When registering a person as an individual entrepreneur, you should be prepared for the fact that you will have to submit a lot of reporting documents. One of the most important actions of a businessman is filing a tax return. It is submitted once or several times a year, depending on the chosen taxation system.

There are several types of declarations. Some of them are not regulated in any way by law, but, nevertheless, they are required to be submitted (for example, “zero”). Let's consider how and where to submit them.

The same points and differences in submitting a report for an individual entrepreneur or LLC

Methods for filing a declaration:

- personally;

- through a representative;

- via the Internet;

- by mail.

- if several taxation systems are used, then the declaration is submitted for each of them;

- the reporting form for the simplified tax system is the same for both individual entrepreneurs and LLCs;

- submitted to the territorial tax office;

- for violation of the deadlines for filing a declaration, a fine is imposed;

- if UTII is used, then the report is submitted quarterly and others.

Submitting reporting documents to the tax office does not differ much between individual entrepreneurs and limited liability companies.

What are the deadlines for registering an individual entrepreneur with the Pension Fund of Russia? How to register it?

How to start a hotel business from scratch? What do you need to know?

Is it possible to fire a single mother for absenteeism? If yes, how to apply? If not, why not?

Two main differences:

Deadlines for filing declarations under the simplified tax system:

- for individual entrepreneurs – until April 30;

- for LLC – until March 31.

List of documents required for filing a declaration:

- for individual entrepreneurs you need a TIN, a registration certificate and an extract from the Unified State Register of Entrepreneurs;

- for LLC: INN, OGRN, extract from the Unified State Register of Legal Entities or data of the head, activity codes, address and name of the organization.

If an entrepreneur or organization has chosen a general taxation system, then the individual entrepreneur pays personal income tax, and the LLC pays income tax.

Property tax can also be considered a difference between forms of organization. An individual entrepreneur does not pay it, but for a company its payment is mandatory.

Additional information about the content and rules for filling out the document

Section 1 of the document is usually devoted to the amount of taxes at the end of the year, quarterly advance payments. The second section is devoted to detailed calculations, taking into account contributions to various funds. The third section is needed by taxpayers if, based on the results of last year, they received government grants or other types of assistance from the state.

Important. Sections are filled in depending on the object of taxation in force in a particular case.

The title page is required for everyone and contains the following information:

- Telephone number for contact.

- Main OKVED code.

- Code by location.

- Federal Tax Service code.

- The year for which the reporting is prepared.

- Correction number.

- Indication of the reporting period.

- Full name or name of the enterprise.

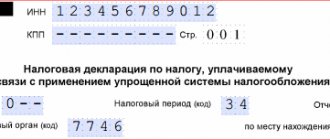

- TIN and checkpoint.

Note. For individual entrepreneurs and LLCs using the simplified tax system, if they choose income as an object of taxation, section 1.1 is needed. It is necessary to indicate the data from the calculation in section 2.1. Line 110 records the overpayment if it appeared at the end of the billing period.

Such transfers are returned to the current account, or then used to reduce the main base.

About the estimated income of individual entrepreneurs

An example of filling is here.

This type of tax report is required for individual entrepreneurs who carry out profit-making activities using the general taxation system. This type of report is called 4-NDFL. For newly registered entrepreneurs, its submission is required.

Based on the data transmitted in it, the government agency calculates the amount of advance payments for taxes . It must be handed over within five days after the expiration of a month from the date of first received income. Businessmen who have been working for several years submit this type of report along with their main declaration.

The declaration form is unified and consists of 1 sheet . It's easy to fill out.

Let us note 3 important points when drawing up this declaration:

- the amount of expected income must be indicated minus future expenses;

- Only the amount that is planned to be received from the entrepreneur’s activities is subject to reflection;

- The income figure is written down without kopecks, in full rubles.

There is no liability for failure to submit for those who have been working for a long time. Payments will be calculated based on data from previous years. But those who have just started their work may be fined 200 rubles.

Zero

This type of report (popularly known as “nulevka”) is submitted by an individual entrepreneur if he has not carried out any profit-making activities . Also, this declaration is submitted if the individual entrepreneur is registered before the official deadline for submitting information, and the business has not yet developed, that is, its balance tends to zero. Accordingly, he will not pay taxes, but he is obliged to report.

If you do not submit the declaration on time, the entrepreneur will be brought to administrative or tax liability. More often this is the imposition of penalties. The minimum fine is 1000 rubles. Moreover, if the submission of reports is delayed not for the first time, the amount of the fine may be doubled.

For individual entrepreneurs without employees, as well as for those who use UTII

It is much easier to report to those who do not have employees in their enterprise. There is no need to take into account the wage fund, and there is no need to pay contributions to the Insurance Fund. Since 2014, filing a report on the average headcount has ceased to be mandatory. If an entrepreneur has no employees and is on the simplified tax system, he will only need to submit a single tax return . The tax itself must be paid quarterly.

The declaration for individual entrepreneurs using UTII requires quarterly submission - no later than the 20th day of the month following the last month of the quarter. For the first quarter of 2015, you should report according to the new version of the declaration.

Only 5 days are allotted for tax payment after the deadline for submitting information, that is, until January 25 (we close the previous year), April, July and October of each tax period. If this date falls on a weekend or holiday, then the last working day after the 25th is considered the last day. You can submit your declaration using standard methods.

If an entrepreneur delays submitting information for more than 10 days, the government agency has the right to stop the movement of funds through his current account (“freezing”). The fine that will be imposed on the businessman will range from 5% to 30% of the amount of unpaid tax, but not less than one thousand rubles . A percentage of the amount will be calculated for each full or partial month after the deadline for official payment.

Declaration according to OSNO - maximum reporting for individual entrepreneurs

If we compare tax regimes, then the general system has the maximum amount of reporting on declarations during the tax period.

The easiest to prepare (and the first to submit) is a forward-looking declaration in form 4-NDFL. According to it, the regulator issues advance payment requirements to individual entrepreneurs. These calculations are made by the entrepreneur independently and submitted to the Federal Tax Service by the fifth day after the month in which the businessman received his first income. This is a minimal form that takes up one page.

Brief instructions for filling out the required lines:

- at the top of the declaration - the TIN of the private entrepreneur - we put the number indicated in the individual entrepreneur’s certificate;

- line “adjustment number” - set “0- -” (zero and two dashes). If an updated declaration is submitted (if the amount of income changes by more than 50%), we put: “1—”, “2—”, etc.;

- “tax period” - reporting year;

- line “submitted to the tax authority (code)” - indicate the code of the Federal Tax Service where the individual entrepreneur is registered, you can check it using the link;

- “taxpayer category code” - individual entrepreneurs put “720” (persons engaged in private practice - “730”, lawyers - “740”, individual entrepreneurs - heads of peasant farms - “770”);

- “OKTMO code” - the code of the municipality at the place of registration of the individual entrepreneur, you can find out on the website of the Federal Tax Service of the Russian Federation or here;

- “Full name” - according to the individual entrepreneur’s passport;

- “contact phone number” - the number is indicated in the format “+7 (code)xxxxxxxx”;

- “amount of estimated income (RUB)” - the planned income of the individual entrepreneur (including expenses). We put the numbers in rubles without kopecks, align them to the right;

- “on page 1 with supporting documents or their copies attached” - the individual entrepreneur is not obliged to give these explanations, put three dashes;

- “I confirm the accuracy and completeness of the information specified in this declaration” - put “1” if it is submitted by an individual entrepreneur, and “2” if it is endorsed by his representative;

- “signature” - endorsed by the individual entrepreneur.

A few nuances that should be taken into account when filling out and submitting 4-NDFL:

- documents that confirm the individual entrepreneur’s plans for micro-business income are not needed (this is not the responsibility of the individual entrepreneur);

- a private entrepreneur is not responsible for his calculation of income in the 4-NDFL form;

- If you predict that your planned annual income will exceed (or decrease) by more than 50%, you need to submit a second (corrective) declaration to the Federal Tax Service, and the tax authorities will recalculate the advance payments. Full adjustments to advance payments (overpayment or debt) will be made according to the 3-NDFL declaration at the end of the reporting period.

Please know: individual entrepreneurs who have been operating under OSNO for more than the first reporting year do not have to submit a forward-looking declaration.

The main report of individual entrepreneurs on the results of the year is the 3-NDFL declaration - this is the main document on personal income tax. persons

Personal income tax payments must be received by the tax authority by April 30. If the reporting deadline falls on a weekend, the deadline is moved to the first working day of the next week. The 3-NDFL declaration contains data from the Book of Income, Expenses and Household Accounting. operations (KUDiR). Entrepreneurs at OSNO are required to maintain this document constantly, in the current mode.

Photo gallery: sample of filling out 3-NDFL

Title page of declaration 3-NDFL sample filling

Declaration 3-NDFL, page 2, sample filling

Third page 3-NDFL

Final page 3-NDFL

There are no strict requirements for the generation and submission of reports in forms 4-NDFL and 3-NDFL; they can be generated and submitted in any available way: on paper or electronically (detailed information on how to submit declarations to the Federal Tax Service can be found in a separate chapter below) .

Current forms for filling out personal income tax returns can be downloaded here.

There are two life situations that you should pay attention to when considering the issue of declaring personal income tax:

- closure of individual entrepreneurs;

- temporary business stop.

When an entrepreneur decides to end his activities as a private entrepreneur, he is obliged to:

- 5 days after the business stops, submit a 3-NDFL tax return on actual income for the reporting period;

- pay the tax within 15 calendar days from the date of submission of the declaration.

There are cases when an entrepreneur does not conduct business during the reporting tax period, does not receive income, and there is no cash flow in his current accounts. This fact does not exempt individual entrepreneurs from providing 3-NDFL (see Article No. 289 of the Tax Code of the Russian Federation). At the end of the reporting period, within the standard deadline for declaring personal income tax (before April 30), the entrepreneur is required to submit personal income tax reporting to the regulator. If the activity was not carried out for the entire period, the 3-NDFL declaration will be “zero”. This is the name for standard reporting, where a zero is entered in the column with the units of the physical indicator of income on which the tax is imposed.

Penalties for evading personal income tax reporting are very serious. And if an entrepreneur can face a maximum of 200 rubles for failure to submit a 4-NDFL form, then for 3-NDFL sanctions can reach astronomical proportions, in more detail at the end of the article.

Video: filling out a tax return according to form 3-NDFL

The third type of reporting that an individual entrepreneur must submit to OSNO is a VAT return.

Declaration of value added tax takes place every calendar quarter, until the 25th day of the next month.

Private entrepreneurs whose income for 3 months does not exceed 2 million rubles are entitled to an exemption from filing a VAT return and paying taxes.

You need to know: VAT calculations are submitted to the tax office only through electronic document management (EDF). A VAT return submitted on paper will not be accepted by the Federal Tax Service.

If the tax regulator finds errors that result in an underestimation of the tax amount, the entrepreneur receives a request to provide an updated declaration. This problem must be resolved within 5 working days - draw up an adjustment declaration or prove your case by providing additional supporting documents. If an error in the calculations of the VAT return did not underestimate the tax payment or exceeded the amount of the tax levy, the tax authorities will “turn a blind eye” to this, but explanations will need to be provided.

Video: extended VAT return

You need to know: in the case when an entrepreneur did not have transactions subject to VAT in the reporting tax period (for a quarter) (invoices were not issued to counterparties) and there was no cash flow on current accounts, the individual entrepreneur has the right to provide the Federal Tax Service with a Unified ( simplified) declaration.

The simplified zero declaration form can be downloaded on the non-profit website of the Consultant via the link. At the same time, if standard VAT reporting must be sent to the tax office only in electronic form, then a simplified VAT return can be submitted both via EDI and in paper form. The deadline for submitting a single VAT return is the 20th day after the end of the calendar quarter.

Another way out of the situation, if the individual entrepreneur does not intend to work with VAT, is to relieve oneself of reporting obligations for 1 year (exemption is not provided for a longer period). To do this, you need to submit 2 documents to the inspectorate before the 20th day of the month in which the individual entrepreneur wants to evade VAT:

- notice of VAT cancellation (the form can be downloaded from the link);

- an extract from the Individual Entrepreneur’s Income and Expense Accounting Book.

In this case, the simplified VAT declaration will need to be completed only once at the end of the reporting year.

Table: regulations for declaring activities under OSNO in 2018

| Regularity | reporting form | Deadline | deadline for reporting in 2021/period | nuances | |

| every quarter | VAT declaration | before the 25th day of the first month of the next quarter | 25.04.2018 | I quarter | Available only via EDI |

| 25.07.2018 | II quarter | ||||

| 25.10.2018 | III quarter | ||||

| 25.01.2019 | IV quarter | ||||

| quarter without VAT transactions | Single (simplified) declaration | until the 20th | individually | periods in which there was no activity | |

| year | Declaration 3-NDFL | until April 30 | 30.04.2018 | year | must be rented, even in the absence of individual entrepreneur activity |

| No | Declaration 4-NDFL | separately | 5 days of the next month from the start of work | forward-looking declaration | |

Declaration for individual entrepreneurs using the simplified tax system

Individual entrepreneurs who have chosen a simplified tax system to conduct their business must submit a report by April 30 of each tax period (this is a calendar year). This type of declaration is called 3-NDFL; it is unified and consists of 6 sheets. It is served once a year. Its form is established by the legislator of the Russian Federation. You can submit it in one of the 4 ways described above. It has two types: “income” and “income minus expenses”.

The declaration is filled out manually or using a program provided by the Federal Tax Service . It is believed that this type of declaration is the easiest to fill out. The report is submitted to the territorial tax office in the same four ways as other types of declarations.

The fine for failure to submit this type of report is calculated in the same manner as for late declaration when using the UTII system.

How to fill out a declaration on the simplified tax system: watch the video.

Declaration form according to the simplified tax system

The simplified tax system declaration for 2021 for payers of this preferential regime was approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected]

Please note: by order dated December 25, 2020 No. ED-7-3/ [email protected] the Federal Tax Service approved a new declaration form, which applies to reporting already for 2021! And for 2021 you must report using the old form.

In total, the form contains 8 pages, but different pages are filled out for different tax objects. In this article we will look at filling out only the “Revenue” object, as the most popular option.

Prepare a simplified taxation system declaration online

The completed tax return under the simplified tax system Income will include the following pages:

- title page;

- section 1.1;

- section 2.1.1;

- section 2.1.2, if the simplifier pays a trade fee

- section 3, if targeted funding has been received (see paragraphs 1 and 2 of Article 251 of the Tax Code of the Russian Federation).

Sections 1.2 and 2.2 are intended only for the object “Income minus expenses”, therefore payers of the simplified tax system of 6% do not fill them out and do not attach them to the declaration.

It turns out that if an individual entrepreneur on the simplified tax system for income did not pay the trade fee and did not receive targeted funds, then he only needs to fill out 3 pages: the title page, sections 1.1 and 2.1.1.