Who needs to submit a declaration

Legal entities and individual entrepreneurs reasonably have a question: do they need to submit a land tax return for 2021, and if so, to whom? This tax document must be prepared by those organizations that own or own land plots and are recognized as taxpayers for land tax in 2021. Those who are exempt from paying it under Art. will also have to report. 395 Tax Code of the Russian Federation. This tax is local, and it is payable to the budget at the location of the land. The authorities of the constituent entities of the Russian Federation set rates by their own legislative acts, so they differ in different regions and should not exceed the limits allowed by the Tax Code of the Russian Federation.

In accordance with the amendments made to Federal Law No. 347 of November 4, 2014, for individual entrepreneurs, the payment is calculated by the tax authorities, after which they send a notification of its payment by mail.

Who is renting?

Changes to the land tax declaration were made by order of the Federal Tax Service dated March 2, 2018 No. ММВ-7-21.

The amendments affected the procedure for filling out the form by legal entities that were provided with a land plot for housing construction. In addition, the barcodes in the declaration have changed. The main innovation is line 145 “Ki Coefficient”.

In 2021, organizations must take into account changes in cadastral value from the date information about this is entered into the Unified State Register of Real Estate. Previously, changes had to be taken into account from the next tax period. This need arises in the following situations:

- the type of permitted use of the site has changed;

- the site has been transferred to another category of land;

- the area of the site has changed.

To reflect changes in cadastral value, a new indicator “Coefficient Ki” has been introduced into the declaration. It is shown in line 145 of section 2. The rules for calculating the coefficient are fixed in the Tax Code.

To show the change in cadastral value, you will need to fill out the second two sections for one plot. In one section 2 in line 050 you will need to show the original cadastral value, and in the other - the new cadastral value.

The 2021 return must be submitted no later than February 1, 2021.

The declaration must be submitted to the tax office at the location of the land plot. Moreover, if a company has several sites on the territory of one municipality, only one report should be submitted.

Payers submit the declaration to the inspection in person or through a representative, send it by mail with a list of the contents, or transmit it via telecommunication channels.

There are two options for submitting a declaration on paper:

- with the attachment of a removable medium containing data in electronic form in an established format;

- using a two-dimensional barcode.

If an organization has a plot of land that is located outside its location, the tax return can be submitted early, that is, before February 1 of the year following the previous one. Moreover, the declaration must be submitted at the location of the disposed object.

But if a declaration was not submitted before deregistration of the land plot, it will have to be submitted at the location of the parent company. Without forgetting to indicate the OKTMO code at the address of the retired site (letter of the Federal Tax Service of Russia dated March 22, 2021 No. BS-4-21/5366).

Read in the taker

Practical encyclopedia of an accountant

All changes for 2021 have already been made to the berator by experts. In answer to any question, you have everything you need: an exact algorithm of actions, current examples from real accounting practice, postings and samples of filling out documents.

Tax returns for land tax are required to be submitted by organizations (legal entities) that are taxpayers of land tax. If the organization does not have any objects of taxation with land tax, then it is not necessary to submit a declaration (clause 1 of Article 388, clause 1 of Article 398 of the Tax Code of the Russian Federation).

Land tax must be paid by organizations that have a land plot recognized as an object of taxation in accordance with Article 389 of the Tax Code of the Russian Federation, on the right of ownership, the right of permanent (perpetual) use or the right of lifelong inheritable possession. There is no need to pay tax on land plots that are under the right of gratuitous temporary use or lease - Article 388 of the Tax Code of the Russian Federation.

As for individual entrepreneurs, they do not have to submit a land tax return for 2021 (even if they are recognized as land tax payers). The fact is that individual entrepreneurs do not have to calculate land tax on their own - the Federal Tax Service does it for them. Therefore, there is no need to submit a land tax return for 2016 (clause 3 of Article 396, clause 4 of Article 397, clause 1 of Article 398 of the Tax Code of the Russian Federation). Individual entrepreneurs must simply pay land tax for 2021 based on a notification from the inspectorate.

Submit the land declaration for 2021 to the Federal Tax Service at the location of the land plot (clause 1 of Article 398 of the Tax Code of the Russian Federation). However, the largest taxpayers must submit declarations at the place of their registration as such (clause 4 of Article 398 of the Tax Code of the Russian Federation).

It is worth noting that a legal entity may have several different land plots located in different municipalities. Then follow this approach:

- if these territories are under the jurisdiction of one Federal Tax Service, then submit one land declaration for 2021 - for each land plot, fill out a separate section 2;

- if municipalities are supervised by different Federal Tax Service Inspectors, then submit declarations to each inspectorate associated with a specific land plot (letter of the Federal Tax Service of Russia dated August 7, 2015 No. BS-4-11/13839).

The land tax return for 2021 must be submitted no later than February 1, 2021. You can submit reports to the Federal Tax Service as follows:

- “on paper” - through a legal or authorized representative, or by mail with a list of attachments;

- in electronic form in established formats with an electronic signature in accordance with the Procedure approved by the order of the Ministry of Taxes of Russia dated 02.04. 2002 No. BG-3-32/169.

Share with friends on social networks

In the Russian Federation, land plots are owned by various legal entities and individuals who use them for business activities. By law, they are required to pay a fee to the treasury and report this to the tax authorities.

However, only the owners of land plots specified in the regulations must submit a land tax declaration:

- Organizations of agricultural activities that are engaged in growing products for the purpose of making a profit.

- Communities of a dacha and horticultural nature with private plots.

- Companies that have land with production buildings located on it.

- Groups of citizens participating in shared ownership of forest lands.

- Travel companies with health camps, sanatoriums, recreation centers, etc.

The law also specifies preferential categories exempt from paying land duties:

- territories in state ownership.

- plots removed from circulation according to the legislation of the Russian Federation;

- parts of the land fund representing historical and cultural values.

- plots issued to developers for the construction of apartment buildings.

When summing up the results for the year, the accountant needs to collect the necessary information to draw up a report. When the land tax return is completed, it must be sent to the tax office.

There are 2 ways to do this:

- It is sent via the Internet resource in electronic form using special programs for submitting reports in digital format.

- Submitted on paper personally by the head of the organization or through a responsible executor appointed by the director with the execution of the appropriate power of attorney for these actions.

- Send by registered mail with a list of enclosed documents. In this case, the date of submission of the declaration will be considered the date indicated on the receipt for payment for postal services.

What is staffing? Detailed information is in the article. When can an employer refuse to allow you to go on vacation? Find out here.

Tax return for land tax: sample, rules and procedure for filling out

The procedure for filling out the reporting form is regulated by Appendix No. 3 to the corresponding order of the Federal Tax Service of Russia. The report form consists of three pages:

- 1st page - title page;

- 2nd page - section 1. The amount of land tax to be paid to the budget;

- 3rd page - section 2. Calculation of the tax base and the amount of land tax.

A sample filling is given for a Russian commercial organization, VESNA LLC, which is registered in the federal city of St. Petersburg. Carries out activities in the wholesale trade of food, drinks and tobacco, the company owns one plot of land located in the same city, cadastral number - 78:06:0004005:71. The cadastral value of the plot is 1,200,000 rubles. The organization has owned it for 12 months, the tax rate is set at 1.5%. KBK 182 1 06 06031 03 1000 110. OKTMO - 45908000. The LLC made advance payments to the budget during the year and transferred the following amounts:

- I quarter - 4500 rubles;

- II quarter - 4500 rubles;

- III quarter - 4500 rubles.

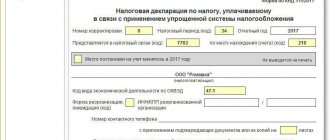

1 page - title page

The title page is filled out directly by the taxpayer himself, with the exception of the field “To be filled out by a tax authority employee.”

Let's consider a sample of filling out a tax return for land tax for 2021 for each field separately:

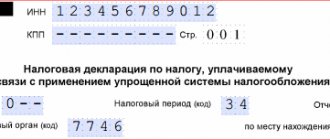

- the corresponding values are indicated in “TIN” and “KPP”, then they are automatically entered on each page;

- in the “Adjustment number”, if provided for the first time, indicate 000, for subsequent adjustments - 001, 002, and so on;

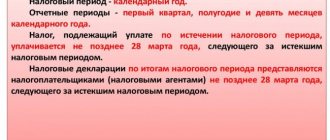

- in the “Tax period” we enter the required date of the tax period. For a calendar year - 34;

- in the “Reporting year” - the date the form was filled out;

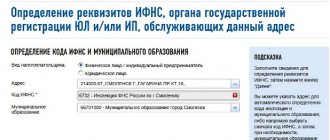

- Each inspection to which reports are submitted has a personal, non-repeating four-digit code in its Federal Tax Service Inspectorate or on the official website of the Federal Tax Service. The 2 digits of the code at the beginning indicate the region, the other 2 digits indicate the code of the inspection itself. Since the tax return for land tax 2021 is submitted to the Federal Tax Service at the location of the plot or share in the plot, in our case the Federal Tax Service Inspectorate No. 9 of the Central District of St. Petersburg is indicated;

- The taxpayer enters the code at the location (accounting). In our case - 270;

- We enter the name of the organization in the empty and longest field of the title page, separating the words from each other with an empty cell. For our example: VESNA LLC;

- in the next line we enter the payer’s contact phone number;

- Next, we indicate the number of pages to be submitted to the inspection. Ours submits a report for 2021 on 3 pages, without attachments;

- in the place where it is necessary to indicate the taxpayer, enter the value 1 and full name. director or proxy;

- at the end we will put a date and signature;

- in the “Name of the document confirming powers under a power of attorney” there is a dash, since the report was signed by the director of the company in his own hand.

Page 2 - section 1. The amount of land tax payable to the budget

Let's consider a sample of filling out a tax return for land tax 2021 for each field separately:

- first you need to indicate the name of the production sharing agreement, since in our situation it is missing, we put a dash;

- in 010 we write the budget classification code KBK in accordance with the legislative acts of the Russian Federation on budget classification. Each time we check the relevance of the specified BCC. Our plot is located in the federal city of St. Petersburg - we indicate KBK 182 1 0600 110;

- 020 “OKTMO” indicates the code of the municipality in whose territory the mandatory fee is paid. For our company, we will enter 45908000 in the 2021 land tax return;

- 021 - total amount of payment calculated and subject to payment to the budget according to the corresponding codes KBK and OKTMO;

- from 023 to 027, the values of advance payments paid for the 1st, 2nd and 3rd quarters are recorded, respectively;

Advance payments = 1/4 × interest rate × cadastral value of the land plot (share) = 1/4 × 1.5% × 1,200,000 = 45,000 rubles;

- 030 is calculated as follows: 021 - (023 + 025 + 027). If the result is a value with a “–” sign, then a dash is placed everywhere;

- 040 = 021 – (023 + 025 + 027). The amount is calculated to decrease, therefore, if the result is: a negative value, put it without the minus sign;

- positive - put a dash. In fields 030 and 040, according to the conditions of our example, we put dashes;

Page 3 - section 2. Calculation of the tax base and the amount of land tax

Let's consider filling out section 2 of the tax return for each field separately:

- TIN and checkpoint are entered automatically from the first page;

- We enter the cadastral number of the plot, this number is included in the certificate of state registration of ownership, from an extract from the Unified State Register or from the cadastral passport. 78:06:0004005:71;

- 010 - from Order of the Ministry of Finance No. 150n dated December 16, 2014, select and indicate the budget classification code;

- 020 - from the All-Russian Classifier of Territories of the Moscow Region we enter into the OKATO declaration;

- 030 - from Appendix No. 5 to the Federal Tax Service order No. MMV-7-11 / [email protected] select and indicate the land category code. Other lands - 003008000000;

- 050 - we take the cadastral value of the plot from the relevant Rosreestr documents or from the cadastral passport;

- 060 — enter the share size. If the land belongs entirely to the organization, put a dash;

- from 070 to 100 in the declaration we fill in the relevant information about benefits, which we take from the Tax Code of the Russian Federation and from documents confirming the rights to benefits. In most cases, commercial enterprises do not have benefits. In our case, there are no benefits either, which means dashes are added;

- 110 - the cadastral value of the object is indicated here. We have 1,200,000 rubles;

- 120 - we take the rate from the legislative acts of the local regulatory level, since the fee is local. For the category of our site, a rate of 1.5% is applied;

- 130 - indicate the period of ownership of the plot during the tax period. Indicated in full months. 12 full months;

- 140 - calculated as follows: line 160 (KV) = tenure / 12, for us = 1, since VESNA LLC owned the site for 12 months;

- 150 - determined by the formula: 110 (tax base) × 120 (rate) × 140 (Q coefficient). This amount is also reflected in field 250. 150 = 1,200,000 × 1.5% × 1 = 18,000 rubles;

- from 180 to 240 - we will fill in the data on the existing benefit. In our case there are none - we put dashes;

- 250 - enter the total payment amount that the organization pays to the budget.

Legal documents

- by order of the Federal Tax Service of Russia dated September 4, 2019 No. ММВ-7-21/ [email protected]

- Art. 395 Tax Code of the Russian Federation

- Federal Law No. 347 dated November 4, 2014

- Article 398

- by order of the Federal Tax Service of Russia dated May 10, 2017 No. ММВ-7-21/ [email protected]

- by order of the Federal Tax Service dated August 30, 2018 No. ММВ-7-21/ [email protected]

- Order of the Ministry of Finance No. 150n dated December 16, 2014

- Order of the Federal Tax Service No. ММВ-7-11/ [email protected]

Sample of filling out the declaration for 2020

Title page

In this section, you must indicate the organization’s data: name, INN and KPP, information about the person who filled out and submitted the ND, date of submission and signature. You must also provide information about the tax period and adjustment number.

Section 1

This section provides information about the tax (advances) paid during the year and the amount of payment at the end of the reporting period. If a legal entity has several plots located in different municipalities, it is necessary to enter data for all OKTMOs by filling out the appropriate blocks of the section.

Section 2

This section includes information about each land plot owned by the organization. There should be sheets of section 2 according to the number of land plots. Thus, if a legal entity owns five land plots (related to one tax) the declaration will have 5 sheets of section 2.

It should be noted that OKTMO indicates only the municipal district, and not the district, village council or subject.

Normative base

All individuals and legal entities who have received an inheritance or have other rights to a land plot or its perpetual use must transfer land tax to the treasury. This norm is specified in Article 389 of the Tax Code of the Russian Federation.

This law has exceptions that allow you not to pay the mandatory tax fee.

It includes the following plots of land:

- transferred for free use;

- used under a lease agreement;

- withdrawn from circulation;

- forest lands where logging is carried out;

- located under apartment buildings and included in their common property.

The tax amount does not exceed 1.5% of the cadastral value.

The rate is regulated by regional authorities in accordance with the Federal Law and the Tax Code of the Russian Federation.

After calculating and paying the fee, organizations are required to submit a completed declaration to the tax authorities.

Rules for filling out a land declaration

The current land tax declaration form was approved by order of the tax service ММВ-7-21/ [email protected] , dated 2021. The regulatory document lists the rules that taxpayers must adhere to when preparing a report. The main requirements include the following:

- The form contains information for the past 12 months.

- Numbers and other designations are entered into the report from left to right.

- Fields should not be left empty. If the accountant does not have data to enter, the cell is crossed out.

- The total values written in the report are rounded to full rubles according to the current mathematical rules (less than 50 kopecks - downwards, more - up).

- Sheets of the form must be numbered, starting with the title page. The number consists of three digits, for example, “001”, “002”, etc.

If the declaration is submitted on paper, the sheets are not stapled; only one-sided printing is acceptable. It is not permitted to use any means to correct errors.

If the report is sent electronically, it is endorsed with an enhanced digital signature issued to the general director of the company, entrepreneur or other official.