How to submit simplified reporting?

Reporting must be submitted to the Federal Tax Service. The annual report, according to paragraph 1 of Article 23 of the Tax Code of the Russian Federation, must be submitted either electronically or in paper form. The form of submission is chosen at the discretion of the company. Most organizations submit the document in electronic form, since tax legislation contains requirements for the use of electronic forms for companies with more than 100 employees and firms that report VAT. The Federal Tax Service has developed a simplified reporting format KND 0710096 for submission via the Internet.

Who takes simplified accounting?

Law No. 402 on “Accounting” dated December 6, 2011 established the right to maintain simplified format accounting for the following entities:

- Companies that belong to small businesses.

- NPO (based on Federal Law No. 7 “On Non-Profit Companies”).

- Persons participating in the Skolkovo project.

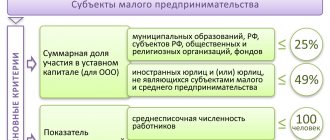

In most cases, simplified reporting is submitted by small businesses. How can you tell if a company is a small business? The list of characteristics of such entities is listed in Federal Law No. 209 of July 24, 2007. The company must meet a number of criteria:

- Annual revenue does not exceed 800 million rubles.

- No more than 49% of securities are owned by foreign persons.

- The number of employees in the company does not exceed one hundred people.

The restrictions set out in paragraph 5 of Article 6 of Federal Law No. 402 should be taken into account. In particular, simplified reporting cannot be used by such entities as:

- State organizations.

- Organizations subject to mandatory audit.

- Housing and housing construction cooperatives.

- Microfinance structures.

- Lawyers' offices.

- Credit consumer structures.

- Notary offices.

- Legal advice offices.

- Law offices.

- Political parties.

- Non-profit organizations that are included in the register specified in paragraph 10 of Article 13.1 of Federal Law No. 7.

These entities must submit reports in full format.

IMPORTANT! Even if the listed organizations meet all the characteristics of small businesses, they will still have to fill out full reports. Simplified reporting has a number of advantages: simplicity, no need to provide all the information

However, not all organizations can use it. When maintaining and submitting documentation, you must be based on existing regulations

Simplified reporting has a number of advantages: simplicity, no need to provide all the information. However, not all organizations can use it. When maintaining and submitting documentation, you must be based on existing regulations.

Forms for simplified accounting

Further, using a direct link, you can download simplified accounting statements 2021 for free:

Let's look at these forms in more detail. In the header of each form you must indicate general information about the organization.

The balance sheet contains data for the last 3 years, including the reporting year. In the financial results report – for the last 2 years, including the reporting year.

Simplified balance sheet

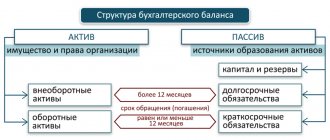

In a simplified balance sheet, the indicators are enlarged, but the principle remains the same - the presence of assets and liabilities that are equal.

In a simplified balance sheet, you should select the code of the indicator that has a greater share in the line.

Let's consider how the lines of the balance sheet and the accounting accounts relate. When calculating, it is necessary to use the balance at the end of the reporting year in the accounting accounts. In the general case, we take not the total balance, but the expanded balance - according to subaccounts. We take this scheme as a basis, since each specific case may have its own nuances.

Income statement

Similarly with indicating the code in the balance sheet, in the statement of financial results in the line you must select the code that corresponds to the indicator with the highest specific weight.

EXAMPLE

In line 2120, the cost price is 5 million rubles, commercial expenses are 1 million. rub., management expenses – 600 thousand rubles. Thus, the code in the line “Expenses for ordinary activities” will be 2120, relating to cost.

Let us present the ratio of the lines of the financial results statement and the balance of the accounting accounts. Here we take the turns on accounts 90 and 91.

The parentheses mean "-". For example, the result obtained at line 2400:

- negative (loss) – put in brackets;

- positive (profit) – write without brackets.

Accounting financial statements form according to KND 0710099 form download

Accounting financial statements form according to KND 0710098 form can be downloaded in Excel format on our website or you can view a sample (template) on the official portal “Consultant Plus”.

Important - when printing sheets, it is necessary to ensure the accessibility and safety of the barcode on each page (it is possible without a frame). The new version differs significantly from the previous edition; only the calculation algorithm remains unchanged.

Due dates

The legislation of Russia (Federal Law of the Russian Federation) establishes the deadlines for submitting financial statements - before the end of March/beginning of April in the next period after the reporting year. For example, businessmen had to submit declarations for 2015 by April 2021, etc. Let us add that these deadlines have nothing to do with documentation for deductions - they can be submitted at any time.

Average number of employees

Every quarter, businessmen who have even one employee under their command (employment contract) are required to send current data (the quarterly report on the average number of employees can be changed during the year) using forms 1-RSB and 4-FSS.

How does this impact the accounting profession?

Companies eligible for simplified accounting may decide whether or not they will adhere to this benefit. In the first case, it is clear that such an organization does not need a highly qualified chief accountant. An average level of qualification is sufficient.

In the second case, such a decision is made, as a rule, if the founder or manager is personally interested in its quality. The audit here can only be proactive, so it is the interested parties who will set the requirements for the level of qualifications of the chief accountant, as well as the level of remuneration for his work.

In relation to organizations that do not have the right to maintain simplified accounting and prepare reports using a simplified methodology, two decisions can also be made that will affect the requirements for the qualification level of the chief accountant and the level of remuneration for his work:

Form for KND 1152017 for 2016 download the form for free

Accounting financial statements form according to KND 0710098 for 2016, free download form excel (Word alternative) is presented at the end of the publication. You should know that it relates to personal income tax standards 3, but the Federal Tax Service can recommend exactly the specified option in a typewritten/machine-readable format. The Ministry of Finance is obliged to post information (how the report has changed) on the appropriate resources/stands; it must first approve and accept them.

What is: definition

In essence, accounting financial statements, which can be downloaded for free, are a universal form based on the results of work, which, after being filled out correctly, will be accepted by the tax office (FTS), the pension fund (PFR), and an accountant. It is also suitable for declaring income for individuals if a deduction was claimed (medical or educational services or property) or taxes on income were not paid.

Application form

You can see an example of correct filling (instructions) on the legal resource “Consultant Plus”. Please note that this option is relevant for individual entrepreneurs, small businesses and large organizations. The following information will be required to fill out:

- OKVED, OKUDa codes;

- adjustment and its number and TIN;

- code and address of the tax service and taxpayer;

- Date of completion.

If one of the values is missing, a dash is placed in the items and sections. In the absence of activity (when there is no income, at closing), zero accounting reports are submitted according to the simplified tax system.

Composition of simplified reporting

The content of simplified reporting is set out in paragraph 1 of Article 14 of Federal Law No. 402. This:

- Balance.

- Data on financial values.

- Appendix to the report on the company's performance.

The list of applications is set out in paragraphs 2.4 of Order No. 66n of the Ministry of Finance:

- Statement of changes in capital.

- Cash flow report.

- Report on the intended use of funds.

- Comments on the reporting.

NPOs are not required to prepare a report on the intended use of funds. This document is replaced by the annual reporting form. In relation to the reporting form in question, some relaxations apply, which are set out in order No. 66n. In particular, the document records aggregated indicators:

- Balance.

- Financial indicators.

- Targeted use of funds.

Companies that use simplified reporting have the right to either use existing forms or develop them independently. Paragraph 6 of Order No. 66n states that the document should record only data that gives an idea of the results of the structure’s activities. Order No. 66n lists templates for reporting forms.

Nuances of working on simplified reporting

The 2015 message from the Ministry of Finance contains a list of benefits that apply to simplified reporting:

- The decision to indicate data is made on the basis of its significance.

- You may not disclose information about enterprise segments or discontinued operations.

- Events after the end of the reporting period are recorded only if it is really necessary.

- If adjustments have been made to the accounting policies, the changes are recorded in the reporting.

- If significant mistakes were made in previous years, they need to be corrected. This affects information about current income and expenses, but does not change data about retained earnings/losses.

Those nuances that were not specified in the law can be determined by the company independently.

Filling out simplified accounting reports

The reporting does not include information that is not considered material for a number of companies. Such information includes expenses for basic activities, current income taxes and other indicators. The reporting contains the following data:

- Revenue. You must first subtract VAT and excise taxes from it.

- Expenses related to the basic activities of the enterprise, including commercial expenses and management expenses.

- Interest payable on existing loans and borrowings.

- Other income. That is, income that is not related to the basic activities of the company.

- Other expenses from which interest payable is deducted.

- Income tax.

- Net profit.

This is the basic information you need to provide. If necessary, this list can be expanded.

Accounting statements of the organization in 2021

05 June 2021 Newly created organizations submit financial statements within the deadlines established by law.

But in some cases, generally established deadlines are shifted. In what terms and for what period do new organizations need to report? How does the date of entry into the Unified State Register of Legal Entities affect the reporting deadlines?

What is included in accounting for beginners? We will answer these questions in our publication. 1 . Accounting statements are a set of data reflecting the results of an enterprise’s activities for a specific period. Reporting is based on accounting data. The purpose of financial statements is to provide information to company owners, investors and government agencies.

There are certain requirements for financial statements.

You will learn more about them from the article. The following types of financial statements are distinguished: Statistical - for statistical authorities.

Group 2: not eligible for simplified accounting

- any JSC (both public and non-public (subclause 1, clause 1, article 5 of Law No. 307-FZ);

- LLC, if it issues securities (for example, bonds) admitted to organized trading (subclause 2, clause 1, article 5 of Law No. 307-FZ);

- any organization if its revenue from the sale of products (goods) and work performed in 2015 exceeded 400 million rubles. (Subclause 4, Clause 1, Article 5 of Law No. 307-FZ; accounting data is taken into account here!);

- any organization if the amount of its balance sheet assets as of December 31, 2016 was more than 60 million rubles. (subparagraph 4, paragraph 1, article 5 of Law No. 307-FZ);

- an organization whose mandatory audit is separately established by federal laws (subclause 6, clause 1, article 5 of Law No. 307-FZ).

Disable

Since the accounting statements of such organizations affect the property interests of these users, it has been determined that its quality should allow them to make informed economic decisions. That is, reporting must reflect the real economic state of the organization and, accordingly, have predictive properties.

How will the legislator ensure the proper quality of this reporting?

Firstly, obliging organizations to create reliable reports on the financial condition of the organization in accordance with the requirements of Law No. 402-FZ.

Secondly, a ban on the use of simplified methods of accounting and reporting by these organizations.

Thirdly, mandatory confirmation of the annual financial statements prepared by such organizations by audit organizations (with increased requirements for the activities of such organizations).

Disable

Deadline and liability for failure to provide

The usual deadline for submitting financial statements for 2021 for small businesses and all other business entities is March 31. In 2020, due to the coronavirus epidemic, the deadlines have been postponed to May 6.

Failure to provide or untimely provision of financial statements, even in an abbreviated version, is an offense. For each document not provided, a legal entity will be fined 200 rubles, and its officials - in the amount of 300 to 500 rubles. In addition, the sanctions of Article 19.7 of the Code of Administrative Offenses of the Russian Federation, which provides for administrative liability for late statistical reporting, will be applied. The fine under this article for an official is up to 5,000 rubles.

Legal documents

- letter of the Ministry of Finance No. 07-04-07/27289, Federal Tax Service No. VD-4-1/ [email protected] dated 04/07/2020

- by order of the Ministry of Finance No. 66n

- Federal Law No. 402 of December 6, 2011 “On Accounting”

- Federal Law No. 209 of July 24, 2007 “On the development of small and medium-sized businesses in the Russian Federation”

- By Order of the Government of the Russian Federation No. 1459-r dated July 25, 2015

- Federal Law No. 7 of January 12, 1996 “On Non-Profit Organizations”

- by order of the Ministry of Finance of Russia No. 43n dated 07/06/1999

- by order of the Ministry of Finance of Russia No. 34n dated July 29, 1998

- Information of the Ministry of Finance No. PZ-3/2015

- PBU 1/2008

- PBU 10/99

- Article 19.7 of the Code of Administrative Offenses of the Russian Federation