Author of the article Marina Afanasyeva Tax consultant with 4 years of work experience.

Hello. First, a short answer to the question - documents to receive a tax deduction must be submitted to the tax office only at your place of residence . Permanent registration is now a place of residence. It does not matter that the apartment is located in one city, and the owner is registered in another. We also submit documents at the place of residence.

Articles on the topic

All about deductions for purchasing an apartment. Separately - when purchased with a mortgage.

→Find out for free what deductions you are entitled to and how much money you can return. Specialists from ReturnNalog.ru will figure out what deductions you are entitled to, calculate them, prepare documents and submit them to the tax office within 24 hours. Accompaniment until receiving money.VerniteNalog.ru

Declaration 3-NDFL - what is it

In simple words, tax return 3 personal income tax is a regular annual report on finances and taxes. This form is used not only to pay taxes, but also to receive a tax deduction and a refund of funds already paid.

A tax deduction is issued when purchasing a home, as well as paying for:

- training of the ward;

- treatment;

- charitable expenses;

- contributions for voluntary pension insurance;

- and a number of other deductions that a citizen could make over the past three-year period.

The abbreviation means personal income tax. This form is filled out for the Federal Tax Service - the Federal Tax Service.

Who must submit the 3-NDFL declaration

Citizens who have their own independent income, permanent or one-time, must report on Form 3 personal income tax and pay the appropriate taxes themselves.

Self-employed individuals submit a declaration to legalize their income. These incomes include:

- rental of housing or other premises, equipment and other items;

- individual teaching activities;

- work as a private lawyer, notary and other private practice.

The same applies to tax residents who pay taxes in Russia. In general, this is humane, since our taxes are softer than in most countries.

Individual entrepreneurs on OSNO submit a 3-NDFL report in any case, even in the absence of real income. If there is no profit, a declaration with zero income is drawn up.

Preparing a zero return means that there is no real income and there is nothing to pay taxes on. On the other hand, there is nothing to file a tax deduction for.

Some entrepreneurs believe that if there is no income, there is no need to fill out a tax return. But this is not so, because in the absence of a zero declaration, an individual entrepreneur risks receiving a rather serious fine and penalty, ruining his financial history and even becoming prohibited from traveling abroad as a particularly persistent defaulter.

In what cases is it served?

When selling an apartment, if the period of ownership is more than 5 years, a declaration is not submitted. For apartments received as a result of donation, inheritance or privatization, the tenure period is reduced to 3 years.

When selling cars, equipment, land plots and garages, a declaration does not need to be submitted if the period of ownership is more than 3 years.

If the period of ownership of the property is less than specified, you will have to file an income tax return and pay the appropriate tax.

Winnings and prizes worth up to 4 thousand rubles are not taxed, and if the winning amount is more than 15,000, the payment of taxes on the amount is assigned to the organizer of the drawing or the donor of the prizes. Accordingly, the range for the lucky ones is very small.

The declaration in form 3-NDFL is submitted to the tax office at the place of registration or temporary registration.

Filing a declaration is due to the need to legalize one’s income or, in the case of filing a zero return for an individual entrepreneur, to report the absence of income or taxable base.

justice pro...

To receive a tax deduction and declare income in cases established by law, an individual submits a declaration. Which tax office should I file the 3rd personal income tax return with? In the article we will answer this question, in addition, you will find out where to submit documents for a tax deduction, whether it is possible to submit a declaration not at the place of registration, but at the place of temporary registration, work or location of property.

Why is it so important to determine which tax office to file the 3rd personal income tax return with? If you choose the wrong inspection agency and submit a declaration, for example, by mail, then you will lose time (it may take a long time until it turns out that the 3rd personal income tax was sent to the wrong address). And time (in this case, the deadline for submitting documents) in relation to declaring income and receiving deductions plays an important role. Thus, for failure to submit a declaration to the relevant tax authority within the period established by the legislation on taxes and fees, a fine is imposed (for example, when declaring income from the sale of a car for less than the minimum period of ownership). As for the tax deduction, the answer to the question “where to file the 3rd personal income tax return” is also important for you, since the deadline for applying for a refund of the amount of tax overpaid in the corresponding year may expire. In addition, the refundable amount of tax can be significant, so you are always interested in a speedy return of funds in the form of previously paid personal income tax.

To which inspection is the 3rd personal income tax declaration submitted according to the law?

The tax return is submitted to the tax authority at the place of registration of the taxpayer (clause 3 of Article 80 of the Tax Code of the Russian Federation).

Taxpayers - individuals are subject to registration with the tax authorities at their place of residence , as well as at the location of the real estate and vehicles they own (clause 1 of Article 83 of the Tax Code of the Russian Federation).

What is considered a place of residence according to the Tax Code of the Russian Federation?

Place of residence of an individual - the address at which the individual is registered at the place of residence in the manner established by the legislation of the Russian Federation (Article 11 of the Tax Code of the Russian Federation).

The concept of “place of residence” should be distinguished from the concept of “place of residence,” which recognizes the place where an individual resides temporarily at the address at which the individual is registered at the place of residence in the manner established by the legislation of the Russian Federation.

Based on the above, “place of residence” and “place of permanent registration” (registration) are identical concepts. And the place of stay is the so-called place of temporary registration.

Thus, we have found out where to file the 3rd personal income tax return in the general case - the 3rd personal income tax declaration is submitted to the tax office at registration . If an individual does not have a place of residence on the territory of Russia, for the purposes of the Tax Code of the Russian Federation, the place of residence may be determined at the request of this individual at the place of his residence.

In this case, the tax return may be

- submitted by the taxpayer to the tax authority in person or through a representative,

- sent by mail with a description of the attachment,

- transmitted in electronic form via telecommunication channels or through the taxpayer’s personal account.

Recently, a personal income tax return on paper can be submitted to the tax authority through the multifunctional center for the provision of state and municipal services (MFC).

Where to submit documents for tax deductions

Currently, the law provides for the receipt of various types of tax deductions for personal income tax, in particular, deductions for expenses for the purchase of an apartment, room, land, construction and purchase of a house, repayment of mortgage interest, treatment, training, life insurance, etc.

If you want to find out which tax office to submit 3-NDFL for refund, you need to find out which tax office you belong to by registration. This is where you will send your 3rd personal income tax return and other necessary documents to receive a tax deduction.

Note that some of the deductions can be received through the employer (most often this is how 13% of the apartment is returned). In this case, there is no need to prepare and submit a tax return 3 personal income tax. Which tax office to apply for a tax deduction for the purchase of an apartment (if you receive it through the Federal Tax Service or at work) will depend on which Federal Tax Service Inspectorate you belong to at your place of permanent registration.

Where to file the 3rd personal income tax return? This question is important for those who declare their income and receive a tax deduction

We will answer other frequently asked questions on the topic under consideration.

Where to file personal income tax return 3 to receive a tax deduction if you live in another city?

Registration of a tax deduction is a benefit, therefore the law does not impose the obligation to return 13% and, accordingly, submit a declaration. Persons who are not required to submit a tax return have the right to submit such a declaration to the tax authority at their place of residence (clause 2 of Article 229 of the Tax Code of the Russian Federation).

Therefore, a taxpayer working in one city, but at the same time having permanent registration in another city, submits a tax return 3 personal income tax to the registration inspectorate to receive a tax deduction (Letter of the Ministry of Finance of the Russian Federation dated April 20, 2021 N 03-04-05/23779) .

Example

The man works in Moscow, but is registered in Omsk. In 2021, he had dental treatment for a fee. To receive a tax deduction, he submits a declaration for 2021 to the Federal Tax Service at his place of registration in Omsk and issues a tax refund. At the same time, he does not have to go to Omsk to submit a declaration - he can submit 3 personal income taxes and the remaining documents for deduction via the Internet or by mail.

Is it possible to submit documents for a tax deduction at a location other than your place of registration?

If you are temporarily registered at one address and registered at another, then in order to receive a tax deduction you need to submit a 3rd personal income tax declaration to the tax office at your place of registration (Letter of the Federal Tax Service of the Russian Federation dated 02.06.2006 N GI-6-04 / [email protected] , Letter from the Federal Tax Service dated January 30, 2015 N ED-3-15/ [email protected] ).

Is it possible to file a 3rd personal income tax declaration when purchasing an apartment at the location of the property?

No, in this case, documents for obtaining a property deduction and personal income tax declaration 3 are submitted at the place of residence (i.e., the taxpayer’s place of registration).

Which tax return should I file when selling an apartment or car?

The obligation to file a declaration 3 of personal income tax when selling property does not always arise. For example, if you sold a car that you owned for more than 3 years, then you do not need to fill out a declaration. Taxpayers who are required to submit a declaration submit it to the tax authority at their place of registration (clause 3 of Article 228 of the Tax Code of the Russian Federation).

To which tax inspectorate is the 3-NDFL declaration submitted when selling property if there is no registration?

Citizens registered at the place of residence, but who do not have a residence permit on the territory of the Russian Federation, who have the obligation to submit a tax return for personal income tax, submit such a declaration to the tax authority at the place of residence (Letter of the Federal Tax Service of the Russian Federation dated 02.06.2006 N GI-6-04/ [ email protected] ). And if, at the time of filing a tax return, there is no place of residence (place of stay) in the territory of the Russian Federation, the tax return is submitted to the tax authority with which the person is or was registered, respectively, at the location of the real estate or vehicles owned by him (Letter of the Federal Tax Service Russia dated December 3, 2018 No. BS-3-11/ [email protected] , Letter of the Federal Tax Service of the Russian Federation dated August 28, 2018 No. BS-4-11/ [email protected] ).

Where to file the 3rd personal income tax return - at your place of residence or registration?

This question is not entirely correct, because... According to tax legislation, the place of residence is the place of registration. In general, the 3rd personal income tax declaration is submitted at the place of registration (and not at the place of stay)

Now you know which tax office to submit your 3rd personal income tax return to and where to submit documents for a tax deduction. To answer these questions, we turned to legislative norms, as well as clarifications from government bodies. In general, the declaration is submitted to the inspectorate at the place of registration (i.e., place of residence).

Posted by:

Ralenko Anton Andreevich

Moscow 2020

How to correctly fill out the declaration form 3-NDFL

Accounting reporting forms are constantly changing and improving in accordance with changes in legislation, which is also very changeable in the financial sector. Accountants have special programs that must be updated in a timely manner and monitor changes in legislation.

The tax office simply will not accept incorrectly filled out forms. And given that returns must be filed on time, an accountant’s mistake can cost the company serious money. However, you cannot use last year’s forms - they may have changed.

The only possible exception is if you submitted outdated forms before the next change was made and this is reflected in the postmarks.

For individuals, you can obtain a form from the tax office or download it from the Tax Service website. Although the easiest way is to fill out the 3-NDFL declaration online on the State Services website or on the Federal Tax Service website.

3-NDFL 2021

There are several ways to fill out the declaration:

- submit manually on a printed official form;

- fill out electronically on a prepared form in a Microsoft Excel file;

- using any online service;

- order filling from a lawyer;

- using the free program from the Federal Tax Service “Declaration”.

It doesn’t matter whether the personal income tax is filled out manually or on a laptop, there are some rules that you should know when filling it out :

- the paper form is filled out with a blue or black pen in block capital letters;

- each letter fits into a separate cell;

- all numbers are aligned to the right;

- all amounts are rounded to the nearest ruble;

- Cross-outs or corrections are not permitted;

- there must be dashes in empty cells;

- You need to fill out only the sheets necessary for each specific case.

The entire declaration consists of nineteen sheets, including the title page, the first and second sections, and sheets with letters. The procedure for drawing up a 3-NDFL declaration involves filling out only those sheets that are necessary in each specific case. In this case, you need to start with the sheets designated by letters, and based on them, enter data into the sheets of sections 1 and 2.

A sample of filling out the declaration is available on the official website of the Federal Tax Service, where you can download the form for filling out yourself and see exactly what the completed tax return 3-NDFL looks like.

On our website you can not only fill out 3-NDFL using the link below, but you can also get additional explanatory information and accurate information about all the innovations.

3-NDFL 2021

Each sheet of the declaration must be numbered and contain the full name, tax identification number, signature of the taxpayer, as well as the date the document was filled out.

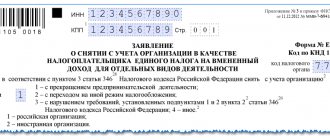

The title page must indicate:

- adjustment number (initial or updated declaration);

- tax period code and the period itself;

- tax authority code;

- code of the country;

- taxpayer category code;

- Full name, date and place of birth, contact telephone number and passport details of the taxpayer;

- taxpayer status;

- number of pages of the declaration.

The taxpayer category code in the 3-NDFL declaration indicates the field of activity. For example, code 720 means a private entrepreneur. All reference materials with codes and new meanings are fully included in the free Declaration program. This program also contains an example of filling out the 3-NDFL declaration and a fairly convenient tip for filling out forms.

| Code | Taxpayer category in 3-NDFL |

| 720 | An individual registered as an individual entrepreneur |

| 730 | Notary engaged in private practice and other persons engaged in private practice |

| 740 | Lawyer who established a law office |

| 750 | Arbitration manager |

| 760 | Another individual declaring income in accordance with Articles 227.1 and 228 of the Tax Code, as well as for the purpose of obtaining tax deductions in accordance with Articles 218-221 or for another purpose |

| 770 | Individual entrepreneur - head of a peasant (farm) enterprise |

Letter Sheets:

- A, B, C - for income and expenses in Russia and abroad, as well as from legal or entrepreneurial activities;

- G - for tax-free income;

- D1, 2 - tax deduction for the construction or purchase of real estate, as well as deductions for income from its sale;

- E1, 2 - social deductions;

- F - professional deductions;

- Z - transactions with shares or securities;

- And - income from investment.

The second section calculates the income tax payable, and the first section contains the final data.

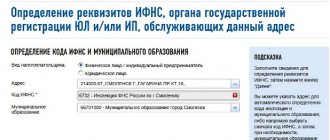

Rules for specifying the code according to OKTMO

- First of all, you need to take into account where the tax agent was registered and indicate the OKTMO code in the appropriate line. In the case where the employee’s salary was paid by the main branch of the organization, it is necessary to indicate where exactly this branch is located. If an employee received income from several branches simultaneously, then he needs to fill out two separate declarations, indicating, respectively, two different OKTMO codes.

- The code of the municipality that must be entered in the 2-NDFL and 3-NDFL declarations must be taken from the all-Russian classifier, which was approved in 2005. You can also contact your territorial tax authority to obtain such data. In addition, you can find out the number using the Internet service of the Federal Tax Service or use the tax service software (by the way, using this program, forms 2-NDFL and 3-NDFL can be filled out automatically.

- In most cases, the OKTMO code consists of eleven digits, but if the code consists of eight digits, then dashes must be placed in the remaining fields. For example, the Nevsky district (St. Petersburg) corresponds to the code 40 378 000. In the 3-NDFL certificate, this number must be written as “40378—”.

- OKTMO place of residence in the 3-NDFL declaration is usually indicated at the place of actual registration of an individual entrepreneur or individual.

Important! Regarding the last point, individuals (not individual entrepreneurs), as a rule, also need to indicate the source of income (that is, the code of the enterprise that transfers wages). The special number can be indicated in sheet A (“Profit from sources in the Russian Federation”).

Finally, it is worth noting that in judicial practice there have been cases when an accountant incorrectly indicated OKTMO, but by a court decision no penalties were applied to him. Based on the budget classification code, it was extremely clear that the personal income tax declaration had already been paid.

How to fill out 3-NDFL online in 2021

Detailed instructions for filling it out electronically are posted on the Federal Tax Service website along with an assistant program. To gain access to the taxpayer’s electronic personal account, you need to register at any branch of the Federal Tax Service.

It is convenient to use an electronic personal account in cases where your own region of registration or temporary registration is too far away, and there is no time to rely on mail.

Filling out 3-NDFL in the taxpayer’s personal account is much simpler than the paper version. You can fill out such a document for free by logging into your personal account on the Federal Tax Service website.

In order to fill out the 3-NDFL declaration online yourself, you need to follow a few simple steps:

- Register on the website of the Federal Tax Service.

- Issue a certificate for electronic signature.

- Log in to your personal account.

- In the “Drawing up ND” section, indicate the tax period.

- Check and correct the data filled in automatically.

- Pull up the data from the 2-NDFL certificate, if it is submitted by the employer.

- If necessary, indicate tax deductions.

- Summarize and create a file after carefully checking the entered information.

- Certify the document with an electronic signature and send it for verification.

- When accepting an electronic declaration, you can attach scanned copies of the necessary documents to it.

Electronic filing of a declaration on the tax website is possible from any region or even country.

Program for filling out 3-NDFL

You can also submit a 3-NDFL tax return in your personal account on the State Services website. In this case, the “Declaration” program is well suited, thanks to which it is possible to fill out a declaration for free.

It provides step-by-step filling of document columns with display of hints, which will prevent the occurrence of omissions due to inattention. This is really convenient, since the presence of reference books will eliminate possible errors.

Anyone can fill out a 3-NDFL declaration in the program by registering on the tax service website. To gain access to your personal account, you will need to appear in person with your passport and TIN at any tax office.

Required documents

When sending by mail, documents are sent by letter with a description of the attachment. But you can also submit documents in person, through a proxy with a certified power of attorney for each year, or through a verified personal account.

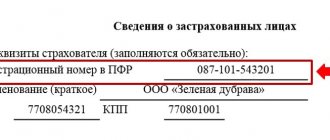

To file a 3-NDFL declaration, you need to collect a complete package of documents in your electronic account - it is generated automatically. This:

- user's passport data;

- registration or registration;

- TIN.

It is also necessary to provide supporting documents for a tax deduction - a certificate of purchase of real estate, treatment, training, and so on.

These documents are provided in educational or hospital institutions upon personal application.

The source of tax deduction payments is the budget. A prerequisite for a deduction must be income taxed at standard tax rates, since a deduction can only be obtained from money that has already been transferred.

How to make an updated declaration

If the main declaration has code 000, the amended declaration receives code 001. Repeated amendments receive code 002, and so on.

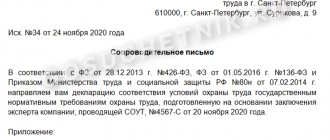

The same free program “Declaration” can provide assistance in filling out a corrective declaration. It also contains a sample cover letter for an updated 3-NDFL declaration.

cover letter for 3-NDFL

To fill out the updated declaration you must:

- Create a title page as described above.

- Specify the correction number: 001 - when submitting clarifications for the first time, 002 - when applying again, and so on.

- Correctly fill out all items about expenses and income.

- Insert the date of the document and your personal signature.

When submitting an updated declaration, all missing documents that were not initially submitted to the Federal Tax Service should be attached to it.

You can also file an updated declaration in the taxpayer’s personal account.

How to fill out 3-NDFL for tax deduction

When purchasing an apartment, in order to return funds under a mortgage agreement, the need to issue a refund for a child’s education, and in other situations that allow the return of funds, documents for a property deduction are drawn up.

The deduction is not provided when purchasing real estate from an employer or relatives, or when purchasing using maternity capital or funds from other persons. And it is also important that the right to deduction is not used in advance.

To apply for a 3-NDFL tax deduction, you must fill out the title page and sheet A according to the instructions described earlier, and add to them :

- when selling real estate - completed sheet D2 and sections 1 and 2;

- when renting out real estate - completed sections 1 and 2;

- when purchasing real estate or taking a mortgage loan - completed sheet D1 and sections 1 and 2;

- to pay for treatment or education - completed sheet E1 and sections 1 and 2;

- when paying insurance premiums - completed sheet E2 and sections 1 and 2.

The deduction amount is limited to 260,000 when purchasing a home. When applying for a mortgage, the deduction amount can be increased to 390,000 rubles - this is the maximum possible deduction.

Social tax deductions are limited to 15.6 thousand rubles per year.

To receive tax compensation, you must fill out 3-NDFL for three years.

Documents can be submitted online

The declaration with other documents can be submitted through State Services, but this will require an enhanced qualified electronic signature. This signature is written about here.

→Find out for free what deductions you are entitled to and how much money you can return. Specialists from ReturnNalog.ru will figure out what deductions you are entitled to, calculate them, prepare documents and submit them to the tax office within 24 hours. Accompaniment until receiving money.VerniteNalog.ru

If you have questions, you can consult for free. To do this, you can use the form below, the online consultant window and telephone numbers (24 hours a day, seven days a week): 8 Moscow and region; 8 St. Petersburg and region; all regions of the Russian Federation.

How and where to submit a declaration

A person who has personal income is required to submit a tax return at his place of registration. You can submit documents in person, through a proxy, or send a declaration by mail.

Important point: postage stamps on the envelope should indicate that the documents were sent on time. Inside the letter there should be a list of documents.

The most convenient way to submit a 3-NDFL declaration is through State Services - the official website where you can independently track absolutely all taxes, fines, penalties, as well as fill out already prepared and updated forms and send them from your personal account.

Filing a tax return online is very convenient, as you can get a guaranteed quick response and track the receipt and processing of submitted data in real time.

At the same time, the rules for filing a declaration online are much simpler than filling out paper forms: it is enough to correctly fill out form 3-NDFL in your personal account on the State Services website or on the Federal Tax Service website. The program will not allow you to send an incorrectly filled out form and will independently select data for almost the entire package of documents.

Documents for submitting 3-NDFL to the tax office

Documents for submitting 3-NDFL are documents confirming the identity of the payer, as well as confirming his rights to social and property deductions.

List of required documents for property deduction:

- any contract for the receipt of real estate;

- receipts and payment documents;

- act of acceptance and transfer of an object with participation in shared construction;

- documents confirming ownership;

- personal statement on the distribution of property deductions between husband and wife, if necessary;

- loan agreement and certificate of payment of interest on a mortgage loan.

To receive a social deduction you will need the following documents::

- copies of contracts for education or treatment;

- receipts and payment documents;

- prescriptions for medicines, with an indication of their issuance for the tax service;

- documents confirming the transfer of donations to charitable foundations;

- document on full-time study;

- copies of licenses from medical or educational institutions;

- certificate 2-NDFL;

- if necessary, documents on the relationship of the applicant and the person being trained or the person undergoing treatment.

To receive a deduction, the required list of documents must be attached to the 3-NDFL tax return.

Where can you submit a 3-NDFL declaration if it is not possible to submit it at your place of registration?

There are situations: the taxpayer is informed to which tax office to submit the 3-NDFL return, but physically cannot do this for one reason or another. What options are possible in this case? There are several of them:

- Send the declaration by Russian Post, making sure to fill out an inventory of the attachment. The inventory of the investment is drawn up in duplicate. There is a special form used for sending by mail. This document confirms the list of documents sent. In this option, the date of filing the declaration is the date of departure indicated on the postmark (clause 4 of Article 80 of the Tax Code of the Russian Federation).

- Submit your declaration online. This can be done through “State Services” or your personal account on the website of the Federal Tax Service, by registering and confirming your identity through special certification centers. However, you need to remember that when submitting a declaration in the indicated way for the first time, you do not have to wait until the last day.

- The law provides for the submission of reports to tax authorities at the taxpayer’s registered address by his representative. In this case, the representative must have a notarized power of attorney with him.

Deadline for submitting the 3-NDFL declaration

The tax period for filing a return is quarterly, six months, a year or 3 years. Each period has its own code, which is indicated on the title page.

The deadline for submitting 3-NDFL reports is determined by law from January to April of the year following the tax period. Therefore, the deadline for filing a tax return for individuals for 2021 is April 30th.

If the declaration is submitted for the purpose of tax refund, then it is not necessary to submit it before the 30th. The period for providing 3-NDFL for tax compensation is unlimited.

What is a land tax return?

A tax return for land tax is a document of a certain form, which contains a written statement from the taxpayer about the land plot, the calculated amount of tax, tax benefits, the tax base and other data that allows you to calculate the calculation and amount of tax payment.

The declaration is drawn up in the form established by the Federal Tax Service.

The document consists of the following sections:

- Title page;

- Section 1 “Amount of land tax payable to the budget”;

- Section 2 “Calculation of the tax base and the amount of land tax.”

Tax returns are submitted by payers no later than February 1 of the following year for the previous tax period.

You can provide it in several ways:

- In paper form along with removable media containing information in electronic form of the established format;

- In paper form using a two-dimensional barcode;

- In electronic form in the prescribed form: the transfer occurs through the use of the taxpayer’s personal account or telecommunication channels.

If there are no rights to taxable objects (land plots in our case), the declaration is not submitted.

The current current form of the land tax declaration is established by order of the Federal Tax Service of Russia dated October 28, 2011 No. ММВ-7-11/ [email protected] The procedure for filling out the land tax declaration is given in detail in the 3rd appendix of this order of the Federal Tax Service.

In 2021, the features of filling out and submitting a tax return have not changed. There are also no changes in 2021, but the situation may change at any time.

Penalty for late filing of 3-NDFL

A fine for failure to submit a 3-NDFL with a minimum amount of 1 thousand rubles is most often received by beginning individual entrepreneurs, who believe that in the absence of income and a taxable base, there is no need to fill out unnecessary documents. This is wrong. Failure to submit even a zero declaration on time will result in a fine and possible further inspection.

Those who failed to submit 3-NDFL on time or evaded paying taxes will face penalties of up to 30% of the declared amount. The minimum fine is 1 thousand rubles.

In case of intentional tax evasion, criminal proceedings may be initiated. The limitation period in this case is determined by the Criminal Code.