Direct and indirect costs

Direct costs are costs associated with the production of a particular type of product (performing certain works, providing certain services), which can be directly included in the cost of these products (works, services).

Indirect costs are costs that are associated with the production of several types of products (works, services). They cannot be directly attributed to a specific type of product.

Let's consider how direct expenses should be reflected correctly in accounting and tax accounting during production, provision of services or performance of work in 1C: Enterprise Accounting 3.

Illustrated tutorial on “1C: Accounting 8”

Regulatory operations for accounting and tax accounting

Distribution of general business expenses in accounting.

In the register of information “Accounting policies of organizations” (menu “Enterprise” › “Accounting policies” › “Accounting policies of organizations” ) you must first determine whether the organization uses the “direct costing” or not. The “direct costing” method provides for the following procedure for closing account 26 “General business expenses”: general business expenses accumulated during the month on the specified account are fully included in management expenses at the end of the month - debited to account 90.08 “Management expenses”. If the use of the “direct costing” method is not established, then general business expenses will be included in the expenses of the main and auxiliary production.

Distribution of overhead costs in accounting.

General production expenses (account 25) are included in the expenses of the main and auxiliary production and are distributed according to product groups (in the context of which accounting is kept on accounts 20 “Main production” and 23 “Auxiliary production”).

Methods for distributing indirect costs of organizations.

Depending on the specifics of the enterprise’s production activities, different distribution bases may be used when distributing general business and production expenses.

The cost distribution base in the form of a distribution method is established in the information register “Methods for the distribution of indirect expenses of organizations” (menu “Enterprise” › “Accounting policies” › “Methods for the distribution of indirect expenses of organizations” ).

Here in the “Distribution Base” you can select one of the following distribution methods:

- “Output volume” – the quantity of products produced in the current month and services provided is used as the distribution base;

- “Planned cost” – the planned cost of products released in the current month and services provided is used as the distribution base;

- “Payment” – the amount of expenses reflected on cost items with the type “Payment” is used as the distribution base;

- “Material costs” – the amount of expenses reflected on cost items with the type “Material costs” is used as the distribution base;

- “Revenue” – the amount of income reflected in the credit turnover of account 90.01 “Revenue” is used as the distribution base;

- “Direct costs” – the amount of expenses reflected in the items of direct production costs is used as the distribution base;

- “Individual direct cost items” – the amount of expenses reflected in direct cost items, combined into a random list, is used as the distribution base. Lists of cost items included in the indirect cost distribution base are stored in the directory of the same name.

For general production and general business expenses, you can set the distribution method accurate to the department and cost item. This may be necessary when different types of expenses require different distribution methods.

If it is necessary to establish one general distribution method for all general and general production expenses, then when setting the distribution method, you do not need to specify the cost account, division and cost item.

Similarly, by not specifying a number of parameters, you can set a general distribution method for all expenses accounted for in one account or in one department.

When establishing a distribution method in the information register “Methods for distribution of indirect expenses of organizations”, the date from which the distribution method is valid is indicated. If, starting from a certain period, it is necessary to change the method of distribution of expenses, then a new entry is entered into the information register, which indicates the new method of distribution and the date from which the new method should be applied.

In tax accounting, direct general production and general business expenses are distributed in the same way as in accounting, using the information register “Methods for the distribution of indirect expenses of organizations” as the distribution base. The exception is regulated expenses (advertising expenses, entertainment expenses and voluntary insurance expenses.

Direct expenses in accounting in 1C 8.3

In accordance with the instructions for using the Chart of Accounts, approved. By order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, direct expenses in accounting (BU) are those expenses that, in the production or provision of services, are reflected in the debit of accounts 20 “Main production”, 23 “Auxiliary production” and 29 “Service production and facilities” . The balance of direct expense accounts at the end of the month shows the value of work in progress.

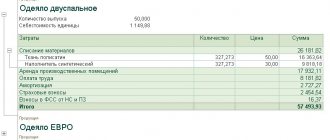

To reflect 20 direct expenses on the debit side of the account for accounting in 1C: Enterprise Accounting 3.0, you must set the parameters in the Accounting Policy (Fig. 1)

The flag indicates those types of activities, the costs of which are planned to be accounted for on account 20 (for the production of products and (or) performance of work and provision of services to customers). The checkboxes are checked in order to keep or not keep records of direct expenses in accounting as a debit to account 20.

If this expense is direct according to the accounting policy of the organization, then in the transactions in 1C: Enterprise Accounting 3.0 you need to reflect the expense on the debit of account 20.

Self-separation

The list of direct expenses is approximate, and the organization has the right to independently establish one different from that given in the Tax Code. This list should be fixed in the accounting policy (letters of the Ministry of Finance of Russia dated May 25, 2010 No. 03-03-06/2/101, dated November 12, 2009 No. 03-03-06/1/742, Federal Tax Service of Russia for the city of Moscow dated February 2, 2010 No. 16-12 / [email protected] ). Although there is an opinion that when dividing costs into direct and indirect, the taxpayer should be guided by the above provisions of Article 318 of the Tax Code (letter of the Ministry of Finance of Russia dated May 29, 2009 No. 03-03-06/1/355). In other words, the list of direct expenses given in the code is mandatory, and the organization, at its discretion, can add others to them.

We are of the opinion that the organization has the right to independently decide which expenses are recognized as direct. In this case, you should justify your decision. After all, during a tax audit, inspectors will definitely be interested in indirect expenses and will try to prove their direct origin. The court also pointed out this: excluding material costs from direct costs and including them in indirect costs without proper economic justification entails an illegal understatement of the income tax base. Regardless of the fact that the organization has the right to determine the list of direct expenses itself in its accounting policy, material costs can be classified as indirect expenses only if there is no real possibility of classifying them as direct (clause 1 of Article 252 of the Tax Code of the Russian Federation, resolution of the Federal Antimonopoly Service of the Ural District dated 25 February 2010 No. Ф09-799/10-С3).

Important

If in the accounting policy the organization has not determined which expenses are considered direct, then by default officials believe that direct expenses correspond to the list specified in Article 318 of the Tax Code (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated November 6, 2009 No. F03-4942/2009) . When legislation introduces changes to this list, the organization will be required to take into account the corresponding changes from the moment they enter into force (Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated November 20, 2009 No. A82-7247/2008-99). Therefore, it is better to independently approve the list of direct expenses in the accounting policy.

As practice shows, it is not always possible to clearly classify specific types of costs as direct or indirect costs. It depends on the type of activity. In this regard, the organization should register such costs separately in the accounting policy and classify them as direct or indirect expenses, that is, add specifics on “disputed” expenses. These actions will serve as a good shield against the nagging of tax authorities (Resolution of the Federal Antimonopoly Service of the Ural District dated April 28, 2008 No. F09-2757/08-S3).

Indirect costs in accounting in 1C 8.3

In accounting, indirect costs are usually understood as general production and general business (administrative) expenses, which are recorded, respectively, in accounts 25 “General production expenses” and 26 “General expenses”.

Indirect costs are distributed among the cost of manufactured products (works, services) and reduce profits at the time of its (their) sale. Commercial organizations can recognize management expenses in the period of their occurrence (clause 9 of PBU 10/99).

And if the procedure for dividing expenses into direct and indirect in accounting is determined by the correspondence of accounts, then for tax accounting purposes in 1C Enterprise Accounting 3.0 direct expenses can be reflected in different accounts 20, 25, 26 and do not depend on correspondence. And here it is important for the accountant (user) to correctly determine and configure the composition of direct expenses in the 1C: Enterprise Accounting 3.0 program, because tax accounting data is used in calculating income tax.

Read more

Why is separation necessary?

The most important difference is that the amount of indirect expenses in full relates to the expenses of the current reporting (tax) period, and direct expenses - to the expenses of the current period as goods and work are sold, that is, taking into account the balances of work in progress (letters from the Ministry of Finance of Russia dated March 25 2010 No. 03-03-06/1/182, dated June 9, 2009 No. 03-03-06/1/382 ). The exception is cases when the organization’s activities are related to the provision of services. These taxpayers have the right to attribute the amount of direct expenses of the reporting (tax) period in full to the reduction of income from production and sales of this reporting (tax) period without distribution to the balances of work in progress (paragraph 3 of paragraph 2 of Article 318 of the Tax Code of the Russian Federation, letter from the Ministry of Finance of Russia dated August 31, 2009 No. 03-03-06/1/557).

Important

For tax purposes, a service is an activity whose results do not have material expression and are sold and consumed in the process of carrying out this activity (Article 38 of the Tax Code of the Russian Federation). Moreover, the provision of services and the performance of work are different things, since the result of the work has a material expression and can be realized.

If an organization combines the provision of services with the performance of work, then part of the direct costs that fall on services can be fully attributed to the expenses of the reporting (tax) period (letter of the Ministry of Finance of Russia dated September 11, 2009 No. 03-03-06/ 4/77).

To determine the portion of direct costs that fall on products sold in the current period, direct costs should be distributed among the balances of work in progress, the balances of finished products in the warehouse and the balances of products shipped but not sold at the end of the reporting month. You do not take into account the amount of direct expenses attributable to these balances in the current reporting (tax) period.

Due to the linking of direct costs to sales, organizations tend to transfer part of them to indirect costs or even limit themselves to only the latter. But this cannot be done, because the Tax Code clearly states that expenses should be divided into direct and indirect, and the organization has the right to decide how exactly.

When filling out an income tax return, the amount of direct expenses for goods, works, and services sold should be reflected on line 010-030 of Appendix No. 2 to sheet 02. The amount of indirect expenses - on line 040 and partially deciphered on lines 041 - 055 of Appendix No. 2 to sheet 02. The amount of these lines is reflected in line 130 of Appendix No. 2 to sheet 02, the value of which is transferred to line 030 “Expenses that reduce the amount of income from sales” of sheet 02 of the declaration.

Setting up the program

The distribution of indirect costs, as well as most of the functionality of the 1C 8.3 program, will not work correctly without the correct initial setup.

In the “Main” section, follow the “Accounting Policies” link.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

At the very bottom of the window that opens, click on the “Income Tax” hyperlink.

Methods for allocating direct costs

After this, a window will appear with several settings sections. Select “Income tax” and in the section that opens, open the “List of direct expenses” link. This setting is necessary because all costs except those listed as direct will be taken into account as indirect in the future.

In our case, the list of direct costs was empty and the program offered to fill it out automatically.

Next, you will see a list of costs taken into account as direct ones. Set it up according to your organization's accounting rules.

Methods for allocating indirect costs

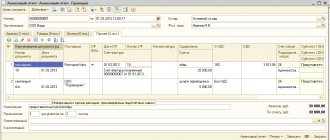

Now go back to the 1C 8.3 accounting policy window and open the “Methods for distributing indirect costs” link.

You will see a list of rules for posting general and production expenses. Create a new entry and fill it out.

The most important thing here is to correctly indicate how indirect costs will be distributed (field “Distribution base”). Depending on the value specified here, indirect costs will be distributed in proportion to quantity, production cost, revenue, etc.

Now go to the “Production” menu and select the item of the same name.

In the window that opens, set the “Production” flag.