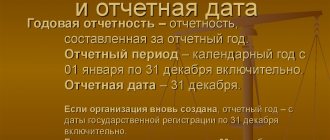

How to draw up a balance sheet - reporting requirements

Before asking yourself how to draw up a balance sheet, you need to familiarize yourself with the basic requirements for this form of reporting. The legislation establishes the following basic requirements:

- reflection of only reliable and complete information about property and liabilities;

- generation of data based on the rules established by accounting legislation;

- presentation of neutral information in relation to users, that is, they should not infringe on the rights of some users in the interests of others;

- providing data for at least two reporting periods - current and previous;

- drawing up a balance sheet in Russian and in Russian currency;

- signing of the balance sheet by the head of the company.

Organizational form and accounting

You don’t even need to look at the “Accounting from Scratch” textbooks to determine whether you need it or not. Thus, depending on the form of organization, a company can maintain full or simplified accounting. Of course, the choice of working as an individual entrepreneur, LLC or even JSC depends not only on the future form of accounting, however, it would be nice to become familiar with the difference, which is what we will do now. An individual entrepreneur is a form of organizing business activity in which a legal entity is not created. An individual entrepreneur is, first of all, an individual who operates to make a profit. An individual entrepreneur cannot have property separate from the individual and, therefore, if he becomes bankrupt, then everyone will have to pay, right down to the last thread.

LLC and JSC are organizations and they bear responsibility with their capital, and not with the property of the founders. The difference also lies in how many people can directly participate in management. Moreover, organizing a joint-stock company is somewhat more difficult.

Full accounting is carried out only in LLCs and JSCs, which implies the presence of a balance sheet, profit and loss indicators, as well as full archive maintenance. Individual entrepreneurs, in accordance with Federal Law No. 402-FZ, have the right not to maintain full accounting records. However, do not confuse accounting with its tax counterpart, since individual entrepreneurs still must submit reports to the Federal Tax Service.

The reporting deadlines are determined by the chosen taxation system. Most often, individual entrepreneurs choose a simplified taxation system, however, you can choose UTII, Unified Agricultural Tax and even a patent. As a rule, to maintain tax records for an individual entrepreneur, it is necessary to hire an accountant, unless, of course, he is capable of maintaining records on his own.

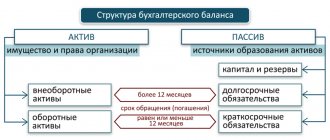

Balance sheet structure

The balance sheet of an enterprise characterizes the financial position of an economic entity as of a specific reporting date and is a table with certain columns. Since it reflects assets and liabilities, the table is divided into two large sections:

- Asset – to reflect the property and assets of the organization,

- Liability – to reflect the obligations of the organization.

Each section of the balance sheet is divided into groups that have individual lines with a specific name. The current form of the balance sheet can be taken from the order of the Ministry of Finance of the Russian Federation “On the forms of financial statements of organizations” dated July 2, 2010 No. 66n. Note that you cannot delete any lines from it, but you can add columns if necessary.

Line-by-line information is collected from synthetic accounting accounts or taken from the balance sheet for a specific period.

Calculation of liquidity and solvency ratios

The concept of “organizational insolvency” is associated with the assessment of solvency, the assessment of which uses two criteria: insufficient property to pay the debt and the inability of debtors to pay. The degree of solvency for current liabilities of Ktl is determined as the ratio of current borrowed funds (short-term liabilities) to average monthly gross revenue. However, from the financial results statement we can only obtain the net revenue indicator (see Table 3).

The liquidity of an asset is understood as its ability to be transformed into cash. The shorter the period of possible transformation into cash, the higher the liquidity of assets. The liquidity of an enterprise means that the enterprise has current assets in an amount sufficient to pay off current liabilities. To assess the level of liquidity, indicators of absolute, critical and current liquidity are calculated.

Calculation by balance lines:

As a result, we obtain the following values:

Based on the calculated indicators, we can draw a conclusion about the liquidity of funds of the analyzed enterprise and its solvency for the reporting year.

The absolute liquidity ratio (Ka) characterizes the degree to which current liabilities are covered by cash and cash equivalents as of the reporting date. A value of 0.2-0.5 or more is considered standard.

The critical liquidity ratio (CL) characterizes the degree to which current liabilities are covered by the most liquid assets and expected receipts from buyers. The recommended value of the indicator is greater than or equal to 1.0.

The current liquidity ratio (CLR) characterizes the degree to which current liabilities are covered by working capital, and the optimal ratio is 2/1.

However, the balance sheet reflects the position of current assets and current liabilities at the end of the month, and the situation may change significantly subsequently. These may be problems with delayed payments from buyers and customers, or the emergence of any financial difficulties. To assess solvency, credit organizations usually use current account statements for the analyzed period, analyzing the flow of funds in the organization's current accounts.

How to make a balance sheet - example (step by step instructions)

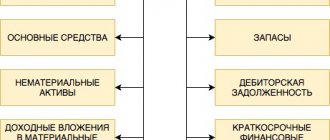

The procedure for drawing up the balance sheet is based on filling out the corresponding lines according to the balance sheet data for the reporting period, taking into account the requirements of PBU 4/99. To fill out the balance sheet, indicators are taken from the “turnover” in the form of an expanded balance for all accounting accounts. Fixed assets and intangible assets are reflected in the balance sheet minus depreciation. If the company's work results in a loss, its amount is reflected in parentheses as a negative number.

Each column of the balance sheet has a special encoding specified in Appendix No. 4 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. Based on the line names, you can understand how to fill out the balance sheet.

Example of a balance sheet form

Let's look at an example of how to fill out the balance sheet of an enterprise created in 2021.

To do this, we will need input data based on the indicators of the balance sheet of Iskra LLC for 2017:

| № | Name | Balance line | Amount, thousand rubles |

| 1 | Fuel | Reserves | 2720 |

| 2 | Production equipment in workshops | Fixed assets | 9000 |

| 3 | Items for resale | Reserves | 734 |

| 4 | Tara | Reserves | 215 |

| 5 | Buyers' debt | Accounts receivable | 7 |

| 6 | Cash register | Cash | 70 |

| 7 | VAT on purchases | VAT on purchased assets | 1700 |

| 8 | Production materials | Reserves | 2200 |

| 9 | Securities | Financial investments | 113 |

| 10 | Computer programs | Intangible assets | 750 |

| 11 | Money in the current account | Cash | 4000 |

| 12 | Advance issued to employees for reporting purposes | Accounts receivable | 12 |

| 13 | Transfers on the way | Cash | 112 |

| 14 | Debt to suppliers | Accounts payable | 1250 |

| 15 | Tax debt | Accounts payable | 1600 |

| 16 | Wage arrears | Accounts payable | 1000 |

| 17 | Obtained a long-term bank loan | Long-term borrowed funds | 120 |

| 18 | Authorized capital | Authorized capital | 10 123 |

| 19 | Reserve capital | Reserve capital | 5800 |

| 20 | revenue of the future periods | revenue of the future periods | 340 |

| 21 | Profit received in the reporting year | retained earnings | 1400 |

How to fill out the balance sheet in this case: the indicators need to be posted on the corresponding lines of the balance sheet form and the totals must be summed up.

***

Compiling reports over 3 years makes them more informative for users, but it is necessary to adjust the figures to ensure their comparability.

Similar articles

- Accounting calendar for 2021 - reporting

- Basic rules for evaluating balance sheet items

- Rules for filling out form No. 3 for the balance sheet

- Explanatory note to the balance sheet 2018 sample

- We draw up a balance sheet for an enterprise in the form of an LLC

primer_balansa_str_2.png

It should be noted: the structure of the balance sheet is such that the totals of assets and liabilities should always be equal. This is explained by the use of the double entry method in accounting, in which the same transaction is reflected in the debit and credit of accounts simultaneously. If there is no equality between assets and liabilities, then the balance sheet is drawn up incorrectly.

In our example balance sheet, only 2017 is presented, but it must also contain information from at least one previous period. Organizations newly created in 2021 fill out only one balance sheet column - as of December 31, 2017.

Attention - on the balance sheet asset

Basic asset principle: the lower the line, the faster the assets reflected in it can be converted into money (liquidity principle).

Among the assets, fixed assets turned out to be the most “heavy” - 77% of the balance sheet currency. It can be assumed that the company has significant overhead costs, and if sales volumes fall, it will be difficult for it to maintain its financial stability without borrowing funds.

A gradual decline in the indicators of the line “Fixed assets” (annually by 3–4%) may indicate that management is not investing in the modernization of production. As a result, demand for products may fall - they will be replaced by more advanced analogues of competitors. As a result, revenues and profits may decline.

Stable indicators in the “Inventories” line can confirm the good work of suppliers maintaining the necessary stock for production, or, conversely, indicate that there are unused raw materials and materials in warehouses.

An empty Cash and Cash Equivalents line should raise red flags, although an empty line does not always mean there is a complete shortage of cash. Perhaps financiers invested them profitably (the line “Financial investments” appeared), and soon you can expect good income (for example, in the form of interest).

Brief summary

The presented sample balance sheet for 2021 is the most simplified form, since it contains information only on the main accounting accounts. In practice, accountants justifiably have a question about how to draw up a balance sheet, since the company carries out a wide variety of operations.

The most important! Competently maintain operational accounting and timely reflect all actions on the appropriate analytical and synthetic accounts so that the data from them is correctly distributed among the lines of the organization’s balance sheet.

Statement of changes in equity

This report breaks down all of the company's capital movements in detail. The report consists of three sections. By the name of the line, you can easily understand what information should be entered for a particular code.

Among accountants, the form is also called Form No. 3.

In our example, Flagi LLC had no activities in 2021 and 2017, so the corresponding lines in the report will be empty.

Line 3311 is equal to balance line 1370. The total for line 3300 will coincide with the amount for line 1300 of the balance sheet. Section 2 of the report is not completed, since Flags LLC did not have any adjustments.

Section 3 of the report will tell users about the availability of net assets. In our case, they are equal to 125 thousand rubles. (total assets less current liabilities, 300 - 175 = 125).

Calculation of coefficients characterizing financial stability

To assess financial stability, the following relative indicators can be used to characterize the state of working capital, the structure of funding sources, and the financial independence of the enterprise:

| Name | Recommended value | Formula |

| Coefficient of provision of current assets with own working capital (Kss) | greater than or equal to 1.0 | Kss = SOS/OA, SOS = Capital and reserves – Non-current assets; |

| Coefficient of provision of inventories with own working capital (Kmz) | from 0.6 to 0.8 | Kmz = SOS/W |

| Equity capital agility ratio (Kmsk) | 0,5 | Kmsk = SOS/KR |

| Long-term borrowing ratio (Kdz) | less than or equal to 1.0 | Kdz = Long-term borrowed funds / Equity funds |

| Autonomy coefficient (Ka) | greater than or equal to 0.5 | Ka = SC/WB |

| Financial activity ratio (financial leverage) (Kfa) | Kfa = (DZS+KZS)/KR | |

| Financial stability coefficient (share of long-term sources of financing in assets) (Kfu) | from 0.5 to 0.7 | Kfu = (KR+DZS)/VB |

| where, SOS – own working capital; OA – current assets; Z – reserves; KR – capital and reserves; SK – equity capital; VB – balance sheet currency (total cost of financing sources); DZS – long-term borrowed funds; KZS – short-term borrowed funds |

Let us summarize the procedure for calculating the considered coefficients using the corresponding balance sheet line codes:

When using the indicated indicators of financial stability in analytical practice, it is necessary to keep in mind that they reflect the financial condition as of a date that has already passed. Therefore, it is advisable to consider them in dynamics over several reporting periods, which will indicate a certain consistency in the activities of the enterprise. In addition, the recommended values of these coefficients are conditional and depend on the characteristics of financial and economic activities, on internal and external economic factors.

Analysis of the structure and dynamics of property and sources of financing

An assessment of the structure and dynamics of property (assets) gives an idea of the ratio of fixed and working capital, the share of inventories in current assets, as well as changes in their value for the analyzed period.

The structure and dynamics of sources of financing (liabilities) shows the shares of own, borrowed and borrowed funds, as well as their changes over the analyzed period, which is a well-known technique for analyzing financial statements.

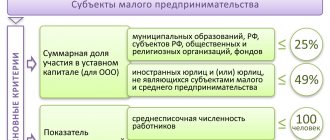

However, this information is not particularly important when assessing the activities of a small enterprise. The authorized capital of a small enterprise is usually small

They carry out their current activities mainly from their own funds and accounts payable. Trade and purchasing activities and settlement operations, as a rule, are carried out on an advance payment basis or through obtaining a commercial (commodity) loan. Therefore, a very important factor is maintaining liquidity and solvency, which characterize the ability of an enterprise to timely and fully make payments on current obligations.

Tags: asset, balance sheet, accountant, currency, balance sheet currency, capital, ratio, credit, tax, residual value of fixed assets, explanatory note, order, problems, expense