What is cash discipline?

This is a set of rules for processing cash transactions. They describe how you must accept, store and issue cash. It is very important in this matter not to confuse concepts such as “cash register” and “cash register”.

A cash register (cash register, cash register, online cash register) is a device that is used to accept cash from customers for goods or services. This operation is recorded for subsequent transfer to the Federal Tax Service, and the client is issued a fiscal receipt.

The enterprise cash register (operating cash desk) is a record of all actions in the company that relate to cash. Money accepted via cash register is also deposited into the organization’s general cash register. This money is then either issued for cash expenses or collected at the servicing bank for crediting to a current account. The cash desk physically stores the company's money and everything that happens to it must be confirmed by relevant documents. This is called cash discipline.

In general, when maintaining cash discipline, you need to rely on the following principles:

- All transactions with cash must be documented.

- It is important to strictly monitor compliance with the cash register limit.

- When issuing money for any needs, appropriate documents must be issued.

- The limit on cash payments between two business entities cannot be exceeded; today this amount should not exceed 100 thousand rubles per contract.

What common

In addition to the name, the following points are common between the cash register as a wallet and the cash register as a machine:

- in both cases, the class reflects the change in cash ;

- in both cases, these operations are accompanied by the preparation of receipt and expenditure documents and require accounting (see table below);

The concepts are related very simply: accounting for transactions that went through cash registers is part of the entire cash accounting of the company.

Table. Cash transactions and documents

| Cash desk is... | Cash transactions | Documents about the operations performed |

| The total amount of cash of the enterprise |

|

|

| Cash register equipment (operations on cash registers are part of cash accounting) |

|

|

Who should observe cash discipline?

All subjects of the administrative and economic sector working with cash are required to observe cash discipline. This obligation applies regardless of whether cash is accepted through a cash register or via BSO. The tax regime also does not matter.

It is worth noting that for individual entrepreneurs the rules for maintaining cash discipline are somewhat simplified. For example, this concerns the abolition of registration of receipt and expenditure orders and the cash book. They only need to be completed when issuing cash for wages to employees.

The simplification also applies to the cash balance limit. There is no need to install it for individual entrepreneurs, provided that the number of employees is less than 100 and the annual revenue is less than 800 million rubles.

A complete list of cash discipline rules can be found in the instructions of the Central Bank of the Russian Federation (Instruction No. 3210-U dated March 11, 2014).

Moscow State University of Printing Arts

4.

ACCOUNTING FOR CASH OPERATIONS

4.1.

Cash transactions and their role in the activities of a trading enterprise

Trade and catering enterprises in the course of their activities establish economic ties with suppliers of inventory items and buyers. Relations between the parties are formalized by contracts. Strict fulfillment of contractual obligations and proper organization of payments between enterprises lead to the timely receipt of funds. At the same time, in the course of its activities, a trading enterprise makes monetary payments with the employees of the enterprise, with social security authorities and other organizations and individuals.

Settlements between enterprises are carried out non-cash through banks, as well as in cash through the cash desk of an enterprise within the limits established by law.

A trading company, like any legal entity, chooses a bank for credit and settlement services. In addition to current accounts, banks can open current and special accounts for storing special-purpose funds (letters of credit and check books). Credit relations of an enterprise with banks are formalized by loan agreements.

The main objectives of organizing cash accounting and settlements are:

- • timely, complete and accurate reflection of cash accounting transactions and settlements;

• constant monitoring of the availability and safety of funds in the cash register, in current and other bank accounts;

• control of the use of funds;

• control of the correctness and timeliness of payments to suppliers and customers;

• monitoring the timeliness and accuracy of payments to the budget, banks, and employees;

• control of settlement transactions to prevent the formation of overdue accounts payable and receivable;

• control of the correct use of a bank loan and the timing of its repayment.

A special place in the operations of a trading enterprise is occupied by cash transactions, since a significant part of the revenue of these organizations comes through cash registers (the likelihood of abuse in this area is maximum, therefore it is primarily subject to various types of audits both from tax authorities and other control authorities) .

To receive, store, and issue funds, a commercial enterprise must have a cash register. The procedure for organizing a cash register and accounting for cash at enterprises is regulated by Letter of the Central Bank of the Russian Federation dated October 4, 1993 No. 18 “Procedure for conducting cash transactions in the Russian Federation.”

To accept cash from customers, trading enterprises must use cash register equipment. Enterprises can have cash in their cash registers only within the limits established by banks in agreement with the heads of the enterprises. If necessary, limits on cash balances in the cash register are revised.

Enterprises are required to hand over to the bank all cash in excess of the established cash balance limits in the manner and within the time limits agreed upon with the servicing banks. In this case, cash can be deposited at the daytime and evening cash desks of banks, collectors and joint cash desks at enterprises for subsequent delivery to the bank, as well as communications companies for transfer to bank accounts on the basis of concluded agreements. At the same time, enterprises that have constant cash revenue, in agreement with the banks that serve them, can spend it on wages, the purchase of agricultural products, and the purchase of containers and things from the population. But it should be noted that enterprises do not have the right to accumulate cash in their cash registers in excess of established limits for future expenses, including wages. Enterprises have the right to keep cash in their cash registers in excess of established limits only for wages, payment of social insurance benefits and scholarships for no more than three working days (for enterprises located in the Far North and equivalent areas - up to 5 days), including the day you receive them at the bank. The accumulation of cash in the cash registers of enterprises in excess of established limits is required to be monitored by the banks servicing them, which, using the Recommendations for the implementation by bank institutions of checks of compliance by enterprises, organizations and institutions with the Procedure for conducting cash transactions, send information about relevant violations to the tax authorities to attract the heads of enterprises to financial and administrative responsibility. Thus, for the accumulation of cash in cash registers in excess of established limits in accordance with Decree of the President of the Russian Federation of May 23, 1994 No. 1006 (as amended on July 25, 2000), a fine is levied in the amount of 3 times the amount of detected excess cash. During inspections, banks also reveal facts of cash payments in excess of the established limits, which currently amount to 100 thousand rubles. one deal at a time. For violation of the established limit, a fine of 2 times the amount of the payment made is collected. It should be remembered that non-recording or incomplete posting of cash is punishable by a fine of 3 times the amount not received. In addition, an administrative fine in the amount of 50 times the minimum monthly wage established by law is imposed on the heads of the organization who committed corresponding violations of the Procedure for Conducting Cash Transactions.

4.2.

Procedure for using cash registers

Trade enterprises are required to carry out settlements with the population, as well as with legal entities, through cash registers, as required by the Federal Law “On the use of cash register equipment when making cash payments and (or) settlements using payment cards” dated April 25, 2003 No. 54-FZ. In this case, trading enterprises are obliged to:

- • register cash registers;

• use serviceable cash registers to carry out cash settlements with the population;

• issue to the buyer (client), together with the purchase (after the provision of the service), a receipt printed by a cash register for the purchase (service), confirming the fulfillment of obligations under the purchase and sale (service) agreement between the buyer (client) and the relevant enterprise;

• provide employees of tax authorities and cash register technical service centers with unhindered access to cash registers;

• post price tags for goods sold (price lists for services provided) in a place accessible to the buyer (client), which must correspond to documents confirming the announced prices and tariffs.

Registration and re-registration of cash registers is carried out by enterprises submitting a corresponding application to the tax authority at their location with the device’s passport attached and is carried out within 5 days, and the enterprise receives a registration card.

Tax authorities monitor compliance with the rules for the use of cash registers, and penalties are applied for violation of them. Settlements with the population at commercial enterprises are carried out by cashiers-operators through operating cash desks. At trading enterprises, as a rule, there are both operating rooms and a main cash register.

After issuing an order to hire a cashier, the head of the enterprise is obliged, against receipt, to familiarize him with the Procedure for conducting cash transactions in the Russian Federation. Then an agreement on full financial responsibility is concluded with the cashier. The cashier, in accordance with the current legislation on the material liability of workers and employees, bears full financial responsibility for the safety of all valuables accepted by him and for damage caused to the enterprise both as a result of intentional actions and negligent or dishonest attitude towards his duties. The cashier is prohibited from entrusting the work assigned to him to other persons. At enterprises that have one cashier, if it is necessary to temporarily replace him, the duties of a cashier are assigned to another employee by written order of the head of the enterprise (decision, resolution). An agreement on financial responsibility is concluded with this employee. In the event of a cashier suddenly leaving work (illness, etc.), the valuables under his account are immediately recalculated by another cashier, to whom they are transferred, in the presence of the head and chief accountant of the enterprise or in the presence of a commission of persons appointed by the head of the enterprise. An act signed by the indicated persons is drawn up on the results of the recalculation and transfer of valuables.

In small enterprises that do not have a cashier on staff, the latter’s duties can be performed by the chief accountant or another employee by written order of the head of the enterprise, subject to the conclusion of a liability agreement with him.

4.3.

Documenting cash transactions

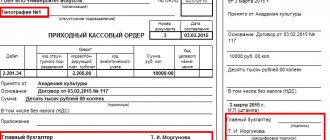

Reception of cash by the cash desks of organizations (main cash desks) is formalized by cash receipt orders signed by the chief accountant or a person authorized to do so by written order of the head of the enterprise. In this case, the depositor of money is given a receipt for the cash receipt order, signed by the chief accountant or a person authorized to do so, and the cashier, certified by the seal (stamp) of the cashier or the imprint of the cash register. When cash arrives from the bank to the cash desk of the enterprise, a cash receipt order is also issued. In this case, the receipt is attached to the corresponding bank statement from the current account. Receipt orders are numbered in order, starting from January 1 until the end of the year. The date the order was issued is also indicated. In the column “Corresponding account, subaccount” the account credited in this operation is indicated, i.e. The accounting entry is recorded. Below is the name of the legal entity or individual from whom the funds were received. In the “Bases” line, a link is given either to the manager’s order, or to the employee’s statement, or to another document.

Cash orders are drawn up on the basis of primary documents documenting a business transaction, the name of which is indicated in the “Appendices” line in the cash order.

Cash issuance from the cash register of enterprises is carried out according to cash receipts orders or properly executed other documents (pay slips, applications for the issuance of money, etc.). Documents for the issuance of money are signed by the manager, chief accountant of the enterprise or persons authorized to do so. The delivery of money to the bank is formalized by an announcement for a cash deposit. When issuing money according to an expenditure cash order or a document replacing it to an individual, the cashier requires the presentation of a document (passport or other document) identifying the recipient, writes down the name and number of the document, by whom and when it was issued. The recipient personally indicates the amount received in words. When receiving money via payroll, the amount in words is not indicated. The cashier can give money only to the person named in the cash receipt order or a document replacing it. If money is issued by power of attorney, executed in the prescribed manner, in the text of the order after the last name, first name and patronymic of the recipient of the money, the cashier indicates the last name, first name and patronymic of the person entrusted with receiving the money. The power of attorney remains in the cash documents for the day as an attachment to the cash receipt order or statement.

The issuance of cash receipts and debit orders or documents replacing them in the hands of persons depositing or receiving money is prohibited. Reception and issuance of money under cash orders can only be carried out on the day they are drawn up. When receiving cash receipts and debit orders or documents replacing them, the cashier is required to check:

- • the presence and authenticity of the signature of the chief accountant on the documents, and on the cash receipt order - the authorization inscription (signature) of the head of the enterprise or persons authorized to do so;

• correctness of documents;

• availability of applications listed in the documents.

If one of these requirements is not met, the cashier returns the documents to the accounting department for proper processing. Receipt and expense cash orders or documents replacing them are signed by the cashier immediately after receiving or issuing money on them, and the documents attached to them are canceled with a stamp or the inscription “Paid” indicating the date (day, month, year). Incoming and outgoing cash orders or documents replacing them are registered by the accounting department in the register of incoming and outgoing cash documents before being transferred to the cash desk. Expense cash orders issued for payrolls for wages and other payments equivalent to it are registered after the issuance of wages and payments equivalent to it.

All receipts and withdrawals of money from the enterprise are recorded in the cash book. Each enterprise maintains only one cash book, the sheets of which must be numbered, laced and sealed with a wax or mastic seal. The number of sheets in the cash book is certified by the signatures of the manager and chief accountant. Entries in the cash book are made in 2 copies using carbon paper using ink or a ballpoint pen. The second copies of the sheets must be tear-off sheets; they serve as the cashier’s report. The first copies of sheets remain in the cash book. The first and second copies of sheets are numbered with the same numbers. Erasures and unspecified corrections in the cash book are not permitted. The corrections made are certified by the signatures of the cashier, as well as the chief accountant of the enterprise or the person replacing him.

Entries in the cash book are made by the cashier immediately after receiving or issuing money for each order or other document replacing it. Every day at the end of the working day, the cashier calculates the results of transactions for the day for receipts at the cash register and expenses from the cash register and withdraws, using the balance of funds in the cash register at the beginning of the working day, the balance of money in the cash register at the end of the working day (it is also the balance at the beginning of the next day ). The second tear-off sheet from the cash book (a copy of the entries in the cash book for the day) with incoming and outgoing cash documents is submitted to the accounting department as a cashier's report against a receipt in the cash book. The accountant enters the numbers of corresponding accounts and checks the correctness of arithmetic operations. Control over the correct maintenance of the cash book rests with the chief accountant of the enterprise.

In the conditions of using an automated form of accounting, the registration of cash orders, the register of receipts, expenditures and cash orders and the cash book are maintained on a computer. In this case, the sheets of the cash book are printed daily and at the end of the reporting period (month, quarter, year - depending on the volume of cash transactions at the enterprise) they are stitched into a book, followed by the sheets being stitched and sealed.

As already mentioned, every day the cashier submits to the accounting department as his report the second tear-off sheet of the cash book with the receipt and expense cash documents attached to it. The cashier's report, in which the accountant entered the correspondence of accounts, serves as the basis for filling out the accounting register for account 50 “Cash”. In this case, each available cashier’s report generates one line of this register. At the end of the reporting month, debit and credit turnovers on account 50 “Cash” are calculated and, using the initial balance at the beginning of the month, the balance at the end of the month is displayed. The account balance must match the amount on the cashier's last report and the amount of money actually available in the cash register.

At the end of the working day, the chief (senior) cashier hands over the prepared proceeds to the collector for delivery to the bank and subsequent crediting to the current account of the trading enterprise. In accounting, the amounts of revenue handed over to collectors are recorded in account 57 “Transfers in transit.” The basis for accepting account 57 amounts of funds are receipts from bank institutions, post offices, copies of accompanying statements for the delivery of proceeds to bank collectors, etc. The most common form of surrender of trade proceeds in a trading enterprise is a contractual form with the participation of a bank representative - the collector. The proceeds are transferred to the collector at the time set by the bank. Before this, the cashier prepares the proceeds for delivery by selecting the funds by banknotes, putting them in packs of 100 pieces of the same denomination and tying them up. The operation of transferring proceeds to collectors is formalized using a transmittal sheet drawn up in two copies. This document specifies the donor and recipient of the proceeds, and bank details for crediting funds. The reverse side of the statement, containing a banknote list of all transferred proceeds, allows you to control the amount. The cashier puts the first copy of the transmittal sheet, drawn up in the prescribed manner, into a money bag with the collected money placed there, and then seals it. The bag is handed over to the collector in exchange for an empty one with the corresponding numbering and a second copy of the statement, called the invoice. The cashier indicates in the appropriate log book the amount of revenue handed over and the bag number, gives it to the collector for signature, who, in addition, records the date and time of receipt of funds. The money bag received from the collector is opened at the bank and the amount of money invested in it is compared with that indicated in the transmittal sheet. In this case, if a discrepancy between the amounts or non-payment banknotes is detected, the bank employee unilaterally draws up a report, the form of which is on the transmittal sheet. After verification, the money is credited to the account of the trading enterprise, which is confirmed by the return of the second copy of the statement to the accounting department of the enterprise.

4.4.

even cash transactions

Basic operations on account 50 “Cash”:

Dt 50 “Cash desk”;

Kt 90 “Sales”, subaccount “Revenue” - revenue received from the sale of goods.

Dt 50 “Cash desk”;

Kt 73 “Settlements with personnel for other operations”, subaccount “Settlements for compensation of material damage” - received from financially responsible persons in compensation for the amount of shortage of goods.

Dt 50 “Cash desk”;

Kt 71 “Settlements with accountable persons” - the accountable person returned the cash previously issued from the cash register.

Dt 50 “Cash desk”;

Kt 91 “Other income and expenses”, subaccount “Other income” - reflects the amount of surpluses identified based on the results of the inventory.

Dt 60 “Settlements with suppliers and contractors”;

Kt 50 “Cash desk” - paid in cash to suppliers.

Dt 71 “Settlements with accountable persons”;

Kt 50 “Cashier” - cash was issued from the cash register for reporting.

Dt 70 “Settlements with personnel for wages”;

Kt 50 “Cashier” - wages were issued to the employees of the enterprise.

Dt 94 “Shortages and losses from damage to valuables”;

Kt 50 “Cash desk” - reflects the amount of the shortage identified based on the results of the inventory.

Dt 57 “Translations on the way”;

Kt 50 “Cashier” - at the end of the day, cash is deposited at the bank for crediting to the current account.

Dt 51 “Current accounts”;

Kt 57 “Transfers on the way” - the trading proceeds handed over the day before are credited to the company’s current account.

4.5.

Organization of operating cash desks at commercial enterprises

Operational cash desks are serviced by cashiers-operators who receive cash for the valuables sold. Such calculations are carried out using cash registers.

As already noted, Federal Law No. 54-FZ of April 25, 2003 “On the use of cash register equipment when making cash payments and (or) payments using payment cards” granted the right to certain categories of organizations and individuals in the case of the provision of services the population to conduct payments without the use of cash registers, but with the mandatory use of legally established forms as strict reporting documents. In addition, in a number of cases, organizations and individual entrepreneurs, due to the specifics of their activities or the characteristics of their location, are allowed to make payments without the use of cash registers (Clause 2 of Article 2 of this Law).

Enterprises that make payments using cash registers are required to issue the buyer a cash receipt confirming the receipt of cash from him. It should be remembered that invoices, receipts and other documents issued by enterprises do not replace a cash receipt. The check is valid only on the day it is issued to the buyer; it must be redeemed simultaneously with the issuance of the goods (or receipt for work performed) using stamps or tears in the designated places. On cash register receipts, conventional codes and stamps are used indicating the numbers of cash registers, the date of receipt of cash and the amounts received. Persons who have mastered the rules for operating cash registers to the extent of the technical minimum and have studied the Standard Rules for the Operation of Cash Registers, approved by the Ministry of Finance of the Russian Federation on August 30, 1993, are allowed to work on a cash register. A liability agreement is concluded with persons admitted to work, as well as as well as with the cashiers of the main cash register.

For each cash register, the administration creates a Cashier-Operator Journal in form No. KM-4, which must be laced, numbered and sealed with the signatures of the tax inspector, director and chief (senior) accountant of the enterprise. However, the Cashier-Operator Journal does not replace the cash report.

Standard rules for operating cash registers allow for maintaining a common ledger for all machines. In this case, entries are made in the numbering order of all cash registers (No. 1, 2, 3, etc.) with the serial number of the cash register indicated in the numerator; counters of inoperative cash registers are repeated daily, indicating the reasons for inactivity (in stock, under repair, etc.) and certified by the signature of a representative of the enterprise administration. All entries in the book are made in chronological order in ink, without blots. When making corrections to the Journal, they must be specified and certified by the signatures of the cashier-operator, the director of the enterprise and the chief (senior) accountant.

The cash register passport, the cashier-operator's journal, acts and other documents are kept by the director of the enterprise, his deputy or the chief (senior) accountant.

The readings of the summing cash and control counters are recorded in the cashier-operator's journal, and the data at the beginning and at the end of the working day is certified by the signatures of the administration representative and the cashier-operator. Thus, the difference between the meter readings at the beginning and end of the day, which should coincide with the sectional meter readings, is the daily revenue. The posting of daily revenue is confirmed by the main cash register in the cash report. Its amount must coincide with the amount handed over by the cashier-operator to the senior cashier and placed in the collection bag with the final check of the cash register. In case of discrepancies, actual revenue is determined by summing the indicators printed on the control tape; The administration representative and the cashier must find out the reason for the discrepancies. Identified shortages or surpluses are entered in the appropriate columns of the Cashier-Operator Journal. Based on the results of the audit, in the event of a shortage of funds, the administration of the enterprise must take measures to recover it from the guilty persons in the prescribed manner, and if there is a surplus of funds, take them into account and classify them as non-operating income.

In a trading company, the amount of revenue from the operating cash desk may be reduced by the amounts returned to customers. The cashier-operator can issue money on checks returned by customers only if they have the signature of the director (manager) or his deputy and only on checks issued at this cash desk. For the amounts of the corresponding checks, the cashier, together with the administration of the enterprise, draws up an act in form No. KM-3 on the return of funds to customers for unused cash receipts. The cashier sticks the checks themselves on a sheet of paper and submits them to the accounting department along with the receipt. The returned amounts, together with the zero checks printed per day (which are used to check the clarity of the printing of details on the receipt and control tapes, as well as the correct installation of the dater and numerator) are reflected in the Cashier-operator's Journal. Thus, the amount of revenue is reduced by the total amount of the act of returning funds to customers for unused checks.

In addition, in trading enterprises, funds can be received at the cash desk not only for goods sold. For example, in the case of a commission sale, when goods previously handed over for commission are returned to the consignor, the cashier receives a storage fee from him. The cashier records such receipts in the receipt sheet. The cashier closes the receipt sheet daily by counting the amount of money received and signs it together with the accountant and manager. In this case, a cash receipt order is issued for the total amount of funds received, which is attached to the report and submitted to the accounting department:

Dt 50 “Cash desk”;

Kt 91 “Other income and expenses”, subaccount “Other income”.

The transfer of the readings of summing money counters to zeros (cancellation) can be done in accordance with the Rules for the operation of cash registers when putting a new machine into operation and during inventory, and, if necessary, in case of repair of money meters in workshops - only in agreement with the tax inspectorates with their mandatory participation representative The translation of the readings of summing money meters, the control of meters before and after their transfer to zero is drawn up by an act in the KM-1 form in two copies, one of which is transferred to the tax office as a control, and the second remains at the trading enterprise.

The transfer of a cash machine to another enterprise or workshop for repair and back is carried out using a consignment note and is formalized by an act in form No. KM-2, which records the readings of sectional and control counters (registers). No later than the next day, the invoice and act are submitted to the accounting department of the enterprise. An appropriate note about this is made in the Cashier-Operator's Journal at the end of the entry for the day. Along with the car, its passport is also handed over, in which the corresponding entry is made. When repairing cash meters directly at enterprises, a report is also drawn up in form No. KM-2 with a recording of the readings of cash and control meters before and after the repair.

At the end of the working day, the cashier-operator hands over the proceeds to the senior cashier (or directly to the bank through collection) against receipt, and the money must be collected by banknotes. The senior cashier is also given acts and other documents for calculating revenues necessary for drawing up a summary report, which is transmitted along with cash orders to the accounting department.

Maintaining cash discipline for LLCs and individual entrepreneurs. List of documents

One of the requirements of cash discipline is the presence of a cashier , and his duties can be performed by the director of the enterprise or (in the case of individual entrepreneurs) by the individual entrepreneur himself. In a situation where there is more than one cashier, a senior cashier must be appointed.

In addition to the cashier, the company must have a person who is responsible for generating cash documents. Most often, this responsibility is assigned to the chief accountant. However, as in the situation with a cashier, the role of this person can be played by the cashier or directly undertaken by the individual himself. Responsibilities for generating cash documents can be delegated to an organization that maintains accounting records.

Documents that need to be completed for cash transactions:

- A cash receipt order (PKO) is issued for each receipt of cash at the cash desk. When cash is accepted using a cash register or BSO, then one such order can be issued for the total amount per shift.

- An expense cash order (RKO) is issued for each expense transaction, i.e. for any withdrawal of money from the cash register. It is imperative to check the correctness of filling out such orders and verify the identity of the employee to whom the money is issued.

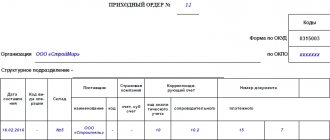

- Cash book (form KO-4) – records of all income and expense transactions are kept here, i.e. the data of each PKO and RKO must be reflected in it. The cashier's responsibilities include daily reconciliation of cash amounts with balances on cash documents. This may not be done if there were no operations during the shift.

- The accounting book (form KO-5) must be filled out if the enterprise has more than one cashier. This book reflects all movements of money between cashiers and the senior cashier. They must be certified with personal signatures.

- Payroll and payroll must be prepared and signed by employees when payments are made to them.

Maintaining cash documents is acceptable both in paper and electronic form

When completed manually, documents must be certified by original signatures.

Documents in electronic form are drawn up using a computer (other equipment) ensuring their protection from unauthorized access and signed with electronic signatures.

Important! Cash discipline does not include books of income and expenses, BSO, as well as the report and journal of the cashier-operator.

Maintaining a cash book in a separate department

The responsibility for maintaining a cash book is assigned to all separate divisions of the organization in which cash transactions are carried out. Such clarifications were given by the cash circulation department of the Bank of Russia in letter dated May 4, 2012 No. 29-1-1-6/3255. The Federal Tax Service of Russia adheres to a similar position in its letter dated May 17, 2013 No. AS-4-2/8827.

What is a cash balance limit?

The cash register limit or carryover balance is the maximum possible amount of cash that can be left in the cash register at the end of the shift. Anything in excess of this amount must be deposited in the bank. True, small deviations are acceptable on days when a large amount of cash is expected to be issued (paydays) or on holidays.

Setting a cash register limit should be approached extremely responsibly, since if the limit is not set at the end of the work shift, there should not be a single ruble in the cash register. Otherwise, there will be a violation for which administrative liability and a fine are provided.

An order to set a cash limit.

The limit must be calculated and fixed in an internal order, which can set a limit both for a specific period of time and for an unlimited period, i.e. until a new order is issued.

Simplified procedure.

For small enterprises (less than 100 employees and revenue for the previous year less than 800 million rubles) and individual entrepreneurs, from June 1, 2014, establishing a cash balance limit is not mandatory. However, to cancel it, it is necessary to issue an appropriate order based on the Directive of the Bank of Russia dated March 11, 2014 No. 3210-U, which must certainly contain the following wording: “Keep cash in the cash register without setting a limit on the cash balance.”

Cash book

It is used to record the issuance and receipt of cash. The book is numbered, laced and certified with a seal, which is placed on the last page. A record is also made here indicating the number of sheets. The last page should bear signatures. accountant and company manager. Each sheet of the book is divided into 2 equal parts. One (with a horizontal ruler) should be filled in like the first copy, the other - like the second copy. The latter is drawn up on the back and front sides using carbon paper. Both copies are numbered with the same number. The first ones remain in the book, and the second ones are torn off. The latter act as reporting cash documents. They do not come off until the end of all operations for the current day. Entries begin on the front side of the first copy after the column “Balance at the beginning of the day.” Before filling, the sheet must be folded along the tear line. The cut-off part is placed under the one that remains in the book. To enter information after the “Transfer”, the tear-off side is superimposed on the front side of the second copy. The entries continue along the horizontal line on the reverse side of the continuous part.

How, according to the rules of cash discipline, money is issued to accountable persons

Accountable money is cash given to an employee to pay for business expenses, travel expenses and other needs of the enterprise.

To issue such money, an application from the employee receiving the money is required, in which it is necessary to indicate the full amount, period and purpose of receiving it. The application must have the signature of the manager.

If business or other expenses of the enterprise are paid with the employee’s own funds, they are also subject to reimbursement on the basis of an application, which must indicate that “the employee has no debt on previously issued advances.” This is a legal requirement that an employee must fully account for previously received advances before receiving accountable money.

To provide a report on spent funds, the employee is given 3 working days from the expiration of the period for which the funds were issued, or from the date of return to work. Expenses are confirmed by appropriate receipts, which are attached to the expense report. This is necessary to accept them as expenses and to correctly calculate the tax base. In addition, for funds spent without supporting documents, it is necessary to pay insurance premiums and withhold personal income tax.

Restriction on the issuance of money according to the rules

You should also pay close attention to cash payments between business entities. This does not apply to settlements with individuals. Legal entities and individual entrepreneurs can make cash payments among themselves, but not more than 100 thousand rubles within the limits of one agreement.

This restriction also does not apply when issuing from the payroll office to employees accountable funds to an individual employee, if this money is not planned to be used to pay for goods and services on behalf of the organization on the basis of a power of attorney.

Who and when can take money from the cash register for personal needs?

Any income of the organization belongs directly to the organization. Therefore, payment for the personal needs of the founders, even if there is only one, cannot be made from the cash desk of the enterprise.

This does not apply to individual entrepreneurs, who can use money both from the cash register and from the current account in any quantity, provided there are no arrears in paying insurance and tax contributions.

If an individual entrepreneur does not have an order to cancel the maintenance of cash documents, in order to receive cash from the cash register, an expense order must be drawn up containing the following wording: “Issuing funds to the entrepreneur for his own needs” or “Transferring income from current activities to the entrepreneur.”

Pay slips

Registration of cash documents is carried out during calculations and payment of wages to employees of the enterprise. The accounting department draws up the corresponding statement in 1 copy. The accrual of wages is carried out according to the information present in the primary documentation for accounting for actual time worked, output, etc. The “Accrued” lines indicate the amounts in accordance with the types of payments from the payroll. Other income (material and social benefits) provided to the employee, repaid from the profit of the enterprise and subject to inclusion in the tax base, is also entered here. At the same time, deductions from wages are calculated and the amount to be paid to the employee is established. The total amount to be paid to employees is indicated on the title page of the statement. The head of the enterprise must sign the authorization for the payment of wages. In case of its absence, this document is issued by an authorized employee. At the end of the statement, the amounts of deposited and paid salaries are entered. After the expiration of the period established for the payment of funds to employees, the mark “Deposited” is placed opposite the names of the employees who did not receive the money in column 23. An expenditure order is drawn up based on the amount issued. Its number and date of completion must be indicated in the payroll slip on the last sheet.

What do tax authorities pay attention to during an audit?

Previously, banks were authorized to verify compliance with cash discipline rules. However, since 2012, this competence has been transferred to representatives of the Federal Tax Service, who, during an on-site inspection, can control:

- correct accounting of cash in the cash register;

- information recorded on the fiscal memory of the cash register by printing reports;

- any documents related to the execution of cash transactions (receipt and expense orders, cash register reports, cash book);

- timely issuance of cash receipts to customers.

Basis for conducting cash transactions

An organization that carries out cash circulation is required to have a cash register, a special room and a financially responsible person (cashier).

Conducting cash transactions is based both on compliance with legislative acts and on local acts (regulations, orders, etc.) developed within the organization that do not contradict the law. Cash must be held in accordance with the requirements for this process.

Thus, the company forms a certain set of rules for conducting cash transactions, compliance with which is cash discipline .

Fines for violation of cash discipline

Cash discipline obliges business entities to comply with the rules and provides for serious liability for their violation. A set of possible violations of cash discipline is contained in Art. 14.5 and 15.1 of the Code of the Russian Federation on Administrative Offences.

Not using CCT

According to Article 14.5 of the Code of Administrative Offenses, this is a violation and provides for liability in the form of a fine:

- for officials - from 3,000 to 4,000 rubles;

- for legal entities - from 30,000 to 40,000 rubles.

As practice shows, a fine for such violations is imposed on the entire organization, although only one employee can really be at fault.

Of course, companies are interested in having only the employee fined, since the amount of the fine (according to Article 14.5 of the Code of Administrative Offenses of the Russian Federation) is much lower. However, it should be borne in mind that when seeking to impose a fine on an official, you can end up with two. Since the law allows for the imposition of a fine on both the person who committed the violation and the organization in which it was committed.

Exceeding the cash limit

Based on Article 15.1 of the Code of the Russian Federation on Administrative Offences, for violating cash register limits you can receive a fine of 40,000 to 50,000 rubles. Cash discipline since 2021 obliges these limits to be strictly observed. If the company's revenue was less than 800 million rubles, and the number of employees is less than 100 people, the company can immediately cancel the cash balance limit from mid-2015, classifying itself as a small enterprise.

Non-receipt of cash proceeds

Funds not properly received in the cash register in accordance with Art. 15.1 of the Code of the Russian Federation on Administrative Offences, are the basis for significant fines (up to 50,000 rubles).

Exceeding the cash payment limit

Taking into account the limit of 100,000 rubles, questions arise regarding the calculation of these amounts, for example, if the agreement is not drawn up on paper or if similar contracts are drawn up for different amounts that are less than the established limit

For non-compliance with the procedure for handling cash, fines are provided, according to Art. 15.1 Code of Administrative Offenses of the Russian Federation:

- from 40 to 50 thousand rubles. for legal entities persons (organizations);

- from 4 to 5 thousand rubles. for officials and individual entrepreneurs.

Cases related to non-compliance with the Directives of the Central Bank of the Russian Federation are within the competence of the tax authorities (Article 23.5 of the Code of Administrative Offenses of the Russian Federation).

Help report

This document contains the readings of cash register counters and revenue per shift (working day). The certificate report is filled out in 1 copy daily. The cashier-operator must sign it and hand it over to the chief official (head of the enterprise). At the same time, a receipt order is filled out. In small companies, money is handed over directly to collectors. When transferring cash, the relevant bank cash documents are filled out. Revenue per shift (working day) is established in accordance with the indicators of summing counters at the beginning and end of the day. In this case, amounts returned to customers on unused checks are deducted. The established revenue is confirmed by the heads of departments. The senior cashier, as well as the head of the enterprise, signs the receipt of funds in the report. The certificate-report serves as the basis for compiling summary “Information on KKM meter readings and company revenue.”

Setting a cash balance limit

The organization sets the cash limit independently based on the specifics of the organization’s activities and the volume of cash flows and approves it by order of the manager.

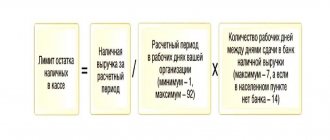

To calculate the cash limit, you can use the methods reflected in Central Bank Directive N 3210-U: based on cash flow (depending on the specifics).

The operating legal entity makes calculations based on the volume of receipts (issues) of cash, and the organized legal entity - based on the expected volumes of receipts (issues).

The balance limit is calculated using the formula:

Limit = volume of cash receipts (issues) / settlement period (1 – 92 days) * number of days due for delivery to the bank

Formation of cash documents

All facts of economic activity are subject to registration with primary documents. In connection with the use of online cash registers, it is allowed to maintain cash documents both electronically (with an electronic signature) and paper form, as well as in a combined form. For example, in order for the person depositing money to the cash register to have a supporting document, the PKO can be drawn up in paper form, where the tear-off part of the PKO remains with the person who deposited the money to the cash register.

From 01/01/2013, standard forms are not mandatory for use; documents for conducting cash transactions remain mandatory (information of the Ministry of Finance of Russia No. PZ-10/2012).

RKO and PKO are used to confirm the fact of movement of money through the cash register. These documents are drawn up directly when money flows through the cash register, are generated in 1 copy by the cashier, signed by the manager and the chief accountant (or a person authorized for such actions), and the results of the movement of money must be recorded in the registration journal (KO-4), which individual entrepreneurs may not lead.

The procedure for conducting cash transactions

The procedure for maintaining a cash register was approved by the Central Bank by Directive No. 3210-U dated March 11, 2014. Due to the widespread use of online cash registers, this procedure has been narrowed, which is determined by the organization or individual entrepreneur independently and prescribed in the Regulations (on the safety of cash, storage, transportation).

In this case, an important role is played by the fact that the Central Bank allows the registration of PKO and RKO in electronic form and a combination of electronic and paper documents is allowed. It should be noted that for electronic documents there must be an electronic signature of the cashier and chief accountant .

Responsibility for cash transactions rests with the cashier, but if the company is not large, then another responsible person (director or chief accountant) can take on the responsibilities of the cashier and this point must be included in the appropriate provision. In this case, the person responsible for the cash desk must be a full-time employee of the organization.

Synthetic accounting of cash transactions is carried out on account 50 (active) the debit reflects the receipt of money, the credit - the issue), for which the following sub-accounts are allowed to be opened:

- 1 Cash desk of the organization

- 2 Operating cash desk

- 3 Cash documents

For organizations, a cash limit must be set; amounts above the limit must be transferred to credit institutions (this does not apply to individual entrepreneurs - they have the right to keep as much cash as they see fit).

Rules for registration of accounting documentation

Procedure for preparing cash documents:

- The paper carrier is filled in with a ballpoint pen. You can also use a typewriter. The electronic version involves the use of a computer and printer;

- The chief accountant and cashier have the right to sign cash documents. In the absence of a chief accountant, the manager becomes responsible for the preparation of cash documents;

- a tear-off receipt is invalid without the “Paid” stamp;

- A dash is placed in empty fields.

Choosing a cash register program

There are two types of store programs: a cash register program that simply records sales, and a cash register program as part of an inventory system. Of the two options, experienced entrepreneurs always advise choosing the second. It's simple - when you use a cash register program synchronized with the accounting program, all your sales go into the accounting system, which displays information about purchases, sales, write-offs, and balances. This simplifies the analysis of your work and makes it possible to remotely monitor the operation of the store.

One such program is the CloudShop checkout program. You can download it for free on Android and iOS operating systems. The program works in full compliance with Federal Law-54. Benefits of the cash register program:

- Using CloudShop cash register software is beneficial for an entrepreneur. You just need to download the program and buy a fiscal registrar. There is integration with the Atol brand fiscal printer, as well as the Evotor smart terminal.

- To connect, you can use the detailed instructions for connecting the CCP.

- The CloudShop cash register program records not only sales, but also receipts, expenses, and returns.

- The CloudShop store cash register program automates the work of both one store and the work of a chain of stores. Moreover, the number of stores is not limited.

- The cash register program synchronizes with any barcode scanner.

- Unified technical support. For example, your system is not working correctly. You don’t know what the problem is - in the cash register or in the accounting program. All issues can be resolved in one place.

- And finally, the cash register program opens up wide possibilities for the inventory accounting system.