Home Accounting and HR Accounting

A balance sheet is a form of financial reporting that must be submitted to the tax office by almost all organizations conducting financial and economic activities, as well as entrepreneurs working under the basic tax accounting system.

Today we will look in detail at the essence of the balance sheet form, what types of this financial reporting form exist, how to fill them out, when and where to submit them.

Read our material to the end, we hope it will be useful to you, we will also look a little at the latest innovations.

General information about the balance sheet

According to the law, all economic entities are required to maintain their internal financial records and submit reports to the tax authorities. These reports may have different compositions and forms, and different deadlines for submission.

Large firms must submit all five forms of standard accounting reporting to the tax office, and small firms can independently choose which type of standard or abbreviated reports they will submit to the Federal Tax Service, for example, you can submit 5 forms or only 2 reports - Balance Sheet and Profit Report.

For companies and individual entrepreneurs operating under a simplified tax system, it is possible to submit a Balance Sheet and Profit Report in a simplified format. Let us consider further in detail the essence of the balance sheet form, as well as the full and simplified form of this report.

The balance sheet is a form of reporting that most fully presents information about its financial and economic activities for the current and previous periods, as well as its financial condition for these periods. This form of reporting reflects the sources of income, assets and liabilities at the disposal of an economic entity.

The annual balance sheet is always drawn up, but on the basis of operational records from accounting registers, which are confirmed by supporting primary documents for the entire reporting period. Usually the Balance is provided for the year. It is important that the accounting registers reflect all financial and business transactions for the year, without omissions, distortions or errors.

When preparing reports, it is important to understand that the tax office may require any primary documents for the reporting period or even documents for previous reporting periods for several years. Therefore, it is important to always have a file of primary documents filled out in accordance with all the rules and ensure that they are correctly reflected in all accounting registers.

When submitting any financial statements to regulatory government agencies, it is important that all reports due for submission are submitted on time and without errors. If the deadline for submitting all necessary reports is violated, or if they are inaccurate or distorted, serious fines are provided and sometimes even criminal charges may be applied.

In itself, filing incorrect reports or simply not submitting them, entails incorrect tax assessments, and for under-assessed or unpaid taxes on time, penalties are also provided, and daily penalties are charged for late payment of the accrued tax.

It is also important to note here that the Balance Sheet and other necessary final annual reports are also submitted by those economic entities that did not operate this year, since the lack of activity is not a sufficient reason for exemption from submitting reports to the tax office. For such cases, so-called “zeros” are provided; it is possible to submit reports in a simpler, abbreviated form.

The balance sheet, like other reports, can be submitted in paper or digital form. Reports in paper form can be submitted in person to the tax office or sent by mail in an envelope. The easiest way to submit reports is using electronic services via the Internet. For example, you can do this through Kontur, the websites of the Federal Tax Service or State Services and other services. In order to send reports digitally, you must have the appropriate electronic keys and enter into agreements for digital document flow.

In general, all companies that operate on Russian territory must submit a balance sheet, and only entrepreneurs who, depending on annual revenue and the applicable taxation system, can choose the procedure for their financial and economic accounting and reporting package.

Deadlines for submitting LLC reports to the simplified tax system in 2016

Companies using the simplified taxation system submit a VAT return if their activities are included in the list of exceptions specified in paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation. In other cases, the simplified company does not submit a VAT return.

Companies using a simplified taxation system are not exempt from submitting reports to the Pension Fund, Social Insurance Fund and Federal Tax Service.

The Federal Tax Service must submit information about the average number of employees and certificates in forms 2-NDFL and 6-NDFL. You need to report to the Social Insurance Fund for 2016 in Form 4-FSS, and then in 2021 you need to submit a Unified calculation of insurance premiums to the Federal Tax Service.

The reporting of simplifiers in forms 2-NDFL, 6-NDFL, 4-FSS, RSV-1 is no different from the reporting of organizations using the general taxation system. We have written about the reporting procedure above; see the table for details.

In addition, an organization using the simplified tax system is obliged to report and pay transport and land tax if it has property on its balance sheet that is subject to taxation.

A company submits its financial statements using the simplified taxation system in the same way as a company using OSNO.

| Reporting | Where to take it | Deadlines and reporting procedures |

| Declaration according to the simplified tax system | To the Federal Tax Service | The simplified taxation system declaration for 2021 must be submitted no later than March 31, 2017, either in paper or electronic form. The deadline has been postponed to April 2, 2021, since if the last day of the deadline falls on a weekend and (or) non-working holiday, the deadline is considered to be the next working day. The procedure and deadline for submitting a declaration under the simplified tax system is established in Article 346.23 of the Tax Code of the Russian Federation. Tax for 2021 must be transferred to the budget by March 31, 2017. Deadline for payment of advance payments by the company using the simplified tax system: The deadlines for paying advance payments are established in paragraph 7 of Article 346.21 of the Tax Code of the Russian Federation. |

October has arrived and it’s time to submit reports for 9 months of the current year. The second month of autumn has traditionally become a “hot” time, especially for accountants working under the general taxation regime. In order not to miss anything, we have compiled a table that sets out the deadlines for submitting reports for the 3rd quarter (9 months) of 2016

From this article you will learn

:

- what tax reports are submitted for the 3rd quarter of 2021

- what tax reports are submitted based on the results of 9 months of 2016

- You can find out which forms to submit throughout 2016

Please note that a topic has been created on the Clerk.Ru forum. This topic collects in real time the latest news regarding the submission of reports for 9 months of 2021. The reporting of organizations and individual entrepreneurs on UTII and the simplified tax system, as well as individual entrepreneurs on OSNO is located

| Declaration form, calculation, information | Approved | Deadline |

| Social Insurance Fund | ||

| Approved by order of the Federal Social Insurance Fund of the Russian Federation dated February 26, 2015 No. 59 (as amended by order No. 260 dated July 4, 2016) | ||

| VAT | ||

| Presentation of the log of received and issued invoices in the established format in electronic form for the fourth quarter of 2015. The log is submitted by non-VAT payers, taxpayers exempt under Article 145 of the Tax Code, not recognized as tax agents, in the case of issuing and (or) receiving invoices by them - invoices when carrying out business activities under intermediary agreements. | The 20th of October | |

| Approved by order of the Ministry of Finance of the Russian Federation No. 69n dated 07.07.10 | The 20th of October | |

| Approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ dated 10.29.14 | the 25th of October | |

| UTII | ||

| Approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ dated 07/04/14 (as amended on 12/22/2015) | The 20th of October | |

| Unified (simplified) tax return | ||

| Approved by order of the Ministry of Finance of the Russian Federation No. 62n dated 10.02.07 | The 20th of October | |

| Water tax | ||

| Approved by order of the Federal Tax Service of the Russian Federation dated November 9, 2015 N ММВ-7-3/ | The 20th of October | |

| Alcohol reporting | ||

| Declarations on the volume of production, turnover and (or) use of ethyl alcohol, alcoholic and alcohol-containing products, on the use of production facilities, on the volume of grapes harvested and grapes used for the production of wine products | Approved by Decree of the Government of the Russian Federation dated 08/09/2012 N 815 (as amended on 05/13/2016) | The 20th of October |

| Insurance contributions to the Pension Fund and Health Insurance Fund | ||

| Approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 194p dated 06/04/15 | ||

| Approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 20, 2015 N 269p | October 31 | |

| Register of insured persons for whom additional insurance contributions for funded pension have been transferred and employer contributions have been paid (DSV-3) | Approved by Resolution of the Board of the Pension Fund of the Russian Federation 06/09/2016 N 482p | The 20th of October |

| Income tax | ||

| Approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ dated November 26, 2014 | 28 of October | |

| Approved by order of the Federal Tax Service of Russia dated 03/02/2016 N ММВ-7-3/ | 28 of October | |

| Approved by order of the Ministry of Taxes and Taxes of the Russian Federation dated January 5, 2004 No. BG-3-23/1 | 28 of October |

What is the deadline to submit the balance sheet for 2021 to the Federal Tax Service? Who should take it? Are individual entrepreneurs required to submit a balance sheet? The answers to these questions are given in this consultation.

Balance due dates

The balance is submitted to the tax office no later than March 31. Please note that starting from 2021, the Balance Sheet must be submitted only to the Federal Tax Service; this reporting is no longer required to be submitted to Rosstat.

Typically, a balance sheet is filed for an annual reporting period. But, for newly created companies, during the reorganization of the company, as well as during liquidation, this report is submitted for the period of the official existence of the organization in this reporting year. When an organization is liquidated (or reorganized), the report is submitted within 3 months (from the date of liquidation or reorganization according to the Unified State Legal Entity).

Sometimes it is important to accurately record the date of submission of reports:

- When submitting documents in person in paper form, this is the date on the tax inspector’s stamp;

- When sending statements by mail, this is the date of the mailing receipt;

- When sending a report digitally, this is the date of acceptance of your tax reporting, according to information confirmation from the Federal Tax Service website.

Deadlines for submitting LLC reports to the simplified tax system in 2016

Companies using the simplified taxation system submit a VAT return if their activities are included in the list of exceptions specified in paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation. In other cases, the simplified company does not submit a VAT return.

Companies using a simplified taxation system are not exempt from submitting reports to the Pension Fund, Social Insurance Fund and Federal Tax Service.

The Federal Tax Service must submit information about the average number of employees and certificates in forms 2-NDFL and 6-NDFL. You need to report to the Social Insurance Fund for 2016 in Form 4-FSS, and then in 2021 you need to submit a Unified calculation of insurance premiums to the Federal Tax Service.

The reporting of simplifiers in forms 2-NDFL, 6-NDFL, 4-FSS, RSV-1 is no different from the reporting of organizations using the general taxation system. We have written about the reporting procedure above; see the table for details.

In addition, an organization using the simplified tax system is obliged to report and pay transport and land tax if it has property on its balance sheet that is subject to taxation.

A company submits its financial statements using the simplified taxation system in the same way as a company using OSNO.

| Reporting | Where to take it | Deadlines and reporting procedures |

| Declaration according to the simplified tax system | To the Federal Tax Service | The simplified taxation system declaration for 2021 must be submitted no later than March 31, 2017, either in paper or electronic form. The deadline has been postponed to April 2, 2021, since if the last day of the deadline falls on a weekend and (or) non-working holiday, the deadline is considered to be the next working day. The procedure and deadline for submitting a declaration under the simplified tax system is established in Article 346.23 of the Tax Code of the Russian Federation. Tax for 2021 must be transferred to the budget by March 31, 2017. Deadline for payment of advance payments by the company using the simplified tax system: The deadlines for paying advance payments are established in paragraph 7 of Article 346.21 of the Tax Code of the Russian Federation. |

How often should I return my balance?

Currently, the state requires that a balance be submitted only once a year: on any suitable day from March 1 to March 31. This period is specified both in accounting (clause 2 of article 18 of law No. 402-FZ) and in tax legislation (subclause 5 of clause 1 of article 23 of the Tax Code) legislation.

Attention! The balance sheet for owners and other interested parties can be submitted at any other frequency (clause 4 of Art.

13 of Law No. 402-FZ). At the same time, there is no need to submit interim reporting to tax authorities or statistics.

What happens to the company if the deadline is missed?

If you fail to submit your report on time, punishment will inevitably come. Fortunately, its value does not depend on balance sheet indicators, as happens in the case of a late tax return.

The amount of material losses in this case can be:

- If you do not send the balance to the tax authorities or do it with a delay, you will be fined in the amount of 200 rubles. (Clause 1 of Article 126 of the Tax Code). Administrative punishment under Art. 15.6 Code of Administrative Offences;

- if your balance is not received by the statistical authorities, a penalty of 3,000 to 5,000 rubles may follow. according to Art. 19.7 Code of Administrative Offences.

For more information on how the state plans to toughen the punishment if the balance is not submitted to the statistical authorities on time, see the material “Fines for failure to submit reports to Rosstat may be increased”

When to submit a balance sheet if the reporting period is shortened or extended?

Typically the reporting period is one year. During this time, you need to draw up a balance sheet and submit it to all authorities within the established time frame.

But you can register and start working from any date within the calendar year, and then the reporting period will be shorter than traditional. At the same time, the deadline for preparing the balance sheet is usual: within 3 months after the end of the reporting period.

Another case is the liquidation of a company. For such a company, the reporting period ends with the date of entry into the Unified State Register of Legal Entities on liquidation (Article 17 of Federal Law No. 402), and the same 3-month period applies for the preparation and submission of reports.

For more information about where the liquidation balance sheet is submitted, see the material “Where to submit the liquidation balance sheet”

An extended reporting period occurs when the decision to start a business is made at the end of the year and registration occurs after September 30 (for example, in October 2015). Then, according to paragraph 3 of Art. 15 of Law No. 402-FZ, the reporting period increases and lasts from October 1, 2015 to December 31, 2021. And the deadline for submitting the balance sheet is moved to March 31, 2021.

Results

Reports must be submitted within the time strictly established by law. Delaying the deadline for submitting the balance sheet or forgetting about this obligation cannot avoid penalties.

Article taken from the site

Accountants probably remember that once upon a time balance sheets were submitted once a quarter. Now you need to submit it to the Federal Tax Service only at the end of the year. In this article we will tell you when to submit the balance sheet form and how to fill out the sections of the reporting form.

Some of the most common errors in Balance and how to fix them

Let's look at typical mistakes when drawing up a Balance Sheet:

- Incorrect indication of the estimated value of assets; revaluation or inventory may be required to correct this error.

- Inconsistency of financial data in interrelated reporting forms, on different lines, for different reporting periods - the accountant needs to carefully check the data in the relevant accounting registers; it may be necessary to make adjustments to the previous ones in the reporting forms and submit updated forms to the tax office.

- Sometimes, after submitting the final reporting form, it may be revealed that inaccuracies were made, perhaps something was taken into account incorrectly, then it is also necessary to submit updated reporting forms with explanations to the tax office.

Composition of annual financial statements 2021

The annual financial statements of commercial companies must include:

- Balance sheet;

- Statement of changes in equity;

- Cash flow statement;

- explanatory notes to the balance sheet and reports;

- auditor's report - if the organization is subject to mandatory audit.

Statement of financial results (profit and loss statement);

The forms of the balance sheet and the above-mentioned reports were approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

Attention! Insurance and credit organizations have their own reporting forms. For more information about them, see the relevant paragraphs of this reference material.

Balance sheet in simplified form

Some organizations, as well as entrepreneurs, can conduct accounting and prepare reports in a simplified, abbreviated form. In fact, there are several types of simplified reporting forms; let us first consider the abbreviated form of the Balance Sheet for clarity.

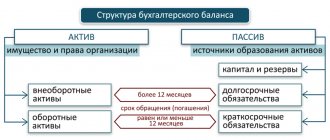

The Balance Sheet form has two main parts, assets and liabilities. In the Balance sheet form, it is necessary to enter not only data for the current reporting date, but also indicate balances as of the previous reporting date.

Each line of the balance sheet reflects the total balance of the corresponding asset or liability as of the reporting date for individual assets and liabilities.

Information for past periods is always transferred from previous reports, and current data is taken from accounting registers or from the electronic balance sheet of an accounting program (1C or others).

When filling out a report, dashes are usually placed in the empty lines.

The simplified form of this report itself has much fewer lines, and it looks simpler. Completing such a report requires significantly less time and effort. Let's consider the procedure for filling out the abbreviated Balance in detail.

Filling out the Balance in a simplified form

The balance sheet, like any other form of reporting, must begin by filling out the title part, where the important details of the company are indicated:

- The name of the company, its organizational form, or indicate individual entrepreneur;

- Kind of activity;

- TIN and other basic statistical codes;

- Location;

- Reporting date.

Next, you need to fill out the tabular part containing information about the company’s property - its assets and liabilities. The Balance Sheet is approved, usually by the head or chief accountant of the organization. Don't forget to also set the date for preparing your reports.

In the tabular part of the simplified balance sheet form, it is necessary to provide data for the current reporting year and provide information for the previous 2 years.

As already noted, the balance sheet contains 2 parts - assets and liabilities. First, let's look at how to fill out the assets section.

The abbreviated Balance Sheet includes several groups of assets:

- Tangible non-current assets - this includes the total balances of fixed assets Account 01 (minus depreciation Account 02), the cost of equipment found during installation Account 07, the balance of investments in assets Account 08;

- Intangible non-current assets - this includes the total balances of intangible assets Account 04 (less depreciation Account 05), deferred tax assets Account 09, financial investments Account 58;

- Inventories - on this line you need to add up materials Account 10, production balances Account 20 and for manufactured products Account 43, as well as the balance of inventory balances Account 41, balance of sales expenses Account 43;

- Cash - here it is necessary to add up and record the total amount of balances as of the reporting date at the cash desk of Account 50, the balance of current accounts in rubles and in currency Accounts 51 and 52, and also add transfers of Account 57;

- Current assets - you must indicate the balance of mutual settlements with your buyers / customers Account 62, as well as for your suppliers / contractors (Account 60), tax balances Account 68, 69, for settlements with employees (Account 70, 71, 73), as well as indicate the balances in the calculations for the founders of Account 75 and other counterparties of Account 76. If you made provisions for doubtful debts, then you need to subtract your existing balance of Account 63 (credit).

In the final asset line, you need to add up all the asset data presented above.

Now let's look at the second part of the balance sheet, which reflects liabilities, but unlike the debit balance of assets, the credit balance is usually indicated for liabilities. Liabilities are also usually formed into several groups by type:

- Capital and reserves - here you need to add up the balance of the company’s authorized capital, as well as reserve and additional capital (Account 80, 82 and 83), indicate the balance of retained earnings Account 84. You must subtract from this total amount if you have debit balances on your own shares and retained earnings (Account 81 and 84).

- Long-term loans of the company - loan balance Account 67;

- Other long-term obligations - for small businesses there are usually dashes here;

- Short-term loans of the company - balance Account 66;

- Accounts payable - here it is necessary to indicate the total credit balance of the accounts that have already been indicated above, but here the credit balance of Accounts 60, 62, 76, 70, 71, 73, 68, 69, 75-2 is taken.

- Other short-term liabilities of the company are the balance of future income, and if you have reserves for future expenses and deferred tax liabilities (Account 98, 96, 77).

In the final line of liabilities, it is necessary to add up all the above data on liabilities.

Note that if everything was done correctly, then the total data on assets and liabilities should be equal. If you have any difference in these data, then you need to double-check the data in the accounting registers and your total calculations. Sometimes such an error may occur due to the fact that you incorrectly accounted for or assigned an asset or liability to the wrong accounting group.

The Simplified Balance Sheet is usually submitted with the income statement form. This set of reports usually includes an explanatory note. In the explanatory part of the reporting, only the most important additional data is provided. For example, these could be provisions of your accounting policies that explain the procedure for compiling indicators for these reports or facts of activity that are not disclosed in the submitted reports. Also, the explanatory section may provide data on transactions with the owners of the company, data on dividend payments, changes in the authorized capital, etc.

Rules for submitting financial statements

Reports prepared by economic entities are submitted to the tax authorities at the place of registration of the enterprise annually. The deadline for submitting reports to the Federal Tax Service is three months from the end of the financial year.

In addition to submitting it to the tax service, it must also be provided with “statistics”. This procedure is provided for by Order No. 220 of Rosstat dated March 31, 2014. This procedure stipulates that a copy of the annual reporting shall be submitted to the statistics service at the place of registration of the enterprise.

There are three ways in which you can fulfill the obligation to submit reports:

- personally to the territorial authority,

- via postal service,

- through telecommunication channels, in electronic form.

In the latter case, the person submitting the reporting needs to sign an agreement with. Or use the intermediary services of one of the many accounting firms that have such an agreement.

In the case of submitting reports to statistical authorities, it is advisable to submit reports with a letter, in the text of which indicate the necessary contact information: email address, mobile or landline phone numbers. When sending a copy of the report by post, it is worth doing it by registered letter with acknowledgment of delivery.

If the organization is not exempt, according to the law, from mandatory accounting, and, accordingly, from the need to prepare financial statements, and also if it is not considered a religious organization that at the end of the year did not have an obligation to pay taxes, then The reporting deadline is March 31 of the year following the reporting year. Let us remind you that a legal entity or individual entrepreneur may be exempt from accounting in the event of a transition to one of the special tax regimes provided for by the Tax Code of the Russian Federation (USN, UTII). Keeping a ledger of income and expenses, which may be mandatory in these cases, is not accounting.

A similar period, no later than three months from the end of the financial year, is provided for submitting a copy of the report to the territorial bodies of state statistics.

The day of submission of financial statements to both tax authorities and statistical authorities is determined as follows:

- for reports submitted personally to the relevant body - the date indicated on the stamp of the body to which the reports were submitted,

- for reporting sent by post – the date stamped by the post office on the shipping receipt,

- for reporting sent via telecommunication networks - the date recorded by the telecom operator and indicated in a special electronic document - notification of receipt.

Filling out a standard Balance

The Standard Balance Sheet is a more cumbersome and detailed form than the form discussed above. The general principle of filling out both balance forms is the same. Both of these forms have a title section at the top, which contains the details of the company, followed by a tabular section containing data on the assets and liabilities of the company.

The main difference between the full and simplified forms of the balance sheet is that the full form reflects more detailed data for each group of assets and liabilities.

As already noted, the balance sheet contains two main parts: assets and liabilities.

On the balance sheet, assets are divided into two main groups and several subgroups:

- Fixed assets

- Intangible non-current assets – balance of Account 04 (except for R&D), less depreciation of Account 05;

- R&D;

- Intangible assets - balances from Account 08.11;

- Material assets (exploration) – balances from Account 08.12;

- Fixed assets of the organization - balance of Account 01 (minus depreciation of Account 02);

- Investments in MC - balance of Account 03 (minus depreciation of Account 02);

- Investments - balance of Account 58 (minus Account 59), balance of Account 73 (for loans over 12 months);

- Deferred tax payments – balances of Account 09 (minus balance of Account 77, if any);

- Other noncurrent assets;

- The total amount for this entire section;

- Current assets

- Inventories - here we add up materials Account 10 (minus Account 14) or add up Accounts 15 and 16, balance total balances for production Account 20 (as well as 21, 23, 29, 44, 46) and finished products Account 43, goods Account 41 (minus , if there is Account 42), Account 45, sales expenses Account 43;

- VAT – Account 19;

- Accounts receivable - here you need to indicate the balances in mutual settlements with your buyers/customers (Account 62), as well as with suppliers/contractors (Account 60), balances for tax calculations (Account 68, 69), for settlements with employees (Account 70, 71, 73), as well as indicate balances for the founders of Account 75 and other debtors/creditors (Account 76). If you have reserves for doubtful debts, then you need to subtract your existing credit balance Account 63.

- Investments (except for cash equivalents) - balance of Account 58 (less balance of Account 59), deposits of Account 55, settlements on existing loans Account 73;

- Cash and cash equivalents - here it is necessary to add up and record the total amount of balances as of the reporting date for the cash register of Account 50, current accounts in rubles and in foreign currency Accounts 51 and 52, special accounts in banks Account 55, and also add transfers of Account 57;

- Other current assets;

- The total amount of this section;

In the final asset line, you need to add up all the above data on assets - balance sheet.

Now let's look at the second part of the balance sheet, which reflects liabilities. For liabilities, the credit balance is usually indicated. Passives are also usually divided into several groups by type. On the balance sheet, liabilities are divided into three main groups and several subgroups:

- Capital and reserves

- Charter quantity – balance balance Account 80;

- Shares of the company - balance Account 81;

- Revaluation of fixed assets and intangible assets - balance Account 83;

- Additional inventory (without revaluations of OS and intangible assets);

- The company's reserve balance is Account 82;

- The balance of your retained earnings or loss is the balance from Account 84;

- The total amount of this section;

- Long-term liabilities of the company

- Loan balance – Account 67 (here you must indicate the company’s loans taken out for a period of more than a year, with accrued interest);

- Deferred tax liabilities at the end of the year - balance of Account 77 (minus balance of Account 09);

- Estimated liabilities of the company - balance from Account 96 (for a period of more than a year);

- Indicate the company's other obligations (for more than a year);

- The total amount of this section;

- Short-term liabilities of the company

- The balance of your company’s short-term loans is Account 66 (here you must indicate the company’s loans taken out for a period of up to a year, with accrued interest);

- Balance of accounts payable - here you need to indicate the total credit balance of the accounts that have already been indicated above, but here the credit balance of Accounts 60, 62, 70, 71, 73, 68, 69, 75-2, 76 is taken.

- Balance of other short-term liabilities of the company;

- Balance balance of future income - balances of Account 98, also indicate if there is Account 86;

- The balance of the company's estimated liabilities is the balance of Account 96 (for a period of up to a year);

- Indicate other obligations of the company for a period of up to a year;

- The sum of the lines for this section;

In the final line of liabilities, you need to add up all the above data on liabilities - balance.

The totals for assets and liabilities must be equal. If these amounts are unequal, then you need to double-check the data in the accounting registers, total calculations, and also check the correctness of the allocation of assets and liabilities into groups.

Balance Analysis

As is already clear from the above, the Balance Sheet contains a lot of important information about any company. Therefore, this reporting form may be requested from you not only by the tax office, but, for example, by the bank when issuing a loan. Some companies, when concluding important or large contracts, ask the partner company to provide them with a Balance Sheet.

When considering and analyzing the balance sheet, they often take into account the amount of the company’s turnover, the company’s individual assets that are important to them, the availability of equity capital, the company’s debt load, the amount of any debt and other significant data. The relationship between the individual articles of this report and each other is important; if the company has any financial problems, they will be immediately obvious to any specialist, just at one glance at the company’s Balance Sheet.

Another very important point is the dynamics of the financial indicators of the Balance Sheet. The indicators presented in the Balance Sheet for three years perfectly reflect the dynamics of the company's development - they can show the steady growth of the company, existing problems with development or stagnation, as well as a deterioration in the financial condition.

A competent specialist, having analyzed any Balance Sheet, will immediately see the strengths and weaknesses of the company and will even be able to suggest ways of financial recovery or the most effective points of growth for this organization.