Distinctive features of the current balance sheet

The forms of financial statements used to date are established by the current edition of Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

From June 1, 2021, the edition dated April 19, 2019 is in effect. The basic approach to the preparation of accounting reports corresponds to the following principles: it must be done according to accounting data, be complete, reliable, and useful for users. However, such reporting may have abbreviated versions. Recommendations for the preparation and presentation of forms are contained in the current edition of PBU 4/99.

For information on how to apply this PBU, read the article “PBU 4/99 - financial statements of an organization (nuances)” .

The full form of the balance sheet introduced by Order No. 66n (Appendix 1) is distinguished by the fact that it:

- offered only as one of the possible report options;

- assumes that the report compiler has a preferential right to independently detail the indicators;

- proposes to provide data for 3 dates (reporting date and the end of 2 years preceding the reporting year);

- provides a column for links to possible explanations by line;

- does not contain a section with information on off-balance sheet accounts.

The same document contains a simplified balance sheet form (Appendix 5), the use of which is available to persons specified in clause 4 of Art. 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

You can check whether you filled out the balance sheet correctly using step-by-step instructions from ConsultantPlus. If you do not have access to the system, get a trial online access and go to the Typical Situation for free.

Procedure for submitting financial statements

Starting with reporting for 2021, the following rules for the preparation and submission of accounting reports apply (see laws dated November 28, 2018 No. 444-FZ, dated November 28, 2018 No. 447-FZ):

- Accounting statements can be prepared on paper or in the form of an electronic document signed with an electronic signature. A paper copy must be made for interested parties or government agencies if required by law or contract.

- Most companies only have to submit annual reports to the tax office; they are not required to be submitted to Rosstat. This continues to be done only by organizations whose reports contain information classified as state secrets, as well as organizations in cases established by the Government of the Russian Federation.

- Tax authorities accept reporting exclusively in electronic form using the TKS. Some relief has been made for small and medium-sized enterprises: for 2021 they will still be able to report on paper, but from reporting for 2021 they will also have to switch to electronic submission. The audit report (in case of a mandatory audit) must also be submitted in the form of an electronic document.

- When preparing reports for the Federal Tax Service, you must use an electronic format and follow the submission procedure approved by the Federal Tax Service.

- The reporting deadline remained the same: no later than three months after the end of the reporting period. The auditor's report must be submitted along with the financial statements or within 10 business days from the day following the date of the audit report, but no later than December 31 of the year following the reporting year.

- The Federal Tax Service must maintain a special state information resource for accounting. Interested parties will be able to obtain information from it for a fee.

Balance sheet for 2021 according to the new form in 2021

The balance sheet for 2021 is submitted in March 2021 by all organizations - small, medium and large. One copy goes to the tax office, the other to Rosstat. Along with the balance sheet, you must send a statement of financial results.

You can download official forms and samples, as well as find out the deadlines and procedure for filling them out in our article. We provide the most complete instructions for filling out financial statements with an explanation of all lines and examples.

Fill out your balance online in the Bukhsoft program

In the article:

Changes

In 2021, companies submit reports for 2021 according to the old rules. Then the rules will change. Firstly, the form will become electronic; it will no longer be possible to submit it on paper. Secondly, reporting to Rosstat is canceled; companies will submit reports only to the tax office. All laws have already been signed, see a detailed review here

.

Composition of financial statements for 2021

Individual entrepreneurs do not submit financial statements.

Organizations submit financial statements for 2021 to two bodies: the Federal Tax Service and statistics at the place of registration.

The financial statements for 2021 consist of:

For what needs to be done before drawing up an annual report, see the article “What to check in the accounting program before closing the accounting year.”

You can also attach other explanations to the financial statements, presented in tabular or text form. And it is mandatory - an audit report confirming the reliability of the financial statements if the organization is subject to audit in accordance with the law (clause 10 of Article 13 of Law No. 402-FZ).

At the same time, the annual financial statements of a non-profit organization consist of a balance sheet, a report on the intended use of funds and appendices to them.

Attention! Small businesses can still prepare reports in a simplified form. Firstly, they have the right to include in the balance sheet and financial performance statement only indicators for groups of items, that is, without detail.

And secondly, in the appendices to the balance sheet and financial statements, they need to provide only the most important information, without knowledge of which it is impossible to assess the financial position of the organization or the financial results of its activities.

If such information is not available, just fill out the forms.

Since most “simplified” forms are small commercial enterprises, we will consider both the procedure for filling out the general form and the simplified one.

Let us recall that the document reflects the property and financial condition of the organization as of the reporting date. And the income statement allows you to track the financial results of activities for the reporting period. All indicators for the second form are calculated on an accrual basis from the beginning of the reporting year. If the indicators to be filled in are negative, they are placed in parentheses.

Please note: when submitting a document to the statistical authorities and the tax inspectorate, after the column “Name of the indicator” you need to independently add the column “Code” and provide the indicator codes in it according to Appendix No. 4 to Order No. 66n.

At the same time, small businesses that include aggregated indicators in the form (without their detail), the line code is indicated by the indicator that has the largest share in the aggregated indicator (clause.

5 of order No. 66n).

Data in reporting forms are given in thousands of rubles without decimal places. An organization that has expensive property (significant turnover) can display data in millions of rubles without decimal places.

Corrections to 2021 forms are not permitted. In addition, there should be no erasures or erasures in the financial statements. If the value of any numerical indicator is missing, then a dash must be placed in the line.

Previously, Rosstat published the financial statements for 2021 of all Russian companies. This information is available in the “Simplified” service. Counterparties.” To view your balance and make sure the supplier is reliable, get free access

to the program for 24 hours.

Find out balance

Service “ Simplified. Verification of counterparties

» checks companies according to the methods of the Federal Tax Service and prepares reports on each transaction. Such a report is signed with an enhanced digital signature, which means it will be accepted by your Federal Tax Service to confirm that you exercised due diligence when choosing counterparties.

The editors of the Simplified magazine have created a service specifically for accountants and small business managers.

Firstly

, we have introduced the traffic light principle: the counterparty is highlighted

in red

(cannot work),

yellow

(need to be checked) or

green

(safe to work).

Therefore, you do not have to be an advanced computer user or understand the intricacies of Article 54.1 of the Tax Code of the Russian Federation on due diligence.

Our service will carry out the analysis without your participation, and will give you a ready-made and understandable result in a second.

Secondly

, we have an attractive price - especially for small businesses.

And today we also have a maximum discount for you - 50%. The cost of annual service with an unlimited number of checks is 9,900 rubles. Download and pay your bill

, this is the best offer of the year!

Download invoice

Due dates

The company's annual financial statements are submitted to the tax authority within three months after the end of the reporting year (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation). A similar deadline is established for submitting reports to statistical authorities (clause 2 of article 18 of Law No. 402-FZ).

The deadline for submitting reports for 2021 to the Federal Tax Service and Statistics is no later than March 31, 2021 . But since March 31 is Sunday, the deadline is postponed to the next working day - April 1.

If you prepare interim financial statements for your own purposes (they are prepared optionally), you do not need to submit them to any regulatory authorities.

In what form is the report submitted: paper or electronic?

In 2021, the Tax Code of the Russian Federation does not establish the obligation of organizations to submit financial statements to the tax office in electronic form. Filing reports electronically is a taxpayer's right.

Therefore, companies have the right to send reports to the Federal Tax Service on paper. To do this, the head of the company or his representative can personally contact the inspectorate. Or documents can be sent by mail with a list of attachments.

As for accounting reports to the statistical institution, it is also allowed to be submitted on paper. There is no legal obligation to report online.

Meanwhile, the Federal Tax Service recommends sending the TCS report to those who submit other reports electronically.

Form

The 2021 form and financial results report are on file. This reporting is recommended by the Federal Tax Service of Russia, so it is safe to submit it.

Balance sheet form 2021 general form download free of charge (in Excel according to KND 0710099)

Download a simplified form of the balance sheet for 2018 ( in Excel according to KND 0710096)

Balance sheet for 2021 in a simplified form

The simplified form of the balance sheet, given in Appendix No. 5 to Order No. 66n, can only be used by small businesses and contains columns in which aggregated indicators are given for each item:

- as of the reporting date (when filling out for 2021 - as of December 31, 2018);

- as of December 31 of the previous year (when filling out for 2021 - as of December 31, 2021);

- as of December 31 of the year preceding the previous one (when filling out for 2021 - as of December 31, 2015).

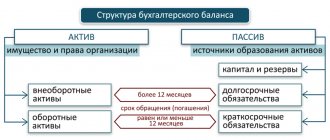

The form consists of an active and a passive. Section totals are calculated in lines with codes 1600 and 1700 and must be equal. The codes for the remaining lines, entered in independently added column 2, indicate the indicator that has the largest share in the aggregated indicator (clause 5 of order No. 66n).

The asset reflects the amount of non-current and current assets, the liability - the amount of equity capital and borrowed funds, as well as accounts payable.

Let's list what is included in the enlarged items of the simplified balance sheet under the simplified taxation system in 2021.

At the same time, we will not reveal what specifically relates to the components of each indicator, since we will talk about this in detail later when we move on to the balance sheet compiled in the general form.

After reviewing all the forms, we will give an example of filling out a simplified balance sheet form. And also, for comparison, a sample of filling out a balance sheet using the general form.

General balance sheet

The general form is given in Appendix No. 1 to Order No. 66n. And, as we said earlier, small businesses have an alternative - a simplified one. But no one prohibits such companies from using the general form.

The document, in its general form, has columns in which the following indicators are given for each article:

- as of the reporting date (when filling out for 2021 - as of December 31, 2018);

- as of December 31 of the previous year (when filling out for 2021 - as of December 31, 2021);

- as of December 31 of the year preceding the previous one (when filling out for 2021 - as of December 31, 2015).

Column 1 of the balance sheet is intended to indicate the number of the corresponding explanation to the balance sheet (if an explanatory note is drawn up). Organizations add column 3 independently to enter the line code in it.

The balance sheet contains two parts - assets and liabilities, which must be equal to each other. The asset reflects the amount of non-current and current assets, and the liability - the amount of equity capital and borrowed funds, as well as accounts payable.

Section I. Non-current assets

Intangible assets. The residual value of intangible assets is reflected on line 1110. Clause 3 of PBU 14/2007 “Accounting for intangible assets”, approved by order of the Ministry of Finance of Russia dated 27.

12.2007 No. 153n, allows you to find out what belongs to this group.

Thus, in order to accept an object for accounting as an intangible asset, it is necessary that the following conditions be simultaneously met:

- the object is capable of generating economic benefits in the future, and the organization has the right to receive them;

- the object can be separated or separated (identified) from other assets;

- the object is intended for use for a long time, that is, its useful life exceeds 12 months;

- it is possible to reliably determine the actual (initial) cost of the object;

- the object lacks a material form.

For example, if the specified conditions are met, intangible assets include works of science, literature and art, programs for electronic computers, inventions, utility models, selection achievements, production secrets (know-how), trademarks and service marks. Intangible assets also take into account business reputation arising in connection with the purchase of an enterprise as a property complex (in whole or part thereof).

Please note: intangible assets do not include expenses associated with the formation of a legal entity (organizational expenses), intellectual and business qualities of the organization’s personnel, their qualifications and ability to work (clause 4 of PBU 14/2007).

Results of research and development. Research and development expenses recorded on account 04 “Intangible assets” are reflected on line 1120.

Intangible and tangible search assets. These two indicators are given in lines numbered 1130 and 1140. They are intended for organizations - users of subsoil to reflect information on the costs of developing natural resources (PBU 24/2011 “Accounting for the costs of developing natural resources”, approved by order of the Ministry of Finance of Russia dated 06.10.2011 No. 125n).

Fixed assets. For depreciable objects, the residual value of fixed assets is recorded in line 1150. If we are talking about non-depreciable property, then the line indicates its original cost.

Source: https://www.26-2.ru/art/351891-2019-balans-19

Changes in the balance sheet in 2015–2020

The latest changes, which came into force on June 1, 2019, were made to the balance sheet and other accounting records by order of the Ministry of Finance dated April 19, 2019 No. 61n. The key changes are:

- now reporting can only be prepared in thousand rubles, millions can no longer be used as a unit of measurement;

- OKVED in the header has been replaced by OKVED 2;

- The balance sheet must contain information about the audit organization (auditor).

The auditor mark should only be given to those companies that are subject to mandatory audit. Tax authorities will use it both to impose a fine on the organization itself if it ignored the obligation to undergo an audit, and in order to know from which auditor they can request information on the organization in accordance with Art. 93 Tax Code of the Russian Federation.

More significant changes have occurred in Form 2. Read more about them here.

Machine-readable reporting forms recommended by the Federal Tax Service can be downloaded here.

The last time the balance was corrected on 05/17/2015 by order of the Ministry of Finance of the Russian Federation dated 04/06/2015 No. 57n. Then the changes affected mainly the profit and loss statement, which was renamed the financial results statement, and the balance sheet was affected only in relation to the abolition of the chief accountant’s signature under it.

By the same order, simplified reporting forms, previously divided into those intended for SMEs and NPOs, are combined into one simplified form that can be used by both SMEs and NPOs, as well as participants in the Skolkovo project.

Read more about simplified reporting here.

In 2016-2018, no changes were made to the form of the balance sheet.

Form 2. Statement of financial results

When preparing a statement of financial results, the same rules apply as when creating a balance sheet. Another thing is that here it is necessary to carry out calculations very carefully to reflect the net profit after tax indicator. This indicator must be identical to the organization’s income tax return. They must be the same, otherwise the Federal Tax Service may apply penalties. Accounting statements forms 1 and 2 (filling sample) are presented below:

- Sample of filling out Form 1 (balance);

- Sample of filling out form 2 (report).

You can also download the form (Form 2 of financial statements):

- Balance sheet;

- Report form.

Similar articles

- New forms of financial statements in 2021

- Financial statements in TOGS: what is it?

- Accounting calendar for 2021 - reporting

- Accounting statements for 2021 under the simplified tax system

- Composition of financial statements 2021 for small businesses

Where is a sample of filling out the balance sheet for 2020-2021

The 2020-2021 balance sheet form can be downloaded from our website using the link below:

The balance sheet form can also be found, filled out and sent to its destination on the Federal Tax Service website, in the taxpayer’s personal account.

Filling out the balance sheet form for 2021 in 2021 must take into account data from the accounting accounts and obey the following rules:

- When generating a report, the reporting period is a year. Interim reporting is prepared only by decision of management or owners.

- An approved form is used, which, if deeper detail is necessary, can be supplemented with new lines.

- The form provides for the reflection of indicators for the current year and for the previous 2 years.

- The balance sheet should include indicators in a net valuation, that is, cleared of regulatory values (for example, depreciation of fixed assets).

- Debit and credit balances for accounts in the balance sheet are shown in detail if the net valuation rule does not apply to these accounts. In a net valuation, property is reflected in the asset at its book value, that is, fixed assets and intangible assets - at the residual value, and inventory and materials - at the cost minus reserves (if they are formed).

- Interest on long-term loans should be shown as part of short-term debt, and interest on financial investments should be shown as part of settlements with the counterparty.

- The issue of reducing the debt to customers from whom an advance was received by the amount of VAT accrued on these advances is decided by the reporting preparer independently.

- A separate column provides links to explanations, disclosing information, etc.

For an example of compiling a balance sheet, see ConsultantPlus by receiving trial demo access to the K+ system for free (click on the link below):

Balance sheet – form 1: how to fill it out correctly, what errors occur

Maintaining accounting records for a business entity involves filling out certain reporting forms for certain dates. The balance sheet occupies a special place in the financial statements, to which many regulatory and other bodies assign a leading role. Therefore, it is important to know how to fill out a balance sheet and which accounts go where.

Who must submit a balance sheet?

The balance sheet is one of the financial reporting forms. The legislation establishes that all legal entities, regardless of their organizational form and the applicable taxation regime, must prepare and submit reports to tax and statistical authorities.

This obligation also applies to non-profit organizations and bar associations. Balance sheets and profit and loss statements do not have to be submitted only to entrepreneurs, as well as branches of foreign companies. But they can do this on their own initiative.

Attention! Previously, some organizations were exempt from preparing a balance sheet, but currently such provisions are no longer in effect. Business entities classified as small businesses are given the right to submit reports in a simplified form. It includes a balance sheet in Form 1 and a statement of financial results in Form 2, so enterprises must send it to regulatory authorities.

Balance due dates

According to the general rules, the balance sheet - Form 1 must be submitted as part of the reporting for the past year no later than March 31 of the following year. This deadline must be observed when submitting balance sheets and other forms to the Federal Tax Service and statistics.

In addition, under certain conditions, an audit report must be sent to Rosstat as an attachment. The deadline is set for ten days, but no later than December 31 of the following year.

Some organizations need to submit financial statements and publish them due to the type of activity they carry out, or according to other criteria defined by law. For example, tour operators must send their reports to Rostrud within three months from the date of their approval.

The legislation provides for separate deadlines for organizations that registered after September 30 of the reporting year.

Due to the fact that their calendar year may be determined differently in this case, the due date may be set by such organizations on March 31 of the second year after the current one.

For example, Rebus LLC received an extract from the Unified State Register of Legal Entities on October 25, 2017; the accounting report must be submitted for the first time on March 31, 2019.

Attention! Accounting statements are usually submitted based on the total for the year. However, it is possible to present it quarterly. In this case it is called intermediate. Such documentation is very often needed when applying for loans from banks, company owners, etc.

Where is it provided?

The provisions of federal laws establish that Form 1 balance sheet and Form 2 profit and loss statement, and in certain cases other forms, must be submitted:

- Federal Tax Service - reporting must be submitted at the place of registration of the company. Therefore, branches and other separate divisions do not submit it, and only the parent company submits consolidated statements. This must be done at the place where it is registered, taking into account these departments.

- Rosstat - currently submitting reports to statistical authorities is mandatory. If this is not done, then, just as in the first case, the company and officials may be held liable.

- For the founders and other owners of the company - this is due to the fact that each annual report of the organization must be approved by its owners.

- To other bodies, if the relevant regulations define such a duty.

Currently, when concluding contracts, many large companies ask for Form 1 Balance Sheet, Form 2 Profit and Loss Statement. This should be done at the discretion of the company management.

However, at present, many specialized companies through which you can submit reports have a service that allows you to obtain all the necessary information about a partner according to his TIN or OGRN. This data is provided by the Federal Tax Service itself based on previously submitted reports.

Delivery methods

The OKUD form 0710001, which is part of the annual report, can be submitted to the Federal Tax Service and Rosstat in the following ways:

Attention! The legislation stipulates the submission of the report in electronic form if the number of employees of the organization is more than 100 people.

Balance sheet form 2021 free download

Balance sheet form 1 form 2021 free download in Word format.

Balance sheet form 1 form 2021 download free in Excel format.

Balance sheet with line codes form download in Excel format.

filling out the balance sheet in Form 1 for 2021 in PDF format.

Title part

After the name of the form, it is indicated on what date it is being generated. The actual date of submission of the report must be entered in the table, in the line “Date (day, month, year)”. Next, the full name of the subject is written down, and opposite in the table is its OKPO code.

After this, his TIN is indicated on the next line in the table. Next, you need to indicate the main type of activity - first in words, and then in a table using the OKVED2 code. Then the organizational form and form of ownership are indicated.

On the contrary, the corresponding codes are entered in the table, for example:

- The code for LLC is 65.

- for private property - 16.

On the next line you need to choose in what units the data in the balance sheet is presented - in thousands or millions. The table displays the required OKEI code. The last line contains the address of the subject's location.

Fixed assets

Line “Intangible assets” 1110 is the balance of account 04 (except for R&D work) minus the balance of account 05.

Line “Research results” 1120 - account balance 04 for sub-accounts that reflect R&D;

Line “Intangible search requests” 1130 - account balance 08, subaccount of intangible costs for search work.

Line “Material search requests” 1140 – account balance 08, subaccount for the costs of material assets for search work.

Line “Fixed assets” 1150 - account balance 01 minus account balance 02.

Line “Income-bearing investments in MC” 1160 - the balance of account 03 minus the balance of account 02 in terms of accrued depreciation on assets related to income-generating investments.

Line “Financial investments” 1170 - account balance 58 minus account balance 59, as well as account balance 73 in terms of interest-bearing loans over 12 months.

Line “Deferred tax assets” 1180 - account balance 09, it is possible to reduce it by account balance 77.

Line “Other non-current assets” 1190 - other indicators that need to be reflected in the section, but they are not included in any line.

The line “Total for section” 1100 is the sum of lines from 1110 to 1190.

Current assets

Line “Inventories” 1210 - the sum of indicators is entered in the line:

- account balance 10 minus account balance 14, or account balances 15, 16

- Balances on production accounts: 20, 21, 23, 29, 44, 46

- Balances of goods on accounts 41 (minus the balance on account 42), 43

- account balance is 45.

Line “Value added tax” 1220 - account balance 19.

Line “Accounts receivable” 1230 - the sum of indicators is entered:

- Debit balances of accounts 62 and 76 minus the credit balance of account 63 in the subaccount “Reserves for long-term debts”;

- The debit balance of the account is 60 for advances made for the supply of products and services.

- Debit balance of account 76, subaccount “Insurance payments”;

- The debit balance of the account is 73, excluding the amounts of loans on which interest is accrued;

- Debit balance of account 58, subaccount “Granted loans for which interest is not accrued.”

- Debit account balance 75;

- Debit account balance 68, 69

- The debit balance of the account is 71.

Line “Financial investments” 1240 - the sum of indicators is entered:

- account balance 58 minus account balance 59;

- account balance 55, subaccount “Deposits”;

- account balance 73, subaccount “Loan settlements”.

Line “Cash” 1250 - the sum of account balances 50, 51, 52, 55, 57 is entered.

Line “Other current assets” 1260 - indicators that should be shown in the section, but were not included in any previous line.

The line “Total for section” 1200 is the sum for lines from 1210 to 1260.

Line “Balance” 1600 - the sum of lines 1100 and 1200.

Capital and reserves

Line “Authorized capital of the organization” 1310 - account balance 80.

Line “Own shares” 1320 - account balance 81.

Line “Revaluation of non-current assets” 1340 - account balance 83 in terms of the amounts of revaluation of fixed assets and intangible assets.

Line “Additional capital” 1350 – account balance 83 without the amounts of additional valuation of fixed assets and intangible assets.

Line “Reserve capital” 1360 - the sum of account balances 82, as well as 84 in terms of special funds.

Line “Retained earnings (uncovered loss)” 1370 - account balance 84 without special funds.

Line “Total for section” 1300 - the sum for lines 1310, as well as from 1340 to 1370 minus line 1320.

long term duties

Line “Borrowed funds” 1410 - account balance 67, including the amount of loans and interest accrued on them.

Line “Deferred tax liabilities” 1420 - account balance 77, it can be reduced by account balance 09.

Line “Estimated liabilities” 1430 - account balance 96 for the subaccount of estimated liabilities for more than 12 months.

Line “Other liabilities” 1450 - credit balances of accounts 60, 62, 68, 69, 70, 76 for which liabilities with a maturity period of more than 12 months are reflected.

Line “Total for section” 1400 - the sum for lines from 1410 to 1450.

Short-term liabilities

Line “Borrowed funds” 1510 - account balance 66, including loan amounts and interest accrued on them.

Line “Accounts payable” 1520 - The amount of indicators is entered in the court:

- Balances of accounts 60 and 76, which show the debt to suppliers and contractors;

- The balance on the credit of account 70, except for the debt on payment of income on shares and shares;

- The balance on the credit of the sub-account “Settlements on deposited amounts” of account 76;

- Credit balances of accounts 68 and 69;

- Account credit balance 71;

- Balances on the subaccounts “Calculations for claims” and “Calculations for property insurance” on account 76;

- Credit balances on accounts 76 and 62 for advances received;

- Credit balance on the subaccounts “Calculations for the payment of income” of account 75 and “Calculations of income for the payment of income on shares” of account 70

Line “Deferred income” 1530 - loan balances for accounts 86 and 98.

Line “Estimated liabilities” 1540 - balance from account 96 in the subaccount of estimated liabilities for less than 12 months;

Line “Other short-term liabilities” 1550 - other short-term liabilities that cannot be included in the previous terms of Section V.

The line “Total for section” 1500 is the sum for lines from 1510 to 1550.

Line “Balance” 1700 - the amount for lines 1300, 1400 and 1500.

Common mistakes when filling out a balance

When filling out a balance sheet, novice accountants often make the following mistakes:

- Accounts receivable and payable are shown as a collapsed indicator. This is a mistake - in the balance sheet you need to show separately the debt to debtors or creditors and separately - received or paid advances. Profits and losses should be reflected using the same principle.

- The amount of the advance received should not be reflected in pure form, but together with the VAT received with this payment.

- Fixed and intangible assets are reflected at historical cost. This is not true. These values must be adjusted to the amount of accrued depreciation for each type of property.

- Interest-free loans are shown as part of financial investments. This is incorrect; they should be shown as part of accounts receivable by maturity.

- Negative indicators are written with a minus sign. According to the instructions for filling out the form, negative values must be shown in parentheses without a minus.

Source: https://buhproffi.ru/otchetnost/buhgalterskij-balans.html

Results

To compile the balance sheet for 2021, the forms of its full and simplified forms recommended by Order No. 66n are still used. From June 1, the edition dated April 19, 2019 is in effect. Entering data into the balance sheet is subject to a number of requirements for both the reporting itself and the accounting data that serves as a source of information for it.

Sources:

- Federal Law of December 6, 2011 No. 402-FZ

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.