In what cases does the tax office block an account?

There are four grounds for blocking a company account:

- Based on the results of the tax audit, additional taxes were assessed and a decision was made to impose tax liability. If there is reason to believe that the company will not pay additional taxes, the inspectorate may take interim measures in the form of suspending transactions on bank accounts.

- The company did not submit a tax return within 10 days after the last deadline.

- Within 10 days, the company did not provide the opportunity to receive tax documents in electronic form.

- The inspection sent the company a request to provide documents or explanations, but the company did not send a receipt to the inspection for acceptance of this request within 10 days.

When the arrest is lifted after submitting the required reports

The deadline for unblocking the account after submitting reports, on the basis of clause. 1 clause 3.1 art. 76 of the Tax Code of the Russian Federation is determined by the time the tax authority made a decision to lift the suspension of operations on the account. In this case, the starting point in the calculation is the submission by the taxpayer of a declaration to the tax office.

After fulfilling the obligation to submit reports, the Federal Tax Service Inspectorate, no later than the next working day, makes a decision to cancel the arrest and sends it to the bank. The bank, in turn, executes the decision within one day.

Consequently, the period for removing the seizure from the account will be no more than three working days.

When is it illegal to block an account?

Judicial practice knows cases where companies managed to prove that blocking an account was illegal.

The company did not submit the declaration, despite the fact that there was no obligation to submit it

The company was registered. Along with the registration documents, a notice of the transition to a simplified system was submitted. However, in fact, the company did not switch to a simplified system. During the year, she provided tax reporting under the general taxation system, including VAT returns.

The tax office accepted these reports without any questions, but at the end of the year, when the company did not submit a declaration under the simplified tax system, it blocked its current account.

The company went to court to challenge the decision to block the account. The court supported this requirement, since the company, despite the fact that it submitted a notice of transition to a simplified taxation system, did not actually switch to it and worked on the general taxation system.

Consequently, the company had no obligation to file a declaration under the simplified tax system. In this case, the inspectorate blocked the account illegally.

The company did not provide advance income tax calculations; the inspectorate blocked the current account

In this case, the Federal Tax Service relied on subparagraph 1 of paragraph 3 of Article 76 of the Tax Code.

The company had to go all the way to the Supreme Court, which, unlike previous instances, noted that this legal norm does not provide the tax authorities with the opportunity to block an account in case of failure to submit an advance payment calculation.

A tax return and an advance payment calculation are different documents. In case of failure to submit a tax return, the inspectorate may block the account, but for failure to submit an advance payment calculation, it cannot.

The inspectorate assessed additional taxes based on the results of the audit. The value of the company's property exceeded the amount of the arrears, but the tax authorities still took interim measures in the form of suspending transactions on bank accounts. However, by virtue of the law, if the value of the company’s property exceeds the amount of debt, then the inspectorate cannot block the account. She can block the account only for the amount of the difference between additional charges and the value of the assets.

The inspectorate blocked the account due to procedural violations

For example, the inspection revealed tax arrears. After that, she made a demand for payment of arrears. The company has 10 days to make voluntary payment. As long as the period allotted for voluntary payment of the debt has not expired, the tax office cannot block the company’s account. Blocking becomes possible only if the company voluntarily fails to pay the tax.

How a current account is blocked

You can learn in detail about the procedure for suspending account transactions, indicating the articles of the Tax Code of the Russian Federation, on the website of the tax service. And here we will provide basic information.

If an organization or entrepreneur has a debt to the budget, then the Federal Tax Service is first obliged to make a corresponding demand. You have eight working days from the date of receipt of the letter to pay the arrears. The problem is that correspondence from the tax office is considered delivered on the sixth day after sending; proof of its receipt is not required. The taxpayer may not even know that he has incurred a debt to the budget.

It’s even worse if the reason for the blocking was an unsubmitted declaration. In a letter dated 07.28.16 No. AS-3-15/ [email protected] the Federal Tax Service indicated that tax legislation does not oblige to warn an organization or individual entrepreneur about the need to report. Established reporting deadlines are available to everyone, and they must be adhered to without reminders.

If the payment requirement is not fulfilled or the declaration is not received on time, the inspection makes a decision to block and transfers it to the bank. The decision of the Federal Tax Service must be executed immediately, so the bank informs the client about the blocking that has already taken place, and not about its possibility.

A copy of the decision to suspend transactions on accounts must be sent to the taxpayer no later than the next day. That is, it is impossible to find out about the blocking in advance; it is possible that the bank itself will be the first to notify about it, and the message from the Federal Tax Service will arrive later, moreover, against a signature.

Can the suspension of transactions on accounts be considered illegal if a copy of the decision from the tax office never arrived? There are several court decisions in which the courts took the side of taxpayers, but there is also the opposite practice.

Checking your current account for blocking is also carried out on the tax service website. To do this, you need to keep the TIN of the organization or individual entrepreneur, the BIC of the bank and request information about current suspensions.

In the same way, you can check your current account for blocking if you plan to make a payment to a counterparty. To do this, indicate the TIN and BIC of the business partner’s bank. Sometimes it turns out that the information is already in the Federal Tax Service system, but it has not yet reached the bank. Therefore, it is convenient to use this service if you suspect that such a decision may be made against you, but do not know whether it is still possible to make payments.

When blocked, debit transactions on the account are prohibited, except for those whose priority is higher than paying taxes. These are enforcement documents on claims for compensation for harm caused to life or health, alimony, severance pay, employment and copyright contracts.

As for the salary, which is paid without executive documents, it is in the same order as the transfer of taxes. Money is written off for claims that are in the same queue in calendar order. That is, if a document about transferring money from a blocked current account to a salary arrived before the order from the Federal Tax Service, it must be executed by the bank.

The amount blocked on the account depends on the reason for the suspension of operations. If this is an unsubmitted declaration or payment of insurance premiums, then all funds are blocked. If we are talking about non-payment of taxes and other payments, then only the amount of arrears is blocked.

How many accounts can the INFS block if there are several of them? The Tax Code of the Russian Federation does not establish special rules on this issue. However, in practice, all accounts of an organization or individual entrepreneur are blocked, because otherwise the measure of influence on the taxpayer will be incomplete. However, you cannot open a new current account in any bank.

How to unblock an account?

Essentially, there are only two options:

- comply with tax requirements. In this case, you need to take a certified account statement and payment from the bank and submit them to the tax office;

- prove that the tax office blocked the account illegally. To do this, you need to carefully analyze the situation, see what the tax office refers to when blocking, and especially carefully check the deadlines - was the inspectorate too hasty in blocking the account? Maybe the deadline for voluntary repayment of tax debt has not yet expired?

How to speed up unlocking

In practice, an LLC or individual entrepreneur may encounter situations that interfere with the normal unblocking of accounts. If the reason for freezing the account has been eliminated, but it turns out that you still cannot use it, you should remember the time it takes for the funds to “pass”, which can be three days. For example, you have paid off the arrears, but the funds have not yet been received by the tax authorities, naturally, the restrictions are not lifted. In this case, you can take expediting measures to prove to the tax authorities that you have complied with their requirements. To do this, you need to deliver written proof to the Federal Tax Service that you have already paid the required amount. Such paper can be a payment order (original), which has a bank mark on payment, or a bank statement.

How to punish the inspectorate for illegally blocking an account?

The company may request from the tax authorities:

- Interest for each day of illegal account blocking. Moreover, there are two options - if the account was blocked illegally, then the inspectorate must pay interest starting from the first day of blocking. The second option is if the account was blocked legally and the company eliminated the violation, but the tax office was late in unblocking the account. In this case, you need to demand interest for each day following the day on which the account should have been unblocked.

- Losses, including lost profits.

In order to receive interest from the inspection, the company is not required to prove that the illegal blocking caused damage. Interest is collected regardless of damage. Judicial practice speaks about this.

Everything is clear with percentages. They are calculated according to the key rate of the Central Bank, which at the time of writing this article is 7.25%. But with losses, including lost profits, it’s more interesting. Judicial practice has revealed 3 cases when a company has a good chance of recovering lost profits:

- The company was unable to place money in the deposit

There is a sensational case where the Metro company sued the tax authorities for 1.9 million rubles. losses. The fact is that the company was going to place about 3 billion rubles. in the form of bank deposits. But she was unable to do this because the account was blocked, which, as it later turned out, was illegal.

In order to receive lost profits from the tax authorities due to the inability to deposit money, you will need to prove in court that the company even tried to deposit money.

- The company was unable to pay the loan, and the bank charged penalties and interest

Everything is clear here - the company was unable to pay due to an illegally blocked account, therefore, the bank assessed penalties and fines due to the fault of the tax office.

There are two important points here. The court will side with the company if it had enough money to pay the loan. If a company does not have enough funds to pay, it would not be able to pay regardless of whether its account was blocked or not. And secondly, if by the time the tax office made a decision to block the bank’s license, the bank’s license was revoked, the court will side with the inspectorate. After all, when a bank’s license is revoked, the company is deprived of the opportunity to manage its money, regardless of whether the account was blocked or not.

- The company lost a counterparty due to the tax authorities illegally blocking the account

For example, the company was unable to pay under the contract and the counterparty terminated it. How to justify the amount of damages in this case? You need to look at the terms of the contract and calculate the expected amount of profit.

How are accounts frozen?

Blocking bank accounts is a measure of coercion or enforcement of the legal obligations of an entrepreneur, because according to Art. 57 of the Constitution of the Russian Federation, he is obliged to pay all established taxes and fees on time and report on his activities.

Blocking procedure

- The tax authority’s decision to suspend monetary transactions of a certain individual entrepreneur or LLC is made by the head or deputy and sent to the bank.

- A copy of the decision is sent to the account owner with notification.

- The bank, having received the decision of the tax authority, immediately and unconditionally implements it, informing about the balance of funds in the seized account. The bank is not authorized to check the legality of the tax inspectorate's decision.

IMPORTANT! It is legal to stop the movement of funds only in accounts opened on the basis of an agreement with the bank. Deposits, loans, letters of credit and other accounts are not subject to blocking by the tax office.

Blocked but not dead

The “frozen” state of an account does not mean an automatic complete ban on all banking transactions. Paragraph 3 p.1. Article 76 of the Tax Code and Art. 855 of the Civil Code explains what settlement operations can be carried out with a seized account.

So, you can top up your account without restrictions.

It is also possible to write off funds from a problem account, but only in an order that precedes the required tax payments.

- It is customary to pay compensation for health and moral damage and alimony established by the court first.

- The second priority belongs to wages or severance pay for hired workers.

- The third stage of payment according to tax requirements is divided with planned contributions to pension and other funds.

PLEASE NOTE! If the order is equal, those funds for which payment documents were received earlier will be written off first.

conclusions

The tax office can block an account for various reasons : when the company has not submitted a tax return to the inspectorate;

has not provided the opportunity to receive tax documents in electronic form or does not send a receipt to the inspectorate regarding receipt of the request. Often, the tax office blocks an account without legal grounds . To unblock an account, you need to either comply with tax requirements or send a complaint to the Federal Tax Service justifying the illegality of blocking.

If the tax office blocked the account illegally or did not remove the blocking on time , then it must pay interest and compensate for the damage caused.

Reasons for a blocked current account

Issues related to the suspension of actions on bank current accounts are declared in the Tax Code of the Russian Federation. The closed list, where new items cannot be added, lists 4 reasons that give the fiscal authority the right provided by law to “freeze” an account:

- The tax return was not submitted on time (paragraph 1, clause 3, article 76 of the Tax Code of the Russian Federation).

- There are arrears in accordance with the tax requirements set - mandatory payments have not been made (clause 7 of Article 46, clause 1,8 of Article 69, clause 2 of Article 76 of the Tax Code of the Russian Federation).

ATTENTION! The account should not be “frozen” in its entirety, but in the amount corresponding to the arrears. - The procedure for electronic reporting has been violated - the tax office is not informed about the acceptance of documents sent by it in electronic form (clause 5.1 of Article 23 of the Tax Code of the Russian Federation).

- The results of a tax audit imply that the enterprise is held liable (clause 1 of Article 76 of the Tax Code of the Russian Federation).

Declare on time!

The law allows the fiscal service to seize accounts starting from the 11th day of delay from the required date of submission of the declaration, for a period of 3 years. Sometimes the INFS makes erroneous or illegal decisions to block an account, which can be challenged:

- the deadline for filing the declaration was violated due to the fault of the computer server or postal service;

- a tax return submitted on time was not accepted by the tax authorities due to errors in registration (outdated form, error in indicating the tax period, incorrectness on the title page);

- other reporting documents other than the tax return (advance report, accounting documents, statistical data, etc.) were not submitted on time;

- documents requested by the inspectorate during the inspection were not provided.

You are not exempt from paying taxes

From Art. 46 of the Tax Code it follows that payment of all taxes, fines, etc. is mandatory, otherwise they will be collected from current accounts. The tax authority blocks the company's accounts and then collects the amount of debt from them by sending collection orders to the bank.

IMPORTANT! For this reason, only the amount due for payment will be blocked in the account; other funds can still be freely disposed of.

Don't ignore tax requirements

This basis for blocking is the most recent innovation; it has been in effect since January 1, 2015. Within 6 days from the day when the tax office sent a request to provide it with certain papers or explanations, in response it is necessary to confirm the acceptance of these requirements by sending a receipt.

Check by tax authorities

Carrying out an on-site or desk inspection, the INFS may, as a result, order the owner to pay a fine, penalty, etc., or in another way hold the company accountable. A decision to block accounts may not be made, but, most likely, such a strict interim measure will be chosen if:

- the owner has not previously paid taxes and required fees on time;

- there are debts on the personal account;

- suspicions arose of serious tax violations, for example, “double-entry bookkeeping.”

ATTENTION! Before freezing accounts, the tax authority must make a decision to seize property. Accounts are blocked only if the value of the company's seized property does not approximately cover the amount to be paid.

Blocking as a security measure for the fulfillment of tax obligations

The third situation that may cause the tax office to block a current account is blocking as a security measure for the fulfillment of tax obligations. This form of freezing is often faced by enterprises that have a tense relationship with the tax authorities. That is, legal battles have already taken place several times and a decision has been made, which at a particular point in time continues to remain unfulfilled.

What could be the problem? Tax officials made a decision based on the results of the audit. You, in turn, are in no hurry to implement it, but are engaged in the process of challenging it, trying to cancel it. After the inspector makes a decision to prosecute for committing a tax offense. they have the opportunity to take advantage of the provisions of Article 101 of the Tax Code of the Russian Federation. Paragraph 10 clearly states that blocking may be the norm for interim measures.

In what cases does a violation of taxpayer rights occur?

Despite the fact that blocking a tax account as a means of ensuring the fulfillment of tax obligations is a very common and frequently used measure, sometimes Federal Tax Service employees do this not entirely within the law. So to speak, the company is being manipulated because not all businessmen are savvy in law and cannot properly defend their rights.

The fact is that any interim measure for the fulfillment of obligations is clearly divided into property restrictions and monetary restrictions. Security inspectors can take advantage of the measure of blocking an account only after imposing a ban on the alienation of company property and if the total value of such property - all assets minus cash on the balance sheet - is less than the total amount of tax debt.

That is, this is a rather rare situation, although it is used very often by tax authorities as an interim measure. Unfortunately, such use is not always legal. Since the taxpayer does not have enough time to understand all the procedural intricacies, he does not think about the fact that this could simply be an excess of authority of the inspectors.

In fact, in many cases you can find a reason to punish tax officials. For example, he has the right to block not your entire account, but only the amount that will cover the difference between the size of your debt and the value of the property that has already been taken as an interim measure.

In practice, everything happens differently. No one estimates the value of the property based on the balance sheet, and the block falls on the entire amount of the account balance. This is very convenient for the Federal Tax Service, but extremely inconvenient for the company, as it causes unnecessary trouble in removing the account from being blocked. And this is a direct violation of taxpayer rights.

What should the company do in this case?

An entrepreneur faced with blocking an account as an interim measure must definitely check whether the amount of debt actually exceeds the value of all assets minus money according to accounting data. You also need to find out how much your account was blocked for. That is, the blockage fell on the entire balance of the account or, nevertheless, on the difference between the total assets on the balance sheet minus the amount that accounts for cash. This is a very important point that should not be ignored.

If the inspection violated the procedure for applying an interim measure, ignored the procedure for banning the alienation of property, or blocked the full amount, although it did not have the right to do so, then the decision to block the account is invalid. In this case, the company has the right to file a complaint with at least the head of the territorial tax office, as well as launch a procedure for filing a complaint and seeking a pre-trial settlement with the Federal Tax Service in your region.

Try to appeal the decision. It is clear that there is not always enough time and energy for such litigation, but if your account is blocked illegally at least once, then, believe me, similar measures will continue to be used. The absence of response measures on the part of the company to the violation of its rights will lead to the fact that accounts will continue to be blocked with or without reason.

How to unfreeze the account in this case

If you have figured out that the account is indeed blocked legally, and all procedures were carried out legally, then it is obvious that it will be possible to unblock it only after the decision of the Federal Tax Service has been executed. To unfreeze, the inspection must receive documents confirming the write-off of debts. Based on them, the tax authorities will make a decision to unblock the account and the procedure for lifting sanctions will be carried out within the time frame familiar to you (written above). The decision will also be sent to the servicing bank.

How to avoid account blocking

The Central Bank, seeing the tension of the situation with account blocking, published a manual for businessmen, which provides instructions on how to avoid account blocking.

General recommendations for businessmen from the Central Bank of the Russian Federation:

- It is necessary to inform the bank and the tax service about changes: addresses, founders, OKVED, etc.

- Check entries in the Unified State Register of Legal Entities on the tax website. If the address is being verified, the register will indicate that the information is unreliable. It will disappear after the address is confirmed.

- It is important to fill out payment documents carefully and in detail. The same is required from counterparties. It is better to indicate all the comprehensive information: for what product, service, on the basis of what document, etc.

- There is no need to split your business into many companies and individual entrepreneurs. For example, one is responsible for the material base, another has all employees registered, the third concludes contracts, the fourth is engaged in trade, etc. This scheme is direct evidence that there is an attempt to minimize the tax base.

- Bank requests should not be ignored. If a financial organization has any suspicions, it is better to immediately remove all questions by providing documents. Otherwise, there is a chance not only to lose your account and the money on it, but also to be blacklisted.

Bankers complement the recommendations of the Central Bank:

- pay taxes from one current account and on time;

- all employees must be on staff;

- It is better to pay salaries through a current account. Its level should not be below the subsistence level;

- all employee fees must be paid on time and in accordance with the number of people hired;

- each counterparty must be checked through the services of the tax office or bank;

- all expenses for business activities must be accounted for;

- limit cash withdrawals: issue salaries through a salary project, pay for entertainment expenses with a business card, buy stationery and pay office expenses by bank transfer, conduct settlements with counterparties through a bank;

- avoid errors in documentation;

- deposit cash into the account.

So, the main thing in doing business is attentiveness, caution and timely response to letters and requests from the bank or tax office.

According to our website, the most favorable bank for opening a current account, in which blocking occurs less frequently than in others, is Modulbank.

Open an account

Blocking by bank decision

You need to know that absolutely all customer transactions are under the control of the bank’s financial monitoring service.

If your actions suddenly seem strange to the bank or there is a suspicion that you are engaged in illegal transactions, the bank will block your account.

And your task is to documentally prove to the bank that your transactions are legal.

Everyone has probably already heard about Law 115-FZ “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism.” Even if you understand that you have nothing to do with the financing of terrorism, you certainly feel the impact of this law on yourself. In the form of banking control. Referring to this law, banks invade our personal lives, asking for information about the legality of deposits into the account, the validity of payments and cash withdrawals.

How does the banking control system work?

All banks are built into the Russian financial control system, which is managed by Rosfinmonitoring. At least once a week, Rosfinmonitoring sends to all financial organizations a list of dangerous companies and individuals against whom there are suspicions (or even accusations) of criminal activities of terrorist financing. And they are obliged to quickly respond and stop suspicious transactions of their clients, control financial flows and prevent illegal schemes.

To do this, each bank develops its own internal control system , creates a special service, appoints responsible persons, and implements an electronic system for responding to banking transactions, which defines their criteria leading to blocking of accounts and cards. This information is confidential. A limited circle of banking personnel is allowed to access it. The law allows the bank to independently classify transactions of bank clients as “doubtful”. In general, as the bank decided, so it will be.

Bankers, confused by the massive raids by clients and in fear of the Central Bank and Rosfinmonitoring, turned to the Central Bank for clarification on which transactions should be considered suspicious and which documents will prove the legality of the transactions. But there was no clarification from the Central Bank - Nabiullina recalled the freedom of the bank’s agreement with the client. It is clear that it is convenient for the Central Bank to keep banks on a short leash and, on occasion, find a “jamb” in the bad guy and revoke the license. Apparently, the total cleanup of banks will continue.

“Hackers” and “cashers”, secret entrepreneurs and the most ordinary people can fall under financial control. About this - the article “Oops!..Your card is blocked.”

All banking transactions are analyzed automatically and suspicious transactions are recorded. What comes under suspicion is analyzed by experts - the bank’s financial monitors. A lot also depends on their literacy, qualifications, and professionalism.

But the responsibility for “mistakes” in this area is very high - significant fines, deprivation of licenses, and bringing officials to administrative and criminal liability. Officials hold on to their seats. Their controllers, the Central Bank and Rosfinmonitoring, do not stand on ceremony.

What signs are questionable, what clients are suspicious - the truth is known to a limited circle of people. But there are observations and analysis of what is happening. I am sharing them with you.

Reasons for blocking an account under 115-FZ

- your counterparty is on the black list of Rosfinmonitoring,

- any transactions amounting to more than 600,000 rubles,

- the parties conduct transactions on behalf of persons on the wanted list,

- the bank began to suspect the authenticity of the documents,

- a large number of transfers are carried out in favor of individuals,

- frequently and a lot of cash withdrawals from your current account - 30% or more of turnover per week,

- You quickly withdraw the money you receive, leaving a minimum account balance,

- low tax burden - less than 1% of turnover,

- oddities when paying taxes - revenue is received with VAT, but transfers to counterparties are without VAT, or revenue is credited to the account, but taxes are not paid (paid, for example, to another account in another bank). Need clarification

- incomprehensibility about running a business - expenses that confirm real activity are not paid - rent, utilities, salaries,

- negative information about a mass or false address of a legal entity. Bank employees are required to personally go out to check the accuracy of the address,

- mass or “nominee” director of the company. An explanation from the director will be required and, most likely, his personal appearance at the bank,

- doubts about the legality of transactions or a suspicious purpose of payment - an inaccurate description, the same phrase in several payments, or strange payment purposes that do not comply with the organization’s OKVED code.

How to act

Actively!

Step 1. Exhale, calm down and don't panic. There is no need to be indignant and call on bank employees to respect the rights of the client.

From this moment on, no one is interested in your rights, the presumption of innocence does not work, you are under suspicion. “In laundering proceeds from crime and financing of terrorism.” Forget that the customer is always right. The larger the bank, the less interesting it is in you as a client, even a financially wealthy one.

Step 2. Find out the reason for the blocking and how to quickly resolve the situation. Each bank has different algorithms of action, but one thing is common - they block first, and then sort it out.

Some banks will explain to you over the phone what supporting documents you should submit, others will send you a list by email or post it in your personal account. Important banks will have to come to the branch.

There is no point in getting angry or annoyed with the client department manager. He doesn’t influence anything, he voices to you questions from bank financial monitors, accepts and transmits documents. The bank's control service specialists will not communicate directly with you. It is forbidden.

Step 3 . I advise you to act immediately - collect the requested documents and hand them over strictly according to the inventory, indicating the date and signature of the employee who received them. Take a copy of the inventory for yourself.

If the documents presented are not enough, be prepared to bring the missing ones.

It happens that freezing is associated with a misunderstanding. In this case, the bank will not delay in unlocking the account.

What documents may be requested? Any. The bank decides for itself what supporting documents to request from you. It's his right. Threatening legal action is useless. They are on the side of the banks. And there are a lot of such disputes. The courts believe that the bank has the right to decide what is suspicious and what is not. The bank exercises financial control; the law does not limit it in the choice of methods and measures.

Therefore there is no point in arguing. And get upset too. Of course, it’s unpleasant and unfair. But these are Russian realities, it is better to implement than to argue in vain.

Therefore, it is better not to waste your energy and time. The sooner you submit documents, the sooner the bank will consider your application for unlocking.

Important points

1. Control the deadline

If you have submitted all the requested documents confirming the legality of the activity and the legality of the transaction, the bank is obliged to restore service.

The average account blocking period is 1-1.5 months. A customer-oriented bank will resolve the issue quickly - in 1.5-2 weeks this is quite realistic. A friendly bank needs 3-5 days.

If the unlocking period is delayed, start pressing. Shake everyone up - call the call center, the customer department, write letters in your personal account, email all bank addresses you find, send by mail. Let them get irritated. But the bank is obliged to respond to your statements. Become a nuisance - let them sort it out faster - and you will fall behind.

2. Keep the entire process of communication with the bank under control

Your documents may lie around or get lost between offices, and your business may become clouded. Therefore, keep all actions under control.

After submitting the documents, write an email to the bank (or send it on paper, by mail) stating that you have submitted documents to the bank’s request, what documents and when. Declare your readiness to provide, if necessary, additional documents and explanations. For all your correspondence (covering letters, applications to expedite the resolution of the issue, etc.), receive feedback from the bank - acceptance marks: the number of the assigned request in the bank’s electronic system, the application number when contacting the call center or notification of receipt of a registered letter in the event postal item.

3. Prepare to advocate for yourself

Study the legislation, study the list of questionable transactions in section 6.1 of Law 115-FZ. Try to understand which transactions raised the bank's suspicions.

Re-read the agreement with the bank. You will be very surprised when you realize that the bank is right. The bank has the right to block money in your accounts without any warning.

Important! Calculate your losses - if you have to close accounts, deposits, or transfer funds to another bank.

4. Don’t give in to provocations

You may be asked to close all accounts and take all the money. Then unblocking will not be required.

This is beneficial to the bank:

- the bank will get rid of the problem client. Understanding is long and uninteresting,

- your file will be handed over to the archive, which is unlikely to be reached by Central Bank inspectors during a bank audit,

- if you have accounts or deposits, you can withdraw the money in accordance with the terms of termination of the contract - it is possible that with losses or without accrued interest. Read the agreement with the bank.

Advice. If you are sure that you are right, do not be fooled by provocations. Make your own decision - stay or leave. But in any case, get it unblocked, remove all suspicions, and then move to another bank. Why is it important?

If the suspicion is not removed and you run away from this bank to another, you will receive a “black” mark in the banking control system and ruin your reputation for other banks.

Taking advantage of your vulnerable position, the bank may offer you to sign an additional agreement to the contract with increased tariffs for conducting dubious transactions, offer to transfer all the money to another bank, or withdraw all the money in cash with a protective tariff. Appetites are good from 5 to 20% of the account balance. Rosfinmonitoring did not give banks any authority to make such earnings, but there is no direct prohibition in the law. The bank is no longer interested in you as a client, but it wants to make money from you. This is a blatant attempt to take advantage of you. They cannot force you; it is up to you to accept this condition, sign the agreement or not.

A stunningly disgusting incident occurred with one well-known bank, which requested from its client documents (in sufficient volume) confirming a transaction of 12 million rubles within SIX WORKING HOURS. The company's employees did not have time to fulfill the bank's insane demand on time, for which they received a restriction of banking services without renewal, a message about the closure of the account, and permission to transfer the account balance to another bank. But! With deduction in favor of the bank of the commission provided for by the terms of banking services in the amount of 15%, which is 1.6 million rubles. For what services did the bank decide to earn 1.6 million commission? Quickly grab a bigger jackpot when transferring money from one account to another? Will anything crack?

The court supported the company, recognizing the bank's actions as unjust enrichment. And by the way, there are plenty of lawsuits against this bank.

If you are interested in the details, here is the document: Decision of the Moscow Arbitration Court. Case No. A40-241820/18-25-1569 dated November 30, 2021

5. Don’t be fooled by intimidation

The bank does not have the right to simply accuse you of illegally receiving funds or transferring them. If they try to put pressure on you and demand that you “pay taxes,” declare that this is not the bank’s business and threaten to sue. In case of escalation of the situation, threats and intimidation, I advise you to record conversations with a voice recorder. Remain calm, do not be fooled by the harshness of bank clerks inflated with their own importance. Remember that they have no right to put pressure on you or blame you. And if they also create problems for the bank - in the form of litigation - they may even be thrown out of work.

If the bank accepted the documents upon request, but does not want to understand and refused to unblock the account, its actions can be appealed. I advise you to act in parallel - send a complaint to the Central Bank and a statement of claim to the Arbitration Court. Demand that the bank's actions be declared illegal.

About the complaint to the Central Bank

You should not count on a quick and friendly response from the Central Bank. The period for consideration of your complaint is 30 days. Central Bank employees are leisurely and swaggering controllers. Unfortunately, I didn’t meet any others among them. They will react, of course, but don’t expect a quick reaction.

About going to court

Demand that the bank's actions be declared illegal. According to Article 65 of the Arbitration Procedure Code of the Russian Federation, the bank is obliged to prove that it had grounds for suspending or refusing to carry out transactions on behalf of the client. If your transactions are completely legal and you have submitted all supporting documents, then the court will side with you and oblige the bank to unblock your account.

What is blocking a bank account?

This term implies a complete “freezing” of funds in the account of a specific individual. The use and disposal of money becomes impossible, but the client will retain ownership rights.

A complete “freeze” of all money is extremely rare. More often we are talking about blocking a certain amount already deposited in the account, or about an incoming transaction. For example, a person received a payment of 150 thousand rubles, but the bank considered it suspicious and blocked it. The remaining money remains available for any operations.

Sometimes the bank imposes restrictions on possible actions with the account. For example, a client can freely transfer money, open deposits or pay using them in online stores, but cannot cash them out.

Sberbank explains in detail what Federal Law 115 is and what it threatens to individuals

In the future, we will consider the option of completely blocking the account, since, strictly speaking, the reasons for the “freezing” and the methods for restoring access to money are the same in all cases - this applies to the entire amount or only part of it. Below we will talk about what actions will help avoid blocking.

Account blocking is carried out using the following mechanism:

- The customer completes a transaction or receives money;

- The operation seems suspicious to the bank, and it begins checking it, requesting data from the Federal Tax Service or from the client himself;

- If the suspicions are justified, the account or amount is blocked;

- Information about this is sent in form 550-P to Rosfinmonitoring and the Central Bank;

- Rosfinmonitoring prepares a general “black list” and distributes it to all banks.

Getting on the stop list is especially critical for an entrepreneur. If one financial institution puts a “black mark” on it, this will be a signal to others: the client is unreliable and it is better not to contact him. But it’s also not good for an individual. Any bank can refuse him, for example, to open a current account or issue a loan, having received data from the “black list”.

Remember about civil liability for bank account transactions that fall within the scope of the law (according to Sberbank)

How to withdraw money from a blocked account

The withdrawal of funds depends on who initiated the blocking of the account.

If the current account has been blocked by the Federal Tax Service, then there may be the following options for solving the problem:

- if the account is blocked for a specific amount, for example, in terms of tax debt, then the remaining money is freely available to the company. Accordingly, she has the right to dispose of them at her own discretion;

- if the current account is completely blocked, then you can try to get some of the money through a writ of execution regarding non-payment of wages. To do this, the employee needs to apply to the judicial authorities with a claim for payment of wages. This method is characterized by a lengthy and complex process, but high efficiency. You can also create a commission to resolve labor disputes, which will collect the necessary documentation on the issue of wages owed to employees and send it to the bank to resolve the issue.

If the bank itself has blocked the current account, then you can also use the method associated with the writ of execution regarding the payment of wages. In addition, you can try to return the money to the supplier or transfer funds to the company’s current account in another bank. Even if the account is blocked, the money on it is not confiscated, and therefore the bank is obliged to return it. Each specific situation is considered individually, but you need to try all possible options for interacting with a credit institution.

Blocking a current account for late submission of a declaration

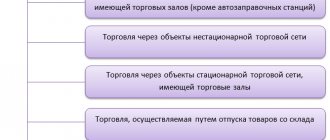

If a taxpayer is delayed in submitting any of the declarations provided for by the Tax Code of the Russian Federation for more than 10 days, the Federal Tax Service has the right to restrict all transactions on his bank accounts. This is provided for by paragraph 3 of Article 76 of the Tax Code of the Russian Federation, as well as paragraph 6 of Article 6.1 of the Tax Code of the Russian Federation. Tax officials have this right only in relation to failure to submit tax returns; late submission of all other reports does not lead to such consequences. The account is blocked completely; its owner cannot manage it in full. The law exclusively allows payments related to labor relations and the payment of taxes and fees. Data on such payments and their order are given in the table.

| Payment | Payment order |

| According to executive documents on compensation for harm caused to life and health, and on the collection of alimony | First of all |

| According to executive documents on the payment of severance pay, wages under employment contracts and remuneration to the authors of the results of intellectual activity | Second stage |

| Transferring salaries to employees (as well as receiving cash for issuing them) | Third stage |

| On instructions from the Federal Tax Service to transfer debts on taxes and fees to the budget and on instructions from the Pension Fund of the Russian Federation or the Social Insurance Fund to transfer insurance contributions | |

| According to enforcement documents providing for the satisfaction of other monetary claims (for example, compensation for material damage) | Fourth stage |

| For the payment of taxes, fees, insurance premiums, as well as penalties for their late payment and fines for violation of tax legislation and legislation on compulsory social insurance | Fifth stage |