Who pays property tax

Tax payers are:

- Organizations using basic tax system. They pay tax on the following property:

- objects (including movable ones) that are on the balance sheet and are listed as fixed assets;

- residential real estate, which is not recognized as fixed assets.

- Organizations using special tax regimes of the simplified tax system and UTII. They pay tax:

- from real estate objects specified in paragraph 1 of Article 378.2 of the Tax Code, for which the tax base is calculated based on the cadastral value (for example, shopping centers, administrative centers and premises located in them);

- from residential real estate, which is not accounted for as fixed assets.

- Foreign organizations if they own taxable property or under a concession agreement.

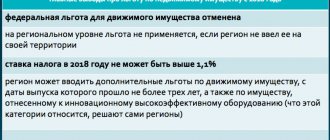

About movable property

Tax on movable property recognized as fixed assets is paid only by companies on the special tax base. 2021 was the last year in which they paid it in the same manner. Starting this year, new rules apply. In particular, issues regarding the imposition of taxes on one or another type of movable property and the provision of benefits are resolved at the regional level.

Deadline for submitting the declaration and sanctions

Property tax reporting must be done by March 30 of the year following the reporting year. Thus, for 2017 you need to submit a declaration no later than March 30, 2018 .

Late deadlines may result in sanctions under Article 119 of the Tax Code. This is a penalty of 5% of the tax amount for each full and partial month of delay. The minimum fine is 1 thousand rubles , the maximum is 30% of the tax amount . In addition, the official may receive a penalty in accordance with Article 15.5 of the Administrative Code in the form of a fine in the amount of 300-500 rubles.

Find out about other important reporting deadlines coming up soon.

Places for submitting the declaration

Organizations submit a property tax report at their location. However, if there are separate units, there are nuances. In particular, if the OP is located in other regions, then the following should be reported:

- at the location of the unit that has its own balance sheet;

- at the location of each property, if they are located in other regions.

Under certain circumstances, a company with separate divisions and property in other regions may report to the Federal Tax Service at its location . In this case, the following conditions must be met:

- the organization does not belong to the category of the largest taxpayers;

- the tax is payable only to the budget of the subject;

- the basis for calculating tax is the book value;

- The tax office allowed this.

In what form should reports be submitted?

To file a property tax return, standard rules from Article 80 of the Tax Code of the Russian Federation . The following are required to report in electronic format:

- taxpayers from the largest category;

- organizations in which the average number of employees exceeds 100 people for the previous calendar year;

- new companies with more than 100 employees .

All other organizations can independently choose the form of filing the declaration. It can be sent to the TKS inspection, by mail, or submitted in person.

How to calculate property tax

The base for property tax for legal entities is:

- in the general case - its average annual cost ;

- in relation to real estate objects specified in Article 378.2 of the Tax Code of the Russian Federation - cadastral value .

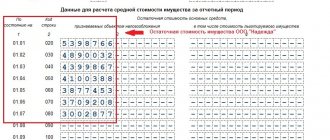

To determine the average annual cost it is necessary:

- add up the residual value of real estate at the end of each month;

- divide the result by 13.

Next, the average annual or cadastral value is multiplied by the rate. The rate is set by the authorities of the constituent entity of the Russian Federation, but cannot exceed 2.2% .

The result will be the amount of tax payable for the year. If advance payments , they must be subtracted from this amount.

If a legal entity owned the property for less than a full year, tax should be paid only for this period. First, the coefficient is calculated : the number of months of ownership of the object is divided by 12. Next, the tax base is adjusted taking into account this coefficient.

Tax rates

Tax rates are adopted by regional authorities; each enterprise can find them out on the website of the regional Federal Tax Service. If interest rates are not determined, then property tax, when a declaration for the year is submitted, is calculated at the maximum established rates in accordance with Article 380 of the Tax Code of the Russian Federation:

- for calculating property liabilities based on the average residual value - 2.2%;

- for calculating property obligations according to cadastral valuation - 2%.

The same article 380 provides a list of types of property that are subject to taxation at rates that change every accounting year. The new property tax declaration reflects the tax calculation for these objects in a separate column. In 2021, the following bet rates are set:

- list of objects in clause 3 of Art. 380 (power lines, pipelines and their components) – 1.6%;

- list of objects in clause 3.2 of Art. 380 (railway tracks, structures that are their technological component) – 1%.

In accordance with tax legislation, the tax base is formed in relation to each individual group of property, as well as for those types of fixed assets that have different taxes on the property of legal entities; the declaration reflects their calculations in separate columns.

We fill out a declaration on property tax for legal entities

The declaration form and the procedure for filling it out (hereinafter referred to as the Procedure) were approved by order of the Federal Tax Service dated March 31, 2021, number MMV-7-21/ [email protected] . The form consists of a title page and sections 1, 2, 2.1 and 3. The declaration is filled out in relation to the amounts of tax payable according to the corresponding municipal code, that is, in the context of OKTMO .

Next, we'll look at how to fill out each section.

Title page

The title page contains basic information about the taxpayer, the declaration and the tax authority. The following lines are filled in at the top of the sheet:

- TIN - for an organization it is 10 characters.

- KPP - indicates the code assigned by the Federal Tax Service at the location of the company, separate division or real estate (if it is in other regions).

- Tax period - code “34”, corresponding to the year. The exception is companies that are being liquidated or reorganized - they indicate the code “50”.

- Reporting year — 2021.

- Submitted to the tax authority (code) - the code of the tax authority is indicated. In this case, the first 2 digits indicate the region, the second - the Federal Tax Service number.

- At the location (registration) - enter the code “214”, corresponding to the legal entity.

- Taxpayer - indicate the name of the organization as shown in the following image (full organizational and legal form and name):

Sample of filling out the main details of the declaration

If we are talking about a reorganized / liquidated entity, then it is necessary to fill out the appropriate block that follows the name. In it you need to indicate the TIN/KPP of the organization, as well as the code of the reorganization (liquidation) form :

- 1 - transformation;

- 2 - merger;

- 3 - separation;

- 5 - connection;

- 6 - separation with simultaneous joining;

- 0—liquidation.

Contact phone number - you should indicate a phone number that is available for contact. Indicate the code of the country, city or other locality and telephone number without spaces or other symbols.

The lower part of the title page confirms the accuracy and completeness of the information provided . One of the codes is indicated:

- 1 - if the declaration was signed by the head of the organization;

- 2 - if signed by a representative.

Next you should indicate the full name of the person who signed the declaration :

- head of the organization;

- representative - if this is an individual;

- an authorized representative of a legal entity, if the taxpayer is represented by a legal entity.

In the latter case, in the lines below, you need to indicate the name of the representative company .

Next, indicate the name and details of the document that confirms the authority of the representative.

Filling out the bottom of the title page if the declaration was signed by the director

Filling out a property tax return

The most interesting change for most legal entities is the new section 2.1 “Information on real estate objects taxed at the average annual value.”

Please note: real estate that was written off in 2017 does not need to be reflected in section 2.1.

The table will help you prepare a new section:

| Line number | Type of information | Nuances of filling |

| 010 | Cadastral number | Indicate the number according to the Unified State Register of Real Estate. If there is no number, fill in line 020 or 030 based on the rules below |

| 020 | Conditional number | Fill in if the property does not have a cadastral number. Take the conditional number from the Unified State Register of Real Estate. If there is no conditional number, fill in line 030 |

| 030 | Inventory number | Fill in if the property does not have a cadastral or conditional number. Take the inventory number from the BTI passport or the organization’s accounting data |

| 040 | Code OKOF | The field contains 12 characters, which corresponds to the new OKOF encoding. If the object has a 9-digit code according to the old OKOF, nothing needs to be changed. Enter the existing code, the last three cells of the field will simply remain empty |

| 050 | Residual value of fixed assets as of December 31, 2017 | If in one inventory card you take into account several objects with separate cadastral numbers, line 050 must be filled in for each of them. Calculate the residual value for a specific object as follows: multiply its share in the total area of objects from the card by the total residual value |

In addition to the new section, there are also changes:

- no need to enter the OKVED code;

- the representative indicates not only the name, but also the details of the document confirming the authority;

- in section 3, where information about retail real estate is entered, you now need to indicate the code of the type of property. For objects included in the regional list, this is code “11”;

- in section 3 the purpose of lines 030 and 035 has changed . The first one must be filled out if the retail property has several owners. The second - if the cadastral value of the entire commercial building is determined, but the value of the company's premises is not;

- in section 2 a line appeared for the coefficient Kzhd. It does not need to be filled out if the organization does not have public railway tracks or structures that are an integral part of them.

Other changes to the form are technical. All amendments are taken into account in the electronic format for filing the declaration.

| Document: | Order of the Federal Tax Service of Russia dated March 31, 2017 N ММВ-7-21/ [email protected] (applies from filing a declaration for 2021) |

| We recommend: | How to fill out a property tax return for 2017? (Typical situation) Cancellation of the federal incentive for personal property: who must pay tax and at what rates in 2021? |

The material was prepared by specialists

Section 1

This section consists of line blocks 010-040 . You must fill in as many blocks as OKTMO tax is due. The blocks are filled in like this:

- line 010 displays the OKTMO code;

- line 020 indicates the budget classification code;

- line 030 reflects the positive result of the tax calculation, that is, its amount that is payable to the budget;

- line 040 reflects the tax amount if it turns out with a minus sign (tax to be reduced).

Sample of filling out lines 010-040 of Section 1

Section 2

This section is intended to calculate the average annual value of the property. It should be filled out separately in relation to property:

- located at the location of the organization;

- relating to separate divisions;

- taxed at different rates, and so on.

The full list can be found in paragraph 5.2 of Section V of the Procedure .

The following table contains line-by-line completion of section 2.

Table 1. How to fill out section 2 of the corporate property tax return

| Field | Index |

| Property type code (line code 001) | Code from Appendix No. 5 to the Procedure |

| OKTMO code | Must match the code from line 010 of the corresponding Section 1 block |

| Lines 020-140 | Residual value of fixed assets at the beginning of each month (date indicated in column 1). Column 4 indicates the cost of preferential property included in the amount indicated in column 3 |

| Line 141 | Cost of real estate included in the property |

| Line 150 | Average annual value of property ( sum of lines 020-140 divided by 13 ). |

| Line 160 | Before the “/” sign - tax benefit code, if any (Appendix No. 6 to the Order). After the "/" sign:

|

| Line 170 | The average annual value of property, which is not taxed ( the sum of indicators from column 3 of lines 020-140, divided by 13 ). |

| Line 180 | Filled in only if the property type code is “02” . The share of the book value of a real estate property in the territory of the corresponding constituent entity of the Russian Federation. |

| Line 190 | In general, tax base = Line 150 - Line 170. If the property type code is “02” (line 180 has a value): base = (Line 150 - Line 170) x Line 180 |

| Line 200 | To be filled in if the law of the subject establishes a reduced rate:

|

| Line 210 | Tax rate |

| Line 215 | Coefficient applied to railway tracks |

| Line 220 | Tax amount for the year: Line 190 x Line 210 / 100 |

| Line 230 | Amount of advance payments |

| Line 240 | If you have a regional benefit with a code 2012500:

|

| Line 250 | Amount of tax benefit by code from line 240 |

| To be filled in if the property type code is “04” . The amount of tax paid outside the Russian Federation in respect of property owned by a Russian legal entity is indicated. | |

| Line 270 | Residual value of fixed assets at the end of the year |

Section 2.1

This section contains information about the objects in respect of which Section 2 was completed. It consists of blocks of lines 010-050 , which indicate:

- on line 010 - cadastral number of the object;

- on line 020 - conditional number from the Real Estate Register;

- on line 030 - inventory number (in the absence of cadastral and conditional);

- on line 040 - code OKOF;

- on line 050 - the residual value of the object at the end of the year.

The number of blocks must correspond to the number of taxable properties.

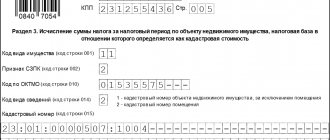

Section 3

The last section of the declaration is intended to calculate property tax, which is calculated based on the cadastral value of the property. Filling out the rows is in the following table.

Table 2. Filling out section 3 of the corporate property tax return

| Field | Index |

| Property type code (line code 001) | Code from Appendix No. 5 to the Procedure , usually code “ 11 ” |

| OKTMO code (line code 010) | OKTMO |

| Line 014 | Cadastral number of the building (structure, structure) |

| Line 015 | Cadastral number of the premises inside the building, if the object is this premises |

| Line 020 | Cadastral value of the property |

| Line 025 | Non-taxable part of the cost (included in line 020) |

| Line 030 | If the object is in common (shared) ownership, indicates the size of the share |

| Line 035 | Filled in if the cadastral value is determined for the building, but not for the premises inside, which is the object of taxation. A share equal to: Room area / Building area is indicated |

| Line 040 | Before the “/” sign - the benefit code in accordance with Appendix No. 6 to the Procedure (except for codes 2012400 and 2012500). Only for code 2012000 : after the “/” sign - the number, clause, subclause of the regional law that introduced the benefit |

| Line 050 | To be filled in if the object is located on the territory of different constituent entities of the Russian Federation. The share of the cadastral value related to the given region is indicated |

| Line 060 | Tax base: (Line 020 - Line 025) x Line 030 (if filled out) x Line 050 (if filled out) |

| Line 070 | If a benefit with a code is installed 2012400:

|

| Line 080 | Amount of preferential rate (if Line 070 is filled in) |

| Line 090 | For foreign organizations. A coefficient is indicated equal to: number of months of ownership of the object / 12 |

| Line 100 | Tax amount for the year:

|

| Line 110 | Amount of advance payments within a year |

| Line 120 | If there is a benefit with a code 2012500:

|

| Line 130 | Benefit amount from Line 120 |

Features and examples of filling

The procedure for filling out property tax declarations and declaration forms are approved in Order MMV-7-11/895 dated November 24, 2011. The composition includes the following sections:

- consolidated section 1, which indicates all amounts of taxes payable;

- section 2 with the tax base and the amount of residual value;

- section 3, in which the base is determined based on ∑cad.st.

The filling rules indicate that a complete package is required for submission, that is, all three sections, even if one of them does not contain data. Submission deadlines for 2021 are presented in the table:

| Period | Submission deadline |

| Reporting | strictly up to 30 cal. days from the end of the reporting period (according to paragraph 2 of Article 386 of the Tax Code of the Russian Federation). |

| Tax | strictly until March 30 of the next time period (according to paragraph 3 of Article 386 of the Tax Code of the Russian Federation). |

If the last day for submission falls on a weekend or holiday, then submission of documentation is allowed on the next first working day (according to clause 7 of Article 6.1 of the Tax Code of the Russian Federation).

| Reporting period | Submission deadline |

| For the first quarter 2021 | until 05/02/2017 |

| For half a year/II quarter 2021 | until July 31, 2017 |

| For 9 months/III quarter 2021 | until October 30, 2017 |

| For the full year 2021 | until March 30, 2018 |

Declarations can be submitted by taxpayers both on paper and in electronic form. But the electronic form is mandatory for such persons (according to Article 80, paragraph 3):

- for enterprises with more than 100 employees;

- for new enterprises (or after reorganization), the number of employees is from 100 people).

According to the new requirements (No. ММВ-7-21/271 dated March 31, 2017), forms for taxation of property assets must comply with the following rules:

- all amounts are indicated in full rubles with rounding - less than 50 kopecks downward, from 50 kopecks upward;

- Continuous numbering is used for pages from the first title page (in this case, all appendices are included in the general set);

- Correction of errors and blots is not allowed;

- double-sided printing on paper is not used;

- there is no use of fastening individual sheets using means that violate the integrity of the paper (staples, stitching);

- When filling, only blue, black, and violet inks are used;

- To fill the lines, notation is used from left to right from the left acquaintance;

- in electronic form, alignment should be done to the right edge, that is, to the last familiar place;

- When printing a completed form, Courier New font with a height of 16-18 is used (the frames of familiar places can be skipped, as well as dashes).

Section 1

An example of filling out can be seen on the official website, but there is nothing complicated about it. The first to fill out is the title page, where all the information about the taxpayer is indicated. Next, you can begin filling out the 1st section, where all tax amounts are grouped by OKTMO codes in line 010. For each block, the BCC is indicated (in line 020). Line 030 includes the amount of property tax minus advance payments already paid in 2016 (for the previous period).

Section 2

It is recommended to fill out this section last; numerical information on property objects is recorded in it; on line 001 you must indicate property codes, on line 010 OKTMO codes, on 020-140 - fixed assets at residual value at the beginning of each period. In column 4, all benefits, if any, should be indicated; in their absence, the lines remain blank (dashes are added). Page 260 is filled in by those taxpayers whose property is located abroad. The residual value is indicated in line 270.

Section 3

When filling out the 3rd section of the declaration, you must indicate all the balance sheet objects available at a particular point in time and the cadastral value, which is recognized in this case as the tax base.

Expert opinion

Natalya Titova

Property lawyer. Work experience as a lawyer - 11 years. A large number of cases won

View lawyer's comments

For each object, this value is calculated separately, and at the end the total cost is summed up. This section also indicates the OKTMO code in line 010, cadastral numbers for structures in lines 014 and 015, and ∑rest in line 020. at the beginning of the period, in line 025 - the cost that is not subject to taxation. Benefits are filled in on line 040, in the same way as line 160 in section 2 is filled out.

Line 060 is ∑cad.st., but excluding its non-taxable amount, the rate is entered in line 080 (it cannot be more than 2%). Line 110 indicates all advance payments already paid, which are summed up, taking into account the OKTMO codes. If there are benefits, then you need to fill out lines 070, 120, 130.

Sample filling

See how to fill out the corporate property tax return for 2021:

- Title page:

- Section 1:

- Section 2:

- Section 2.1:

- Section 3:

Filling out the declaration - basic requirements

Details about the procedure for filling out a property tax declaration are described in Appendix No. 3 and No. 6 to Order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895. There you can familiarize yourself with the details and nuances of filling out each of the sheets (sections) of the reporting document. Here we will focus on the main requirements for this reporting:

- starting from the Title Page (01), the pages are numbered consecutively;

- double-sided printing on paper is not allowed;

- black, blue or violet ink is used;

- fields should be filled out from left to right, starting from the leftmost familiar place;

- errors cannot be corrected using a proofreader or similar means;

- Do not fasten sheets in a way that could damage the paper;

- Values of cost indicators are indicated only in full rubles. Values less than 50 kopecks are discarded, and 50 kopecks or more are rounded to the full ruble;

- if software is used to prepare documents, then in the printer printout it is allowed for blank familiarizations to have no framing of familiarity or dashes. But the size and location should not change. Character size: 16–18 points, Courier New font;

- in case of filling using software, the values of numerical indicators are aligned to the right (last) familiarity.