sick leave. Opens the hospital obstetrician-gynecologist, and in his absence, a general practitioner or paramedic:

- if the pregnancy proceeds normally and one child is born, maternity leave is issued at 30 weeks of pregnancy for 140 days: 70 days before childbirth and 70 days after;

- if childbirth begins prematurely, then sick leave is issued at 22–30 weeks of pregnancy for 156 days,

- if the birth was accompanied by complications, 16 days are added to the postpartum leave, that is, it increases to 86 days;

- for women living or working in an area of radiation contamination, prenatal sick leave has been increased to 90 days,

- when carrying twins, maternity leave and sick leave are given at 28 weeks for 194 days: 84 days before birth and 110 days after the birth of children, and if a multiple pregnancy is established only during childbirth, prenatal leave will be as usual - 70 days, and after birth – 124 days,

- those who adopted a baby no older than three months receive leave from the date of adoption until the expiration of 70 days from the date of his birth, and if they adopt several children at once, then until the expiration of 110 days from the date of their birth.

Additional days to the main 140 are not issued as a primary certificate of incapacity for work, but as a continuation of the main sick leave in connection with maternity leave.

A sick leave cannot be issued by a doctor later than the 30th week of pregnancy, but some women are in no hurry to go on maternity leave, continuing to work. This is their legal right, but maternity leave in such cases will be shorter: it is issued from the day the expectant mother submits a certificate of incapacity and her application for leave to the accounting department.

A woman can receive sick leave before maternity leave if her health worsens, if this is related to pregnancy, or if she has an illness not related to pregnancy. Such sick leave is issued on a general basis.

Grandmother on maternity leave

Sometimes parental leave needs to be taken out for a grandparent. According to Articles 256 and 257 of the Labor Code of the Russian Federation, parental leave for a child up to 3 years old can be taken by any family member who will care for the child. Vacation can be taken in full or only part.

To do this, you must provide the following documents:

- statement;

- child's birth certificate;

- a certificate from the parents’ place of work confirming non-use of leave and non-receipt of child care benefits.

What is the amount of other payments to pregnant women and those giving birth in 2020-2021?

Russian legislation, in addition to the BiR benefit, has provided for additional payments intended for pregnant women and those who have already given birth and reimbursed by the Social Insurance Fund.

These are the benefits:

- For registration at a medical institution in the early stages of pregnancy. From February 1, 2021, its value increased to 708.23 rubles.

- One-time payment for the birth of a child. It was also increased from the specified date to RUB 18,886.32.

- For child care up to 1.5 years old - as well as the BiR benefit, determined on the basis of information about the recipient’s earnings for the previous two years. It indicates the minimum for 2021: 7,082.85 rubles. no matter what the child's age is. The maximum is determined on the basis of average daily earnings, calculated on the basis of the maximum values according to the calculation bases for contributions to VNiM. In 2021 it is 29,600.48 rubles. per month. Find out how this benefit is calculated from the article.

For the amounts of “children’s” benefits for other periods, see the directory from ConsultantPlus. Trial access to this and other system materials can be obtained free of charge.

NOTE! The employer has the right, at his own expense, to pay financial aid to a pregnant or already established mother in any amount approved by the order of the enterprise, regulations on wages or other local regulations.

Work and maternity leave

The law allows a woman to remain with her child until he turns 3 years old without losing his job. The mother receives a childcare benefit for children up to one and a half years old in the amount of 40% of the average monthly salary, as well as a compensation payment of 50 rubles monthly. The benefit during the second half of the vacation does not in any way affect the financial situation of the family, so a woman often looks for options to combine child care and part-time work.

The state does not prohibit a mother from leaving maternity leave before its end.

If necessary, a woman can go to work immediately after maternity leave. To do this, you do not need to write an application, just go to work, as after a regular sick leave.

Also, a woman can return to work at any time, without waiting for the end of maternity leave. Typically, an employer reassigns or hires a temporary employee for the duration of his employee’s maternity leave, so early termination of maternity leave entails his dismissal or reassignment and takes time.

If a woman goes to work part-time, she retains the right to child care benefits for up to 1.5 years and receives a salary. Part-time work means that a woman will work less than 8 hours a day or less than 40 hours a week.

For teachers and representatives of other professions who work part-time, a reduced schedule is drawn up taking into account the workload. If an employee wants to go to work part-time, the employer is obliged to provide this opportunity.

While on maternity leave, you can get a full-time job in another organization. In order not to lose benefits, a woman should sign a work contract, but not enter the organization in her work book.

Who is entitled to receive maternity benefits in 2021

Maternity benefits (or maternity benefits) can be received by women preparing to become mothers and insured in the compulsory social insurance system. That is, contributions for temporary disability and in connection with maternity (VNiM) should be calculated from their wages. The following persons are considered insured:

- those who signed the employment contract;

- working as civilian personnel in military formations of the Russian Federation abroad.

Those who are not working have the right to count on payments under the BiR

- those dismissed due to the liquidation of the company, as well as women who completed their activities as individual entrepreneurs, notaries, and lawyers within 12 months before they were declared unemployed by the employment center;

- female military personnel and contract women in law enforcement, customs, fire service, etc.;

- Full-time students in educational and scientific organizations on a budgetary or commercial basis.

In addition, benefits can be received by individual entrepreneurs, notaries, and lawyers who have paid the entire amount of annual contributions to VNIM, calculated on the basis of the minimum wage, a year before the occurrence of the insured event.

Women applying for maternity leave must provide the employer or the relevant authority with a certificate of incapacity for work, which will serve as the basis for the payment.

Important! ConsultantPlus warns: Recalling a woman from maternity leave is not allowed (Letter of Rostrud dated May 24, 2013 N 1755-TZ). Labor legislation provides for the possibility of recalling an employee only from annual paid leave (Article 125 of the Labor Code of the Russian Federation). However, a woman can interrupt maternity leave on her own initiative. Let's consider several options for the development of events. Read more about how to deal with benefits when leaving maternity leave early in K+. This can be done for free.

What do you need to remember?

- Maternity leave consists of two types of leave: for pregnancy and childbirth and for caring for a child under 3 years of age.

- To apply for maternity leave, you need to write an application to the HR department and provide a sick leave certificate from the antenatal clinic.

- A woman has the right to a one-time maternity benefit, a monthly childcare benefit for up to 1.5 years, and a number of others.

- Any family member involved in actual care, not just the mother, can go on parental leave. To do this, you need to provide certificates from your parents’ places of work stating that they did not use their parental leave.

- You can work while on maternity leave, even while maintaining child care benefits.

Emergency hotline for the population : we provide free consultations to pensioners, parents and beneficiaries of any category from legal experts over the phone.

How to accurately calculate the accounting allowance

Since 2021, the employer has not paid workers money for maternity leave. This is done by the FSS. And the employer is only required to transfer documents and information to the fund for the calculation and payment of benefits.

For the list of documents, see the Ready-made solution from ConsultantPlus. Get a free trial and jump into the content.

As for calculating the benefit amount, in 2021 it occurs as usual.

The calculation formula can be presented as follows:

Allowance for BiR = Average daily earnings × Number of days of vacation for BiR.

The number of days of maternity leave in general cases is 140 days (70 days before childbirth and 70 after). The number of days increases with multiple pregnancies and complicated births. The doctor indicates the start and end dates of the period of incapacity for work, and based on them and the employee’s application for leave under the BiR, the accountant will calculate its duration.

Average daily earnings = Earnings for the previous two years / Number of days in the billing period.

Earnings for the previous two years include all amounts of salary, vacation pay, bonuses and other remuneration from which contributions to VNiM were calculated.

The denominator indicates the number of calendar days corresponding to two calculation years, minus those that the employee was on sick leave, maternity leave or parental leave.