Property is available not only to people, but also to organizations. If we draw an obvious parallel between a specific person who owns property and some large corporation, it is easy to see that not only people, but also companies are rich. Continuing this parallel, it is worth saying that companies, just like people, have the corresponding owner rights and the right to dispose of their own property at their own discretion. Respecting and complying with the laws of the country of doing business, each organization, regardless of its size, number of employees and amount of capital, must not only pay taxes on time, but also know what benefits for the property tax of legal entities are provided to it in the territory of the Russian Federation.

The entire property base is divided into movable and immovable base. It is subject to taxes and has tax benefits.

- 8.1 “Simplified” is a priority

Real estate

The level of rates is specified in the Tax Code and should not be higher than the maximum limit specified by law. Property duty is paid by companies at these rates. And the size of the rates is completely determined by the regional authorities. For different real estate, different rates are provided, depending on the region where the business is conducted and the organization operates.

| For what | How many |

| Real estate in Moscow | 1,4% |

| Real estate in other cities | 2% |

Property categories

Depending on the category of property, different tax rates apply and a slightly different procedure for calculating the fee is applied.

According to the provisions of the Civil Code of the Russian Federation, the following types of property can be distinguished:

- Real estate:

- Inextricably linked to the earth;

- Subject to mandatory state registration;

- Moving an object is impossible without violating the original state and integrity of the object;

- The list includes: Buildings;

- Facilities;

- Unfinished construction projects;

- Spaceships;

- Monuments;

- Subsoil resources;

- Water and sea vessels;

- Movable:

- Can change its position and location without hindrance;

- Subject to registration only in exceptional cases;

- Movables include: Vehicles (except those classified as immovable);

- Money;

- Equipment;

- Shares in business;

- Securities;

- Company inventory.

Who plays favorites with the law?

Not all companies are required to pay tax duty. An interesting article of the Tax Code No. 381 lists the lucky subjects who received freedom “from the hands” of the law:

Do not pay any property tax:

- Lawyers (colleges)

- Legal advisors (bureau)

- Participants of the Skolkovo project

Certain types of property are not subject to tax:

- Property base of criminal enforcement authorities

- Church and monastery property

- Pharmaceutical equipment

- Basic funds on the balance sheet of organizations – residents of free and special economic zones

Important! Zero tax does not serve as an exemption from filing a property tax return. It still must be submitted, indicating all fixed assets, without exception, that are not taxed.

Results

Benefits for corporate property tax are established by the Tax Code and can also be introduced at the regional level.

The right to a benefit must be documented. Persons exempt from property tax include special regime residents, for whom, since 2015, the obligation to pay this tax on real estate for a certain purpose has been introduced with a tax base in the form of cadastral value. There are also benefits for property taxes paid by individuals. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

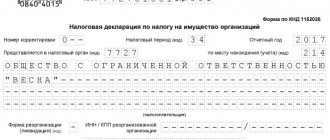

Updated declaration

Starting from 2021, the tax duty for legal entities is calculated based on the cadastral price. The price at the time the property is entered into the state real estate register is taken.

Note! Since 2021, an updated sample property tax return for legal entities has been introduced. For the convenience of accountants, some data and OKVED codes have been removed from the declaration.

In the new sample declaration there is a column to be filled out, numbered 2.1 , where the following is entered:

- Numbering according to the cadastre with coding designation

- Encoding according to OKOF.

- The volume of the price of all property on the balance sheet.

Real estate tax

The law introduced additional clarifications on the calculation of the tax base and the payment of fees in relation to real estate assets of companies, provided that their cadastral value was established during the year.

This category includes the following real estate assets:

- Assets of foreign companies that do not carry out business activities in the Russian Federation through permanent representative offices;

- Assets of foreign companies that do not relate to their activities in Russia through permanent representative offices;

- Residential buildings that are not on the balance sheet of fixed assets (in accordance with PBU 6/01).

The tax base and advance payment for the current year for the above-mentioned objects will be established based on the cadastral value calculated on the day the data was entered into the unified real estate register (provided that such an indicator was determined during the year).

Federal benefits

No. 381 of the Tax Code of the Russian Federation , does not expire . The effect of this article does not depend on the wishes of regional authorities.

There are two main categories of federal benefits:

- Relaxations that completely exempt the company from taxes.

- Exempting only from payments on certain types of property.

The following are completely exempt from property taxes:

| Type of company activity | Characteristics of preferential property |

| Religion | Has a purpose |

| Criminal - executive | Used in the work of the institution |

| Medical | Owned by prosthetic and orthopedic companies |

| Scientific | Is the property of companies recognized at the federal level as scientific centers |

Also, companies that are organizations of residents limited in their capabilities due to health conditions (disability) are completely exempt from the tax burden if their number in the company is at least 80% of the entire team.

Partially exempt from the tax burden:

- Penal organizations.

- Churches and parishes.

Attention! Federal relaxations on these points can only be obtained if there is approval from regional authorities.

Federal benefits are completely tax exempt. There are two options when it comes to delivery:

- temporary (for 3.5 or 5 years);

- unlimited

We remind you that even if you thoroughly study all the data that is in the public domain, this will not replace the experience of professional lawyers! To get a detailed free consultation and resolve your issue as reliably as possible, you can contact specialists through the online form .

Registration of federal benefits

To receive a property tax benefit, an organization must contact the Federal Tax Service with the appropriate application and declaration, indicating the preferential coding.

Important information! The amount of tax duty in the declaration is based on accounting indicators with a mandatory indication of the base - the average annual cost of fixed assets.

The accountant (accounting) of the company is required to pay the tax. Therefore, the use of benefits is also relevant to accounting.

The “start” for obtaining benefits is the submission of the organization’s reports to the tax office. To this end, a number of actions must be taken:

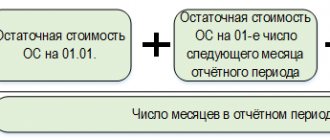

- The tax base from which the duty is calculated and paid is determined: this is the average annual or cadastral price of the property. With an annual average, the valuation is carried out at the residual value, namely: the difference between the original price of the property and its price after depreciation.

- The duty rate established by the subject of the Russian Federation is determined. Its size depends on the property type and nature of the company’s activities.

- The calculation is carried out using the formula: tax base x tax rate/100.

Property tax: preferential taxation in the constituent entities of the Russian Federation

The powers of local governments include the independent establishment of benefits. According to the Tax Code, property tax benefits are not individual in nature and are not established depending on the form of ownership of the organization (Article 3, 56 of the Tax Code of the Russian Federation).

In accordance with the ruling of the Supreme Court of the Russian Federation dated 06/07/2006 No. 59-G06-9, it is impossible to establish a property tax benefit if its use depends on the share of foreign participation in the authorized capital of the taxpayer, since there is a dependence on the place of origin of the capital, which is contrary to Russian tax legislation .

The legislation of the constituent entities of the Russian Federation cannot contradict the Tax Code; accordingly, property tax benefits cannot be established as a change in the elements of property tax (Chapter 30 of the Tax Code of the Russian Federation).

Legislative bodies of constituent entities of the Russian Federation can create additional conditions allowing the use of benefits.

An example is the Moscow region, where taxpayers, when using benefits, are required to provide a calculation of the amount of released funds at the end of the tax period and a report on their use. This provision is enshrined in paragraph 3 of Art. 4 of the Law of the Moscow Region “On Preferential Taxation...” dated November 24, 2004 No. 151/2004-OZ.

Regional benefits

The local authorities of each region have the legislative right to introduce other tax deductions under certain conditions for their compliance. Let's take the Moscow region as an example: here they use the funds saved from paying taxes to carry out social projects.

Local authorities cannot change or set restrictions on the time frame of benefits, since the deadlines are set in accordance with a letter from the Ministry of Finance.

Regional relaxations usually concern such objects as:

- Organizations receiving government funding.

- Institutions of power and management.

- Companies that carry out: social activities, sports, educational and medical.

- Firms that own property of special importance.

Novella 2021

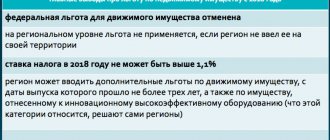

Starting this year, Russia has introduced an additional burden for organizations - a tax on movable objects.

The situation is as follows:

- There are no concessions at the federal level regarding the taxation of movable assets of organizations;

- Preferential grounds may be contained in the regulations of the region (since the issue is entirely within the competence of the subjects);

- Business entities have the right to count on preferential tax conditions if regional authorities adopted the relevant law before the beginning of 2021;

- If there were no relaxations before the current year, then organizations pay a fee on movable property on a general basis - at the maximum rate, a multiple of 1.1%;

- From the beginning of 2021, the rate may be doubled.

In fact, from January 2021, taxation of movable objects falls under the exclusive competence of regional authorities. Legislative initiatives of the subject can independently make decisions on exemption from the tax burden of levying a fee on movable property:

- Accepted for accounting since the beginning of 2013;

- Included in the 3-10 depreciation group.

Regional laws may offer incentives or complete exemptions from the fee in relation to:

- Property (equipment) belonging to the category of innovative, highly efficient (the specific list is determined by the relevant law of the constituent entity of Russia);

- A movable object that has been in operation for no more than 3 years from the date of release.

Regional benefits cannot be applied to the following categories of movable property (property is subject to taxation on a general basis, the 1.1% rate limit does not apply):

- Accepted for registration after 2013;

- Included in the volume of fixed assets due to:

- Liquidation of the organization;

- Reorganizations;

- Transactions between related parties.

Movable property

When property is easily moved without compromising its integrity or changing its purpose, it is considered “movable” property.

According to the letter of the law, movable property is not only transport, but also all other things:

- money supply,

- securities of different values and assets,

- cars for various purposes;

- communication lines, etc.

Important! Regulation in matters of benefits for organizations has been transferred to regional authorities. Only local managers at the regional level can decide who should pay property tax and who should receive benefits.

“Simplified” is a priority

Small business structures are exempt from tax on movable property, subject to the use of a “simplified tax” and a single tax on imputed income.

The “simplified” people have a significant privilege given by law - this is the absence of the obligation to pay tax on movable objects. Simply put, they are obliged to do only one thing - to pay real estate taxes to the state treasury, the base of which is determined by the market value of the property.

Benefit for movable property

The whole point of this tax break is contained in Article 381 of the tax code: tax duty can be avoided in the case when movable property is registered by the owner strictly after the end of 2012. The exception is movable property received during the liquidation procedure in relation to a legal entity.

The tax rate, if movable property does not fall into the category of beneficiaries, in 2021 cannot exceed 1.1%. Meanwhile, it is quite possible to increase this tax rate next year to 2.2%.

Is there an exemption from property tax for individual entrepreneurs and LLCs under special regimes?

Yes, it exists. Among those who are exempt from property tax are organizations and individual entrepreneurs with special regimes. In this case, the following conditions must be met:

| No. | Condition | IP | Organization |

| 1 | The tax regime chosen is | STS, UST, UTII or patent (only for individual entrepreneurs) | |

| 2 | Property in use | As part of business activities | Ownership of the company |

| 3 | Special conditions | There are available documents confirming the use of property in work (lease agreement, agreement with suppliers, payment documents, etc.) | It is on the balance sheet of the enterprise |

However, we note that starting from 01/01/2015, individual entrepreneurs and companies in special regimes must pay tax on the real estate they own for a specific purpose based on its cadastral value (Article 378.2 of the Tax Code of the Russian Federation).

Latest changes in taxation of property of organizations

Starting in 2021, all movable fixed assets will be exempt from taxation. Such changes to the Tax Code of the Russian Federation were introduced by Federal Law No. 302-FZ dated August 3, 2018. Only real estate will be recognized as the object of taxation.

If the company is not the owner of buildings, structures, premises, then from 01/01/2019 it will not be a taxpayer. Consequently, the organization will be exempt from the need to calculate tax and submit appropriate reports.

Legal documents

- Chapter 32 of the Tax Code of the Russian Federation

- Article 380 of the Tax Code of the Russian Federation

- Article 381 of the Tax Code of the Russian Federation

- Art. 386 Tax Code of the Russian Federation

- By Order of the Federal Tax Service dated March 31, 2017 No. ММВ-7-21/ [email protected]

- Federal Law dated August 3, 2018 No. 302-FZ

How to get benefits

Responsibility for accounting in the organization rests with the chief accountant, who is responsible for maintaining records and preparing reports for the tax service. Even those enterprises that are entitled to receive corporate property tax benefits must submit appropriate reports to the Federal Tax Service. In addition, documents must be submitted to confirm the possibility of property benefits. And when calculating the tax rate, it will be equal to zero.

Rates – there are payers with preferential conditions

Establishing accrual coefficients is the responsibility of the regions. But this does not mean that some organizations pay little, while for others the burden is unbearable, since the law has established federal restrictions. In 2019, the maximum rate, depending on the calculation base, is:

- average annual cost – 2.2%. Applies to objects without preferential tax treatment;

- cadastral valuation – 2%. The difference with Moscow and the regions (when they paid more in the capital) has been canceled in 2021.

Local rates are determined taking into account the category of the paying enterprise and the characteristics of the objects of taxation.

Who pays less

The tax burden has been reduced for the property of enterprises of infrastructure importance. Taxes with a maximum rate of 1.9% are imposed in the current year (clause 3 of Article 380):

- main pipelines;

- power transmission lines;

- structurally provided technological structures of such property.

The list is specified by Prospect Resolution No. 504 (as amended in 2017). In 2021, the limit for such objects has also increased, but still the figure is less than the general norms.

No need to pay: zero rate

The tax rate is recognized as zero for real estate (clause 3.1 of Article 380):

- gas main pipelines, OS for gas production, helium production;

- ensuring the operation of main gas pipelines and gas production technological lines;

- for the development of reserves and deposits of fossil raw materials, if the object is technically included in the line according to the documents.

It should be noted that a zero coefficient is provided if three conditions are met in a comprehensive manner:

- the facilities have been in operation since 01/01/2015;

- located at least partially in Yakutia, Irkutsk or Amur regions;

- belong to the taxpayer as property.

Zero rates are in effect until 2035, and then this clause of the law loses force.

A coefficient of zero does not mean removal of taxpayer status. Therefore, the accounting department of the enterprise, in any case, prepares and sends a tax return to the Federal Tax Service.

Who gets tax breaks?

The list of benefits provided is set out in Article 381 of the Tax Code of the Russian Federation. Reducing accruals is practiced in relation to these structures:

| Tax structures | What property is exempt from taxation? |

| Penal structures. | Benefits are provided in respect of property that is used to fulfill criminal-executive needs. Such structures include, inter alia, pre-trial detention centers and research centers. A detailed list is contained in the Decree of the Russian Federation of February 1, 2000 No. 89. |

| Religious structures | Benefits are provided for facilities necessary for carrying out religious activities. The structures under consideration must meet the following criteria: religion, religious services, religious education |

| Disability communities | In public structures, the number of disabled people should not be less than 80%. Benefits apply to facilities necessary for conducting statutory activities. Benefits will not be provided for some items: car tires, hunting rifles, fur products, jewelry, yachts. |

| Structures selling pharmaceutical products | This form of activity should be the main one. Benefits are provided for pharmaceuticals aimed at combating epidemics. |

| Companies with cultural and historical objects on their balance sheets | The list of property for which benefits are provided includes objects of archaeological heritage and scientific significance. |

| Organizations that have nuclear industry facilities on their balance sheet. | These include radioactive components and structures with nuclear reactors. |

| Institutions that have railway tracks and roads for public vehicles on their balance sheet. | Benefits are provided only for certain objects for which they are accepted. |

| Structures that have space objects on their balance sheets | Benefits are regulated by the Law of the Russian Federation of 1993 No. 5663-1. |

| Structures for the production of prosthetic and orthopedic structures. | Benefits are provided regardless of the organizational form of the company. |

| Property of Bar Associations | To receive benefits, the board must comply with all laws of the Russian Federation. |

| Structures that have officially received the status of a scientific center | The procedure for assigning this status is stipulated by Presidential Decree No. 939. |

| Scientific structures of the Academy of Sciences of the Russian Federation (medical, agricultural and others). | The benefit began to operate at the beginning of 2006 |

Benefits for citizens

The list of persons who have the right not to pay property tax is given below:

- Heroes of the Soviet Union and the Russian Federation, awarded the Order of Glory of three degrees.

- Disabled people: 1st, 2nd groups, childhood, disabled children.

- Those who took part in the Second World War, Citizens. war, other military operations during the USSR, WWII volunteers, employees of internal affairs bodies, state security, working directly at the front.

- “Chernobyl victims” and categories of citizens equated to them.

- Military personnel with 20 years of service who were discharged from service.

- “Liquidators” of accidents at nuclear military installations, testers, citizens with radiation sickness.

- Family members of the deceased military man, for whom he was considered the breadwinner.

- Pensioners and citizens of equal age, including those receiving lifetime maintenance.

- Serving in Afghanistan and similar combat environments.

- Family members of military and civil servants who died in service.

- Creative figures using premises, apartments for workshops, museums, libraries.

- Owners of small buildings and structures (no more than 50 sq. m.) located on personal land plots.

These grounds are contained in the federal legislative norms of the Tax Code of the Russian Federation. Local benefits are additionally established by local government authorities. We have already discussed how to obtain information about tax benefits in a specific region or municipality through the tax website. You can also submit a request to the Federal Tax Service.

What property will a legal taxpayer save on?

Not all assets are subject to maximum taxes. The balance sheet may contain objects that are completely exempt from taxation, or property with a preferential tax regime.

The following are not subject to taxation:

- property of 1 and 2 depreciation groups according to classification;

- space objects;

- international vessels of state registry;

- enterprise lands;

- Natural resources;

- cultural heritage property;

- nuclear facilities;

- nuclear icebreakers

Property with preferential tax treatment (the list of benefits is defined in Article 381 of the Tax Code):

- fixed assets of the movable category, recorded from 01/01/2013;

- energy efficient facilities for 3 years after commissioning;

- core assets of religious organizations;

- funds for the main activities of public associations of disabled people;

- OS of pharmaceutical enterprises for the production of anti-epidemic veterinary drugs;

- fixed assets of prosthetic and orthopedic companies;

- property of associations of lawyers and lawyers;

- facilities of management companies of the Skolkovo innovation project;

- balance sheet funds of enterprises in territories with a special economic regime.

All these benefits are provided to organizations at the federal level. Since 2021, preferences for movable, energy-efficient property nominally retain the status of all-Russian ones, but in fact all powers of assignment have been transferred to the executive authorities of the constituent entities.

Which legal entities are entitled to exemption from property tax?

As directly follows from Article 381 of the above-mentioned legislative act, the following organizations (firms, companies) have the right to be exempt from property tax:

- Structures of the penal system.

- Religious organizations registered in the country.

- Companies with at least half of their employees with disabilities, whose total salary share is at least 1/4 of the total payroll.

- All-Russian public organization of disabled people and organizations whose property it owns - subject to the social orientation of their activities and assistance to citizens with disabilities.

- Pharmaceutical manufacturing companies.

All of the above are exempt from paying tax only in relation to property directly used in production or commercial activities.

In accordance with the same article, the following are exempted from the specified tax liability in full:

- Enterprises related to the production of prosthetics and orthopedic products.

- Legal organizations, bar associations and bureaus.

- Companies serving recognized innovative .

As in the previous case, property eligible for the 100% tax benefit must be used exclusively for professional purposes.

Whoever the taxpayer is, a legal entity or an ordinary citizen, in order to receive any tax benefit it is not enough for him to declare his right: he must collect documents confirming it and submit an application to the tax office, and then every year indicate which property should be withdrawn from under tax.

Otherwise, the state will make a decision on its own - and it cannot be argued that it will be optimal from the point of view of the interested citizen or organization.

4 / 5 ( 1 voice )