Correctly filling out a paper form of temporary disability is a responsibility that lies not only with the medical institution, but also with the employee’s employer. We will tell you how to fill out a sick leave form for an employer (with a 2021 sample and comments) in this material. The rules in this regard are regulated by orders of the Ministry of Health and Social Development of Russia dated April 26, 2011 No. 347n and dated June 29, 2011 No. 624n. Compliance with them allows you to pay the employee monetary compensation for the period of incapacity from the Social Fund. insurance and not get into trouble with this body.

Also see:

- How to pay for electronic sick leave

- In which regions will sick leave be paid directly by the Social Insurance Fund in 2021?

What pen should I use to fill out a sick leave form?

Paragraph 65 of the order (Order No. 624n) states that only the following types of pens are allowed to be used to fill out sick leave:

- gel;

- feather;

- capillary.

It is important to note the following point: correctly filling out a sick leave certificate in 2021 does not imply the use of a ballpoint pen for these purposes.

The FSS Letter No. 17-03-09/06-3841P dated October 23, 2014 states that combined filling is also possible. That is, some of the data is entered by hand, and the other on the computer. Using only the capabilities of computer technology for these purposes is another option that does not contradict existing rules.

Step-by-step instructions: how to apply for sick leave in 2021

If the employer makes a mistake when drawing up a document, then the inaccuracies will have to be corrected according to the established rules. To avoid mistakes, we fill out the sick leave certificate correctly in the section for the employer.

Step No. 1. Indicate the name of the employer

In the provided cells, in capital block letters, enter the abbreviated name of the organization. If there is no abbreviated name, enter the full name. Abort when the field cells run out. There is no need to put quotation marks. The space between words is one empty cell.

Step No. 2. Specify the type of employment

We determine what place of work the employee is employed in: primary or part-time. Check the appropriate box on the completed sick leave form.

Specialists who work part-time in several companies at once have the right to provide a certificate of incapacity for work to each of their employers. In this case, the medical institution issues several certificates of incapacity for work at once - one for each organization.

Step No. 3. Specify the registration code in the Social Insurance Fund and the code of subordination

In this field you must indicate the code assigned to the company upon registration with the territorial branch of the Social Insurance Fund. Let us remind you that FSS representatives register policyholders independently. The procedure for entering an organization into the Social Insurance information database is carried out on the basis of information sent by the Federal Tax Service when registering a taxpayer.

The subordination code identifies the FSS branch to which the employer is attached. We indicate the four-digit branch code. If the company is attached to the fund's head office (not to a branch), then the code consists of 5 characters.

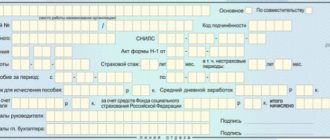

Step No. 4. Specify the employee’s INN and SNILS

We indicate the number of the sick employee’s insurance certificate issued by the Pension Fund of Russia. The TIN is indicated only if it is available. If the employee does not have a TIN or there is no information about the code, then leave the field blank.

Step No. 5. Determine special conditions for calculating benefits

In some cases, the calculation of sickness benefits differs from generally accepted norms. Each exception has a unique code. All types of special calculation conditions are listed on the back of the form (codes 43 to 51).

Step No. 6. Provide information about the work injury

If a certificate of incapacity for work is issued due to the fact that the employee was injured at work, then it is necessary to fill out a special field in the form. This is the date when the act was drawn up in form N-1. If the employee’s illness is not related to work-related injuries (see example of an employer’s sick leave form), this field is not filled out.

Step No. 7. Specify the start date of work

In most cases, the employer leaves this field on the sick leave blank. It will have to be filled out if the employee violated the deadlines within which he was supposed to start work. Such a violation becomes grounds for cancellation of the employment contract. If the contract was terminated, then what should I put in the “Date of start of work” column on the sick leave certificate for 2021? In this field, indicate the start date of work under the employment agreement.

Step No. 8. Determine insurance and non-insurance periods

The insurance period is all periods of an employee’s work activity during which he was insured, and the employer paid VNiM insurance premiums for him. Usually these are periods of work under employment contracts, but the total insurance period will also have to include periods of service in internal affairs bodies, periods of military and civil service.

In non-insurance periods, include periods of military service starting from 01/01/2007. If the service began before the specified date, then indicate in the column the period from 01/01/2007 to the actual end date.

IMPORTANT!

The employer enters the duration of the periods in years and full months on the certificate of incapacity for work. Non-insurance periods are necessarily included in the total insurance period.

Step No. 9. Specify the periods for calculating benefits

These columns of the certificate of incapacity for work are filled in with the dates of the beginning and end of the illness. Format for entering information: DD.MM.YYYY.

IMPORTANT!

Important information about the duration of illnesses: “Maximum duration of sick leave in 2021.”

Step No. 10. Calculate average earnings

To calculate sickness benefits, you will need to calculate several calculations. Average earnings for calculating benefits is one of them. It is determined in total for the two calendar years preceding the year of illness. Include only those amounts from which VNIM contributions were calculated.

Step No. 11. Calculate earnings per day

To calculate the average daily earnings, the amount of average earnings is divided by the number of days worked. We divide two fully worked years into 730 days. Please note that this algorithm is not applicable to the calculation of maternity benefits. The procedure for calculating and registering sick leave for pregnancy and childbirth in 2021 is in the article “How to calculate sick leave for pregnancy and childbirth.”

Step No. 12. Calculate benefit amounts

As a general rule, sickness benefits are paid from two sources:

- The first three days are paid by the employer.

- Remaining sick days - Social Insurance Fund.

The calculation is made taking into account the length of service coefficient. For work experience from 6 months to 5 years, pay a benefit in the amount of 60% of average earnings, from 5 to 8 years - 80%, over 8 years - 100%.

If the total insurance period is less than six months, the benefit is calculated based on the minimum wage.

For more information on how to fill out a sick leave from the minimum wage in 2021, see the article “Why do you need a minimum wage for a sick leave?”

Enter the information on the sick leave form in the following order: in the columns, fill in the appropriate amounts at the expense of the employer and at the expense of the Social Insurance Fund. Then add up the total (the total amount of payments from both sources).

Step No. 13. Indicate the responsible persons

The rules for issuing sick leave by an employer in 2021 stipulate that the form is signed by the employer and the chief accountant of the enterprise. Please note that the initials of the manager and chief accountant are indicated without dots.

IMPORTANT!

If the organization does not have a chief accountant position, the manager signs the calculation twice. That is, full name. and the signature of the boss on the sick leave form filled out by the employer are duplicated.

IMPORTANT!

The completed calculation on the sick leave certificate should be certified with a round seal, but only if the employer has one. Make sure that the print does not fall on the filled cells. Otherwise, reading problems will occur.

Current example of filling out sick leave by an employer in 2021

Sick leave: filling out by employer and sample 2021

What data does the employer’s employee to whom this authority is delegated write down on the temporary disability certificate?

In the upper left corner is the name of the company, and to the right is the person’s only place of work or does he hold a part-time position here.

Next, indicate the subordination code and registration number. Below is information about the employee: TIN and SNILS. Then they indicate the length of service the subordinate has developed, as well as the dates during which he was unwell.

The sample for an employer to fill out a continuation of sick leave also involves indicating the amount of average earnings - for calculating benefits, as well as the daily amount. Below is the amount to be paid. They indicate how much money goes to the employee from the employer, and how much from the Social Insurance Fund. Then the final amount to be paid is given. The example of filling out a sick leave form given below clearly reflects everything that has been said.

Finally, indicate the surnames and initials of the head of the company and the employee who is delegated to fill out the form (accountant or HR employee). These specialists also sign the document. The place for printing is located on the right.

Possible questions and difficulties

- Does the employer need to fill it out when making direct payments from the Social Insurance Fund? Need to. Participants in the “Direct Payments” project from the Social Insurance Fund enter the same information as in standard cases, with the exception of the items “FSS Payments” and “Total Accrual Amount”. These fields are left blank.

- Can an employer fill out a sheet for a healthcare worker? No, this is unacceptable.

- Entering information into the continuation sheet . In this case, the primary sheet is filled out by the employer in the same manner, and the medical worker indicates code 31 instead of the end date of sick leave, which means that the employee continues to be ill. The employer submits sick leave to the Social Insurance Fund as before. At the end of the sick leave, the medical worker and the employer fill out another sheet in the standard manner.

- What program can be used to fill it out? A special program developed by the FSS. It can be found and downloaded on the official website of the institution.

- How to fill out if the company does not have a chief accountant? The sheet is filled out in the same order. All signatures are placed by the head of the organization or another person acting on the basis of a power of attorney from the accountant. There is no need to indicate or provide the details of this person.

- Who issues a notice to a dismissed employee? Drawing up a notice after dismissal is also the responsibility of the medical organization and the employer.

- Are there any special features for the employer - individual entrepreneur? The individual entrepreneur issues a sheet for the employee under standard conditions. To apply for sick leave for an entrepreneur, you must be registered with the Social Insurance Fund as an individual, and not just an employer. The individual entrepreneur fills out the document for himself, certifying it with his own signatures. The benefit is calculated based on the current minimum wage in accordance with Part 1.1 of Art. 14 Federal Law No. 255.

- Features for sheets during pregnancy . The benefit for pregnant women is calculated in the amount of the full average daily earnings for the previous 2 years of work without deducting personal income tax. Compensation is entirely payable from the Social Insurance Fund. The amount of the benefit is calculated based on the amount of daily earnings multiplied by the number of days of sick leave in accordance with the data of the medical record, the duration of which can reach 150 days.

- If there was a violation of the regime . This will become the basis for reducing the amount of benefits in accordance with Art. 8 Federal Law No. 255. The total amount will not exceed 1 minimum wage (find out the rules for calculating and filling out sick leave from the minimum wage here).

- Is it possible to submit electronically ? Yes. The sheet is drawn up on electronic media in the Social Insurance Fund UIIS “Sotsstrakh” system. The employee will be given a unique number, which he will transfer to the accounting department, where they will continue to fill in the system. It is acceptable to draw up a sheet on paper, but using machine text.

- Is it possible not to fill it out at all ? No, in order to make Social Insurance payments, filling out the form is mandatory for both the medical organization and the employer.

If the employee complies with the sick leave regime, he will receive monetary compensation in full. In case of violation, he is entitled to an amount not exceeding 1 minimum wage. Payment of benefits is carried out on the next day after the assignment of benefits, established for the payment of wages.

If you find an error, please select a piece of text and press Ctrl+Enter.

FSS pilot project: filling out sick leave

The question of filling out a temporary disability certificate under the Social Insurance Fund pilot project adopted in some regions worries many personnel specialists and accountants. However, it should be noted that the pilot project does not affect the rules for registering sick leave at all.

Its essence is that the amount of money due to the employee from the fourth day of his period of incapacity for work is paid by the Social Insurance Fund. The sample for filling out sick leave by the employer remains the same.

Also see “FSS pilot project and filling out sick leave”.

Correction of errors and inaccuracies

Paragraph 65 of the rules approved by Order No. 624n states that the use of corrective agents to cover up errors made when issuing a certificate of temporary incapacity for work for an employee is strictly prohibited. Instead, you need to turn the document over and write the correct information on the back.

In addition, the employer must review the records made at the medical facility. To do this, you should know how a doctor’s sick leave form should be filled out. Thus, the employer determines the degree of criticality of the mistakes made.

If the information in the document is written in capital letters, it is not necessary to reissue it. If the name or initials of the employee to whom the sick leave was issued are indicated with an error, then you will need to request a duplicate with the correct spelling. Otherwise, the Social Insurance Fund receives grounds not to pay monetary compensation to the company employee for long-term illness.

Also see “100% sick leave: when paid in full.”

It is almost impossible to find a photo of a correctly filled out sick leave certificate, for example, on the Internet. After all, it contains a lot of personal information about a specific person. But if you follow the rules for filling out sick leave, which are discussed in this article, this will guarantee the employee payment of the monetary compensation due to him and will save the company from problems with the Social Insurance Fund. This is why it is so important not to make mistakes.

Read also

01.09.2016