Financial assistance to employees is one of the social guarantees in difficult life situations

Any person experiences circumstances when financial support becomes necessary. So, this is usually associated with unfavorable life situations, as well as joyful events that become no less costly.

The financial assistance paid by the institution to employees in such cases is one of the social guarantees used by the organization’s management in relations with the employee. Since support in the form of financial assistance is a transfer of funds, special attention should be paid to the competent and legally correct execution of documents, as well as the system of their taxation.

We’ll talk more about the reasons for paying financial assistance to employees and the preparation of the relevant documents below.

Who can count on receiving financial support

This type of support provided by organizations has a special focus - to financially support an employee who is in a difficult financial situation.

Since the main purpose of assistance is to provide the necessary material conditions to solve the employee’s financial problems, such a payment does not depend in any way on the employee’s own achievements; any employee who finds himself in a difficult situation can receive it.

Financial assistance is social and exclusively individual in nature, therefore it is accrued only upon the application of the employee, to which he attaches documents confirming the occurrence of circumstances that led to the need for this payment.

Please note that material support is not taken into account when calculating an employee’s average earnings, which is important when providing him with vacation or maternity benefits.

How to correctly write an application for financial assistance for treatment

An application for financial support in case of a serious illness is usually submitted after a course of treatment has been completed. To submit a substantiated application, the application must be supplemented with an extract from a medical illness, documents for the purchase of medicines, and certificates with a diagnosis. And all this must be certified by the seal of the attending doctor.

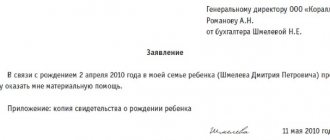

Despite the fact that the application template for financial support is not regulated by law, it still refers to an official document, the preparation of which must comply with the rules of business etiquette.

- In the right corner, starting from the top, you need to display the position and full name. the boss who is authorized to resolve the issue. This could be the boss or his deputy, or the chairman of the trade union committee.

- Below, the position and full name are displayed. document submitter. If the company is large, then most likely you will have to display the department where the author of the petition works.

- Next, in the middle of the line of the sheet, enter the name of the form - “Application”.

- The text of the appeal sets out the essence of the request, clearly displaying the problem. It is advisable to support your request with documentation.

- At the end of the form, the author of the letter puts the date and signs with a transcript of the surname.

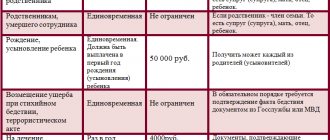

List of grounds for making payments to an employee

Grounds for providing financial assistance to employees

The current labor and civil legislation does not regulate the procedure and reasons for which financial assistance is accrued by the employer, therefore the circumstances upon the occurrence of which this type of financial support is paid are determined only by the organization itself in local regulations developed by the employer.

Thus, the grounds for receiving financial assistance may be listed in the relevant Regulations or collective agreement. Also, some organizations stipulate such grounds directly in the employment contract or in the Regulations on bonuses.

At the same time, this is not an entirely correct approach, since the type of payment in question does not depend on the employee’s labor achievements and is a social support measure.

Social financial assistance

Despite the fact that an employment relationship has been concluded between the employee and the employer, this does not mean that all payments transferred to the employee are related to wages. In addition to the employment contract, the employer and its employees can sign a collective agreement, which applies not only to labor relations, but also to social ones.

Those payments that, on the basis of a collective agreement, are of a social nature are not a lever for stimulating workers, since they do not depend on their qualifications, as well as the complexity of the work performed and its quality. In other words, such payments are not remuneration for work. Based on this, we can conclude that assistance to an employee for expensive treatment should not be subject to insurance premiums if the conditions for social benefits are met (Presidium of the Supreme Arbitration Court of the Russian Federation, Resolution No. 17744/12 of May 14, 2013). According to the court ruling, the financial assistance provided for by the company’s collective agreement, despite the fact that it is not included in the list of payments exempt from insurance premiums, may not be included in the base for their calculation.

Amount and types of assistance provided

Amount and types of financial assistance to employees

This type of financial support, such as material assistance, can be divided into the following types:

- one-time (one-time) and periodic (depending, respectively, on the accrual periods);

- monetary (rubles) or material (goods, food, etc.);

- targeted (related to certain circumstances that arose for the employee) and non-targeted (does not require a specific purpose supported by documents, and is therefore limited to a limited amount).

The amount of financial assistance can only be established directly by the head of the organization and determined based on the specific case and financial capabilities of the organization.

Material financial support can be paid from funds that are profits received when the company carries out its activities. The decision on the need to accrue cash benefits in an organization is made directly by management.

At the same time, it is necessary to pay attention that this type of social support cannot necessarily be provided in monetary form. According to the local regulations of the organization that regulate this issue, financial assistance can be provided with necessary items or goods. Also, at the discretion of management, financial assistance can be provided by providing any services free of charge or paying bills for these services.

When and who is entitled to financial assistance for treatment?

Employees of enterprises can count on financial assistance under the following circumstances:

- In emergency situations.

- At birth and caring for children.

- Due to the deterioration of the health of a colleague and/or his relatives.

- The passing of a relative.

- Under other circumstances.

The provision of financial support in case of illness of an employee (or his relative) is provided by order of the head of the company. The amount of such assistance may be regulated by internal departmental documents, for example, in a collective agreement or in an employment contract.

If force majeure circumstances arise, the employee will need to submit an application to the company management for financial assistance. The appeal can be written in a free style, but if the company has adopted approved rules for providing financial assistance, it must be based on them. Certification certificates will need to be attached to the application. With financial assistance for health restoration, this could be:

- A photocopy of the medical history.

- A photocopy of the treating doctor's recommendations.

- Photocopy of the hospital form.

- A photocopy of the contract for the operation.

- Materials certifying the need for expensive medical services.

- Materials certifying the actual costs under the agreement, signed by the applicant.

You can purchase support:

- Low-income workers.

- Temporarily unemployed citizens.

- Parents of a disabled child.

- Relatives of a deceased relative at his funeral.

- Large families with children under 14 and 18 years of age.

- Orphans.

- Family members whose breadwinner has died or been killed.

Documents that must be provided to the employee

As noted above, the procedure for paying such monetary benefits as financial assistance is fixed in the internal regulatory documents of the organization.

To receive financial support, an employee must submit an application addressed to the head of the enterprise, which must reflect the reasons for receiving this type of payment, as well as attach the relevant documents.

Let's take a closer look at what documents you will need to present to your manager in each of the above situations.

The need for expensive treatment:

- a doctor's note;

- agreement for the provision of paid services with the clinic;

- documents confirming payment for medications;

- prescriptions certified by the signature and seal of the attending physician;

- documents about the need for expensive treatment.

Significant monetary damage:

- Documents that confirm the fact of the situation and were issued by an authorized organization.

- A copy of the certificate of material damage, certified by the relevant authority.

Wedding, birth of a child:

- marriage certificate (copy);

- birth certificate (copy).

Death of close relatives:

- Death certificate (copy).

- A document that can be used to confirm relationship with the deceased.

Other difficult life situations:

- single mother's certificate;

- document confirming the presence of disability;

- documents confirming another difficult situation of the employee.

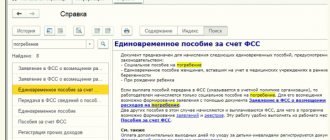

Procedure for consideration of the application

Employee application for financial assistance

In the process of considering an employee’s personal application with a request to pay financial assistance, the head of the organization endorses a document indicating further actions - to satisfy this application or to refuse social benefits.

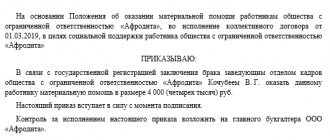

After approval of the employee’s application, an order is prepared to transfer cash or other payment to the employee. The manager's order must indicate, among other things, the basis, amount and timing of payment of the support provided, and the source of this payment.

The order, due to the absence of a legal requirement for the execution of this document, is issued in a free form developed and applied by a specific organization, and is also registered in the internal document flow journal.

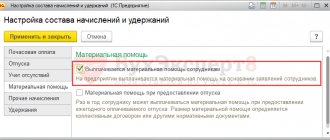

Features of the design of the Regulations on financial assistance

The possibility of making financial assistance payments to employees from the employer is provided, as mentioned above, by the local regulations of a particular organization.

The current legislation does not regulate the procedure for approving this document, therefore the Regulations on financial assistance (hereinafter referred to as the Regulations) are drawn up in free form in compliance with the requirements of Art. 8 of the Labor Code of the Russian Federation. At the same time, if there is a trade union body in the organization, coordination with it for the approval of the Regulations is mandatory.

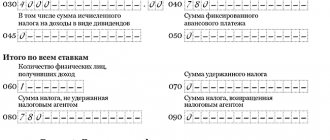

Taxation of financial aid for treatment

Issues of taxation of personal income tax and insurance contributions for financial assistance for treatment of an employee are regulated by Art. 217 and art. 422 of the Tax Code.

In accordance with Art. 207 of the Tax Code of the Russian Federation, namely clause 1, an must pay personal income tax on payments received.

Based on Art. 419 and art. 420 of the Tax Code of the Russian Federation, the employer independently pays insurance premiums from funds paid to the employee.

In general , financial assistance for the treatment of an employee is not subject to personal income tax and insurance premiums are not charged on it - according to clause 1 of Art. 422 and art. 217 of the Tax Code of the Russian Federation, if the amount of financial assistance does not exceed 4 thousand rubles during one calendar year.

There is a nuance - if the employer paid for the employee’s treatment directly to the medical institution. And when an employer applies OSNO, he may not be subject to personal income tax on amounts spent on the treatment of an employee. This follows from paragraph 10 of Art. 217 of the Tax Code of the Russian Federation (see letters of the Ministry of Finance dated March 16, 2020 No. 03-04-06/19819, dated January 24, 2019 No. 03-04-05/3804).

At the same time, these payments are subject to insurance premiums in full in accordance with the established procedure.

But employers using special regimes (under which they do not pay income tax) will have to calculate both contributions and personal income tax from medical assistance for treatment according to the general rules - with a usual deduction of no more than 4,000 rubles.