What does the document look like?

The new form of the accompanying inventory was approved separately by Resolution of the Board of the Pension Fund of the Russian Federation No. 485p dated September 27, 2019. Until February 2020, another form ADV-6-1 was in force, but now it is not used.

The updated form of the document is called “Inventory of documents submitted by the policyholder to the Pension Fund of the Russian Federation” and is one of the reporting forms regarding the provision of information about personalized registration of insured citizens to the Pension Fund of the Russian Federation.

ADV-6-1-2

After the inventory in form ADV-6-1 has been prepared together with all documents and a package of forms in the specified order: SZV-1, SZV-3, SZV-4-1, SZV-4-2, SZV-K, the package is needed sew and number. Attach to it a list of insured persons for whom data is provided. The list is compiled in any form. The entire package is certified by a seal (if any) and the signature of the appointed executor (personnel employee or accountant), as well as the signature of the manager. On ADV-6-1 it is written: “I assure that the contents of all documents included in the package consisting of the above number of forms are correct.”

Form ADV-6-1 can be found here:

When to fill it out

The accompanying register is filled out when sending information to the Pension Fund using standardized forms:

- Questionnaire ADV-1 (sample of completion and current form in special material) - created when sending individual information of an employee to create an insurance certificate (SNILS or ADI-REG) for the first time.

- ADV-2 - if an employee has changed individual data and a replacement (update) of SNILS is necessary.

- ADV-3 - sending information to create a duplicate of SNILS if the employee has lost or misplaced it.

- SZV-K - when generating information about an employee’s length of service before 2002, it is compiled at the individual request of the Pension Fund of the Russian Federation.

- Other documents provided by the policyholder to the Pension Fund of the Russian Federation upon individual requests.

When to submit

The inventory should be sent to the Pension Fund when providing the following reporting forms:

- ADV-1 - contains individual information about the employee for the first registration of SNILS;

- ADV-2 - if it is necessary to replace or update SNILS due to an employee changing his individual data;

- ADV-3 - if it is necessary to issue a duplicate of SNILS due to loss or loss;

- SZV-K - contains information about the work experience of the insured person for the period until 2002;

- other documents provided upon individual requests.

Previously, policyholders provided other documents, for example, a list of documents on accrued and paid insurance premiums and the insurance experience of insured persons, transferred by the policyholder to the Pension Fund of the Russian Federation or form ADV-6-3, which is no longer used in connection with the publication of the Resolution of the Board of the Pension Fund of the Russian Federation dated September 27. 2019 No. 485p.

Structure of the accompanying inventory

The standardized register consists of four conditional blocks:

- The first block contains information about the policyholder. Here you must indicate the registration number of the institution issued by the Pension Fund, then enter the TIN, KPP and indicate the name. When changing the name or in other exceptional cases, we indicate additional information in the “Note” field.

- The second block is a tabular part, which presents the reporting forms named above. Here the policyholder indicates the number of documents sent to the Pension Fund.

- The third block is filled out during electronic document management with the OPFR. The block contains the package number assigned by the policyholder’s electronic system upon dispatch, and after receipt, the OPS system assigns a special number to this package.

- The fourth block is information about the contractor and the head of the insured organization, their signatures.

General information

Form ADV-6-1 is an accompanying inventory of documentation submitted by the employer to the Pension Fund. Such an inventory is attached when transferring documents to the Pension Fund on:

- individual registration: ADV-1 (for citizens and foreigners), ADV-2, ADV-3;

- payments and contributions to the Pension Fund: SZV-1, SZV-2, SZV-4-1, SZV-4-2.

Standards:

- The updated form of this inventory was approved by Appendix 1 to Resolution No. 473p of the Pension Fund Board of June 1, 2006. A complete list of documents that require an inventory is given in paragraph 30 of Appendix 2 to this Resolution.

- The new inventory form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 2p.

- An employee of the accounting department or human resources department is responsible for filling out the inventory. Filling out this document is not a problem; all rules and requirements are listed in Resolution 473p of the Pension Fund of the Russian Federation dated June 1, 2016.

The inventory form is divided into 3 parts:

- Information about the policyholder whose documentation is transferred to the Pension Fund.

- The number of submitted forms for personalized accounting of each type.

- Bottom of the description. Filled out when transferring data on length of service, salary, accrued contributions to the Pension Fund (different types of SZV forms). It is necessary to enter the full amounts of contributions, earnings and the period for which the accrual is made.

Signatures follow. Placed by the employee who filled out the inventory form and by the director of the organization.

Form ADV-6. List of documents submitted by the employer to the Pension Fund of Russia

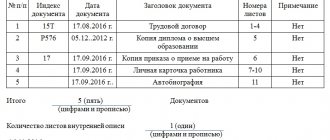

Form ADV-6 is provided by the employer to the territorial body of the Pension Fund of the Russian Federation as part of a bundle of incoming documents submitted starting from the 2002 billing period. Filled out according to the following scheme:

1. Codes for OKUD and OKPO are temporarily not indicated.

2. Details of the employer submitting the documents:

Pension Fund registration number: required. The number under which the employer is registered as a payer of contributions to the Pension Fund is indicated, indicating the region and district codes according to the classification adopted by the Pension Fund.

Format: XXX-XXX-XXXXXX.

Taxpayer Identification Number: required. The taxpayer identification number is indicated.

Checkpoint: required to be filled out. The reason code for registration is indicated.

Name (short): required. The short name of the organization is indicated.

3. Notes: to be filled in by a Pension Fund employee when receiving a stack of documents.

4. Number of documents in a pack: required to be filled out. The number of documents in a bundle of the corresponding type is indicated.

5. Number of the bundle of documents assigned by the policyholder: the serial number of the bundle of documents assigned by the policyholder is indicated.

6. Registration number of the bundle in the territorial office of the Pension Fund of Russia: filled in by a Pension Fund employee when receiving a bundle of documents. The incoming number is indicated, under which a stack of documents was registered at the territorial office of the Pension Fund of Russia.

For forms SZV-1 or SZV-3

(must be completed when submitting information on forms SZV-1 or SZV-3 for periods before 01/01/2002)

7. Reporting period: the year for which information is provided is indicated. Cannot be filled in if the value of the “Billing period” attribute has already been specified.

8. Information on earnings (remuneration) and income for the reporting period, taken into account when assigning a pension (total for a stack of documents):

Total accrued

including temporary disability benefits and scholarships

The details are filled out in accordance with the rules for filling out forms SZV-1 and SZV-3. The total values in rubles and kopecks for the entire pack are indicated.

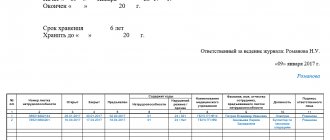

9. Details: Performer, Signature, Explanation of signature must be filled out.

10. Details: Name of the manager’s position, Signature, Explanation of signature must be filled out.

The inventory is supplemented with the words: “I assure that the contents of all documents included in the bundle consisting of the above number of forms are correct.”

11. Date: must be filled in (DD name of the month YYYY).

12. M.P.: stamp is required.

Why is the questionnaire needed?

If an employed citizen does not have an insurance certificate, then according to Federal Law No. 27, the employer is assigned an obligation to submit an application to obtain it. If a new specialist comes to the company who has not previously worked officially, and therefore has never had a SNILS issued, then personalized information about the citizen is sent to the PF representatives by the direct employer.

Based on the ADV-1 questionnaire, an insurance certificate is generated and issued. The legislation strictly stipulates the deadlines during which the head of the enterprise is obliged to transfer the questionnaire to PF employees for new specialists. This is given 14 days from the date of signing the contract.

It does not matter whether an employment agreement is signed between the director of the company and the employee, a GPC agreement, or whether the person will work for only a few days. Such requirements are given in Order of the Ministry of Health and Social Development No. 987n.

Important! If after the interview it is revealed that the citizen does not have SNILS, then before filling out the ADV-1 questionnaire, the person draws up an application in any form to receive a certificate.

General rules of formation

Typically, the document is filled out by representatives of the enterprise’s personnel service. For this purpose, the points of Appendix No. 2 to the Pension Fund Resolution No. 2p are taken into account.

The basic rules of the procedure include:

- Only a strictly unified form is used, therefore the use of free form is prohibited;

- AVD-1, updated in 2021, can be found on the PF website;

- documentation is filled out by hand using a ballpoint pen or using a computer;

- if manual filling is selected, then it is allowed to use different colors, except red or green;

- information in the questionnaire is transferred from official documents belonging to the insured person, and these include a passport, as well as various statements or certificates;

- when sending a correctly completed application form to the Pension Fund, all personal accounting forms are grouped into separate packages, and one package should not contain more than 200 documents;

- For each package, an accompanying inventory is generated, for which the ADV-6-1 form is used.

Reference! When creating a special package of documents, only papers with the same format are selected.

Structure and procedure for filling out the EDV-1 inventory form

Section 1 “Details of the policyholder submitting the documents” - are indicated in the same way as SZV-STAZH.

Section 2 “Reporting period (code)” - set O

We indicate the same type of information as in SZV-STAZH.

The “Correcting” type is selected if it is necessary to correct the data of section 5 of the EFA-1 form with the “Initial” type, and the “Cancelling” type is presented to cancel the data of section 5 of the EFA-1 form with the “Initial” type.

Section 3 “List of incoming documents”

The column “Number of insured persons” of Section 3 indicates the number of insured persons, information on which is contained in the forms submitted simultaneously with EFA-1:

- according to the SZV-STAZH form - the number of insured persons indicated in Table 3 of the form;

- according to the SZV-ISH form - the number of SZV-ISH forms included in the package;

- according to the SZV-KORR form - the number of SZV-KORR forms included in the package.

In the case when EDV-1 is submitted simultaneously with a package of documents containing SZV-KORR forms (with the exception of the SZV-KORR form with the “Special” type), only sections 1–3 of the form are filled out.

Section 4 “Data on the policyholder” - do not fill out.

Section 5 “Basis for reflecting data on periods of work of the insured person in conditions that give the right to early assignment of a pension in accordance with Part 1 of Article 30 and Article 31 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”

Filled out if the SZV-STAZH forms (with the type of information “ISH”) and SZV-ISH, submitted simultaneously with the EDV-1 form, contain information about insured persons employed in the types of work specified in clauses 1–18 h 1 tbsp. 30 of the Federal Law of December 28, 2013 No. 400-FZ, that is, if there is information in columns 9, 10 and 12 of section 3 SZV-STAZH.